Key Insights

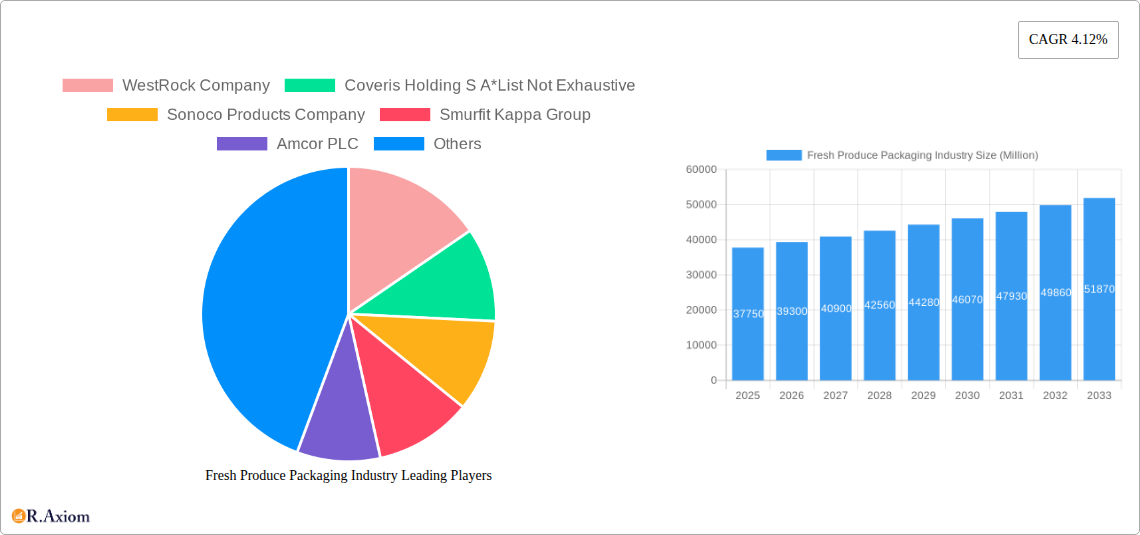

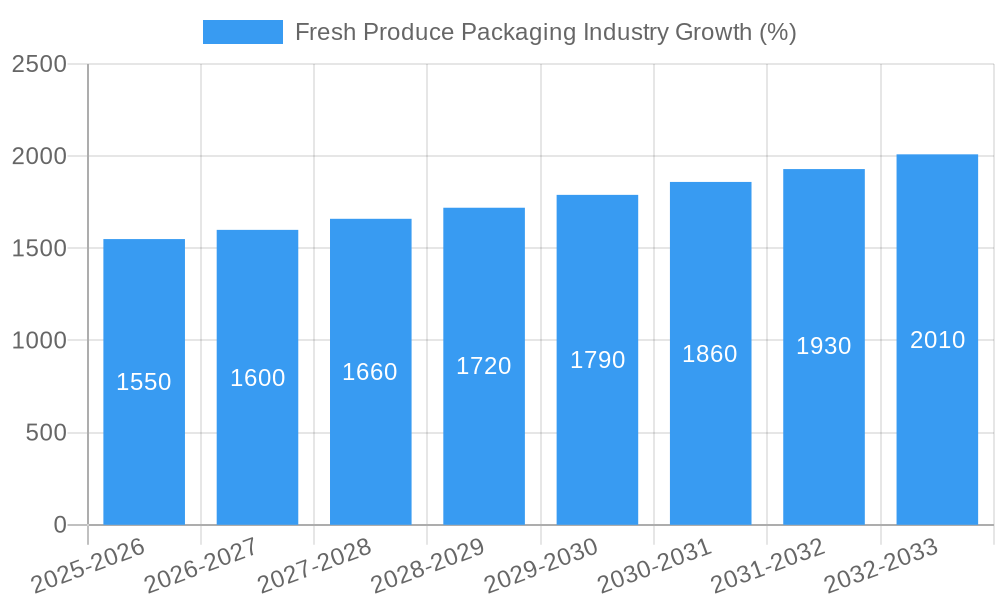

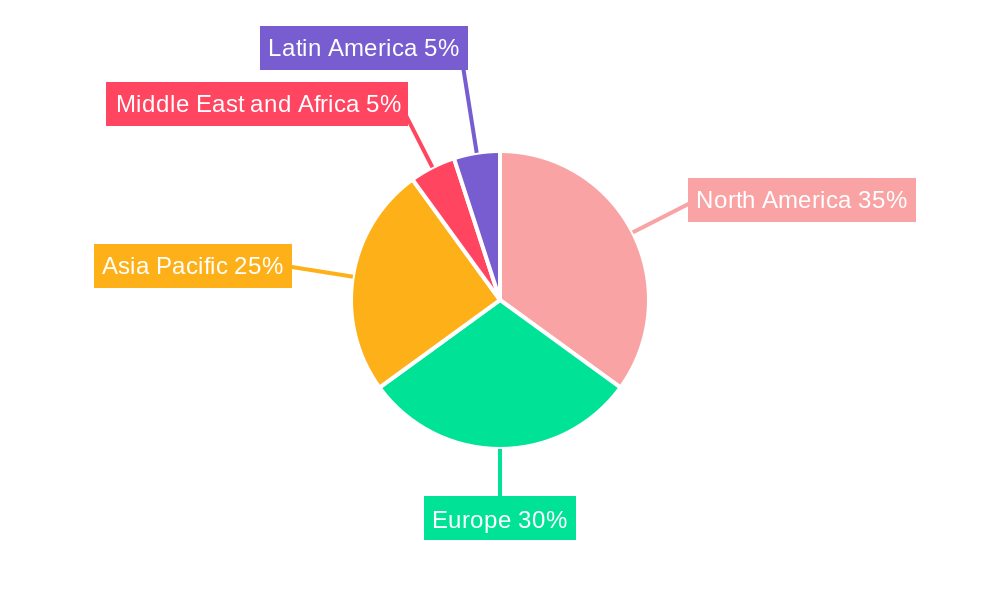

The fresh produce packaging market, valued at $37.75 billion in 2025, is projected to experience robust growth, driven by increasing consumer demand for fresh and convenient produce, coupled with a rising awareness of food waste reduction. The market's Compound Annual Growth Rate (CAGR) of 4.12% from 2025 to 2033 indicates a steady expansion, fueled by several key factors. These include the growing adoption of sustainable packaging solutions, innovations in extending shelf life through modified atmosphere packaging (MAP) and active packaging technologies, and the increasing popularity of e-commerce for grocery shopping, demanding efficient and protective packaging. The market is segmented by packaging material (plastic containers, corrugated boxes, bags and pouches, film lidding and laminates, trays) and application (fruits and vegetables), reflecting diverse consumer preferences and produce characteristics. Major players like WestRock, Amcor, and Smurfit Kappa are driving innovation and market consolidation. Regional variations exist, with North America and Europe likely holding significant market shares due to established infrastructure and consumer purchasing power. The Asia-Pacific region is poised for substantial growth, driven by expanding middle classes and evolving retail landscapes.

Challenges persist, however. Fluctuating raw material prices, particularly for plastics, pose a significant threat to profitability. Environmental concerns surrounding plastic waste are also impacting packaging choices, pushing the industry to develop eco-friendly alternatives such as biodegradable and compostable materials. Stringent regulations related to food safety and packaging materials also present hurdles for manufacturers. Nevertheless, the ongoing investments in research and development of innovative, sustainable, and functional packaging solutions indicate a positive outlook for the fresh produce packaging market over the forecast period. The industry's adaptability to shifting consumer preferences, technological advancements, and environmental considerations will determine its continued success in the coming years.

Fresh Produce Packaging Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Fresh Produce Packaging Industry, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects. The report utilizes rigorous data analysis and forecasts to provide actionable intelligence for navigating the evolving fresh produce packaging market. The total market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Fresh Produce Packaging Industry Market Concentration & Innovation

The fresh produce packaging market is characterized by a moderately concentrated landscape with several key players holding significant market share. The top ten companies— including WestRock Company, Coveris Holding S.A, Sonoco Products Company, Smurfit Kappa Group, Amcor PLC, Mondi PLC, International Paper Company, Berry Global Inc, Reynolds Consumer Products Inc, and Sealed Air Corporation — account for approximately xx% of the global market in 2025. However, the market also exhibits a degree of fragmentation, particularly within niche segments and regional markets.

Market Concentration Metrics (2025):

- Top 5 Players Market Share: xx%

- Top 10 Players Market Share: xx%

- Average M&A Deal Value (2019-2024): xx Million

Innovation Drivers:

- Sustainable Packaging Solutions: Growing consumer demand for eco-friendly packaging is driving innovation in biodegradable, compostable, and recycled materials.

- Extended Shelf Life Technologies: Advancements in modified atmosphere packaging (MAP) and active packaging are extending the shelf life of fresh produce, reducing waste.

- Smart Packaging: Integration of sensors and traceability technologies is enhancing supply chain visibility and improving product safety.

Regulatory Landscape:

Stringent food safety regulations and evolving environmental policies are shaping the industry, influencing material choices and packaging designs.

Product Substitutes:

The market faces competition from alternative preservation methods, such as irradiation and controlled atmosphere storage.

End-User Trends:

Consumers increasingly prioritize convenience, sustainability, and product freshness, influencing packaging choices.

M&A Activity: Recent mergers and acquisitions demonstrate consolidation within the industry, with larger players seeking to expand their market reach and product portfolios. The value of M&A deals fluctuates yearly, influenced by economic conditions and industry trends.

Fresh Produce Packaging Industry Industry Trends & Insights

The global fresh produce packaging market is experiencing robust growth, driven by several key factors. Rising consumer demand for fresh produce, coupled with increasing urbanization and changing lifestyles, is boosting packaging demand. Technological advancements in packaging materials and designs are enhancing product preservation and extending shelf life, reducing food waste. The global market is estimated to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Market Growth Drivers:

- Increased Consumer Demand for Fresh Produce: Growing awareness of health benefits and changing dietary preferences are driving consumption.

- Technological Advancements: Innovations in packaging materials and technologies are improving product preservation and reducing waste.

- E-commerce Growth: The rise of online grocery shopping is increasing demand for effective and convenient packaging solutions.

- Growing Focus on Sustainability: Consumers are increasingly demanding eco-friendly packaging options, leading to the adoption of sustainable materials and practices.

Technological Disruptions:

The adoption of automation and smart packaging technologies is improving efficiency and traceability within the supply chain. The industry is witnessing a shift towards sustainable materials, driven by environmental concerns and regulations.

Consumer Preferences:

Consumers are increasingly demanding packaging that is convenient, aesthetically pleasing, informative, and environmentally friendly.

Competitive Dynamics:

The market is characterized by intense competition among established players and emerging companies, with a focus on product innovation, cost optimization, and supply chain efficiency. Market penetration for sustainable packaging solutions is gradually increasing, reflecting consumer preferences and regulatory pressures.

Dominant Markets & Segments in Fresh Produce Packaging Industry

The North American region is projected to dominate the fresh produce packaging market during the forecast period, driven by high consumption of fresh produce, robust retail infrastructure, and technological advancements. However, Asia-Pacific is expected to show significant growth due to rapid economic development and increasing consumer spending.

By Packaging Material Type:

- Plastic Containers: This segment holds a significant market share due to its versatility, cost-effectiveness, and barrier properties.

- Corrugated Boxes: Widely used for bulk transportation and storage due to their strength and recyclability.

- Bags and Pouches: Popular for packaging smaller quantities of produce for retail sale, offering convenience and shelf appeal.

- Film Lidding and Laminates: Used for enhancing shelf life and maintaining product freshness.

- Trays: Offer a combination of protection, presentation, and convenience.

By Application:

- Fruits: The fruits segment accounts for a larger market share compared to vegetables, driven by higher consumption and diverse packaging needs.

- Vegetables: This segment is expected to experience steady growth due to increasing health consciousness and diverse vegetable consumption patterns.

Key Drivers (Regional Dominance):

- North America: Robust retail infrastructure, high consumption of fresh produce, and a focus on sustainable packaging.

- Europe: Stringent regulations on packaging materials and a growing consumer preference for eco-friendly options.

- Asia-Pacific: Rapid economic growth, rising disposable incomes, and increased demand for fresh produce.

Fresh Produce Packaging Industry Product Developments

Recent innovations focus on sustainable and efficient packaging solutions. Developments include biodegradable and compostable materials, improved barrier properties to extend shelf life, and smart packaging technologies for enhanced traceability and supply chain management. These innovations aim to address consumer demand for sustainable products while improving efficiency and reducing waste throughout the supply chain. The focus is on creating packaging that is both functional and environmentally responsible, aligning with market trends and regulatory pressures.

Report Scope & Segmentation Analysis

This report segments the fresh produce packaging market by packaging material type (Plastic Containers, Corrugated Boxes, Bags and Pouches, Film Lidding and Laminates, Trays) and application (Fruits, Vegetables). Each segment’s analysis includes market size, growth projections, and competitive dynamics. Growth projections vary based on specific regional and segmental factors, with high growth potential in sustainable materials and technologically advanced packaging. The competitive landscape within each segment is analyzed, considering factors such as market share, innovation, and strategic initiatives.

Key Drivers of Fresh Produce Packaging Growth

The growth of the fresh produce packaging industry is propelled by factors such as increased consumer demand for fresh produce, heightened focus on minimizing food waste, technological advancements in packaging materials and designs, and the growth of e-commerce in the grocery sector. Government regulations promoting sustainable packaging practices further contribute to the expansion of this market.

Challenges in the Fresh Produce Packaging Industry Sector

The industry faces challenges like fluctuating raw material prices, stringent regulatory compliance requirements, and increasing competition. Supply chain disruptions and the need to balance sustainability with cost-effectiveness pose further obstacles. These factors can impact profitability and necessitate efficient resource management and technological innovation to mitigate their impact.

Emerging Opportunities in Fresh Produce Packaging Industry

Emerging opportunities include growing demand for sustainable packaging, increasing adoption of smart packaging technologies, and the expansion of e-commerce in the grocery sector. New markets in developing economies, along with innovative packaging designs that enhance product freshness and reduce waste, present significant growth potentials.

Leading Players in the Fresh Produce Packaging Industry Market

- WestRock Company

- Coveris Holding S.A

- Sonoco Products Company

- Smurfit Kappa Group

- Amcor PLC

- Mondi PLC

- International Paper Company

- Berry Global Inc

- Reynolds Consumer Products Inc

- Sealed Air Corporation

Key Developments in Fresh Produce Packaging Industry

- July 2022: Mondi Group launched its Grow&Go range of corrugated packaging solutions for fresh produce, enhancing logistics and reducing waste.

- April 2022: Berry Global achieved ISCC PLUS certification for its North American rigid plastic foodservice sites, enabling the use of certified circular products.

Strategic Outlook for Fresh Produce Packaging Industry Market

The future of the fresh produce packaging market is promising, driven by increasing consumer demand, technological innovation, and a growing focus on sustainability. The market is expected to experience continued growth, with opportunities for companies that can adapt to evolving consumer preferences and regulatory changes. Strategic investments in sustainable materials, innovative packaging designs, and efficient supply chain management are crucial for success in this dynamic market.

Fresh Produce Packaging Industry Segmentation

-

1. Packaging Material Type

- 1.1. Plastic Containers

- 1.2. Corrugated Boxes

- 1.3. Bags and Pouches

- 1.4. Film Lidding and Laminates

- 1.5. Trays

-

2. Application

- 2.1. Fruits

- 2.2. Vegetables

Fresh Produce Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

Fresh Produce Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Need Among Consumers for Healthier Lifestyle; Increased Organic Production Worldwide

- 3.3. Market Restrains

- 3.3.1. Regulations Restricting the Sale and Availability of Pharmaceutical Plastic Products; Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power

- 3.4. Market Trends

- 3.4.1. Corrugated Boxes as Packaging Material Type to Witness a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 5.1.1. Plastic Containers

- 5.1.2. Corrugated Boxes

- 5.1.3. Bags and Pouches

- 5.1.4. Film Lidding and Laminates

- 5.1.5. Trays

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fruits

- 5.2.2. Vegetables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 6. North America Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 6.1.1. Plastic Containers

- 6.1.2. Corrugated Boxes

- 6.1.3. Bags and Pouches

- 6.1.4. Film Lidding and Laminates

- 6.1.5. Trays

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Fruits

- 6.2.2. Vegetables

- 6.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 7. Europe Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 7.1.1. Plastic Containers

- 7.1.2. Corrugated Boxes

- 7.1.3. Bags and Pouches

- 7.1.4. Film Lidding and Laminates

- 7.1.5. Trays

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Fruits

- 7.2.2. Vegetables

- 7.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 8. Asia Pacific Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 8.1.1. Plastic Containers

- 8.1.2. Corrugated Boxes

- 8.1.3. Bags and Pouches

- 8.1.4. Film Lidding and Laminates

- 8.1.5. Trays

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Fruits

- 8.2.2. Vegetables

- 8.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 9. Middle East and Africa Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 9.1.1. Plastic Containers

- 9.1.2. Corrugated Boxes

- 9.1.3. Bags and Pouches

- 9.1.4. Film Lidding and Laminates

- 9.1.5. Trays

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Fruits

- 9.2.2. Vegetables

- 9.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 10. Latin America Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 10.1.1. Plastic Containers

- 10.1.2. Corrugated Boxes

- 10.1.3. Bags and Pouches

- 10.1.4. Film Lidding and Laminates

- 10.1.5. Trays

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Fruits

- 10.2.2. Vegetables

- 10.1. Market Analysis, Insights and Forecast - by Packaging Material Type

- 11. North America Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Middle East and Africa Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America Fresh Produce Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 WestRock Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Coveris Holding S A*List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Sonoco Products Company

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Smurfit Kappa Group

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Amcor PLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Mondi PLC

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 International Paper Company

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Berry Global Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Reynolds Consumer Products Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Sealed Air Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 WestRock Company

List of Figures

- Figure 1: Global Fresh Produce Packaging Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Fresh Produce Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Fresh Produce Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Fresh Produce Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Fresh Produce Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Fresh Produce Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Fresh Produce Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Fresh Produce Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Fresh Produce Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Fresh Produce Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Fresh Produce Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Fresh Produce Packaging Industry Revenue (Million), by Packaging Material Type 2024 & 2032

- Figure 13: North America Fresh Produce Packaging Industry Revenue Share (%), by Packaging Material Type 2024 & 2032

- Figure 14: North America Fresh Produce Packaging Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Fresh Produce Packaging Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Fresh Produce Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Fresh Produce Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Fresh Produce Packaging Industry Revenue (Million), by Packaging Material Type 2024 & 2032

- Figure 19: Europe Fresh Produce Packaging Industry Revenue Share (%), by Packaging Material Type 2024 & 2032

- Figure 20: Europe Fresh Produce Packaging Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Fresh Produce Packaging Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Fresh Produce Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Fresh Produce Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Fresh Produce Packaging Industry Revenue (Million), by Packaging Material Type 2024 & 2032

- Figure 25: Asia Pacific Fresh Produce Packaging Industry Revenue Share (%), by Packaging Material Type 2024 & 2032

- Figure 26: Asia Pacific Fresh Produce Packaging Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific Fresh Produce Packaging Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Fresh Produce Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Fresh Produce Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Fresh Produce Packaging Industry Revenue (Million), by Packaging Material Type 2024 & 2032

- Figure 31: Middle East and Africa Fresh Produce Packaging Industry Revenue Share (%), by Packaging Material Type 2024 & 2032

- Figure 32: Middle East and Africa Fresh Produce Packaging Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Middle East and Africa Fresh Produce Packaging Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Middle East and Africa Fresh Produce Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Fresh Produce Packaging Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Fresh Produce Packaging Industry Revenue (Million), by Packaging Material Type 2024 & 2032

- Figure 37: Latin America Fresh Produce Packaging Industry Revenue Share (%), by Packaging Material Type 2024 & 2032

- Figure 38: Latin America Fresh Produce Packaging Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Latin America Fresh Produce Packaging Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Latin America Fresh Produce Packaging Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Latin America Fresh Produce Packaging Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Packaging Material Type 2019 & 2032

- Table 3: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Fresh Produce Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Fresh Produce Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Fresh Produce Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Fresh Produce Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Fresh Produce Packaging Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Packaging Material Type 2019 & 2032

- Table 16: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Packaging Material Type 2019 & 2032

- Table 19: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Packaging Material Type 2019 & 2032

- Table 22: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Packaging Material Type 2019 & 2032

- Table 25: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Packaging Material Type 2019 & 2032

- Table 28: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Fresh Produce Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fresh Produce Packaging Industry?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the Fresh Produce Packaging Industry?

Key companies in the market include WestRock Company, Coveris Holding S A*List Not Exhaustive, Sonoco Products Company, Smurfit Kappa Group, Amcor PLC, Mondi PLC, International Paper Company, Berry Global Inc, Reynolds Consumer Products Inc, Sealed Air Corporation.

3. What are the main segments of the Fresh Produce Packaging Industry?

The market segments include Packaging Material Type, Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 37.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Need Among Consumers for Healthier Lifestyle; Increased Organic Production Worldwide.

6. What are the notable trends driving market growth?

Corrugated Boxes as Packaging Material Type to Witness a Significant Share in the Market.

7. Are there any restraints impacting market growth?

Regulations Restricting the Sale and Availability of Pharmaceutical Plastic Products; Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power.

8. Can you provide examples of recent developments in the market?

July 2022 - Mondi Group, a global enterprise in packaging and paper, launched a range of fit-for-purpose corrugated packaging solutions named Grow&Go for protecting and transporting fresh produce. The Grow&Go range offers logistical advantages such as space-saving afforded by palletized flat corrugated packaging. After assembly and filling, all packaging options are perfectly stackable and tough enough to prevent damage and waste. These are available for a range of options such as heavy bulk shipments, light fruit and vegetable assortments for on-shelf display, and many more. The entire Grow&Go portfolio complies with food contact standards and is made entirely of paper.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fresh Produce Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fresh Produce Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fresh Produce Packaging Industry?

To stay informed about further developments, trends, and reports in the Fresh Produce Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence