Key Insights

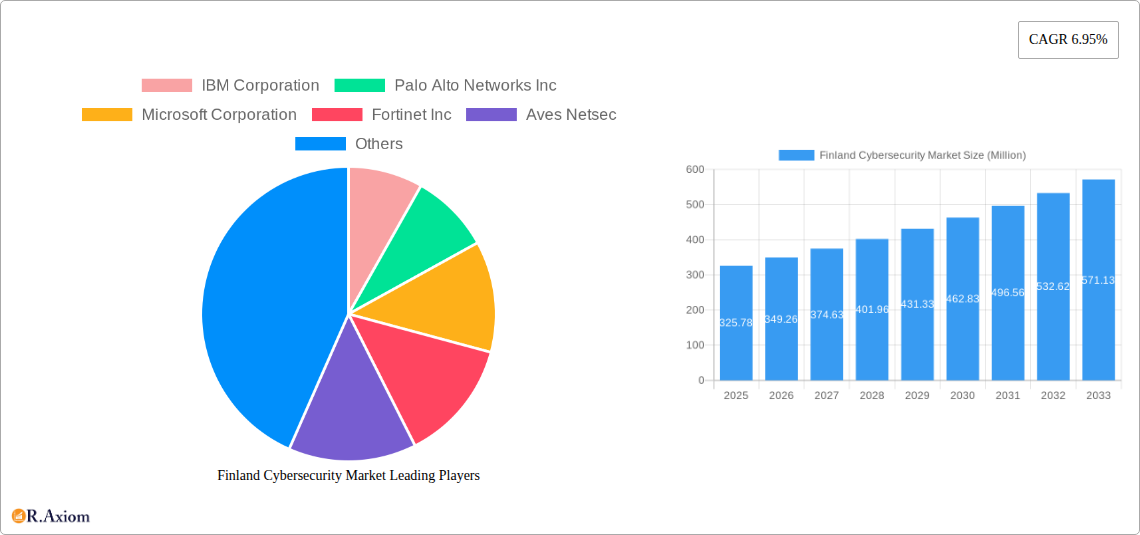

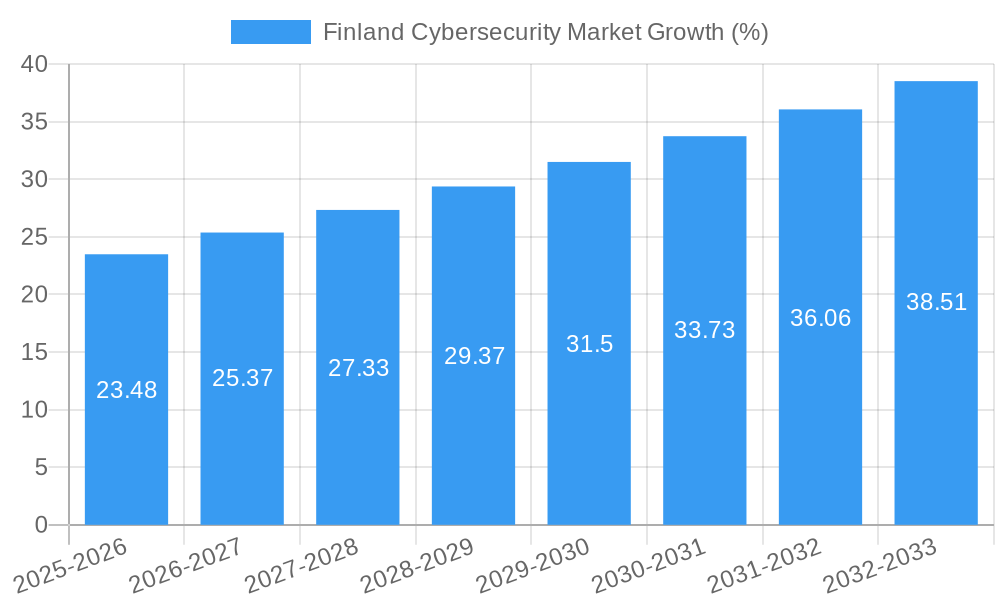

The Finland cybersecurity market, valued at €325.78 million in 2025, is projected to experience robust growth, driven by increasing digitalization, rising cyber threats targeting Finnish businesses and government entities, and the stringent data privacy regulations (like GDPR) demanding robust security measures. The market's Compound Annual Growth Rate (CAGR) of 6.95% from 2025 to 2033 indicates a significant expansion in the coming years. Key drivers include the growing adoption of cloud computing, the Internet of Things (IoT), and the increasing reliance on remote work, all of which expand the attack surface and necessitate sophisticated cybersecurity solutions. The increasing sophistication of cyberattacks, including ransomware and phishing, further fuels market demand. Furthermore, proactive investments by the Finnish government in cybersecurity infrastructure and awareness campaigns are expected to stimulate market growth. Significant growth is also expected from the increasing adoption of advanced security technologies such as AI-powered threat detection and response systems.

Market segmentation, while not explicitly detailed, likely includes various solutions such as network security, endpoint security, cloud security, and security information and event management (SIEM). Leading players like IBM, Palo Alto Networks, Microsoft, Fortinet, and several Finnish firms (Aves Netsec, Barona Oy, F-Secure, SSH Communications Security, Hoxhun) are actively competing to capture market share. While challenges such as budget constraints for smaller businesses and the shortage of skilled cybersecurity professionals could act as restraints, the overall market outlook remains positive, indicating substantial growth opportunities for existing and new entrants in the coming years. The strong emphasis on data protection and the nation's focus on technological innovation will continue to bolster the growth trajectory.

Finland Cybersecurity Market: 2019-2033 Comprehensive Report

This comprehensive report provides an in-depth analysis of the Finland Cybersecurity Market from 2019 to 2033, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The report covers market size, segmentation, growth drivers, challenges, key players, and future outlook, providing a complete picture of this dynamic market. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033 and the historical period is 2019-2024. The report's data is based on thorough research and analysis, utilizing both primary and secondary data sources to ensure accuracy and reliability.

Finland Cybersecurity Market Concentration & Innovation

The Finland cybersecurity market exhibits a moderately concentrated landscape with a few dominant players and a growing number of niche players. Market share data for 2024 indicates that F-Secure and SSH Communications Security hold significant positions, while international giants like IBM Corporation, Palo Alto Networks Inc., and Microsoft Corporation are also actively competing. The market's innovation is driven by several factors:

- Stringent Regulatory Frameworks: Finland's robust data protection regulations and cybersecurity mandates are driving investments in advanced security solutions.

- Rising Cyber Threats: The increasing sophistication and frequency of cyberattacks targeting Finnish businesses and critical infrastructure are fueling demand for innovative security technologies.

- Technological Advancements: The adoption of AI, machine learning, and cloud-based security solutions is significantly shaping the market's technological landscape.

- Mergers & Acquisitions (M&A): The Finnish cybersecurity market has witnessed several M&A activities in recent years, with deal values varying from xx Million to xx Million, aiming to expand market reach and capabilities. Examples include the acquisition of smaller companies by larger players to strengthen their product portfolios.

- Product Substitutes: The emergence of open-source security solutions and alternative approaches presents a competitive challenge to established vendors.

- End-User Trends: A growing preference for cloud-based security solutions and managed security services is reshaping the market.

Finland Cybersecurity Market Industry Trends & Insights

The Finland Cybersecurity Market is experiencing robust growth, driven by a surge in cyber threats, increasing digitalization across sectors, and the government's focus on bolstering national cybersecurity. The market's CAGR during the historical period (2019-2024) was xx%, and is projected to reach xx% during the forecast period (2025-2033). Market penetration of advanced security solutions like endpoint detection and response (EDR) and security information and event management (SIEM) is increasing steadily. Key market drivers include:

- Government Initiatives: Significant investments by the Finnish government in national cybersecurity infrastructure and awareness campaigns are significantly boosting market growth.

- Technological Disruptions: The adoption of AI and machine learning in cybersecurity is enhancing threat detection and response capabilities.

- Growing Adoption of Cloud Services: Increased reliance on cloud services necessitates robust security solutions to protect data and applications.

- Consumer Preferences: Enterprises are increasingly demanding integrated security solutions that simplify management and improve visibility across their IT infrastructure.

- Competitive Dynamics: Intense competition among established and emerging players is driving innovation and affordability.

Dominant Markets & Segments in Finland Cybersecurity Market

The Helsinki-Uusimaa region dominates the Finland cybersecurity market due to its high concentration of businesses, government agencies, and technology hubs. Key drivers of this dominance include:

- Strong Economic Base: The region boasts a robust and technology-driven economy, fueling demand for advanced cybersecurity solutions.

- Developed Infrastructure: The presence of advanced IT infrastructure and high internet penetration rates create a favorable environment for cybersecurity growth.

- Skilled Workforce: A highly skilled workforce in the ICT sector provides a strong talent pool for the cybersecurity industry.

Other segments, such as the BFSI and healthcare sectors, are also exhibiting rapid growth due to increasing regulatory scrutiny and the sensitivity of their data.

Finland Cybersecurity Market Product Developments

Recent product innovations focus on AI-driven threat detection, cloud security solutions, and integrated security platforms. Companies are emphasizing ease of use, improved threat intelligence, and automated response capabilities to meet the evolving demands of businesses. This is leading to the development of sophisticated solutions designed to address the challenges posed by increasingly complex cyber threats.

Report Scope & Segmentation Analysis

This report segments the Finland Cybersecurity Market based on several factors, including:

By Solution: Network Security, Endpoint Security, Cloud Security, Data Security, Application Security, and others. Each segment shows varying growth projections and market sizes, reflecting the changing priorities of businesses and the evolving threat landscape. Competitive dynamics vary significantly across each segment, with some experiencing higher competition than others.

By Service: Managed Security Services, Professional Services, and Training & Awareness. The managed security services segment is experiencing significant growth due to the rising demand for outsourced cybersecurity expertise. Competition within the professional services segment is intense, driven by the specialized nature of the services offered.

By Deployment Mode: Cloud-based and on-premise deployments. Growth in cloud-based deployment reflects the broader industry shift towards cloud-based infrastructure.

By End-User: BFSI, Government, Healthcare, Telecom, and others. Growth varies across end-user segments, reflecting the varying degrees of digitalization and cybersecurity maturity.

Key Drivers of Finland Cybersecurity Market Growth

The Finnish cybersecurity market's growth is primarily driven by:

- Increasing Cyberattacks: A significant rise in sophisticated cyberattacks targeting businesses and critical infrastructure is increasing the demand for advanced security solutions.

- Stringent Government Regulations: Stricter data protection regulations are driving organizations to invest in robust cybersecurity measures to comply with legal requirements.

- Growing Digitalization: The widespread adoption of digital technologies across all sectors is expanding the attack surface and necessitating stronger cybersecurity defenses.

- Technological Advancements: Innovations in AI, machine learning, and cloud computing are enhancing the capabilities of cybersecurity solutions.

Challenges in the Finland Cybersecurity Market Sector

The market faces challenges, including:

- Skills Shortage: A significant shortage of qualified cybersecurity professionals hampers effective threat response and security implementation.

- High Costs of Security Solutions: The cost of deploying and maintaining advanced security solutions can be a barrier for smaller businesses.

- Complexity of Security Management: Managing diverse security solutions and integrating them effectively can be complex and challenging.

- Evolving Threat Landscape: The constantly evolving nature of cyber threats requires continuous adaptation and investment in security solutions.

Emerging Opportunities in Finland Cybersecurity Market

The market offers several emerging opportunities:

- Growth of IoT Security: The increasing adoption of IoT devices presents opportunities for solutions that address the unique security challenges posed by these devices.

- Demand for AI-driven Security: The demand for AI-powered security solutions that enhance threat detection, prevention, and response is expected to grow substantially.

- Rise of Cybersecurity as a Service (CSaaS): The adoption of CSaaS offerings is expected to accelerate, providing flexible and scalable security solutions to businesses of all sizes.

- Focus on Critical Infrastructure Security: The security of critical infrastructure is becoming a high priority, creating opportunities for specialized security solutions.

Leading Players in the Finland Cybersecurity Market Market

- IBM Corporation

- Palo Alto Networks Inc

- Microsoft Corporation

- Fortinet Inc

- Aves Netsec

- Trellix

- Barona Oy

- F-Secure

- SSH Communications Security

- Hoxhun

Key Developments in Finland Cybersecurity Market Industry

June 2024: Nixu, a European cybersecurity service provider under DNV, signed three pivotal agreements with Lockheed Martin Corporation to enhance Finland's cyber resilience. These collaborations, involving academic and business partners, focus on improving resilience and threat intelligence over three years.

February 2024: Nokia integrated its NetGuard Cybersecurity Dome software with a telco-centric GenAI assistant in Finland, enhancing threat detection and resolution for CSPs and enterprises, particularly against GenAI-powered attacks targeting critical infrastructure.

Strategic Outlook for Finland Cybersecurity Market Market

The Finland Cybersecurity Market is poised for continued growth, driven by increasing digitalization, heightened cyber threats, and government initiatives. The market's future potential lies in the adoption of AI-driven security, cloud-based solutions, and specialized offerings for critical infrastructure. The focus on enhancing national cybersecurity resilience and addressing the skills gap will be crucial for sustainable market growth.

Finland Cybersecurity Market Segmentation

-

1. Offering

-

1.1. Solutions

- 1.1.1. Application Security

- 1.1.2. Cloud Security

- 1.1.3. Consumer Security Software

- 1.1.4. Data Security

- 1.1.5. Identity and Access Management

- 1.1.6. Infrastructure Protection

- 1.1.7. Integrated Risk Management

- 1.1.8. Network Security Equipment

- 1.1.9. Other Solutions

-

1.2. Services

- 1.2.1. Professional Services

- 1.2.2. Managed Services

-

1.1. Solutions

-

2. Deployment

- 2.1. Cloud

- 2.2. On-Premise

-

3. End-User Industry

-

3.1. IT and Telecom

- 3.1.1. Use Cases

- 3.2. BFSI

- 3.3. Retail and E-Commerce

- 3.4. Oil Gas and Energy

- 3.5. Manufacturing

- 3.6. Government and Defense

- 3.7. Other End-users

-

3.1. IT and Telecom

Finland Cybersecurity Market Segmentation By Geography

- 1. Finland

Finland Cybersecurity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.95% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Network Security Solutions by SMEs; Growing Digital Transformation and the Adoption of IoT Devices; Increase in Adoption of Data-intensive Approach and Decisions

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Network Security Solutions by SMEs; Growing Digital Transformation and the Adoption of IoT Devices; Increase in Adoption of Data-intensive Approach and Decisions

- 3.4. Market Trends

- 3.4.1. Retractable Safety Syringes Segment Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Finland Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Solutions

- 5.1.1.1. Application Security

- 5.1.1.2. Cloud Security

- 5.1.1.3. Consumer Security Software

- 5.1.1.4. Data Security

- 5.1.1.5. Identity and Access Management

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Integrated Risk Management

- 5.1.1.8. Network Security Equipment

- 5.1.1.9. Other Solutions

- 5.1.2. Services

- 5.1.2.1. Professional Services

- 5.1.2.2. Managed Services

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-Premise

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. IT and Telecom

- 5.3.1.1. Use Cases

- 5.3.2. BFSI

- 5.3.3. Retail and E-Commerce

- 5.3.4. Oil Gas and Energy

- 5.3.5. Manufacturing

- 5.3.6. Government and Defense

- 5.3.7. Other End-users

- 5.3.1. IT and Telecom

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Finland

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Palo Alto Networks Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microsoft Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fortinet Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aves Netsec

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Trellix

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Barona Oy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 F-Secure

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SSH Communications Security

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hoxhun

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Finland Cybersecurity Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Finland Cybersecurity Market Share (%) by Company 2024

List of Tables

- Table 1: Finland Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Finland Cybersecurity Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Finland Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 4: Finland Cybersecurity Market Volume Million Forecast, by Offering 2019 & 2032

- Table 5: Finland Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 6: Finland Cybersecurity Market Volume Million Forecast, by Deployment 2019 & 2032

- Table 7: Finland Cybersecurity Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: Finland Cybersecurity Market Volume Million Forecast, by End-User Industry 2019 & 2032

- Table 9: Finland Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Finland Cybersecurity Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Finland Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 12: Finland Cybersecurity Market Volume Million Forecast, by Offering 2019 & 2032

- Table 13: Finland Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 14: Finland Cybersecurity Market Volume Million Forecast, by Deployment 2019 & 2032

- Table 15: Finland Cybersecurity Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 16: Finland Cybersecurity Market Volume Million Forecast, by End-User Industry 2019 & 2032

- Table 17: Finland Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Finland Cybersecurity Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Finland Cybersecurity Market?

The projected CAGR is approximately 6.95%.

2. Which companies are prominent players in the Finland Cybersecurity Market?

Key companies in the market include IBM Corporation, Palo Alto Networks Inc, Microsoft Corporation, Fortinet Inc, Aves Netsec, Trellix, Barona Oy, F-Secure, SSH Communications Security, Hoxhun.

3. What are the main segments of the Finland Cybersecurity Market?

The market segments include Offering, Deployment, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 325.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Network Security Solutions by SMEs; Growing Digital Transformation and the Adoption of IoT Devices; Increase in Adoption of Data-intensive Approach and Decisions.

6. What are the notable trends driving market growth?

Retractable Safety Syringes Segment Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Adoption of Network Security Solutions by SMEs; Growing Digital Transformation and the Adoption of IoT Devices; Increase in Adoption of Data-intensive Approach and Decisions.

8. Can you provide examples of recent developments in the market?

June 2024: Nixu, a European cyber security service provider under DNV, inked three pivotal agreements with Lockheed Martin Corporation. The aim is to bolster Finland's cyber resilience. These three-year collaborations involve a consortium of academic and business partners, focusing on enhancing resilience and threat intelligence.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Finland Cybersecurity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Finland Cybersecurity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Finland Cybersecurity Market?

To stay informed about further developments, trends, and reports in the Finland Cybersecurity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence