Key Insights

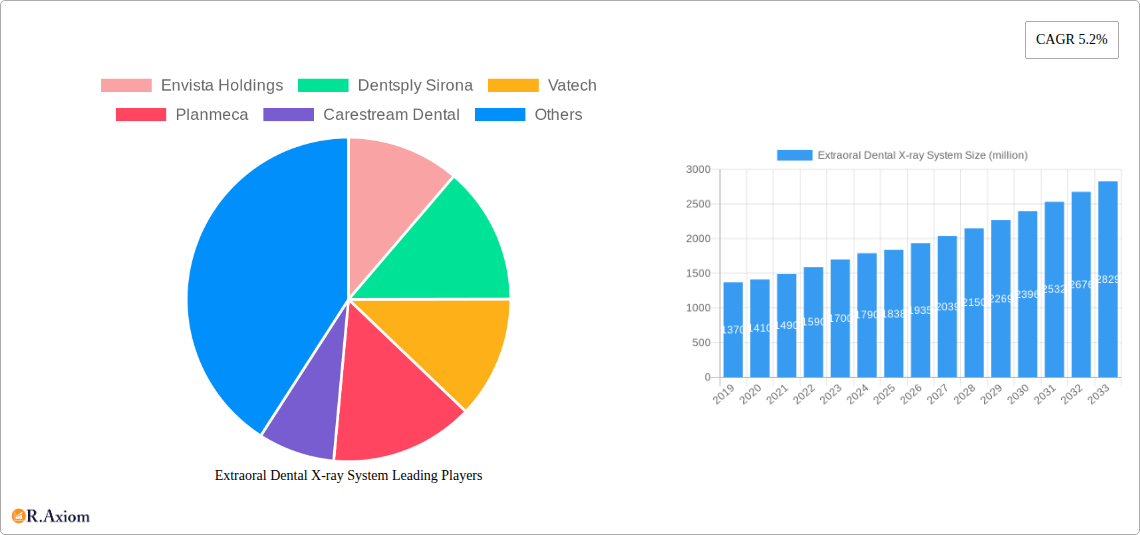

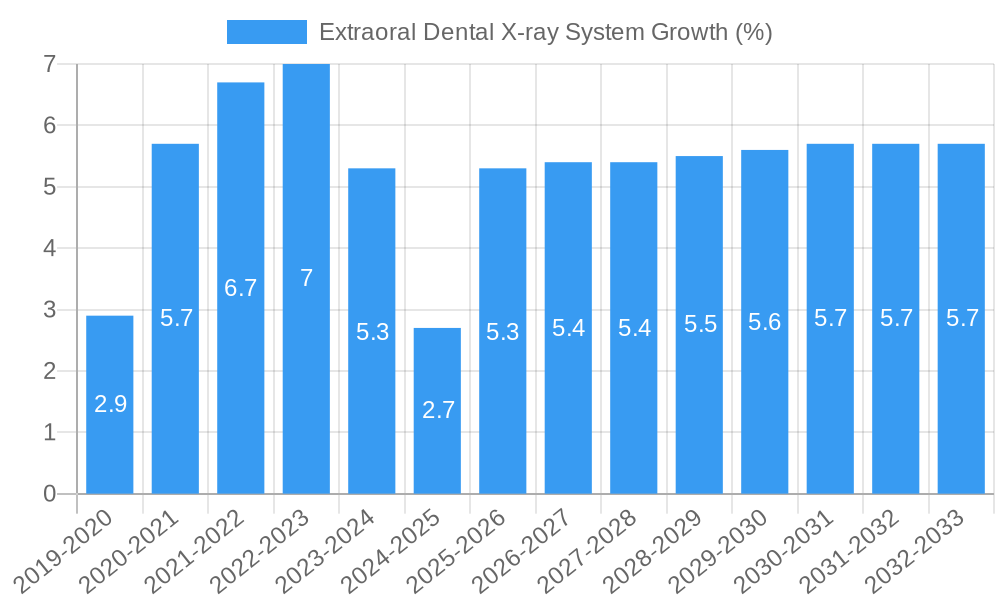

The global Extraoral Dental X-ray System market is poised for robust expansion, projected to reach a substantial market size of approximately USD 1838 million by the base year 2025. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 5.2% anticipated over the forecast period from 2025 to 2033. Key drivers fueling this upward trajectory include the increasing prevalence of dental caries and periodontal diseases, a growing awareness of oral hygiene, and the rising demand for advanced diagnostic imaging solutions in both hospital and dental clinic settings. The introduction of innovative technologies like Cone Beam Computed Tomography (CBCT) is further stimulating market penetration, offering dentists unparalleled detail for treatment planning and execution.

The market's dynamics are further shaped by a focus on enhanced patient comfort and reduced radiation exposure, pushing manufacturers towards developing sophisticated, user-friendly systems. Leading companies such as Envista Holdings, Dentsply Sirona, Vatech, and Planmeca are at the forefront of this innovation, continually investing in research and development to refine product offerings. While the market is generally characterized by strong growth, potential restraints could include the high initial cost of advanced systems and the need for specialized training for optimal utilization. Nevertheless, the expanding scope of dental procedures and the continuous technological advancements ensure a promising outlook for the Extraoral Dental X-ray System market globally.

This comprehensive report provides an in-depth analysis of the global Extraoral Dental X-ray System market, a critical segment within the dental imaging technology landscape. Spanning from 2019 to 2033, with a base year of 2025, this study offers invaluable insights into market dynamics, technological advancements, and strategic opportunities for industry stakeholders. Leveraging high-traffic keywords such as "dental imaging solutions," "CBCT technology," "panoramic dental x-ray," "oral diagnostics," and "dental equipment market," this report is meticulously crafted for maximum search engine visibility and engagement with professionals in the dental industry, including dentists, orthodontists, oral surgeons, hospital administrators, and dental equipment manufacturers.

Extraoral Dental X-ray System Market Concentration & Innovation

The Extraoral Dental X-ray System market exhibits a moderate to high level of concentration, with a few key players dominating a significant portion of the market share. Key companies like Envista Holdings and Dentsply Sirona have consistently invested in research and development, driving innovation through the integration of advanced digital imaging technologies and artificial intelligence for enhanced diagnostic accuracy. Regulatory frameworks, such as those established by the FDA and CE, play a crucial role in shaping market entry and product approval, ensuring patient safety and device efficacy. The threat of product substitutes, while present in the form of intraoral X-ray systems and other diagnostic tools, is mitigated by the distinct advantages offered by extraoral systems in terms of field of view and comprehensive imaging capabilities, particularly for full-mouth assessments. End-user trends are increasingly leaning towards systems that offer faster scan times, lower radiation doses, and seamless integration with practice management software. Mergers and acquisitions (M&A) activities, with reported deal values in the tens to hundreds of millions of dollars, indicate strategic consolidation and efforts to expand product portfolios and geographical reach. For instance, strategic acquisitions have allowed companies to integrate new technologies like AI-powered image analysis and advanced visualization software. The market share distribution is dynamic, with leading players holding substantial percentages, driving competition through continuous product upgrades and service enhancements.

Extraoral Dental X-ray System Industry Trends & Insights

The global Extraoral Dental X-ray System industry is poised for robust growth, driven by a confluence of escalating demand for advanced oral healthcare solutions and significant technological advancements. The market penetration of digital dental imaging, a key growth driver, has been steadily increasing, replacing traditional film-based radiography due to its superior image quality, reduced radiation exposure, and enhanced workflow efficiency. The Compound Annual Growth Rate (CAGR) is projected to be between 6% and 8% over the forecast period (2025–2033), a testament to the industry's dynamism. Technological disruptions, including the widespread adoption of Cone Beam Computed Tomography (CBCT) and the continuous refinement of panoramic X-ray units, are revolutionizing diagnostic capabilities. CBCT technology, in particular, offers three-dimensional imaging that is invaluable for complex procedures like dental implants, orthodontics, and endodontics, leading to more precise treatment planning and improved patient outcomes. Consumer preferences are shifting towards practices that utilize state-of-the-art equipment, emphasizing patient comfort and the perception of advanced care. This demand fuels innovation and investment in user-friendly interfaces, faster scan times, and compact system designs. Competitive dynamics are characterized by intense innovation, with manufacturers striving to differentiate their offerings through features such as high-resolution imaging, reduced artifacts, advanced software solutions for image manipulation and analysis, and integration with digital dentistry workflows. Furthermore, the increasing awareness among the general population regarding the importance of oral health and regular dental check-ups is a significant market expansion driver. The rising prevalence of dental conditions such as periodontal disease, dental caries, and malocclusions necessitates accurate and efficient diagnostic tools, directly boosting the demand for extraoral dental X-ray systems. The ongoing digitalization of dental practices, coupled with the growing trend of teledentistry, further accentuates the need for sophisticated imaging equipment that can facilitate remote consultations and diagnostics. The global market size is anticipated to reach several billion dollars within the forecast period, underscoring its significant economic impact.

Dominant Markets & Segments in Extraoral Dental X-ray System

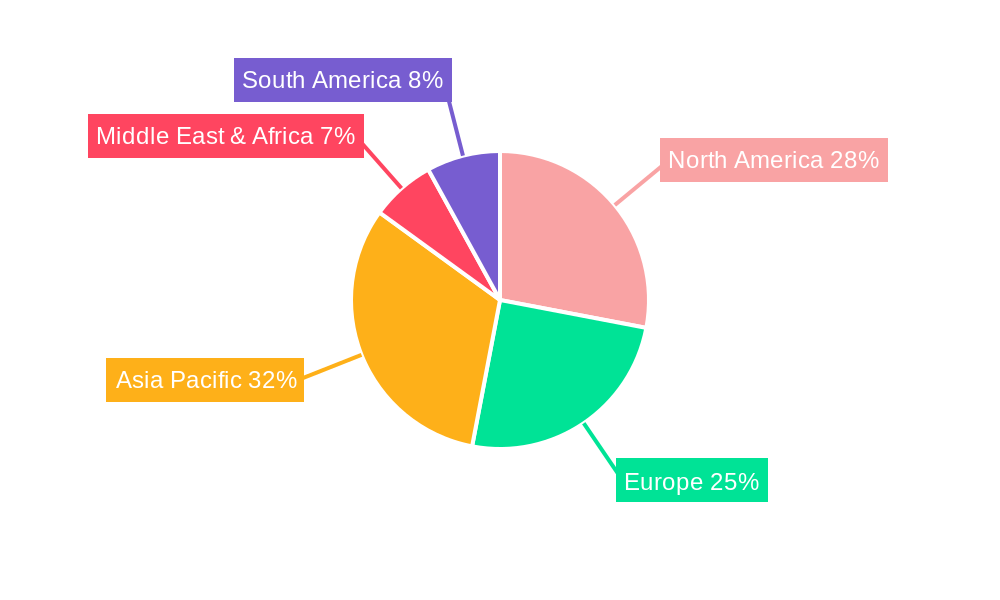

The Extraoral Dental X-ray System market is characterized by distinct regional dominance and segment leadership, driven by economic policies, healthcare infrastructure development, and evolving patient demographics.

Dominant Region: North America and Europe

North America and Europe currently represent the most dominant markets for extraoral dental x-ray systems. This dominance is attributed to:

- High Disposable Income and Healthcare Spending: These regions boast a high level of disposable income, allowing for greater patient investment in advanced dental care and a stronger willingness to adopt new technologies in dental practices. Robust healthcare spending further supports the acquisition of sophisticated medical equipment.

- Advanced Dental Infrastructure: Well-established dental practices with a strong emphasis on preventive care and advanced diagnostics form the backbone of this market. The presence of numerous specialized dental clinics and hospitals equipped with the latest technology drives demand.

- Favorable Reimbursement Policies: Favorable reimbursement policies for diagnostic procedures, including dental imaging, encourage dentists to utilize advanced equipment for comprehensive patient care.

- Early Adoption of Technological Innovations: Both regions have historically been early adopters of new technologies, including digital radiography and CBCT, leading to higher market penetration of extraoral systems.

Leading Segment by Application: Dental Clinic

Within the application segment, Dental Clinics represent the largest and fastest-growing market for extraoral dental x-ray systems.

- High Volume of Procedures: Dental clinics perform a vast majority of routine and specialized dental procedures that benefit from extraoral imaging, such as panoramic assessments for orthodontics, wisdom tooth evaluation, and implant planning.

- Focus on Patient Convenience and Workflow: The emphasis in dental clinics is on efficient patient throughput and seamless integration of diagnostic tools into daily workflows. Extraoral systems offer faster acquisition times and easier positioning compared to some intraoral methods for comprehensive views.

- Growing Number of Group Practices: The trend towards larger group dental practices, which have greater purchasing power and a more centralized approach to technology adoption, further fuels demand in this segment.

- Integration with Digital Dentistry: Dental clinics are at the forefront of adopting digital dentistry solutions, including CAD/CAM, intraoral scanners, and practice management software. Extraoral x-ray systems that integrate seamlessly with these digital workflows are highly sought after.

Leading Segment by Type: CBCT

In terms of system types, CBCT (Cone Beam Computed Tomography) units are experiencing the most significant growth and are rapidly becoming indispensable in advanced dental practices.

- Unparalleled Diagnostic Capabilities: CBCT provides detailed 3D imaging, offering superior visualization of anatomical structures like jaws, teeth, nerves, and sinuses. This is crucial for complex diagnoses and treatment planning in periodontics, endodontics, oral surgery, and implantology.

- Reduced Radiation Doses: Compared to medical CT scans, CBCT systems offer significantly lower radiation doses, making them a safer choice for dental patients.

- Enhanced Treatment Precision: The 3D data generated by CBCT allows for precise virtual surgical planning, leading to improved surgical outcomes, reduced complications, and faster recovery times for patients.

- Increasing Accessibility and Affordability: As the technology matures, CBCT units are becoming more accessible and affordable, enabling a wider range of dental practices to invest in this advanced imaging modality. The market size for CBCT within the extraoral segment is projected to grow at a higher CAGR than panoramic units.

Extraoral Dental X-ray System Product Developments

Product developments in the Extraoral Dental X-ray System market are characterized by a relentless pursuit of enhanced diagnostic accuracy, patient safety, and workflow efficiency. Innovations are focused on higher resolution imaging, reduced radiation dosages through advanced detector technology, and faster scan times to improve patient comfort and practice throughput. Integration of artificial intelligence (AI) for automated image analysis, artifact reduction, and treatment planning assistance is a significant trend. Furthermore, manufacturers are developing more compact and ergonomic designs, making these systems suitable for a wider range of practice environments. These advancements provide significant competitive advantages by offering clinicians superior diagnostic tools, leading to better patient outcomes and improved practice economics.

Report Scope & Segmentation Analysis

This report meticulously segments the Extraoral Dental X-ray System market across key dimensions to provide granular insights.

Application Segmentation:

- Hospital: While hospitals utilize these systems for specialized oral and maxillofacial procedures and trauma cases, their market share is generally smaller compared to private dental practices. Growth is driven by the increasing complexity of surgical interventions and the need for precise pre-operative imaging. Market size is estimated to be in the hundreds of millions of dollars, with steady growth.

- Dental Clinic: This segment represents the largest and most dynamic part of the market. Growth is propelled by the widespread adoption of digital dentistry, the increasing demand for preventive and cosmetic dentistry, and the need for advanced diagnostic tools for a wide range of treatments. Market size is in the billions of dollars, with a projected CAGR between 7% and 9%.

Type Segmentation:

- Panoramic X-ray Units: These systems provide a broad view of the teeth, jaws, and surrounding structures, making them essential for routine dental diagnostics, orthodontic assessments, and the evaluation of impacted teeth. The market size is substantial, in the low billions of dollars, with moderate but consistent growth driven by their affordability and established role in dental practice.

- CBCT (Cone Beam Computed Tomography): CBCT offers 3D imaging, revolutionizing diagnostics for complex procedures like dental implants, endodontics, and orthodontics. This segment is experiencing rapid expansion due to its superior diagnostic capabilities and increasing technological sophistication. Market size is in the billions of dollars, with the highest projected CAGR (9%–11%) within the extraoral segment, indicating significant future dominance.

Key Drivers of Extraoral Dental X-ray System Growth

The growth of the Extraoral Dental X-ray System market is propelled by several interconnected factors. Technologically, the increasing adoption of digital radiography, coupled with advancements in CBCT resolution and AI-powered image analysis, is transforming diagnostic capabilities. Economically, rising global healthcare expenditure, a growing middle class with increased disposable income in emerging economies, and favorable reimbursement policies for advanced dental diagnostics are significant drivers. Regulatory bodies, by establishing clear guidelines for radiation safety and device efficacy, implicitly encourage the adoption of modern, compliant extraoral systems. Furthermore, the growing awareness of oral health's impact on overall well-being and the aging global population, which often requires more complex dental interventions, are creating sustained demand for these diagnostic tools. The increasing prevalence of dental conditions such as periodontal disease and malocclusions further necessitates accurate imaging.

Challenges in the Extraoral Dental X-ray System Sector

Despite robust growth, the Extraoral Dental X-ray System sector faces several challenges. High initial investment costs for advanced CBCT systems can be a barrier for smaller dental practices. Stringent regulatory approval processes in certain regions can lead to prolonged market entry timelines and increased compliance costs. Supply chain disruptions, exacerbated by geopolitical events and global manufacturing complexities, can impact the availability of components and finished products, leading to price volatility. Intense competition among established players and new entrants also puts pressure on profit margins, necessitating continuous innovation and cost optimization. The need for specialized training for dental professionals to effectively utilize the advanced features of some systems also presents a potential hurdle to widespread adoption.

Emerging Opportunities in Extraoral Dental X-ray System

Emerging opportunities in the Extraoral Dental X-ray System market lie in several key areas. The increasing demand for minimally invasive dental procedures, particularly in orthodontics and implantology, presents a significant growth avenue for CBCT systems due to their precise diagnostic capabilities. The expansion of teledentistry and remote diagnostic services creates opportunities for connected extraoral imaging systems that can facilitate seamless data sharing and remote consultations. Untapped markets in emerging economies, with rapidly growing middle classes and improving healthcare infrastructure, offer substantial potential for market penetration. Furthermore, the development of AI-driven diagnostic software that can offer predictive analytics for dental diseases and treatment outcomes is an exciting area for innovation and market differentiation. The integration of extraoral systems with other digital dentistry tools, such as intraoral scanners and 3D printers, to create a fully integrated digital workflow, is another promising avenue.

Leading Players in the Extraoral Dental X-ray System Market

- Envista Holdings

- Dentsply Sirona

- Vatech

- Planmeca

- Carestream Dental

- Morita

- Yoshida

- Air Techniques

- NewTom (Cefla)

- Midmark

- Asahi Roentgen

- Acteon

- Meyer

- LargeV

Key Developments in Extraoral Dental X-ray System Industry

- 2023 December: Introduction of next-generation CBCT systems with ultra-low radiation doses and enhanced AI-powered image reconstruction, significantly improving diagnostic clarity for complex cases.

- 2023 October: Launch of a cloud-based platform for seamless integration and remote access to extraoral x-ray data, supporting teledentistry initiatives and collaborative diagnostics.

- 2022 November: A major manufacturer acquired a startup specializing in AI-driven dental imaging analytics, aiming to integrate advanced diagnostic algorithms into their product lines.

- 2022 May: Release of highly compact panoramic x-ray units designed for smaller dental practices, addressing space constraints and affordability concerns.

- 2021 September: Significant advancements in detector technology leading to higher resolution images in CBCT scans, enabling earlier detection of subtle pathologies.

Strategic Outlook for Extraoral Dental X-ray System Market

The strategic outlook for the Extraoral Dental X-ray System market is overwhelmingly positive, characterized by sustained innovation and expanding global demand. Future growth will be fueled by the continued integration of artificial intelligence for enhanced diagnostics and workflow automation, making dental practices more efficient and patient-centric. The increasing adoption of CBCT technology will be a primary growth catalyst, driven by its unparalleled 3D imaging capabilities and its crucial role in complex treatment planning. Expansion into emerging economies, coupled with the growing emphasis on preventive oral healthcare worldwide, will create significant new market opportunities. Companies that focus on developing user-friendly interfaces, providing robust customer support, and ensuring seamless integration with the broader digital dentistry ecosystem will be best positioned for long-term success. The market is expected to witness further strategic partnerships and acquisitions as companies seek to consolidate their positions and leverage synergistic technologies.

Extraoral Dental X-ray System Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Dental Clinic

-

2. Types

- 2.1. Panoramic X-ray Units

- 2.2. CBCT

Extraoral Dental X-ray System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Extraoral Dental X-ray System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Extraoral Dental X-ray System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Dental Clinic

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Panoramic X-ray Units

- 5.2.2. CBCT

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Extraoral Dental X-ray System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Dental Clinic

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Panoramic X-ray Units

- 6.2.2. CBCT

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Extraoral Dental X-ray System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Dental Clinic

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Panoramic X-ray Units

- 7.2.2. CBCT

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Extraoral Dental X-ray System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Dental Clinic

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Panoramic X-ray Units

- 8.2.2. CBCT

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Extraoral Dental X-ray System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Dental Clinic

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Panoramic X-ray Units

- 9.2.2. CBCT

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Extraoral Dental X-ray System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Dental Clinic

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Panoramic X-ray Units

- 10.2.2. CBCT

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Envista Holdings

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dentsply Sirona

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vatech

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Planmeca

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Carestream Dental

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Morita

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Yoshida

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Air Techniques

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NewTom (Cefla)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Midmark

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Asahi Roentgen

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Acteon

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Meyer

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 LargeV

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Envista Holdings

List of Figures

- Figure 1: Global Extraoral Dental X-ray System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Extraoral Dental X-ray System Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Extraoral Dental X-ray System Revenue (million), by Application 2024 & 2032

- Figure 4: North America Extraoral Dental X-ray System Volume (K), by Application 2024 & 2032

- Figure 5: North America Extraoral Dental X-ray System Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Extraoral Dental X-ray System Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Extraoral Dental X-ray System Revenue (million), by Types 2024 & 2032

- Figure 8: North America Extraoral Dental X-ray System Volume (K), by Types 2024 & 2032

- Figure 9: North America Extraoral Dental X-ray System Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Extraoral Dental X-ray System Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Extraoral Dental X-ray System Revenue (million), by Country 2024 & 2032

- Figure 12: North America Extraoral Dental X-ray System Volume (K), by Country 2024 & 2032

- Figure 13: North America Extraoral Dental X-ray System Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Extraoral Dental X-ray System Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Extraoral Dental X-ray System Revenue (million), by Application 2024 & 2032

- Figure 16: South America Extraoral Dental X-ray System Volume (K), by Application 2024 & 2032

- Figure 17: South America Extraoral Dental X-ray System Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Extraoral Dental X-ray System Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Extraoral Dental X-ray System Revenue (million), by Types 2024 & 2032

- Figure 20: South America Extraoral Dental X-ray System Volume (K), by Types 2024 & 2032

- Figure 21: South America Extraoral Dental X-ray System Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Extraoral Dental X-ray System Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Extraoral Dental X-ray System Revenue (million), by Country 2024 & 2032

- Figure 24: South America Extraoral Dental X-ray System Volume (K), by Country 2024 & 2032

- Figure 25: South America Extraoral Dental X-ray System Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Extraoral Dental X-ray System Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Extraoral Dental X-ray System Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Extraoral Dental X-ray System Volume (K), by Application 2024 & 2032

- Figure 29: Europe Extraoral Dental X-ray System Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Extraoral Dental X-ray System Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Extraoral Dental X-ray System Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Extraoral Dental X-ray System Volume (K), by Types 2024 & 2032

- Figure 33: Europe Extraoral Dental X-ray System Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Extraoral Dental X-ray System Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Extraoral Dental X-ray System Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Extraoral Dental X-ray System Volume (K), by Country 2024 & 2032

- Figure 37: Europe Extraoral Dental X-ray System Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Extraoral Dental X-ray System Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Extraoral Dental X-ray System Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Extraoral Dental X-ray System Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Extraoral Dental X-ray System Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Extraoral Dental X-ray System Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Extraoral Dental X-ray System Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Extraoral Dental X-ray System Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Extraoral Dental X-ray System Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Extraoral Dental X-ray System Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Extraoral Dental X-ray System Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Extraoral Dental X-ray System Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Extraoral Dental X-ray System Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Extraoral Dental X-ray System Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Extraoral Dental X-ray System Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Extraoral Dental X-ray System Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Extraoral Dental X-ray System Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Extraoral Dental X-ray System Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Extraoral Dental X-ray System Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Extraoral Dental X-ray System Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Extraoral Dental X-ray System Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Extraoral Dental X-ray System Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Extraoral Dental X-ray System Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Extraoral Dental X-ray System Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Extraoral Dental X-ray System Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Extraoral Dental X-ray System Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Extraoral Dental X-ray System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Extraoral Dental X-ray System Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Extraoral Dental X-ray System Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Extraoral Dental X-ray System Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Extraoral Dental X-ray System Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Extraoral Dental X-ray System Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Extraoral Dental X-ray System Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Extraoral Dental X-ray System Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Extraoral Dental X-ray System Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Extraoral Dental X-ray System Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Extraoral Dental X-ray System Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Extraoral Dental X-ray System Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Extraoral Dental X-ray System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Extraoral Dental X-ray System Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Extraoral Dental X-ray System Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Extraoral Dental X-ray System Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Extraoral Dental X-ray System Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Extraoral Dental X-ray System Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Extraoral Dental X-ray System Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Extraoral Dental X-ray System Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Extraoral Dental X-ray System Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Extraoral Dental X-ray System Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Extraoral Dental X-ray System Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Extraoral Dental X-ray System Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Extraoral Dental X-ray System Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Extraoral Dental X-ray System Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Extraoral Dental X-ray System Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Extraoral Dental X-ray System Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Extraoral Dental X-ray System Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Extraoral Dental X-ray System Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Extraoral Dental X-ray System Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Extraoral Dental X-ray System Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Extraoral Dental X-ray System Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Extraoral Dental X-ray System Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Extraoral Dental X-ray System Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Extraoral Dental X-ray System Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Extraoral Dental X-ray System Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Extraoral Dental X-ray System Volume K Forecast, by Country 2019 & 2032

- Table 81: China Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Extraoral Dental X-ray System Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Extraoral Dental X-ray System Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Extraoral Dental X-ray System?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Extraoral Dental X-ray System?

Key companies in the market include Envista Holdings, Dentsply Sirona, Vatech, Planmeca, Carestream Dental, Morita, Yoshida, Air Techniques, NewTom (Cefla), Midmark, Asahi Roentgen, Acteon, Meyer, LargeV.

3. What are the main segments of the Extraoral Dental X-ray System?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 1838 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Extraoral Dental X-ray System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Extraoral Dental X-ray System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Extraoral Dental X-ray System?

To stay informed about further developments, trends, and reports in the Extraoral Dental X-ray System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence