Key Insights

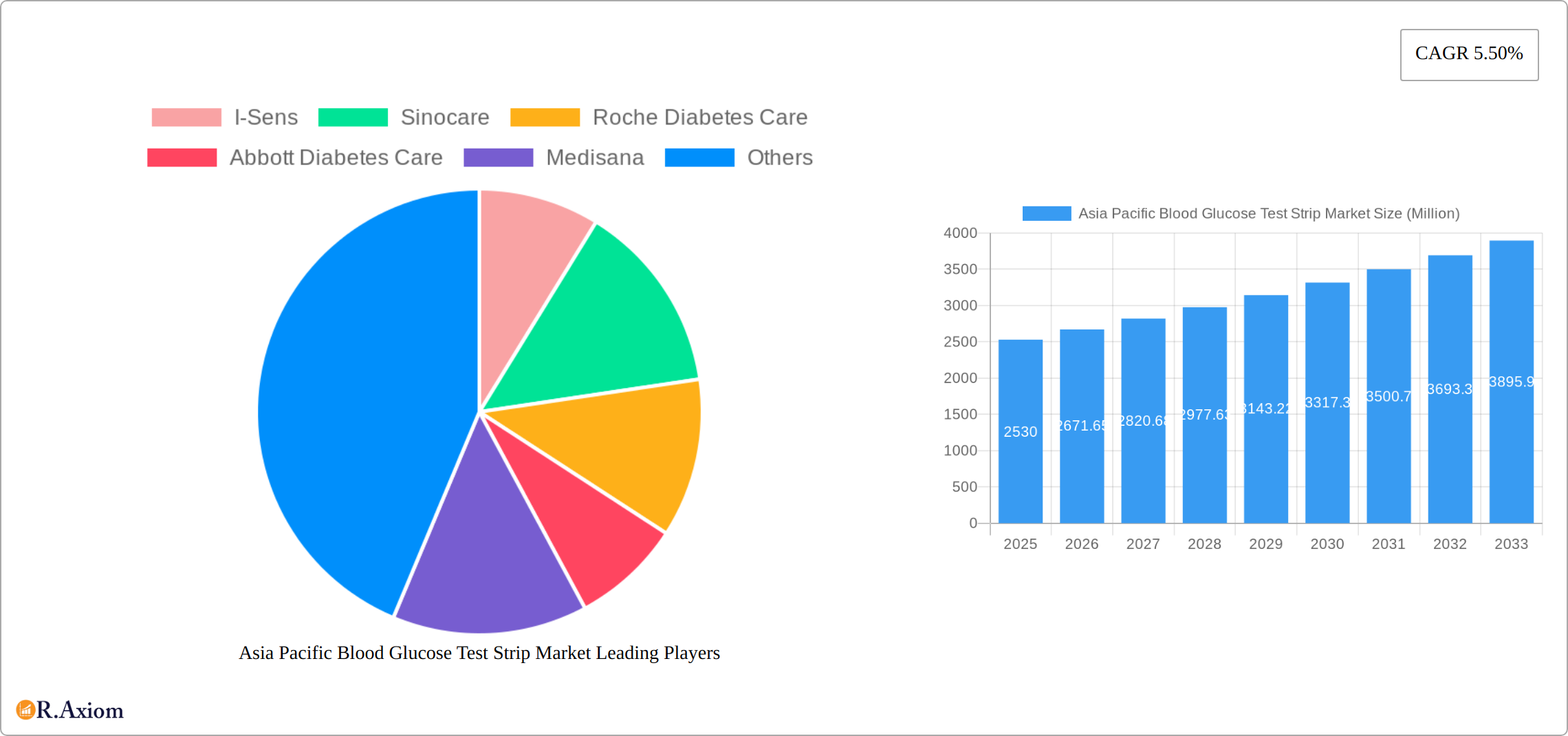

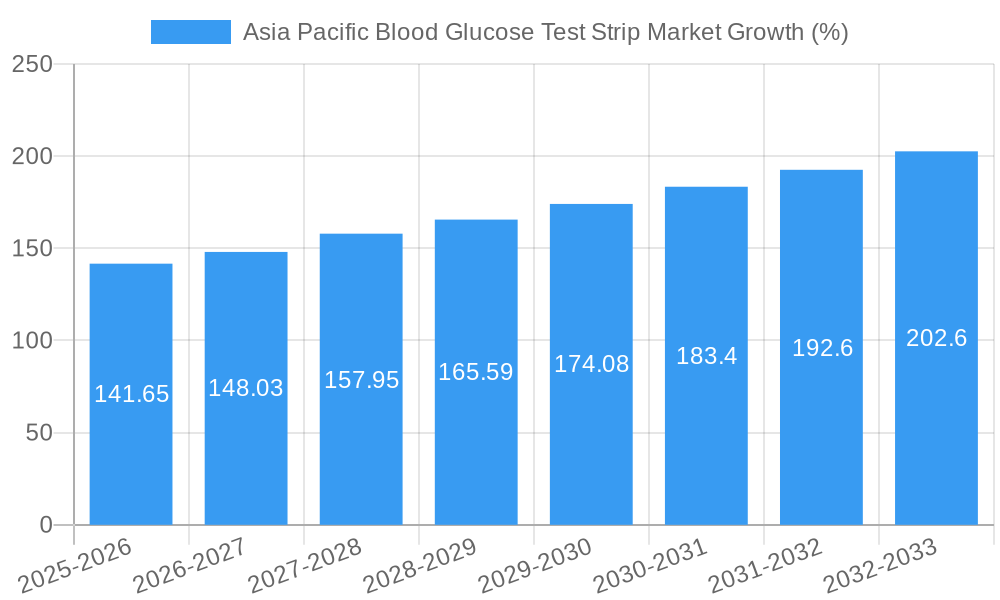

The Asia-Pacific blood glucose test strip market, valued at $2.53 billion in 2025, is projected to experience robust growth, driven by rising diabetes prevalence, particularly in countries like China, India, and Japan. The increasing geriatric population within the region significantly contributes to this demand, as older individuals are more susceptible to diabetes and require regular blood glucose monitoring. Furthermore, the rising adoption of home-based self-monitoring, facilitated by affordable and user-friendly glucometers and test strips, fuels market expansion. Technological advancements leading to more accurate, convenient, and less invasive testing methods also contribute to growth. The market segmentation reveals a significant share held by test strips, reflecting the consumable nature of these products compared to the glucometers themselves. While hospital and clinic purchases represent a substantial segment, the home/personal use segment is experiencing the fastest growth rate, indicative of increasing awareness and proactive diabetes management among individuals. Competition is fierce, with major players like Roche, Abbott, and I-Sens vying for market share, alongside numerous regional players catering to specific market needs. Growth is expected to be propelled by government initiatives aimed at improving diabetes care, increased public awareness campaigns, and expanding access to affordable healthcare.

However, challenges remain. Price sensitivity among consumers, particularly in developing economies, can impact sales. The potential for substitute technologies, such as continuous glucose monitors (CGMs), though currently expensive, represents a long-term threat to the market. Stringent regulatory requirements for medical devices can also impede market entry for new players. Despite these constraints, the Asia-Pacific blood glucose test strip market exhibits a positive outlook, projected to maintain a Compound Annual Growth Rate (CAGR) of 5.50% throughout the forecast period (2025-2033), driven primarily by increasing diabetes prevalence and improving healthcare infrastructure across the region. The market is predicted to see considerable expansion in the next decade, fueled by the aforementioned factors and creating significant opportunities for established and emerging players alike.

This comprehensive report provides an in-depth analysis of the Asia Pacific blood glucose test strip market, offering valuable insights for industry stakeholders, investors, and market entrants. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and forecast period 2025-2033. It analyzes market dynamics, including market size, growth drivers, challenges, opportunities, and competitive landscape. The report meticulously segments the market by components (Glucometer Devices, Test Strips, Lancets) and end-users (Hospital/Clinics, Home/Personal), providing a granular understanding of the market's structure and evolution.

Asia Pacific Blood Glucose Test Strip Market Concentration & Innovation

The Asia Pacific blood glucose test strip market exhibits a moderately concentrated structure, with key players like I-Sens, Sinocare, Roche Diabetes Care, Abbott Diabetes Care, Medisana, Morpen Laboratories, Acon, Rossmax International, Dr Trust, Bionime Corporation, Arkray, LifeScan, and Ascensia Diabetes Care holding significant market share. The exact market share for each company is being analyzed and will be detailed in the full report but an estimated xx% is accounted for by the top 7 players. Innovation in the market is driven by factors such as the increasing prevalence of diabetes, technological advancements (like non-invasive monitoring and connected devices), and stringent regulatory frameworks pushing for improved accuracy and usability.

Mergers and acquisitions (M&A) activity has been relatively modest, with deal values averaging approximately xx Million in recent years. However, the increasing demand for advanced technologies is expected to drive further consolidation in the market. Product substitutes, such as continuous glucose monitoring (CGM) systems, are emerging and present both challenges and opportunities for traditional test strip manufacturers. End-user trends are shifting towards home-based testing due to convenience and cost-effectiveness, influencing product development and market segmentation.

Asia Pacific Blood Glucose Test Strip Market Industry Trends & Insights

The Asia Pacific blood glucose test strip market is experiencing significant growth, driven by a rising prevalence of diabetes, increasing awareness about diabetes management, and expanding healthcare infrastructure, particularly in emerging economies. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%. Technological advancements, including the development of more accurate, user-friendly, and connected devices, are further fueling market expansion. Consumer preferences are shifting towards smaller, more discreet devices with improved data management capabilities. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants offering innovative products and services. Market penetration is high in developed countries within the region, but considerable untapped potential exists in many developing markets.

Dominant Markets & Segments in Asia Pacific Blood Glucose Test Strip Market

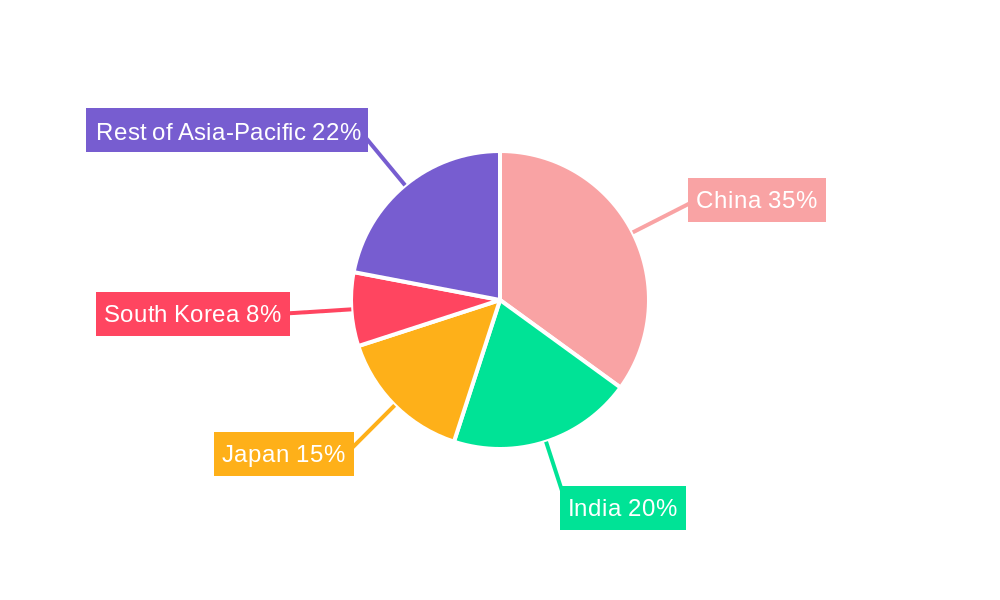

Leading Region: India currently holds a significant share of the Asia Pacific blood glucose test strip market. This dominance is attributed to a multitude of factors including the alarmingly high prevalence of diabetes, a rapidly expanding healthcare infrastructure undergoing modernization, and robust government initiatives focused on diabetes management and prevention. China is a close second, exhibiting similar growth drivers.

Leading Country: India exhibits the highest market share within the Asia-Pacific region, driven by its substantial diabetic population – one of the largest globally – and a considerable increase in healthcare spending, particularly in the realm of chronic disease management. This growth is further fueled by rising disposable incomes and increased health insurance penetration.

Dominant Components Segment: Test strips constitute the largest segment, commanding approximately 70% of the market. This dominance stems from their indispensable role in conjunction with blood glucose monitoring devices, making them a consistently high-demand component within the diabetes care ecosystem.

Dominant End-User Segment: The home/personal care segment is the primary driver of market growth, as self-monitoring of blood glucose is an integral part of daily diabetes management for millions of individuals. This segment is further bolstered by increasing awareness campaigns promoting self-care and proactive health management.

Key drivers for dominance include:

- Economic factors: Rising disposable incomes, coupled with increasing health insurance coverage and accessibility, are empowering individuals to invest in better healthcare solutions, including blood glucose monitoring.

- Government initiatives: National and regional government programs focused on diabetes awareness, prevention, and management are significantly impacting market growth by fostering early detection and encouraging regular blood glucose monitoring. These programs often include subsidies and educational campaigns.

- Healthcare infrastructure: Significant investments in healthcare infrastructure are not only improving access to testing facilities but also expanding the reach of specialized diabetes care centers and enhancing the overall quality of care.

Asia Pacific Blood Glucose Test Strip Market Product Developments

Recent product innovations focus on enhanced accuracy, user-friendliness, and connectivity features. Many manufacturers are integrating Bluetooth capabilities into their devices to allow seamless data transfer to mobile apps and cloud platforms. This allows for remote patient monitoring and personalized diabetes management. The market is also seeing a rise in the development of self-monitoring devices and glucometers that provide actionable insights. These innovations are enhancing market fit by catering to consumer demand for convenient and efficient blood glucose monitoring solutions.

Report Scope & Segmentation Analysis

The report segments the Asia Pacific blood glucose test strip market by:

Components:

Glucometer Devices: This segment is expected to witness significant growth due to ongoing technological advancements and increasing demand for advanced features. Market size projections and competitive dynamics will be detailed in the full report.

Test Strips: This segment holds the largest market share, driven by regular use and high consumption among diabetic patients. Growth projections will be provided in the complete report.

Lancets: This segment is projected to register moderate growth, primarily driven by the increased use of blood glucose meters. Competitive dynamics and market size are fully detailed in the complete report.

End-User:

Hospital/Clinics: This segment is expected to witness stable growth due to its steady demand in healthcare settings. Market size predictions and competitive analysis are provided in the full report.

Home/Personal: This segment exhibits high growth, reflecting the increasing preference for home-based diabetes management. Growth projections and competitive landscapes are thoroughly analyzed in the full report.

Key Drivers of Asia Pacific Blood Glucose Test Strip Market Growth

The market's robust growth trajectory is fueled by several key factors:

Rising prevalence of diabetes: The escalating incidence of diabetes across the Asia-Pacific region is a paramount driver. This increase is attributed to factors such as lifestyle changes, urbanization, and a growing aging population.

Technological advancements: Continuous innovation in glucometer devices, test strips, and related technologies is enhancing accuracy, convenience, and user experience, thereby broadening market appeal and increasing adoption rates.

Government initiatives: Government policies aimed at improving diabetes care and affordability are accelerating market expansion by creating a favorable regulatory environment and incentivizing wider adoption.

Increased healthcare spending: Growing healthcare expenditure, both public and private, is directly translating into improved access to diagnostic tools and diabetes management resources.

Challenges in the Asia Pacific Blood Glucose Test Strip Market Sector

The market faces certain challenges:

Stringent regulatory approvals: Navigating complex regulatory processes can delay product launches.

Price competition: Intense competition among numerous players puts pressure on pricing.

Supply chain disruptions: Geopolitical factors and logistical issues can impact the availability of raw materials.

Emerging Opportunities in Asia Pacific Blood Glucose Test Strip Market

Non-invasive glucose monitoring: The development of non-invasive technologies holds immense potential for growth.

Integration with digital health platforms: Combining blood glucose monitoring with telehealth platforms enhances patient care.

Expansion into rural markets: Reaching underserved populations in rural areas presents a significant opportunity.

Leading Players in the Asia Pacific Blood Glucose Test Strip Market Market

- I-Sens

- Sinocare

- Roche Diabetes Care

- Abbott Diabetes Care

- Medisana

- Morpen Laboratories

- Acon

- Rossmax International

- Dr Trust

- Bionime Corporation

- Arkray

- LifeScan

- Ascensia Diabetes Care

- Other Company Share Analysis (details to be provided in full report)

Key Developments in Asia Pacific Blood Glucose Test Strip Market Industry

January 2023: LifeScan's publication of real-world data showcasing the enhanced glycemic control achieved through the combined use of its blood glucose meter and a mobile diabetes management app underscores the growing market trend towards connected and data-driven diabetes management solutions.

March 2022: Quantum Operation Inc.'s unveiling of a non-invasive continuous glucose monitor represents a potential paradigm shift, signaling a future where less-invasive and more convenient monitoring technologies could significantly reshape the market landscape. This highlights the potential for future innovation and disruption.

[Add another recent development here with date and a brief description]

Strategic Outlook for Asia Pacific Blood Glucose Test Strip Market Market

The Asia Pacific blood glucose test strip market is poised for continued robust growth, driven by the synergistic effect of several factors. The persistently high prevalence of diabetes, coupled with continuous technological advancements, improved healthcare access, and supportive government policies, creates a fertile ground for market expansion. The increasing adoption of advanced, connected devices, offering remote monitoring capabilities and data-driven insights, presents significant opportunities for growth and new market entrants. The ongoing research and development in non-invasive monitoring technologies promise to redefine the landscape, potentially leading to a paradigm shift in the years to come. Furthermore, the focus on personalized medicine and the development of more sophisticated algorithms for data analysis are also expected to significantly impact future market growth.

Asia Pacific Blood Glucose Test Strip Market Segmentation

-

1. Components

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

-

2. End User

- 2.1. Hospital/Clinics

- 2.2. Home/Personal

-

3. Geography

- 3.1. Japan

- 3.2. South Korea

- 3.3. China

- 3.4. India

- 3.5. Australia

- 3.6. Vietnam

- 3.7. Malaysia

- 3.8. Indonesia

- 3.9. Philippines

- 3.10. Thailand

- 3.11. Rest of Asia-Pacific

Asia Pacific Blood Glucose Test Strip Market Segmentation By Geography

- 1. Japan

- 2. South Korea

- 3. China

- 4. India

- 5. Australia

- 6. Vietnam

- 7. Malaysia

- 8. Indonesia

- 9. Philippines

- 10. Thailand

- 11. Rest of Asia Pacific

Asia Pacific Blood Glucose Test Strip Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Test strips segment holds the highest market share in the current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Components

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospital/Clinics

- 5.2.2. Home/Personal

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Japan

- 5.3.2. South Korea

- 5.3.3. China

- 5.3.4. India

- 5.3.5. Australia

- 5.3.6. Vietnam

- 5.3.7. Malaysia

- 5.3.8. Indonesia

- 5.3.9. Philippines

- 5.3.10. Thailand

- 5.3.11. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.4.2. South Korea

- 5.4.3. China

- 5.4.4. India

- 5.4.5. Australia

- 5.4.6. Vietnam

- 5.4.7. Malaysia

- 5.4.8. Indonesia

- 5.4.9. Philippines

- 5.4.10. Thailand

- 5.4.11. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Components

- 6. Japan Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Components

- 6.1.1. Glucometer Devices

- 6.1.2. Test Strips

- 6.1.3. Lancets

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospital/Clinics

- 6.2.2. Home/Personal

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Japan

- 6.3.2. South Korea

- 6.3.3. China

- 6.3.4. India

- 6.3.5. Australia

- 6.3.6. Vietnam

- 6.3.7. Malaysia

- 6.3.8. Indonesia

- 6.3.9. Philippines

- 6.3.10. Thailand

- 6.3.11. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Components

- 7. South Korea Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Components

- 7.1.1. Glucometer Devices

- 7.1.2. Test Strips

- 7.1.3. Lancets

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospital/Clinics

- 7.2.2. Home/Personal

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Japan

- 7.3.2. South Korea

- 7.3.3. China

- 7.3.4. India

- 7.3.5. Australia

- 7.3.6. Vietnam

- 7.3.7. Malaysia

- 7.3.8. Indonesia

- 7.3.9. Philippines

- 7.3.10. Thailand

- 7.3.11. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Components

- 8. China Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Components

- 8.1.1. Glucometer Devices

- 8.1.2. Test Strips

- 8.1.3. Lancets

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospital/Clinics

- 8.2.2. Home/Personal

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Japan

- 8.3.2. South Korea

- 8.3.3. China

- 8.3.4. India

- 8.3.5. Australia

- 8.3.6. Vietnam

- 8.3.7. Malaysia

- 8.3.8. Indonesia

- 8.3.9. Philippines

- 8.3.10. Thailand

- 8.3.11. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Components

- 9. India Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Components

- 9.1.1. Glucometer Devices

- 9.1.2. Test Strips

- 9.1.3. Lancets

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospital/Clinics

- 9.2.2. Home/Personal

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Japan

- 9.3.2. South Korea

- 9.3.3. China

- 9.3.4. India

- 9.3.5. Australia

- 9.3.6. Vietnam

- 9.3.7. Malaysia

- 9.3.8. Indonesia

- 9.3.9. Philippines

- 9.3.10. Thailand

- 9.3.11. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Components

- 10. Australia Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Components

- 10.1.1. Glucometer Devices

- 10.1.2. Test Strips

- 10.1.3. Lancets

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospital/Clinics

- 10.2.2. Home/Personal

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Japan

- 10.3.2. South Korea

- 10.3.3. China

- 10.3.4. India

- 10.3.5. Australia

- 10.3.6. Vietnam

- 10.3.7. Malaysia

- 10.3.8. Indonesia

- 10.3.9. Philippines

- 10.3.10. Thailand

- 10.3.11. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Components

- 11. Vietnam Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Components

- 11.1.1. Glucometer Devices

- 11.1.2. Test Strips

- 11.1.3. Lancets

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Hospital/Clinics

- 11.2.2. Home/Personal

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Japan

- 11.3.2. South Korea

- 11.3.3. China

- 11.3.4. India

- 11.3.5. Australia

- 11.3.6. Vietnam

- 11.3.7. Malaysia

- 11.3.8. Indonesia

- 11.3.9. Philippines

- 11.3.10. Thailand

- 11.3.11. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Components

- 12. Malaysia Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Components

- 12.1.1. Glucometer Devices

- 12.1.2. Test Strips

- 12.1.3. Lancets

- 12.2. Market Analysis, Insights and Forecast - by End User

- 12.2.1. Hospital/Clinics

- 12.2.2. Home/Personal

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Japan

- 12.3.2. South Korea

- 12.3.3. China

- 12.3.4. India

- 12.3.5. Australia

- 12.3.6. Vietnam

- 12.3.7. Malaysia

- 12.3.8. Indonesia

- 12.3.9. Philippines

- 12.3.10. Thailand

- 12.3.11. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Components

- 13. Indonesia Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Components

- 13.1.1. Glucometer Devices

- 13.1.2. Test Strips

- 13.1.3. Lancets

- 13.2. Market Analysis, Insights and Forecast - by End User

- 13.2.1. Hospital/Clinics

- 13.2.2. Home/Personal

- 13.3. Market Analysis, Insights and Forecast - by Geography

- 13.3.1. Japan

- 13.3.2. South Korea

- 13.3.3. China

- 13.3.4. India

- 13.3.5. Australia

- 13.3.6. Vietnam

- 13.3.7. Malaysia

- 13.3.8. Indonesia

- 13.3.9. Philippines

- 13.3.10. Thailand

- 13.3.11. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Components

- 14. Philippines Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - by Components

- 14.1.1. Glucometer Devices

- 14.1.2. Test Strips

- 14.1.3. Lancets

- 14.2. Market Analysis, Insights and Forecast - by End User

- 14.2.1. Hospital/Clinics

- 14.2.2. Home/Personal

- 14.3. Market Analysis, Insights and Forecast - by Geography

- 14.3.1. Japan

- 14.3.2. South Korea

- 14.3.3. China

- 14.3.4. India

- 14.3.5. Australia

- 14.3.6. Vietnam

- 14.3.7. Malaysia

- 14.3.8. Indonesia

- 14.3.9. Philippines

- 14.3.10. Thailand

- 14.3.11. Rest of Asia-Pacific

- 14.1. Market Analysis, Insights and Forecast - by Components

- 15. Thailand Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - by Components

- 15.1.1. Glucometer Devices

- 15.1.2. Test Strips

- 15.1.3. Lancets

- 15.2. Market Analysis, Insights and Forecast - by End User

- 15.2.1. Hospital/Clinics

- 15.2.2. Home/Personal

- 15.3. Market Analysis, Insights and Forecast - by Geography

- 15.3.1. Japan

- 15.3.2. South Korea

- 15.3.3. China

- 15.3.4. India

- 15.3.5. Australia

- 15.3.6. Vietnam

- 15.3.7. Malaysia

- 15.3.8. Indonesia

- 15.3.9. Philippines

- 15.3.10. Thailand

- 15.3.11. Rest of Asia-Pacific

- 15.1. Market Analysis, Insights and Forecast - by Components

- 16. Rest of Asia Pacific Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - by Components

- 16.1.1. Glucometer Devices

- 16.1.2. Test Strips

- 16.1.3. Lancets

- 16.2. Market Analysis, Insights and Forecast - by End User

- 16.2.1. Hospital/Clinics

- 16.2.2. Home/Personal

- 16.3. Market Analysis, Insights and Forecast - by Geography

- 16.3.1. Japan

- 16.3.2. South Korea

- 16.3.3. China

- 16.3.4. India

- 16.3.5. Australia

- 16.3.6. Vietnam

- 16.3.7. Malaysia

- 16.3.8. Indonesia

- 16.3.9. Philippines

- 16.3.10. Thailand

- 16.3.11. Rest of Asia-Pacific

- 16.1. Market Analysis, Insights and Forecast - by Components

- 17. China Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 18. Japan Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 19. India Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 20. South Korea Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 21. Taiwan Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 22. Australia Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 23. Rest of Asia-Pacific Asia Pacific Blood Glucose Test Strip Market Analysis, Insights and Forecast, 2019-2031

- 24. Competitive Analysis

- 24.1. Market Share Analysis 2024

- 24.2. Company Profiles

- 24.2.1 I-Sens

- 24.2.1.1. Overview

- 24.2.1.2. Products

- 24.2.1.3. SWOT Analysis

- 24.2.1.4. Recent Developments

- 24.2.1.5. Financials (Based on Availability)

- 24.2.2 Sinocare

- 24.2.2.1. Overview

- 24.2.2.2. Products

- 24.2.2.3. SWOT Analysis

- 24.2.2.4. Recent Developments

- 24.2.2.5. Financials (Based on Availability)

- 24.2.3 Roche Diabetes Care

- 24.2.3.1. Overview

- 24.2.3.2. Products

- 24.2.3.3. SWOT Analysis

- 24.2.3.4. Recent Developments

- 24.2.3.5. Financials (Based on Availability)

- 24.2.4 Abbott Diabetes Care

- 24.2.4.1. Overview

- 24.2.4.2. Products

- 24.2.4.3. SWOT Analysis

- 24.2.4.4. Recent Developments

- 24.2.4.5. Financials (Based on Availability)

- 24.2.5 Medisana

- 24.2.5.1. Overview

- 24.2.5.2. Products

- 24.2.5.3. SWOT Analysis

- 24.2.5.4. Recent Developments

- 24.2.5.5. Financials (Based on Availability)

- 24.2.6 Morpen Laboratories

- 24.2.6.1. Overview

- 24.2.6.2. Products

- 24.2.6.3. SWOT Analysis

- 24.2.6.4. Recent Developments

- 24.2.6.5. Financials (Based on Availability)

- 24.2.7 Acon

- 24.2.7.1. Overview

- 24.2.7.2. Products

- 24.2.7.3. SWOT Analysis

- 24.2.7.4. Recent Developments

- 24.2.7.5. Financials (Based on Availability)

- 24.2.8 Rossmax International*List Not Exhaustive 7 2 Company Share Analysis

- 24.2.8.1. Overview

- 24.2.8.2. Products

- 24.2.8.3. SWOT Analysis

- 24.2.8.4. Recent Developments

- 24.2.8.5. Financials (Based on Availability)

- 24.2.9 Dr Trust

- 24.2.9.1. Overview

- 24.2.9.2. Products

- 24.2.9.3. SWOT Analysis

- 24.2.9.4. Recent Developments

- 24.2.9.5. Financials (Based on Availability)

- 24.2.10 Bionime Corporation

- 24.2.10.1. Overview

- 24.2.10.2. Products

- 24.2.10.3. SWOT Analysis

- 24.2.10.4. Recent Developments

- 24.2.10.5. Financials (Based on Availability)

- 24.2.11 Arkray

- 24.2.11.1. Overview

- 24.2.11.2. Products

- 24.2.11.3. SWOT Analysis

- 24.2.11.4. Recent Developments

- 24.2.11.5. Financials (Based on Availability)

- 24.2.12 LifeScan

- 24.2.12.1. Overview

- 24.2.12.2. Products

- 24.2.12.3. SWOT Analysis

- 24.2.12.4. Recent Developments

- 24.2.12.5. Financials (Based on Availability)

- 24.2.13 Other Company Share Analyse

- 24.2.13.1. Overview

- 24.2.13.2. Products

- 24.2.13.3. SWOT Analysis

- 24.2.13.4. Recent Developments

- 24.2.13.5. Financials (Based on Availability)

- 24.2.14 Ascensia Diabetes Care

- 24.2.14.1. Overview

- 24.2.14.2. Products

- 24.2.14.3. SWOT Analysis

- 24.2.14.4. Recent Developments

- 24.2.14.5. Financials (Based on Availability)

- 24.2.1 I-Sens

List of Figures

- Figure 1: Asia Pacific Blood Glucose Test Strip Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Blood Glucose Test Strip Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Components 2019 & 2032

- Table 4: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Components 2019 & 2032

- Table 5: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 7: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 9: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: China Asia Pacific Blood Glucose Test Strip Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: China Asia Pacific Blood Glucose Test Strip Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia Pacific Blood Glucose Test Strip Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Asia Pacific Blood Glucose Test Strip Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: India Asia Pacific Blood Glucose Test Strip Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Asia Pacific Blood Glucose Test Strip Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia Pacific Blood Glucose Test Strip Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia Pacific Blood Glucose Test Strip Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Taiwan Asia Pacific Blood Glucose Test Strip Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Taiwan Asia Pacific Blood Glucose Test Strip Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Australia Asia Pacific Blood Glucose Test Strip Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Asia Pacific Blood Glucose Test Strip Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia-Pacific Asia Pacific Blood Glucose Test Strip Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Asia-Pacific Asia Pacific Blood Glucose Test Strip Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Components 2019 & 2032

- Table 28: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Components 2019 & 2032

- Table 29: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 31: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 33: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 35: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Components 2019 & 2032

- Table 36: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Components 2019 & 2032

- Table 37: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by End User 2019 & 2032

- Table 38: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 39: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 41: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 43: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Components 2019 & 2032

- Table 44: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Components 2019 & 2032

- Table 45: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by End User 2019 & 2032

- Table 46: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 47: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 48: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 49: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 51: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Components 2019 & 2032

- Table 52: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Components 2019 & 2032

- Table 53: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by End User 2019 & 2032

- Table 54: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 55: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 56: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 57: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 59: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Components 2019 & 2032

- Table 60: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Components 2019 & 2032

- Table 61: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by End User 2019 & 2032

- Table 62: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 63: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 64: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 65: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 67: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Components 2019 & 2032

- Table 68: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Components 2019 & 2032

- Table 69: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by End User 2019 & 2032

- Table 70: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 71: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 72: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 73: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Country 2019 & 2032

- Table 74: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 75: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Components 2019 & 2032

- Table 76: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Components 2019 & 2032

- Table 77: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by End User 2019 & 2032

- Table 78: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 79: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 80: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 81: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Country 2019 & 2032

- Table 82: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 83: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Components 2019 & 2032

- Table 84: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Components 2019 & 2032

- Table 85: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by End User 2019 & 2032

- Table 86: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 87: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 88: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 89: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Country 2019 & 2032

- Table 90: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 91: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Components 2019 & 2032

- Table 92: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Components 2019 & 2032

- Table 93: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by End User 2019 & 2032

- Table 94: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 95: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 96: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 97: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Country 2019 & 2032

- Table 98: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 99: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Components 2019 & 2032

- Table 100: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Components 2019 & 2032

- Table 101: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by End User 2019 & 2032

- Table 102: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 103: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 104: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 105: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Country 2019 & 2032

- Table 106: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 107: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Components 2019 & 2032

- Table 108: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Components 2019 & 2032

- Table 109: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by End User 2019 & 2032

- Table 110: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 111: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 112: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 113: Asia Pacific Blood Glucose Test Strip Market Revenue Million Forecast, by Country 2019 & 2032

- Table 114: Asia Pacific Blood Glucose Test Strip Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Blood Glucose Test Strip Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Asia Pacific Blood Glucose Test Strip Market?

Key companies in the market include I-Sens, Sinocare, Roche Diabetes Care, Abbott Diabetes Care, Medisana, Morpen Laboratories, Acon, Rossmax International*List Not Exhaustive 7 2 Company Share Analysis, Dr Trust, Bionime Corporation, Arkray, LifeScan, Other Company Share Analyse, Ascensia Diabetes Care.

3. What are the main segments of the Asia Pacific Blood Glucose Test Strip Market?

The market segments include Components, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Test strips segment holds the highest market share in the current year.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

January, 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published Improved Glycemic Control Using a Bluetooth Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Evidence From Over 144,000 People With Diabetes, detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes - one of the largest combined blood glucose meter and mobile diabetes app datasets ever published.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Blood Glucose Test Strip Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Blood Glucose Test Strip Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Blood Glucose Test Strip Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Blood Glucose Test Strip Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence