Key Insights

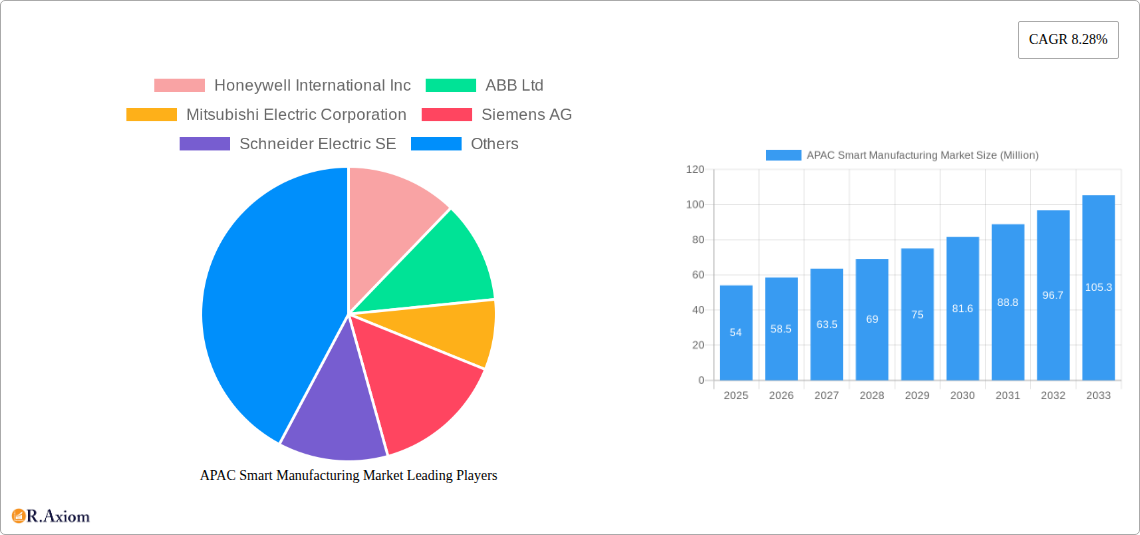

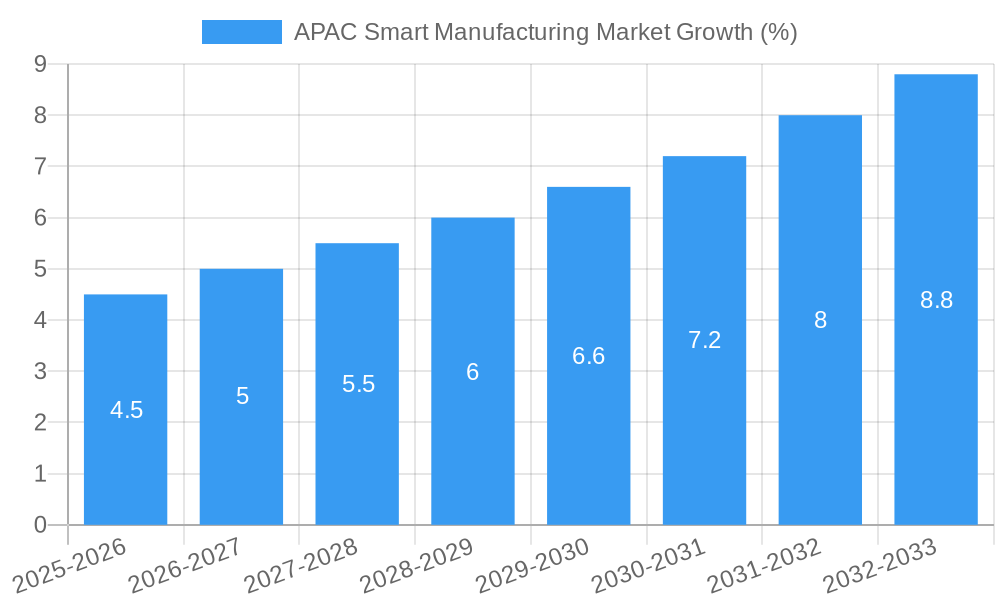

The Asia-Pacific (APAC) smart manufacturing market, valued at $54.00 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.28% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the increasing adoption of Industry 4.0 technologies across diverse sectors like automotive, semiconductors, and oil & gas is significantly boosting demand for smart manufacturing solutions. Automation, driven by industrial robotics and advanced manufacturing execution systems (MES), is streamlining production processes, improving efficiency, and reducing operational costs. Furthermore, the growing need for real-time data analysis and predictive maintenance through cloud platforms and analytics is enhancing operational visibility and optimizing resource allocation. Government initiatives promoting digitalization and automation in manufacturing across the region, particularly in countries like China, Japan, and India, are also propelling market growth. However, challenges remain, including the high initial investment costs associated with implementing smart manufacturing technologies, cybersecurity concerns related to interconnected systems, and the need for skilled workforce development to manage and maintain these advanced systems.

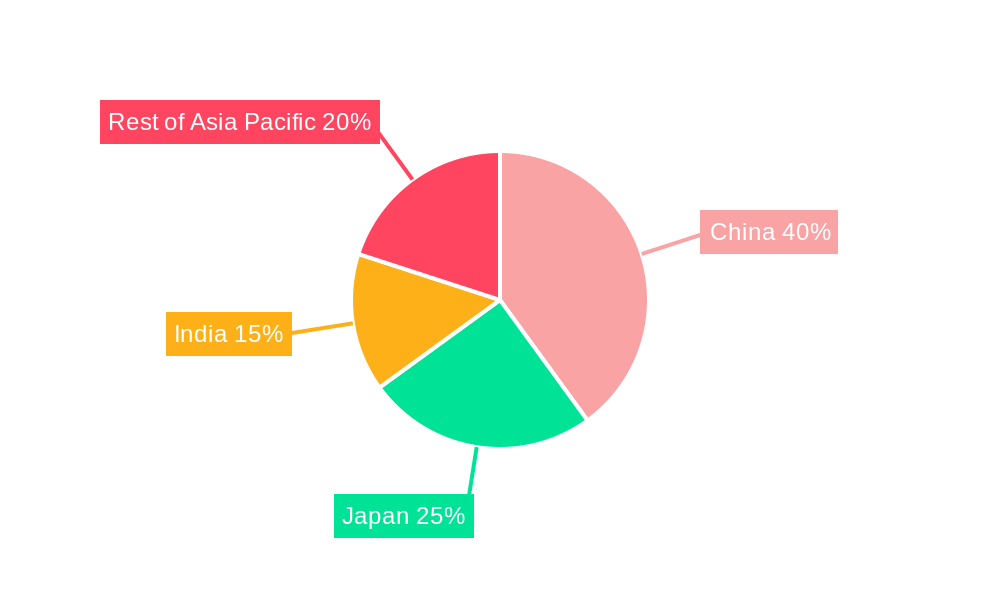

Despite these restraints, the market's growth trajectory remains positive. The segmental breakdown reveals a strong contribution from enabling technologies such as industrial control systems, machine vision, and industrial robotics. The automotive and semiconductor industries are major end-user segments, driving significant demand. Considering the substantial investments in infrastructure development and technological advancements across APAC, the market is expected to witness continuous expansion throughout the forecast period. The continued emphasis on improving productivity, reducing waste, and enhancing product quality will drive further adoption of smart manufacturing technologies in various industries, ensuring sustained market growth in the coming years. China, Japan, and India, as major manufacturing hubs, are expected to be key contributors to this regional expansion.

APAC Smart Manufacturing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific (APAC) smart manufacturing market, covering the period 2019-2033. It offers actionable insights for stakeholders, including manufacturers, investors, and policymakers, by examining market trends, key players, and future growth opportunities. The report leverages extensive data analysis to forecast market size and growth, identify dominant segments, and assess the competitive landscape. This analysis incorporates crucial data points like CAGR, market penetration, and M&A deal values. The study period is 2019-2033, with 2025 as the base and estimated year, and 2025-2033 as the forecast period.

APAC Smart Manufacturing Market Concentration & Innovation

The APAC smart manufacturing market is characterized by a moderately concentrated landscape, with several global giants and regional players vying for market share. Key players, including Honeywell International Inc, ABB Ltd, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Fanuc Corporation, Robert Bosch GmbH, Cisco Systems Inc, Rockwell Automation Inc, Yokogawa Electric Corporation, and Emerson Electric Company, hold significant market share, driving innovation through continuous product development and strategic partnerships. However, the market also witnesses the emergence of numerous smaller companies, specializing in niche technologies, contributing to overall market dynamism.

Market concentration is further influenced by factors such as:

- Mergers and Acquisitions (M&A) activity: While precise M&A deal values for the APAC smart manufacturing sector aren't readily available for this report, it is evident that considerable consolidation is occurring, with larger companies acquiring smaller specialized firms to expand their product portfolios and market reach. xx Million in M&A deals are predicted for 2025.

- Regulatory frameworks: Government policies promoting industrial automation and digitalization are boosting market growth, though varying regulatory landscapes across APAC nations can present both opportunities and challenges.

- Innovation drivers: The push for increased efficiency, productivity, and sustainability is fostering innovation in areas such as AI-powered industrial robotics, advanced analytics, and cybersecurity solutions.

- Product substitutes: Although direct substitutes are limited, cost-effective alternatives or legacy systems can impact the adoption rate of specific smart manufacturing technologies.

- End-user trends: The increasing adoption of Industry 4.0 principles across various end-user industries is significantly influencing market expansion.

APAC Smart Manufacturing Market Industry Trends & Insights

The APAC smart manufacturing market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%. This growth is fueled by:

- Technological disruptions: The rapid advancement of technologies such as AI, machine learning, IoT, and cloud computing is revolutionizing manufacturing processes, boosting efficiency, and improving product quality. Market penetration of AI in manufacturing is projected to reach xx% by 2033.

- Government initiatives: Many APAC governments are actively promoting industrial automation and digitalization through various incentive schemes and policy support, further accelerating market growth.

- Consumer preferences: Increasing consumer demand for customized products and faster delivery times is pushing manufacturers towards flexible and agile production models enabled by smart manufacturing technologies.

- Competitive dynamics: The presence of both established players and innovative startups fosters healthy competition, driving innovation and price optimization within the APAC smart manufacturing market. This creates a dynamic environment with both challenges and opportunities for all participants.

- Rising labor costs: In many APAC countries, rising labor costs encourage companies to automate processes to reduce operational expenses.

Dominant Markets & Segments in APAC Smart Manufacturing Market

While the entire APAC region shows promising growth, China and other rapidly developing economies demonstrate particularly strong dominance due to their extensive manufacturing sectors and proactive government support. Within the enabling technologies segment, Industrial Robotics and Industrial Control Systems currently hold the largest market share. The Automotive and Semiconductor sectors are the leading end-user industries.

Key Drivers for Dominant Segments:

- Industrial Robotics: High automation needs in automotive and electronics manufacturing fuel strong demand.

- Industrial Control Systems: Critical infrastructure for automated production processes, ensuring consistent growth.

- Automotive: Large-scale production volumes and a push for automation drive significant demand.

- Semiconductor: The need for precision and high-throughput manufacturing necessitates advanced technologies.

Detailed Dominance Analysis:

China's robust manufacturing base, coupled with significant government investments in smart manufacturing initiatives, positions it as the leading market. The country’s economic policies encouraging automation and technological upgrades contribute significantly to the segment's rapid growth. Other countries like South Korea, Japan, and Singapore follow suit with significant investments in smart manufacturing technologies. These countries' superior infrastructure and skilled workforce also play crucial roles.

APAC Smart Manufacturing Market Product Developments

Recent years have witnessed significant product innovations, focusing on enhancing efficiency, connectivity, and data analytics capabilities. The integration of AI and machine learning into industrial robots, MES systems, and machine vision systems is a prominent trend, improving process optimization, predictive maintenance, and quality control. Cloud-based platforms are gaining popularity due to their scalability and accessibility, enabling manufacturers to better manage and analyze data from diverse sources. Furthermore, the increasing emphasis on cybersecurity is prompting the development of more robust and sophisticated security solutions specifically tailored for industrial environments.

Report Scope & Segmentation Analysis

This report segments the APAC smart manufacturing market based on enabling technologies and end-user industries. Each segment's market size, growth projections, and competitive landscape are analyzed.

Enabling Technologies: Industrial Control Systems, Manufacturing Execution System (MES), Industrial Robotics, Machine Vision Systems, Cloud, Analytics and Platforms, Cybersecurity, Sensors & Transmitters, Connectivity/Communication, Other Field, Control and Safety Solutions each represent unique market opportunities with varied growth rates depending on technological advancements and end-user industry needs.

End-user Industries: Automotive, Semiconductor, Oil and Gas, Chemical and Petrochemical, Pharmaceutical, Aerospace and Defense, Food and Beverages, and Other End-user Industries all present distinct market dynamics and levels of smart manufacturing adoption based on the industry's unique requirements and technological maturity.

Key Drivers of APAC Smart Manufacturing Market Growth

The APAC smart manufacturing market is propelled by a convergence of factors:

- Technological advancements: AI, IoT, and cloud computing are transforming manufacturing processes.

- Government support: Various initiatives across the region incentivize smart manufacturing adoption.

- Rising labor costs: Automation is increasingly attractive as labor costs increase.

- Increased demand for customized products: Smart manufacturing enables flexible production to meet diverse needs.

Challenges in the APAC Smart Manufacturing Market Sector

Despite its growth potential, the APAC smart manufacturing market faces several challenges:

- High initial investment costs: Implementing smart manufacturing technologies can be expensive, particularly for smaller businesses.

- Data security and privacy concerns: The increasing reliance on data raises security risks.

- Lack of skilled workforce: A shortage of personnel with the necessary expertise can hinder adoption.

- Integration complexities: Integrating different systems and technologies can be challenging.

Emerging Opportunities in APAC Smart Manufacturing Market

Significant opportunities exist in areas such as:

- Edge computing: Processing data closer to the source for faster insights and reduced latency.

- Digital twin technology: Creating virtual representations of physical assets for enhanced simulation and optimization.

- Sustainable manufacturing: Adopting smart technologies to minimize environmental impact.

- Expansion into smaller and medium-sized enterprises (SMEs): Providing affordable and accessible smart manufacturing solutions to a wider range of businesses.

Leading Players in the APAC Smart Manufacturing Market Market

- Honeywell International Inc

- ABB Ltd

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Fanuc Corporation

- Robert Bosch GmbH

- Cisco Systems Inc

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- Emerson Electric Company

Key Developments in APAC Smart Manufacturing Market Industry

- November 2022: ABB opened its first smart instrumentation plant in Bangalore, expanding its manufacturing capacity in the region.

- January 2022: Honeywell partnered with Navin Fluorine International Limited to manufacture eco-friendly refrigerants in India, strengthening its presence in the region.

Strategic Outlook for APAC Smart Manufacturing Market Market

The APAC smart manufacturing market is poised for sustained growth, driven by ongoing technological advancements, supportive government policies, and increasing industry demand for efficiency and flexibility. The focus on digital transformation and sustainability will continue to shape market dynamics, creating ample opportunities for both established players and emerging innovators. The market's future potential hinges on addressing challenges related to infrastructure development, talent acquisition, and data security, ensuring a secure and scalable environment for technological integration and adoption across diverse industries.

APAC Smart Manufacturing Market Segmentation

-

1. Enabling Technologies

-

1.1. Industrial Control Systems

- 1.1.1. Programmable Logic Controller (PLC)

- 1.1.2. Supervis

- 1.1.3. Distributed Control System (DCS)

- 1.1.4. Human Machine Interface (HMI)

- 1.1.5. Product Lifecycle Management (PLM)

- 1.1.6. Manufacturing Execution System (MES)

- 1.2. Industrial Robotics

- 1.3. Machine Vision Systems

- 1.4. Cloud, Analytics and Platforms

- 1.5. Cybersecurity

- 1.6. Sensors & Transmitters

- 1.7. Connectivity/Communication

- 1.8. Other Field, Control and Safety Solutions

-

1.1. Industrial Control Systems

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Semiconductor

- 2.3. Oil and Gas

- 2.4. Chemical and Petrochemical

- 2.5. Pharmaceutical

- 2.6. Aerospace and Defense

- 2.7. Food and Beverages

- 2.8. Other End-user Industries

APAC Smart Manufacturing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Smart Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Diversification Strategies being Adopted by the Manufacturing Companies; Initiatives Undertaken by the Government to Increase Growth in Manufacturing Sector

- 3.3. Market Restrains

- 3.3.1. Relatively High Deployment Costs; Complex Design compared to Traditional Sensors

- 3.4. Market Trends

- 3.4.1. Oil and Gas is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Smart Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 5.1.1. Industrial Control Systems

- 5.1.1.1. Programmable Logic Controller (PLC)

- 5.1.1.2. Supervis

- 5.1.1.3. Distributed Control System (DCS)

- 5.1.1.4. Human Machine Interface (HMI)

- 5.1.1.5. Product Lifecycle Management (PLM)

- 5.1.1.6. Manufacturing Execution System (MES)

- 5.1.2. Industrial Robotics

- 5.1.3. Machine Vision Systems

- 5.1.4. Cloud, Analytics and Platforms

- 5.1.5. Cybersecurity

- 5.1.6. Sensors & Transmitters

- 5.1.7. Connectivity/Communication

- 5.1.8. Other Field, Control and Safety Solutions

- 5.1.1. Industrial Control Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Semiconductor

- 5.2.3. Oil and Gas

- 5.2.4. Chemical and Petrochemical

- 5.2.5. Pharmaceutical

- 5.2.6. Aerospace and Defense

- 5.2.7. Food and Beverages

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 6. North America APAC Smart Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 6.1.1. Industrial Control Systems

- 6.1.1.1. Programmable Logic Controller (PLC)

- 6.1.1.2. Supervis

- 6.1.1.3. Distributed Control System (DCS)

- 6.1.1.4. Human Machine Interface (HMI)

- 6.1.1.5. Product Lifecycle Management (PLM)

- 6.1.1.6. Manufacturing Execution System (MES)

- 6.1.2. Industrial Robotics

- 6.1.3. Machine Vision Systems

- 6.1.4. Cloud, Analytics and Platforms

- 6.1.5. Cybersecurity

- 6.1.6. Sensors & Transmitters

- 6.1.7. Connectivity/Communication

- 6.1.8. Other Field, Control and Safety Solutions

- 6.1.1. Industrial Control Systems

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Semiconductor

- 6.2.3. Oil and Gas

- 6.2.4. Chemical and Petrochemical

- 6.2.5. Pharmaceutical

- 6.2.6. Aerospace and Defense

- 6.2.7. Food and Beverages

- 6.2.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 7. South America APAC Smart Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 7.1.1. Industrial Control Systems

- 7.1.1.1. Programmable Logic Controller (PLC)

- 7.1.1.2. Supervis

- 7.1.1.3. Distributed Control System (DCS)

- 7.1.1.4. Human Machine Interface (HMI)

- 7.1.1.5. Product Lifecycle Management (PLM)

- 7.1.1.6. Manufacturing Execution System (MES)

- 7.1.2. Industrial Robotics

- 7.1.3. Machine Vision Systems

- 7.1.4. Cloud, Analytics and Platforms

- 7.1.5. Cybersecurity

- 7.1.6. Sensors & Transmitters

- 7.1.7. Connectivity/Communication

- 7.1.8. Other Field, Control and Safety Solutions

- 7.1.1. Industrial Control Systems

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Semiconductor

- 7.2.3. Oil and Gas

- 7.2.4. Chemical and Petrochemical

- 7.2.5. Pharmaceutical

- 7.2.6. Aerospace and Defense

- 7.2.7. Food and Beverages

- 7.2.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 8. Europe APAC Smart Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 8.1.1. Industrial Control Systems

- 8.1.1.1. Programmable Logic Controller (PLC)

- 8.1.1.2. Supervis

- 8.1.1.3. Distributed Control System (DCS)

- 8.1.1.4. Human Machine Interface (HMI)

- 8.1.1.5. Product Lifecycle Management (PLM)

- 8.1.1.6. Manufacturing Execution System (MES)

- 8.1.2. Industrial Robotics

- 8.1.3. Machine Vision Systems

- 8.1.4. Cloud, Analytics and Platforms

- 8.1.5. Cybersecurity

- 8.1.6. Sensors & Transmitters

- 8.1.7. Connectivity/Communication

- 8.1.8. Other Field, Control and Safety Solutions

- 8.1.1. Industrial Control Systems

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Semiconductor

- 8.2.3. Oil and Gas

- 8.2.4. Chemical and Petrochemical

- 8.2.5. Pharmaceutical

- 8.2.6. Aerospace and Defense

- 8.2.7. Food and Beverages

- 8.2.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 9. Middle East & Africa APAC Smart Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 9.1.1. Industrial Control Systems

- 9.1.1.1. Programmable Logic Controller (PLC)

- 9.1.1.2. Supervis

- 9.1.1.3. Distributed Control System (DCS)

- 9.1.1.4. Human Machine Interface (HMI)

- 9.1.1.5. Product Lifecycle Management (PLM)

- 9.1.1.6. Manufacturing Execution System (MES)

- 9.1.2. Industrial Robotics

- 9.1.3. Machine Vision Systems

- 9.1.4. Cloud, Analytics and Platforms

- 9.1.5. Cybersecurity

- 9.1.6. Sensors & Transmitters

- 9.1.7. Connectivity/Communication

- 9.1.8. Other Field, Control and Safety Solutions

- 9.1.1. Industrial Control Systems

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Semiconductor

- 9.2.3. Oil and Gas

- 9.2.4. Chemical and Petrochemical

- 9.2.5. Pharmaceutical

- 9.2.6. Aerospace and Defense

- 9.2.7. Food and Beverages

- 9.2.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 10. Asia Pacific APAC Smart Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 10.1.1. Industrial Control Systems

- 10.1.1.1. Programmable Logic Controller (PLC)

- 10.1.1.2. Supervis

- 10.1.1.3. Distributed Control System (DCS)

- 10.1.1.4. Human Machine Interface (HMI)

- 10.1.1.5. Product Lifecycle Management (PLM)

- 10.1.1.6. Manufacturing Execution System (MES)

- 10.1.2. Industrial Robotics

- 10.1.3. Machine Vision Systems

- 10.1.4. Cloud, Analytics and Platforms

- 10.1.5. Cybersecurity

- 10.1.6. Sensors & Transmitters

- 10.1.7. Connectivity/Communication

- 10.1.8. Other Field, Control and Safety Solutions

- 10.1.1. Industrial Control Systems

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Semiconductor

- 10.2.3. Oil and Gas

- 10.2.4. Chemical and Petrochemical

- 10.2.5. Pharmaceutical

- 10.2.6. Aerospace and Defense

- 10.2.7. Food and Beverages

- 10.2.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Enabling Technologies

- 11. China APAC Smart Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan APAC Smart Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 13. India APAC Smart Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Asia Pacific APAC Smart Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Honeywell International Inc

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 ABB Ltd

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Mitsubishi Electric Corporation

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Siemens AG

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Schneider Electric SE

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Fanuc Corporation

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Robert Bosch GmbH

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Cisco Systems Inc

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Rockwell Automation Inc

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Yokogawa Electric Corporation

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Emerson Electric Company

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global APAC Smart Manufacturing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific APAC Smart Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific APAC Smart Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America APAC Smart Manufacturing Market Revenue (Million), by Enabling Technologies 2024 & 2032

- Figure 5: North America APAC Smart Manufacturing Market Revenue Share (%), by Enabling Technologies 2024 & 2032

- Figure 6: North America APAC Smart Manufacturing Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 7: North America APAC Smart Manufacturing Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 8: North America APAC Smart Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America APAC Smart Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America APAC Smart Manufacturing Market Revenue (Million), by Enabling Technologies 2024 & 2032

- Figure 11: South America APAC Smart Manufacturing Market Revenue Share (%), by Enabling Technologies 2024 & 2032

- Figure 12: South America APAC Smart Manufacturing Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: South America APAC Smart Manufacturing Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: South America APAC Smart Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 15: South America APAC Smart Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe APAC Smart Manufacturing Market Revenue (Million), by Enabling Technologies 2024 & 2032

- Figure 17: Europe APAC Smart Manufacturing Market Revenue Share (%), by Enabling Technologies 2024 & 2032

- Figure 18: Europe APAC Smart Manufacturing Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: Europe APAC Smart Manufacturing Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: Europe APAC Smart Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe APAC Smart Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa APAC Smart Manufacturing Market Revenue (Million), by Enabling Technologies 2024 & 2032

- Figure 23: Middle East & Africa APAC Smart Manufacturing Market Revenue Share (%), by Enabling Technologies 2024 & 2032

- Figure 24: Middle East & Africa APAC Smart Manufacturing Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Middle East & Africa APAC Smart Manufacturing Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Middle East & Africa APAC Smart Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa APAC Smart Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific APAC Smart Manufacturing Market Revenue (Million), by Enabling Technologies 2024 & 2032

- Figure 29: Asia Pacific APAC Smart Manufacturing Market Revenue Share (%), by Enabling Technologies 2024 & 2032

- Figure 30: Asia Pacific APAC Smart Manufacturing Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Asia Pacific APAC Smart Manufacturing Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Asia Pacific APAC Smart Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific APAC Smart Manufacturing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Smart Manufacturing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Smart Manufacturing Market Revenue Million Forecast, by Enabling Technologies 2019 & 2032

- Table 3: Global APAC Smart Manufacturing Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global APAC Smart Manufacturing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global APAC Smart Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of Asia Pacific APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global APAC Smart Manufacturing Market Revenue Million Forecast, by Enabling Technologies 2019 & 2032

- Table 11: Global APAC Smart Manufacturing Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: Global APAC Smart Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global APAC Smart Manufacturing Market Revenue Million Forecast, by Enabling Technologies 2019 & 2032

- Table 17: Global APAC Smart Manufacturing Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Global APAC Smart Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global APAC Smart Manufacturing Market Revenue Million Forecast, by Enabling Technologies 2019 & 2032

- Table 23: Global APAC Smart Manufacturing Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Global APAC Smart Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global APAC Smart Manufacturing Market Revenue Million Forecast, by Enabling Technologies 2019 & 2032

- Table 35: Global APAC Smart Manufacturing Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 36: Global APAC Smart Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global APAC Smart Manufacturing Market Revenue Million Forecast, by Enabling Technologies 2019 & 2032

- Table 44: Global APAC Smart Manufacturing Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 45: Global APAC Smart Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: China APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: ASEAN APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Oceania APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Asia Pacific APAC Smart Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Smart Manufacturing Market?

The projected CAGR is approximately 8.28%.

2. Which companies are prominent players in the APAC Smart Manufacturing Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Fanuc Corporation, Robert Bosch GmbH, Cisco Systems Inc , Rockwell Automation Inc, Yokogawa Electric Corporation, Emerson Electric Company.

3. What are the main segments of the APAC Smart Manufacturing Market?

The market segments include Enabling Technologies, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Diversification Strategies being Adopted by the Manufacturing Companies; Initiatives Undertaken by the Government to Increase Growth in Manufacturing Sector.

6. What are the notable trends driving market growth?

Oil and Gas is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Relatively High Deployment Costs; Complex Design compared to Traditional Sensors.

8. Can you provide examples of recent developments in the market?

November 2022: ABB announced the opening of its first smart instrumentation plant in Bangalore to support the region's ambition of transforming into a global design and manufacturing hub. Moreover, the new building will manufacture field instruments such as pressure and temperature transmitters, IP converters, and electromagnetic flowmeters for various industries, including power, oil and gas, pharmaceutical, water, and other segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Smart Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Smart Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Smart Manufacturing Market?

To stay informed about further developments, trends, and reports in the APAC Smart Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence