Key Insights

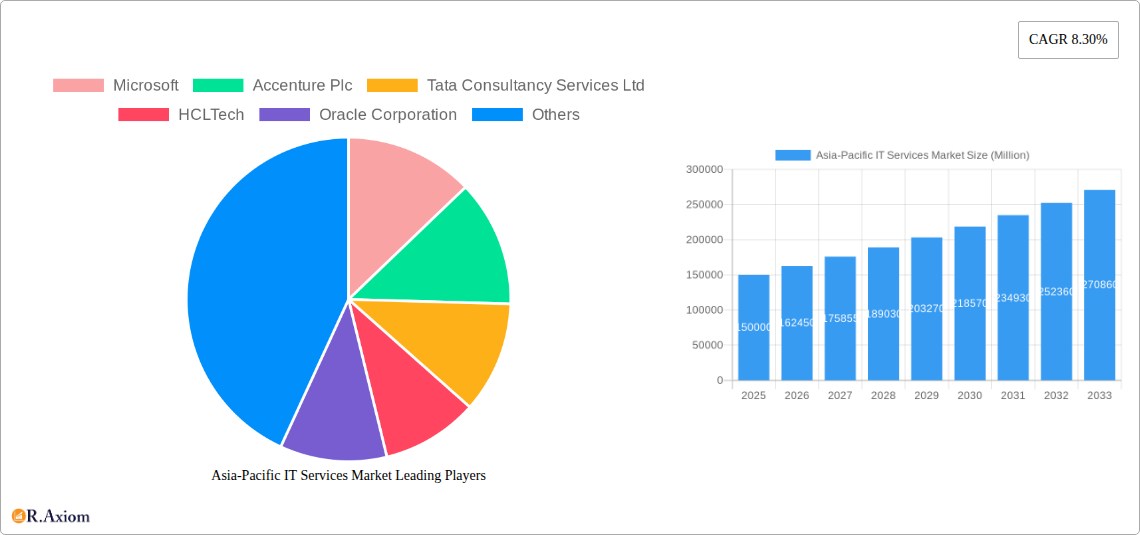

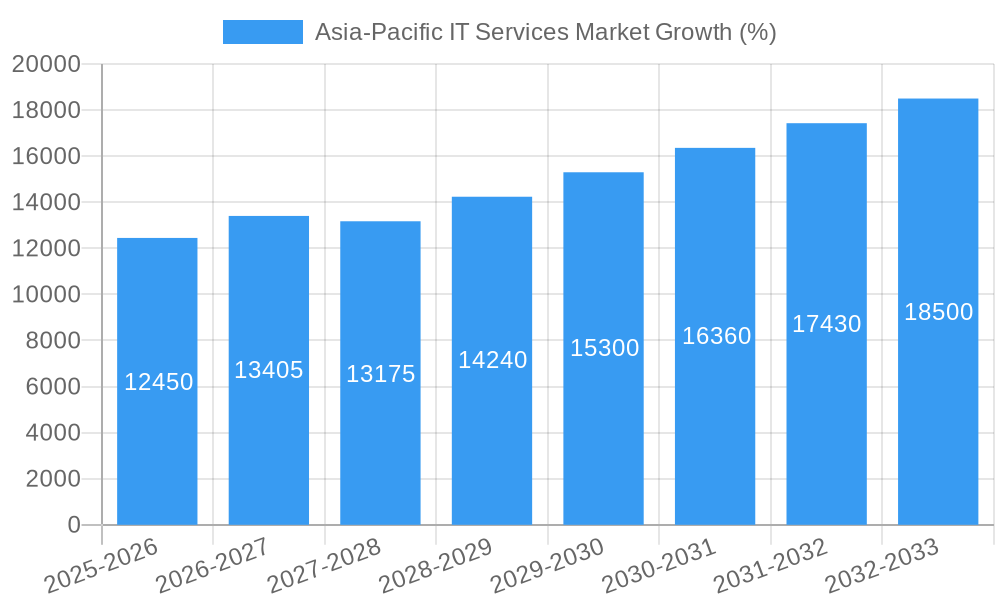

The Asia-Pacific IT services market is experiencing robust growth, driven by increasing digital transformation initiatives across various sectors and the region's expanding technological infrastructure. A compound annual growth rate (CAGR) of 8.30% from 2019 to 2024 suggests a significant market expansion. This growth is fueled by several key factors. The burgeoning adoption of cloud computing, big data analytics, and artificial intelligence (AI) across manufacturing, BFSI (Banking, Financial Services, and Insurance), healthcare, and retail sectors is a primary driver. Government initiatives promoting digitalization and smart city projects in countries like China, India, and Singapore further contribute to this upward trajectory. Furthermore, the rising demand for IT outsourcing and business process outsourcing (BPO) services from global companies seeking cost-effective solutions is significantly boosting market expansion. Specific countries like India and China, with their large talent pools and cost advantages, are attracting substantial investments and becoming major hubs for IT service delivery.

However, challenges remain. While the market enjoys strong growth, certain restraints exist. These include concerns about data security and privacy, the shortage of skilled IT professionals, and the potential impact of geopolitical instability on cross-border collaborations. Competition among established players like Microsoft, Accenture, TCS, HCLTech, and Infosys is fierce, requiring companies to constantly innovate and adapt to maintain market share. Despite these challenges, the long-term outlook for the Asia-Pacific IT services market remains positive, with projections indicating continued growth through 2033. The diversification of services and the adoption of emerging technologies will play a vital role in shaping the market’s future trajectory. The segment breakdown by type (IT consulting, outsourcing, etc.) and end-user further reveals growth opportunities for specialized service providers.

Asia-Pacific IT Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific IT services market, offering invaluable insights for businesses, investors, and industry stakeholders. The report covers market size, segmentation, growth drivers, challenges, opportunities, and key players, utilizing data from 2019-2024 (historical period) and projecting trends through 2033 (forecast period), with 2025 as the base and estimated year. The report leverages data-driven analysis to illuminate the competitive landscape and future potential of this dynamic sector.

Asia-Pacific IT Services Market Concentration & Innovation

The Asia-Pacific IT services market exhibits a moderately concentrated landscape, with a few multinational giants and several regional players dominating the scene. Market share is largely influenced by factors including technological capabilities, global reach, and strategic partnerships. While precise market share figures for individual players fluctuate yearly, companies like Microsoft, Accenture Plc, Tata Consultancy Services Ltd, and HCLTech consistently hold significant portions of the market. The average M&A deal value in the region over the past five years has been approximately xx Million, indicating robust consolidation and expansion activity.

Innovation drivers within the market are primarily fueled by the escalating demand for digital transformation, cloud computing, cybersecurity, and AI-powered solutions. Stringent data privacy regulations, such as GDPR and similar regional counterparts, significantly impact market dynamics. Product substitutes are primarily found within niche segments, with open-source software and specialized solutions challenging established players in certain areas. End-user trends are shifting towards agile methodologies, DevOps, and a greater focus on outcomes-based pricing models.

- Key Metrics:

- Average M&A Deal Value (2019-2024): xx Million

- Top 5 Players Combined Market Share (2024): xx% (estimated)

- Number of M&A deals (2019-2024): xx

Asia-Pacific IT Services Market Industry Trends & Insights

The Asia-Pacific IT services market is experiencing robust growth, propelled by several key factors. The region's burgeoning digital economy, coupled with significant investments in infrastructure and rising government initiatives promoting digital transformation across various sectors, fuels this expansion. Technological advancements, such as the widespread adoption of cloud computing, AI, big data analytics, and the Internet of Things (IoT), are driving market transformation and creating new avenues for growth. Consumer preferences are shifting towards personalized services, secure and scalable solutions, and a preference for outcome-based service models.

Competitive dynamics are intensely competitive, with established players constantly vying for market share and emerging players challenging the status quo through innovative offerings and competitive pricing. The market is witnessing a significant rise in the adoption of cloud-based solutions, driving increased demand for cloud consulting and implementation services. The Compound Annual Growth Rate (CAGR) for the Asia-Pacific IT services market during the forecast period (2025-2033) is estimated at xx%. Market penetration of cloud-based solutions is projected to reach xx% by 2033.

Dominant Markets & Segments in Asia-Pacific IT Services Market

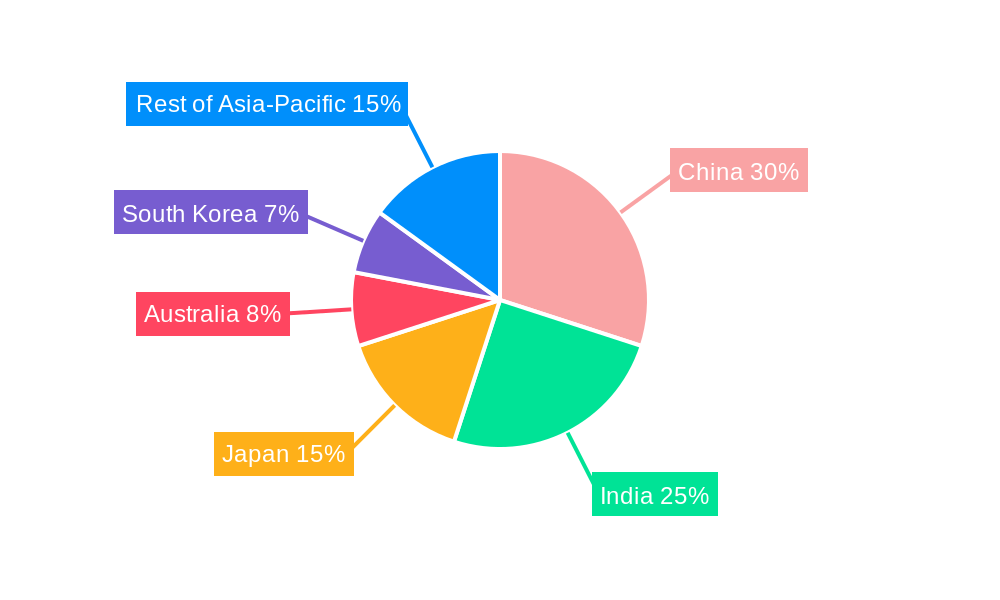

By Country: China and India dominate the Asia-Pacific IT services market due to their large populations, robust IT infrastructure, and burgeoning digital economies. These countries present immense opportunities for IT service providers. Japan and Australia also hold significant market share, driven by a strong technological base and high levels of IT adoption.

By Type: IT Outsourcing and IT Consulting and Implementation are the dominant segments, driven by the increasing demand for cost-effective solutions and expert guidance in digital transformation initiatives.

By End-user: The BFSI (Banking, Financial Services, and Insurance) and Manufacturing sectors are the largest consumers of IT services, followed by the Government and Healthcare sectors. These sectors drive significant demand due to their need for robust security systems, operational efficiency, and data management capabilities.

Key Drivers (by region):

- China: Government initiatives promoting digitalization, strong domestic demand, and a vast talent pool.

- India: Cost-effectiveness, extensive talent pool, and robust IT infrastructure.

- Japan: High technological adoption, focus on innovation, and substantial investments in digital infrastructure.

- Australia: Strong regulatory frameworks, high internet penetration, and focus on cybersecurity.

Asia-Pacific IT Services Market Product Developments

Recent years have witnessed significant innovation in the Asia-Pacific IT services market, with a strong focus on cloud-native solutions, AI-powered services, cybersecurity enhancements, and improved integration capabilities. This reflects an increased focus on addressing the evolving needs of businesses across diverse sectors. New products emphasize scalability, agility, and cost-effectiveness, enabling businesses to embrace digital transformation seamlessly.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific IT services market by type (IT Consulting and Implementation, IT Outsourcing, Business Process Outsourcing, Other Types), end-user (Manufacturing, Government, BFSI, Healthcare, Retail and Consumer Goods, Logistics, Other End-users), and country (Australia, China, India, Japan, Indonesia, Malaysia, Singapore, South Korea, Taiwan, Thailand, Rest of Asia-Pacific). Each segment's growth trajectory, market size, and competitive dynamics are analyzed in detail, providing a granular understanding of the market landscape. Growth projections for each segment vary depending on factors such as technological advancements, economic conditions, and government regulations. Market sizes are presented in Millions for each segment across the historical and forecast periods. Competitive dynamics are assessed based on market share, innovation capabilities, and pricing strategies of key players.

Key Drivers of Asia-Pacific IT Services Market Growth

The Asia-Pacific IT services market's growth is primarily driven by the increasing adoption of cloud computing, big data analytics, and AI, along with a growing need for digital transformation across various industries. Government initiatives promoting digitalization, robust economic growth in several countries, and a large pool of skilled IT professionals also contribute significantly. Furthermore, the rising demand for cybersecurity solutions and the increasing adoption of IoT devices fuel market expansion.

Challenges in the Asia-Pacific IT Services Market Sector

The Asia-Pacific IT services market faces several challenges including the increasing competition from global players, concerns about data security and privacy, and the shortage of skilled IT professionals. Regulatory changes and varying levels of digital infrastructure across the region also pose hurdles. These challenges impact the market's growth trajectory and operational efficiency for businesses. The estimated impact on market growth due to these challenges is approximately xx% (estimated).

Emerging Opportunities in Asia-Pacific IT Services Market

Emerging opportunities lie in the growing adoption of 5G technology, the expansion of the IoT market, and the increasing demand for AI-powered solutions. The rise of edge computing and the growth of the digital economy in several countries present significant potential for growth. Furthermore, the focus on sustainable and ethical AI development creates new market niches for specialized IT services.

Leading Players in the Asia-Pacific IT Services Market Market

- Microsoft

- Accenture Plc

- Tata Consultancy Services Ltd

- HCLTech

- Oracle Corporation

- Wipro Ltd

- Infosys Ltd

- Dell Technologies Inc

- Capgemini SE

- Cognizant Technology Solutions

Key Developments in Asia-Pacific IT Services Market Industry

- November 2022: HCLTech introduced a cybersecurity suite hosted by Amazon Web Services, expanding its Cloud Security-as-a-Service (CSaaS) capabilities. This strengthens its competitive position in the cloud security market.

- November 2022: HCLTech signed a multi-year deal with SR Technics to digitally transform its operations using RISE with SAP and Microsoft Azure. This demonstrates the increasing demand for cloud-based ERP solutions and digital transformation services.

- November 2022: Tata Consultancy Services (TCS) received the 2022 Best IT Supplier Award from Infineon Technologies AG, recognizing its consistent delivery of high-quality services and innovation. This reinforces TCS's reputation for excellence and strengthens its market standing.

Strategic Outlook for Asia-Pacific IT Services Market Market

The Asia-Pacific IT services market is poised for significant growth over the next decade, driven by technological advancements, increasing digital adoption across industries, and supportive government policies. Opportunities abound for companies that can effectively leverage emerging technologies, address cybersecurity concerns, and provide innovative and cost-effective solutions tailored to the specific needs of various sectors. The market presents a dynamic landscape with considerable potential for both established and emerging players.

Asia-Pacific IT Services Market Segmentation

-

1. Type

- 1.1. IT Consulting and Implementation

- 1.2. IT Outsourcing

- 1.3. Business Process Outsourcing

- 1.4. Other Types

-

2. End-user

- 2.1. Manufacturing

- 2.2. Government

- 2.3. BFSI

- 2.4. Healthcare

- 2.5. Retail and Consumer Goods

- 2.6. Logistics

- 2.7. Other End-users

Asia-Pacific IT Services Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific IT Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Acceleration of Digital Transformation Across Industries and Adoption of New Technologies; Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations

- 3.3. Market Restrains

- 3.3.1 Data Security

- 3.3.2 Customization

- 3.3.3 and Data Migration

- 3.4. Market Trends

- 3.4.1. Growing Demand for Cloud Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific IT Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. IT Consulting and Implementation

- 5.1.2. IT Outsourcing

- 5.1.3. Business Process Outsourcing

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Manufacturing

- 5.2.2. Government

- 5.2.3. BFSI

- 5.2.4. Healthcare

- 5.2.5. Retail and Consumer Goods

- 5.2.6. Logistics

- 5.2.7. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific IT Services Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific IT Services Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific IT Services Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific IT Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific IT Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific IT Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific IT Services Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Microsoft

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Accenture Plc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Tata Consultancy Services Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 HCLTech

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Oracle Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Wipro Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Infosys Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Dell Technologies Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Capgemini SE

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Cognizant Technology Solutions

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Google

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Microsoft

List of Figures

- Figure 1: Asia-Pacific IT Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific IT Services Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific IT Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific IT Services Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific IT Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Asia-Pacific IT Services Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Asia-Pacific IT Services Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 6: Asia-Pacific IT Services Market Volume K Unit Forecast, by End-user 2019 & 2032

- Table 7: Asia-Pacific IT Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific IT Services Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific IT Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia-Pacific IT Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: China Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Japan Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: India Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: South Korea Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Taiwan Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Asia-Pacific IT Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Asia-Pacific IT Services Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 27: Asia-Pacific IT Services Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 28: Asia-Pacific IT Services Market Volume K Unit Forecast, by End-user 2019 & 2032

- Table 29: Asia-Pacific IT Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific IT Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: China Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: China Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Japan Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: South Korea Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Korea Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: India Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Australia Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Australia Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: New Zealand Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: New Zealand Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Indonesia Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Indonesia Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Malaysia Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Malaysia Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Singapore Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Singapore Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Thailand Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Thailand Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Vietnam Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Vietnam Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Philippines Asia-Pacific IT Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Philippines Asia-Pacific IT Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific IT Services Market?

The projected CAGR is approximately 8.30%.

2. Which companies are prominent players in the Asia-Pacific IT Services Market?

Key companies in the market include Microsoft, Accenture Plc, Tata Consultancy Services Ltd, HCLTech, Oracle Corporation, Wipro Ltd, Infosys Ltd, Dell Technologies Inc, Capgemini SE, Cognizant Technology Solutions, Google.

3. What are the main segments of the Asia-Pacific IT Services Market?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Acceleration of Digital Transformation Across Industries and Adoption of New Technologies; Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations.

6. What are the notable trends driving market growth?

Growing Demand for Cloud Services.

7. Are there any restraints impacting market growth?

Data Security. Customization. and Data Migration.

8. Can you provide examples of recent developments in the market?

November 2022: HCLTech introduced a cybersecurity suite hosted by Amazon Web Services. This strengthens and expands HCLTech's Cloud Security-as-a-Service (CSaaS) capabilities for AWS-based companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific IT Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific IT Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific IT Services Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific IT Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence