Key Insights

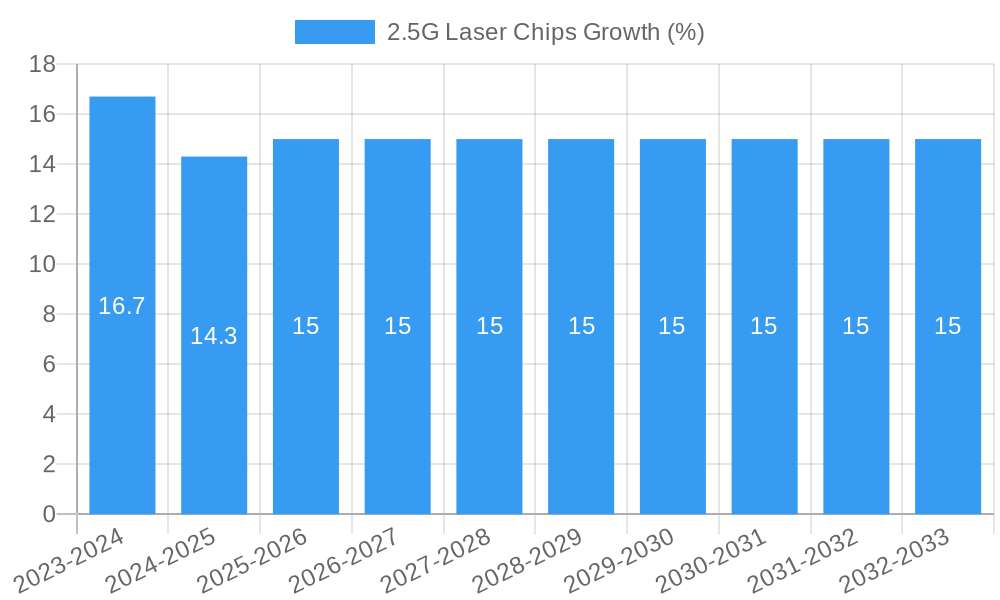

The global 2.5G laser chip market is poised for significant expansion, projected to reach an estimated market size of $1.2 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 15% anticipated over the forecast period. This growth is primarily fueled by the escalating demand from the communication industry, particularly for enhanced fiber-to-the-home (FTTH) deployments and the increasing prevalence of high-speed internet services. Data centers are also a major contributor, requiring advanced laser chips for efficient data transmission and network infrastructure. The market's dynamism is further shaped by ongoing technological advancements, leading to the development of more sophisticated chip types like FP (Fabry-Perot) Laser Chips and EML (Electro-absorption Modulated Laser) Laser Chips, which offer superior performance characteristics.

Several key drivers are propelling this market forward. The relentless surge in data consumption, driven by video streaming, cloud computing, and the expansion of IoT devices, necessitates greater bandwidth and faster communication speeds, directly impacting the demand for 2.5G laser chips. Furthermore, government initiatives promoting digital infrastructure development across various regions are creating substantial opportunities. However, challenges such as the high cost of research and development for next-generation laser chip technologies and potential supply chain disruptions could act as restraints. Despite these hurdles, the market is characterized by intense competition among established players and emerging innovators, fostering a landscape of continuous product improvement and strategic collaborations.

This in-depth report provides a detailed analysis of the global 2.5G laser chip market, covering historical trends, current dynamics, and future projections. With a study period spanning from 2019 to 2033, this report offers critical insights for industry stakeholders, including manufacturers, investors, and technology providers. The base year for analysis is 2025, with the estimated year also being 2025 and the forecast period from 2025 to 2033. The historical period for review is 2019–2024. We delve into market concentration, technological innovations, industry trends, dominant segments, product developments, key drivers, challenges, emerging opportunities, leading players, and significant industry developments. This report aims to equip you with actionable intelligence to navigate and capitalize on the evolving 2.5G laser chip landscape, focusing on high-traffic keywords such as "2.5G laser chip market," "telecom laser diodes," "data center optical components," "FP laser chip," "DFB laser chip," "EML laser chip," and "VCSEL laser chip."

2.5G Laser Chips Market Concentration & Innovation

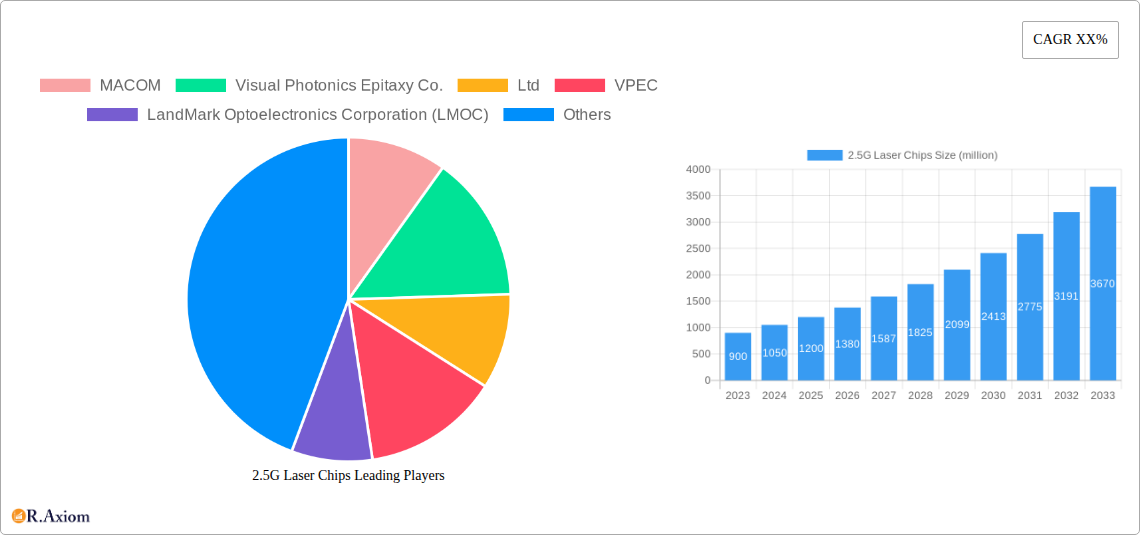

The 2.5G laser chip market exhibits a moderate to high concentration, with several key players dominating the landscape. Innovation is a primary driver, fueled by the relentless demand for higher bandwidth and lower latency in communication networks and data centers. Companies are investing heavily in Research and Development to enhance chip performance, power efficiency, and cost-effectiveness. Regulatory frameworks, while generally supportive of technological advancement, can influence market entry and product standards, particularly concerning safety and interoperability. Product substitutes, such as higher-speed laser chips or alternative optical components, are constantly emerging, necessitating continuous innovation from 2.5G laser chip manufacturers. End-user trends strongly favor miniaturization, increased integration, and improved thermal management for advanced optical modules. Merger and acquisition (M&A) activities are a significant aspect of market consolidation and strategic expansion. For instance, the total value of M&A deals within the photonics industry related to laser components has reached an estimated 150 million in recent years, indicating a trend towards consolidation and acquisition of specialized technologies. Market share distribution shows that the top five players collectively hold an estimated 75% of the global 2.5G laser chip market.

2.5G Laser Chips Industry Trends & Insights

The 2.5G laser chip industry is experiencing robust growth, driven by the ever-increasing demand for high-speed data transmission across various sectors. The primary growth driver is the expansion of telecommunication networks, including the ongoing deployment of 5G infrastructure and the continuous evolution of fiber-to-the-home (FTTH) initiatives. The burgeoning data center industry also plays a crucial role, with escalating data traffic and the need for efficient optical interconnects for servers, storage, and networking equipment. Technological disruptions, such as advancements in semiconductor fabrication processes and material science, are enabling the development of more powerful, compact, and energy-efficient 2.5G laser chips. Consumer preferences are increasingly shifting towards solutions that offer superior performance, reliability, and cost-effectiveness, directly impacting the design and manufacturing of these chips. Competitive dynamics within the market are intense, with companies vying for market share through product differentiation, strategic partnerships, and cost leadership. The Compound Annual Growth Rate (CAGR) for the 2.5G laser chip market is projected to be around 8.5% over the forecast period. Market penetration in emerging economies is expected to accelerate, driven by digital transformation initiatives and increasing internet accessibility. The market size is estimated to reach 2,000 million by the end of the forecast period.

Dominant Markets & Segments in 2.5G Laser Chips

The Communication Industry segment stands as the dominant market for 2.5G laser chips, driven by the foundational role these components play in global telecommunications infrastructure. The continuous demand for higher bandwidth in mobile networks, broadband internet services, and enterprise communication systems fuels this dominance. Economic policies supporting digital infrastructure development and government investments in telecommunication upgrades further bolster this segment. Within the Communication Industry, DFB Laser Chips represent a significant portion of demand due to their reliability and suitability for medium-range optical communication, with an estimated market share of 35%.

The Data Center segment is the second-largest and fastest-growing market for 2.5G laser chips. The exponential growth in data generation and processing, coupled with the increasing adoption of cloud computing and AI technologies, necessitates robust and high-performance optical interconnects. Infrastructure upgrades within data centers, including the deployment of faster servers and switches, directly translate into a higher demand for efficient laser chips. The market penetration of VCSEL laser chips within data centers for short-reach interconnects is projected to reach an impressive 40% by 2030, demonstrating rapid adoption.

Among the types, DFB Laser Chips and FP Laser Chips currently hold substantial market shares, serving critical roles in various communication applications. However, EML Laser Chips are gaining traction due to their higher modulation speeds, making them increasingly relevant for demanding data center and high-speed communication applications. The market size for DFB Laser Chips is estimated to be 750 million in the base year, while FP Laser Chips are valued at approximately 600 million. The forecast for EML Laser Chips indicates a strong upward trend, with an anticipated market size of 450 million by the end of the forecast period.

2.5G Laser Chips Product Developments

Product development in the 2.5G laser chip market is characterized by a focus on enhancing performance parameters such as output power, spectral purity, and modulation speed, while simultaneously reducing power consumption and cost. Innovations are geared towards enabling denser optical modules and supporting higher data rates within existing infrastructure. Key applications include the development of more efficient transceivers for fiber optic communication, optical modules for data centers, and specialized laser sources for industrial sensing and metrology. Competitive advantages are being realized through proprietary manufacturing techniques, advanced material science, and the integration of laser chips into complex optoelectronic subsystems. The market is witnessing a trend towards miniaturized and highly integrated laser chip solutions designed for pluggable modules and compact optical systems.

Report Scope & Segmentation Analysis

This report meticulously segments the 2.5G laser chip market based on critical parameters to provide granular insights. The primary segmentation includes:

Application:

- Communication Industry: This segment encompasses fiber optic communication, telecommunications infrastructure, and broadband access networks. Projected market size for this segment is estimated at 1,500 million by 2033, with a CAGR of 9.0%.

- Data Center: This includes optical interconnects for servers, switches, routers, and storage systems within data centers. Expected market size is 800 million by 2033, with a CAGR of 10.5%.

- Other: This broad category includes applications such as industrial automation, medical devices, and scientific instrumentation. Estimated market size is 150 million by 2033, with a CAGR of 6.0%.

Types:

- FP Laser Chip: Fabry-Perot laser diodes, widely used in short to medium-reach applications. Market size is projected to be 700 million by 2033.

- DFB Laser Chip: Distributed Feedback laser diodes, essential for medium to long-reach optical communication. Estimated market size of 950 million by 2033.

- EML Laser Chip: Electro-absorption Modulated Laser chips, offering high-speed modulation capabilities for advanced networks. Expected market size of 600 million by 2033.

- VCSEL Laser Chip: Vertical-Cavity Surface-Emitting Laser chips, increasingly adopted for short-reach interconnects in data centers. Projected market size of 400 million by 2033.

Key Drivers of 2.5G Laser Chips Growth

Several key drivers are propelling the growth of the 2.5G laser chip market. Firstly, the accelerating global demand for high-speed data communication, driven by the proliferation of connected devices, cloud computing, and the Internet of Things (IoT), necessitates advanced optical components. Secondly, the continuous expansion and upgrade of telecommunication networks, including the rollout of 5G and the ongoing deployment of fiber optics, directly fuels the demand for reliable 2.5G laser chips. Thirdly, the rapid growth of the data center industry, with its insatiable appetite for bandwidth and efficient interconnects, represents a significant market opportunity. Finally, ongoing technological advancements in semiconductor manufacturing and material science are enabling the production of more cost-effective, higher-performance, and energy-efficient laser chips, further stimulating market expansion. The estimated market size in 2025 is 1,500 million.

Challenges in the 2.5G Laser Chips Sector

Despite the robust growth, the 2.5G laser chip sector faces several challenges. Intense competition among numerous players leads to pricing pressures and thinning profit margins, especially in commoditized segments. Supply chain disruptions, exacerbated by geopolitical events and raw material availability, can impact production timelines and costs. Stringent quality control and reliability standards, particularly for telecommunication and data center applications, require significant investment in testing and validation. Furthermore, the rapid pace of technological evolution means that manufacturers must constantly innovate to avoid product obsolescence, necessitating substantial R&D expenditure. The increasing complexity of manufacturing processes also adds to operational costs and the need for highly skilled labor. The estimated cost of R&D for next-generation laser chips is projected to be 80 million annually.

Emerging Opportunities in 2.5G Laser Chips

Emerging opportunities in the 2.5G laser chip market are abundant, driven by technological advancements and evolving market demands. The expansion of edge computing infrastructure and the increasing demand for faster data processing at the network edge present a significant opportunity. The growing adoption of high-definition video streaming and immersive technologies like augmented reality (AR) and virtual reality (VR) will also drive demand for higher bandwidth optical solutions. Furthermore, the increasing use of laser chips in emerging applications such as advanced sensing, industrial automation, and even in certain medical diagnostics offers diversification potential. The development of co-packaged optics (CPO) and silicon photonics integration also opens new avenues for innovative laser chip designs and functionalities. The market for VCSEL laser chips in consumer electronics is projected to grow by 15% annually.

Leading Players in the 2.5G Laser Chips Market

- MACOM

- Visual Photonics Epitaxy Co.,Ltd

- VPEC

- LandMark Optoelectronics Corporation (LMOC)

- Henan Shijia Photons Technology Co.,ltd.

- Suzhou Everbright Photonics Co.,Ltd.

- Yuanjie Semiconductor Technology Co.,Ltd.

- IQE Taiwan Corporation

- Optocom Corporation

- Broadcom

- Mitsubishi Electric

- Sumitomo Electric Industries Co.,Ltd.

- EMCORE Corporation

- Hisense Broadband

- Memsensing Microsystems(Suzhou,China)

- FuJian Z.K. Litecore

- Hubei AR-CHIP Tech

Key Developments in 2.5G Laser Chips Industry

- 2023: Introduction of higher output power DFB laser chips with improved spectral purity for 5G fronthaul applications.

- 2022: Launch of new series of compact EML laser chips optimized for high-density data center interconnects, supporting data rates up to 100Gbps.

- 2021: Several leading companies announced significant investments in R&D for advanced laser chip fabrication technologies, focusing on yield improvement and cost reduction.

- 2020: Increased M&A activity within the optical components sector, with acquisitions targeting companies specializing in high-performance laser chip technology. The estimated deal value for these strategic acquisitions reached 70 million.

- 2019: Advancements in VCSEL technology led to wider adoption in short-reach datacenter applications, with market penetration increasing by an estimated 10% in this year.

Strategic Outlook for 2.5G Laser Chips Market

- 2023: Introduction of higher output power DFB laser chips with improved spectral purity for 5G fronthaul applications.

- 2022: Launch of new series of compact EML laser chips optimized for high-density data center interconnects, supporting data rates up to 100Gbps.

- 2021: Several leading companies announced significant investments in R&D for advanced laser chip fabrication technologies, focusing on yield improvement and cost reduction.

- 2020: Increased M&A activity within the optical components sector, with acquisitions targeting companies specializing in high-performance laser chip technology. The estimated deal value for these strategic acquisitions reached 70 million.

- 2019: Advancements in VCSEL technology led to wider adoption in short-reach datacenter applications, with market penetration increasing by an estimated 10% in this year.

Strategic Outlook for 2.5G Laser Chips Market

The strategic outlook for the 2.5G laser chips market remains highly positive. The sustained growth in data traffic, coupled with the ongoing expansion of 5G networks and the relentless demand from data centers, provides a strong foundation for continued market expansion. Key growth catalysts include the increasing adoption of higher-speed communication standards, the development of new applications leveraging optical technologies, and the continuous drive for cost optimization and energy efficiency in component manufacturing. Companies that focus on innovation, strategic partnerships, and supply chain resilience will be well-positioned to capitalize on the opportunities. The market is expected to witness further consolidation and specialization as players strive to offer differentiated and high-value solutions. The estimated total market revenue in 2033 is projected to be 2,000 million.

2.5G Laser Chips Segmentation

-

1. Application

- 1.1. Communication Industry

- 1.2. Data Center

- 1.3. Other

-

2. Types

- 2.1. FP Laser Chip

- 2.2. DFB Laser Chip

- 2.3. EML Laser Chip

- 2.4. VCSEL Laser Chip

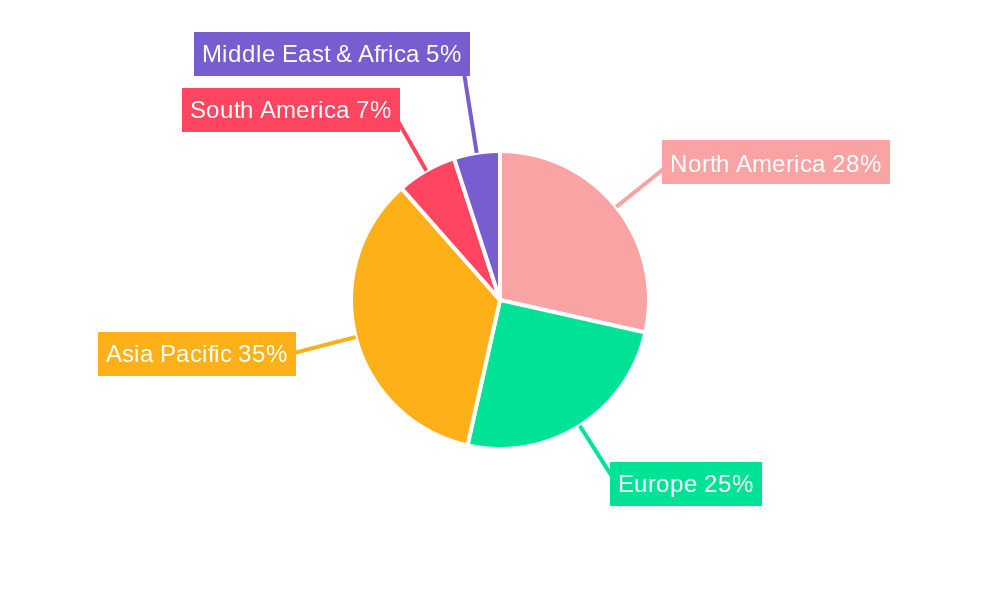

2.5G Laser Chips Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

2.5G Laser Chips REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 2.5G Laser Chips Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication Industry

- 5.1.2. Data Center

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. FP Laser Chip

- 5.2.2. DFB Laser Chip

- 5.2.3. EML Laser Chip

- 5.2.4. VCSEL Laser Chip

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America 2.5G Laser Chips Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Communication Industry

- 6.1.2. Data Center

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. FP Laser Chip

- 6.2.2. DFB Laser Chip

- 6.2.3. EML Laser Chip

- 6.2.4. VCSEL Laser Chip

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America 2.5G Laser Chips Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Communication Industry

- 7.1.2. Data Center

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. FP Laser Chip

- 7.2.2. DFB Laser Chip

- 7.2.3. EML Laser Chip

- 7.2.4. VCSEL Laser Chip

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe 2.5G Laser Chips Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Communication Industry

- 8.1.2. Data Center

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. FP Laser Chip

- 8.2.2. DFB Laser Chip

- 8.2.3. EML Laser Chip

- 8.2.4. VCSEL Laser Chip

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa 2.5G Laser Chips Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Communication Industry

- 9.1.2. Data Center

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. FP Laser Chip

- 9.2.2. DFB Laser Chip

- 9.2.3. EML Laser Chip

- 9.2.4. VCSEL Laser Chip

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific 2.5G Laser Chips Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Communication Industry

- 10.1.2. Data Center

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. FP Laser Chip

- 10.2.2. DFB Laser Chip

- 10.2.3. EML Laser Chip

- 10.2.4. VCSEL Laser Chip

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 MACOM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Visual Photonics Epitaxy Co.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 VPEC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LandMark Optoelectronics Corporation (LMOC)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Henan Shijia Photons Technology Co.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Suzhou Everbright Photonics Co.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 YuanjieSemiconductorTechnology Co.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ltd.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 IQE Taiwan Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Optocom Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Broadcom

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Mitsubishi Electric

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sumitomo Electric Industries Co.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Ltd.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 EMCORE Corporation

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Hisense Broadband

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Memsensing Microsystems(Suzhou

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 China)

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 FuJian Z.K. Litecore

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Hubei AR-CHIP Tech

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 MACOM

List of Figures

- Figure 1: Global 2.5G Laser Chips Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America 2.5G Laser Chips Revenue (million), by Application 2024 & 2032

- Figure 3: North America 2.5G Laser Chips Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America 2.5G Laser Chips Revenue (million), by Types 2024 & 2032

- Figure 5: North America 2.5G Laser Chips Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America 2.5G Laser Chips Revenue (million), by Country 2024 & 2032

- Figure 7: North America 2.5G Laser Chips Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America 2.5G Laser Chips Revenue (million), by Application 2024 & 2032

- Figure 9: South America 2.5G Laser Chips Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America 2.5G Laser Chips Revenue (million), by Types 2024 & 2032

- Figure 11: South America 2.5G Laser Chips Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America 2.5G Laser Chips Revenue (million), by Country 2024 & 2032

- Figure 13: South America 2.5G Laser Chips Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe 2.5G Laser Chips Revenue (million), by Application 2024 & 2032

- Figure 15: Europe 2.5G Laser Chips Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe 2.5G Laser Chips Revenue (million), by Types 2024 & 2032

- Figure 17: Europe 2.5G Laser Chips Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe 2.5G Laser Chips Revenue (million), by Country 2024 & 2032

- Figure 19: Europe 2.5G Laser Chips Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa 2.5G Laser Chips Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa 2.5G Laser Chips Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa 2.5G Laser Chips Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa 2.5G Laser Chips Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa 2.5G Laser Chips Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa 2.5G Laser Chips Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific 2.5G Laser Chips Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific 2.5G Laser Chips Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific 2.5G Laser Chips Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific 2.5G Laser Chips Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific 2.5G Laser Chips Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific 2.5G Laser Chips Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global 2.5G Laser Chips Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global 2.5G Laser Chips Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global 2.5G Laser Chips Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global 2.5G Laser Chips Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global 2.5G Laser Chips Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global 2.5G Laser Chips Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global 2.5G Laser Chips Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global 2.5G Laser Chips Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global 2.5G Laser Chips Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global 2.5G Laser Chips Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global 2.5G Laser Chips Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global 2.5G Laser Chips Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global 2.5G Laser Chips Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global 2.5G Laser Chips Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global 2.5G Laser Chips Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global 2.5G Laser Chips Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global 2.5G Laser Chips Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global 2.5G Laser Chips Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global 2.5G Laser Chips Revenue million Forecast, by Country 2019 & 2032

- Table 41: China 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific 2.5G Laser Chips Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 2.5G Laser Chips?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the 2.5G Laser Chips?

Key companies in the market include MACOM, Visual Photonics Epitaxy Co., Ltd, VPEC, LandMark Optoelectronics Corporation (LMOC), Henan Shijia Photons Technology Co., ltd., Suzhou Everbright Photonics Co., Ltd., YuanjieSemiconductorTechnology Co., Ltd., IQE Taiwan Corporation, Optocom Corporation, Broadcom, Mitsubishi Electric, Sumitomo Electric Industries Co., Ltd., EMCORE Corporation, Hisense Broadband, Memsensing Microsystems(Suzhou, China), FuJian Z.K. Litecore, Hubei AR-CHIP Tech.

3. What are the main segments of the 2.5G Laser Chips?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "2.5G Laser Chips," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 2.5G Laser Chips report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 2.5G Laser Chips?

To stay informed about further developments, trends, and reports in the 2.5G Laser Chips, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence