Key Insights

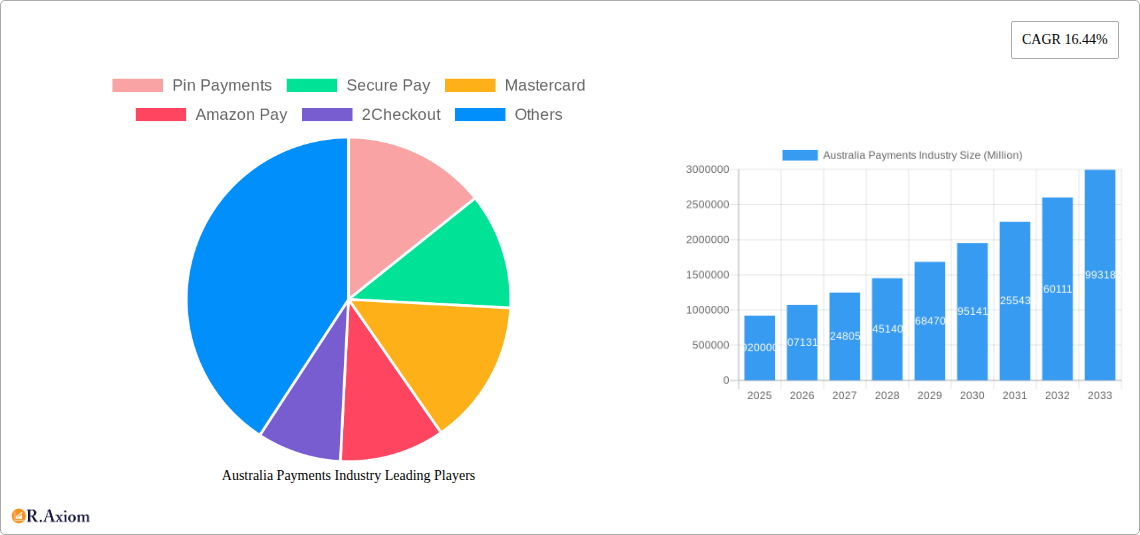

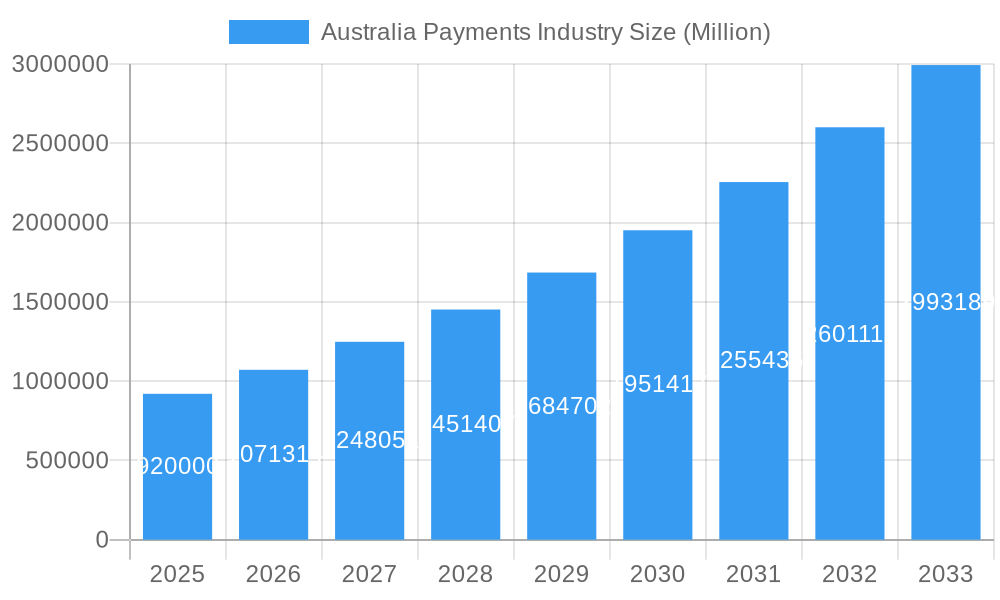

The Australian payments industry is poised for substantial growth, driven by a robust market size of AUD 0.92 million in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 16.44% through to 2033. This impressive expansion is fueled by several key drivers, including the increasing adoption of digital payment methods, a burgeoning e-commerce landscape, and a growing consumer preference for convenience and speed. The market's trajectory is further supported by significant investments in payment infrastructure and technological advancements, such as the rollout of new payment technologies and enhanced security measures, which are building greater trust and utility for consumers and businesses alike. The shift towards contactless payments, accelerated by recent global events, continues to reshape transaction habits across the nation, making digital wallets and card payments increasingly dominant.

Australia Payments Industry Market Size (In Billion)

The Australian payments market is segmented across various modes of payment and end-user industries, reflecting a dynamic and evolving ecosystem. Within payment modes, Point of Sale transactions, particularly card payments and digital wallets including mobile wallets, are experiencing significant uptake, supplanting traditional cash transactions. Online sales also contribute substantially, albeit with a greater reliance on "Other" payment methods as the digital economy matures. Key end-user industries such as Retail, Entertainment, and Hospitality are at the forefront of this transformation, leveraging digital payment solutions to enhance customer experience and streamline operations. While growth is robust, potential restraints such as evolving regulatory landscapes and the need for continuous cybersecurity investments could present challenges. However, the overall outlook remains exceptionally strong, with established players like Mastercard, Visa, and Amazon Pay, alongside emerging innovators, actively shaping the future of payments in Australia.

Australia Payments Industry Company Market Share

Australia Payments Industry Market Concentration & Innovation

The Australian payments industry, a dynamic and rapidly evolving sector, is characterized by a moderate level of market concentration, with established global players and agile domestic innovators coexisting. Key companies like Mastercard, Visa, Amazon Pay, Google Pay, Pin Payments, Secure Pay, eway, WorldPay, and Square exert significant influence. The industry is propelled by continuous innovation, driven by the demand for faster, more secure, and convenient transaction methods. Regulatory frameworks, overseen by bodies like the Reserve Bank of Australia, play a crucial role in fostering a secure and competitive environment. The advent of real-time payments through initiatives like the New Payments Platform (NPP) has been a significant innovation, enabling instant fund transfers and new service development. Product substitutes are increasingly sophisticated, with digital wallets and buy-now-pay-later (BNPL) services challenging traditional card payments. End-user trends indicate a strong preference for contactless transactions and seamless online payment experiences. Mergers and acquisitions (M&A) activity, while not always publicly disclosed in terms of specific deal values, are a constant feature, as companies seek to expand their market reach, acquire new technologies, or consolidate their positions. For instance, the acquisition of smaller fintech companies by larger financial institutions or payment processors is a recurring theme, reflecting a strategic push for growth and market dominance.

Australia Payments Industry Industry Trends & Insights

The Australian payments industry is projected for robust growth, driven by a confluence of technological advancements, shifting consumer behaviors, and supportive economic policies. The compound annual growth rate (CAGR) for the Australian payments market is estimated to be in the range of 8-10% during the forecast period of 2025-2033, a testament to its dynamism. This growth is underpinned by increasing digital penetration, with a significant portion of the population embracing online and mobile transactions. The rise of contactless payments has become a dominant trend, with consumers preferring the speed and convenience of tapping their cards or mobile devices for in-store purchases. Mobile wallets, in particular, have witnessed exponential growth, integrating seamlessly with smartphones and offering a secure and streamlined payment experience.

Technological disruptions are at the forefront of this evolution. The widespread adoption of the New Payments Platform (NPP) has revolutionized the speed and efficiency of transactions, enabling real-time payments and fostering innovation in payment services. This has paved the way for new business models and enhanced customer experiences. Furthermore, the proliferation of Application Programming Interfaces (APIs) is facilitating greater interoperability between financial institutions and fintech companies, leading to the development of integrated payment solutions.

Consumer preferences are increasingly leaning towards digital-first solutions. Younger demographics, in particular, are driving the demand for intuitive and mobile-centric payment methods. The convenience of online shopping, coupled with the ease of making payments through various digital channels, has significantly contributed to the growth of e-commerce. Buy-Now-Pay-Later (BNPL) services have also gained considerable traction, offering consumers flexible payment options and boosting impulse purchases.

The competitive landscape is dynamic, with a mix of established financial institutions, global payment giants, and innovative fintech startups vying for market share. Companies are continually investing in research and development to offer cutting-edge payment solutions that cater to evolving consumer needs. The focus on enhancing security measures, such as tokenization and biometric authentication, is paramount to building trust and ensuring the integrity of transactions. Market penetration for digital payment methods is expected to reach over 70% by 2028, indicating a significant shift away from traditional cash-based transactions.

Dominant Markets & Segments in Australia Payments Industry

The Australian payments industry is witnessing a significant shift in dominance across various segments, driven by technological advancements and evolving consumer preferences. Point of Sale (POS) transactions, particularly Card Pay and Digital Wallet (includes Mobile Wallets), are emerging as the dominant modes of payment, gradually eclipsing traditional Cash transactions. The convenience and speed offered by contactless card payments and the ever-increasing adoption of mobile wallets like Google Pay and Apple Pay are primary drivers of this shift. For in-store purchases, Card Pay is projected to hold a market share of approximately 60% by 2025, with Digital Wallets rapidly gaining ground and expected to capture around 30% of the POS market. Cash transactions are anticipated to see a decline, potentially falling to below 5% of POS transactions.

In the Online Sale segment, Others which encompasses a broad range of digital payment methods beyond traditional card processing, including BNPL services, direct bank transfers, and emerging payment gateways, is the undisputed leader. The proliferation of e-commerce and the increasing reliance on digital platforms for purchasing goods and services have fueled the growth of these diverse online payment solutions. This segment is expected to experience a CAGR of over 12% during the forecast period.

The End-user Industry landscape is also experiencing shifts in payment dominance. The Retail sector continues to be the largest contributor to payment volumes, driven by both physical and online sales. However, the Entertainment sector, encompassing digital streaming services, online gaming, and ticketing, is exhibiting particularly strong growth in digital payment adoption. The Hospitality sector is also seeing a significant rise in digital and contactless payment preferences, driven by efficiency and enhanced customer experience. The Healthcare industry is increasingly adopting digital payment solutions for appointments, billing, and prescription fulfillment, improving administrative efficiency and patient convenience. Other end-user industries, such as utilities and government services, are also progressively digitizing their payment processes.

Key drivers for the dominance of these segments include:

- Economic Policies: Government initiatives promoting digital transformation and cashless societies.

- Infrastructure: Widespread availability of high-speed internet and robust telecommunications networks supporting digital transactions.

- Technological Advancements: Continuous innovation in payment technologies, including contactless readers, mobile payment platforms, and secure online gateways.

- Consumer Behavior: Growing preference for convenience, speed, and security in payment methods, particularly among younger demographics.

- E-commerce Growth: The sustained expansion of online retail and digital service platforms.

- Regulatory Support: Favorable regulations that encourage the adoption of new payment technologies and ensure consumer protection.

The interplay of these factors is reshaping the Australian payments landscape, with digital and contactless solutions firmly establishing their dominance.

Australia Payments Industry Product Developments

Product developments in the Australian payments industry are characterized by a strong focus on enhancing user experience, security, and efficiency. Innovations in contactless payment technology continue to evolve, offering faster and more secure transaction capabilities for both consumers and businesses. The integration of biometric authentication methods, such as fingerprint and facial recognition, is becoming increasingly prevalent, bolstering security protocols. Furthermore, the development of advanced fraud detection and prevention systems, powered by artificial intelligence and machine learning, is a critical competitive advantage for payment providers. The expansion of real-time payment networks has enabled the creation of novel payment solutions, including instant cross-border transactions and integrated peer-to-peer payment functionalities. The competitive landscape is pushing for seamless integration across various platforms and devices, creating a truly omnichannel payment experience.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the Australian Payments Industry, encompassing key segments that define its market dynamics. The segmentation includes:

Mode of Payment: This section delves into the performance of various payment methods. We will analyze Point of Sale (POS) transactions, further breaking them down into Card Pay (credit, debit, and prepaid cards), Digital Wallet (includes Mobile Wallets) such as Google Pay and Amazon Pay, and a residual category for Others including contactless technologies beyond standard wallets. The Online Sale segment will also be examined, with a focus on Others encompassing a wide array of digital payment gateways, BNPL services, and direct bank transfers that facilitate e-commerce transactions.

End-user Industry: The report categorizes payment activity across key sectors. This includes the dominant Retail industry, the rapidly growing Entertainment sector, the evolving Healthcare industry, the service-oriented Hospitality sector, and a broader category for Other End-user Industries to capture diverse payment flows.

Each segment's growth projections, current market sizes, and competitive dynamics are meticulously analyzed, providing stakeholders with actionable insights into specific market opportunities and challenges.

Key Drivers of Australia Payments Industry Growth

The Australian payments industry is experiencing significant growth driven by several key factors. Technologically, the widespread adoption of real-time payment systems like the New Payments Platform (NPP) is transforming transaction speeds and enabling new service innovations. The continuous advancement of mobile payment technologies and digital wallets, facilitated by increasing smartphone penetration, is another major driver. Economically, a robust consumer spending environment and the expansion of e-commerce, fueled by convenience and accessibility, are propelling payment volumes. Government initiatives aimed at promoting digital inclusion and a cashless society, coupled with favorable regulatory frameworks that encourage innovation and competition, also play a crucial role. The increasing preference for contactless and secure payment solutions among consumers further solidifies these growth trends.

Challenges in the Australia Payments Industry Sector

Despite its growth trajectory, the Australian payments industry faces several significant challenges. Regulatory hurdles, particularly concerning data privacy and evolving compliance requirements, can pose complexities for new entrants and established players alike. Cybersecurity threats and the constant need for robust fraud prevention measures represent ongoing challenges, demanding continuous investment in sophisticated security technologies. Intense competitive pressures from both traditional financial institutions and agile fintech companies can lead to margin erosion and necessitate constant innovation. Furthermore, the digital divide, while narrowing, still presents a barrier for segments of the population not fully embracing digital payment methods, requiring inclusive strategies. The cost of implementing and maintaining advanced payment infrastructure also remains a consideration.

Emerging Opportunities in Australia Payments Industry

Emerging opportunities in the Australian payments industry are abundant and largely driven by technological innovation and evolving consumer demands. The continued expansion of the "Internet of Things" (IoT) presents opportunities for embedded payments within connected devices, from smart home appliances to vehicles. The burgeoning fintech sector is continuously innovating, with a focus on niche markets and specialized payment solutions, such as cross-border payments for small businesses and integrated payment solutions for specific industries. The growing demand for personalized financial services and data analytics offers opportunities for payment providers to offer value-added services. Furthermore, the increasing adoption of cryptocurrencies and blockchain technology, while still nascent, represents a long-term opportunity for innovative payment solutions that leverage these emerging technologies for faster and more cost-effective transactions.

Leading Players in the Australia Payments Industry Market

- Mastercard

- Visa

- Amazon Pay

- Google Pay

- Pin Payments

- Secure Pay

- 2Checkout

- eway

- WorldPay

- Square

Key Developments in Australia Payments Industry Industry

- 2023/Q4: Launch of new real-time payment solutions by major banks leveraging the NPP, enhancing P2P and B2B payment capabilities.

- 2024/Q1: Significant increase in BNPL adoption by merchants across various sectors, driven by consumer demand for flexible payment options.

- 2024/Q2: Expansion of wearable payment technology adoption, with more consumers using smartwatches and fitness trackers for contactless payments.

- 2024/Q3: Increased investment in AI-powered fraud detection systems by payment processors to combat sophisticated cyber threats.

- 2024/Q4: Introduction of enhanced security protocols by card networks, including advanced tokenization and multi-factor authentication for online transactions.

- 2025/Q1: Continued consolidation within the fintech space, with strategic acquisitions aimed at expanding service offerings and market reach.

Strategic Outlook for Australia Payments Industry Market

The strategic outlook for the Australian payments industry is one of sustained innovation and digital transformation. Growth catalysts will continue to be driven by the relentless pursuit of seamless and secure payment experiences for consumers and businesses. The increasing integration of AI and machine learning in payment processing will enhance fraud prevention and personalize customer offerings. Further expansion of real-time payment capabilities and the exploration of new digital asset integrations will redefine transaction paradigms. Strategic partnerships between traditional financial institutions and agile fintechs will remain crucial for leveraging combined strengths and addressing evolving market needs, ensuring Australia remains at the forefront of global payment innovation.

Australia Payments Industry Segmentation

-

1. Mode of Payment

-

1.1. Point of Sale

- 1.1.1. Card Pay

- 1.1.2. Digital Wallet (includes Mobile Wallets)

- 1.1.3. Cash

- 1.1.4. Others

-

1.2. Online Sale

- 1.2.1. Others (

-

1.1. Point of Sale

-

2. End-user Industry

- 2.1. Retail

- 2.2. Entertainment

- 2.3. Healthcare

- 2.4. Hospitality

- 2.5. Other End-user Industries

Australia Payments Industry Segmentation By Geography

- 1. Australia

Australia Payments Industry Regional Market Share

Geographic Coverage of Australia Payments Industry

Australia Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 High Proliferation of E-commerce

- 3.2.2 including the rise of m-commerce and cross-border e-commerce supported by the increase in purchasing power; Enablement Programs by Key Retailers and Government encouraging digitization of the market; Growth of Real-time Payments in Germany

- 3.3. Market Restrains

- 3.3.1. ; Threat to Security of Fingerprint Data Within the System; Limitations of the Technology Leading to Breaches

- 3.4. Market Trends

- 3.4.1. E-Commerce Segment is Anticipated to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Payments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 5.1.1. Point of Sale

- 5.1.1.1. Card Pay

- 5.1.1.2. Digital Wallet (includes Mobile Wallets)

- 5.1.1.3. Cash

- 5.1.1.4. Others

- 5.1.2. Online Sale

- 5.1.2.1. Others (

- 5.1.1. Point of Sale

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Retail

- 5.2.2. Entertainment

- 5.2.3. Healthcare

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Mode of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pin Payments

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Secure Pay

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mastercard

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amazon Pay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 2Checkout

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Google Pay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Visa*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 eway

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 WorldPay

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Square

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pin Payments

List of Figures

- Figure 1: Australia Payments Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Payments Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Payments Industry Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 2: Australia Payments Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Australia Payments Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Payments Industry Revenue Million Forecast, by Mode of Payment 2020 & 2033

- Table 5: Australia Payments Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Australia Payments Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Payments Industry?

The projected CAGR is approximately 16.44%.

2. Which companies are prominent players in the Australia Payments Industry?

Key companies in the market include Pin Payments, Secure Pay, Mastercard, Amazon Pay, 2Checkout, Google Pay, Visa*List Not Exhaustive, eway, WorldPay, Square.

3. What are the main segments of the Australia Payments Industry?

The market segments include Mode of Payment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.92 Million as of 2022.

5. What are some drivers contributing to market growth?

High Proliferation of E-commerce. including the rise of m-commerce and cross-border e-commerce supported by the increase in purchasing power; Enablement Programs by Key Retailers and Government encouraging digitization of the market; Growth of Real-time Payments in Germany.

6. What are the notable trends driving market growth?

E-Commerce Segment is Anticipated to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Threat to Security of Fingerprint Data Within the System; Limitations of the Technology Leading to Breaches.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Payments Industry?

To stay informed about further developments, trends, and reports in the Australia Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence