Key Insights

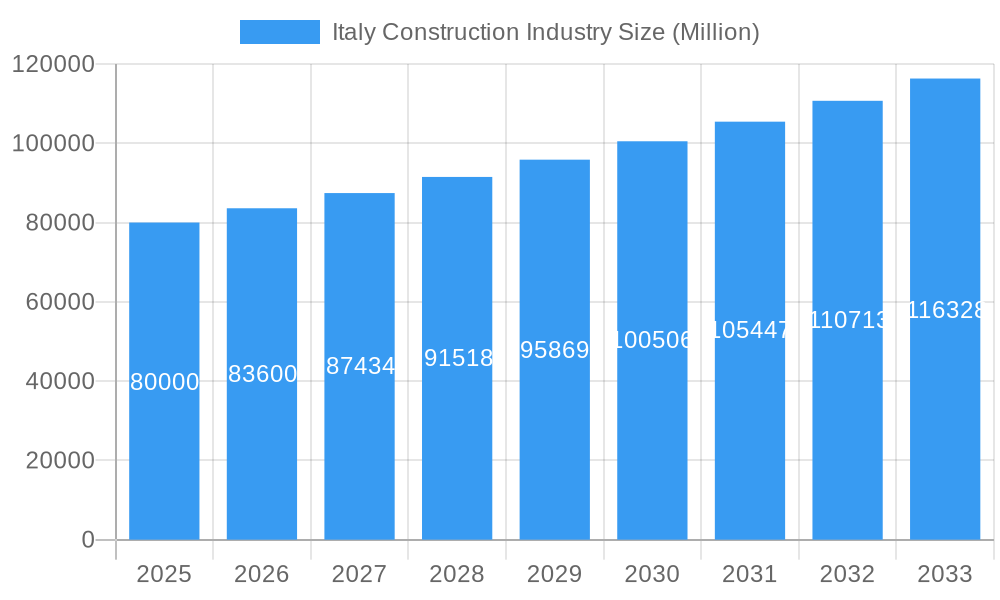

The Italian construction market, estimated at €111.64 billion in the base year 2025, is poised for substantial expansion with a projected Compound Annual Growth Rate (CAGR) of 2.6% through 2033. This growth is propelled by significant government investment in infrastructure, largely driven by the National Recovery and Resilience Plan (PNRR) and EU funding. Demand is robust across residential, commercial, and industrial segments. A growing emphasis on sustainable and energy-efficient buildings is fostering innovation and adoption of green construction technologies. The thriving tourism sector also contributes to infrastructure development. While material price volatility and labor shortages pose challenges, the market outlook remains positive. Key industry players include Maire Tecnimont, Webuild, and Salcef Group, alongside a competitive landscape of regional firms. Market segmentation highlights the dominance of residential construction, with steady growth in commercial and infrastructure projects, reflecting the diverse economic needs of Italy. Modernization initiatives and Italy's strategic European location further support long-term growth.

Italy Construction Industry Market Size (In Billion)

Future prospects for the Italian construction industry involve navigating opportunities and challenges. Effective PNRR implementation is critical for sustained infrastructure investment. The industry must adapt to evolving sustainability regulations and embrace digital transformation to enhance efficiency and productivity. Addressing labor shortages through workforce development and attracting younger talent is vital for growth momentum. Strategic planning and adaptive business models are necessary to mitigate economic volatility and global supply chain disruptions. Despite these hurdles, strong underlying demand, bolstered by governmental and private investment, indicates consistent market growth. The long-term forecast predicts continued expansion, supported by Italy's resilient economy and the ongoing demand for modern infrastructure.

Italy Construction Industry Company Market Share

Italy Construction Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Italy construction industry, encompassing market size, segmentation, growth drivers, challenges, and key players. The report covers the historical period (2019-2024), the base year (2025), and forecasts until 2033, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The total market value is projected to reach xx Million by 2033.

Italy Construction Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Italian construction market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is characterized by a mix of large multinational players and smaller, specialized firms. Webuild, Webuild, and SAIPEM SpA hold significant market share, though the exact figures remain proprietary data. The overall market concentration is moderate, with a few dominant players and numerous smaller companies.

Innovation in the sector is driven by several factors:

- Government initiatives: Incentives for sustainable construction practices and digitalization are fostering innovation.

- Technological advancements: BIM (Building Information Modeling), advanced construction materials, and automation are increasing efficiency and productivity.

- Sustainability concerns: Growing environmental awareness is driving demand for green building technologies and practices.

M&A activity has been relatively modest in recent years, with deal values totaling approximately xx Million during the historical period. Regulatory frameworks, including building codes and environmental regulations, heavily influence market dynamics. The increasing adoption of prefabricated building components represents a notable shift, posing a challenge to traditional construction methods.

Italy Construction Industry Industry Trends & Insights

The Italian construction industry is expected to experience steady growth over the forecast period (2025-2033), driven by several key factors. The projected Compound Annual Growth Rate (CAGR) for the overall market is estimated to be xx%. Infrastructure development, spurred by government spending on transportation and energy projects, is a primary driver of growth. Residential construction, influenced by demographic trends and government housing policies, also contributes significantly. Increased private investment in commercial and industrial projects further fuels market expansion.

Technological disruptions, such as the increasing use of robotics and 3D printing, are gradually altering industry practices, though their market penetration remains relatively low (estimated at xx% in 2025). Consumer preferences are increasingly leaning towards sustainable and energy-efficient buildings, leading to a surge in demand for green construction solutions. Competitive dynamics are characterized by intense competition among large and small players, particularly in the residential segment.

Dominant Markets & Segments in Italy Construction Industry

The infrastructure segment holds a dominant position within the Italian construction market, driven by significant government investments in transportation networks, energy infrastructure, and other public works. The northern regions of Italy tend to have a higher concentration of large-scale projects.

Key Drivers for Infrastructure Dominance:

- Significant government spending: Public investment in infrastructure modernization and development is substantial.

- EU funding: Access to European Union funds for infrastructure projects further boosts the sector.

- Aging infrastructure: The need for renovation and upgrade of existing infrastructure creates substantial demand.

The residential segment is also considerable.

Commercial and Industrial segments: Growth in these sectors is linked to economic activity and business confidence. The energy and utilities sector shows notable growth potential, driven by the transition to renewable energy sources.

Italy Construction Industry Product Developments

Recent product innovations include advanced building materials with improved durability and sustainability features, prefabricated building components for faster construction times, and specialized software for project management and BIM applications. The market is witnessing a shift toward sustainable and energy-efficient solutions, with an emphasis on modular and prefabricated construction methods to improve efficiency and reduce environmental impact. These innovations directly address market demand for cost-effective, environmentally conscious, and timely construction solutions.

Report Scope & Segmentation Analysis

The report segments the Italian construction market by sector: Residential, Commercial, Industrial, Infrastructure, and Energy and Utilities. Each sector has unique growth trajectories and competitive dynamics. The Infrastructure sector holds the largest market share in 2025, estimated at xx Million, followed by Residential at xx Million, and the others having comparatively smaller shares. Projections suggest continued growth in all sectors over the forecast period, although the pace of growth may vary.

Key Drivers of Italy Construction Industry Growth

The growth of the Italian construction industry is propelled by several factors. Government investments in infrastructure projects, particularly related to transportation and energy, provide a strong impetus. Economic growth, if sustained, will positively impact both residential and commercial construction. Furthermore, the ongoing drive towards sustainable construction practices, supported by government incentives and EU regulations, fuels innovation and market expansion.

Challenges in the Italy Construction Industry Sector

The Italian construction industry faces several challenges. Bureaucratic processes and regulatory hurdles often lead to delays in project approvals and completion. Supply chain disruptions, exacerbated by global events and material price volatility, can impact project costs and timelines. Competition, particularly among smaller firms, is intense, which can lead to price wars and reduced profit margins. These factors combined can represent a significant impediment to growth and profitability. The estimated cost impact from these challenges is approximately xx Million annually.

Emerging Opportunities in Italy Construction Industry

Several emerging opportunities exist for the Italian construction industry. The increasing focus on sustainable construction practices creates a demand for green building materials and technologies. The adoption of innovative construction methods, like 3D printing and modular construction, offers potential for efficiency gains. Furthermore, the development of smart buildings and infrastructure presents growth opportunities.

Leading Players in the Italy Construction Industry Market

- MaireTecnimont Spa

- Cooperativa Muratori Cementisti Ravenna

- Webuild

- Itinera

- Salcef Group SpA

- Astaldi SpA

- Bentini Construction SpA

- SAIPEM SpA

- Bonatti Societa per Azioni

- Cimolai SpA

- Rizzani de Eccher SpA

- Impresa Pizzarotti & C SpA

- GLF SpA

Key Developments in Italy Construction Industry Industry

- 2022 Q3: Government announces a new infrastructure development plan, allocating xx Million to projects nationwide.

- 2023 Q1: Webuild secures a major contract for a high-speed rail project, valued at xx Million.

- 2024 Q2: Several construction firms merge, creating larger entities with increased market share.

Further specific developments would be included in the final report with detailed impacts.

Strategic Outlook for Italy Construction Industry Market

The Italian construction industry is poised for continued growth in the coming years. Government investments in infrastructure, coupled with a gradual economic recovery and the growing emphasis on sustainable construction, offer significant opportunities for market expansion. The increasing adoption of innovative technologies and construction methods presents further growth potential. The market is expected to remain dynamic, with opportunities and challenges coexisting.

Italy Construction Industry Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure

- 1.5. Energy and Utilities

Italy Construction Industry Segmentation By Geography

- 1. Italy

Italy Construction Industry Regional Market Share

Geographic Coverage of Italy Construction Industry

Italy Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions

- 3.3. Market Restrains

- 3.3.1. The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. The Residential Sector is Witnessing Lucrative Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MaireTecnimont Spa

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cooperativa Muratori Cementisti Ravenna

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Webuild

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Itinera**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Salcef Group SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Astaldi SpA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bentini Construction SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAIPEM SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bonatti Societa per Azioni

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cimolai SpA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rizzani de Eccher SpA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Impresa Pizzarotti & C SpA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 GLF SpA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 MaireTecnimont Spa

List of Figures

- Figure 1: Italy Construction Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Construction Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 2: Italy Construction Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Italy Construction Industry Revenue billion Forecast, by Sector 2020 & 2033

- Table 4: Italy Construction Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Construction Industry?

The projected CAGR is approximately 2.6%.

2. Which companies are prominent players in the Italy Construction Industry?

Key companies in the market include MaireTecnimont Spa, Cooperativa Muratori Cementisti Ravenna, Webuild, Itinera**List Not Exhaustive, Salcef Group SpA, Astaldi SpA, Bentini Construction SpA, SAIPEM SpA, Bonatti Societa per Azioni, Cimolai SpA, Rizzani de Eccher SpA, Impresa Pizzarotti & C SpA, GLF SpA.

3. What are the main segments of the Italy Construction Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 111.64 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions.

6. What are the notable trends driving market growth?

The Residential Sector is Witnessing Lucrative Growth.

7. Are there any restraints impacting market growth?

The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Construction Industry?

To stay informed about further developments, trends, and reports in the Italy Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence