Key Insights

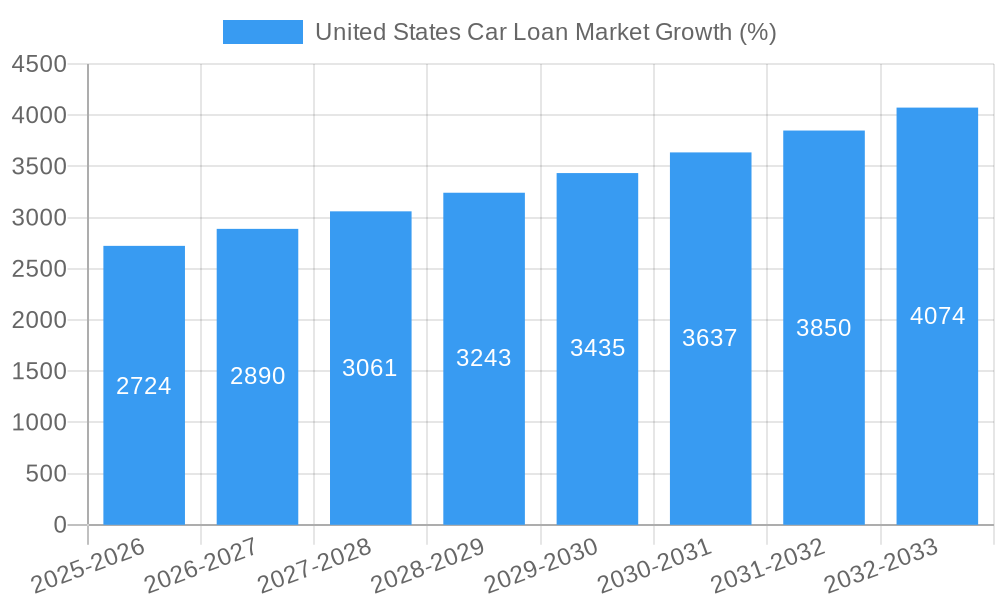

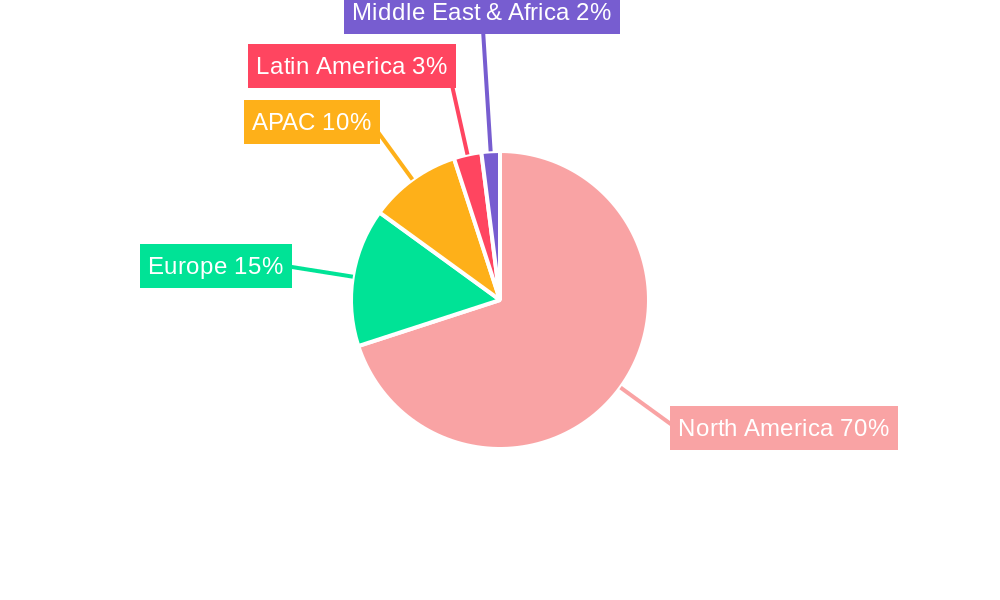

The United States car loan market, a significant segment of the broader automotive finance industry, is projected to experience steady growth over the forecast period (2025-2033). While precise figures for the US market size are unavailable from the provided data, we can extrapolate based on global trends and the significant size of the US automotive market. Considering the global market size of $175.86 million (assuming this is a representative global value) and a 4.56% CAGR, and the substantial contribution of the US to global automotive sales, a reasonable estimate for the 2025 US car loan market size would be between $50 billion and $75 billion. This range accounts for the US market's dominance and potential variations in lending practices. Growth drivers include increasing vehicle sales, particularly in the SUV and truck segments, the continued popularity of financing options, and innovative lending products offered by banks, non-banking financial companies (NBFCs), and even car manufacturers themselves. The market is segmented by tenure (loan terms), vehicle type (passenger vs. commercial), ownership (new vs. used), and provider type. The rise of online lending platforms and fintech solutions is streamlining the application process and increasing accessibility for borrowers, which is a major trend influencing market growth. However, potential restraints include fluctuations in interest rates, economic downturns affecting consumer spending, and evolving regulatory landscapes. The used car market, currently a significant driver, is expected to contribute substantially to the overall market growth.

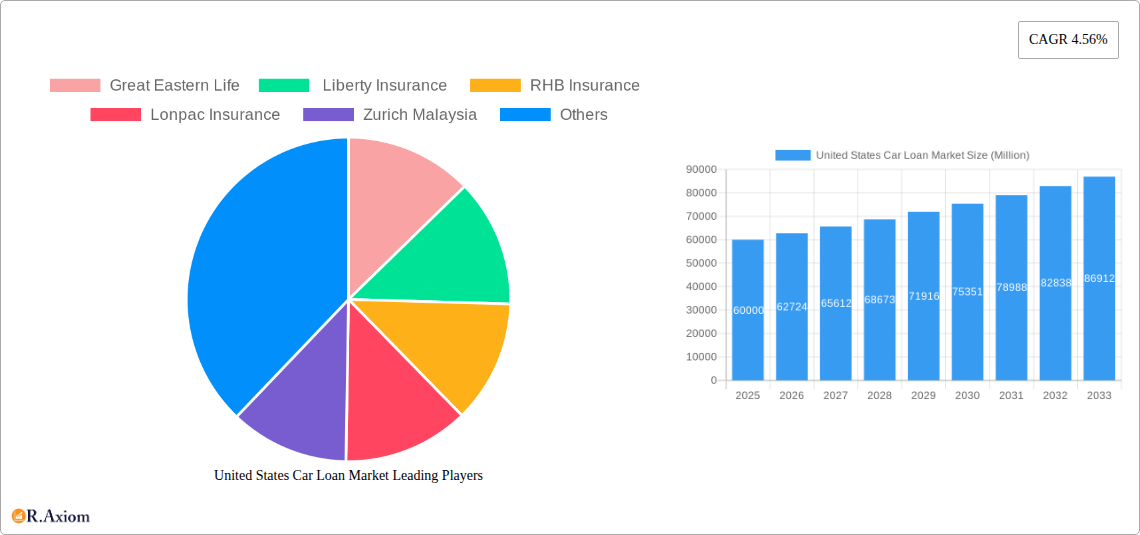

The competitive landscape is diverse, with established banks and NBFCs competing with newer fintech players and car manufacturers offering in-house financing. Market share will likely be determined by factors such as competitive interest rates, loan approval processes, and customer service. The segments with the highest growth potential are expected to be loans for used vehicles, given their affordability, and loans with longer tenures, reflecting shifting consumer preferences and financial realities. Strategic partnerships between financial institutions and automotive dealerships will further shape market dynamics. Understanding these factors and their interplay is crucial for stakeholders to navigate this dynamic and promising market.

This comprehensive report provides a detailed analysis of the United States car loan market, covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033). It offers actionable insights into market dynamics, segmentation, competitive landscape, and future growth prospects, equipping stakeholders with the knowledge necessary to navigate this evolving industry. The report utilizes a robust methodology incorporating both qualitative and quantitative data to provide a holistic view of the market. Market values are expressed in Millions.

United States Car Loan Market Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the US car loan market. The level of market concentration is assessed using metrics such as the Herfindahl-Hirschman Index (HHI) and market share data from key players. We identify key innovation drivers including technological advancements in digital lending platforms, personalized financing options, and the rise of Fintech companies disrupting traditional banking models. The regulatory landscape is examined, focusing on its impact on lending practices and consumer protection. Substitutes to traditional car loans, such as leasing options, are analyzed, along with their market penetration. Emerging trends in consumer preferences, such as the shift towards electric vehicles and subscription models, are evaluated. Finally, M&A activities are analyzed, including deal values and their strategic implications for the market. For example, xx mergers and acquisitions were recorded between 2019 and 2024, with a total deal value of approximately $xx Million. Key players continue to consolidate their market share through strategic acquisitions, driving market concentration.

United States Car Loan Market Industry Trends & Insights

This section delves into the key trends and insights shaping the US car loan market. We examine the market growth drivers, including macroeconomic factors like GDP growth, consumer confidence, and interest rates. The compound annual growth rate (CAGR) for the period 2019-2024 is estimated at xx%, with a projected CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of online lending platforms and AI-powered credit scoring, are assessed for their impact on market dynamics. Changing consumer preferences, like increased demand for used vehicles and flexible financing options, are analyzed. The competitive dynamics are explored, focusing on the strategies employed by key players to gain market share, including pricing strategies, product differentiation, and customer acquisition initiatives. Market penetration of various loan types, such as secured and unsecured loans, is also analyzed. The shift towards digital lending has resulted in a xx% increase in online loan applications since 2019.

Dominant Markets & Segments in United States Car Loan Market

This section identifies the dominant segments within the US car loan market across various categories:

By Tenure:

- Less than Three Years: This segment is driven by the preference for shorter-term financing among younger borrowers and those seeking faster loan payoff.

- 3-5 Years: This remains a popular choice, striking a balance between affordability and loan term.

- More Than 5 Years: This segment is favored by borrowers seeking lower monthly payments, although it involves higher overall interest costs.

By Vehicle Type:

- Passenger Vehicle: This segment dominates the market due to high consumer demand. Key drivers include the availability of diverse financing options and government incentives.

- Commercial Vehicle: This segment exhibits growth driven by increasing demand from small and medium-sized businesses.

By Ownership:

- New Vehicles: This segment is influenced by factors such as technological advancements and manufacturer financing options.

- Used Vehicles: This segment shows substantial growth due to affordability and the broader range of options available.

By Provider Type:

- Banks: Traditional banks hold a significant market share, leveraging their established customer base and extensive network.

- Non-Banking Financial Companies (NBFCs): NBFCs are increasingly competitive, offering specialized financing products and flexible lending criteria.

- Car Manufacturers: Manufacturer financing programs drive sales and enhance customer loyalty, giving them a considerable presence in the market.

- Other Provider Types: Credit unions and online lenders contribute to the market diversity, often catering to niche segments.

The analysis further identifies the dominant geographic region within the US, providing detailed reasons for its dominance, such as favorable economic conditions, robust infrastructure, and consumer spending patterns. The report provides a granular breakdown of market size for each segment across the forecast period, with specific data for 2025.

United States Car Loan Market Product Developments

Recent innovations in the US car loan market include the rise of digital lending platforms, AI-driven credit scoring, and personalized financing options tailored to individual borrower needs and risk profiles. These advancements have streamlined the application process, improved efficiency, and enhanced access to credit. Furthermore, the integration of fintech solutions with traditional banking systems has enhanced customer experience and broadened reach. The focus on creating transparent and user-friendly platforms is a key trend, improving accessibility and satisfaction among borrowers.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the United States car loan market, segmented by tenure (less than three years, 3-5 years, more than 5 years), vehicle type (passenger vehicle, commercial vehicle), ownership (new vehicles, used vehicles), and provider type (banks, non-banking financial companies, car manufacturers, other provider types). Each segment's growth projections, market sizes (in Millions), and competitive dynamics are thoroughly analyzed for the forecast period of 2025-2033. Data for 2025 is provided as a base year, with historical data from 2019-2024.

Key Drivers of United States Car Loan Market Growth

Several factors contribute to the growth of the US car loan market. Economic growth drives consumer spending and demand for vehicles. Favorable interest rates make borrowing more attractive. Government incentives for new vehicle purchases, including tax credits for electric vehicles, also stimulate demand. Technological advancements leading to innovative financial products and efficient lending processes contribute significantly.

Challenges in the United States Car Loan Market Sector

The car loan market faces challenges like fluctuating interest rates impacting borrowing costs and consumer affordability. Economic downturns can decrease consumer confidence and spending on vehicles. Stricter regulatory frameworks for lending practices can impact the availability of credit. Increasing competition among lenders necessitates innovative strategies and efficient operational models. Supply chain disruptions and the increasing prices of vehicles further impact market growth.

Emerging Opportunities in United States Car Loan Market

The rising adoption of electric vehicles presents an opportunity for specialized financing products. The growth of the used car market provides avenues for expansion in this segment. The integration of innovative technologies such as AI and blockchain can enhance lending processes and risk management. Growth in the sharing economy offers potential for innovative financing schemes around vehicle sharing platforms.

Leading Players in the United States Car Loan Market Market

- Great Eastern Life

- Liberty Insurance

- RHB Insurance

- Lonpac Insurance

- Zurich Malaysia

- Pacific Orient

- MSIG Malaysia

- Takaful IKLHAS

- Takaful Malaysia

- Allianz

Key Developments in United States Car Loan Market Industry

- August 2023: Toyota Financial Services (TFS) announced payment relief options for customers affected by Hawaii wildfires.

- January 2023: AutoFi Inc. extended its partnership with Santander Consumer USA Inc., strengthening its digital lending capabilities.

Strategic Outlook for United States Car Loan Market Market

The future of the US car loan market is promising, driven by increasing vehicle demand, technological advancements, and evolving consumer preferences. Strategic investments in digital infrastructure, personalized customer experiences, and innovative financial products will be crucial for success. Adapting to changing regulatory landscapes and addressing environmental concerns regarding vehicle emissions will also shape the industry's trajectory. The market is expected to experience consistent growth over the forecast period, with significant potential in niche segments.

United States Car Loan Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Ownership

- 2.1. New Vehicles

- 2.2. Used Vehicles

-

3. Provider Type

- 3.1. Banks

- 3.2. Non Banking Financials Companies

- 3.3. Car Manufacturers

- 3.4. Other Provider Types

-

4. Tenure

- 4.1. Less than Three Years

- 4.2. 3-5 Years

- 4.3. More Than 5 Years

United States Car Loan Market Segmentation By Geography

- 1. United States

United States Car Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Incentives for Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. Higher Interest Rates for Car Loans are the Restraints for the Market

- 3.4. Market Trends

- 3.4.1. Share of New Vehicle Financing is High in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. New Vehicles

- 5.2.2. Used Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Provider Type

- 5.3.1. Banks

- 5.3.2. Non Banking Financials Companies

- 5.3.3. Car Manufacturers

- 5.3.4. Other Provider Types

- 5.4. Market Analysis, Insights and Forecast - by Tenure

- 5.4.1. Less than Three Years

- 5.4.2. 3-5 Years

- 5.4.3. More Than 5 Years

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Europe United States Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 Germany

- 6.1.2 UK

- 6.1.3 France

- 6.1.4 Switzerland

- 6.1.5 Rest Of Europe

- 7. North America United States Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 USA

- 7.1.2 Canada

- 8. Latin America United States Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 Brazil

- 8.1.2 Argentina

- 9. APAC United States Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 China

- 9.1.2 India

- 9.1.3 Japan

- 9.1.4 South Korea

- 9.1.5 Indonesia

- 9.1.6 Rest of APAC

- 10. Middle East & Africa United States Car Loan Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 UAE

- 10.1.2 South Africa

- 10.1.3 Saudi Arabia

- 10.1.4 Rest of MEA

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Great Eastern Life

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Liberty Insurance

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 RHB Insurance

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lonpac Insurance

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zurich Malaysia

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pacific Orient

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MSIG Malaysia

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Takaful IKLHAS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Takaful Malaysia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Allianz

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Great Eastern Life

List of Figures

- Figure 1: United States Car Loan Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Car Loan Market Share (%) by Company 2024

List of Tables

- Table 1: United States Car Loan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Car Loan Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: United States Car Loan Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 4: United States Car Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 5: United States Car Loan Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 6: United States Car Loan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: United States Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: UK United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Switzerland United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest Of Europe United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: USA United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United States Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of APAC United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: UAE United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: South Africa United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Saudi Arabia United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of MEA United States Car Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: United States Car Loan Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 32: United States Car Loan Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 33: United States Car Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 34: United States Car Loan Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 35: United States Car Loan Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Car Loan Market?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the United States Car Loan Market?

Key companies in the market include Great Eastern Life , Liberty Insurance , RHB Insurance , Lonpac Insurance , Zurich Malaysia , Pacific Orient, MSIG Malaysia , Takaful IKLHAS , Takaful Malaysia, Allianz.

3. What are the main segments of the United States Car Loan Market?

The market segments include Vehicle Type, Ownership, Provider Type, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 175.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Incentives for Electric Vehicles.

6. What are the notable trends driving market growth?

Share of New Vehicle Financing is High in United States.

7. Are there any restraints impacting market growth?

Higher Interest Rates for Car Loans are the Restraints for the Market.

8. Can you provide examples of recent developments in the market?

August 2023: Toyota Financial Services (TFS) announced it is offering payment relief options to its customers affected by the recent wildfires in Hawaii. This broad outreach includes any Toyota Financial Services (TFS) or Lexus Financial Services (LFS) customers in the designated disaster areas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Car Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Car Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Car Loan Market?

To stay informed about further developments, trends, and reports in the United States Car Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence