Key Insights

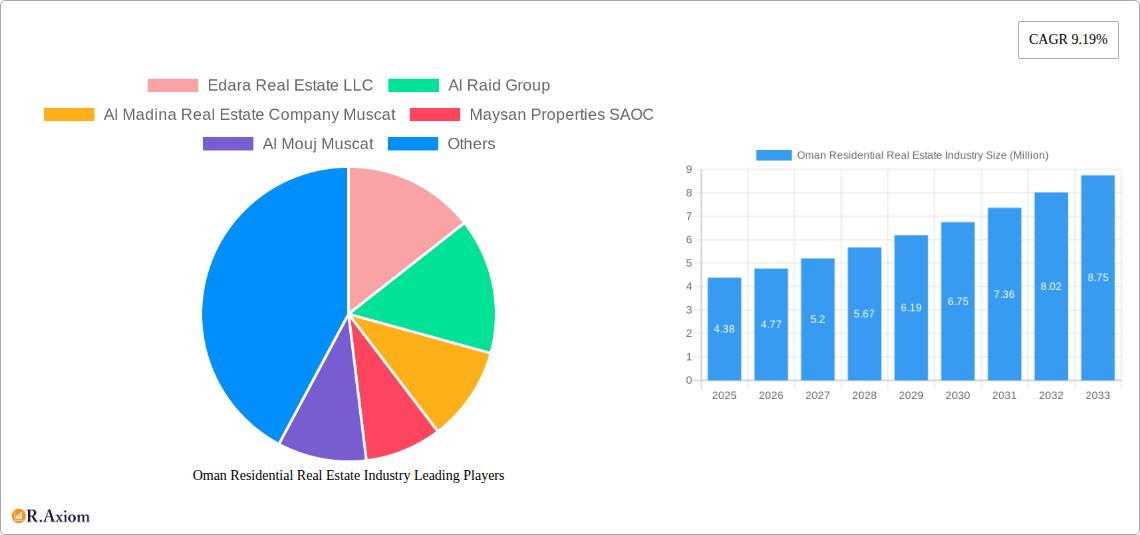

The Oman Residential Real Estate Industry is poised for substantial expansion, projecting a market size of USD 4.38 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.19% anticipated to extend through 2033. This dynamic growth is primarily fueled by a confluence of economic diversification initiatives, increasing foreign investment, and a burgeoning expatriate population seeking quality housing solutions. Key drivers include government support for the real estate sector, attractive mortgage facilities, and the development of mega-projects that enhance urban living standards. The market is experiencing a notable trend towards modern, sustainable living spaces, with a particular emphasis on high-rise apartments and condominiums in prime urban centers, catering to both young professionals and established families. Simultaneously, the demand for spacious villas and landed houses remains strong, particularly in suburban areas and coastal regions offering a more tranquil lifestyle. This dual demand underscores the market's maturity and its ability to cater to a diverse range of buyer preferences and financial capacities.

Oman Residential Real Estate Industry Market Size (In Million)

The projected trajectory of the Oman Residential Real Estate Industry indicates a sustained upward momentum. While the market benefits from strong growth drivers and evolving consumer preferences, certain factors warrant attention. Potential restraints include fluctuations in global oil prices, which can indirectly impact consumer confidence and purchasing power, and regulatory changes that might affect foreign ownership or development. However, the proactive measures by the Omani government to diversify its economy and streamline investment processes are expected to mitigate these challenges. Key urban hubs such as Muscat, Dhofar, and Musandam are anticipated to lead this growth, attracting significant development and investment. The competitive landscape features established local developers and international real estate service providers, all vying to capitalize on the increasing demand for quality residential properties across various segments. This vibrant market ecosystem, characterized by innovation and a focus on customer-centric offerings, is set to define the future of residential living in Oman.

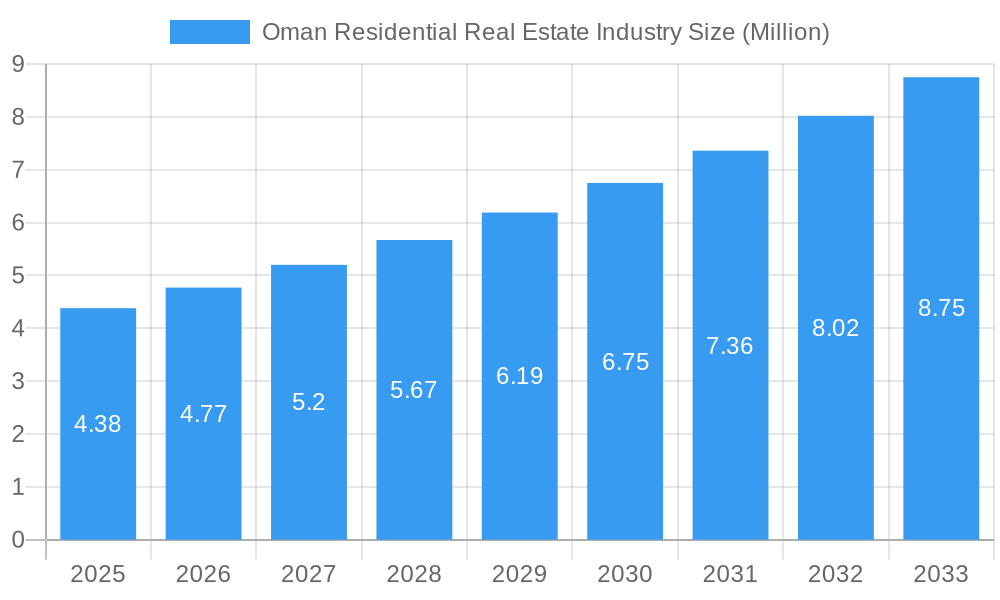

Oman Residential Real Estate Industry Company Market Share

This in-depth report provides a detailed analysis of the Oman Residential Real Estate Industry, covering market dynamics, trends, opportunities, and challenges from 2019 to 2033. Focusing on key segments and dominant markets, this report equips industry stakeholders with actionable insights and strategic recommendations. The study period encompasses historical data (2019-2024), a base year (2025), and a robust forecast period (2025-2033).

Oman Residential Real Estate Industry Market Concentration & Innovation

The Oman Residential Real Estate Industry exhibits a moderate market concentration, with a few dominant developers holding significant market share, alongside a growing number of niche players and international brands. Innovation drivers are primarily fueled by a demand for modern living spaces, smart home technologies, and sustainable construction practices. Regulatory frameworks, overseen by governmental bodies like the Ministry of Housing and Urban Planning, are continuously evolving to attract foreign investment and streamline property transactions, though potential complexities remain. Product substitutes, such as rental markets and alternative investment avenues, exert some influence but are generally less preferred for long-term wealth accumulation. End-user trends are shifting towards greater emphasis on community living, lifestyle amenities, and family-friendly environments. Merger and acquisition (M&A) activities, while not yet at a high volume, are anticipated to increase as larger developers seek to consolidate market presence and acquire innovative projects. Projected M&A deal values are expected to reach tens of millions of Omani Rials, with market share for leading companies estimated to range between 5% and 15% in specific prime locations.

Oman Residential Real Estate Industry Industry Trends & Insights

The Oman Residential Real Estate Industry is poised for significant growth, driven by a confluence of economic, demographic, and policy factors. A projected Compound Annual Growth Rate (CAGR) of approximately 6% over the forecast period (2025-2033) underscores the industry's positive trajectory. This expansion is propelled by sustained government investment in infrastructure development, including new transportation networks and urban renewal projects, which enhance property values and accessibility. The Sultanate's commitment to economic diversification under Vision 2040 is attracting foreign direct investment, creating job opportunities, and subsequently increasing the demand for quality residential properties across key cities.

Technological disruptions are playing an increasingly vital role. The adoption of Building Information Modeling (BIM) is enhancing design efficiency and reducing construction costs. The integration of smart home technologies, from automated climate control and security systems to integrated digital concierge services, is becoming a standard expectation for discerning buyers, particularly in the luxury segment. Online property portals and virtual reality (VR) tours are transforming the buyer's journey, offering greater convenience and wider reach.

Consumer preferences are evolving significantly. There is a discernible shift towards smaller, more manageable, yet amenity-rich living spaces in urban centers, alongside a persistent demand for larger family homes and villas in more serene environments. The rise of millennial and Gen Z homebuyers is introducing new demands for sustainable and eco-friendly properties, as well as flexible living arrangements. Furthermore, the concept of integrated communities, offering a blend of residential, retail, and recreational facilities, is gaining traction.

Competitive dynamics are intensifying, with established local developers competing with international real estate firms. This competition is fostering innovation in project design, marketing strategies, and customer service. Market penetration for new developments, particularly in prime locations and for well-conceived projects, is expected to remain high, often exceeding 80% within the first two years of launch for well-positioned properties. The industry is also witnessing a growing interest in mixed-use developments, further blurring the lines between residential and commercial real estate. The overall outlook suggests a resilient and dynamic market, receptive to innovation and attuned to evolving consumer needs.

Dominant Markets & Segments in Oman Residential Real Estate Industry

Muscat: The Epicenter of Demand and Development

Muscat, the capital city, unequivocally dominates the Oman Residential Real Estate Industry. Its status as the economic and administrative hub, coupled with its appeal as a prime tourist destination, drives sustained demand for residential properties. The city's ongoing urban development projects, including the expansion of residential areas and the enhancement of public amenities, further solidify its position. Economic policies aimed at attracting expatriates and facilitating foreign ownership in designated areas are crucial growth catalysts, boosting demand for apartments, condominiums, and villas. The infrastructure development within Muscat, encompassing improved road networks, public transportation, and world-class facilities, significantly enhances the desirability and value of residential properties. The market penetration for new residential projects in prime Muscat locations is consistently high.

- Key Drivers of Muscat's Dominance:

- Economic Hub: Concentration of businesses, government entities, and job opportunities.

- Infrastructure Investment: Continuous upgrades to transportation, utilities, and public spaces.

- Foreign Investment Policies: Initiatives encouraging expatriate residency and property ownership.

- Lifestyle Appeal: Rich cultural heritage, modern amenities, and attractive coastal living.

- Developer Focus: A disproportionate number of major real estate developments are concentrated in Muscat.

Villas and Landed Houses: Enduring Appeal for Families and Investors

Villas and landed houses represent a consistently strong segment within the Oman Residential Real Estate Industry, catering to a broad spectrum of buyers seeking space, privacy, and long-term investment value. This segment is particularly popular among Omani nationals and expatriate families who prioritize comfortable living and often seek properties with private gardens and ample outdoor space. The demand for these properties is robust across both established and emerging residential areas. Investment in new infrastructure, particularly in the outskirts of major cities, is creating new opportunities for the development of upscale villa communities. The competitive advantage of villas lies in their perceived value for money in terms of space and privacy compared to apartments in prime locations.

- Key Drivers of Villa & Landed House Demand:

- Family Needs: Desire for space, private gardens, and secure environments.

- Investment Security: Perceived as a stable and appreciating asset class.

- Lifestyle Preferences: Traditional preference for larger homes and outdoor living.

- Government Incentives: Policies supporting homeownership for citizens.

- Master-Planned Communities: Development of integrated communities offering a high quality of life.

Apartments and Condominiums: Urban Living and Investment Opportunities

Apartments and condominiums form a rapidly growing segment, driven by urbanization trends and the demand for modern, convenient living solutions. This segment is particularly attractive to young professionals, couples, and investors seeking properties in well-connected urban centers. The affordability factor compared to villas, coupled with access to shared amenities like swimming pools, gyms, and communal spaces, makes apartments a compelling choice. Developers are increasingly focusing on creating compact, efficient, and aesthetically pleasing apartment complexes that cater to contemporary lifestyles. The growth of the rental market for apartments also contributes to their ongoing demand. Market penetration for well-located and attractively priced apartments is high, especially in Muscat.

- Key Drivers of Apartment & Condominium Demand:

- Urbanization: Increasing population density in cities.

- Affordability: More accessible price points compared to villas.

- Convenience: Low maintenance, access to amenities, and proximity to urban centers.

- Investment Potential: Attractive for rental income and capital appreciation.

- Modern Lifestyles: Suitability for young professionals and couples.

Dhofar and Musandam: Niche Markets with Emerging Potential

While Muscat leads, Dhofar and Musandam represent important niche markets with distinct growth potentials. Dhofar, with its unique climate and natural beauty, is attracting interest for second homes and tourism-related real estate investments. Musandam, with its stunning fjords and exclusive appeal, is emerging as a destination for luxury tourism and high-end residential developments catering to a discerning clientele seeking exclusivity and breathtaking views. Development in these regions is often tied to specific tourism master plans and government initiatives aimed at diversifying economic activities. Infrastructure improvements and targeted marketing are key to unlocking the full potential of these regions.

- Key Drivers for Dhofar & Musandam:

- Tourism Potential: Attractive natural landscapes and unique cultural offerings.

- Lifestyle Appeal: Unique living experiences and recreational opportunities.

- Government Support: Initiatives for regional development and diversification.

- Luxury Market Focus: Catering to a niche segment seeking exclusive properties.

Oman Residential Real Estate Industry Product Developments

The Oman Residential Real Estate Industry is witnessing a surge in product innovations focused on enhancing living experiences and sustainability. Developers are increasingly incorporating smart home technology, offering integrated systems for climate control, security, and entertainment, thereby increasing property value and market appeal. The trend towards eco-friendly construction materials and energy-efficient designs is gaining momentum, appealing to environmentally conscious buyers. Furthermore, the development of integrated communities, featuring a mix of residential units with retail, leisure, and healthcare facilities, is a significant product evolution. These developments offer enhanced convenience and a holistic living experience, creating a strong competitive advantage by meeting the evolving demands of modern homeowners.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Oman Residential Real Estate Industry across key segments. The Apartments and Condominiums segment is characterized by high demand in urban centers, driven by affordability and convenience, with projected market growth of approximately 7% annually. The Villas and Landed Houses segment continues to appeal to families seeking space and privacy, exhibiting steady growth with an estimated market size of several billion Omani Rials. In terms of geographical segmentation, Muscat remains the dominant market, accounting for over 70% of residential transactions and development activities, with robust growth projections. Dhofar and Musandam represent emerging markets with specialized luxury and tourism-linked residential opportunities, projected to experience significant growth from a smaller base, driven by niche tourism and investment initiatives.

Key Drivers of Oman Residential Real Estate Industry Growth

The Oman Residential Real Estate Industry's growth is underpinned by several key factors. Economic diversification initiatives under Vision 2040 are attracting foreign investment and creating employment, increasing demand for housing. Government support and favorable policies, including streamlined property regulations and incentives for developers, are crucial enablers. Infrastructure development, such as new road networks and urban expansion projects, enhances property accessibility and value. The increasing expatriate population, driven by various economic sectors, directly fuels demand for residential units. Finally, a growing emphasis on quality of life and modern amenities is pushing developers to innovate and create desirable living environments.

Challenges in the Oman Residential Real Estate Industry Sector

Despite its positive outlook, the Oman Residential Real Estate Industry faces several challenges. Regulatory complexities and lengthy approval processes can sometimes hinder project timelines and increase development costs. Availability of prime land in sought-after locations can be a constraint, leading to increased land acquisition costs. Fluctuations in global economic conditions and oil prices can impact investor confidence and purchasing power. Ensuring a consistent supply chain for construction materials and skilled labor is vital to avoid project delays. Furthermore, increasing competition necessitates continuous innovation and value proposition refinement to attract buyers in a dynamic market.

Emerging Opportunities in Oman Residential Real Estate Industry

Emerging opportunities in the Oman Residential Real Estate Industry are diverse and promising. The growth of integrated and mixed-use developments offers a holistic living experience and caters to evolving consumer needs. The increasing demand for sustainable and green buildings presents a significant opportunity for developers to differentiate their offerings and attract environmentally conscious buyers. The rise of second-home markets and holiday homes in picturesque locations like Salalah and the Musandam Peninsula is a burgeoning segment. Furthermore, leveraging PropTech solutions, including AI-powered property management and virtual reality tours, can enhance operational efficiency and customer engagement, opening new avenues for growth and market penetration.

Leading Players in the Oman Residential Real Estate Industry Market

- Edara Real Estate LLC

- Al Raid Group

- Al Madina Real Estate Company Muscat

- Maysan Properties SAOC

- Al Mouj Muscat

- Coldwell Banker

- Better Homes

- Harbor Real Estate

- Hilal Properties

- Al-Taher Group

- Abu Malak Global Enterprises Muscat

- Savills

- Wujha Real Estate

- Saraya Bandar Jissah

- Orascom Development Holding AG

- Engel & Voelkers

Key Developments in Oman Residential Real Estate Industry Industry

- October 2022: Al Mouj Muscat launched phase 2 of Zunairah Mansions in the Shatti District. The new phase of the mansions comes in different styles and features six opulent bedrooms with a built-up area of 933 square meters, a garage, covered parking for up to six automobiles, and roomy servant quarters. This development signifies a focus on the ultra-luxury segment and expansion of high-end residential offerings.

- April 2022: Oman Post and Asyad Express signed a partnership agreement with WUJHA Real Estate to invest, design, and develop land aligned with the land investment plan. This collaboration highlights a strategic move towards integrated land development and real estate investment, potentially involving significant real estate portfolios.

Strategic Outlook for Oman Residential Real Estate Industry Market

The strategic outlook for the Oman Residential Real Estate Industry is one of sustained growth and increasing sophistication. The market is expected to benefit from continued government support, economic diversification, and a growing expatriate population. Opportunities lie in the development of smart, sustainable, and integrated communities that cater to evolving lifestyle preferences. The increasing adoption of PropTech will enhance efficiency and customer experience. Developers who focus on delivering high-quality, amenity-rich properties in prime locations, coupled with innovative marketing strategies, will be well-positioned for success. The market's trajectory suggests a robust future with potential for significant returns on investment for astute stakeholders.

Oman Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. Key Cities

- 2.1. Muscat

- 2.2. Dhofar

- 2.3. Musandam

Oman Residential Real Estate Industry Segmentation By Geography

- 1. Oman

Oman Residential Real Estate Industry Regional Market Share

Geographic Coverage of Oman Residential Real Estate Industry

Oman Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urabanization4.; Increasing government investments

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market

- 3.4. Market Trends

- 3.4.1. Supply of Residential Buildings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Muscat

- 5.2.2. Dhofar

- 5.2.3. Musandam

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Edara Real Estate LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Al Raid Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al Madina Real Estate Company Muscat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Maysan Properties SAOC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Al Mouj Muscat

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coldwell Banker

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Better Homes

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Harbor Real Estate

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hilal Properties

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al-Taher Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Abu Malak Global Enterprises Muscat

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Savills

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Wujha Real Estate

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Saraya Bandar Jissah**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Orascom Development Holding AG

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Engel & Voelkers

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Edara Real Estate LLC

List of Figures

- Figure 1: Oman Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Oman Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Oman Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Oman Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Oman Residential Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Oman Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Oman Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Oman Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Residential Real Estate Industry?

The projected CAGR is approximately 9.19%.

2. Which companies are prominent players in the Oman Residential Real Estate Industry?

Key companies in the market include Edara Real Estate LLC, Al Raid Group, Al Madina Real Estate Company Muscat, Maysan Properties SAOC, Al Mouj Muscat, Coldwell Banker, Better Homes, Harbor Real Estate, Hilal Properties, Al-Taher Group, Abu Malak Global Enterprises Muscat, Savills, Wujha Real Estate, Saraya Bandar Jissah**List Not Exhaustive, Orascom Development Holding AG, Engel & Voelkers.

3. What are the main segments of the Oman Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.38 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urabanization4.; Increasing government investments.

6. What are the notable trends driving market growth?

Supply of Residential Buildings.

7. Are there any restraints impacting market growth?

4.; Increasing cost of raw materials affecting the construction industry4.; Slowdown in economic growth affecting the market.

8. Can you provide examples of recent developments in the market?

October 2022, Al Mouj Muscat launched phase 2 of Zunairah Mansions in the Shatti District. The new phase of the mansions comes in different styles and features six opulent bedrooms with a built-up area of 933 square meters, a garage, covered parking for up to six automobiles, and roomy servant quarters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Oman Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence