Key Insights

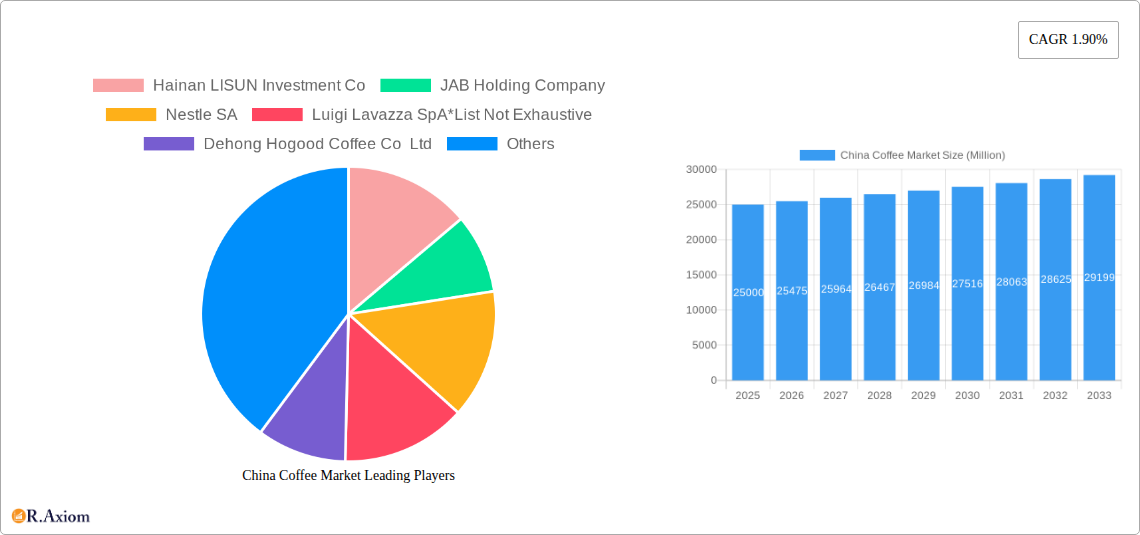

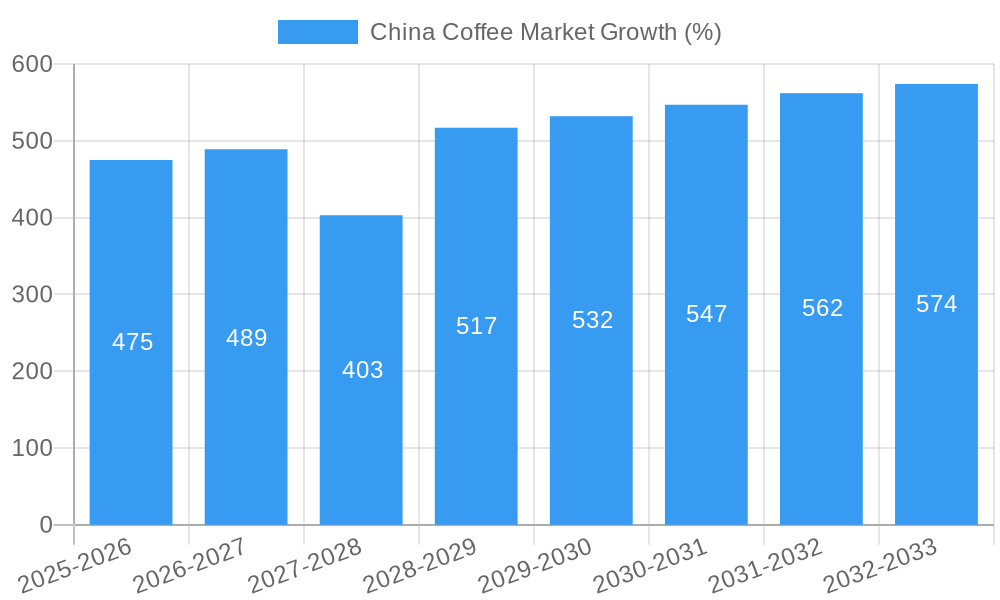

The China coffee market, currently experiencing robust growth, presents a significant opportunity for investors and businesses. While precise market size figures for 2025 aren't provided, a logical estimation, considering a 1.90% CAGR from a presumed base year (let's assume 2019 data is available, although not provided, as a starting point), and taking into account the rapid expansion of coffee consumption in China, suggests a substantial market value in the billions of dollars by 2025. This growth is fueled by several key drivers: a rising middle class with increasing disposable incomes, the growing popularity of Western coffee culture among younger generations, and the expanding presence of international and domestic coffee chains. Furthermore, innovative product offerings, such as readily available coffee pods and capsules, are catering to evolving consumer preferences and convenience demands. While potential restraints like fluctuating coffee bean prices and intense competition among established players and new entrants exist, the overall market trajectory remains positive.

The market segmentation reveals valuable insights into consumer behavior. The "off-trade" channel (supermarkets, convenience stores, online sales) is likely dominant, reflecting the increasing convenience-driven consumption patterns of Chinese consumers. However, the "on-trade" segment (cafes, restaurants) is also poised for significant growth, driven by the increasing popularity of coffee shops as social hubs. Major players like Starbucks, Luckin Coffee, and international brands like Nestle are strategically expanding their presence, while domestic companies are adapting to meet the escalating demand. This dynamic interplay of global and local brands suggests an evolving market landscape characterized by intense competition and innovation, creating a complex but attractive investment environment. Growth will likely continue to be driven by expanding product offerings to cater to diverse tastes, an increase in premium coffee consumption, and continued penetration into less-developed regions within China.

China Coffee Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic China coffee market, encompassing historical data (2019-2024), current estimations (2025), and future projections (2025-2033). It offers invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this rapidly evolving market. The report leverages extensive primary and secondary research, providing a detailed understanding of market size, segmentation, key players, and future trends.

China Coffee Market Market Concentration & Innovation

This section analyzes the competitive landscape of the China coffee market, including market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The Chinese coffee market exhibits a blend of established international players and rapidly growing domestic brands, resulting in a dynamic competitive landscape. Market share data for 2024 reveals a concentrated market with the top 5 players holding approximately xx% of the total market share. However, significant innovation and new entrants are challenging this established order.

Key aspects covered include:

- Market Concentration: Analysis of market share distribution among key players, including Starbucks Corporation, Luckin Coffee, and Nestle SA, highlighting the degree of concentration and competition.

- Innovation Drivers: Examination of factors driving innovation, such as evolving consumer preferences (e.g., increasing demand for specialty coffee, ready-to-drink options), technological advancements (e.g., improved brewing methods, automated vending), and government support for the food and beverage sector.

- Regulatory Framework: Assessment of relevant regulations and policies impacting the coffee market in China, including food safety standards, import/export regulations, and labeling requirements.

- Product Substitutes: Identification and analysis of potential substitutes for coffee, such as tea, energy drinks, and other beverages, and their impact on market dynamics.

- End-User Trends: Exploration of shifting consumer preferences, including the growing demand for premium coffee, sustainable sourcing, and convenient formats like instant coffee and coffee pods.

- M&A Activities: Review of recent mergers and acquisitions in the Chinese coffee market, quantifying deal values and analyzing their impact on market structure. For example, the acquisition of xx by xx in 2023 resulted in a xx Million USD transaction and significantly altered market share dynamics.

China Coffee Market Industry Trends & Insights

This section delves into the key trends and insights shaping the China coffee market's growth trajectory. The market is experiencing robust growth, driven by several factors. The CAGR for the period 2025-2033 is projected to be xx%, indicating a significant expansion. Market penetration, currently at xx%, is expected to rise to xx% by 2033, reflecting increasing coffee consumption among the Chinese population.

- Market Growth Drivers: This section details factors propelling market expansion, such as rising disposable incomes, urbanization, changing lifestyles, and the growing popularity of coffee culture among younger demographics.

- Technological Disruptions: The report will analyze how technological advancements (e.g., online ordering and delivery platforms, innovative brewing technologies, and improved supply chains) are reshaping the industry.

- Consumer Preferences: The evolving tastes and preferences of Chinese consumers, encompassing their preferences for various coffee types (e.g., specialty coffee, instant coffee, ready-to-drink options), will be analyzed in detail.

- Competitive Dynamics: This section will explore the strategies employed by key players to gain market share, including product innovation, branding, distribution network expansion, and price competitiveness.

Dominant Markets & Segments in China Coffee Market

This section identifies the leading regions, countries, and segments within the Chinese coffee market. The analysis will cover both product types (whole-bean, ground coffee, instant coffee, coffee pods and capsules) and distribution channels (on-trade, off-trade).

By Product Type:

- Instant Coffee: This segment enjoys significant market dominance due to its convenience and affordability, appealing to a large consumer base. Key drivers include strong distribution networks and aggressive marketing campaigns.

- Ground Coffee: This segment is experiencing growth, driven by increasing demand for higher-quality coffee experiences, particularly in urban areas with a burgeoning café culture.

- Whole Bean Coffee: Although a smaller segment, whole-bean coffee is experiencing steady growth among affluent consumers who appreciate the artisanal aspects of coffee preparation.

- Coffee Pods and Capsules: This segment shows significant potential, especially in urban centers, with convenient single-serve formats becoming increasingly popular.

By Distribution Channel:

- Off-trade: This segment remains dominant, encompassing supermarkets, hypermarkets, convenience stores, and online retailers, benefiting from widespread reach and established supply chains.

- On-trade: The on-trade segment, comprising cafes, restaurants, and coffee shops, showcases significant growth potential, driven by increasing coffee shop density and expanding café culture.

Key Drivers: This segment will provide detailed analysis of factors driving the dominance of specific segments, such as favorable economic policies, efficient logistics infrastructure, and consumer preferences.

China Coffee Market Product Developments

Recent product innovations highlight a focus on convenience, customization, and premium offerings. Nestle's Nescafe Ice Roast caters to the growing demand for cold coffee, while Luckin Coffee’s Cotti Coffee brand showcases a strategic move to diversify offerings. The entry of Ethiopian coffee brands into the Chinese e-commerce market demonstrates the increasing availability of diverse and high-quality coffee options. Technological trends such as smart brewing devices and personalized coffee blends are also shaping product development. This creates differentiation and enhances the consumer experience, ultimately improving market fit.

Report Scope & Segmentation Analysis

This report covers the China coffee market from 2019 to 2033, with 2025 as the base year. The market is segmented by product type (whole-bean, ground, instant, pods & capsules) and distribution channel (on-trade, off-trade). Each segment's growth projections, market sizes, and competitive dynamics are analyzed. The instant coffee segment is projected to experience the highest growth, driven by its affordability and convenience. The on-trade segment is expected to witness a robust expansion, supported by the rising popularity of coffee shops and cafes. Competitive intensity varies across segments; the instant coffee market is relatively concentrated, while the specialty coffee segment is more fragmented.

Key Drivers of China Coffee Market Growth

Several factors fuel the China coffee market's expansion. Rising disposable incomes, particularly among the younger generation, enable greater spending on premium beverages. Urbanization leads to higher coffee shop density and increased exposure to coffee culture. Government initiatives promoting domestic consumption and foreign investment further contribute to market growth. Technological advancements like e-commerce platforms and improved logistics streamline distribution and access to a wider customer base.

Challenges in the China Coffee Market Sector

The China coffee market faces challenges such as intense competition, particularly from both domestic and international players. Supply chain disruptions and fluctuating raw material prices impact profitability. Stringent food safety regulations require meticulous compliance. Consumer preferences are dynamic, demanding continuous innovation to meet evolving tastes. Furthermore, fluctuating exchange rates can affect the cost of imported coffee beans.

Emerging Opportunities in China Coffee Market

Several opportunities exist in the China coffee market. The growing demand for premium and specialty coffees presents a significant opportunity for companies offering high-quality beans and unique brewing methods. The expansion of e-commerce provides avenues for reaching wider customer segments. The rising popularity of ready-to-drink (RTD) coffee offers new avenues for growth. Furthermore, collaborations with local businesses and integration with digital platforms can significantly enhance market reach and customer engagement.

Leading Players in the China Coffee Market Market

- Hainan LISUN Investment Co

- JAB Holding Company

- Nestle SA

- Luigi Lavazza SpA

- Dehong Hogood Coffee Co Ltd

- Gloria Jean's

- The Kraft Heinz Company

- The Coca-Cola Company

- Luckin Coffee

- Starbucks Corporation

Key Developments in China Coffee Market Industry

- April 2023: Nestle launched Nescafe Ice Roast instant coffee, tapping into the growing cold coffee market.

- September 2022: Luckin Coffee introduced a new brand, "Cotti Coffee," expanding its portfolio.

- January 2022: Ethiopian coffee brands debuted on China's largest e-commerce platform, leveraging e-WTP infrastructure.

Strategic Outlook for China Coffee Market Market

The China coffee market holds immense potential for growth, driven by rising incomes, urbanization, and evolving consumer preferences. Companies that successfully adapt to these trends, focusing on product innovation, efficient distribution, and targeted marketing, will be well-positioned to capitalize on the expanding market. Investing in sustainable sourcing and environmentally friendly practices will also enhance brand appeal and resonate with increasingly conscious consumers. The long-term outlook remains positive, promising substantial returns for businesses willing to embrace the opportunities and navigate the challenges inherent in this dynamic market.

China Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole-bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Specialty Stores

- 2.2.3. Convenience Stores

- 2.2.4. Online Retail Stores

- 2.2.5. Other Distribution Channels

China Coffee Market Segmentation By Geography

- 1. China

China Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and E-commerce Penetration

- 3.3. Market Restrains

- 3.3.1. Detrimental Health Impact of Caffeine Intake

- 3.4. Market Trends

- 3.4.1. Government Initiatives and E-commerce Penetration Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole-bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Specialty Stores

- 5.2.2.3. Convenience Stores

- 5.2.2.4. Online Retail Stores

- 5.2.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China China Coffee Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan China Coffee Market Analysis, Insights and Forecast, 2019-2031

- 8. India China Coffee Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea China Coffee Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan China Coffee Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia China Coffee Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific China Coffee Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Hainan LISUN Investment Co

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 JAB Holding Company

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Nestle SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Luigi Lavazza SpA*List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Dehong Hogood Coffee Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Gloria Jean's

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Kraft Heinz Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 The Coca-Cola Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Luckin Coffee

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Starbucks Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Hainan LISUN Investment Co

List of Figures

- Figure 1: China Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: China Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: China Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: China Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China China Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan China Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India China Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea China Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan China Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia China Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific China Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: China Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: China Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: China Coffee Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Coffee Market?

The projected CAGR is approximately 1.90%.

2. Which companies are prominent players in the China Coffee Market?

Key companies in the market include Hainan LISUN Investment Co, JAB Holding Company, Nestle SA, Luigi Lavazza SpA*List Not Exhaustive, Dehong Hogood Coffee Co Ltd, Gloria Jean's, The Kraft Heinz Company, The Coca-Cola Company, Luckin Coffee, Starbucks Corporation.

3. What are the main segments of the China Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and E-commerce Penetration.

6. What are the notable trends driving market growth?

Government Initiatives and E-commerce Penetration Drive the Market.

7. Are there any restraints impacting market growth?

Detrimental Health Impact of Caffeine Intake.

8. Can you provide examples of recent developments in the market?

April 2023: Nestle, the Swiss food and beverage industry leader, unveiled Nescafe Ice Roast instant coffee in China, catering to the growing demand for "cafe-style cold coffee experiences" in the comfort of one's home.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Coffee Market?

To stay informed about further developments, trends, and reports in the China Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence