Key Insights

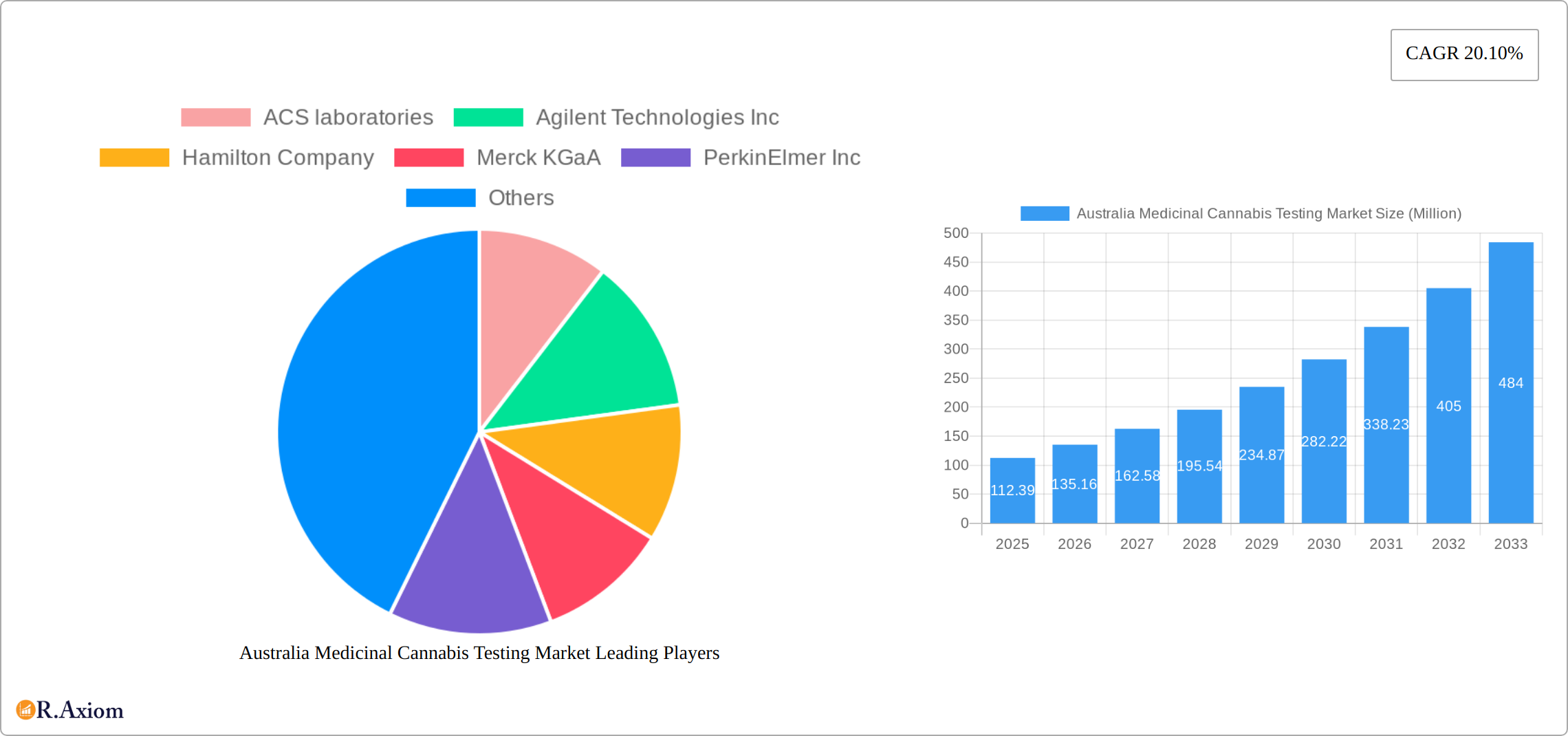

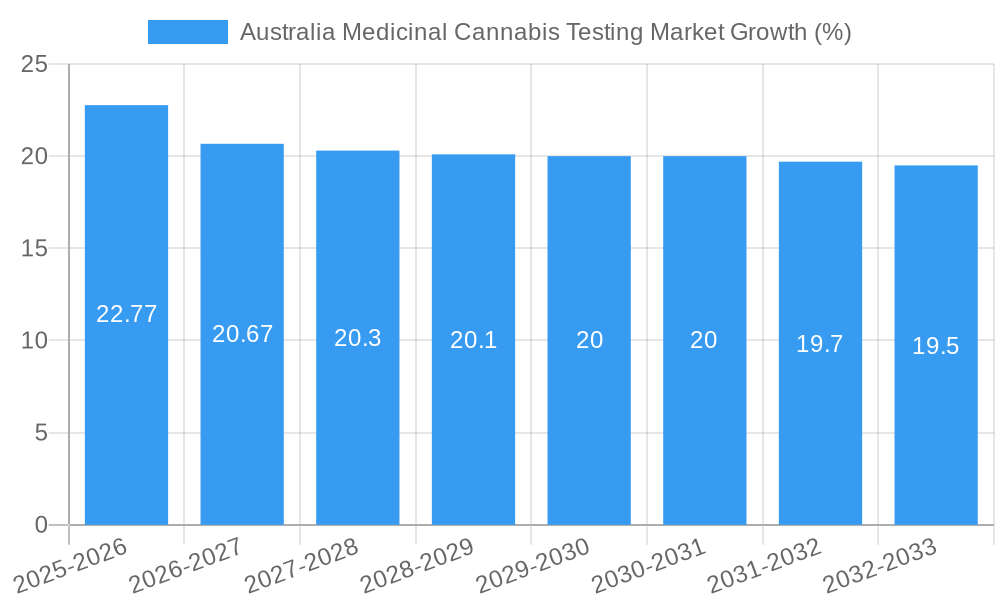

The Australian medicinal cannabis testing market, valued at $112.39 million in 2025, is projected to experience robust growth, driven by the increasing legalization and acceptance of medicinal cannabis within the country. This burgeoning market is fueled by a rising number of patients requiring cannabis-based therapies, coupled with stringent regulatory requirements mandating rigorous quality control and testing procedures. Technological advancements in analytical techniques, such as chromatography and mass spectrometry, are further enhancing the accuracy and efficiency of testing, contributing to market expansion. The market's growth is also supported by the expanding research and development activities aimed at characterizing the chemical composition and therapeutic efficacy of various cannabis strains. Key players in this market, including ACS Laboratories, Agilent Technologies, and Thermo Fisher Scientific, are investing significantly in advanced technologies and expanding their service offerings to meet the growing demand for reliable and comprehensive cannabis testing services.

Competition within the market is expected to intensify as new players enter, driven by lucrative market opportunities. However, challenges remain, including the relatively high cost of testing and potential regulatory hurdles. Despite these challenges, the long-term outlook for the Australian medicinal cannabis testing market remains highly positive, with the market forecast to experience a compound annual growth rate (CAGR) of 20.10% from 2025 to 2033. This growth will be influenced by factors such as increasing cannabis production, broadening patient access, and ongoing improvements in testing technologies, ultimately leading to a substantial market expansion over the next decade. The segments within this market are likely diverse, potentially encompassing various testing services like potency analysis, pesticide screening, and heavy metal detection, each contributing to the overall market value.

This detailed report provides a comprehensive analysis of the Australia Medicinal Cannabis Testing Market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, growth drivers, challenges, and opportunities, empowering stakeholders to make informed strategic decisions. The report leverages extensive data analysis, industry expertise, and up-to-date market intelligence to deliver actionable insights. The base year for this report is 2025, with estimations for the same year and a forecast period spanning 2025-2033. The historical period covered is 2019-2024.

Australia Medicinal Cannabis Testing Market Market Concentration & Innovation

The Australian medicinal cannabis testing market exhibits a moderately concentrated landscape with a handful of dominant players and several smaller, specialized firms. Market share data for 2025 indicates that Thermo Fisher Scientific, Agilent Technologies Inc., and PerkinElmer Inc. hold a combined xx% market share, driven by their comprehensive product portfolios and established presence in the broader analytical instrumentation market. However, smaller, specialized labs like ACS Laboratories and Quantum Analytics are also gaining traction by focusing on niche testing services and rapid turnaround times. Innovation is largely driven by the need for faster, more accurate, and cost-effective testing methods to meet the increasing demand. The regulatory framework, while evolving, plays a crucial role in shaping the market, ensuring quality control and patient safety. This involves stringent guidelines for testing procedures and accreditation requirements, impacting technological advancements and the adoption of new analytical techniques. The market is also witnessing the increased adoption of advanced technologies such as LC-MS/MS, GC-MS, and HPLC. Product substitutes, although limited, are primarily focused on alternative methods for analyzing cannabinoid profiles. End-user trends favour labs offering a comprehensive suite of testing services, including potency analysis, pesticide screening, and heavy metal detection. Recent M&A activity in the market is modest, with deal values in 2024 estimated at approximately $xx Million, primarily focused on consolidation among smaller testing laboratories.

- Market Leaders: Thermo Fisher Scientific, Agilent Technologies Inc., PerkinElmer Inc.

- Emerging Players: ACS Laboratories, Quantum Analytics

- M&A Activity (2024): Estimated $xx Million in deal values.

- Key Innovation Drivers: Faster testing methods, increased accuracy, cost efficiency.

Australia Medicinal Cannabis Testing Market Industry Trends & Insights

The Australian medicinal cannabis testing market is experiencing robust growth, driven by several factors. The increasing legalization and acceptance of medicinal cannabis, coupled with rising patient numbers, are fueling demand for reliable and comprehensive testing services. This has translated into a strong CAGR (Compound Annual Growth Rate) of xx% between 2019 and 2024, and the market is projected to reach $xx Million by 2025. Technological disruptions, particularly the adoption of advanced analytical techniques and automation, are improving efficiency and reducing testing times. Consumer preferences are shifting towards labs offering faster turnaround times, transparent reporting, and comprehensive testing services. The competitive landscape remains dynamic, with established players focusing on expanding their service offerings and smaller firms specializing in niche testing segments. Market penetration is increasing, driven by government regulations mandating rigorous quality control measures for medicinal cannabis products. Furthermore, growing scientific research on the therapeutic benefits of cannabis is bolstering market expansion. The rise of personalized medicine approaches further fuels the demand for precise and detailed testing, leading to tailored treatment plans for patients.

Dominant Markets & Segments in Australia Medicinal Cannabis Testing Market

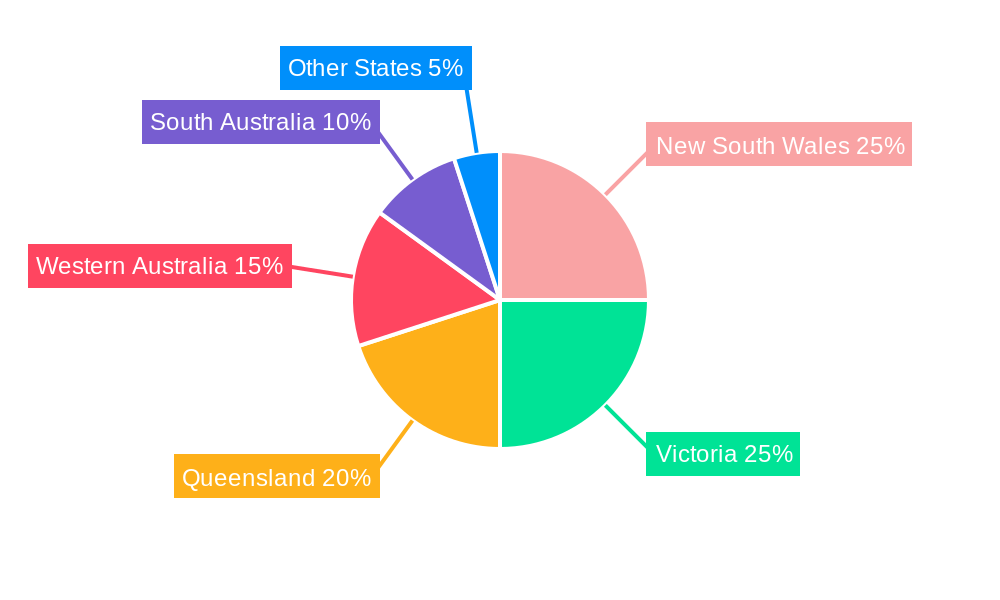

The Australian medicinal cannabis testing market is geographically concentrated, with New South Wales (NSW) and Victoria representing the most dominant regions. This dominance can be primarily attributed to:

- High Patient Numbers: Both NSW and Victoria have the largest numbers of registered medicinal cannabis patients, driving substantial demand for testing services.

- Established Infrastructure: These states boast a well-developed healthcare infrastructure, a higher concentration of licensed cultivators, and a significant number of qualified, accredited laboratories equipped for sophisticated cannabis analysis.

- Favorable Regulatory Landscape: The regulatory environment in NSW and Victoria has been relatively supportive and proactive in establishing clear guidelines for medicinal cannabis production and testing, fostering industry growth and confidence.

While these two states currently lead in market share, other regions such as Queensland and Western Australia are witnessing rapid growth, indicating a potential shift towards a more evenly distributed and competitive market in the coming years. The market is further segmented by crucial testing types including potency testing (THC, CBD, other cannabinoids), pesticide screening, heavy metal analysis, microbial testing for contaminants, and residual solvent detection. End-users are primarily categorized into pharmaceutical companies, licensed cannabis cultivators, and dedicated research institutions. The choice of testing method, ranging from High-Performance Liquid Chromatography (HPLC) to Gas Chromatography-Mass Spectrometry (GC-MS) and Liquid Chromatography-Mass Spectrometry/Mass Spectrometry (LC-MS/MS), significantly impacts the scope and precision of the analysis.

Australia Medicinal Cannabis Testing Market Product Developments

Recent product developments in the Australian medicinal cannabis testing market are significantly enhancing capabilities, with a strong focus on improving the speed, accuracy, and automation of analytical techniques. The integration of advanced software solutions for streamlined data analysis, comprehensive reporting, and robust traceability is rapidly gaining traction, leading to improved operational efficiency and reduced human error. Furthermore, the development and adoption of novel testing methods, such as advanced chromatography techniques coupled with high-resolution mass spectrometry, are providing a more comprehensive and nuanced analysis of cannabis samples. This includes the precise identification and quantification of minor cannabinoids, a broader spectrum of terpenes responsible for aroma and therapeutic effects, and the detection of emerging contaminants. These cutting-edge developments are strategically aimed at delivering greater value to clients by minimizing overall testing time and costs, while simultaneously increasing the depth and reliability of the scientific data provided, supporting product innovation and regulatory compliance.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the Australian medicinal cannabis testing market across several critical parameters to provide a detailed market overview. The geographical segmentation analyzes individual states and territories within Australia, highlighting regional market dynamics and growth potential. The segmentation by product type encompasses the diverse and essential types of tests performed on medicinal cannabis products, including but not limited to potency analysis (quantification of cannabinoids), comprehensive pesticide residue screening, rigorous heavy metal testing, crucial microbial analysis for safety, and the detection of residual solvents from manufacturing processes. The segmentation by end-user identifies key stakeholders, including licensed producers, contract research organizations, academic and scientific researchers, and regulatory bodies overseeing the industry, as well as healthcare providers involved in patient care. Growth projections for each segment are carefully detailed, with the potency testing segment anticipated to remain the largest due to ongoing regulatory requirements for product standardization. This is closely followed by pesticide and microbial testing, which are critical for ensuring product safety and compliance. The precise market size for each segment is thoroughly detailed in the full report. Competitive dynamics are profoundly influenced by factors such as the adoption of cutting-edge technology, adherence to evolving regulatory compliance standards, the establishment of strong client relationships, and the ability to offer cost-effective and efficient testing solutions.

Key Drivers of Australia Medicinal Cannabis Testing Market Growth

The Australian medicinal cannabis testing market is experiencing robust and sustained growth, propelled by several interconnected key factors. The increasing legalization and growing societal acceptance of medicinal cannabis across Australia are directly leading to a substantial surge in the number of registered patients and prescribed products, consequently driving a greater and more consistent demand for comprehensive testing services. Stringent government regulations and evolving quality control measures mandated by bodies like the Therapeutic Goods Administration (TGA) are non-negotiable, thereby fueling the demand for highly accurate, validated, and reliable testing methodologies. Technological advancements, including the development of more sensitive analytical instrumentation, sophisticated automation in laboratory workflows, and enhanced data management systems, are significantly enhancing testing speed, overall efficiency, and the precision of results. Furthermore, ongoing and expanding research into the diverse therapeutic potential of cannabis and its various compounds is driving further exploration, product development, and a deeper understanding of its efficacy and safety, which in turn necessitates more sophisticated testing capabilities.

Challenges in the Australia Medicinal Cannabis Testing Market Sector

Despite significant growth potential, the Australian medicinal cannabis testing market faces several challenges. Regulatory hurdles, including evolving guidelines and accreditation processes, can create complexities for businesses. Supply chain issues, particularly access to high-quality analytical equipment and reagents, can impact testing capacity and cost-efficiency. Intense competition among testing laboratories requires businesses to continually innovate and optimize their services to remain competitive. This competition, combined with the need for high precision and accuracy, also impacts profitability margins.

Emerging Opportunities in Australia Medicinal Cannabis Testing Market

The Australian medicinal cannabis testing market presents promising opportunities. The expansion of the legal medicinal cannabis market creates demand for a wide range of testing services. Advancements in technology, such as automation and AI, can improve efficiency and reduce testing time. Furthermore, increasing research and development into the therapeutic benefits of cannabis opens avenues for specialized testing services targeted towards specific medical conditions or research studies. Finally, there are opportunities to expand into related sectors, including the testing of CBD products and other cannabis-derived compounds.

Leading Players in the Australia Medicinal Cannabis Testing Market Market

- ACS Laboratories

- Agilent Technologies Inc

- Hamilton Company

- Merck KGaA

- PerkinElmer Inc

- Quantum Analytics

- Shimadzu Scientific Instruments

- Thermo Fisher Scientific

- Eurofins Scientific

- Pharmalytics *List Not Exhaustive

Key Developments in Australia Medicinal Cannabis Testing Market Industry

- June 2024: Tilray Medical launched Broken Coast EU-GMP-certified medical cannabis products in Australia, increasing the demand for compliant testing.

- October 2023: Victoria’s Transport Legislation Amendment Bill 2023 enabled studies on medicinal cannabis and road safety, potentially impacting testing protocols.

- February 2023: Aurora Cannabis Inc. and MedReleaf Australia launched CraftPlant, a new medical cannabis brand, further stimulating market growth and testing needs.

Strategic Outlook for Australia Medicinal Cannabis Testing Market Market

The future trajectory of the Australian medicinal cannabis testing market appears exceptionally promising, characterized by continued expansion driven by an accelerating pace of legalization, transformative technological advancements, and a steadily increasing patient population. Significant opportunities are emerging for businesses to strategically capitalize on the escalating demand for specialized analytical services, the implementation of automated testing workflows, and sophisticated data analytics platforms that can offer actionable insights. Strategic partnerships, mergers, and acquisitions, alongside dedicated investments in research and development for novel testing solutions and methodologies, will be paramount for companies seeking to maintain and enhance their competitive edge in this dynamic market. Further regulatory clarity, streamlined approval processes for testing laboratories, and consistent policy frameworks will also be instrumental in facilitating market expansion and attracting a broader spectrum of domestic and international players. The market's long-term prospects are robust, underpinned by the evolving scientific understanding of medicinal cannabis, advancements in analytical capabilities, and the growing integration of cannabis-based therapies into mainstream healthcare.

Australia Medicinal Cannabis Testing Market Segmentation

-

1. Product and Software/Service

- 1.1. Analytical Instruments

- 1.2. Spectroscopy Instruments

- 1.3. Consumables

- 1.4. Cannabis Testing Software and Services

-

2. Service

- 2.1. Potency Testing

- 2.2. Terpene Profiling

- 2.3. Residual Solvent Screening

- 2.4. Heavy Metal Testing

- 2.5. Mycotoxin Testing

- 2.6. Other Types

-

3. End User

- 3.1. Laboratories

- 3.2. Cannabis Drug Manufacturers and Dispensaries

- 3.3. Other End Users

Australia Medicinal Cannabis Testing Market Segmentation By Geography

- 1. Australia

Australia Medicinal Cannabis Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Approvals for Medicinal Cannabis; Increase in Cannabis-based Prescription by Healthcare Practisioners; Growing Prevalence of Chronic Pain

- 3.3. Market Restrains

- 3.3.1. Rise in Approvals for Medicinal Cannabis; Increase in Cannabis-based Prescription by Healthcare Practisioners; Growing Prevalence of Chronic Pain

- 3.4. Market Trends

- 3.4.1. The Potency Testing Segment is Anticipated to Hold a Major Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Medicinal Cannabis Testing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product and Software/Service

- 5.1.1. Analytical Instruments

- 5.1.2. Spectroscopy Instruments

- 5.1.3. Consumables

- 5.1.4. Cannabis Testing Software and Services

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Potency Testing

- 5.2.2. Terpene Profiling

- 5.2.3. Residual Solvent Screening

- 5.2.4. Heavy Metal Testing

- 5.2.5. Mycotoxin Testing

- 5.2.6. Other Types

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Laboratories

- 5.3.2. Cannabis Drug Manufacturers and Dispensaries

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product and Software/Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ACS laboratories

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Agilent Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hamilton Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Merck KGaA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PerkinElmer Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Quantum Analytics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shimadzu Scientific Instruments

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thermo Fisher Scientific

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eurofins Scientific

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pharmalytics*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ACS laboratories

List of Figures

- Figure 1: Australia Medicinal Cannabis Testing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Medicinal Cannabis Testing Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by Product and Software/Service 2019 & 2032

- Table 4: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by Product and Software/Service 2019 & 2032

- Table 5: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by Service 2019 & 2032

- Table 6: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by Service 2019 & 2032

- Table 7: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by End User 2019 & 2032

- Table 9: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by Product and Software/Service 2019 & 2032

- Table 12: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by Product and Software/Service 2019 & 2032

- Table 13: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by Service 2019 & 2032

- Table 14: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by Service 2019 & 2032

- Table 15: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by End User 2019 & 2032

- Table 17: Australia Medicinal Cannabis Testing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Australia Medicinal Cannabis Testing Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Medicinal Cannabis Testing Market?

The projected CAGR is approximately 20.10%.

2. Which companies are prominent players in the Australia Medicinal Cannabis Testing Market?

Key companies in the market include ACS laboratories, Agilent Technologies Inc, Hamilton Company, Merck KGaA, PerkinElmer Inc, Quantum Analytics, Shimadzu Scientific Instruments, Thermo Fisher Scientific, Eurofins Scientific, Pharmalytics*List Not Exhaustive.

3. What are the main segments of the Australia Medicinal Cannabis Testing Market?

The market segments include Product and Software/Service, Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 112.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Approvals for Medicinal Cannabis; Increase in Cannabis-based Prescription by Healthcare Practisioners; Growing Prevalence of Chronic Pain.

6. What are the notable trends driving market growth?

The Potency Testing Segment is Anticipated to Hold a Major Share of the Market.

7. Are there any restraints impacting market growth?

Rise in Approvals for Medicinal Cannabis; Increase in Cannabis-based Prescription by Healthcare Practisioners; Growing Prevalence of Chronic Pain.

8. Can you provide examples of recent developments in the market?

June 2024: Tilray Medical, a division of Tilray Brands Inc. and a global leader in medical cannabis, launched Broken Coast EU-GMP-certified medical cannabis products in Australia.October 2023: Victoria’s Transport Legislation Amendment Bill 2023 amended nine Acts, including the Road Safety Act 1986. This amendment allows a study of medicinal cannabis and road safety and is sufficiently broad to enable the state government to conduct similar studies in relation to other drugs.February 2023: Aurora Cannabis Inc., the Canadian company, and MedReleaf Australia launched a new medical cannabis brand, CraftPlant, for patients in the Australian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Medicinal Cannabis Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Medicinal Cannabis Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Medicinal Cannabis Testing Market?

To stay informed about further developments, trends, and reports in the Australia Medicinal Cannabis Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence