Key Insights

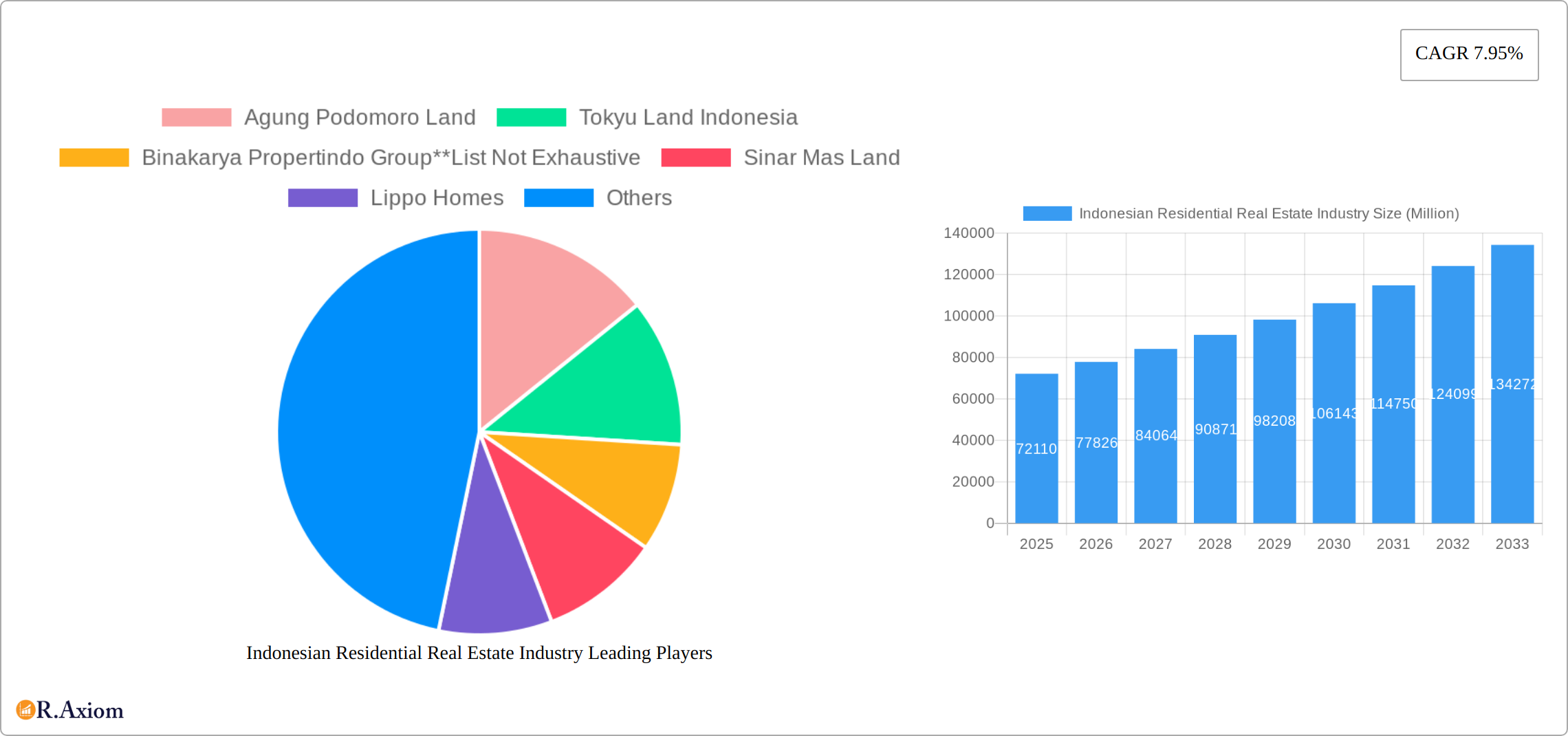

The Indonesian residential real estate market, valued at $72.11 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.95% from 2025 to 2033. This growth is fueled by several key factors. A burgeoning middle class with increasing disposable income is driving demand for improved housing, particularly in rapidly urbanizing areas like Jakarta, Greater Surabaya, and Semarang. Government initiatives aimed at improving infrastructure and affordable housing schemes further contribute to market expansion. The market is segmented into condominiums and apartments, and villas and landed houses, catering to diverse preferences and budgets. Strong population growth and increasing urbanization are significant long-term drivers, while potential challenges include fluctuating interest rates impacting mortgage affordability and land scarcity in prime locations, particularly within major cities. Competition amongst established players like Agung Podomoro Land, Tokyu Land Indonesia, Sinar Mas Land, and Lippo Homes is intense, leading to innovative product development and competitive pricing strategies to attract buyers.

The forecast for 2026-2033 anticipates continued growth, although the pace might moderate slightly towards the latter half of the forecast period due to potential economic fluctuations and adjustments in government policies. However, the long-term outlook remains positive due to the fundamental drivers of population increase and economic development. The strong presence of large, established developers indicates a degree of market maturity, but also suggests the potential for further consolidation and mergers in the coming years. The continued development of supporting infrastructure, particularly transportation networks, will be crucial in unlocking the potential of secondary cities and expanding the market beyond the major metropolitan areas. Strategic investments in affordable housing and sustainable construction practices will also shape the future trajectory of the market.

Indonesian Residential Real Estate Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Indonesian residential real estate industry, covering the period from 2019 to 2033. It offers crucial insights for investors, developers, and industry stakeholders navigating this dynamic market. The report utilizes data from the historical period (2019-2024), a base year of 2025, and projects the market until 2033. All financial figures are expressed in millions of Indonesian Rupiah (IDR).

Indonesian Residential Real Estate Industry Market Concentration & Innovation

The Indonesian residential real estate market is characterized by a dynamic competitive landscape, driven by innovation and shaped by an evolving regulatory environment. While exhibiting moderate concentration, the market features several dominant developers such as Agung Podomoro Land, Sinar Mas Land, and Lippo Homes, whose market shares are subject to annual shifts. The impetus for innovation stems from a dual demand: the increasing consumer desire for sustainable and technologically advanced living spaces, and the government's ongoing commitment to expanding affordable housing access. The regulatory framework, though undergoing continuous refinement, presents both facilitators and hurdles for project approvals and land acquisition processes. Significant merger and acquisition (M&A) activity has been observed in recent years, with deal values reflecting consolidation and strategic expansion efforts among key industry participants. Furthermore, the emergence of alternative housing models like co-living spaces and serviced apartments is gaining momentum, particularly in densely populated urban centers. End-user preferences are increasingly leaning towards properties integrated with smart home functionalities and embracing eco-friendly features, signaling a clear market direction.

- Market Dynamics: Moderate concentration with leading developers holding substantial, albeit fluctuating, market influence.

- Innovation Catalysts: Driven by the pursuit of sustainable construction, the adoption of smart home technologies, and government-backed affordable housing programs.

- M&A Landscape: Active M&A scene, reflecting strategic consolidation and expansion. Deal values are a key indicator of market trends. (Note: Specific financial figures require in-depth market data analysis).

- Regulatory Environment: A constantly adapting regulatory landscape that significantly influences project approvals and land procurement.

- Consumer Preferences: A clear and growing demand for residences that incorporate sustainable practices and advanced technological features.

Indonesian Residential Real Estate Industry Industry Trends & Insights

The Indonesian residential real estate market is characterized by robust growth, driven by factors like a burgeoning population, rapid urbanization, and rising disposable incomes. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, reflecting continued expansion. Technological advancements, particularly in construction techniques and property management, are impacting market dynamics. Consumer preferences are shifting towards more sustainable, technologically advanced, and conveniently located properties, particularly in key urban centers like Jakarta and Surabaya. Competitive dynamics are intense, with established players facing pressure from both smaller developers and international entrants. Market penetration of smart home technologies remains relatively low, but is steadily increasing as affordability improves and consumer awareness grows. The overall market is expected to reach xx Million IDR by 2033, with substantial growth anticipated across various segments.

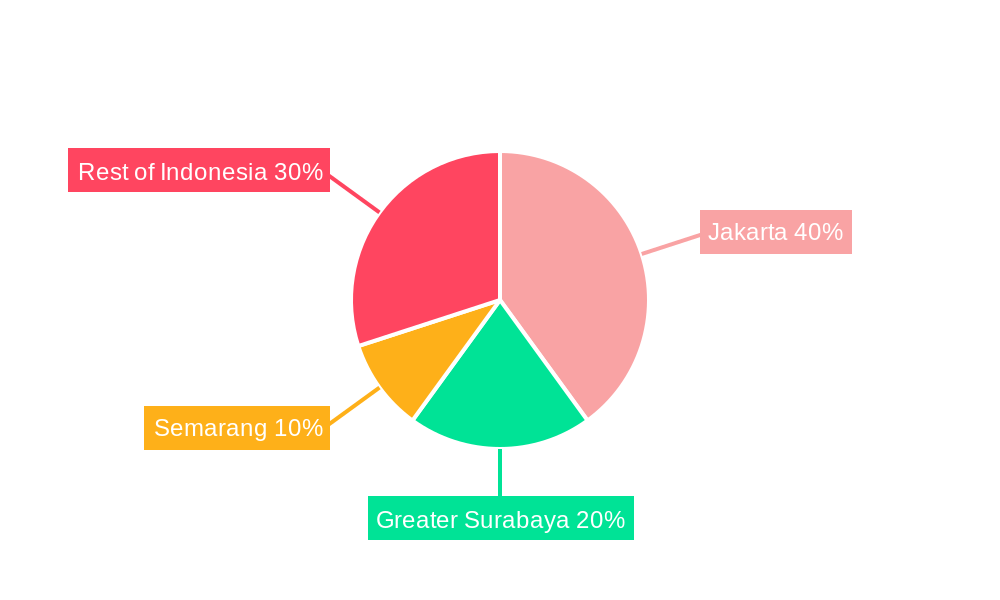

Dominant Markets & Segments in Indonesian Residential Real Estate Industry

Jakarta dominates the Indonesian residential real estate market, driven by its status as the nation's capital, economic hub, and concentration of employment opportunities. Greater Surabaya follows as a significant market due to its role as an industrial and commercial center. Semarang demonstrates moderate growth, while the "Rest of Indonesia" category showcases a diverse range of smaller, but still important, local markets.

- By Type: Condominiums and apartments are the most prevalent, reflecting the growing urban population and demand for higher-density living. Villas and landed houses, while exhibiting slower growth, remain important especially in suburban and rural areas.

- By Key Cities:

- Jakarta: Strong economic activity and high population density fuel demand.

- Greater Surabaya: Significant industrial base and commercial activity contribute to market growth.

- Semarang: Moderate growth driven by local economic expansion and infrastructure development.

- Rest of Indonesia: Diverse local markets exhibit growth based on regional economic conditions.

- Key Drivers: Strong economic growth, urbanization, improved infrastructure (particularly in Jakarta and Surabaya), government policies promoting affordable housing, and rising disposable incomes.

Indonesian Residential Real Estate Industry Product Developments

Product development within the Indonesian residential real estate sector is increasingly focused on integrating cutting-edge sustainable materials and energy-efficient technologies. This approach aims to minimize environmental impact while simultaneously enhancing the overall appeal and long-term value of properties. The widespread adoption of smart home features, encompassing automated systems for lighting, security, and climate control, directly addresses the growing consumer appetite for convenience and modern living. These technological integrations not only serve as crucial differentiators for developers but also significantly bolster the value proposition for end-users, fostering greater market acceptance and driving sales.

Report Scope & Segmentation Analysis

This report segments the Indonesian residential real estate market by property type (condominiums and apartments; villas and landed houses) and by key city (Jakarta, Greater Surabaya, Semarang, Rest of Indonesia). Each segment's growth projection, market size, and competitive dynamics are extensively analyzed within the full report. For example, the condominium and apartment segment is anticipated to experience a CAGR of xx% in the forecast period, driven by the growing urban population and demand for high-density housing in major cities like Jakarta and Surabaya. Villas and landed houses exhibit a moderate growth rate, appealing to families and individuals seeking more space and privacy.

Key Drivers of Indonesian Residential Real Estate Industry Growth

Several factors contribute to the growth of the Indonesian residential real estate market. These include rapid urbanization, the ongoing expansion of the middle class, resulting in greater disposable incomes, and government initiatives promoting affordable housing. Furthermore, infrastructure developments and improving accessibility to key cities boost real estate demand.

Challenges in the Indonesian Residential Real Estate Industry Sector

The sector faces challenges, including land scarcity in major urban centers, particularly in Jakarta, leading to higher land costs and subsequently impacting property pricing. Bureaucratic processes related to land acquisition and project approvals can create delays, impacting project timelines. Furthermore, the market experiences significant competition.

Emerging Opportunities in Indonesian Residential Real Estate Industry

Significant opportunities are emerging in addressing the escalating demand for affordable housing, particularly in the periphery of major urban centers and in rapidly developing secondary cities, driven by ongoing population growth and urbanization. The adoption of innovative construction methodologies, such as modular building techniques and the utilization of sustainable, eco-friendly materials, presents a dual advantage: enabling substantial cost optimization for developers and promoting environmental stewardship. These advancements are key to unlocking new market segments and meeting diverse housing needs.

Leading Players in the Indonesian Residential Real Estate Industry Market

- Agung Podomoro Land

- Tokyu Land Indonesia

- Binakarya Propertindo Group

- Sinar Mas Land

- Lippo Homes

- JABABEKA

- PT Pakuwon Jati

- Ciputra Group

- PP Properti

- Duta Anggada Realty

Key Developments in Indonesian Residential Real Estate Industry Industry

- 2022 Q4: The government unveiled a comprehensive package of new affordable housing initiatives, designed to stimulate growth and investment in specific market segments.

- 2023 Q1: Agung Podomoro Land marked a significant entry into the premium segment with the launch of a new luxury condominium development in Jakarta, poised to influence the high-end property market. (Note: Comprehensive details and further market impacts would be elaborated in a full industry report).

Strategic Outlook for Indonesian Residential Real Estate Industry Market

The Indonesian residential real estate market is poised for sustained expansion throughout the projected period, propelled by robust urbanization trends, consistent economic growth, and supportive government policies. The strategic emphasis on sustainable development practices and the integration of technological advancements will create substantial avenues for forward-thinking developers. Concurrently, navigating the complexities of land acquisition and adapting to evolving regulatory frameworks will remain critical factors in shaping the market's trajectory and competitive dynamics.

Indonesian Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Condominiums and Apartments

- 1.2. Villas and landed houses

-

2. Key Cities

- 2.1. Jakarta

- 2.2. Greater Surabaya

- 2.3. Semarang

- 2.4. Rest of Indonesia

Indonesian Residential Real Estate Industry Segmentation By Geography

- 1. Indonesia

Indonesian Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.95% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investment in Infrastructure Projects; The rising popularity of sustainable architecture

- 3.3. Market Restrains

- 3.3.1. Volatility in Raw material prices

- 3.4. Market Trends

- 3.4.1. Jakarta Emerging as a Prime Rental Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesian Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums and Apartments

- 5.1.2. Villas and landed houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Jakarta

- 5.2.2. Greater Surabaya

- 5.2.3. Semarang

- 5.2.4. Rest of Indonesia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Agung Podomoro Land

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tokyu Land Indonesia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Binakarya Propertindo Group**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sinar Mas Land

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lippo Homes

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JABABEKA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Pakuwon Jati

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ciputra Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PP Properti

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Duta Anggada Realty

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Agung Podomoro Land

List of Figures

- Figure 1: Indonesian Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesian Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesian Residential Real Estate Industry?

The projected CAGR is approximately 7.95%.

2. Which companies are prominent players in the Indonesian Residential Real Estate Industry?

Key companies in the market include Agung Podomoro Land, Tokyu Land Indonesia, Binakarya Propertindo Group**List Not Exhaustive, Sinar Mas Land, Lippo Homes, JABABEKA, PT Pakuwon Jati, Ciputra Group, PP Properti, Duta Anggada Realty.

3. What are the main segments of the Indonesian Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investment in Infrastructure Projects; The rising popularity of sustainable architecture.

6. What are the notable trends driving market growth?

Jakarta Emerging as a Prime Rental Market.

7. Are there any restraints impacting market growth?

Volatility in Raw material prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesian Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesian Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesian Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Indonesian Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence