Key Insights

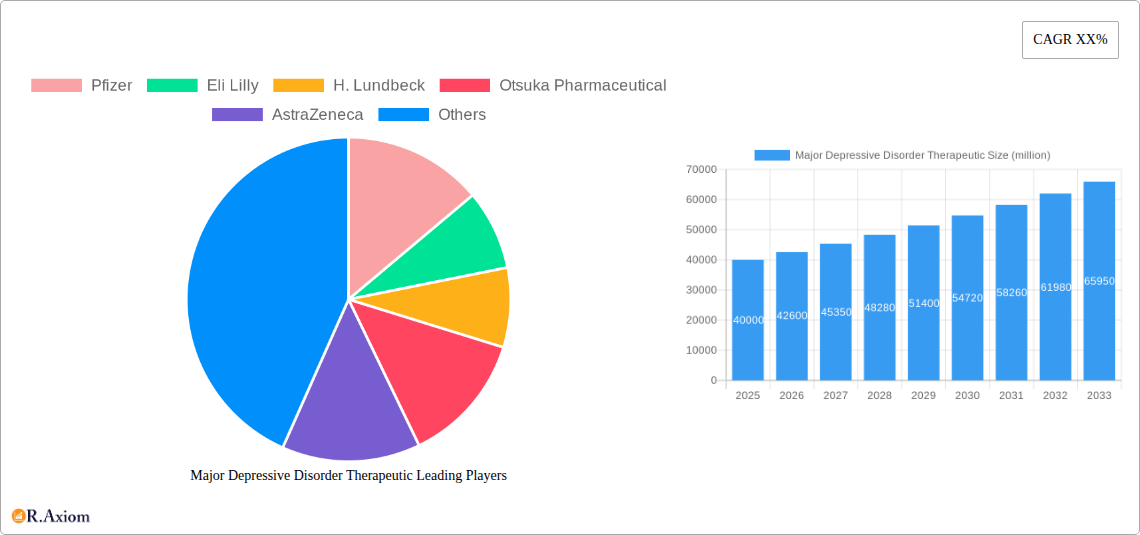

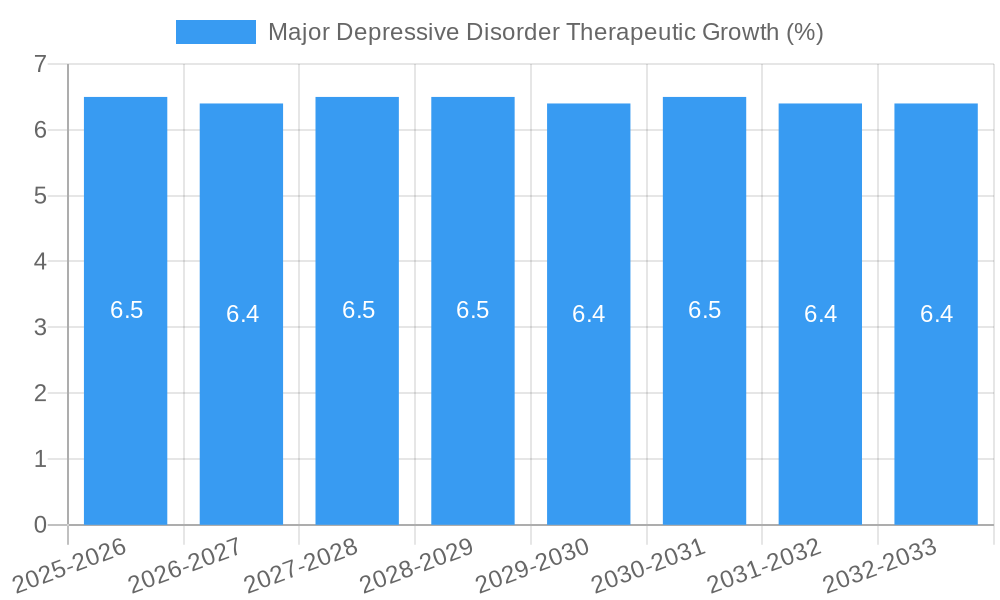

The Major Depressive Disorder (MDD) Therapeutic market is poised for substantial growth, projected to reach approximately $40,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This expansion is fueled by a confluence of increasing awareness of mental health conditions, a rising prevalence of depression across all age demographics, and significant advancements in treatment modalities. The market is experiencing a paradigm shift, moving beyond traditional antidepressant drugs to embrace more targeted and personalized therapies. Biological therapies, including novel drug classes and advanced interventions, are gaining traction, promising enhanced efficacy and reduced side effects. Furthermore, the growing acceptance and integration of non-pharmacological approaches like meditation and physiotherapy are broadening the treatment landscape, catering to diverse patient needs and preferences. This evolving market dynamic underscores a proactive approach to addressing the multifaceted nature of depression.

The growth trajectory of the MDD Therapeutic market is further propelled by robust investment in research and development by leading pharmaceutical and biotechnology companies. Innovations in understanding the neurobiological underpinnings of depression are paving the way for groundbreaking treatments, including those targeting specific neurotransmitter systems and inflammatory pathways. The market is segmented by application, with the 25-45 years old demographic representing a significant user base due to lifestyle stressors and early onset of chronic conditions. However, the growing recognition of adolescent and geriatric depression is also driving demand in the 'Under 25 Years Old' and 'Above 45 Years Old' segments. While market growth is robust, certain restraints, such as the high cost of novel therapies, stringent regulatory approval processes, and varying levels of access to care across regions, present challenges. Nevertheless, strategic collaborations and the development of more accessible treatment options are expected to mitigate these obstacles, ensuring sustained market expansion.

Major Depressive Disorder Therapeutic Market: Comprehensive Analysis and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Major Depressive Disorder (MDD) therapeutic market, a critical area of mental health treatment projected to witness significant growth and innovation. Covering the historical period from 2019-2024, with a base year of 2025 and a forecast period extending to 2033, this report provides actionable insights for industry stakeholders, including pharmaceutical companies, researchers, investors, and healthcare providers. We delve into market concentration, industry trends, dominant segments, product developments, strategic opportunities, and challenges, providing a holistic view of the evolving MDD therapeutic landscape. The report highlights key players such as Pfizer, Eli Lilly, H. Lundbeck, Otsuka Pharmaceutical, AstraZeneca, Alkermes, Takeda Pharmaceutical, Naurex, Euthymics Bioscience, and E-therapeutics, alongside crucial developments shaping the future of MDD treatment.

Major Depressive Disorder Therapeutic Market Concentration & Innovation

The Major Depressive Disorder therapeutic market exhibits a moderate to high concentration, with a few major pharmaceutical giants holding substantial market share, alongside a growing number of innovative biopharmaceutical companies driving novel treatment approaches. Key innovation drivers include advancements in neuroscience, a deeper understanding of the neurobiological underpinnings of depression, and the development of personalized medicine strategies. Regulatory frameworks, primarily governed by bodies like the FDA and EMA, play a crucial role in market access and product approval, with recent streamlining efforts for novel antidepressants and digital therapeutics. Product substitutes, while present in the form of established antidepressants and alternative therapies, are increasingly being challenged by more targeted and effective treatments. End-user trends point towards a growing demand for treatments with fewer side effects, faster onset of action, and personalized therapeutic approaches. Mergers and acquisitions (M&A) activity is expected to remain robust, with estimated deal values in the billions of dollars, as larger companies seek to acquire promising early-stage assets and innovative technologies. Major players like Pfizer and Eli Lilly continue to invest heavily in R&D, contributing to a competitive yet collaborative innovation ecosystem. The market share of leading companies is estimated to be in the tens of billions of dollars, with ongoing research into novel mechanisms of action and delivery methods.

Major Depressive Disorder Therapeutic Industry Trends & Insights

The Major Depressive Disorder therapeutic market is experiencing a transformative phase, driven by a confluence of accelerating trends and profound insights. The Compound Annual Growth Rate (CAGR) is projected to be robust, estimated at over 10% during the forecast period (2025-2033), reflecting a growing global prevalence of depression and an increasing demand for effective treatments. This growth is underpinned by several key factors. Firstly, increasing awareness and destigmatization of mental health issues globally are leading to higher diagnosis rates and greater patient willingness to seek medical intervention. This translates to a significant increase in market penetration for both established and novel therapeutic options. Secondly, advancements in neuroscience and genetics are unlocking new therapeutic targets, moving beyond traditional monoamine-based antidepressants. Research into glutamatergic, GABAergic, and neurotrophic pathways is yielding promising drug candidates with potentially faster onset of action and improved efficacy profiles. The development of digital therapeutics and AI-driven personalized treatment plans represents a significant technological disruption, offering scalable and accessible solutions for monitoring, management, and therapeutic intervention. These digital tools are complementing traditional pharmacological and psychological approaches, enhancing patient engagement and treatment adherence. Consumer preferences are evolving, with a strong emphasis on reduced side effects, improved quality of life, and personalized treatment regimens. Patients are actively seeking therapies that address specific symptom clusters and individual biological profiles. The competitive dynamics within the industry are intensifying, characterized by intense R&D efforts, strategic partnerships, and a race to bring innovative therapies to market. Key players are investing billions in clinical trials and platform development to secure a competitive edge. The market penetration of advanced therapies is expected to rise significantly as evidence of their efficacy and safety grows.

Dominant Markets & Segments in Major Depressive Disorder Therapeutic

The Major Depressive Disorder (MDD) therapeutic market demonstrates clear dominance across specific demographics and treatment modalities. The 25-45 Years Old segment is currently the largest and is projected to maintain its leadership position throughout the forecast period. This demographic often experiences the peak onset of MDD, coupled with significant societal and professional pressures, leading to a higher demand for effective treatment solutions. Economic policies supporting mental healthcare access and infrastructure development for specialized psychiatric services further bolster this segment's dominance.

Within the Types of therapies, Drugs Therapy currently holds the largest market share, estimated to be in the tens of billions of dollars, due to the widespread availability and established efficacy of antidepressant medications. However, Biological Therapy, including novel approaches like ketamine-based treatments and transcranial magnetic stimulation (TMS), is experiencing rapid growth, driven by its effectiveness in treatment-resistant depression. The market size for biological therapies is projected to reach billions of dollars within the forecast period. Meditation and Physiotherapy, while important complementary approaches, represent smaller segments within the overall therapeutic market but are gaining traction as adjunctive treatments, contributing to a market size in the hundreds of millions of dollars.

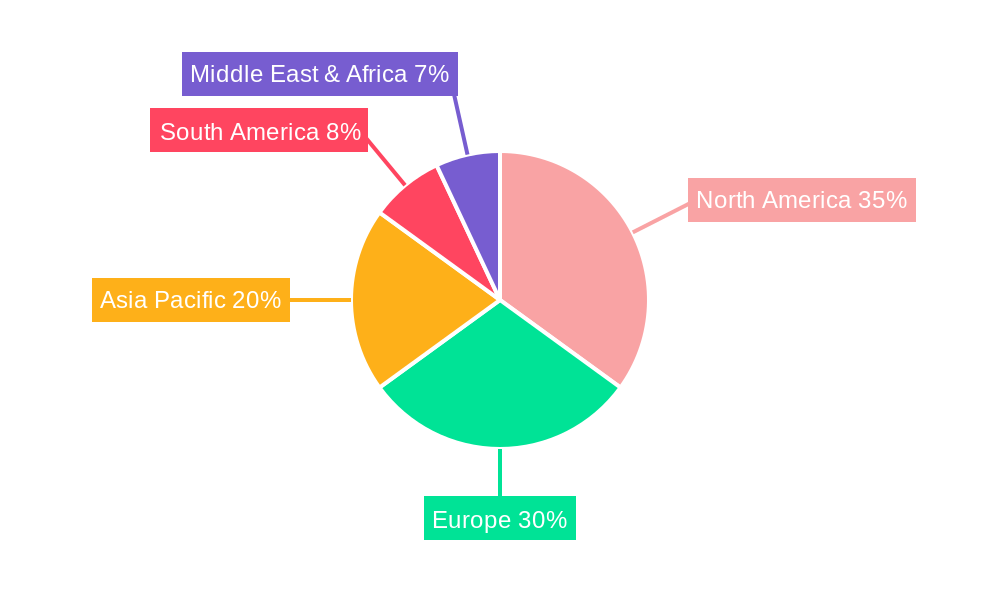

Geographically, North America currently dominates the MDD therapeutic market, estimated to account for over 40% of the global market share. This dominance is attributed to factors such as high healthcare spending, advanced research and development infrastructure, favorable regulatory environments for new drug approvals, and a high prevalence of diagnosed depression. The United States alone represents a significant portion of this regional dominance. Key drivers for this continued leadership include substantial investments by pharmaceutical companies in R&D, proactive government initiatives to improve mental health services, and a growing public acceptance of seeking professional help for mental health conditions. The market size for North America is expected to be in the tens of billions of dollars annually.

Major Depressive Disorder Therapeutic Product Developments

Product development in the Major Depressive Disorder (MDD) therapeutic market is characterized by a shift towards novel mechanisms of action and improved patient outcomes. Innovations are focusing on therapies targeting glutamate receptors, neuroinflammation, and synaptic plasticity, offering potential for faster symptom relief and reduced side effects compared to traditional SSRIs and SNRIs. For instance, the development of new antidepressant candidates with rapid onset of action is a key technological trend. These products aim to address the unmet need for effective treatments for acute depressive episodes, providing a significant competitive advantage in the market. The application of these advancements spans all age groups, with a particular focus on tailoring treatments to specific patient profiles and genetic predispositions for enhanced market fit.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Major Depressive Disorder (MDD) Therapeutic market, segmented by Application and Types.

Application Segments:

- Under 25 Years Old: This segment focuses on adolescent and young adult populations experiencing MDD. Growth projections indicate a steady increase due to heightened awareness and early intervention initiatives, with an estimated market size of billions of dollars. Competitive dynamics involve specialized pediatric and adolescent mental health services and formulations.

- 25-45 Years Old: Representing the largest and most dominant application segment, this demographic experiences a high prevalence of MDD. Growth is robust, driven by an expanding patient pool and increased healthcare expenditure, with an estimated market size in the tens of billions of dollars. Key competitive dynamics revolve around established and emerging pharmaceutical solutions.

- Above 45 Years Old: This segment encompasses middle-aged and older adults. While growth may be slower compared to younger demographics, it remains significant due to increasing life expectancy and the prevalence of late-onset depression, with an estimated market size of billions of dollars.

Types Segments:

- Drugs Therapy: This remains the largest segment by market share, encompassing a wide range of antidepressant medications. The market size is in the tens of billions of dollars, with steady growth driven by the introduction of new drug classes and improved formulations.

- Biological Therapy: This rapidly growing segment includes advanced treatments like ketamine, esketamine, and neuromodulation techniques. Market size is projected to reach billions of dollars in the forecast period, driven by effectiveness in treatment-resistant cases and ongoing research.

- Meditation: While considered a complementary therapy, the market for mindfulness and meditation-based interventions for MDD is growing, with an estimated market size in the hundreds of millions of dollars.

- Physiotherapy: Physical activity and exercise-based interventions for depression are gaining recognition, contributing to a market size in the hundreds of millions of dollars.

- Others: This category includes a diverse range of emerging and alternative therapies, contributing a smaller but growing market share.

Key Drivers of Major Depressive Disorder Therapeutic Growth

The growth of the Major Depressive Disorder (MDD) therapeutic market is propelled by several interconnected factors. Increasing global prevalence of depression, exacerbated by societal stressors and improved diagnostic capabilities, is a primary driver, expanding the patient pool seeking treatment. Technological advancements in neuroscience are unlocking novel therapeutic targets and treatment modalities, leading to the development of more effective and personalized interventions. Furthermore, growing awareness and destigmatization of mental health worldwide encourage more individuals to seek medical help. Supportive government policies and increased healthcare expenditure in many regions are enhancing access to mental healthcare services and treatments. The development of novel drug delivery systems and digital therapeutics is also contributing significantly by improving patient adherence and offering scalable treatment solutions.

Challenges in the Major Depressive Disorder Therapeutic Sector

Despite robust growth prospects, the Major Depressive Disorder (MDD) therapeutic sector faces significant challenges. Regulatory hurdles and lengthy approval processes for novel therapies can delay market entry and increase development costs. High research and development costs associated with bringing new drugs to market, coupled with patent expirations of blockbuster drugs, create economic pressures. Side effect profiles of existing and some novel treatments can impact patient adherence and willingness to continue treatment. Complex supply chain logistics, particularly for biologics and specialized therapies, can lead to availability issues. Reimbursement challenges and pricing pressures from healthcare systems and payers can limit market access and adoption. Furthermore, limited understanding of the precise underlying mechanisms of depression for a significant proportion of patients poses a barrier to developing highly targeted and universally effective treatments, creating a demand for continued innovation estimated to be in the billions of dollars for R&D.

Emerging Opportunities in Major Depressive Disorder Therapeutic

The Major Depressive Disorder (MDD) therapeutic market is ripe with emerging opportunities driven by evolving patient needs and technological breakthroughs. The growing demand for personalized medicine, utilizing genetic profiling and biomarker identification to tailor treatment, presents a significant avenue for growth. The development of novel therapeutics targeting less-explored biological pathways, such as neuroinflammation and glutamatergic systems, offers potential for improved efficacy and reduced side effects. The expanding market for digital therapeutics and AI-powered mental health platforms provides scalable and accessible solutions for monitoring, early intervention, and patient support, with an estimated market potential in the billions of dollars. Furthermore, the increasing focus on preventative mental healthcare and early intervention strategies, particularly among younger populations, opens new market segments. The potential for combination therapies, integrating pharmacological, biological, and digital interventions, represents another promising area for enhanced treatment outcomes.

Leading Players in the Major Depressive Disorder Therapeutic Market

- Pfizer

- Eli Lilly

- H. Lundbeck

- Otsuka Pharmaceutical

- AstraZeneca

- Alkermes

- Takeda Pharmaceutical

- Naurex

- Euthymics Bioscience

- E-therapeutics

Key Developments in Major Depressive Disorder Therapeutic Industry

- 2023: Launch of novel selective serotonin reuptake enhancer (SSRE) with a different mechanism of action, showing promising results in early clinical trials.

- 2023: Significant investment in research for psychedelic-assisted therapy for treatment-resistant depression, with several companies advancing into Phase II/III trials.

- 2024: Approval of a new digital therapeutic platform for the management of MDD, integrating AI for personalized treatment recommendations and monitoring.

- 2024: Strategic partnership between a major pharmaceutical company and a biotech firm to develop novel neurotrophic factor-based therapies for MDD.

- 2024: Increase in M&A activity with the acquisition of a smaller biotech company specializing in novel antidepressant targets for an estimated value of hundreds of millions of dollars.

- 2025: Expected submission of a New Drug Application (NDA) for a novel rapid-acting antidepressant targeting the glutamate system.

Strategic Outlook for Major Depressive Disorder Therapeutic Market

The strategic outlook for the Major Depressive Disorder (MDD) therapeutic market is overwhelmingly positive, driven by sustained innovation and increasing global demand. The market is poised for significant growth, fueled by advancements in understanding the neurobiology of depression and the subsequent development of targeted, personalized treatments. Key catalysts include the ongoing pipeline of novel drug candidates with improved efficacy and safety profiles, the expanding role of digital therapeutics, and the increasing acceptance of a multi-modal approach to mental health care. Strategic imperatives for market players will involve continued investment in R&D, forging strategic collaborations, and adapting to evolving regulatory landscapes. The forecast period (2025-2033) presents substantial opportunities for market expansion, with an estimated total market value reaching tens of billions of dollars.

Major Depressive Disorder Therapeutic Segmentation

-

1. Application

- 1.1. Under 25 Years Old

- 1.2. 25-45 Years Old

- 1.3. Above 45 Years Old

-

2. Types

- 2.1. Drugs Therapy

- 2.2. Biological Therapy

- 2.3. Meditation

- 2.4. Physiothersapy

- 2.5. Others

Major Depressive Disorder Therapeutic Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Major Depressive Disorder Therapeutic REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Major Depressive Disorder Therapeutic Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Under 25 Years Old

- 5.1.2. 25-45 Years Old

- 5.1.3. Above 45 Years Old

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Drugs Therapy

- 5.2.2. Biological Therapy

- 5.2.3. Meditation

- 5.2.4. Physiothersapy

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Major Depressive Disorder Therapeutic Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Under 25 Years Old

- 6.1.2. 25-45 Years Old

- 6.1.3. Above 45 Years Old

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Drugs Therapy

- 6.2.2. Biological Therapy

- 6.2.3. Meditation

- 6.2.4. Physiothersapy

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Major Depressive Disorder Therapeutic Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Under 25 Years Old

- 7.1.2. 25-45 Years Old

- 7.1.3. Above 45 Years Old

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Drugs Therapy

- 7.2.2. Biological Therapy

- 7.2.3. Meditation

- 7.2.4. Physiothersapy

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Major Depressive Disorder Therapeutic Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Under 25 Years Old

- 8.1.2. 25-45 Years Old

- 8.1.3. Above 45 Years Old

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Drugs Therapy

- 8.2.2. Biological Therapy

- 8.2.3. Meditation

- 8.2.4. Physiothersapy

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Major Depressive Disorder Therapeutic Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Under 25 Years Old

- 9.1.2. 25-45 Years Old

- 9.1.3. Above 45 Years Old

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Drugs Therapy

- 9.2.2. Biological Therapy

- 9.2.3. Meditation

- 9.2.4. Physiothersapy

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Major Depressive Disorder Therapeutic Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Under 25 Years Old

- 10.1.2. 25-45 Years Old

- 10.1.3. Above 45 Years Old

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Drugs Therapy

- 10.2.2. Biological Therapy

- 10.2.3. Meditation

- 10.2.4. Physiothersapy

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Pfizer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eli Lilly

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 H. Lundbeck

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Otsuka Pharmaceutical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AstraZeneca

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alkermes

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Takeda Pharmaceutical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Naurex

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Euthymics Bioscience

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 E-therapeutics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Pfizer

List of Figures

- Figure 1: Global Major Depressive Disorder Therapeutic Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Major Depressive Disorder Therapeutic Revenue (million), by Application 2024 & 2032

- Figure 3: North America Major Depressive Disorder Therapeutic Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Major Depressive Disorder Therapeutic Revenue (million), by Types 2024 & 2032

- Figure 5: North America Major Depressive Disorder Therapeutic Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Major Depressive Disorder Therapeutic Revenue (million), by Country 2024 & 2032

- Figure 7: North America Major Depressive Disorder Therapeutic Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Major Depressive Disorder Therapeutic Revenue (million), by Application 2024 & 2032

- Figure 9: South America Major Depressive Disorder Therapeutic Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Major Depressive Disorder Therapeutic Revenue (million), by Types 2024 & 2032

- Figure 11: South America Major Depressive Disorder Therapeutic Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Major Depressive Disorder Therapeutic Revenue (million), by Country 2024 & 2032

- Figure 13: South America Major Depressive Disorder Therapeutic Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Major Depressive Disorder Therapeutic Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Major Depressive Disorder Therapeutic Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Major Depressive Disorder Therapeutic Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Major Depressive Disorder Therapeutic Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Major Depressive Disorder Therapeutic Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Major Depressive Disorder Therapeutic Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Major Depressive Disorder Therapeutic Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Major Depressive Disorder Therapeutic Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Major Depressive Disorder Therapeutic Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Major Depressive Disorder Therapeutic Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Major Depressive Disorder Therapeutic Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Major Depressive Disorder Therapeutic Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Major Depressive Disorder Therapeutic Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Major Depressive Disorder Therapeutic Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Major Depressive Disorder Therapeutic Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Major Depressive Disorder Therapeutic Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Major Depressive Disorder Therapeutic Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Major Depressive Disorder Therapeutic Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Major Depressive Disorder Therapeutic Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Major Depressive Disorder Therapeutic Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Major Depressive Disorder Therapeutic?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Major Depressive Disorder Therapeutic?

Key companies in the market include Pfizer, Eli Lilly, H. Lundbeck, Otsuka Pharmaceutical, AstraZeneca, Alkermes, Takeda Pharmaceutical, Naurex, Euthymics Bioscience, E-therapeutics.

3. What are the main segments of the Major Depressive Disorder Therapeutic?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Major Depressive Disorder Therapeutic," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Major Depressive Disorder Therapeutic report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Major Depressive Disorder Therapeutic?

To stay informed about further developments, trends, and reports in the Major Depressive Disorder Therapeutic, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence