Key Insights

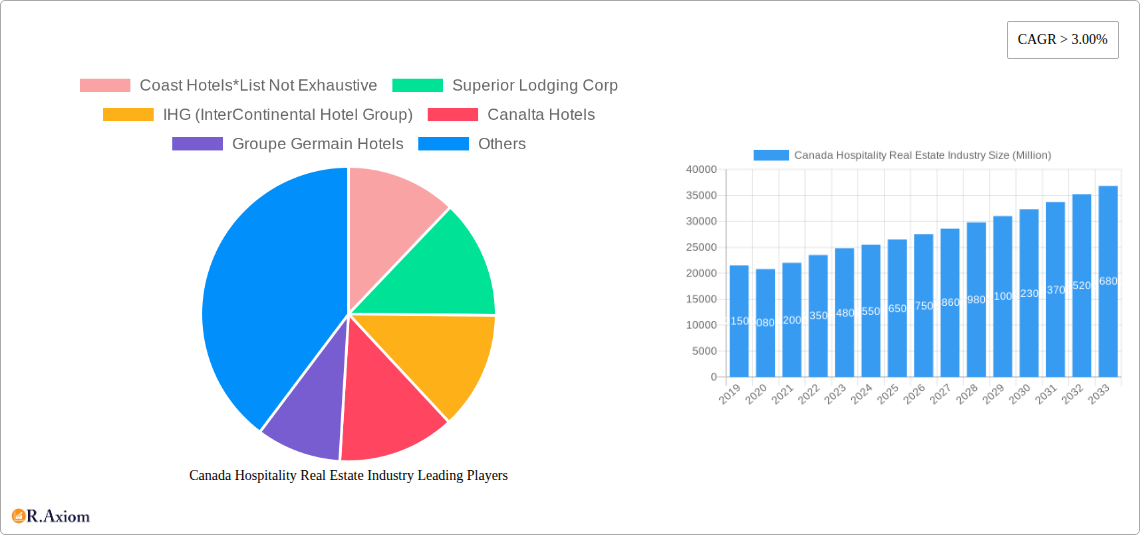

The Canadian hospitality real estate market is projected for substantial growth, with an estimated market size of $3.47 billion by 2025. The Compound Annual Growth Rate (CAGR) is forecasted at 5.1% through 2033. Key growth drivers include a robust tourism sector, increased domestic travel, and a rising demand for varied accommodation options. Significant investments are being made in property upgrades and new developments, particularly within the Hotels and Accommodation, and Spas and Resorts segments. While urban centers remain primary markets, there's a notable shift towards boutique hotels and unique stay experiences in emerging tourist destinations. A strong Canadian economy and favorable exchange rates for international visitors further boost investor confidence and consumer spending. The industry is adapting to evolving traveler preferences, prioritizing sustainability, technology, and personalized services.

Canada Hospitality Real Estate Industry Market Size (In Billion)

Despite a positive outlook, the industry faces challenges such as escalating operational costs, service sector labor shortages, and substantial capital investment requirements for modernization and innovation. Leading entities including IHG, Choice Hotels Canada Inc., and Brookfield Asset Management, alongside specialized firms like InnVest REIT and Westmont Hospitality Group, are addressing these challenges through strategic investments, operational enhancements, and acquisitions. Market concentration is evolving, with both established global brands and agile local players competing for market share. The "Other Property Types" segment, featuring unique lodging and glamping sites, is also experiencing growth, reflecting diversified traveler interests beyond traditional hotels. Canada's diverse landscapes present significant opportunities for niche hospitality development, contributing to the sector's resilience and expansion.

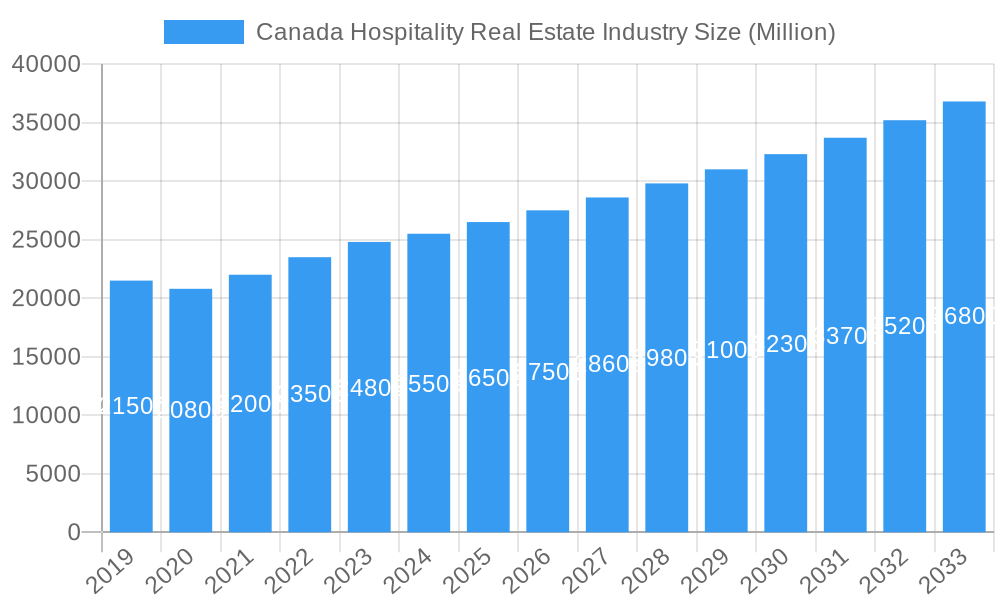

Canada Hospitality Real Estate Industry Company Market Share

This report offers a comprehensive analysis of the Canada Hospitality Real Estate Industry, providing critical insights into market dynamics, growth drivers, emerging opportunities, and the competitive landscape. Covering the historical period of 2019–2024 and projecting through 2033, this report is an essential resource for investors, developers, operators, and policymakers aiming to understand and leverage the evolving Canadian hospitality real estate market.

Canada Hospitality Real Estate Industry Market Concentration & Innovation

The Canadian hospitality real estate market exhibits a moderate level of concentration, with major players like IHG (InterContinental Hotel Group) and Choice Hotels Canada Inc. holding significant market share. The Hotels and Accommodation segment dominates, contributing approximately 75% of the total market value, projected to reach over $45,000 Million by 2025. Innovation is a key differentiator, driven by advancements in property technology (PropTech), sustainable building practices, and personalized guest experiences. Regulatory frameworks, including zoning laws and environmental regulations, influence development and operational strategies. Substitutes, such as short-term rental platforms, continue to present a competitive challenge, though traditional hotels and resorts are adapting through enhanced service offerings and loyalty programs. Mergers and acquisitions (M&A) activity, particularly within the Hotels and Accommodation sector, remains robust, with estimated deal values exceeding $1,500 Million annually over the historical period, reflecting a consolidation trend aimed at achieving economies of scale and expanding brand portfolios.

Canada Hospitality Real Estate Industry Industry Trends & Insights

The Canada Hospitality Real Estate Industry is poised for significant growth, driven by a confluence of evolving consumer preferences, technological advancements, and economic factors. The Hotels and Accommodation segment is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% over the forecast period. This expansion is fueled by increasing domestic and international tourism, a growing demand for unique and experiential stays, and the recovery of business travel post-pandemic. Technological disruptions are revolutionizing the industry, with the integration of AI-powered personalized services, contactless check-in/check-out systems, and smart room technologies becoming standard. Consumer preferences are shifting towards wellness-focused amenities, sustainable practices, and localized experiences, prompting developers and operators to invest in Spas and Resorts and boutique hotel concepts. Competitive dynamics are intense, with established brands vying for market share against emerging disruptors. The market penetration of branded hotels is estimated at around 65%, with significant room for growth in secondary and tertiary markets. The integration of mixed-use developments, incorporating residential and retail components alongside hospitality offerings, is also gaining traction, creating more dynamic and integrated real estate ecosystems. Furthermore, a growing emphasis on the "bleisure" (business and leisure) travel trend is reshaping demand patterns, requiring hotels to offer flexible spaces and amenities that cater to both professional and recreational needs. The rise of the experience economy is also a critical trend, pushing hotels to move beyond mere accommodation and offer curated local activities and immersive cultural engagements.

Dominant Markets & Segments in Canada Hospitality Real Estate Industry

The Hotels and Accommodation segment stands as the undisputed leader within the Canada Hospitality Real Estate Industry, representing an estimated 75% of the total market value in the base year of 2025, projected to reach over $45,000 Million. Within this segment, major urban centers such as Toronto, Vancouver, and Montreal are dominant markets, driven by strong economic activity, international airport connectivity, and a high volume of both corporate and leisure travelers.

Key drivers of dominance in this segment include:

- Economic Policies: Favorable government policies supporting tourism and business investment act as significant catalysts for growth in key urban centers.

- Infrastructure Development: Robust transportation networks, including airports, public transit, and highway systems, enhance accessibility and attractiveness for tourists and business professionals.

- Corporate Presence: The concentration of major corporations in these cities ensures a steady demand for business travel and event hosting.

- Cultural and Entertainment Hubs: The presence of world-class attractions, entertainment venues, and cultural institutions draws significant leisure tourism.

The Spas and Resorts segment, while smaller, is experiencing substantial growth, estimated at a CAGR of 6.2% due to increasing consumer interest in wellness tourism and experiential travel. Prime locations for these properties often include scenic natural landscapes, mountainous regions, and coastal areas, appealing to those seeking relaxation and rejuvenation.

- Natural Attractions: Canada's vast natural beauty, from the Rocky Mountains to coastal regions, provides an ideal backdrop for resort development.

- Wellness Trends: A growing societal emphasis on health and well-being directly translates to increased demand for spa services and wellness-focused accommodations.

- Seasonal Appeal: Many resort destinations benefit from distinct seasonal attractions, such as winter sports or summer outdoor activities, ensuring year-round interest.

The Other Property Types segment, which encompasses serviced apartments, boutique hotels, and alternative accommodations, is also demonstrating promising growth, with an estimated CAGR of 5.5%. This segment's expansion is fueled by the diversification of traveler needs and a demand for more personalized and flexible lodging options.

- Serviced Apartments: The rise of remote work and extended stays is driving demand for apartment-style accommodations offering home-like amenities.

- Boutique Hotels: Travelers increasingly seek unique, localized experiences, leading to the popularity of smaller, character-filled boutique properties.

- Alternative Accommodations: While facing regulatory scrutiny in some areas, platforms offering unique stays continue to capture market share, pushing traditional players to innovate.

Canada Hospitality Real Estate Industry Product Developments

Product developments in the Canadian hospitality real estate sector are increasingly focused on technology integration and sustainable practices. Innovations include smart room controls for enhanced guest comfort, AI-driven personalized service platforms, and advanced energy-efficient building designs. The application of these technologies aims to optimize operational efficiency, reduce environmental impact, and elevate the guest experience, providing a competitive advantage in a dynamic market. For instance, the adoption of contactless technology for check-in and room access has become a crucial market fit, addressing evolving guest expectations for convenience and safety.

Report Scope & Segmentation Analysis

This report segmentates the Canada Hospitality Real Estate Industry by Property Type: Hotels and Accommodation, Spas and Resorts, and Other Property Types.

Hotels and Accommodation: This segment, projected to hold the largest market share with a valuation exceeding $45,000 Million in 2025, encompasses a wide range of properties from budget-friendly motels to luxury hotels. Growth projections are robust, driven by recovering travel demand and evolving traveler preferences for convenience and accessibility. Competitive dynamics are intense, with established brands and independent operators vying for market dominance.

Spas and Resorts: Expected to experience a strong CAGR of 6.2%, this segment is driven by the burgeoning wellness tourism trend and a desire for unique, immersive experiences. Market size is estimated to reach over $8,000 Million by 2025. Growth is concentrated in areas with natural beauty and wellness-focused amenities, with competitive advantages stemming from unique offerings and high-quality service.

Other Property Types: This segment, including serviced apartments, boutique hotels, and unique lodging experiences, is projected to grow at a CAGR of 5.5%, reaching approximately $7,000 Million by 2025. Market growth is fueled by demand for flexible accommodation and personalized experiences. Competitive dynamics involve differentiation through unique offerings and strategic positioning in niche markets.

Key Drivers of Canada Hospitality Real Estate Industry Growth

The growth of the Canada Hospitality Real Estate Industry is propelled by several key factors. Technologically, the widespread adoption of digital booking platforms, property management systems, and AI-driven guest services enhances operational efficiency and customer engagement. Economically, sustained growth in tourism, both domestic and international, alongside a resilient business travel sector, fuels demand for accommodation. Government initiatives aimed at promoting tourism and investment in infrastructure, such as improved transportation networks, also play a crucial role. For example, investments in airport expansions and high-speed rail projects directly support increased visitor numbers.

Challenges in the Canada Hospitality Real Estate Industry Sector

Despite promising growth, the Canada Hospitality Real Estate Industry faces significant challenges. Regulatory hurdles, including stringent zoning laws and complex permitting processes, can impede new development and expansion projects. Supply chain issues, particularly concerning construction materials and labor shortages, can lead to project delays and increased costs. Competitive pressures from alternative accommodation providers, such as short-term rental platforms, continue to challenge traditional hotel models. Furthermore, the increasing cost of real estate in prime locations presents a barrier to entry for new developers and can impact profitability. Labor shortages within the hospitality sector also remain a persistent concern, affecting service quality and operational capacity.

Emerging Opportunities in Canada Hospitality Real Estate Industry

Emerging opportunities in the Canada Hospitality Real Estate Industry lie in the growing demand for sustainable and eco-friendly accommodations, catering to the environmentally conscious traveler. The rise of "workcations" and the increasing popularity of remote work create a demand for extended-stay accommodations and flexible co-working spaces within hotels. Niche tourism segments, such as adventure travel, cultural tourism, and agri-tourism, offer significant potential for specialized property development. Furthermore, the under-penetrated markets in Canada's rural and remote regions present opportunities for unique resort and lodge development, leveraging the country's natural appeal. The increasing demand for experiential travel also opens doors for innovative concepts that integrate local culture, food, and activities into the guest experience.

Leading Players in the Canada Hospitality Real Estate Industry Market

- Coast Hotels

- Superior Lodging Corp

- IHG (InterContinental Hotel Group)

- Canalta Hotels

- Groupe Germain Hotels

- Brookfield Asset Management

- Westmont Hospitality Group

- Choice Hotels Canada Inc

- InnVest REIT

- Fairmount Raffles Hotels International

Key Developments in Canada Hospitality Real Estate Industry Industry

- 2023/08: IHG announces expansion plans with new hotel openings in Western Canada, focusing on upscale brands.

- 2023/05: Brookfield Asset Management acquires a portfolio of Canadian hotels, signaling confidence in the market's recovery.

- 2022/11: Choice Hotels Canada Inc. invests in technology to enhance guest experience and operational efficiency.

- 2022/09: Groupe Germain Hotels launches a new lifestyle hotel brand targeting urban travelers.

- 2022/07: Westmont Hospitality Group expands its portfolio with strategic acquisitions in key Canadian markets.

- 2021/12: InnVest REIT announces a significant refurbishment program for its hotel assets across Canada.

- 2021/10: Fairmont Raffles Hotels International introduces new sustainability initiatives across its Canadian properties.

Strategic Outlook for Canada Hospitality Real Estate Industry Market

The strategic outlook for the Canada Hospitality Real Estate Industry remains positive, with significant growth catalysts in place. Continued recovery in both leisure and business travel, coupled with increasing foreign investment, will drive demand for new developments and the revitalization of existing properties. The industry's ability to adapt to evolving consumer preferences, particularly in wellness and sustainable tourism, will be crucial for long-term success. Strategic investments in technology and innovation will be essential for enhancing operational efficiency and guest satisfaction. Furthermore, exploring untapped regional markets and developing specialized tourism offerings will unlock new avenues for revenue generation and market expansion. The consolidation trend is expected to continue, leading to more integrated and efficient operations.

Canada Hospitality Real Estate Industry Segmentation

-

1. Property Type

- 1.1. Hotels and Accommodation

- 1.2. Spas and Resorts

- 1.3. Other Property Types

Canada Hospitality Real Estate Industry Segmentation By Geography

- 1. Canada

Canada Hospitality Real Estate Industry Regional Market Share

Geographic Coverage of Canada Hospitality Real Estate Industry

Canada Hospitality Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors

- 3.3. Market Restrains

- 3.3.1. Availability of Financing

- 3.4. Market Trends

- 3.4.1. The Rising Number of Tourists is Making A Way for More Hotel Development Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Hospitality Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Hotels and Accommodation

- 5.1.2. Spas and Resorts

- 5.1.3. Other Property Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Coast Hotels*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Superior Lodging Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IHG (InterContinental Hotel Group)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Canalta Hotels

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Groupe Germain Hotels

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Brookfield Asset Management

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Westmont Hospitality Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Choice Hotels Canada Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 6 COMPETITVE INTELLIGENCE 6 1 Market Concentration 6 2 Company profiles

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 InnVest REIT

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Fairmount Raffles Hotels International

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Coast Hotels*List Not Exhaustive

List of Figures

- Figure 1: Canada Hospitality Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Hospitality Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Hospitality Real Estate Industry Revenue billion Forecast, by Property Type 2020 & 2033

- Table 2: Canada Hospitality Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Canada Hospitality Real Estate Industry Revenue billion Forecast, by Property Type 2020 & 2033

- Table 4: Canada Hospitality Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Hospitality Real Estate Industry?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Canada Hospitality Real Estate Industry?

Key companies in the market include Coast Hotels*List Not Exhaustive, Superior Lodging Corp, IHG (InterContinental Hotel Group), Canalta Hotels, Groupe Germain Hotels, Brookfield Asset Management, Westmont Hospitality Group, Choice Hotels Canada Inc, 6 COMPETITVE INTELLIGENCE 6 1 Market Concentration 6 2 Company profiles, InnVest REIT, Fairmount Raffles Hotels International.

3. What are the main segments of the Canada Hospitality Real Estate Industry?

The market segments include Property Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.47 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors.

6. What are the notable trends driving market growth?

The Rising Number of Tourists is Making A Way for More Hotel Development Projects.

7. Are there any restraints impacting market growth?

Availability of Financing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Hospitality Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Hospitality Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Hospitality Real Estate Industry?

To stay informed about further developments, trends, and reports in the Canada Hospitality Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence