Key Insights

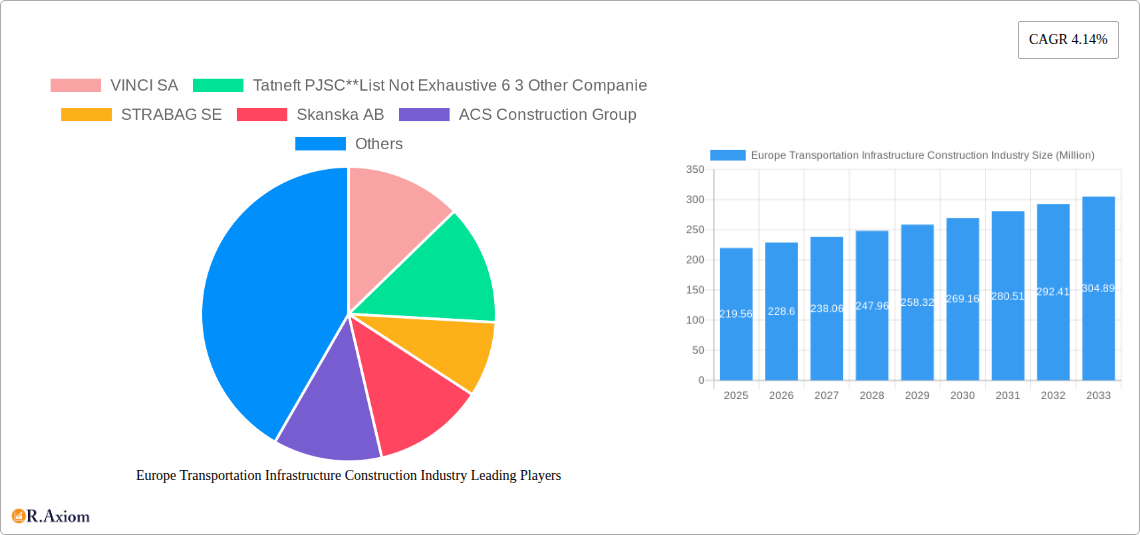

The European transportation infrastructure construction market, valued at €219.56 million in 2025, is projected to experience steady growth, driven by increasing urbanization, rising passenger and freight traffic, and government initiatives to modernize aging infrastructure. A Compound Annual Growth Rate (CAGR) of 4.14% from 2025 to 2033 indicates a significant expansion, reaching an estimated €310 million by 2033. Key growth drivers include substantial investments in high-speed rail networks, smart city projects integrating advanced transportation technologies, and the ongoing need for road maintenance and expansion to accommodate growing traffic volumes. Germany, the United Kingdom, and France represent the largest national markets, contributing significantly to the overall market size. However, the market also presents challenges. Funding constraints for large-scale projects, stringent environmental regulations impacting project timelines, and skilled labor shortages within the construction sector could potentially impede growth. The market is segmented by transportation mode (roads, railways, airways, waterways) and geographically across major European nations, allowing for tailored strategies based on specific regional needs and investment priorities.

Europe Transportation Infrastructure Construction Industry Market Size (In Million)

The competitive landscape is characterized by both large multinational construction firms like VINCI SA, STRABAG SE, and Skanska AB, and national players. These companies are increasingly adopting innovative construction technologies, sustainable practices, and public-private partnerships (PPPs) to enhance project efficiency and reduce environmental impact. Future market trends suggest a growing emphasis on sustainable infrastructure development, incorporating renewable energy sources and eco-friendly materials into projects. Furthermore, the integration of digital technologies, such as Building Information Modeling (BIM) and Internet of Things (IoT) sensors, is expected to streamline project management, improve safety, and enhance overall operational efficiency. The market's continued expansion will depend on consistent government funding, efficient regulatory processes, and a commitment to innovation and sustainable infrastructure solutions.

Europe Transportation Infrastructure Construction Industry Company Market Share

Europe Transportation Infrastructure Construction Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the European transportation infrastructure construction industry, covering the period 2019-2033. With a focus on key market segments, leading players, and emerging trends, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive primary and secondary research to offer actionable insights and robust forecasts. The base year for this analysis is 2025, with a forecast period extending to 2033.

Europe Transportation Infrastructure Construction Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the European transportation infrastructure construction market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities.

The market exhibits moderate concentration, with a few large players such as VINCI SA, STRABAG SE, Skanska AB, ACS Construction Group, Eiffage SA, HOCHTIEF, Bouygues Construction, and Colas SA holding significant market share. These companies collectively account for approximately xx% of the total market revenue in 2025. Smaller players and specialized contractors cater to niche segments. Market share fluctuations are influenced by project wins, geographical expansion strategies, and technological advancements.

- Innovation Drivers: Sustainability initiatives (e.g., green building materials), digitalization (e.g., BIM, AI), and advanced construction techniques are driving innovation.

- Regulatory Frameworks: EU directives and national regulations significantly impact construction practices and project timelines. Harmonization efforts aim to streamline cross-border projects, while variations in regulations across countries present challenges.

- M&A Activity: Consolidation through M&A remains a significant trend, with deal values exceeding €xx Million in the past five years. This is driven by the pursuit of economies of scale, technological capabilities, and geographic expansion.

Europe Transportation Infrastructure Construction Industry Industry Trends & Insights

The European transportation infrastructure construction industry is poised for significant growth driven by increasing urbanization, aging infrastructure, and government investments. The Compound Annual Growth Rate (CAGR) is projected at xx% from 2025 to 2033. This growth is fueled by several key factors:

- Government Initiatives: Significant investments in infrastructure development programs across the EU, such as the EU’s NextGenerationEU program, are creating substantial opportunities.

- Technological Disruptions: The adoption of Building Information Modeling (BIM), Internet of Things (IoT) sensors, and automation technologies is enhancing project efficiency and optimizing resource management.

- Consumer Preferences: Demand for sustainable and resilient infrastructure is growing, influencing the adoption of eco-friendly materials and construction methods.

- Competitive Dynamics: The market is characterized by intense competition, both among large multinational corporations and smaller specialized firms. This competitive pressure drives innovation and cost optimization. Market penetration is expected to increase across all segments.

Dominant Markets & Segments in Europe Transportation Infrastructure Construction Industry

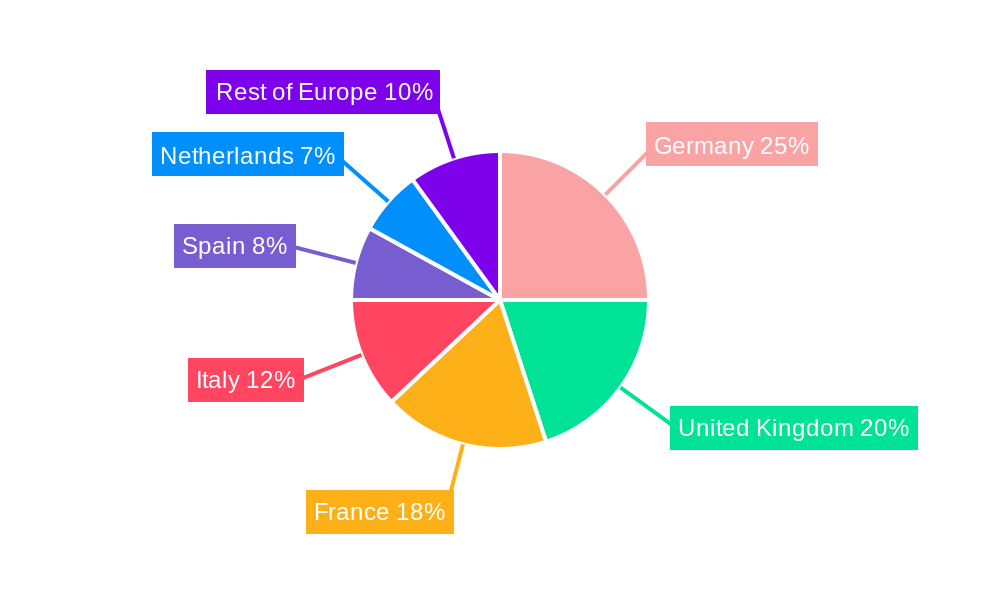

The European transportation infrastructure construction market is geographically diverse, with Germany, the United Kingdom, France, and Spain representing the largest national markets. By mode, the Roads segment currently dominates, driven by ongoing maintenance and expansion projects.

- Germany: Strong economic growth and substantial government investments in infrastructure modernization are key drivers of market dominance.

- United Kingdom: Post-Brexit infrastructure investment programs and ongoing projects are contributing significantly to the market's growth.

- France: Extensive high-speed rail projects and ongoing road upgrades contribute to significant market activity.

- Spain: Increased investments in renewable energy infrastructure and tourism-related projects drive strong demand.

By Mode:

- Roads: The largest segment, driven by ongoing maintenance and expansion of highway networks.

- Railways: Significant investments in high-speed rail networks and modernization projects fuel growth.

- Airways: Airport expansion and modernization projects contribute to moderate growth.

- Waterways: Investments in port infrastructure and inland waterway improvements contribute to relatively slower growth compared to other modes.

Europe Transportation Infrastructure Construction Industry Product Developments

Product innovations focus on sustainable materials, modular construction techniques, and digital technologies to enhance project efficiency and reduce environmental impact. New products and services include prefabricated components, advanced building materials with reduced carbon footprints, and digital twin technologies for asset management. These developments aim to provide cost-effective, sustainable, and efficient solutions that meet evolving market demands.

Report Scope & Segmentation Analysis

This report segments the European transportation infrastructure construction market by mode (Roads, Railways, Airways, Waterways) and by country (Germany, United Kingdom, France, Spain, Italy, Netherlands, Rest of Europe). Each segment's growth projections, market size (in Million), and competitive dynamics are analyzed in detail. For example, the Roads segment exhibits high growth, while Airways and Waterways show moderate growth. Germany and the UK are expected to maintain their leading positions due to large-scale infrastructure projects.

Key Drivers of Europe Transportation Infrastructure Construction Industry Growth

Key drivers of growth include substantial government investments in infrastructure modernization, increasing urbanization, the need to upgrade aging infrastructure, and technological advancements such as BIM and automation. Growing demand for sustainable infrastructure and supportive regulatory frameworks further enhance industry growth.

Challenges in the Europe Transportation Infrastructure Construction Industry Sector

Challenges include regulatory complexities, material cost volatility, skilled labor shortages, and intense competition. Supply chain disruptions, particularly in the wake of geopolitical instability, pose significant operational risks and impact project timelines. These factors can lead to cost overruns and project delays. The impact on project timelines is estimated to be xx%.

Emerging Opportunities in Europe Transportation Infrastructure Construction Industry

Emerging opportunities include the development of sustainable infrastructure, the adoption of innovative construction technologies, and the growth of the digital twin market for asset management. The integration of smart technologies within transportation networks presents significant growth prospects.

Leading Players in the Europe Transportation Infrastructure Construction Industry Market

- VINCI SA

- Tatneft PJSC

- STRABAG SE

- Skanska AB

- ACS Construction Group

- Eiffage SA

- KazMunayGas NC JSC

- HOCHTIEF

- Bouygues Construction

- Colas SA

- 6 Other Companies

Key Developments in Europe Transportation Infrastructure Construction Industry Industry

- 2022 Q4: VINCI SA secured a major contract for a high-speed rail project in France.

- 2023 Q1: The European Commission launched a new funding initiative for sustainable transportation infrastructure.

- 2023 Q2: STRABAG SE announced the acquisition of a smaller construction firm, expanding its market reach.

- (Further developments to be added)

Strategic Outlook for Europe Transportation Infrastructure Construction Industry Market

The European transportation infrastructure construction industry presents strong growth prospects in the forecast period (2025-2033). Government investment, technological innovation, and the demand for sustainable solutions are key catalysts for continued market expansion. Companies that embrace digitalization, sustainability, and strategic partnerships are expected to gain a competitive edge in this evolving landscape.

Europe Transportation Infrastructure Construction Industry Segmentation

-

1. Mode

- 1.1. Roads

- 1.2. Railways

- 1.3. Airways

- 1.4. Waterways

Europe Transportation Infrastructure Construction Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Transportation Infrastructure Construction Industry Regional Market Share

Geographic Coverage of Europe Transportation Infrastructure Construction Industry

Europe Transportation Infrastructure Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Development of sustainable and energy-efficient transportation infrastructure; Growth in demand for new road and railway construction projects

- 3.3. Market Restrains

- 3.3.1. Funding is a major challenge for infrastructure construction and maintenance; Europe's transport network is vulnerable to climate change

- 3.4. Market Trends

- 3.4.1. Increasing investments in the Transport Infrastructure Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roads

- 5.1.2. Railways

- 5.1.3. Airways

- 5.1.4. Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 VINCI SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tatneft PJSC**List Not Exhaustive 6 3 Other Companie

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 STRABAG SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Skanska AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ACS Construction Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eiffage SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KazMunayGas NC JSC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HOCHTIEF

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bouygues Construction

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Colas SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 VINCI SA

List of Figures

- Figure 1: Europe Transportation Infrastructure Construction Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Transportation Infrastructure Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Transportation Infrastructure Construction Industry Revenue Million Forecast, by Mode 2020 & 2033

- Table 2: Europe Transportation Infrastructure Construction Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Europe Transportation Infrastructure Construction Industry Revenue Million Forecast, by Mode 2020 & 2033

- Table 4: Europe Transportation Infrastructure Construction Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Transportation Infrastructure Construction Industry?

The projected CAGR is approximately 4.14%.

2. Which companies are prominent players in the Europe Transportation Infrastructure Construction Industry?

Key companies in the market include VINCI SA, Tatneft PJSC**List Not Exhaustive 6 3 Other Companie, STRABAG SE, Skanska AB, ACS Construction Group, Eiffage SA, KazMunayGas NC JSC, HOCHTIEF, Bouygues Construction, Colas SA.

3. What are the main segments of the Europe Transportation Infrastructure Construction Industry?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 219.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Development of sustainable and energy-efficient transportation infrastructure; Growth in demand for new road and railway construction projects.

6. What are the notable trends driving market growth?

Increasing investments in the Transport Infrastructure Segment.

7. Are there any restraints impacting market growth?

Funding is a major challenge for infrastructure construction and maintenance; Europe's transport network is vulnerable to climate change.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Transportation Infrastructure Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Transportation Infrastructure Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Transportation Infrastructure Construction Industry?

To stay informed about further developments, trends, and reports in the Europe Transportation Infrastructure Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence