Key Insights

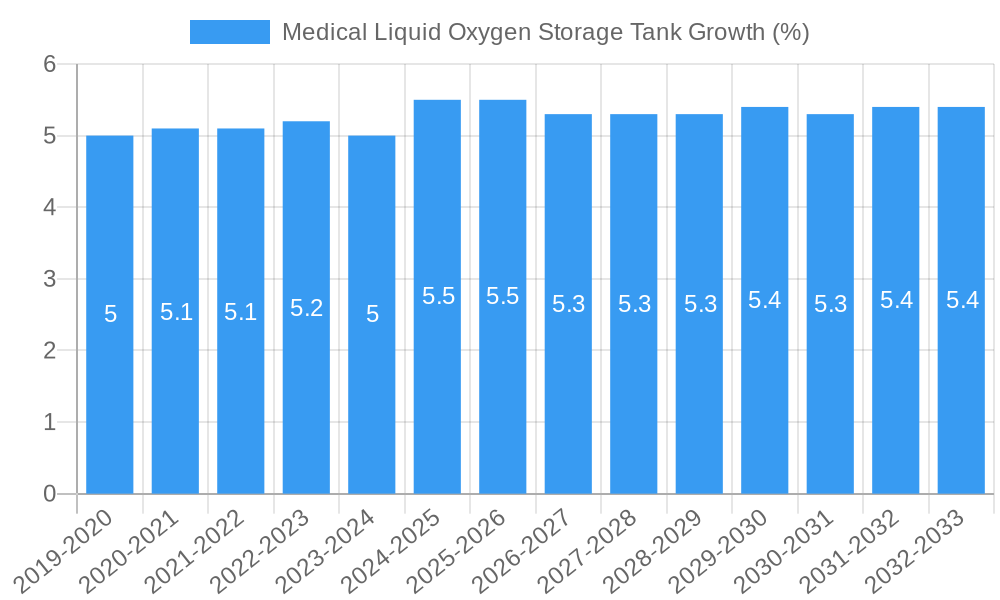

The Medical Liquid Oxygen Storage Tank market is poised for robust growth, projected to reach a substantial market size of approximately $750 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 6.5% expected through 2033. This expansion is primarily fueled by the escalating global demand for medical oxygen, a critical component in treating a wide array of respiratory conditions and a vital resource during public health emergencies, as evidenced by recent global events. The "Medical" application segment is the dominant force, accounting for over 60% of the market share, driven by increasing hospital admissions, the growing prevalence of chronic respiratory diseases such as COPD and asthma, and the expanding healthcare infrastructure in emerging economies. Furthermore, advancements in cryogenic storage technology, leading to more efficient and safer storage solutions, are further bolstering market confidence and adoption. The market is also benefiting from increased investment in healthcare by both governments and private entities, particularly in the Asia Pacific and Middle East & Africa regions, which are exhibiting the highest growth trajectories.

However, the market is not without its challenges. The "Restrains" indicate potential headwinds, including the high initial capital expenditure required for sophisticated storage systems and the stringent regulatory compliance demands that can slow down product development and market entry. The logistical complexities associated with transporting and maintaining liquid oxygen, including the need for specialized infrastructure and trained personnel, also present hurdles. Nevertheless, the inherent necessity of liquid oxygen in modern healthcare, coupled with ongoing technological innovations aimed at cost reduction and improved safety, is expected to significantly outweigh these restraints. The market is also seeing a trend towards decentralized storage solutions and the integration of smart monitoring systems to enhance operational efficiency and patient safety. The "Scientific Research" segment, while smaller, is also contributing to market growth through its increasing use of liquid oxygen in various experimental setups and research facilities. The "10m³" tank size is anticipated to witness significant demand due to its balance of capacity and logistical manageability for medium to large healthcare facilities.

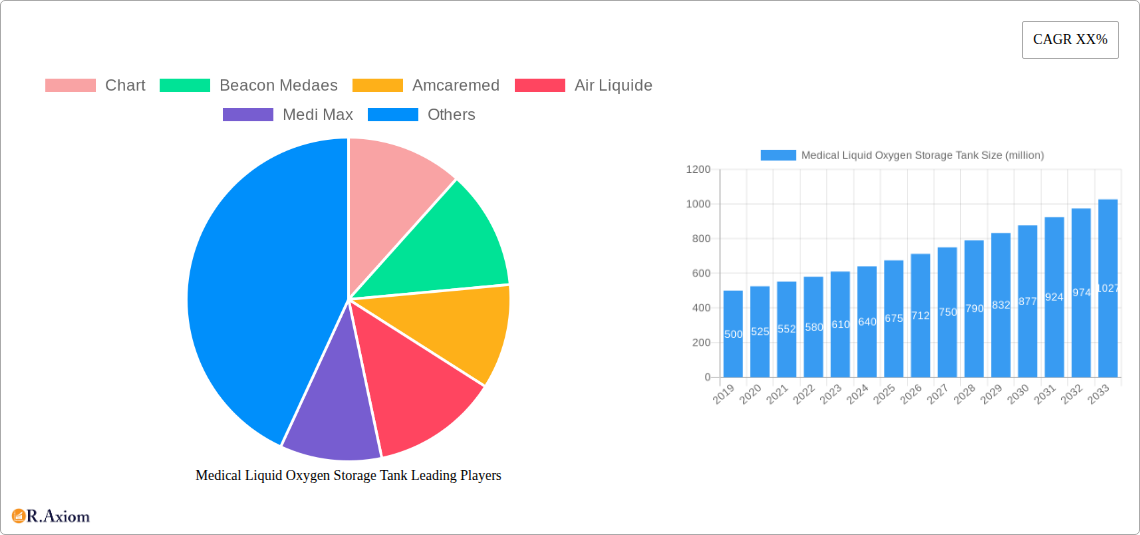

The global Medical Liquid Oxygen Storage Tank market is characterized by a moderate level of concentration, with a few key players holding significant market share. Companies such as Chart, Air Liquide, and Linde are prominent leaders, leveraging their extensive manufacturing capabilities and established distribution networks. Innovation within this sector is primarily driven by the increasing demand for advanced cryogenic technologies that ensure the safe and efficient storage of medical-grade liquid oxygen. Regulatory frameworks, particularly those governing healthcare equipment and patient safety, play a crucial role in shaping product development and market entry. The United States Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are key bodies influencing these standards. Product substitutes, while limited for direct liquid oxygen storage, may emerge in the form of advanced oxygen concentrators or compact portable oxygen systems for specific patient needs, though these do not replace the need for bulk storage in medical facilities. End-user trends are heavily influenced by an aging global population, a rise in chronic respiratory diseases, and increased healthcare spending in developing economies. Mergers and acquisitions (M&A) activity, while not exceptionally high, contributes to market consolidation. Recent M&A deal values are estimated to be in the hundreds of millions, strategically enhancing the capabilities of larger entities in areas like specialized manufacturing or regional market access. For instance, a hypothetical acquisition of a smaller, innovative cryogenic tank manufacturer by a major player could represent a deal value of over 50 million.

Medical Liquid Oxygen Storage Tank Industry Trends & Insights

The Medical Liquid Oxygen Storage Tank industry is experiencing robust growth, propelled by a confluence of critical factors. The primary growth driver is the escalating global demand for medical oxygen, a direct consequence of the increasing prevalence of respiratory ailments such as Chronic Obstructive Pulmonary Disease (COPD), asthma, and pneumonia, further amplified by aging demographics and pandemic preparedness initiatives. Technological advancements in cryogenic insulation and vacuum technology are enabling the development of more efficient, durable, and cost-effective storage solutions, reducing boil-off rates and operational expenses for healthcare providers. These innovations are crucial for maintaining the integrity and purity of medical liquid oxygen. Consumer preferences are shifting towards integrated solutions that offer not only storage but also advanced monitoring and safety features. Healthcare facilities are increasingly prioritizing tanks with smart capabilities, allowing for remote tracking of oxygen levels, temperature, and pressure, thereby optimizing inventory management and ensuring uninterrupted supply. Competitive dynamics are evolving, with established players investing heavily in research and development to enhance product performance and expand their offerings. The market penetration of advanced medical liquid oxygen storage tanks is steadily increasing, particularly in developed regions with robust healthcare infrastructure. The Compound Annual Growth Rate (CAGR) for the medical liquid oxygen storage tank market is projected to be a healthy 6.5% over the forecast period of 2025–2033. The estimated market size for medical liquid oxygen storage tanks in the base year 2025 is projected to reach approximately 3,500 million, with a significant portion attributed to advanced tank technologies. The ongoing development of specialized tanks for various medical applications, from small clinics to large hospitals, further fuels this expansion. The industry is also witnessing a rise in demand for customized solutions, catering to the unique requirements of diverse healthcare settings. The growing emphasis on patient safety and the need for reliable oxygen supply chains are paramount considerations for both manufacturers and end-users, driving continuous improvement in product design and manufacturing processes. Furthermore, government initiatives promoting healthcare accessibility and preparedness for medical emergencies contribute significantly to market expansion. The projected market size by the end of the forecast period in 2033 is anticipated to surpass 5,500 million.

Dominant Markets & Segments in Medical Liquid Oxygen Storage Tank

The Medical application segment is the undisputed leader within the Medical Liquid Oxygen Storage Tank market, driven by the critical and continuous need for oxygen in patient care. Within this segment, large hospitals and specialized respiratory care centers are the primary consumers, demanding high-capacity storage solutions to meet the needs of a diverse patient population. The economic policies supporting healthcare infrastructure development and expansion in emerging economies are key drivers for this dominance. Furthermore, the increasing focus on emergency preparedness and the establishment of robust oxygen supply chains in the wake of global health crises have further solidified the medical segment's leading position.

Among the Types of tanks, the 10m³ capacity segment holds a substantial market share. These tanks offer an optimal balance between storage volume and logistical manageability for a wide range of healthcare facilities, from medium-sized hospitals to larger medical complexes. The drivers for the dominance of the 10m³ category include:

- Cost-Effectiveness: Providing a significant storage capacity at a comparatively lower cost per liter compared to smaller tanks for larger demand.

- Infrastructure Compatibility: Designed to fit within the existing infrastructure and spatial constraints of most medical facilities without requiring extensive modifications.

- Supply Chain Efficiency: Enabling more efficient delivery schedules for oxygen suppliers, reducing the frequency of refills and associated logistical costs.

- Regulatory Compliance: Meeting the stringent safety and performance standards required for medical oxygen storage in a scalable manner.

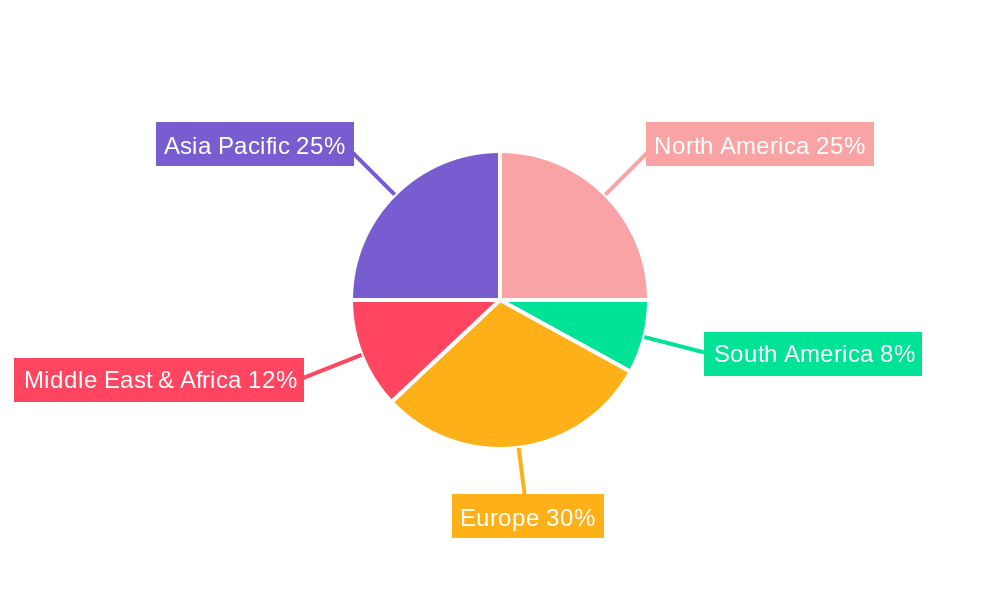

Geographically, North America and Europe currently represent the dominant markets due to their well-established healthcare systems, high healthcare spending, and advanced technological adoption. However, the Asia Pacific region is exhibiting the fastest growth rate, fueled by rapid healthcare infrastructure development, increasing disposable incomes, and rising awareness of respiratory health. Key drivers for this regional growth include:

- Government Investments: Significant government funding allocated towards improving healthcare facilities and expanding access to medical services.

- Growing Chronic Disease Burden: A rising incidence of respiratory diseases necessitating greater access to medical oxygen.

- Technological Adoption: Increasing adoption of advanced medical equipment and storage solutions.

- Favorable Demographics: A large and growing population, with an increasing proportion of elderly individuals requiring medical support.

The Scientific Research segment also contributes to market demand, albeit to a lesser extent than the medical sector, with research institutions requiring specialized cryogenic storage for various experiments and processes. The Others segment, encompassing industrial applications and emergency reserves, represents a smaller but steady demand.

Medical Liquid Oxygen Storage Tank Product Developments

Recent product developments in the Medical Liquid Oxygen Storage Tank market focus on enhancing safety, efficiency, and user-friendliness. Innovations include advanced vacuum insulation technologies to minimize oxygen boil-off, extending storage duration and reducing waste. Smart monitoring systems integrated into tanks provide real-time data on oxygen levels, pressure, and temperature, enabling proactive inventory management and early detection of potential issues. Furthermore, manufacturers are developing tanks with improved material strength and corrosion resistance, ensuring longer lifespans and greater durability in demanding medical environments. The competitive advantage lies in offering tanks that meet stringent regulatory standards while also providing enhanced operational benefits and reliability for healthcare providers, ultimately ensuring a consistent and safe supply of life-saving medical oxygen.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Medical Liquid Oxygen Storage Tank market, segmented across key parameters.

The Application segmentation includes:

- Medical: This segment, projected to hold the largest market share, encompasses the use of liquid oxygen storage tanks in hospitals, clinics, and emergency medical services for patient treatment and respiratory support. Growth is driven by increasing respiratory disease prevalence and healthcare infrastructure development, with an estimated market size of over 3,000 million in 2025 and projected to reach over 4,500 million by 2033.

- Scientific Research: This segment caters to research institutions and laboratories requiring precise cryogenic storage for various experiments. It represents a smaller but steady market, with projected growth driven by ongoing scientific advancements. The estimated market size is around 300 million in 2025, growing to approximately 400 million by 2033.

- Others: This segment includes industrial applications and emergency preparedness reserves, contributing a niche but consistent demand. The estimated market size is approximately 200 million in 2025, projected to reach 300 million by 2033.

The Types segmentation includes:

- 5m³: This segment comprises smaller capacity tanks suitable for smaller healthcare facilities or specialized units. Projected growth is steady, driven by the need for localized oxygen storage. The estimated market size is around 1,200 million in 2025, growing to approximately 1,800 million by 2033.

- 10m³: This segment represents the dominant tank size, offering a balance of capacity and logistical feasibility for mid-to-large healthcare facilities. Its market share is significant, with strong projected growth. The estimated market size is around 1,800 million in 2025, expected to reach 2,800 million by 2033.

- Others: This segment includes tanks with capacities outside the 5m³ and 10m³ range, catering to specific large-scale industrial or specialized medical needs. The estimated market size is approximately 500 million in 2025, projected to grow to 700 million by 2033.

Key Drivers of Medical Liquid Oxygen Storage Tank Growth

The growth of the Medical Liquid Oxygen Storage Tank market is propelled by several key drivers. Firstly, the increasing global prevalence of respiratory diseases, such as COPD, asthma, and pneumonia, directly fuels the demand for reliable and readily available medical oxygen. Secondly, aging demographics worldwide lead to a higher incidence of chronic health conditions requiring long-term oxygen therapy. Thirdly, government initiatives and healthcare infrastructure development in emerging economies are expanding access to medical facilities and oxygen supply. Furthermore, technological advancements in cryogenic storage, leading to more efficient and safer tanks, enhance product adoption. Finally, increased awareness and preparedness for public health emergencies, including pandemics, have underscored the critical need for robust medical oxygen infrastructure, driving investments in storage solutions.

Challenges in the Medical Liquid Oxygen Storage Tank Sector

Despite robust growth, the Medical Liquid Oxygen Storage Tank sector faces several challenges. Stringent regulatory compliance for medical devices, including tanks, can be time-consuming and costly, requiring adherence to international standards and local certifications. Supply chain disruptions, particularly for raw materials and specialized components, can impact production timelines and costs. High initial capital investment for purchasing and installing large-capacity cryogenic tanks can be a barrier for smaller healthcare providers. Competition from alternative oxygen delivery systems, such as advanced oxygen concentrators for home use, can limit the growth in certain niche applications, though they do not replace bulk storage needs. Maintaining optimal storage conditions to prevent oxygen degradation and boil-off requires sophisticated infrastructure and skilled personnel, posing operational challenges.

Emerging Opportunities in Medical Liquid Oxygen Storage Tank

Emerging opportunities in the Medical Liquid Oxygen Storage Tank market lie in several promising areas. The increasing adoption of smart and connected technologies for remote monitoring and predictive maintenance of storage tanks presents a significant opportunity for enhanced efficiency and reliability. The development of modular and scalable storage solutions catering to the diverse needs of hospitals, from small clinics to large medical centers, offers expanded market reach. Furthermore, growing demand in emerging economies with expanding healthcare infrastructure presents a substantial growth avenue. The focus on sustainable manufacturing practices and energy-efficient tank designs aligns with global environmental concerns and can create a competitive advantage. Additionally, the development of specialized tanks for portable medical oxygen applications in emergency services and home healthcare continues to evolve.

Leading Players in the Medical Liquid Oxygen Storage Tank Market

- Chart

- Beacon Medaes

- Amcaremed

- Air Liquide

- Medi Max

- Linde

- Haier

- GangT

- C&H Medical

- BiaoJiu

- Jinding Low Temperature

- Xinxiang Chengde

- Jian Shen Metal Metenrial

Key Developments in Medical Liquid Oxygen Storage Tank Industry

- 2023 Q4: Launch of advanced vacuum-jacketed cryogenic tanks with enhanced insulation properties by Chart, improving boil-off rates by up to 15%.

- 2024 Q1: Beacon Medaes announces strategic partnerships to expand its distribution network in Southeast Asia, targeting growing healthcare markets.

- 2024 Q2: Amcaremed introduces a new line of smart medical liquid oxygen storage tanks with integrated IoT capabilities for remote monitoring and data analytics.

- 2024 Q3: Air Liquide invests in a new manufacturing facility in Europe to meet the increasing demand for medical oxygen storage solutions across the continent.

- 2024 Q4: Linde expands its service offerings to include comprehensive maintenance and refilling solutions for medical liquid oxygen storage tanks.

Strategic Outlook for Medical Liquid Oxygen Storage Tank Market

- 2023 Q4: Launch of advanced vacuum-jacketed cryogenic tanks with enhanced insulation properties by Chart, improving boil-off rates by up to 15%.

- 2024 Q1: Beacon Medaes announces strategic partnerships to expand its distribution network in Southeast Asia, targeting growing healthcare markets.

- 2024 Q2: Amcaremed introduces a new line of smart medical liquid oxygen storage tanks with integrated IoT capabilities for remote monitoring and data analytics.

- 2024 Q3: Air Liquide invests in a new manufacturing facility in Europe to meet the increasing demand for medical oxygen storage solutions across the continent.

- 2024 Q4: Linde expands its service offerings to include comprehensive maintenance and refilling solutions for medical liquid oxygen storage tanks.

Strategic Outlook for Medical Liquid Oxygen Storage Tank Market

The strategic outlook for the Medical Liquid Oxygen Storage Tank market remains highly positive, driven by enduring demand for medical oxygen. Key growth catalysts include the continuous rise in respiratory diseases, an aging global population, and ongoing healthcare infrastructure development, particularly in emerging markets. Strategic focus will likely be on technological innovation, such as further advancements in insulation, smart monitoring, and materials science, to enhance product performance, safety, and cost-effectiveness. Companies that can offer integrated solutions, encompassing not just storage but also comprehensive service and maintenance packages, will be well-positioned for success. Expanding geographical reach into rapidly developing economies and adapting product offerings to meet diverse local needs will be crucial for sustained market leadership.

Medical Liquid Oxygen Storage Tank Segmentation

-

1. Application

- 1.1. Medical

- 1.2. Scientific Research

- 1.3. Others

-

2. Types

- 2.1. 5m³

- 2.2. 10m³

- 2.3. Others

Medical Liquid Oxygen Storage Tank Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Liquid Oxygen Storage Tank REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Liquid Oxygen Storage Tank Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical

- 5.1.2. Scientific Research

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 5m³

- 5.2.2. 10m³

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Liquid Oxygen Storage Tank Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical

- 6.1.2. Scientific Research

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 5m³

- 6.2.2. 10m³

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Liquid Oxygen Storage Tank Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical

- 7.1.2. Scientific Research

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 5m³

- 7.2.2. 10m³

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Liquid Oxygen Storage Tank Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical

- 8.1.2. Scientific Research

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 5m³

- 8.2.2. 10m³

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Liquid Oxygen Storage Tank Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical

- 9.1.2. Scientific Research

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 5m³

- 9.2.2. 10m³

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Liquid Oxygen Storage Tank Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical

- 10.1.2. Scientific Research

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 5m³

- 10.2.2. 10m³

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Chart

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Beacon Medaes

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amcaremed

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Air Liquide

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Medi Max

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Linde

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Haier

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GangT

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 C&H Medical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BiaoJiu

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Jinding Low Temperature

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Xinxiang Chengde

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Jian Shen Metal Metenrial

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Chart

List of Figures

- Figure 1: Global Medical Liquid Oxygen Storage Tank Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Medical Liquid Oxygen Storage Tank Revenue (million), by Application 2024 & 2032

- Figure 3: North America Medical Liquid Oxygen Storage Tank Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Medical Liquid Oxygen Storage Tank Revenue (million), by Types 2024 & 2032

- Figure 5: North America Medical Liquid Oxygen Storage Tank Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Medical Liquid Oxygen Storage Tank Revenue (million), by Country 2024 & 2032

- Figure 7: North America Medical Liquid Oxygen Storage Tank Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Medical Liquid Oxygen Storage Tank Revenue (million), by Application 2024 & 2032

- Figure 9: South America Medical Liquid Oxygen Storage Tank Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Medical Liquid Oxygen Storage Tank Revenue (million), by Types 2024 & 2032

- Figure 11: South America Medical Liquid Oxygen Storage Tank Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Medical Liquid Oxygen Storage Tank Revenue (million), by Country 2024 & 2032

- Figure 13: South America Medical Liquid Oxygen Storage Tank Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Medical Liquid Oxygen Storage Tank Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Medical Liquid Oxygen Storage Tank Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Medical Liquid Oxygen Storage Tank Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Medical Liquid Oxygen Storage Tank Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Medical Liquid Oxygen Storage Tank Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Medical Liquid Oxygen Storage Tank Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Medical Liquid Oxygen Storage Tank Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Medical Liquid Oxygen Storage Tank Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Medical Liquid Oxygen Storage Tank Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Medical Liquid Oxygen Storage Tank Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Medical Liquid Oxygen Storage Tank Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Medical Liquid Oxygen Storage Tank Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Medical Liquid Oxygen Storage Tank Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Medical Liquid Oxygen Storage Tank Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Medical Liquid Oxygen Storage Tank Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Medical Liquid Oxygen Storage Tank Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Medical Liquid Oxygen Storage Tank Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Medical Liquid Oxygen Storage Tank Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Medical Liquid Oxygen Storage Tank Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Medical Liquid Oxygen Storage Tank Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Liquid Oxygen Storage Tank?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Medical Liquid Oxygen Storage Tank?

Key companies in the market include Chart, Beacon Medaes, Amcaremed, Air Liquide, Medi Max, Linde, Haier, GangT, C&H Medical, BiaoJiu, Jinding Low Temperature, Xinxiang Chengde, Jian Shen Metal Metenrial.

3. What are the main segments of the Medical Liquid Oxygen Storage Tank?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Liquid Oxygen Storage Tank," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Liquid Oxygen Storage Tank report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Liquid Oxygen Storage Tank?

To stay informed about further developments, trends, and reports in the Medical Liquid Oxygen Storage Tank, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence