Key Insights

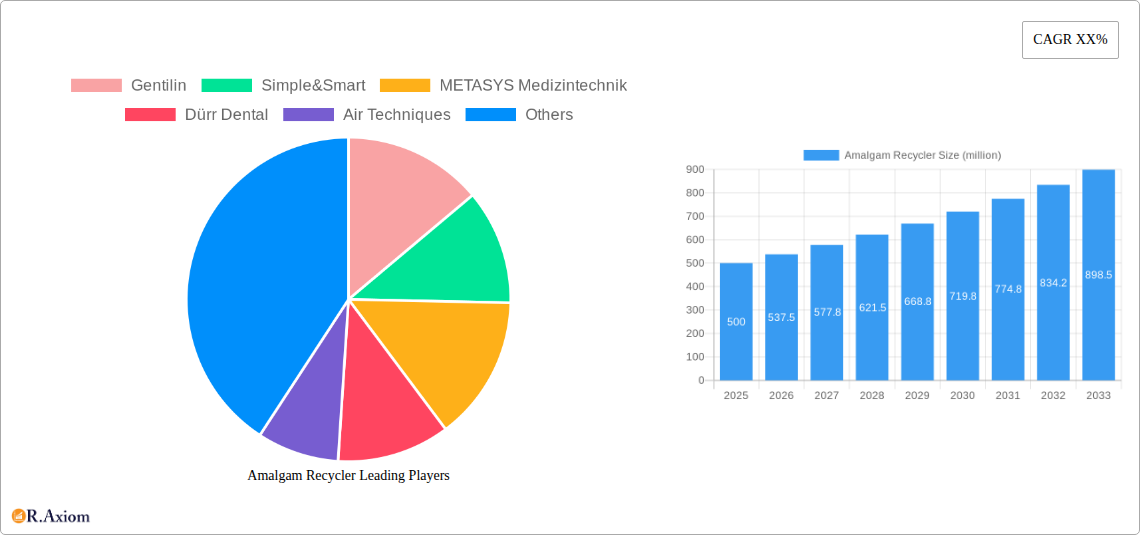

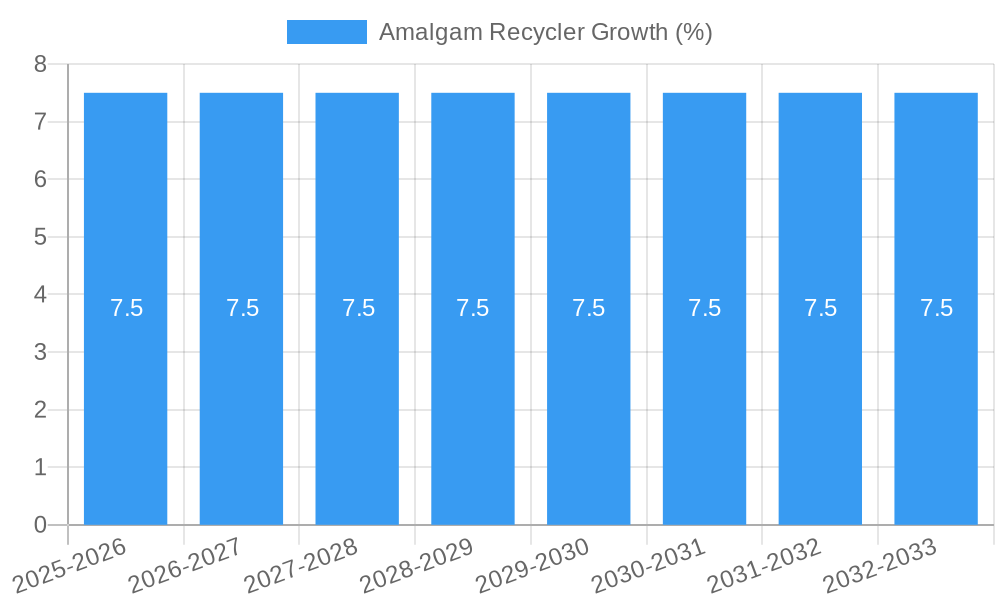

The global Amalgam Recycler market is poised for significant expansion, projected to reach an estimated \$500 million by the end of 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.5% anticipated through 2033. This growth is primarily fueled by the escalating global emphasis on environmental sustainability and stringent regulations governing dental amalgam waste. As healthcare providers and dental practices worldwide strive to minimize their environmental footprint, the demand for efficient and compliant amalgam recycling solutions is surging. Key drivers include increasing awareness among dental professionals about the health and environmental hazards associated with mercury, a component of dental amalgam, and the growing adoption of advanced recycling technologies that ensure high recovery rates and responsible disposal of residual waste. The market benefits from supportive government initiatives and mandates that encourage or require the segregation and recycling of dental waste, thereby creating a favorable landscape for market players.

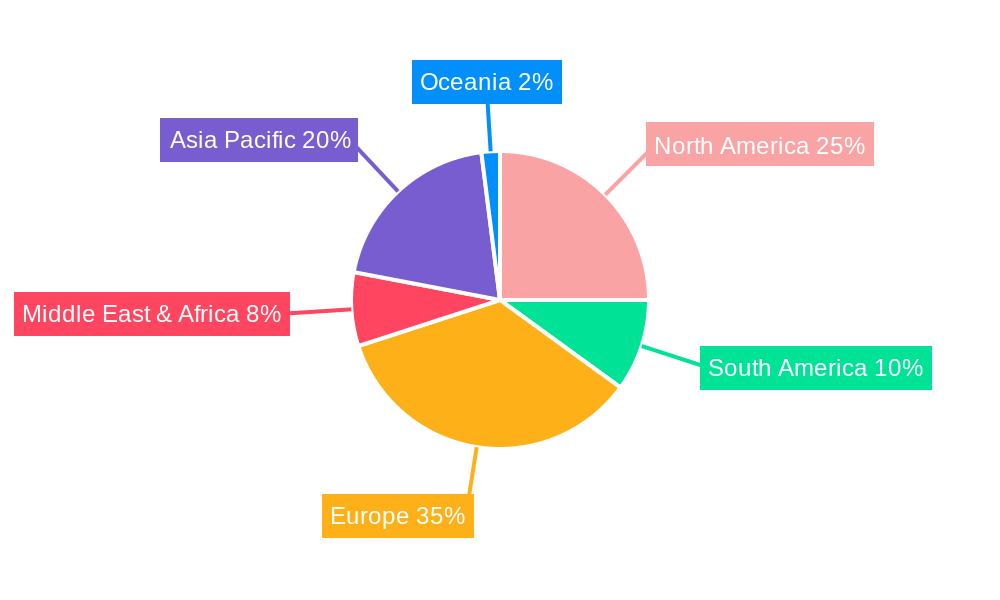

The market is strategically segmented to cater to diverse needs, with "Hospital" and "Specialty Clinic" applications leading the adoption of amalgam recycling systems due to their higher patient volumes and waste generation. In terms of technology, "Portable" amalgam recyclers are gaining traction, offering flexibility and cost-effectiveness for smaller practices and mobile dental units. The competitive landscape features established players like Dürr Dental, Air Techniques, and Sirona, alongside innovative companies such as Gentilin and Simple&Smart, all contributing to market dynamism through continuous product development and expansion into emerging regions. Europe currently holds a dominant market share, driven by strict environmental directives, but the Asia Pacific region, particularly China and India, is expected to witness the fastest growth due to rapid urbanization, increasing dental care access, and a growing focus on environmental compliance in these burgeoning economies. The market, while experiencing strong growth, faces potential restraints such as the initial investment cost for advanced recycling equipment and the need for ongoing operational training for dental staff.

Amalgam Recycler Market Concentration & Innovation

The global Amalgam Recycler market demonstrates moderate concentration, with key players such as Gentilin, METASYS Medizintechnik, Dürr Dental, and Sirona holding significant market shares. Innovation is primarily driven by advancements in recycling efficiency, mercury containment, and compliance with evolving environmental regulations. The regulatory framework, including stringent mercury disposal laws like the Minamata Convention, acts as a powerful catalyst for market growth and necessitates the adoption of advanced amalgam recycling solutions. Product substitutes, while limited in efficacy for dedicated amalgam recovery, are not a significant threat to specialized recyclers. End-user trends are leaning towards higher environmental responsibility and cost-effectiveness, pushing demand for integrated waste management solutions in dental practices and hospitals. Mergers and Acquisitions (M&A) activities, although not extensively documented, are anticipated to increase as larger companies seek to consolidate their market position and acquire innovative technologies. While specific M&A deal values are not publicly disclosed, the strategic importance of sustainable waste management in the healthcare sector suggests substantial investment potential.

Amalgam Recycler Industry Trends & Insights

The Amalgam Recycler market is poised for robust growth, driven by increasing environmental consciousness and stricter regulations governing mercury disposal from dental amalgam waste. The study period, spanning from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, indicates a sustained upward trajectory. Market penetration of amalgam recycling solutions is expected to rise significantly as dental practices and healthcare facilities prioritize compliance and sustainability. Technological disruptions are at the forefront of this growth, with continuous innovation in the design of amalgam separators and recyclers to enhance efficiency, reduce mercury emissions, and facilitate easier waste handling. These advancements are directly responding to evolving consumer preferences, which increasingly favor eco-friendly practices and demand transparent waste management processes from their healthcare providers. Competitive dynamics are intensifying, with established manufacturers and new entrants vying for market share by offering superior product performance, cost-effective solutions, and comprehensive service packages. The estimated Compound Annual Growth Rate (CAGR) for the forecast period is projected to be substantial, reflecting the growing demand for environmentally sound dental waste management. Key industry developments throughout the historical period (2019-2024) and continuing into the forecast period are critical indicators of market health. These include product upgrades that improve mercury capture rates, the development of more compact and user-friendly portable units, and the increasing integration of these recyclers into comprehensive dental practice management systems. The overarching trend is towards a circular economy approach within the dental industry, where used amalgam is not just disposed of but effectively recycled, recovering valuable materials and minimizing environmental impact. The growing awareness of mercury's detrimental effects on public health and the environment further solidifies the necessity and demand for effective amalgam recycling technologies across the globe.

Dominant Markets & Segments in Amalgam Recycler

The Amalgam Recycler market’s dominance is heavily influenced by a confluence of economic policies, robust healthcare infrastructure, and stringent environmental regulations. Regionally, North America and Europe currently lead the market due to well-established dental care systems, a high prevalence of dental amalgam use, and proactive environmental legislation mandating the responsible disposal and recycling of dental waste. For instance, the United States has seen a significant push towards amalgam separation and recycling, driven by EPA guidelines and state-level initiatives. Similarly, the European Union’s directives on waste management and mercury reduction have fostered a strong demand for advanced recycling solutions across member nations.

Within application segments, the Hospital sector represents a significant and growing market. Hospitals, with their larger patient volumes and more extensive dental departments, generate a considerable amount of amalgam waste, necessitating high-capacity and reliable recycling systems. Government mandates and corporate social responsibility initiatives further encourage hospitals to adopt best practices in waste management, including advanced amalgam recycling.

The Specialty Clinic segment is also a key contributor to market growth. Dental specialists, such as orthodontists and periodontists, while perhaps generating less waste per practice than a general dentist, are increasingly recognizing the importance of specialized amalgam recycling solutions to maintain compliance and environmental stewardship. The increasing number of specialized dental clinics globally further fuels this segment.

The Other application segment, encompassing general dental practices, is the largest volume driver for amalgam recyclers. The sheer number of individual dental practices worldwide means that even smaller-scale recycling solutions contribute significantly to the overall market. Economic policies that incentivize small businesses to adopt sustainable practices, coupled with increasing public demand for eco-conscious healthcare providers, are key drivers here.

In terms of product types, Fixed amalgam recyclers, often integrated into central dental vacuum systems, are prevalent in larger dental facilities and hospitals due to their higher capacity, efficiency, and lower per-unit operating cost. These systems are designed for long-term, high-volume use, offering robust mercury capture and easy maintenance.

Conversely, Portable amalgam recyclers are gaining traction, particularly in smaller dental practices and mobile dental units. Their flexibility, ease of installation, and lower upfront cost make them an attractive option for practices seeking a compliant and manageable solution for their amalgam waste. The development of smaller, more efficient portable units is a key trend driving adoption in this segment. The increasing awareness of mercury's environmental impact and the corresponding regulatory pressure worldwide are the fundamental drivers underpinning the dominance of these segments, pushing for higher adoption rates of amalgam recycling technologies.

Amalgam Recycler Product Developments

Product developments in the Amalgam Recycler market are characterized by a focus on enhanced mercury capture efficiency, user-friendly designs, and greater compliance with evolving environmental standards. Innovations include advanced filtration systems that achieve near-zero mercury emissions, automatic shut-off mechanisms for safety, and compact, space-saving designs suitable for diverse dental environments. Companies like Solmetex and Cattani are at the forefront, offering integrated solutions that simplify the collection, separation, and recycling of amalgam waste, thereby providing significant competitive advantages by reducing operational burdens and ensuring adherence to regulations.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Amalgam Recycler market, segmented by Application and Type. The Application segmentation includes Hospital, Specialty Clinic, and Other (general dental practices), each exhibiting distinct growth drivers and market penetration rates. The Type segmentation covers Portable and Fixed amalgam recyclers, reflecting varying operational needs and installation preferences. Projections for each segment indicate a positive growth trajectory, with competitive dynamics shaped by regional regulations and technological advancements.

Key Drivers of Amalgam Recycler Growth

Several key factors are driving the growth of the Amalgam Recycler market. Firstly, stringent environmental regulations globally, such as the Minamata Convention on Mercury, mandate the reduction and proper management of mercury waste, directly increasing the demand for effective recycling solutions. Secondly, growing environmental awareness among healthcare providers and the public is pushing for sustainable practices in dental waste management. Thirdly, technological advancements in recycling efficiency and mercury containment are making these systems more accessible and effective. Finally, economic incentives and government policies supporting green initiatives can also play a role in accelerating adoption.

Challenges in the Amalgam Recycler Sector

The Amalgam Recycler sector faces several challenges. Regulatory complexities and varying enforcement across different regions can create compliance hurdles for manufacturers and users. High initial investment costs for advanced recycling equipment can be a barrier, especially for smaller dental practices. Supply chain disruptions for essential components can impact production and availability. Furthermore, competition from less sophisticated, albeit cheaper, waste disposal methods that may not meet stringent environmental standards poses a continuous challenge.

Emerging Opportunities in Amalgam Recycler

Emerging opportunities in the Amalgam Recycler market lie in the development of highly automated and integrated recycling systems that minimize manual intervention and maximize mercury recovery. The expansion into emerging economies with rapidly growing dental healthcare sectors presents a significant opportunity for market penetration. Furthermore, the focus on a circular economy is fostering demand for solutions that can not only recycle amalgam but also recover other valuable materials from dental waste. The development of IoT-enabled recyclers for remote monitoring and predictive maintenance also represents a promising avenue.

Leading Players in the Amalgam Recycler Market

- Gentilin

- Simple&Smart

- METASYS Medizintechnik

- Dürr Dental

- Air Techniques

- 4TEK SRL

- MEDICA

- Maguire Refining, Inc

- Waste & Compliance Management, Inc

- Solmetex

- Cattani

- William Green

- Sirona

- Dental Recycling North America

Key Developments in Amalgam Recycler Industry

- 2023: Increased focus on biodegradable amalgam waste containment solutions.

- 2023: Introduction of advanced filtration technologies for improved mercury capture rates.

- 2022: Expansion of portable amalgam recycler offerings to cater to smaller dental clinics.

- 2021: Growing emphasis on integrated waste management systems for dental practices.

- 2020: Enhanced regulatory compliance mandates driving product innovation.

- 2019: Significant advancements in the efficiency of central amalgam separation units.

Strategic Outlook for Amalgam Recycler Market

The strategic outlook for the Amalgam Recycler market is highly positive, driven by an unwavering commitment to environmental sustainability and increasingly stringent global regulations. Future growth will be catalyzed by continued innovation in recycling technology, leading to more efficient, cost-effective, and user-friendly solutions. The expansion into underserved markets and the integration of recyclers into comprehensive dental practice management systems will further fuel market penetration. The shift towards a circular economy model in healthcare waste management presents a significant opportunity for the development of novel recycling processes and resource recovery, solidifying the market's growth trajectory.

Amalgam Recycler Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Specialty Clinic

- 1.3. Other

-

2. Types

- 2.1. Portable

- 2.2. Fixed

Amalgam Recycler Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Amalgam Recycler REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Amalgam Recycler Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Specialty Clinic

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Portable

- 5.2.2. Fixed

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Amalgam Recycler Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Specialty Clinic

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Portable

- 6.2.2. Fixed

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Amalgam Recycler Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Specialty Clinic

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Portable

- 7.2.2. Fixed

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Amalgam Recycler Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Specialty Clinic

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Portable

- 8.2.2. Fixed

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Amalgam Recycler Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Specialty Clinic

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Portable

- 9.2.2. Fixed

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Amalgam Recycler Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Specialty Clinic

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Portable

- 10.2.2. Fixed

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Gentilin

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Simple&Smart

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 METASYS Medizintechnik

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dürr Dental

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Air Techniques

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 4TEK SRL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MEDICA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Maguire Refining

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Waste & Compliance Management

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Solmetex

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Cattani

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 William Green

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sirona

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Dental Recycling North America

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Gentilin

List of Figures

- Figure 1: Global Amalgam Recycler Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Amalgam Recycler Revenue (million), by Application 2024 & 2032

- Figure 3: North America Amalgam Recycler Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Amalgam Recycler Revenue (million), by Types 2024 & 2032

- Figure 5: North America Amalgam Recycler Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Amalgam Recycler Revenue (million), by Country 2024 & 2032

- Figure 7: North America Amalgam Recycler Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Amalgam Recycler Revenue (million), by Application 2024 & 2032

- Figure 9: South America Amalgam Recycler Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Amalgam Recycler Revenue (million), by Types 2024 & 2032

- Figure 11: South America Amalgam Recycler Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Amalgam Recycler Revenue (million), by Country 2024 & 2032

- Figure 13: South America Amalgam Recycler Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Amalgam Recycler Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Amalgam Recycler Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Amalgam Recycler Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Amalgam Recycler Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Amalgam Recycler Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Amalgam Recycler Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Amalgam Recycler Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Amalgam Recycler Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Amalgam Recycler Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Amalgam Recycler Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Amalgam Recycler Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Amalgam Recycler Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Amalgam Recycler Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Amalgam Recycler Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Amalgam Recycler Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Amalgam Recycler Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Amalgam Recycler Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Amalgam Recycler Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Amalgam Recycler Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Amalgam Recycler Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Amalgam Recycler Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Amalgam Recycler Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Amalgam Recycler Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Amalgam Recycler Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Amalgam Recycler Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Amalgam Recycler Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Amalgam Recycler Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Amalgam Recycler Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Amalgam Recycler Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Amalgam Recycler Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Amalgam Recycler Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Amalgam Recycler Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Amalgam Recycler Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Amalgam Recycler Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Amalgam Recycler Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Amalgam Recycler Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Amalgam Recycler Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Amalgam Recycler Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Amalgam Recycler?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Amalgam Recycler?

Key companies in the market include Gentilin, Simple&Smart, METASYS Medizintechnik, Dürr Dental, Air Techniques, 4TEK SRL, MEDICA, Maguire Refining, Inc, Waste & Compliance Management, Inc, Solmetex, Cattani, William Green, Sirona, Dental Recycling North America.

3. What are the main segments of the Amalgam Recycler?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Amalgam Recycler," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Amalgam Recycler report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Amalgam Recycler?

To stay informed about further developments, trends, and reports in the Amalgam Recycler, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence