Key Insights

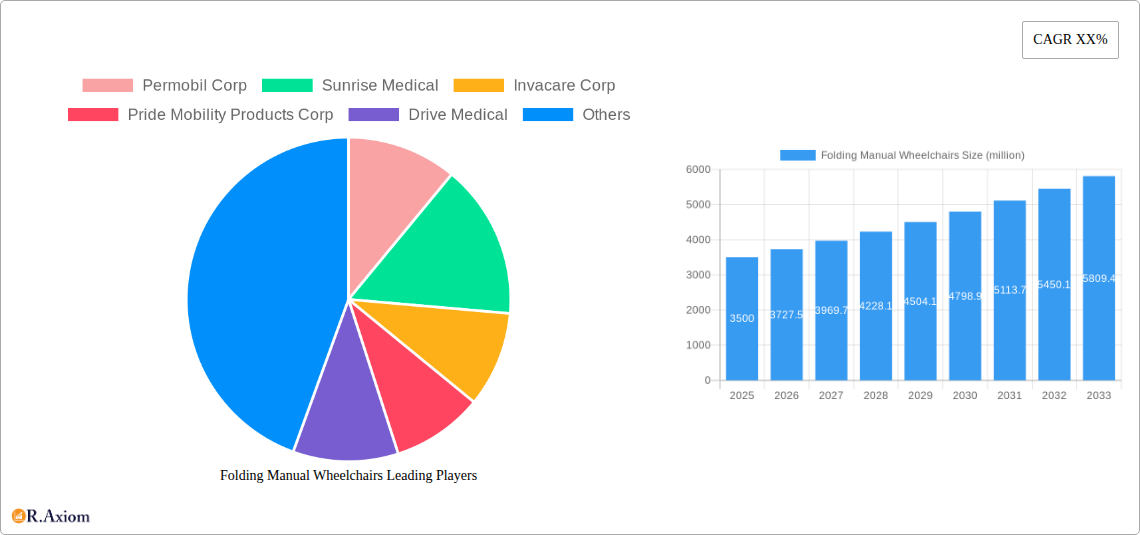

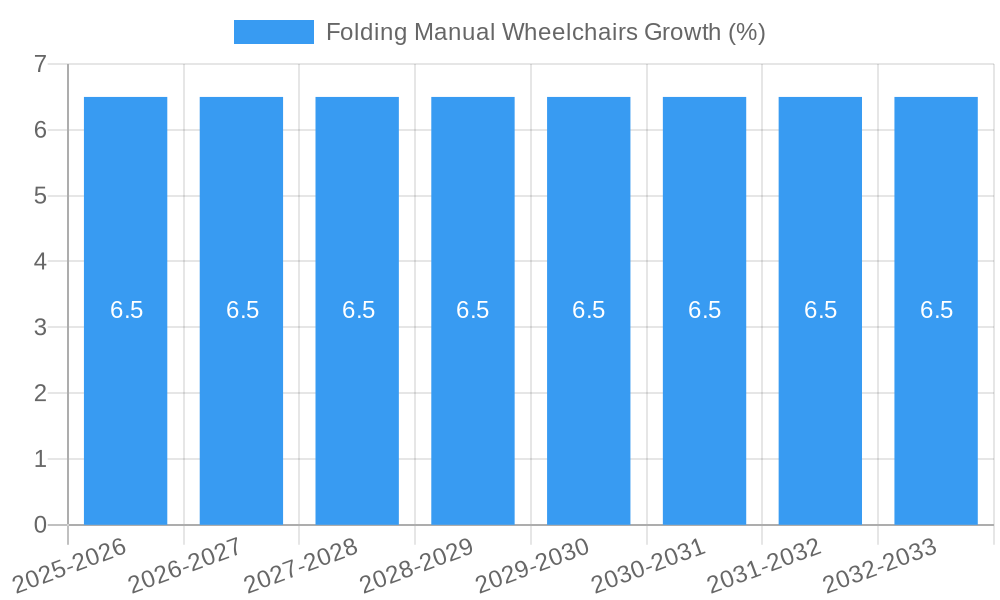

The global folding manual wheelchair market is poised for substantial growth, estimated to reach approximately $3.5 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This expansion is primarily driven by an increasing global elderly population and a rising prevalence of mobility impairments, leading to a greater demand for user-friendly and portable assistive devices. The convenience and affordability of folding manual wheelchairs, compared to their electric counterparts, make them a preferred choice for a significant segment of users. Furthermore, advancements in materials science, leading to lighter and more durable designs, are enhancing user experience and contributing to market uptake. The market is also benefiting from growing awareness and accessibility initiatives aimed at improving the quality of life for individuals with disabilities. Key applications within the market include direct sales through online stores, flagship stores, and specialty medical equipment retailers, with online channels showing particularly robust growth due to convenience and wider product availability.

The market dynamics are further shaped by evolving consumer preferences for compact and easily transportable wheelchairs, particularly for travel and everyday use. This trend is evident in the product types available, with a strong demand for models that fold into one piece for ultimate portability and others that fold into 4-5 pieces for a more compact storage solution. Leading manufacturers such as Permobil Corp, Sunrise Medical, and Invacare Corp are actively innovating to meet these demands, investing in research and development to create more ergonomic and feature-rich products. While the market demonstrates a positive outlook, certain restraints, such as the increasing adoption of powered wheelchairs for users requiring more advanced assistance and stringent regulatory approvals in some regions, could temper growth. However, the inherent advantages of folding manual wheelchairs in terms of cost-effectiveness and simplicity are expected to sustain their market relevance and drive continued expansion in the coming years.

Folding Manual Wheelchairs Market Concentration & Innovation

The global folding manual wheelchair market, projected to reach a valuation of over $3,000 million by 2033, exhibits a moderate level of concentration. Key industry players such as Permobil Corp, Sunrise Medical, Invacare Corp, Pride Mobility Products Corp, Drive Medical, and Ottobock collectively hold a significant market share, estimated to be around 60% of the total market value. However, the landscape also features a growing number of regional manufacturers and specialized brands, contributing to a dynamic competitive environment. Innovation is a primary driver, fueled by advancements in lightweight materials like aluminum alloys and carbon fiber, enhancing portability and user convenience. Regulatory frameworks, particularly those concerning medical device safety and accessibility standards (e.g., FDA in the US, CE marking in Europe), play a crucial role in shaping product development and market entry strategies, ensuring product reliability and user safety. The threat of product substitutes, while present in the form of electric wheelchairs and mobility scooters, is mitigated by the distinct advantages of folding manual wheelchairs in terms of cost-effectiveness, ease of maintenance, and maneuverability in confined spaces. End-user trends are leaning towards more personalized and aesthetically appealing designs, with a focus on enhanced comfort and ergonomic features. Mergers and acquisitions (M&A) activity, while not dominant, is strategic, with larger players acquiring smaller innovators to expand their product portfolios and market reach. M&A deal values are estimated to range from $5 million to $50 million for smaller acquisitions, contributing to market consolidation in specific niches.

Folding Manual Wheelchairs Industry Trends & Insights

The folding manual wheelchair market is poised for robust growth, driven by a confluence of demographic shifts, technological advancements, and increasing healthcare awareness. The global market is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately 5.2% from 2025 to 2033, translating into a market size that will likely exceed $3,000 million by the end of the forecast period. This expansion is primarily fueled by the aging global population, with a significant increase in individuals requiring mobility assistance. The growing prevalence of chronic conditions such as arthritis, diabetes, and cardiovascular diseases, which often lead to mobility impairments, further bolsters demand.

Technological disruptions are reshaping the industry landscape. The integration of advanced materials like aerospace-grade aluminum alloys and carbon fiber composites is leading to the development of ultra-lightweight and highly durable folding manual wheelchairs. This trend significantly enhances portability, making them more convenient for travel and daily use. Innovations in folding mechanisms are also a key focus, with manufacturers developing more compact and intuitive designs that allow for quicker and easier folding and unfolding, often with a single hand. Furthermore, the adoption of ergonomic design principles is improving user comfort and reducing the risk of secondary injuries. This includes advancements in seating systems, backrests, and armrests, tailored to individual user needs.

Consumer preferences are evolving, with a growing demand for personalized and aesthetically pleasing mobility solutions. Beyond basic functionality, users are increasingly seeking wheelchairs that offer a blend of style, comfort, and advanced features. This has led to a surge in customization options, including a wider range of colors, fabric choices, and accessory integrations. The rise of e-commerce and online retail channels has also played a pivotal role in expanding market access and influencing purchasing decisions. Online stores provide a wider selection, competitive pricing, and detailed product information, enabling consumers to make informed choices. The market penetration of folding manual wheelchairs is steadily increasing across both developed and developing economies, driven by improved healthcare infrastructure, rising disposable incomes, and greater awareness of assistive device benefits. The competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on product differentiation to capture market share.

Dominant Markets & Segments in Folding Manual Wheelchairs

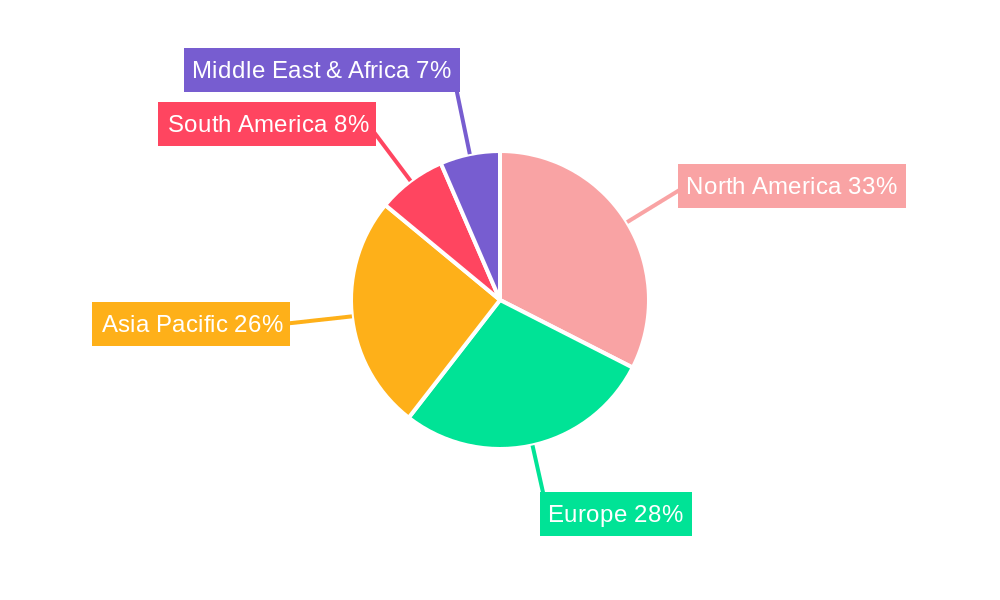

The global folding manual wheelchair market exhibits distinct regional dominance and segmentation patterns, shaped by economic policies, healthcare infrastructure, and consumer demographics. North America currently represents the largest market, driven by a high prevalence of age-related mobility issues, robust healthcare spending, and established distribution networks for medical devices. The United States, in particular, is a key contributor due to its large elderly population and strong reimbursement policies for durable medical equipment. Government initiatives aimed at promoting accessibility and independence for individuals with disabilities further bolster market growth.

In terms of application segments, the Online Store channel is experiencing rapid expansion, projected to capture a significant market share exceeding 35% by 2033. This growth is attributed to the convenience, wider product availability, and competitive pricing offered by e-commerce platforms. Consumers, increasingly comfortable with online purchasing, benefit from detailed product reviews and comparison tools, facilitating informed decisions. Flagship Store & Specialty Store channels, while representing a smaller but stable segment, remain crucial for providing personalized consultations, expert fitting services, and specialized product ranges. These stores cater to users with complex mobility needs requiring tailored solutions and ongoing support. The Other application segment, encompassing direct sales through healthcare providers, rehabilitation centers, and government tenders, also holds a considerable market share, ensuring access for institutional clients and those with specific prescription requirements.

Analyzing the types of folding manual wheelchairs, the Folded into One Piece segment is expected to maintain its dominance, accounting for an estimated 55% of the market by 2033. This preference is driven by the unparalleled ease of use and convenience associated with this design, requiring minimal effort for folding and unfolding, making it ideal for spontaneous use and travel. Key drivers include its compact storage footprint and immediate deployability. The Folded into 4-5 Pieces segment, while smaller, is projected for steady growth, driven by demand for extremely compact and lightweight options that can be disassembled into smaller components for easier transport and storage in tight spaces, such as car trunks or airplane overhead compartments. This segment appeals to users prioritizing maximum portability and minimal bulk. Economic policies promoting healthcare access and a focus on improving the quality of life for individuals with mobility impairments are critical underlying factors driving the growth across all segments and regions. Infrastructure development that enhances accessibility in public spaces also indirectly fuels the demand for reliable and user-friendly mobility devices like folding manual wheelchairs.

Folding Manual Wheelchairs Product Developments

The folding manual wheelchair market is characterized by continuous product innovation, aimed at enhancing user experience and expanding applications. Key developments include the integration of advanced, lightweight materials such as carbon fiber composites and high-strength aluminum alloys, leading to significantly lighter and more durable wheelchairs. Ergonomic designs are being refined with improved seating systems, adjustable backrests, and customizable armrests to enhance user comfort and support. Innovations in folding mechanisms are focused on creating more compact and user-friendly designs, enabling one-handed operation and quicker deployment. Furthermore, manufacturers are focusing on aesthetic appeal, offering a wider range of color options and finishes to cater to diverse consumer preferences. These advancements contribute to improved maneuverability, enhanced portability, and increased user independence, solidifying the competitive advantage of newer models.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global folding manual wheelchairs market, encompassing key segments to offer granular insights. The market is segmented by Application into three primary categories: Online Store, Flagship Store & Specialty Store, and Other. The Online Store segment is projected to exhibit a robust CAGR of approximately 6.5% from 2025 to 2033, driven by expanding e-commerce penetration and convenience. The Flagship Store & Specialty Store segment, while growing at a more moderate pace of around 4.0%, remains vital for high-touch customer service and specialized product offerings. The Other segment, encompassing institutional sales and direct procurement, is expected to grow at a CAGR of approximately 4.8%.

Further segmentation by Types includes Folded into One Piece and Folded into 4-5 Pieces. The Folded into One Piece segment is anticipated to dominate, with an estimated market size of over $1,800 million by 2033 and a CAGR of 5.5%, due to its inherent ease of use. The Folded into 4-5 Pieces segment, while smaller, is projected for significant growth at a CAGR of 6.0%, catering to niche demands for extreme portability. Competitive dynamics within each segment are influenced by product innovation, brand reputation, and distribution strategies.

Key Drivers of Folding Manual Wheelchairs Growth

The folding manual wheelchair market's growth is propelled by several key factors. The escalating global geriatric population, a primary demographic driving demand, is a significant catalyst. Advancements in material science, leading to lighter and more durable wheelchair designs, directly enhance user convenience and portability. Increasing healthcare expenditure worldwide, coupled with enhanced insurance coverage for assistive devices, makes these products more accessible. Furthermore, government initiatives and policies promoting disability inclusion and independent living play a crucial role. The rising awareness of the benefits of manual wheelchairs over less accessible alternatives, particularly for individuals requiring frequent transport and maneuverability in varied environments, also contributes to sustained growth.

Challenges in the Folding Manual Wheelchairs Sector

Despite robust growth prospects, the folding manual wheelchair sector faces several challenges. Stringent regulatory approval processes and evolving safety standards in different regions can increase product development timelines and costs. Fluctuations in raw material prices, particularly for specialized alloys and composites, can impact manufacturing costs and profit margins. Intense competition from established players and emerging low-cost manufacturers can exert downward pressure on pricing. Furthermore, the increasing availability and adoption of electric wheelchairs and mobility scooters pose a competitive threat, particularly for users with more severe mobility impairments or those seeking greater autonomy without manual effort. Ensuring consistent quality across a global supply chain also presents ongoing logistical challenges.

Emerging Opportunities in Folding Manual Wheelchairs

The folding manual wheelchair market presents several emerging opportunities for growth and innovation. The increasing demand for customized and lightweight wheelchairs tailored to individual user needs offers significant potential. The expansion of e-commerce platforms presents a prime opportunity for manufacturers to reach a wider customer base and offer a more personalized shopping experience. Technological advancements in smart wheelchair integration, such as GPS tracking and remote diagnostics, could create new product differentiation. Moreover, the growing focus on sustainability in manufacturing, utilizing recycled materials and eco-friendly production processes, could appeal to a conscious consumer base. Emerging markets in developing economies, with their rapidly growing middle class and improving healthcare infrastructure, represent untapped potential for market penetration.

Leading Players in the Folding Manual Wheelchairs Market

- Permobil Corp

- Sunrise Medical

- Invacare Corp

- Pride Mobility Products Corp

- Drive Medical

- Ottobock

- Hubang

- Merits

- EZ Lite Cruiser

- JBH Wheelchair

- Karma Mobility

- KD Smart Chair

- Eloflex

Key Developments in Folding Manual Wheelchairs Industry

- January 2024: Drive Medical launches a new line of ultra-lightweight folding manual wheelchairs featuring advanced carbon fiber construction.

- October 2023: Sunrise Medical acquires a specialist in ergonomic seating solutions to enhance user comfort in its manual wheelchair offerings.

- July 2023: Permobil Corp announces strategic partnerships to expand its distribution network in emerging Asian markets.

- April 2023: Invacare Corp introduces a simplified folding mechanism designed for enhanced user convenience and one-handed operation.

- December 2022: Pride Mobility Products Corp unveils a range of aesthetically enhanced folding manual wheelchairs with customizable color options.

- August 2022: Ottobock patents an innovative shock-absorption system for improved ride comfort in manual wheelchairs.

Strategic Outlook for Folding Manual Wheelchairs Market

The strategic outlook for the folding manual wheelchairs market is characterized by sustained growth driven by demographic trends and ongoing innovation. Manufacturers are focusing on developing ultra-lightweight, durable, and user-friendly products to meet evolving consumer demands. The expansion of online retail channels presents a significant opportunity for increased market reach and direct customer engagement. Strategic collaborations and potential acquisitions will continue to shape the competitive landscape, with an emphasis on enhancing product portfolios and geographical presence. The growing emphasis on user customization and aesthetic appeal will also be a key differentiator. Addressing the challenges of supply chain management and adapting to evolving regulatory landscapes will be crucial for long-term success. The market is poised to benefit from increasing global efforts to promote independent living and accessibility for individuals with mobility impairments.

Folding Manual Wheelchairs Segmentation

-

1. Application

- 1.1. Online Store

- 1.2. Flagship Store & Specialty Store

- 1.3. Other

-

2. Types

- 2.1. Folded into One Piece

- 2.2. Folded into 4-5 Pieces

Folding Manual Wheelchairs Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Folding Manual Wheelchairs REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Folding Manual Wheelchairs Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Store

- 5.1.2. Flagship Store & Specialty Store

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Folded into One Piece

- 5.2.2. Folded into 4-5 Pieces

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Folding Manual Wheelchairs Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Store

- 6.1.2. Flagship Store & Specialty Store

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Folded into One Piece

- 6.2.2. Folded into 4-5 Pieces

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Folding Manual Wheelchairs Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Store

- 7.1.2. Flagship Store & Specialty Store

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Folded into One Piece

- 7.2.2. Folded into 4-5 Pieces

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Folding Manual Wheelchairs Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Store

- 8.1.2. Flagship Store & Specialty Store

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Folded into One Piece

- 8.2.2. Folded into 4-5 Pieces

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Folding Manual Wheelchairs Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Store

- 9.1.2. Flagship Store & Specialty Store

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Folded into One Piece

- 9.2.2. Folded into 4-5 Pieces

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Folding Manual Wheelchairs Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Store

- 10.1.2. Flagship Store & Specialty Store

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Folded into One Piece

- 10.2.2. Folded into 4-5 Pieces

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Permobil Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sunrise Medical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Invacare Corp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pride Mobility Products Corp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Drive Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ottobock

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hubang

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Merits

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EZ Lite Cruiser

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 JBH Wheelchair

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Karma Mobility

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 KD Smart Chair

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eloflex

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Permobil Corp

List of Figures

- Figure 1: Global Folding Manual Wheelchairs Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Folding Manual Wheelchairs Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Folding Manual Wheelchairs Revenue (million), by Application 2024 & 2032

- Figure 4: North America Folding Manual Wheelchairs Volume (K), by Application 2024 & 2032

- Figure 5: North America Folding Manual Wheelchairs Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Folding Manual Wheelchairs Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Folding Manual Wheelchairs Revenue (million), by Types 2024 & 2032

- Figure 8: North America Folding Manual Wheelchairs Volume (K), by Types 2024 & 2032

- Figure 9: North America Folding Manual Wheelchairs Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Folding Manual Wheelchairs Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Folding Manual Wheelchairs Revenue (million), by Country 2024 & 2032

- Figure 12: North America Folding Manual Wheelchairs Volume (K), by Country 2024 & 2032

- Figure 13: North America Folding Manual Wheelchairs Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Folding Manual Wheelchairs Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Folding Manual Wheelchairs Revenue (million), by Application 2024 & 2032

- Figure 16: South America Folding Manual Wheelchairs Volume (K), by Application 2024 & 2032

- Figure 17: South America Folding Manual Wheelchairs Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Folding Manual Wheelchairs Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Folding Manual Wheelchairs Revenue (million), by Types 2024 & 2032

- Figure 20: South America Folding Manual Wheelchairs Volume (K), by Types 2024 & 2032

- Figure 21: South America Folding Manual Wheelchairs Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Folding Manual Wheelchairs Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Folding Manual Wheelchairs Revenue (million), by Country 2024 & 2032

- Figure 24: South America Folding Manual Wheelchairs Volume (K), by Country 2024 & 2032

- Figure 25: South America Folding Manual Wheelchairs Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Folding Manual Wheelchairs Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Folding Manual Wheelchairs Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Folding Manual Wheelchairs Volume (K), by Application 2024 & 2032

- Figure 29: Europe Folding Manual Wheelchairs Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Folding Manual Wheelchairs Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Folding Manual Wheelchairs Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Folding Manual Wheelchairs Volume (K), by Types 2024 & 2032

- Figure 33: Europe Folding Manual Wheelchairs Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Folding Manual Wheelchairs Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Folding Manual Wheelchairs Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Folding Manual Wheelchairs Volume (K), by Country 2024 & 2032

- Figure 37: Europe Folding Manual Wheelchairs Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Folding Manual Wheelchairs Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Folding Manual Wheelchairs Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Folding Manual Wheelchairs Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Folding Manual Wheelchairs Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Folding Manual Wheelchairs Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Folding Manual Wheelchairs Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Folding Manual Wheelchairs Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Folding Manual Wheelchairs Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Folding Manual Wheelchairs Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Folding Manual Wheelchairs Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Folding Manual Wheelchairs Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Folding Manual Wheelchairs Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Folding Manual Wheelchairs Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Folding Manual Wheelchairs Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Folding Manual Wheelchairs Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Folding Manual Wheelchairs Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Folding Manual Wheelchairs Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Folding Manual Wheelchairs Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Folding Manual Wheelchairs Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Folding Manual Wheelchairs Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Folding Manual Wheelchairs Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Folding Manual Wheelchairs Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Folding Manual Wheelchairs Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Folding Manual Wheelchairs Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Folding Manual Wheelchairs Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Folding Manual Wheelchairs Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Folding Manual Wheelchairs Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Folding Manual Wheelchairs Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Folding Manual Wheelchairs Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Folding Manual Wheelchairs Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Folding Manual Wheelchairs Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Folding Manual Wheelchairs Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Folding Manual Wheelchairs Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Folding Manual Wheelchairs Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Folding Manual Wheelchairs Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Folding Manual Wheelchairs Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Folding Manual Wheelchairs Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Folding Manual Wheelchairs Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Folding Manual Wheelchairs Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Folding Manual Wheelchairs Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Folding Manual Wheelchairs Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Folding Manual Wheelchairs Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Folding Manual Wheelchairs Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Folding Manual Wheelchairs Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Folding Manual Wheelchairs Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Folding Manual Wheelchairs Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Folding Manual Wheelchairs Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Folding Manual Wheelchairs Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Folding Manual Wheelchairs Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Folding Manual Wheelchairs Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Folding Manual Wheelchairs Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Folding Manual Wheelchairs Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Folding Manual Wheelchairs Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Folding Manual Wheelchairs Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Folding Manual Wheelchairs Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Folding Manual Wheelchairs Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Folding Manual Wheelchairs Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Folding Manual Wheelchairs Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Folding Manual Wheelchairs Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Folding Manual Wheelchairs Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Folding Manual Wheelchairs Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Folding Manual Wheelchairs Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Folding Manual Wheelchairs Volume K Forecast, by Country 2019 & 2032

- Table 81: China Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Folding Manual Wheelchairs Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Folding Manual Wheelchairs Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Folding Manual Wheelchairs?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Folding Manual Wheelchairs?

Key companies in the market include Permobil Corp, Sunrise Medical, Invacare Corp, Pride Mobility Products Corp, Drive Medical, Ottobock, Hubang, Merits, EZ Lite Cruiser, JBH Wheelchair, Karma Mobility, KD Smart Chair, Eloflex.

3. What are the main segments of the Folding Manual Wheelchairs?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Folding Manual Wheelchairs," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Folding Manual Wheelchairs report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Folding Manual Wheelchairs?

To stay informed about further developments, trends, and reports in the Folding Manual Wheelchairs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence