Key Insights

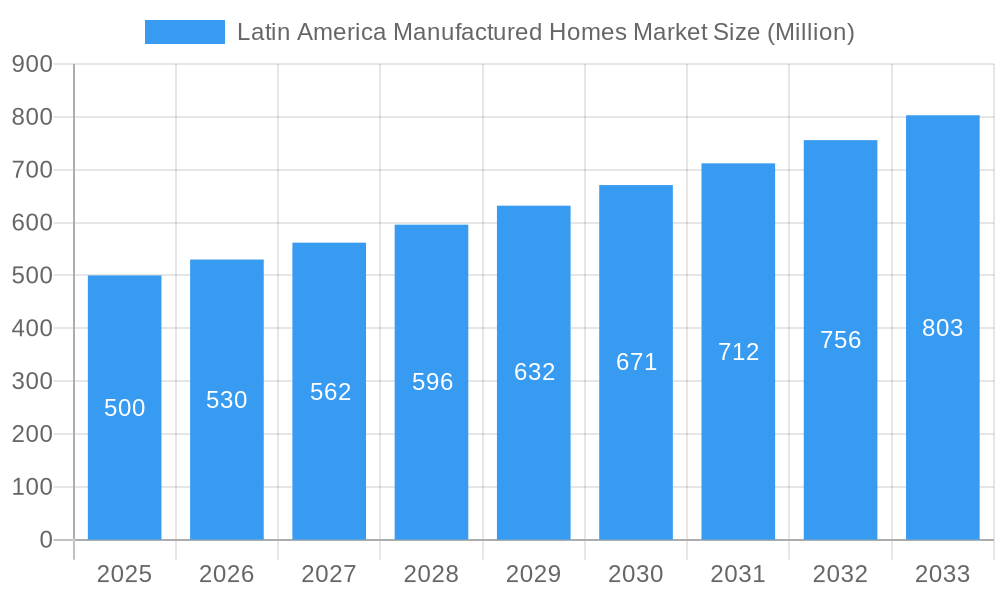

The Latin American manufactured homes market is poised for substantial expansion, fueled by escalating urbanization, a growing need for affordable housing, and supportive government policies. With a projected Compound Annual Growth Rate (CAGR) of 6.9%, the market is expected to reach $1561.5 million by 2025. Key growth drivers include major economies such as Brazil, Mexico, and Argentina. Single-family units currently dominate demand, though this trend may shift with evolving demographics. Leading companies, including Home Nation, Brasmerc Group, and Clayton Homes, are strategically positioned to leverage this growth, alongside emerging players. While government incentives are a significant boon, economic volatility and varied infrastructure development pose potential restraints.

Latin America Manufactured Homes Market Market Size (In Billion)

Macroeconomic stability and accessible financing are critical for sustained growth in the Latin American manufactured homes sector. Consumer preferences are driving innovation in home design and features. Although environmental considerations and regulatory frameworks present challenges, the industry's adaptability and focus on sustainable, energy-efficient solutions are expected to propel continued market development. A diverse competitive landscape, from global enterprises to regional builders, underscores the sector's dynamism and potential for significant future growth across Latin America.

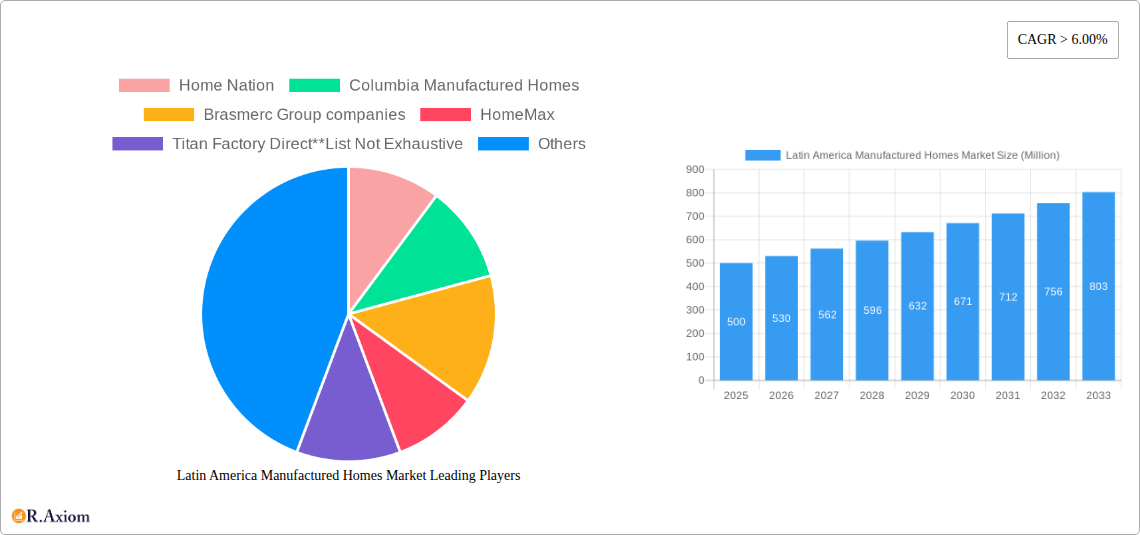

Latin America Manufactured Homes Market Company Market Share

Latin America Manufactured Homes Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America manufactured homes market, offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. The report leverages rigorous data analysis and market intelligence to deliver actionable insights into market trends, growth drivers, challenges, and opportunities. Key players analyzed include Home Nation, Columbia Manufactured Homes, Brasmerc Group companies, HomeMax, Titan Factory Direct, Casas Brazil, DRM Investments LTD, Columbia Discount Homes, CC's Modular & Manufactured Homes, and Clayton Homes (list not exhaustive). Market segmentation includes analysis by type (single-family, multiple-family) and by country (Brazil, Mexico, Argentina, Rest of Latin America).

Latin America Manufactured Homes Market Concentration & Innovation

This section analyzes the competitive landscape, innovation drivers, regulatory frameworks, and market dynamics within the Latin America manufactured homes market. The market exhibits a moderately fragmented structure, with several key players vying for market share. However, larger players such as Clayton Homes and potentially emerging players like Vessel are poised to influence market concentration in the coming years. Several metrics, including market share data and M&A activity, will be presented in the complete report. Innovation is driven by advancements in building materials, construction techniques, and design aesthetics, focusing on affordability and sustainability. Regulatory frameworks vary across Latin American countries, influencing construction standards and market access. The substitution of traditional construction with manufactured homes is driven by cost-effectiveness and shorter construction timelines. End-user trends are shifting towards preferences for eco-friendly and customizable designs. M&A activity, including recent acquisitions like Cavco Industries' purchase of Solitaire Homes, is reshaping the competitive landscape and driving consolidation. The report details the valuation of significant M&A deals within the industry. Analysis of market share will demonstrate how these activities affect overall market concentration.

Latin America Manufactured Homes Market Industry Trends & Insights

The Latin America manufactured homes market is experiencing robust growth, driven by several key factors. The rising demand for affordable housing, coupled with rapid urbanization, is a primary driver. Technological advancements in manufacturing and design are enhancing efficiency and product quality. Consumer preferences are evolving toward more sustainable and energy-efficient homes. The market demonstrates a significant competitive landscape with established players and emerging entrants. The report will present a comprehensive analysis of the CAGR and market penetration for the period under review. Further, the influence of economic factors (such as GDP growth and inflation) and governmental policies that encourage affordable housing will be detailed. Technological disruptions, including the adoption of prefabrication and modular construction methods, are transforming the industry, significantly impacting construction timelines and cost-effectiveness. These trends contribute to the overall growth and competitive dynamics of the market.

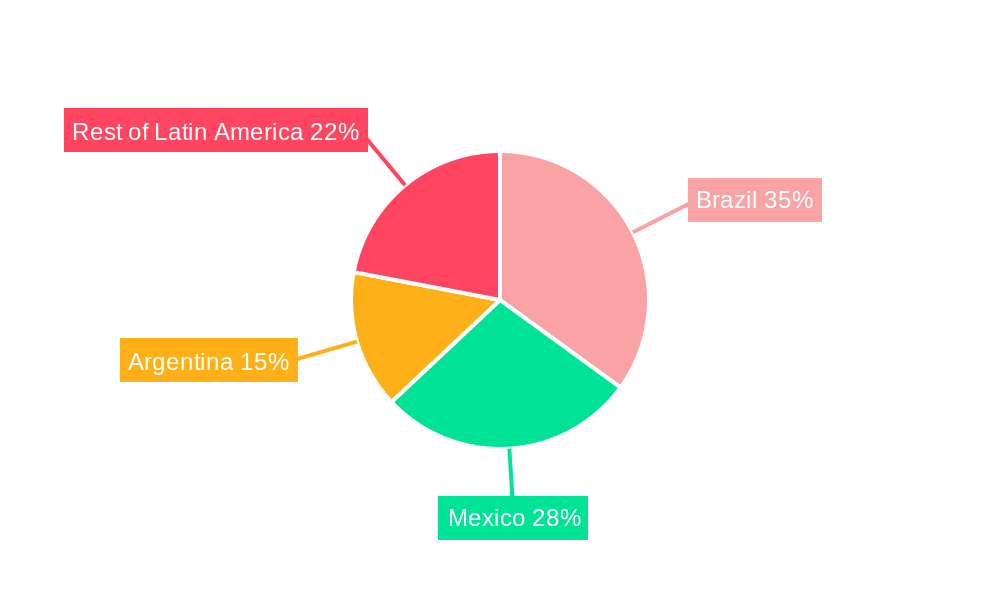

Dominant Markets & Segments in Latin America Manufactured Homes Market

The Latin American manufactured homes market is experiencing diverse growth patterns across different countries and segments.

- Brazil: Remains a dominant market due to its large population and ongoing urbanization. Key drivers include government initiatives aimed at affordable housing and robust economic growth (though subject to volatility).

- Mexico: Shows considerable potential, spurred by foreign investment and the growing middle class. Infrastructure development further fuels the demand for housing.

- Argentina: Faces fluctuating economic conditions impacting growth. Market dynamics are influenced by economic policies and currency fluctuations.

- Rest of Latin America: This segment presents a mix of opportunities and challenges, depending on individual country-specific economic contexts and regulatory environments.

The single-family segment currently holds the largest market share, primarily driven by individual homeownership preferences. However, the multiple-family segment is experiencing notable growth, driven by increasing rental demands in urban areas. Detailed analysis will provide a deep understanding of market dominance considering several factors influencing each segment's and country's performance, including economic stability, infrastructure developments, and regulatory policies affecting construction and housing affordability.

Latin America Manufactured Homes Market Product Developments

Recent product innovations focus on enhanced energy efficiency, incorporating sustainable building materials, and improved design aesthetics to cater to modern preferences. Technological advancements include the use of prefabricated components and modular construction, streamlining the production process and reducing construction time. These innovations offer significant competitive advantages, enhancing cost-effectiveness and providing faster turnaround times, appealing to both builders and buyers seeking affordable and quality housing solutions.

Report Scope & Segmentation Analysis

This report segments the Latin America manufactured homes market by type (single-family and multiple-family) and by country (Brazil, Mexico, Argentina, and the Rest of Latin America). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed. The single-family segment is projected to maintain significant growth due to individual homeownership aspirations. Multiple-family housing is expected to grow at a faster rate, driven by increasing urbanization and rental demand. Country-specific analysis considers varying economic conditions, regulatory frameworks, and infrastructure development influencing market growth in each region.

Key Drivers of Latin America Manufactured Homes Market Growth

Several key factors are driving the growth of the Latin America manufactured homes market. These include the increasing demand for affordable housing fueled by rapid urbanization and population growth. Government initiatives promoting affordable housing and infrastructure development further stimulate market expansion. Technological advancements in manufacturing and design contribute to cost-effectiveness and improved product quality. Furthermore, favorable financing options for affordable housing increase accessibility for a broader consumer base, accelerating market growth.

Challenges in the Latin America Manufactured Homes Market Sector

Challenges in this sector include fluctuating economic conditions across Latin American countries, impacting consumer spending and investment. Regulatory hurdles and bureaucratic processes can impede construction and project timelines. Supply chain disruptions and material cost volatility pose significant operational challenges. Intense competition from traditional housing construction methods creates pricing pressures and limits profitability. These combined factors contribute to uncertainty within the market and require careful consideration from all stakeholders. The report will provide quantified analysis of these challenges and their impact on market growth.

Emerging Opportunities in Latin America Manufactured Homes Market

The market presents substantial opportunities for growth. The increasing adoption of sustainable and eco-friendly building materials and practices aligns with global environmental concerns and consumer preferences. The expansion into underserved markets and regions with significant housing shortages creates new avenues for growth. Technological innovations, such as smart home integration and advanced manufacturing techniques, can further enhance product appeal and differentiation. The market is ripe for expansion of financing and consumer credit solutions to make these homes accessible to a wider demographic.

Leading Players in the Latin America Manufactured Homes Market Market

- Home Nation

- Columbia Manufactured Homes

- Brasmerc Group companies

- HomeMax

- Titan Factory Direct

- Casas Brazil

- DRM Investments LTD

- Columbia Discount Homes

- CC's Modular & Manufactured Homes

- Clayton Homes

Key Developments in Latin America Manufactured Homes Market Industry

August 2022: Vessel, a subsidiary of Weisu (China), announced plans to establish a manufacturing plant in Nuevo Leon, Mexico, with projected operations commencing in late 2023 and sales in 2024. They also indicated expansion plans for Colombia, Ecuador, Argentina, Peru, and Brazil. This signifies significant foreign investment and market entry.

January 2023: Cavco Industries acquired Solitaire Homes, expanding its presence in the US and Mexico. This consolidation will likely influence market competition and potentially pricing strategies within the sector.

Strategic Outlook for Latin America Manufactured Homes Market Market

The Latin America manufactured homes market is poised for sustained growth, driven by the persistent demand for affordable housing and technological advancements. The increasing adoption of sustainable practices and the expansion into new markets represent significant growth catalysts. Addressing the challenges related to economic volatility and regulatory frameworks will be crucial for long-term market success. Strategic partnerships, investment in innovation, and efficient supply chain management will be vital for players seeking to capitalize on this dynamic market's opportunities.

Latin America Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multiple Family

-

2. Countries

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Argentina

- 2.4. Rest of Latin America

Latin America Manufactured Homes Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Manufactured Homes Market Regional Market Share

Geographic Coverage of Latin America Manufactured Homes Market

Latin America Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for New Dwellings Units; Government Initiatives are driving the market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Lack of Skilled Labour

- 3.4. Market Trends

- 3.4.1. Low Construction Cost Propels the Demand for Manufactured Homes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multiple Family

- 5.2. Market Analysis, Insights and Forecast - by Countries

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Argentina

- 5.2.4. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Home Nation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Columbia Manufactured Homes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Brasmerc Group companies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HomeMax

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Titan Factory Direct**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Casas Brazil

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DRM Investments LTD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Columbia Discount Homes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CC's Modular & Manufactured Homes

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Clayton Homes

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Home Nation

List of Figures

- Figure 1: Latin America Manufactured Homes Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Latin America Manufactured Homes Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Manufactured Homes Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Latin America Manufactured Homes Market Revenue million Forecast, by Countries 2020 & 2033

- Table 3: Latin America Manufactured Homes Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Latin America Manufactured Homes Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Latin America Manufactured Homes Market Revenue million Forecast, by Countries 2020 & 2033

- Table 6: Latin America Manufactured Homes Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Manufactured Homes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Manufactured Homes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Manufactured Homes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Manufactured Homes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Manufactured Homes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Manufactured Homes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Manufactured Homes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Manufactured Homes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Manufactured Homes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Manufactured Homes Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Manufactured Homes Market?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the Latin America Manufactured Homes Market?

Key companies in the market include Home Nation, Columbia Manufactured Homes, Brasmerc Group companies, HomeMax, Titan Factory Direct**List Not Exhaustive, Casas Brazil, DRM Investments LTD, Columbia Discount Homes, CC's Modular & Manufactured Homes, Clayton Homes.

3. What are the main segments of the Latin America Manufactured Homes Market?

The market segments include Type, Countries.

4. Can you provide details about the market size?

The market size is estimated to be USD 1561.5 million as of 2022.

5. What are some drivers contributing to market growth?

Demand for New Dwellings Units; Government Initiatives are driving the market.

6. What are the notable trends driving market growth?

Low Construction Cost Propels the Demand for Manufactured Homes.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Lack of Skilled Labour.

8. Can you provide examples of recent developments in the market?

January 2023 - Cavco Industries (producers of manufactured and modular homes in the United States) announced that it has completed the acquisition of manufactured home builder and retailer, Solitaire Homes. Solitaire Homes operates manufacturing facilities in New Mexico, Oklahoma, and Mexico, with retail locations across New Mexico, Oklahoma, and Texas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the Latin America Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence