Key Insights

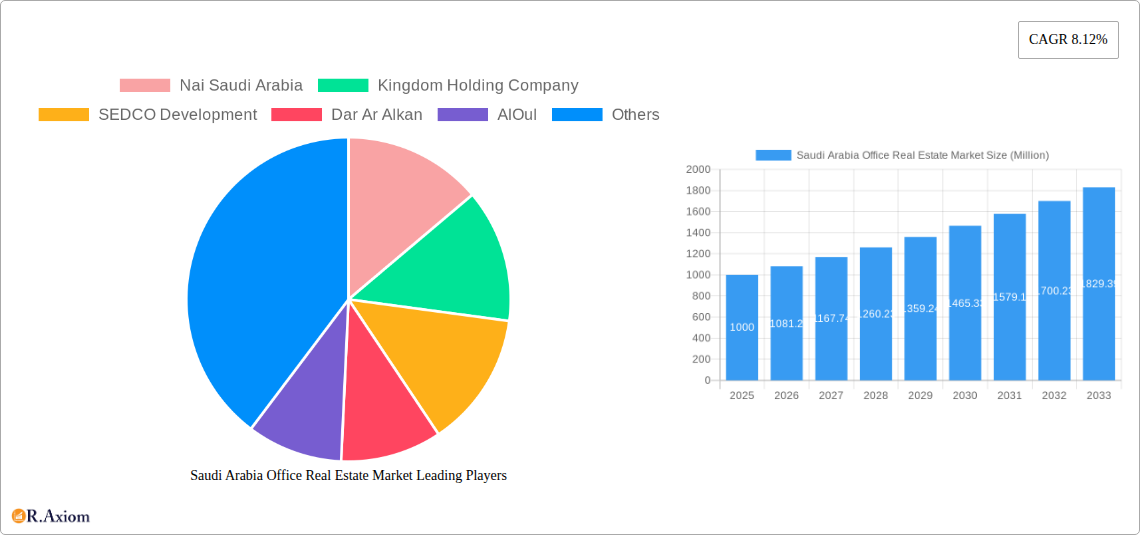

The Saudi Arabian office real estate market, valued at approximately 20874.6 million in 2025, is projected for significant expansion. Forecasted to grow at a Compound Annual Growth Rate (CAGR) of 6.75% from 2025 to 2033, this robust growth is driven by substantial government investment in infrastructure, aligning with Vision 2030 objectives and stimulating demand for contemporary office spaces. The Kingdom's economic diversification, alongside advancements in technology and finance sectors, further amplifies the requirement for premium office facilities. An increasing number of domestic and international corporations establishing operations in Saudi Arabia are intensifying market competition and influencing rental values, especially in key urban centers such as Riyadh, Jeddah, and Makkah. This dynamic environment is fostering the development of advanced, technology-driven office buildings designed to meet the evolving demands of modern enterprises.

Saudi Arabia Office Real Estate Market Market Size (In Billion)

Potential market restraints include the influence of global oil price volatility on economic activity and the availability of skilled labor for construction and operational management of new developments. Geographically, Riyadh, Jeddah, and Makkah lead the market due to their established business ecosystems and concentration of major corporations. Prominent market participants, including Nai Saudi Arabia, Kingdom Holding Company, and SEDCO Development, are instrumental in shaping the market through their development and construction initiatives, often leveraging a combination of local expertise and international collaborations. The market's positive growth outlook is anticipated to continue, though strategic planning by investors and developers will necessitate vigilance regarding potential economic shifts. The development of high-quality office spaces in strategic locations will be paramount to supporting the projected growth of the Saudi Arabian business sector.

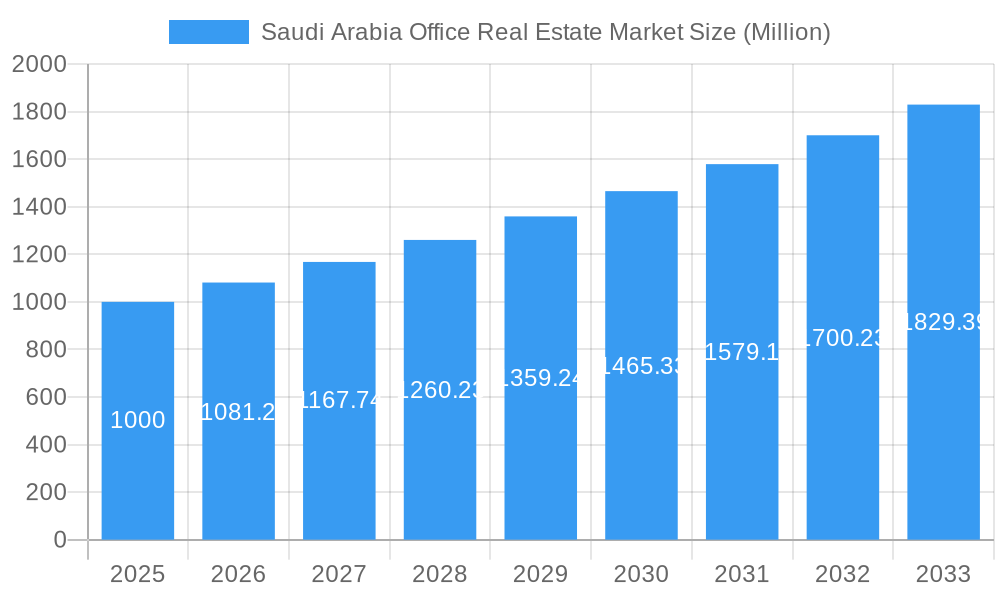

Saudi Arabia Office Real Estate Market Company Market Share

Saudi Arabia Office Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Saudi Arabia office real estate market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, key players, investment opportunities, and future growth potential, making it an essential resource for investors, developers, and industry stakeholders. The report leverages extensive data analysis and expert insights to provide actionable intelligence for informed decision-making.

Keywords: Saudi Arabia, office real estate, market analysis, Riyadh, Jeddah, Makkah, real estate investment, market forecast, industry trends, M&A, CAGR, Kingdom Holding Company, SEDCO Development, Dar Ar Alkan, AlOul, Abdul Latif Jameel, JLL Riyadh, Century 21 Saudi Arabia, Saudi Real Estate Company, Nai Saudi Arabia, Arabian Centres Company, Ajdan Real Estate Development Company, Al-Muhaidib Group, Adeer Real Estate.

Saudi Arabia Office Real Estate Market Concentration & Innovation

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Saudi Arabian office real estate market. The market is moderately concentrated, with a few major players holding significant market share. However, the emergence of smaller, specialized firms and increased foreign investment is leading to heightened competition.

Market Share: While precise market share data for individual companies is proprietary information, Kingdom Holding Company, SEDCO Development, and Dar Ar Alkan are estimated to collectively hold approximately xx% of the market share in 2025. Other prominent players, like AlOul and Abdul Latif Jameel, each hold significant, albeit smaller, portions.

M&A Activity: The value of M&A deals in the Saudi Arabian office real estate sector between 2019 and 2024 totalled approximately xx Million. Significant deals included the acquisition of xx by xx for xx Million (Year). This trend reflects consolidation within the market and the pursuit of growth through acquisitions.

Innovation Drivers: Government initiatives promoting diversification, Vision 2030, and increasing foreign direct investment are major drivers of innovation. Technological advancements in building management systems, smart office technologies, and sustainable building practices are also transforming the market.

Regulatory Framework: Government regulations related to building codes, zoning laws, and foreign investment significantly influence the market. Recent reforms aim to streamline processes and attract further investment.

Product Substitutes: While traditional office spaces remain dominant, co-working spaces and flexible office solutions are gaining traction, posing a degree of competitive pressure on traditional models.

End-User Trends: The demand for high-quality, sustainable, and technologically advanced office spaces is rising, reflecting changes in workplace culture and employee expectations.

Saudi Arabia Office Real Estate Market Industry Trends & Insights

The Saudi Arabian office real estate market is experiencing robust growth fueled by several key factors. The government's Vision 2030 initiative, aimed at diversifying the economy away from oil dependence, is driving substantial infrastructure development and attracting significant foreign investment. This influx of capital is stimulating demand for office spaces across various sectors, from technology and finance to government and healthcare.

The market's compound annual growth rate (CAGR) from 2019 to 2024 is estimated to be xx%, and is projected to reach xx% between 2025 and 2033. This growth is largely driven by increasing urbanization, a burgeoning population, and the establishment of new business hubs. The rise of the gig economy and flexible work arrangements has led to increased demand for co-working spaces and flexible office solutions, although traditional office spaces still constitute the majority of the market.

Technological advancements like smart building technologies and the adoption of sustainable practices are further influencing market dynamics. Increasing adoption of smart office technologies is creating opportunities for innovative solutions that improve energy efficiency, security, and space utilization. A significant competitive aspect of the market revolves around the provision of amenities, as companies increasingly prioritize attractive and well-equipped workplaces for their employees. This is driving a trend towards premium office developments that incorporate high-quality finishes, advanced technological features, and desirable locations.

Market penetration of smart office technologies remains relatively low compared to global standards, suggesting substantial room for future growth. This presents opportunities for technological providers to tap into this expanding market.

Dominant Markets & Segments in Saudi Arabia Office Real Estate Market

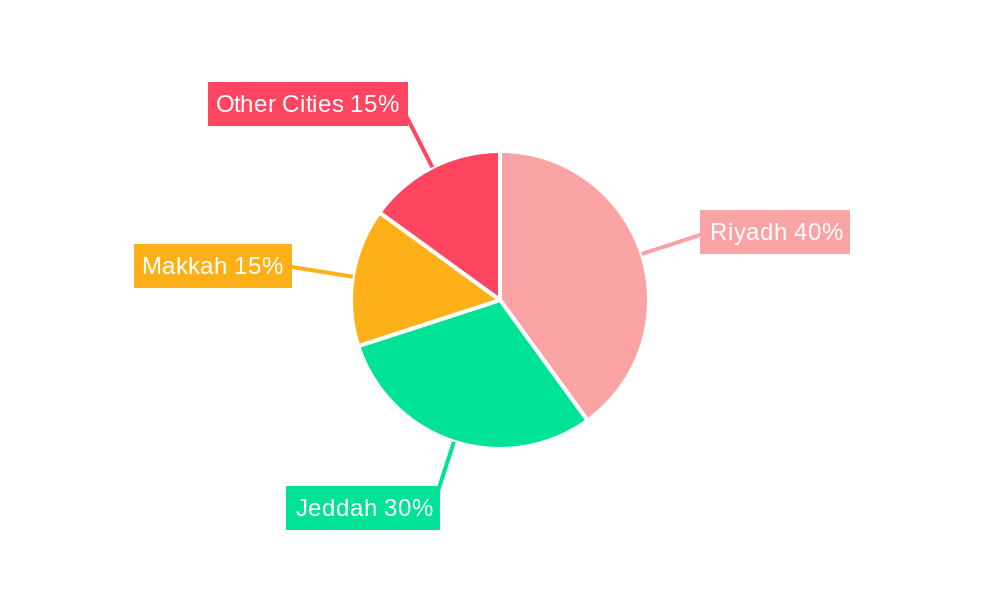

Riyadh emerges as the dominant market segment within the Saudi Arabian office real estate landscape.

Key Drivers of Riyadh's Dominance:

- Economic Hub: Riyadh serves as the economic and administrative center of Saudi Arabia, housing major government agencies, financial institutions, and multinational corporations.

- Infrastructure Development: Significant investments in infrastructure, including transportation and communication networks, enhance Riyadh's attractiveness as a business location.

- Government Policies: Government policies promoting business development and foreign investment further contribute to Riyadh's dominance.

Jeddah and Makkah, although significant, hold smaller market shares compared to Riyadh. Other cities contribute a smaller yet growing segment, particularly as government initiatives to decentralize economic activity gain traction. The demand for office space varies across cities depending on the concentration of specific industries and the overall economic activity.

Saudi Arabia Office Real Estate Market Product Developments

Product innovations focus on incorporating smart building technologies, sustainable designs, and flexible layouts to meet evolving user needs. Green building certifications and advanced security systems are becoming increasingly important differentiating factors. The market is witnessing a shift towards modular office solutions and co-working spaces, catering to the increasing demand for flexibility and cost-effectiveness. These developments improve energy efficiency, optimize space utilization, and enhance the overall tenant experience.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabia office real estate market by key cities:

Riyadh: Riyadh's office market is characterized by strong demand driven by the concentration of businesses and government entities. Growth is projected to be xx% between 2025 and 2033, with a market size of xx Million by 2033. The market is characterized by a mix of Grade A, B, and C office spaces, with a growing demand for high-quality, modern developments.

Jeddah: Jeddah's office market benefits from its strategic location as a major port and commercial hub. Projected growth is xx% from 2025 to 2033, with a market size of xx Million by 2033. The market is witnessing an increase in the development of modern office spaces to cater to the needs of a growing number of companies.

Makkah: Makkah's office market is primarily driven by religious tourism and related businesses. The growth is projected at xx% from 2025-2033. The market size in 2033 is estimated to be xx Million.

Other Cities: This segment comprises smaller cities with developing office markets. The overall market size is estimated to be xx Million in 2033.

Key Drivers of Saudi Arabia Office Real Estate Market Growth

Several factors are driving the growth of the Saudi Arabian office real estate market. Vision 2030 is a key driver, stimulating infrastructure development and attracting foreign investment. Population growth and urbanization are increasing demand for office space. The diversification of the Saudi Arabian economy is creating opportunities across various sectors, increasing demand for office space across all segments. Finally, government initiatives to improve the business environment and attract foreign investment further boost market growth.

Challenges in the Saudi Arabia Office Real Estate Market Sector

Challenges include the volatility of oil prices impacting overall economic growth, competition from other regional markets, and the need to address the growing demand for sustainable and technologically advanced office spaces. Supply chain disruptions and securing skilled labor can impact project timelines and costs. Regulatory hurdles and permitting processes can sometimes create delays and increase development costs.

Emerging Opportunities in Saudi Arabia Office Real Estate Market

Opportunities exist in developing sustainable office spaces, integrating smart technologies, and catering to the growing demand for flexible workspace solutions. There is potential to expand into secondary cities and capitalize on the growth of specific sectors. The market also offers opportunities for technology providers to integrate their products and services into modern office developments.

Leading Players in the Saudi Arabia Office Real Estate Market Market

- Nai Saudi Arabia

- Kingdom Holding Company

- SEDCO Development

- Dar Ar Alkan

- AlOul

- Abdul Latif Jameel

- JLL Riyadh

- Century 21 Saudi Arabia

- Saudi Real Estate Company

Key Developments in Saudi Arabia Office Real Estate Market Industry

November 2022: Arabian Centres Company sold non-core assets worth 2 Billion Saudi Riyals (approximately USD 533 Million) to Adeer Real Estate. This signifies a reallocation of capital towards residential or office development projects.

October 2022: Ajdan Real Estate Development Company initiated the 250 Million Saudi Riyals (USD 66.5 Million) Bayfront commercial project in Al-Khobar. This project signals growing investment in commercial developments outside of major cities.

Strategic Outlook for Saudi Arabia Office Real Estate Market Market

The Saudi Arabian office real estate market exhibits significant growth potential fueled by ongoing government initiatives, economic diversification, and population growth. The increasing focus on sustainable and smart building technologies presents opportunities for innovation and differentiation. The market will likely continue to witness consolidation among major players as companies seek to expand their portfolios and enhance their market share. The long-term outlook remains positive, with substantial growth opportunities for developers and investors.

Saudi Arabia Office Real Estate Market Segmentation

-

1. Key Cities

- 1.1. Riyadh

- 1.2. Jeddah

- 1.3. Makkah

- 1.4. Other Cities

Saudi Arabia Office Real Estate Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Office Real Estate Market Regional Market Share

Geographic Coverage of Saudi Arabia Office Real Estate Market

Saudi Arabia Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Office Spaces in Key Commercial Cities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. Riyadh

- 5.1.2. Jeddah

- 5.1.3. Makkah

- 5.1.4. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nai Saudi Arabia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kingdom Holding Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SEDCO Development

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dar Ar Alkan

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AlOul

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Abdul Latif Jameel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JLL Riyadh

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Century 21 Saudi Arabia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi Real Estate Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Nai Saudi Arabia

List of Figures

- Figure 1: Saudi Arabia Office Real Estate Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Office Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Office Real Estate Market Revenue million Forecast, by Key Cities 2020 & 2033

- Table 2: Saudi Arabia Office Real Estate Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Saudi Arabia Office Real Estate Market Revenue million Forecast, by Key Cities 2020 & 2033

- Table 4: Saudi Arabia Office Real Estate Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Office Real Estate Market?

The projected CAGR is approximately 6.75%.

2. Which companies are prominent players in the Saudi Arabia Office Real Estate Market?

Key companies in the market include Nai Saudi Arabia, Kingdom Holding Company, SEDCO Development, Dar Ar Alkan, AlOul, Abdul Latif Jameel, JLL Riyadh, Century 21 Saudi Arabia, Saudi Real Estate Company.

3. What are the main segments of the Saudi Arabia Office Real Estate Market?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 20874.6 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Increasing Demand for Office Spaces in Key Commercial Cities.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

November 2022: Arabian Centres Company, Saudi Arabia's largest mall operator, has agreed to sell non-core assets worth 2 billion Saudi riyals to Adeer Real Estate. A study determined that the assets were best suited for residential or office space development rather than supporting the mall operator's strategic priorities of developing lifestyle destinations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence