Key Insights

The Internal Beam Radiotherapy market is poised for significant expansion, projected to reach a substantial market size by 2033. This growth is primarily fueled by the increasing incidence of cancer globally, necessitating advanced and targeted radiation therapies. Internal Beam Radiotherapy, also known as brachytherapy, offers a precise method for delivering high doses of radiation directly to cancerous tumors, minimizing damage to surrounding healthy tissues. This localized approach leads to improved patient outcomes and reduced side effects compared to conventional external beam radiation. The market's trajectory is further bolstered by continuous technological advancements in brachytherapy devices, including the development of more sophisticated applicators, imaging guidance systems, and treatment planning software. These innovations enhance treatment accuracy, efficiency, and patient comfort, driving adoption across healthcare settings.

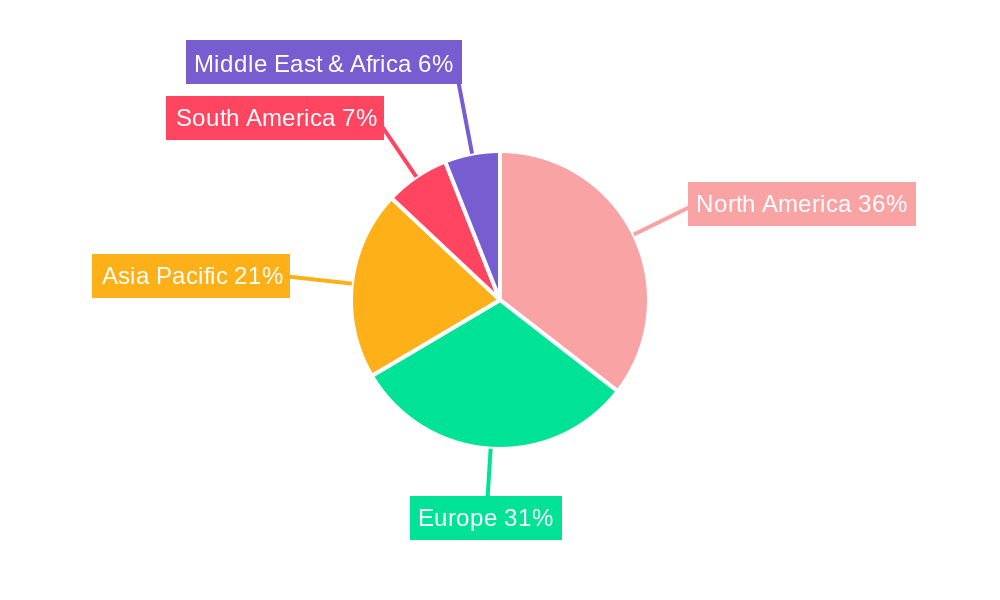

The market's expansion is significantly driven by the increasing demand for minimally invasive cancer treatments and the growing preference for localized radiation delivery. Hospitals and independent radiotherapy centers are investing in advanced brachytherapy systems to offer comprehensive cancer care. The market segments, including Low-dose-rate (LDR), High-dose-rate (HDR), and Pulsed-dose-rate (PDR) brachytherapy, are all contributing to this growth, with HDR brachytherapy currently dominating due to its shorter treatment times and effectiveness. Restraints, such as the high cost of advanced brachytherapy equipment and the need for specialized training for medical professionals, are being addressed through technological affordability initiatives and expanded training programs. Geographically, North America and Europe currently lead the market, driven by well-established healthcare infrastructures and early adoption of advanced medical technologies, with the Asia Pacific region expected to witness the fastest growth due to increasing healthcare expenditure and a rising cancer burden.

Internal Beam Radiotherapy Market Concentration & Innovation

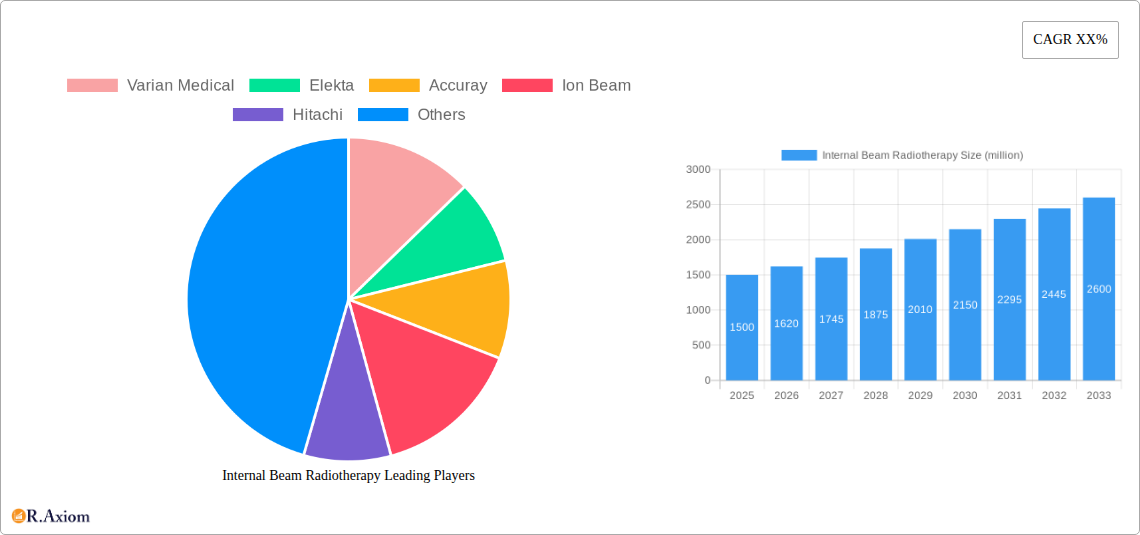

The Internal Beam Radiotherapy market exhibits a moderate concentration, with key players like Varian Medical, Elekta, and Accuray holding significant market shares, estimated at over 70% combined. Innovation in this sector is primarily driven by advancements in miniaturization of radiation sources, improved imaging guidance for precise tumor targeting, and the development of AI-powered treatment planning software. Regulatory frameworks, including stringent FDA and EMA approvals, play a crucial role in shaping product launches and market access, with the approval process for new brachytherapy devices often taking over 24 months. Product substitutes, such as external beam radiotherapy and advanced surgical techniques, offer alternative treatment modalities but often come with distinct side effect profiles and cost considerations. End-user trends indicate a growing preference for minimally invasive procedures, leading to increased demand for sophisticated brachytherapy systems. Mergers and acquisitions (M&A) activity in the historical period (2019-2024) has been moderate, with estimated deal values in the tens of millions of dollars, primarily focused on acquiring innovative technologies and expanding geographical reach.

Internal Beam Radiotherapy Industry Trends & Insights

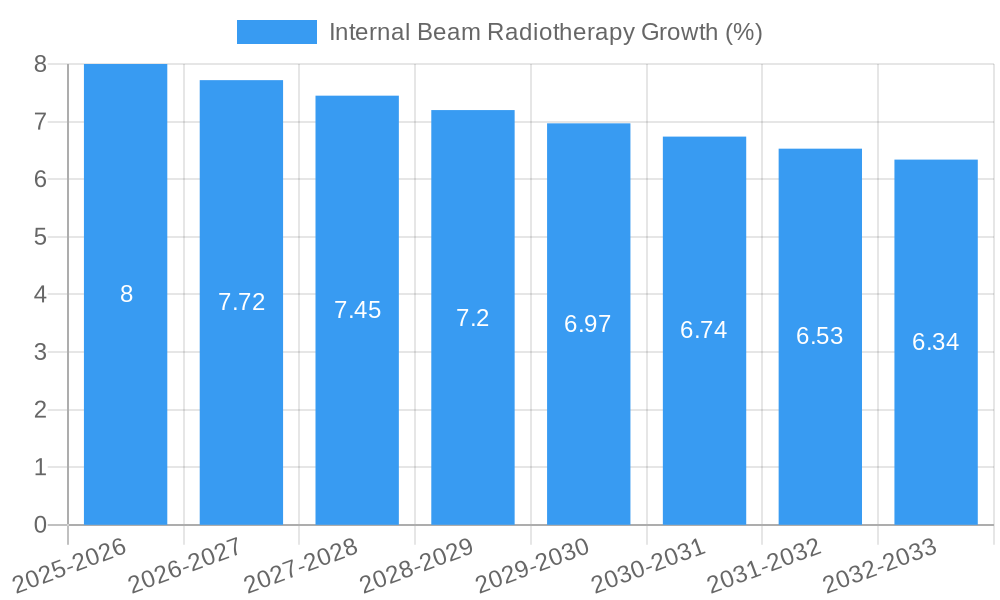

The global Internal Beam Radiotherapy market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This expansion is fueled by several key market growth drivers. Firstly, the increasing global incidence of cancer, particularly prostate, breast, gynecological, and head and neck cancers, directly translates to a higher demand for radiotherapy treatments. In 2025, the estimated cancer patient population requiring radiotherapy is expected to exceed 15 million globally. Secondly, technological disruptions are revolutionizing brachytherapy. Advancements in imaging modalities, such as MRI and ultrasound integration, allow for real-time visualization of the tumor and applicator placement, significantly enhancing treatment precision and reducing off-target radiation exposure. The development of HDR and PDR brachytherapy techniques offers improved dose delivery and shorter treatment times compared to LDR brachytherapy, leading to better patient outcomes and comfort. Consumer preferences are also evolving, with patients increasingly seeking less invasive treatment options that offer faster recovery periods and reduced side effects. Internal Beam Radiotherapy, by its nature, offers localized treatment, minimizing systemic toxicity. Furthermore, growing awareness among healthcare professionals and patients about the efficacy and benefits of brachytherapy, especially for localized cancers, is driving market penetration, which is projected to reach over 30% in key oncology markets by 2033. Competitive dynamics are characterized by intense innovation and strategic partnerships between leading manufacturers and research institutions. Companies are investing heavily in R&D to develop next-generation brachytherapy systems with enhanced safety features, improved dose conformity, and integrated treatment planning capabilities. The market penetration of brachytherapy is estimated to be around 18% in 2025.

Dominant Markets & Segments in Internal Beam Radiotherapy

The Internal Beam Radiotherapy market is dominated by North America, driven by its well-established healthcare infrastructure, high cancer incidence rates, and significant investment in advanced medical technologies. The United States, in particular, accounts for a substantial portion of the global market share, estimated at over 35% in 2025. Key drivers for this dominance include favorable reimbursement policies for brachytherapy procedures, a strong presence of leading radiotherapy equipment manufacturers, and a high adoption rate of advanced medical technologies.

Application: Hospitals Hospitals represent the largest and most dominant segment within the Internal Beam Radiotherapy market. This is due to their comprehensive cancer treatment centers, equipped with multidisciplinary teams, advanced diagnostic tools, and the financial resources to invest in high-end brachytherapy systems. The estimated market share for hospitals is over 75% in 2025. Factors contributing to this dominance include:

- Integrated Cancer Care: Hospitals offer a holistic approach to cancer treatment, integrating surgery, chemotherapy, and radiotherapy, making brachytherapy a natural extension of their service offerings.

- Expertise and Training: Hospitals provide the necessary environment for training oncologists, radiation therapists, and physicists in the complex application of brachytherapy techniques.

- Patient Volume: Hospitals typically manage a larger volume of cancer patients, ensuring consistent utilization of brachytherapy equipment.

- Technological Advancements: Hospitals are more likely to invest in cutting-edge brachytherapy technologies like HDR and PDR systems due to their ability to attract and retain top medical talent and provide superior patient care.

Types: High-dose-rate (HDR) Brachytherapy Within the different types of internal beam radiotherapy, High-dose-rate (HDR) Brachytherapy is the most dominant segment, holding an estimated market share of over 60% in 2025. This dominance is attributed to its superior therapeutic ratio, offering effective tumor destruction with minimal damage to surrounding healthy tissues.

- Treatment Efficacy: HDR brachytherapy allows for high doses of radiation to be delivered precisely to the tumor, shortening treatment courses and improving patient outcomes for various cancers.

- Patient Comfort and Convenience: The shorter treatment sessions and reduced fractionation of HDR brachytherapy lead to greater patient comfort and compliance compared to older LDR techniques.

- Versatility in Applications: HDR brachytherapy is widely used for treating a broad range of cancers, including prostate, breast, cervical, and head and neck cancers, making it a versatile and essential tool in oncology.

- Technological Advancements: Continuous innovations in HDR afterloaders, catheters, and imaging guidance have further solidified its position as the preferred brachytherapy modality.

Internal Beam Radiotherapy Product Developments

The Internal Beam Radiotherapy market is witnessing a surge in product innovations focused on enhancing treatment precision, patient safety, and user experience. Companies are introducing advanced HDR systems with real-time imaging integration, allowing for adaptive radiotherapy where treatment plans can be adjusted during the procedure. Miniaturized radioactive sources and improved applicator designs are enabling more precise tumor targeting, particularly for complex anatomies. These developments aim to broaden the application of brachytherapy to a wider range of cancers and patient profiles, offering significant competitive advantages through superior clinical outcomes and reduced treatment-related toxicities.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Internal Beam Radiotherapy market across key segments to provide a comprehensive understanding of market dynamics.

- Application: Hospitals: This segment encompasses radiotherapy services provided within hospital settings. It is projected to experience a CAGR of approximately 7.8% from 2025 to 2033, driven by the growing consolidation of cancer care services and the adoption of advanced technologies in large medical institutions. The market size for this segment in 2025 is estimated to be over 1.5 billion.

- Application: Independent Radiotherapy Centers: This segment includes standalone centers specializing in radiation therapy. It is anticipated to grow at a CAGR of around 6.5%, reflecting increasing investments in specialized cancer treatment facilities. The market size for this segment in 2025 is estimated to be over 0.5 billion.

- Types: Low-dose-rate (LDR) Brachytherapy: This segment focuses on permanent implantation of radioactive sources. While historically significant, its growth is projected to be slower, around 3.0% CAGR, due to the increasing preference for HDR techniques. The market size for this segment in 2025 is estimated to be over 0.3 billion.

- Types: High-dose-rate (HDR) Brachytherapy: This segment, characterized by temporary implantation of high-activity sources, is expected to exhibit strong growth at a CAGR of approximately 8.5%, driven by its clinical advantages and versatility. The market size for this segment in 2025 is estimated to be over 1.2 billion.

- Types: Pulsed-dose-rate (PDR) Brachytherapy: This niche segment involves intermittent delivery of radiation. It is projected to grow at a CAGR of around 5.5%, finding specific applications where controlled, fractionated dose delivery is crucial. The market size for this segment in 2025 is estimated to be over 0.1 billion.

Key Drivers of Internal Beam Radiotherapy Growth

The growth of the Internal Beam Radiotherapy market is propelled by several significant factors. Technologically, advancements in HDR and PDR systems, coupled with sophisticated imaging guidance like MRI-Linacs, are enhancing treatment efficacy and safety. Economically, increasing healthcare expenditure in emerging economies and favorable reimbursement policies for brachytherapy in developed nations are driving adoption. Regulatory bodies' approvals of new brachytherapy devices and techniques, such as those from the FDA for advanced prostate brachytherapy, further stimulate market expansion. The rising global cancer burden, particularly for prostate and gynecological cancers where brachytherapy is a cornerstone treatment, also represents a fundamental growth driver.

Challenges in the Internal Beam Radiotherapy Sector

Despite its promising growth, the Internal Beam Radiotherapy sector faces several challenges. Regulatory hurdles and lengthy approval processes for new devices, estimated to add 18-30 months to market entry, can slow down innovation adoption. The high initial capital investment required for advanced brachytherapy systems, often ranging from 0.5 million to over 2 million, can be a significant barrier, especially for smaller healthcare facilities or those in resource-limited regions. Competition from alternative radiotherapy techniques, such as Intensity-Modulated Radiation Therapy (IMRT) and Proton Therapy, which offer different treatment paradigms, also presents a challenge. Furthermore, a shortage of trained brachytherapy specialists and physicists globally, estimated at a shortfall of over 1,000 professionals by 2030, can limit the widespread implementation of these advanced treatment modalities.

Emerging Opportunities in Internal Beam Radiotherapy

Emerging opportunities in the Internal Beam Radiotherapy market are abundant, driven by technological innovation and evolving clinical needs. The development of AI-powered treatment planning software promises to optimize dose distribution and reduce treatment planning time, potentially impacting over 50% of all brachytherapy cases by 2030. Expanding applications of brachytherapy to new cancer types, such as liver and pancreatic cancers, presents significant untapped potential, estimated to add over 0.3 billion in market value by 2033. Furthermore, the growing demand for personalized medicine is creating opportunities for tailored brachytherapy approaches, integrating genomics and predictive analytics for improved patient selection and outcome prediction. Increased adoption in emerging markets, with an estimated growth rate of over 9% annually, offers substantial expansion prospects.

Leading Players in the Internal Beam Radiotherapy Market

- Varian Medical

- Elekta

- Accuray

- Ion Beam

- Hitachi

Key Developments in Internal Beam Radiotherapy Industry

- 2023: Varian Medical launched its Halcyon™ system enhancement, improving patient comfort and workflow efficiency for various radiotherapy treatments, including brachytherapy.

- 2023: Elekta introduced its latest generation of Leksell Gamma Knife® Icon™ with advanced imaging capabilities, indirectly benefiting brachytherapy planning and integration.

- 2022: Accuray's CyberKnife® S7™ System received FDA clearance for a wider range of indications, showcasing advancements in precision radiation delivery.

- 2021: Hitachi's Ion Therapy division announced further development in proton therapy advancements, which can influence the broader radiotherapy landscape.

- 2020: Several companies focused on developing advanced brachytherapy applicators for gynecological and prostate cancers, improving dose conformity.

Strategic Outlook for Internal Beam Radiotherapy Market

The strategic outlook for the Internal Beam Radiotherapy market remains highly positive, driven by continuous innovation and a growing demand for effective cancer treatments. Key growth catalysts include the ongoing development of more precise and patient-friendly brachytherapy systems, integration with advanced imaging and AI, and the expansion of applications into previously challenging cancer sites. Strategic partnerships between technology providers and healthcare institutions will be crucial for accelerating the adoption of these advanced solutions. The increasing focus on value-based healthcare and improved patient outcomes will further solidify the role of Internal Beam Radiotherapy as a vital component of comprehensive cancer care, with the market expected to exceed 3.0 billion by 2033.

Internal Beam Radiotherapy Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Independent Radiotherapy Centers

-

2. Types

- 2.1. Low-dose-rate (LDR) Brachytherapy

- 2.2. High-dose-rate (HDR) Brachytherapy

- 2.3. Pulsed-dose-rate (PDR) Brachytherapy

Internal Beam Radiotherapy Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Internal Beam Radiotherapy REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Internal Beam Radiotherapy Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Independent Radiotherapy Centers

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Low-dose-rate (LDR) Brachytherapy

- 5.2.2. High-dose-rate (HDR) Brachytherapy

- 5.2.3. Pulsed-dose-rate (PDR) Brachytherapy

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Internal Beam Radiotherapy Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Independent Radiotherapy Centers

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Low-dose-rate (LDR) Brachytherapy

- 6.2.2. High-dose-rate (HDR) Brachytherapy

- 6.2.3. Pulsed-dose-rate (PDR) Brachytherapy

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Internal Beam Radiotherapy Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Independent Radiotherapy Centers

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Low-dose-rate (LDR) Brachytherapy

- 7.2.2. High-dose-rate (HDR) Brachytherapy

- 7.2.3. Pulsed-dose-rate (PDR) Brachytherapy

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Internal Beam Radiotherapy Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Independent Radiotherapy Centers

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Low-dose-rate (LDR) Brachytherapy

- 8.2.2. High-dose-rate (HDR) Brachytherapy

- 8.2.3. Pulsed-dose-rate (PDR) Brachytherapy

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Internal Beam Radiotherapy Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Independent Radiotherapy Centers

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Low-dose-rate (LDR) Brachytherapy

- 9.2.2. High-dose-rate (HDR) Brachytherapy

- 9.2.3. Pulsed-dose-rate (PDR) Brachytherapy

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Internal Beam Radiotherapy Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Independent Radiotherapy Centers

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Low-dose-rate (LDR) Brachytherapy

- 10.2.2. High-dose-rate (HDR) Brachytherapy

- 10.2.3. Pulsed-dose-rate (PDR) Brachytherapy

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Varian Medical

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Elekta

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Accuray

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ion Beam

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hitachi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Varian Medical

List of Figures

- Figure 1: Global Internal Beam Radiotherapy Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Internal Beam Radiotherapy Revenue (million), by Application 2024 & 2032

- Figure 3: North America Internal Beam Radiotherapy Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Internal Beam Radiotherapy Revenue (million), by Types 2024 & 2032

- Figure 5: North America Internal Beam Radiotherapy Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Internal Beam Radiotherapy Revenue (million), by Country 2024 & 2032

- Figure 7: North America Internal Beam Radiotherapy Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Internal Beam Radiotherapy Revenue (million), by Application 2024 & 2032

- Figure 9: South America Internal Beam Radiotherapy Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Internal Beam Radiotherapy Revenue (million), by Types 2024 & 2032

- Figure 11: South America Internal Beam Radiotherapy Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Internal Beam Radiotherapy Revenue (million), by Country 2024 & 2032

- Figure 13: South America Internal Beam Radiotherapy Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Internal Beam Radiotherapy Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Internal Beam Radiotherapy Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Internal Beam Radiotherapy Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Internal Beam Radiotherapy Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Internal Beam Radiotherapy Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Internal Beam Radiotherapy Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Internal Beam Radiotherapy Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Internal Beam Radiotherapy Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Internal Beam Radiotherapy Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Internal Beam Radiotherapy Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Internal Beam Radiotherapy Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Internal Beam Radiotherapy Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Internal Beam Radiotherapy Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Internal Beam Radiotherapy Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Internal Beam Radiotherapy Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Internal Beam Radiotherapy Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Internal Beam Radiotherapy Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Internal Beam Radiotherapy Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Internal Beam Radiotherapy Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Internal Beam Radiotherapy Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Internal Beam Radiotherapy Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Internal Beam Radiotherapy Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Internal Beam Radiotherapy Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Internal Beam Radiotherapy Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Internal Beam Radiotherapy Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Internal Beam Radiotherapy Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Internal Beam Radiotherapy Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Internal Beam Radiotherapy Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Internal Beam Radiotherapy Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Internal Beam Radiotherapy Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Internal Beam Radiotherapy Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Internal Beam Radiotherapy Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Internal Beam Radiotherapy Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Internal Beam Radiotherapy Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Internal Beam Radiotherapy Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Internal Beam Radiotherapy Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Internal Beam Radiotherapy Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Internal Beam Radiotherapy Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Internal Beam Radiotherapy?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Internal Beam Radiotherapy?

Key companies in the market include Varian Medical, Elekta, Accuray, Ion Beam, Hitachi.

3. What are the main segments of the Internal Beam Radiotherapy?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Internal Beam Radiotherapy," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Internal Beam Radiotherapy report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Internal Beam Radiotherapy?

To stay informed about further developments, trends, and reports in the Internal Beam Radiotherapy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence