Key Insights

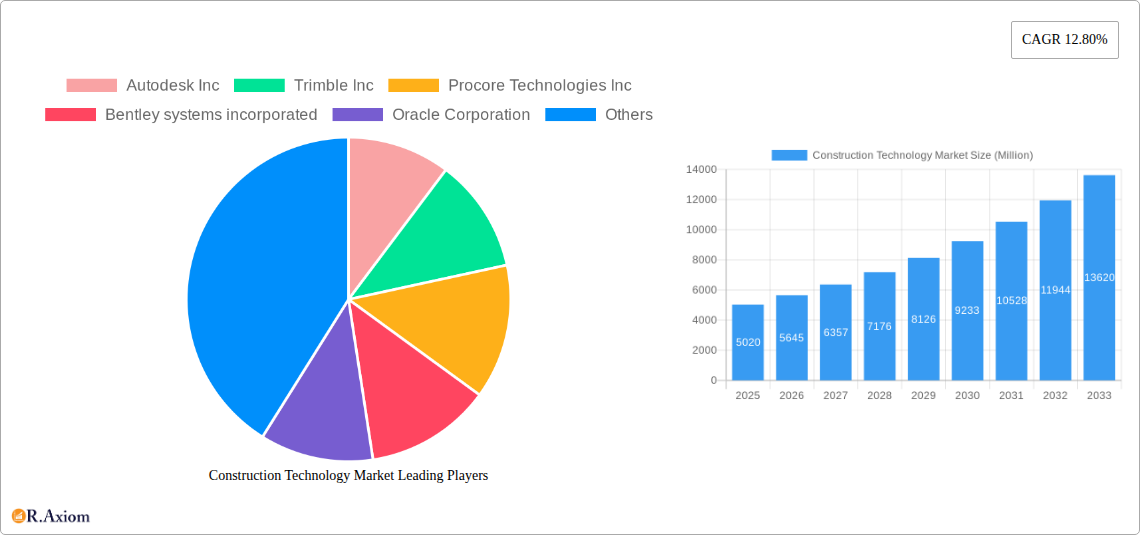

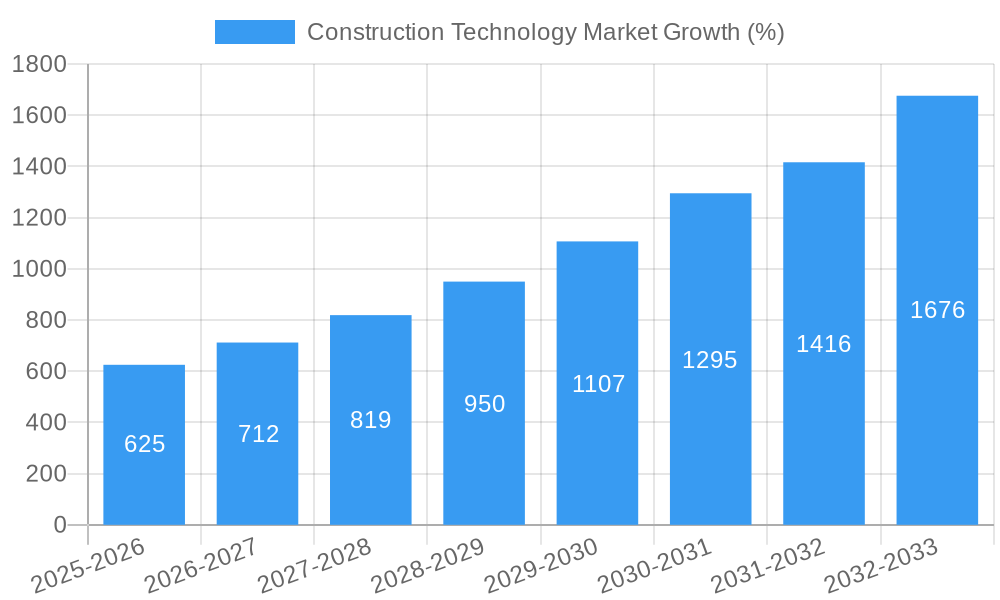

The Construction Technology market is experiencing robust growth, projected to reach $5.02 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.80% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing demand for improved efficiency and productivity within the construction sector is fueling adoption of technologies like Building Information Modeling (BIM), project management software, and drone-based surveying. Secondly, the growing need for enhanced safety and risk mitigation is promoting the use of advanced safety monitoring systems and predictive analytics. Finally, the increasing availability of affordable and user-friendly construction technology solutions is lowering the barrier to entry for smaller firms. Major players like Autodesk, Trimble, and Procore Technologies are leading the innovation, while newer entrants are focusing on niche areas such as AI-powered construction site monitoring and virtual reality for design visualization.

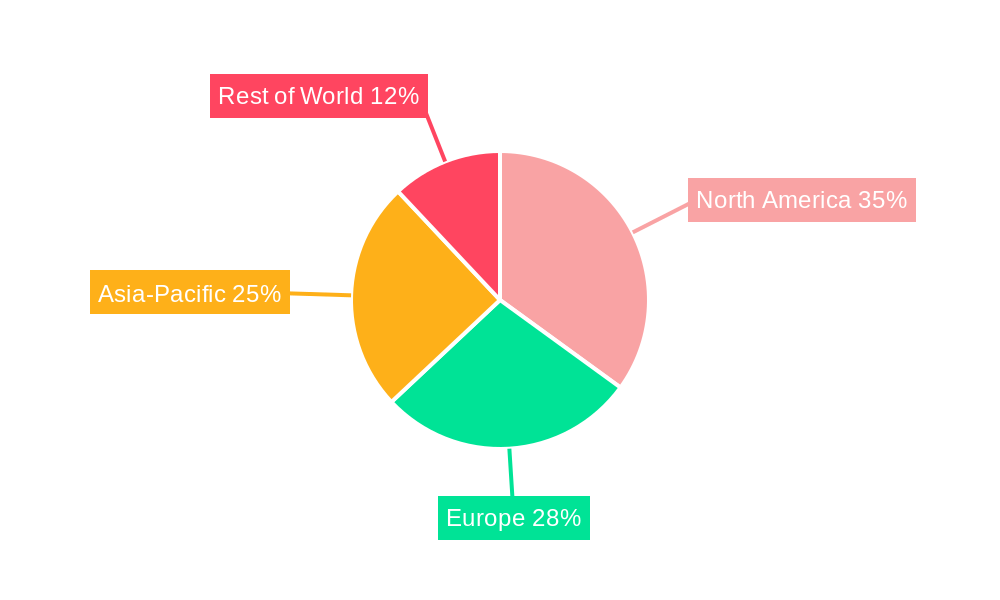

The market's segmentation is likely diverse, encompassing software (BIM, project management, cost estimation), hardware (drones, sensors, 3D printers), and services (consulting, implementation, training). Regional variations will likely exist, with developed economies like North America and Europe demonstrating higher adoption rates due to greater technological awareness and higher investment capacities. However, developing economies are also expected to witness significant growth as construction activity expands and awareness of the benefits of construction technology increases. While challenges remain, such as high initial investment costs and the need for skilled workforce training, the overall market outlook remains positive, suggesting substantial growth opportunities for established and emerging players alike. This growth is further fueled by government initiatives promoting technological adoption within the construction industry.

Construction Technology Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Construction Technology Market, covering historical data (2019-2024), the current market landscape (2025), and future projections (2025-2033). The report offers actionable insights for industry stakeholders, investors, and businesses seeking to understand and capitalize on the evolving dynamics of this rapidly growing sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Construction Technology Market Market Concentration & Innovation

The Construction Technology market is characterized by a moderately concentrated landscape with several key players holding significant market share. While a few dominant companies such as Autodesk Inc, Trimble Inc, and Procore Technologies Inc. control a considerable portion of the market, a large number of smaller, specialized firms are also present, driving innovation and competition. The market share of the top 5 players is estimated at xx%, indicating a competitive yet consolidated environment. Mergers and acquisitions (M&A) activity is frequent, with deal values exceeding xx Million annually in recent years, reflecting consolidation trends and the pursuit of technological advancements. Regulatory frameworks, such as building codes and safety regulations, significantly influence the adoption of new technologies. The market experiences continuous product substitution as newer, more efficient technologies replace older solutions. End-user trends, particularly the growing emphasis on sustainability, digitalization, and improved project efficiency, are major drivers of market growth.

- Market Concentration: Top 5 players hold xx% market share.

- M&A Activity: Annual deal values exceed xx Million.

- Innovation Drivers: Demand for enhanced efficiency, sustainability, and safety.

- Regulatory Impact: Building codes and safety standards influence technology adoption.

- Product Substitution: Continuous replacement of older technologies with newer solutions.

- End-User Trends: Focus on digitalization, sustainability, and project efficiency.

Construction Technology Market Industry Trends & Insights

The Construction Technology market is experiencing robust growth, fueled by several key trends. Increased investment in infrastructure projects globally, coupled with a growing demand for improved project efficiency and reduced costs, is a primary driver. Technological advancements, including Building Information Modeling (BIM), Artificial Intelligence (AI), Internet of Things (IoT), and cloud computing, are revolutionizing construction practices. Consumer preferences are shifting towards sustainable and technologically advanced construction methods, further boosting market demand. The competitive landscape is dynamic, with established players facing increasing competition from innovative startups and specialized firms. The market penetration rate of construction technology is gradually increasing, with xx% of construction projects currently leveraging these technologies. The market is anticipated to experience a compound annual growth rate (CAGR) of xx% during the forecast period.

Dominant Markets & Segments in Construction Technology Market

The North American construction technology market currently holds the leading position, driven by strong economic growth, significant investments in infrastructure development, and a relatively high adoption rate of advanced technologies. The United States is the largest contributor to this market.

- Key Drivers in North America:

- Strong economic growth and infrastructure investments.

- High adoption rate of advanced construction technologies.

- Supportive regulatory environment.

- Dominance Analysis: North America's robust economy, high technological adoption rates, and substantial infrastructure projects contribute to its market leadership. Europe and Asia-Pacific are expected to experience significant growth in the coming years.

Construction Technology Market Product Developments

Recent product innovations focus on integrating AI and machine learning into various construction processes, such as progress tracking, safety monitoring, and predictive analytics. New applications are emerging in areas like drone-based surveying, robotic automation, and modular construction, improving efficiency and precision. These advancements offer competitive advantages through improved project timelines, cost reductions, and enhanced safety measures, leading to increased market adoption.

Report Scope & Segmentation Analysis

This report segments the Construction Technology Market based on several factors including technology type (BIM, IoT, AI, Cloud Computing, etc.), application (building construction, infrastructure development, etc.), and region (North America, Europe, Asia-Pacific, etc.). Each segment exhibits varying growth projections and competitive dynamics. For example, the BIM segment is expected to witness significant growth due to increasing industry adoption. Similarly, the infrastructure development application segment is anticipated to expand rapidly, driven by global infrastructure investment. The market size for each segment is detailed within the full report.

Key Drivers of Construction Technology Market Growth

Several factors are propelling the growth of the Construction Technology market. Technological advancements, such as AI, BIM, and IoT, are significantly improving project efficiency and reducing costs. Government initiatives promoting infrastructure development and sustainable construction practices are also driving market expansion. Furthermore, the increasing demand for higher quality and safer construction projects fuels the adoption of advanced technologies.

Challenges in the Construction Technology Market Sector

Despite the significant growth potential, several challenges hinder the widespread adoption of construction technologies. High initial investment costs and the complexity of integrating new technologies into existing workflows can be significant barriers. Lack of skilled labor proficient in operating and maintaining these technologies also poses a challenge. Additionally, concerns related to data security and privacy are emerging. These factors can collectively hinder the market growth by up to xx% in certain segments.

Emerging Opportunities in Construction Technology Market

The market presents several emerging opportunities. The growing adoption of modular construction and prefabrication offers significant potential for efficiency gains. The integration of advanced materials and sustainable construction methods creates opportunities for innovative solutions. Expanding into developing markets with burgeoning infrastructure projects presents significant growth prospects.

Leading Players in the Construction Technology Market Market

- Autodesk Inc

- Trimble Inc

- Procore Technologies Inc

- Bentley systems incorporated

- Oracle Corporation

- Buildots

- Bluebeam Inc (A NEMETSCHEK Company)

- Esri Inc

- Buildertrend

- Doxel

- Fieldwire by Hilti

- HOCHTIEF ViCon

- Caterpillar Inc

- Newforma Inc

- Construct Connect

- Heavy Construction Systems Specialists LLC (HCSS)

- Jonas Construction Software Inc

- Sage Group Plc

- Accela Inc

- Computer Methods International Corporation (CMiC)

- *List Not Exhaustive

Key Developments in Construction Technology Market Industry

- July 2024: Buildots launched Integrated Tracking for Performance-Driven Construction Management (PDCM), leveraging AI for automated progress tracking and human oversight for quality assurance.

- May 2024: Roofer.com secured USD 7.5 Million in seed funding to expand its AI-powered drone inspection services for roofing and expand into new markets.

Strategic Outlook for Construction Technology Market Market

The Construction Technology market is poised for sustained growth, driven by continued technological innovation, increasing infrastructure investments, and a growing focus on sustainable and efficient construction practices. The integration of AI, BIM, and IoT will continue to transform the industry, creating new opportunities for market participants. Companies that successfully adapt to these evolving trends and invest in research and development will be well-positioned to capitalize on the significant growth potential of this dynamic market.

Construction Technology Market Segmentation

-

1. Type

-

1.1. Solutions

- 1.1.1. Virtual and Augmented Reality

- 1.1.2. Artificial Intelligence

- 1.1.3. 3D Printing

- 1.1.4. Building Information Modeling (BIM) Software

- 1.1.5. Automated Data Collection and Predictive Analytics

- 1.1.6. Drones

- 1.1.7. Robotics

- 1.1.8. Project Management Software

- 1.1.9. Wearables

- 1.1.10. Other Ty

- 1.2. Services

-

1.1. Solutions

Construction Technology Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Construction Technology Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Technological Innovations like AI

- 3.2.2 IoT

- 3.2.3 and Robotics are Increasingly Essential for Boosting Productivity and Ensuring Safety on Construction Sites; Need for Quicker and More Efficient Construction Methods Due to the Rapid Urbanization

- 3.3. Market Restrains

- 3.3.1 Technological Innovations like AI

- 3.3.2 IoT

- 3.3.3 and Robotics are Increasingly Essential for Boosting Productivity and Ensuring Safety on Construction Sites; Need for Quicker and More Efficient Construction Methods Due to the Rapid Urbanization

- 3.4. Market Trends

- 3.4.1. Building Information Modeling (BIM) Software is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Technology Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solutions

- 5.1.1.1. Virtual and Augmented Reality

- 5.1.1.2. Artificial Intelligence

- 5.1.1.3. 3D Printing

- 5.1.1.4. Building Information Modeling (BIM) Software

- 5.1.1.5. Automated Data Collection and Predictive Analytics

- 5.1.1.6. Drones

- 5.1.1.7. Robotics

- 5.1.1.8. Project Management Software

- 5.1.1.9. Wearables

- 5.1.1.10. Other Ty

- 5.1.2. Services

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Construction Technology Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solutions

- 6.1.1.1. Virtual and Augmented Reality

- 6.1.1.2. Artificial Intelligence

- 6.1.1.3. 3D Printing

- 6.1.1.4. Building Information Modeling (BIM) Software

- 6.1.1.5. Automated Data Collection and Predictive Analytics

- 6.1.1.6. Drones

- 6.1.1.7. Robotics

- 6.1.1.8. Project Management Software

- 6.1.1.9. Wearables

- 6.1.1.10. Other Ty

- 6.1.2. Services

- 6.1.1. Solutions

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Construction Technology Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solutions

- 7.1.1.1. Virtual and Augmented Reality

- 7.1.1.2. Artificial Intelligence

- 7.1.1.3. 3D Printing

- 7.1.1.4. Building Information Modeling (BIM) Software

- 7.1.1.5. Automated Data Collection and Predictive Analytics

- 7.1.1.6. Drones

- 7.1.1.7. Robotics

- 7.1.1.8. Project Management Software

- 7.1.1.9. Wearables

- 7.1.1.10. Other Ty

- 7.1.2. Services

- 7.1.1. Solutions

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Construction Technology Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solutions

- 8.1.1.1. Virtual and Augmented Reality

- 8.1.1.2. Artificial Intelligence

- 8.1.1.3. 3D Printing

- 8.1.1.4. Building Information Modeling (BIM) Software

- 8.1.1.5. Automated Data Collection and Predictive Analytics

- 8.1.1.6. Drones

- 8.1.1.7. Robotics

- 8.1.1.8. Project Management Software

- 8.1.1.9. Wearables

- 8.1.1.10. Other Ty

- 8.1.2. Services

- 8.1.1. Solutions

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Construction Technology Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solutions

- 9.1.1.1. Virtual and Augmented Reality

- 9.1.1.2. Artificial Intelligence

- 9.1.1.3. 3D Printing

- 9.1.1.4. Building Information Modeling (BIM) Software

- 9.1.1.5. Automated Data Collection and Predictive Analytics

- 9.1.1.6. Drones

- 9.1.1.7. Robotics

- 9.1.1.8. Project Management Software

- 9.1.1.9. Wearables

- 9.1.1.10. Other Ty

- 9.1.2. Services

- 9.1.1. Solutions

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Construction Technology Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Solutions

- 10.1.1.1. Virtual and Augmented Reality

- 10.1.1.2. Artificial Intelligence

- 10.1.1.3. 3D Printing

- 10.1.1.4. Building Information Modeling (BIM) Software

- 10.1.1.5. Automated Data Collection and Predictive Analytics

- 10.1.1.6. Drones

- 10.1.1.7. Robotics

- 10.1.1.8. Project Management Software

- 10.1.1.9. Wearables

- 10.1.1.10. Other Ty

- 10.1.2. Services

- 10.1.1. Solutions

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Construction Technology Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Solutions

- 11.1.1.1. Virtual and Augmented Reality

- 11.1.1.2. Artificial Intelligence

- 11.1.1.3. 3D Printing

- 11.1.1.4. Building Information Modeling (BIM) Software

- 11.1.1.5. Automated Data Collection and Predictive Analytics

- 11.1.1.6. Drones

- 11.1.1.7. Robotics

- 11.1.1.8. Project Management Software

- 11.1.1.9. Wearables

- 11.1.1.10. Other Ty

- 11.1.2. Services

- 11.1.1. Solutions

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Autodesk Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Trimble Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Procore Technologies Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bentley systems incorporated

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Oracle Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Buildots

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Bluebeam Inc (A NEMETSCHEK Company)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Esri Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Buildertrend

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Doxel

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Fieldwire by Hilti

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 HOCHTIEF ViCon

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Caterpillar Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Newforma Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Construct Connect

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Heavy Construction Systems Specialists LLC (HCSS)

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Jonas Construction Software Inc

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 Sage Group Plc

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 Accela Inc

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.20 Computer Methods International Corporation (CMiC)*List Not Exhaustive

- 12.2.20.1. Overview

- 12.2.20.2. Products

- 12.2.20.3. SWOT Analysis

- 12.2.20.4. Recent Developments

- 12.2.20.5. Financials (Based on Availability)

- 12.2.1 Autodesk Inc

List of Figures

- Figure 1: Global Construction Technology Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Construction Technology Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Construction Technology Market Revenue (Million), by Type 2024 & 2032

- Figure 4: North America Construction Technology Market Volume (Billion), by Type 2024 & 2032

- Figure 5: North America Construction Technology Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Construction Technology Market Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Construction Technology Market Revenue (Million), by Country 2024 & 2032

- Figure 8: North America Construction Technology Market Volume (Billion), by Country 2024 & 2032

- Figure 9: North America Construction Technology Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Construction Technology Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Europe Construction Technology Market Revenue (Million), by Type 2024 & 2032

- Figure 12: Europe Construction Technology Market Volume (Billion), by Type 2024 & 2032

- Figure 13: Europe Construction Technology Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: Europe Construction Technology Market Volume Share (%), by Type 2024 & 2032

- Figure 15: Europe Construction Technology Market Revenue (Million), by Country 2024 & 2032

- Figure 16: Europe Construction Technology Market Volume (Billion), by Country 2024 & 2032

- Figure 17: Europe Construction Technology Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Construction Technology Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Asia Construction Technology Market Revenue (Million), by Type 2024 & 2032

- Figure 20: Asia Construction Technology Market Volume (Billion), by Type 2024 & 2032

- Figure 21: Asia Construction Technology Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Asia Construction Technology Market Volume Share (%), by Type 2024 & 2032

- Figure 23: Asia Construction Technology Market Revenue (Million), by Country 2024 & 2032

- Figure 24: Asia Construction Technology Market Volume (Billion), by Country 2024 & 2032

- Figure 25: Asia Construction Technology Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Construction Technology Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Australia and New Zealand Construction Technology Market Revenue (Million), by Type 2024 & 2032

- Figure 28: Australia and New Zealand Construction Technology Market Volume (Billion), by Type 2024 & 2032

- Figure 29: Australia and New Zealand Construction Technology Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Australia and New Zealand Construction Technology Market Volume Share (%), by Type 2024 & 2032

- Figure 31: Australia and New Zealand Construction Technology Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Construction Technology Market Volume (Billion), by Country 2024 & 2032

- Figure 33: Australia and New Zealand Construction Technology Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Australia and New Zealand Construction Technology Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Latin America Construction Technology Market Revenue (Million), by Type 2024 & 2032

- Figure 36: Latin America Construction Technology Market Volume (Billion), by Type 2024 & 2032

- Figure 37: Latin America Construction Technology Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Latin America Construction Technology Market Volume Share (%), by Type 2024 & 2032

- Figure 39: Latin America Construction Technology Market Revenue (Million), by Country 2024 & 2032

- Figure 40: Latin America Construction Technology Market Volume (Billion), by Country 2024 & 2032

- Figure 41: Latin America Construction Technology Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Latin America Construction Technology Market Volume Share (%), by Country 2024 & 2032

- Figure 43: Middle East and Africa Construction Technology Market Revenue (Million), by Type 2024 & 2032

- Figure 44: Middle East and Africa Construction Technology Market Volume (Billion), by Type 2024 & 2032

- Figure 45: Middle East and Africa Construction Technology Market Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East and Africa Construction Technology Market Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East and Africa Construction Technology Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Middle East and Africa Construction Technology Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Middle East and Africa Construction Technology Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East and Africa Construction Technology Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Construction Technology Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Construction Technology Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Construction Technology Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Construction Technology Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Global Construction Technology Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Construction Technology Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Global Construction Technology Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Global Construction Technology Market Volume Billion Forecast, by Type 2019 & 2032

- Table 9: Global Construction Technology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Construction Technology Market Volume Billion Forecast, by Country 2019 & 2032

- Table 11: Global Construction Technology Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global Construction Technology Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Global Construction Technology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Construction Technology Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: Global Construction Technology Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Construction Technology Market Volume Billion Forecast, by Type 2019 & 2032

- Table 17: Global Construction Technology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Construction Technology Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: Global Construction Technology Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Construction Technology Market Volume Billion Forecast, by Type 2019 & 2032

- Table 21: Global Construction Technology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Construction Technology Market Volume Billion Forecast, by Country 2019 & 2032

- Table 23: Global Construction Technology Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global Construction Technology Market Volume Billion Forecast, by Type 2019 & 2032

- Table 25: Global Construction Technology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Construction Technology Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global Construction Technology Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Construction Technology Market Volume Billion Forecast, by Type 2019 & 2032

- Table 29: Global Construction Technology Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Construction Technology Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Technology Market?

The projected CAGR is approximately 12.80%.

2. Which companies are prominent players in the Construction Technology Market?

Key companies in the market include Autodesk Inc, Trimble Inc, Procore Technologies Inc, Bentley systems incorporated, Oracle Corporation, Buildots, Bluebeam Inc (A NEMETSCHEK Company), Esri Inc, Buildertrend, Doxel, Fieldwire by Hilti, HOCHTIEF ViCon, Caterpillar Inc, Newforma Inc, Construct Connect, Heavy Construction Systems Specialists LLC (HCSS), Jonas Construction Software Inc, Sage Group Plc, Accela Inc, Computer Methods International Corporation (CMiC)*List Not Exhaustive.

3. What are the main segments of the Construction Technology Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Innovations like AI. IoT. and Robotics are Increasingly Essential for Boosting Productivity and Ensuring Safety on Construction Sites; Need for Quicker and More Efficient Construction Methods Due to the Rapid Urbanization.

6. What are the notable trends driving market growth?

Building Information Modeling (BIM) Software is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Technological Innovations like AI. IoT. and Robotics are Increasingly Essential for Boosting Productivity and Ensuring Safety on Construction Sites; Need for Quicker and More Efficient Construction Methods Due to the Rapid Urbanization.

8. Can you provide examples of recent developments in the market?

July 2024: Buildots introduced Integrated Tracking as its latest initiative to propel Performance-Driven Construction Management (PDCM). This move consolidates fragmented progress data into a unified, actionable dataset. By harnessing advanced analytics, users can better anticipate delays, pinpoint root causes, fine-tune task scheduling, and bolster project oversight. This innovative feature empowers project teams to utilize AI for automated progress tracking. Simultaneously, it allows professionals to log and verify tasks requiring human oversight. Examples include confirming the presence of electrical wiring in conduits and completing essential tasks like quality assurance checks and inspections.May 2024: Roofer.com secured USD 7.5 million in a seed round spearheaded by Mucker Capital. The drone conducts scans that generate detailed inspection reports for properties utilizing AI. All inspections are stored on the platform RoofFax, which the company likens to the vehicle condition-monitoring software CarFax. As stated in the release, while Roofer.com primarily targets re-roofing homes for consumers, it also boasts a burgeoning enterprise segment catering to multifamily apartments and commercial buildings. Owing to this funding, the company is set to expand into Austin, Texas - marking its second location and inaugural site outside its Dallas headquarters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Technology Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Technology Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Technology Market?

To stay informed about further developments, trends, and reports in the Construction Technology Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence