Key Insights

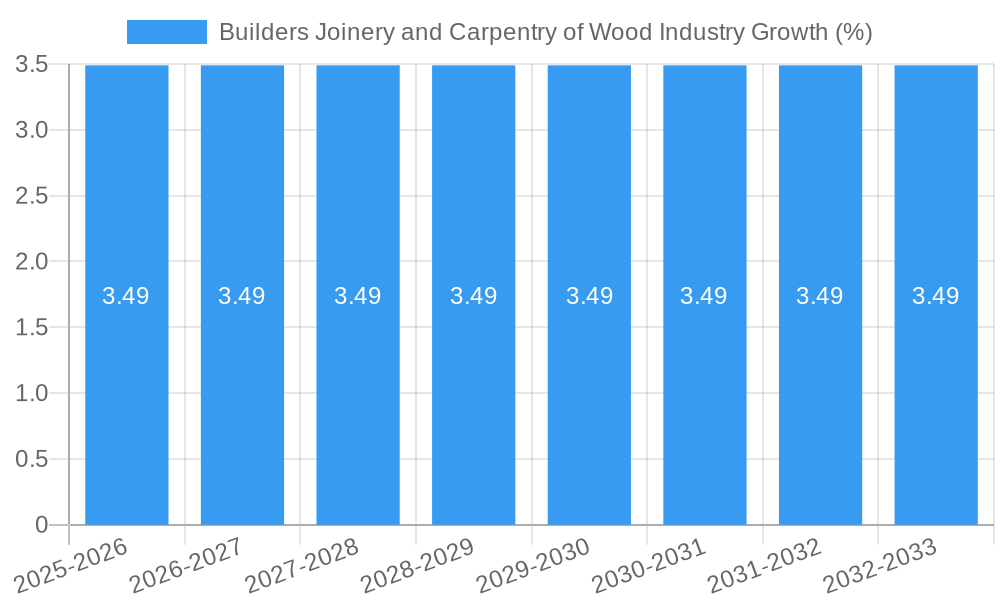

The global builders joinery and carpentry of wood industry, encompassing products like cellular wood panels, windows, doors, and parquet flooring, is a substantial market valued at $76.94 million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.45% from 2019 to 2033. This growth is fueled by several key factors. The increasing demand for sustainable and eco-friendly building materials is significantly boosting the market. Wood, a renewable resource, is gaining preference over synthetic alternatives, especially in residential and commercial construction projects emphasizing green building practices. Furthermore, the resurgence of traditional architectural styles and the popularity of bespoke joinery work in high-end residential projects are contributing to market expansion. The robust growth in the construction sector, particularly in developing economies of Asia Pacific and Latin America, also presents significant opportunities for market players. However, fluctuations in raw material prices and the availability of skilled labor represent challenges to sustained growth. Segmentation reveals that furniture and building applications constitute the primary end-use sectors, while cellular wood panels and windows are leading product categories, indicating a strong demand for both structural and aesthetic components.

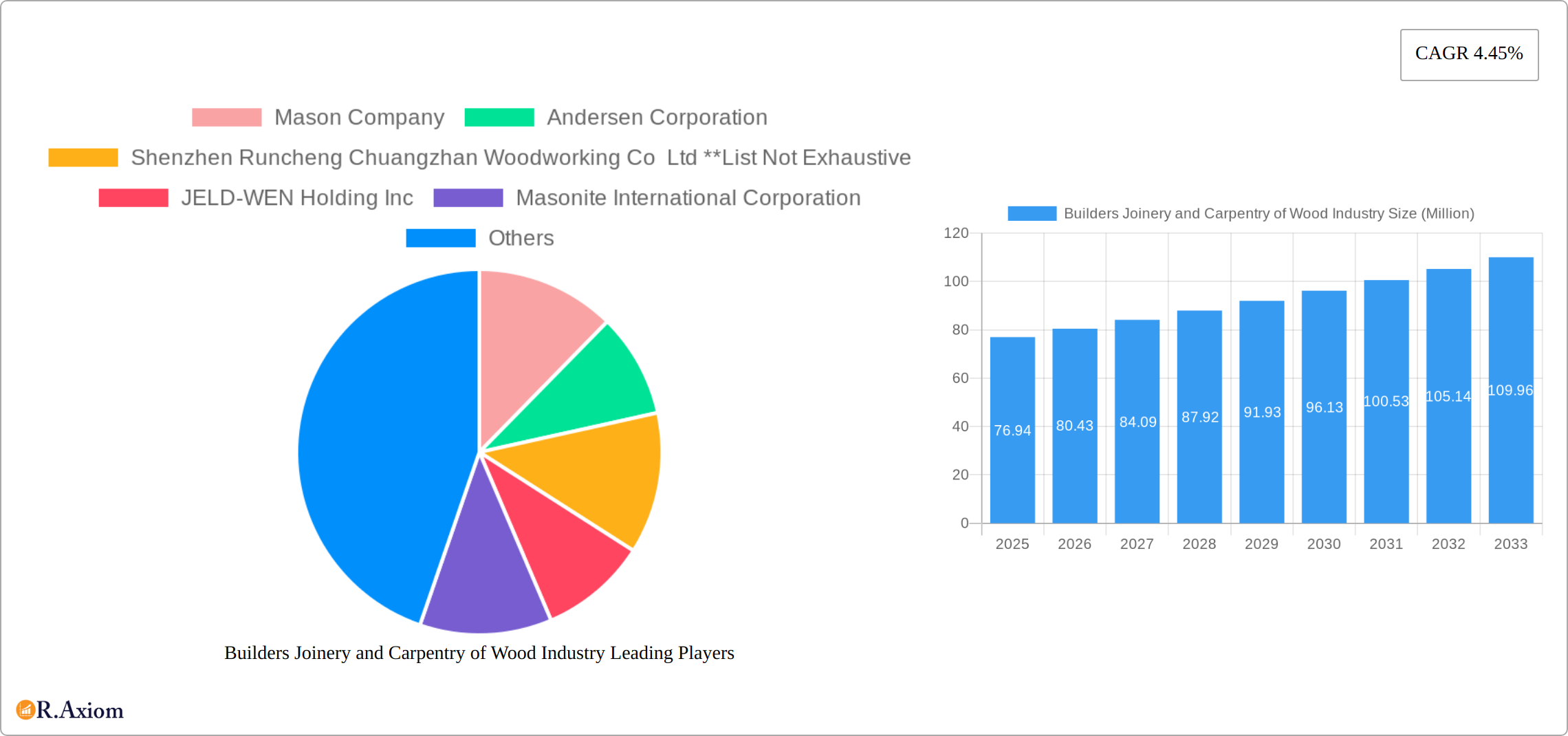

Competition is intense, with both established international players like Andersen Corporation, JELD-WEN, and Masonite, alongside regional manufacturers such as Shenzhen Runcheng Chuangzhan Woodworking Co Ltd, vying for market share. The industry is characterized by a blend of mass production of standardized joinery items and the increasing demand for customized, high-value products. This necessitates manufacturers to balance efficient mass-production techniques with the ability to cater to specific design and aesthetic preferences of architects and consumers. Future growth prospects hinge on technological advancements like improved automation in manufacturing processes, the development of innovative wood-based composites with enhanced durability and performance characteristics, and the adoption of sustainable forestry practices to ensure the long-term viability of the wood supply chain. The market is poised for continued expansion, driven by the evolving needs of the construction industry and consumer preferences for natural, sustainable, and aesthetically pleasing building materials.

Builders Joinery and Carpentry of Wood Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Builders Joinery and Carpentry of Wood Industry, offering invaluable insights for stakeholders across the value chain. The study period covers 2019-2033, with 2025 as the base and estimated year. The report forecasts market trends from 2025-2033, analyzing historical data from 2019-2024. Key players analyzed include Mason Company, Andersen Corporation, Shenzhen Runcheng Chuangzhan Woodworking Co Ltd, JELD-WEN Holding Inc, Masonite International Corporation, Pella Corporation, VELFAC (part of VKR Holding), YKK AP Inc, VELUX Group, and Assa Abloy AB (list not exhaustive). The report segments the market by Type (Cellular Wood Panels, Windows, Assembled Parquet Panels, Doors, Other Types) and Application (Furniture, Building, Other Applications). The total market value is projected to reach xx Million by 2033.

Builders Joinery and Carpentry of Wood Industry Market Concentration & Innovation

The Builders Joinery and Carpentry of Wood Industry presents a moderately concentrated market structure, dominated by several key players commanding substantial market share. Leading companies such as Masonite International Corporation, Andersen Corporation, and JELD-WEN Holding Inc. are prominent examples, collectively holding an estimated xx% of the global market in 2024. This market share distribution is a dynamic landscape, influenced by a complex interplay of factors including groundbreaking innovation, strategic mergers and acquisitions (M&A), and targeted regional market penetration strategies.

- Innovation Drivers: Significant advancements in wood processing technologies, material science breakthroughs (e.g., the development of sustainable wood alternatives and the refinement of protective coatings), and the increasing adoption of automation are key drivers of innovation within the industry. A concurrent and escalating demand for energy-efficient and environmentally sustainable products further fuels this drive for innovation.

- Regulatory Frameworks and Compliance: Stringent building codes and regulations related to energy efficiency, environmental sustainability, and product safety significantly influence product design and manufacturing processes. The diverse and often varying nature of these regulations across different geographical regions contributes to a notable level of market segmentation.

- Competitive Landscape and Product Substitutes: Materials such as PVC, aluminum, and composite materials present a degree of competition to traditional wood products, especially within specific applications. However, the inherent aesthetic appeal and the growing recognition of wood's sustainability remain crucial factors driving its continued and robust demand.

- Evolving End-User Preferences and Trends: The ongoing processes of urbanization, rising disposable incomes, and a clear preference for aesthetically pleasing and sustainable building materials represent key end-user trends that propel market growth. Furthermore, there's a noticeable surge in demand for bespoke, high-quality joinery and carpentry products tailored to individual customer needs.

- Market Consolidation through M&A Activity: Recent mergers and acquisitions, exemplified by Masonite's acquisition of PGT Innovations in December 2023 (valued at approximately USD 3 billion), underscore the ongoing trend of industry consolidation. These strategic transactions reshape the competitive landscape, resulting in increased market concentration and facilitating expansion into new product categories and markets. Masonite's acquisition of Endura Products Inc. in January 2023 further illustrates this proactive and acquisitive strategy.

Builders Joinery and Carpentry of Wood Industry Industry Trends & Insights

The global Builders Joinery and Carpentry of Wood Industry is experiencing robust growth, driven by several key factors. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. This growth is fueled by several key factors including:

- Market Growth Drivers: The construction boom in emerging economies, coupled with rising demand for renovation and refurbishment projects in developed nations, is a primary driver. Increased consumer preference for high-quality, customized joinery and carpentry products also boosts demand. The rising adoption of sustainable building practices further fuels market growth.

- Technological Disruptions: Advancements in computer-aided design (CAD) and computer-aided manufacturing (CAM) technologies are enhancing design flexibility, production efficiency, and precision. Automation in wood processing and manufacturing is improving productivity and reducing costs. The development of new wood composites, such as engineered wood, offers performance advantages over traditional wood.

- Consumer Preferences: Consumers are increasingly demanding energy-efficient, eco-friendly, and aesthetically appealing joinery and carpentry products. The growing popularity of minimalist and modern architectural styles also influences product design trends.

- Competitive Dynamics: The industry is characterized by intense competition, both among established players and emerging businesses. Players are focusing on product differentiation, innovation, cost optimization, and expanding their geographical reach to maintain a competitive edge.

Dominant Markets & Segments in Builders Joinery and Carpentry of Wood Industry

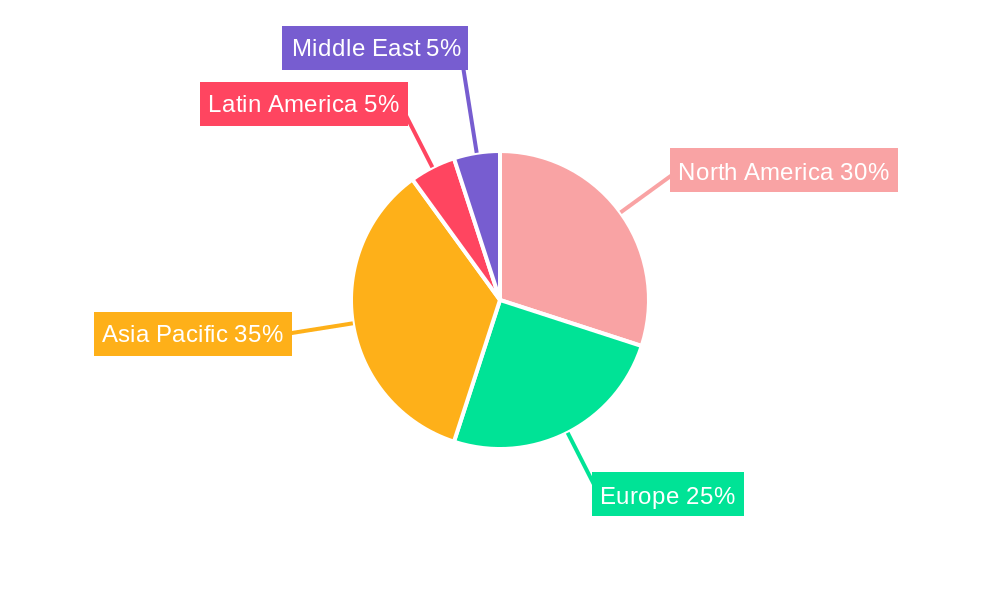

The global market for builders joinery and carpentry products is geographically diverse, with significant variations in segment dominance.

Dominant Region/Country: North America and Europe currently hold the largest market share, driven by high construction activity, strong consumer demand, and established manufacturing bases. However, the Asia-Pacific region is projected to experience the fastest growth, fueled by rapid urbanization and infrastructure development.

Dominant Segments:

- By Type: The doors segment dominates the market in terms of both volume and value, followed by windows. Cellular wood panels are seeing increasing adoption due to their lightweight and environmentally friendly nature.

- By Application: The building sector holds the largest share of the market, followed by the furniture sector. However, the demand for customized joinery and carpentry solutions in other applications, such as interior design, is also growing.

Key Drivers by Segment:

- Doors: Strong residential and commercial construction activity, rising demand for aesthetically pleasing and secure doors.

- Windows: Emphasis on energy efficiency and improved thermal performance of buildings.

- Cellular Wood Panels: Lightweight properties, environmental friendliness, and suitability for various applications.

- Building Application: Booming construction sector, focus on enhancing building aesthetics and functionality.

- Furniture Application: Rising disposable incomes, growing preference for customized furniture.

Builders Joinery and Carpentry of Wood Industry Product Developments

Recent product innovations are characterized by a strong focus on enhancing functionality, sustainability attributes, and aesthetic appeal. This includes the development of energy-efficient windows incorporating advanced glazing technologies, improvements in sound insulation for doors, and the introduction of novel wood composites boasting enhanced strength and durability. Manufacturers are also actively pursuing the development of customized solutions to meet specific client requirements, integrating smart home technologies, and offering sustainable materials such as reclaimed wood. These ongoing developments are strategically aimed at satisfying the growing consumer demand for high-performance, environmentally responsible, and aesthetically pleasing products, ultimately improving market fit and bolstering competitive advantage.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Builders Joinery and Carpentry of Wood Industry based on Type (Cellular Wood Panels, Windows, Assembled Parquet Panels, Doors, Other Types) and Application (Furniture, Building, Other Applications). Each segment undergoes detailed analysis, offering valuable insights into market size, growth projections, competitive dynamics, and key growth drivers. For example, the Windows segment is projected to experience significant growth fueled by the escalating demand for energy-efficient homes and buildings, while the Building application segment will benefit from the sustained global growth in construction activity. The cellular wood panel segment shows strong potential for growth due to its inherent sustainability benefits.

Key Drivers of Builders Joinery and Carpentry of Wood Industry Growth

Several key factors are driving the growth of the Builders Joinery and Carpentry of Wood Industry. These include:

- Technological Advancements: Innovations in wood processing, material science, and automation are enhancing efficiency and product quality.

- Economic Growth: Increased construction activity and rising disposable incomes in several regions are boosting demand.

- Government Initiatives: Policies promoting sustainable building practices and energy efficiency are encouraging the use of eco-friendly wood products.

Challenges in the Builders Joinery and Carpentry of Wood Industry Sector

The industry faces several notable challenges, including:

- Fluctuating Raw Material Prices: The volatility in the cost of wood and other crucial raw materials can significantly impact profitability and operational efficiency.

- Supply Chain Disruptions and Vulnerabilities: Global events and logistical bottlenecks can disrupt the timely supply of essential raw materials and critical components, leading to production delays and increased costs.

- Intense Competition and Market Pressures: The market is characterized by intense competition, demanding that businesses continuously innovate, differentiate their offerings, and adapt to evolving market demands.

Emerging Opportunities in Builders Joinery and Carpentry of Wood Industry

The industry presents several promising opportunities for growth and expansion:

- Growing Demand for Sustainable and Eco-Friendly Products: The increasing emphasis on environmental sustainability presents significant opportunities for manufacturers to develop and market eco-friendly wood products, catering to the growing segment of environmentally conscious consumers.

- Expansion into New and Untapped Markets: Untapped markets in developing economies represent substantial growth potential, offering opportunities for market penetration and expansion into new geographical regions.

- Integration of Smart Home Technologies and Automation: The incorporation of smart features and automation technologies into joinery and carpentry products is creating new revenue streams and enhancing product value propositions.

Leading Players in the Builders Joinery and Carpentry of Wood Industry Market

- Mason Company

- Andersen Corporation

- Shenzhen Runcheng Chuangzhan Woodworking Co Ltd

- JELD-WEN Holding Inc

- Masonite International Corporation

- Pella Corporation

- VELFAC (part of VKR Holding)

- YKK AP Inc

- VELUX Group

- Assa Abloy AB

Key Developments in Builders Joinery and Carpentry of Wood Industry Industry

- December 2023: Masonite International Corporation acquires PGT Innovations for approximately USD 3 billion, expanding its product portfolio and market share.

- January 2023: Masonite International Corp. acquires Endura Products, Inc., further strengthening its position in the market.

Strategic Outlook for Builders Joinery and Carpentry of Wood Industry Market

The Builders Joinery and Carpentry of Wood Industry is poised for continued growth, driven by favorable economic conditions, technological advancements, and increasing consumer demand for high-quality, sustainable products. Opportunities exist in expanding into new markets, developing innovative product lines, and adopting sustainable manufacturing practices. Companies that effectively leverage these opportunities and adapt to changing market dynamics will be well-positioned for success in the coming years.

Builders Joinery and Carpentry of Wood Industry Segmentation

-

1. Type

- 1.1. Cellular Wood Panels

- 1.2. Windows

- 1.3. Assembled Parquet Panels

- 1.4. Doors

- 1.5. Other Types

-

2. Application

- 2.1. Furniture

- 2.2. Building

- 2.3. Other Applications

Builders Joinery and Carpentry of Wood Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Latin America

- 2.1. Brazil

- 2.2. Colombia

- 2.3. Argentina

- 2.4. Rest of Latin America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Rest of Europe

-

4. Asia Pacific

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Rest of Asia Pacific

- 5. Middle East

-

6. Iran

- 6.1. Saudi Arabia

- 6.2. Israel

- 6.3. Rest of Middle East

Builders Joinery and Carpentry of Wood Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sustainable Construction is driving the market; Rapid Urbanization and Increasing Construction Activities

- 3.3. Market Restrains

- 3.3.1. Labor Shortage

- 3.4. Market Trends

- 3.4.1. Increase in building construction is growing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Builders Joinery and Carpentry of Wood Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cellular Wood Panels

- 5.1.2. Windows

- 5.1.3. Assembled Parquet Panels

- 5.1.4. Doors

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Furniture

- 5.2.2. Building

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Latin America

- 5.3.3. Europe

- 5.3.4. Asia Pacific

- 5.3.5. Middle East

- 5.3.6. Iran

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Builders Joinery and Carpentry of Wood Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cellular Wood Panels

- 6.1.2. Windows

- 6.1.3. Assembled Parquet Panels

- 6.1.4. Doors

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Furniture

- 6.2.2. Building

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Latin America Builders Joinery and Carpentry of Wood Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cellular Wood Panels

- 7.1.2. Windows

- 7.1.3. Assembled Parquet Panels

- 7.1.4. Doors

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Furniture

- 7.2.2. Building

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Builders Joinery and Carpentry of Wood Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cellular Wood Panels

- 8.1.2. Windows

- 8.1.3. Assembled Parquet Panels

- 8.1.4. Doors

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Furniture

- 8.2.2. Building

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Asia Pacific Builders Joinery and Carpentry of Wood Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cellular Wood Panels

- 9.1.2. Windows

- 9.1.3. Assembled Parquet Panels

- 9.1.4. Doors

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Furniture

- 9.2.2. Building

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Builders Joinery and Carpentry of Wood Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cellular Wood Panels

- 10.1.2. Windows

- 10.1.3. Assembled Parquet Panels

- 10.1.4. Doors

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Furniture

- 10.2.2. Building

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Iran Builders Joinery and Carpentry of Wood Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Cellular Wood Panels

- 11.1.2. Windows

- 11.1.3. Assembled Parquet Panels

- 11.1.4. Doors

- 11.1.5. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Furniture

- 11.2.2. Building

- 11.2.3. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Builders Joinery and Carpentry of Wood Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Rest of North America

- 13. Latin America Builders Joinery and Carpentry of Wood Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 Colombia

- 13.1.3 Argentina

- 13.1.4 Rest of Latin America

- 14. Europe Builders Joinery and Carpentry of Wood Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Germany

- 14.1.2 United Kingdom

- 14.1.3 France

- 14.1.4 Rest of Europe

- 15. Asia Pacific Builders Joinery and Carpentry of Wood Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 China

- 15.1.2 Japan

- 15.1.3 India

- 15.1.4 Rest of Asia Pacific

- 16. Middle East Builders Joinery and Carpentry of Wood Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Iran Builders Joinery and Carpentry of Wood Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 Saudi Arabia

- 17.1.2 Israel

- 17.1.3 Rest of Middle East

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Mason Company

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Andersen Corporation

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Shenzhen Runcheng Chuangzhan Woodworking Co Ltd **List Not Exhaustive

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 JELD-WEN Holding Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Masonite International Corporation

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Pella Corporation

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 VELFAC (part of VKR Holding)

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 YKK AP Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 VELUX Group

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Assa Abloy AB

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Mason Company

List of Figures

- Figure 1: Global Builders Joinery and Carpentry of Wood Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Latin America Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Latin America Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Asia Pacific Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Asia Pacific Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Iran Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Iran Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Latin America Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Latin America Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Latin America Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Latin America Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Latin America Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Latin America Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: Europe Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: Europe Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Application 2024 & 2032

- Figure 29: Europe Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Type 2024 & 2032

- Figure 33: Asia Pacific Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Type 2024 & 2032

- Figure 34: Asia Pacific Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Application 2024 & 2032

- Figure 35: Asia Pacific Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Application 2024 & 2032

- Figure 36: Asia Pacific Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Asia Pacific Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Type 2024 & 2032

- Figure 39: Middle East Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Type 2024 & 2032

- Figure 40: Middle East Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Application 2024 & 2032

- Figure 41: Middle East Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Iran Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Type 2024 & 2032

- Figure 45: Iran Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Type 2024 & 2032

- Figure 46: Iran Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Application 2024 & 2032

- Figure 47: Iran Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Application 2024 & 2032

- Figure 48: Iran Builders Joinery and Carpentry of Wood Industry Revenue (Million), by Country 2024 & 2032

- Figure 49: Iran Builders Joinery and Carpentry of Wood Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Colombia Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Argentina Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Latin America Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Germany Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: France Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Saudi Arabia Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Israel Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Middle East Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United States Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Canada Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Rest of North America Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 37: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 38: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Brazil Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Colombia Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Argentina Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Latin America Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 45: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Germany Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: United Kingdom Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Europe Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 51: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Asia Pacific Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 58: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 59: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 61: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 62: Global Builders Joinery and Carpentry of Wood Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Saudi Arabia Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Israel Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East Builders Joinery and Carpentry of Wood Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Builders Joinery and Carpentry of Wood Industry?

The projected CAGR is approximately 4.45%.

2. Which companies are prominent players in the Builders Joinery and Carpentry of Wood Industry?

Key companies in the market include Mason Company, Andersen Corporation, Shenzhen Runcheng Chuangzhan Woodworking Co Ltd **List Not Exhaustive, JELD-WEN Holding Inc, Masonite International Corporation, Pella Corporation, VELFAC (part of VKR Holding), YKK AP Inc, VELUX Group, Assa Abloy AB.

3. What are the main segments of the Builders Joinery and Carpentry of Wood Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Sustainable Construction is driving the market; Rapid Urbanization and Increasing Construction Activities.

6. What are the notable trends driving market growth?

Increase in building construction is growing.

7. Are there any restraints impacting market growth?

Labor Shortage.

8. Can you provide examples of recent developments in the market?

December 2023: Masonite International Corporation (Masonite), a global leader in the design, manufacturing, marketing, and distribution of interior and exterior doors, premium door systems, and patio door solutions, announced an agreement to purchase PGT Innovations (PGT). The transaction was valued at approximately USD 3 billion and involved the sale of PGT Innovations to Masonite in exchange for cash and Masonite shares. PGT Innovations is a leading manufacturer of patio doors and premium window solutions, recognized for its leadership in technologically advanced products for impact-rated glass applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Builders Joinery and Carpentry of Wood Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Builders Joinery and Carpentry of Wood Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Builders Joinery and Carpentry of Wood Industry?

To stay informed about further developments, trends, and reports in the Builders Joinery and Carpentry of Wood Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence