Key Insights

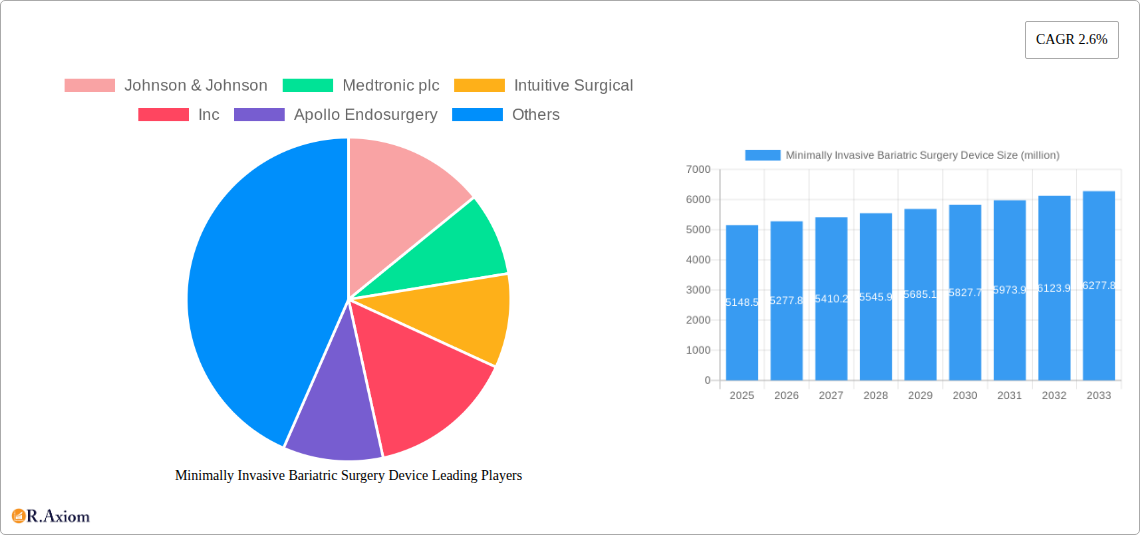

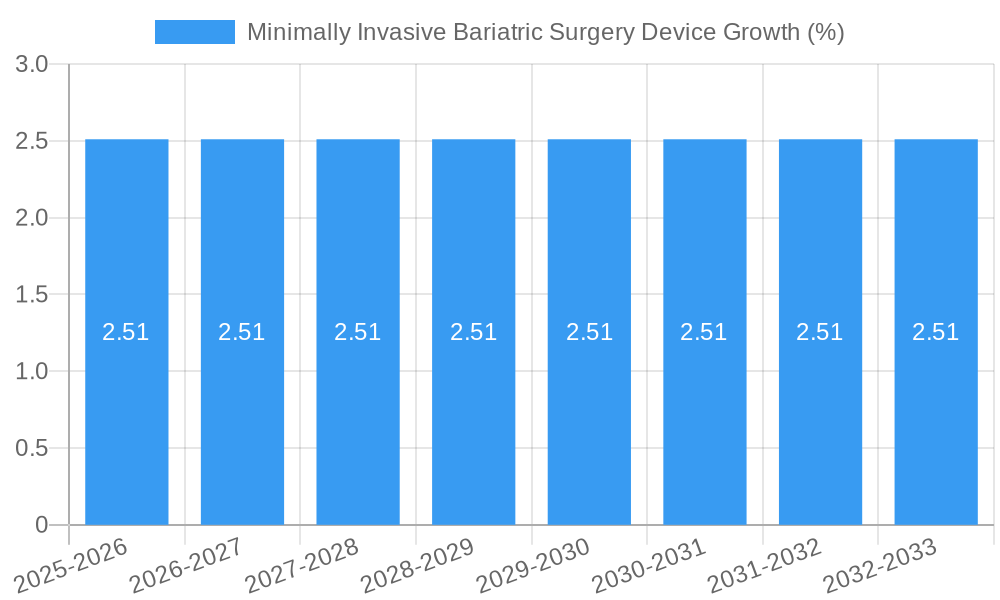

The global Minimally Invasive Bariatric Surgery Device market is projected to reach a substantial valuation of approximately $5,148.5 million by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 2.6%, indicating a steady and consistent expansion of the market. The primary drivers fueling this growth are the increasing prevalence of obesity and related co-morbidities globally, coupled with a rising patient and surgeon preference for minimally invasive procedures due to their associated benefits like reduced pain, shorter hospital stays, and faster recovery times. Technological advancements in surgical stapling, suturing, and vessel sealing devices are also playing a crucial role, enabling more precise and safer bariatric surgeries. The market is segmented by application, with hospitals representing the dominant segment due to their comprehensive surgical facilities and patient volume, followed by clinics. Within the device types, stapling devices are expected to hold a significant market share, followed by suturing and vessel sealing technologies, reflecting their established use and ongoing innovation in bariatric procedures.

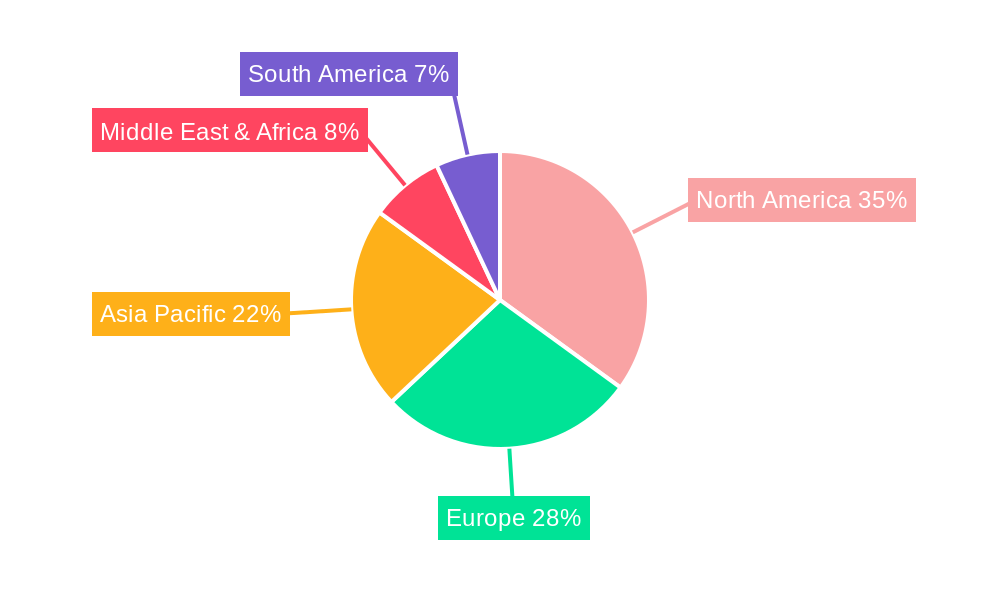

Several key trends are shaping the Minimally Invasive Bariatric Surgery Device landscape. The development of advanced robotic-assisted surgical systems is gaining traction, offering enhanced dexterity and visualization for surgeons, which in turn is driving demand for specialized bariatric robotic instruments. Furthermore, there's a growing focus on single-use and disposable devices to improve infection control and operational efficiency in surgical settings. The market is also witnessing increased research and development activities aimed at creating innovative devices for less invasive weight loss solutions, potentially expanding the patient pool eligible for such interventions. Geographically, North America is anticipated to lead the market, driven by high obesity rates, advanced healthcare infrastructure, and early adoption of new surgical technologies. Asia Pacific is poised for significant growth, fueled by increasing healthcare expenditure, growing awareness of bariatric surgery benefits, and a rising middle class seeking treatment for obesity. Despite the robust growth, certain restraints exist, including the high cost of advanced surgical devices and the need for specialized training for surgeons, which could temper the growth in some emerging markets.

Here is a comprehensive, SEO-optimized report description for Minimally Invasive Bariatric Surgery Devices, designed for immediate use without modification.

Minimally Invasive Bariatric Surgery Device Market Concentration & Innovation

The Minimally Invasive Bariatric Surgery Device market exhibits a moderate to high concentration, with key players like Johnson & Johnson, Medtronic plc, and Intuitive Surgical, Inc. dominating significant market shares estimated in the hundreds of millions. Innovation is a critical driver, fueled by advancements in robotic-assisted surgery, advanced stapling and suturing technologies, and improved vessel sealing techniques. These innovations are crucial for reducing patient recovery times and improving surgical outcomes. Regulatory frameworks, particularly those from the FDA and EMA, play a pivotal role in shaping market access and product approvals, influencing the pace of innovation. Product substitutes, while limited in direct replacement of surgical procedures, include less invasive endoscopic bariatric procedures and non-surgical weight loss interventions, which exert some competitive pressure. End-user trends are increasingly leaning towards patient preference for less invasive options, shorter hospital stays, and faster return to daily activities. Mergers and acquisitions (M&A) are ongoing, with recent deal values estimated in the tens of millions, consolidating market power and expanding product portfolios. For example, Apollo Endosurgery, Inc. has been a target for strategic partnerships. This dynamic landscape necessitates continuous R&D investment and strategic collaborations to maintain market leadership.

- Market Share Distribution: Estimated dominance by top 3 players in the billions.

- M&A Deal Values: Recent transactions in the tens of millions.

- Innovation Focus: Robotic surgery, advanced stapling, vessel sealing, endoscopic solutions.

- Regulatory Impact: Significant influence on product launches and market entry.

- End-User Demand: Growing preference for minimally invasive procedures.

Minimally Invasive Bariatric Surgery Device Industry Trends & Insights

The global Minimally Invasive Bariatric Surgery Device market is poised for substantial growth, driven by a confluence of escalating obesity rates, increasing awareness of bariatric surgery benefits, and rapid technological advancements. The market penetration of bariatric procedures, while still growing, is projected to accelerate significantly, with the Compound Annual Growth Rate (CAGR) estimated between 7% and 9% over the forecast period of 2025–2033. This robust growth is underpinned by several key market growth drivers. The rising global prevalence of obesity and related comorbidities such as type 2 diabetes, hypertension, and cardiovascular diseases is creating a compelling demand for effective and sustainable weight loss solutions. Minimally invasive bariatric surgery has emerged as a superior alternative to traditional open surgery, offering reduced pain, shorter hospital stays, faster recovery times, and lower risk of complications, thereby enhancing patient satisfaction and reducing healthcare costs.

Technological disruptions are at the forefront of this market's evolution. The integration of robotics in bariatric surgery, exemplified by companies like Intuitive Surgical, Inc., is transforming surgical precision, offering enhanced visualization, dexterity, and control for surgeons. This leads to more complex procedures being performed with greater ease and safety. Furthermore, innovations in disposable surgical instruments, including advanced stapling devices with improved staple line integrity and sophisticated vessel sealing technology, are continuously being introduced by manufacturers such as Medtronic plc and Johnson & Johnson. These advancements not only improve surgical outcomes but also contribute to greater efficiency in operating rooms.

Consumer preferences are increasingly shaped by the desire for less invasive interventions and quicker return to normal life. Patients are actively seeking procedures that minimize scarring and post-operative discomfort. This trend favors bariatric devices designed for endoscopic application and percutaneous techniques, expanding the market for companies like Apollo Endosurgery, Inc. and ReShape Lifesciences Inc. The perceived benefits of minimally invasive surgery, coupled with supportive healthcare policies and insurance coverage for bariatric procedures in many developed economies, further bolster consumer demand.

Competitive dynamics within the market are intensifying. Established giants are investing heavily in R&D and strategic acquisitions to maintain their competitive edge, while innovative smaller players are carving out niche markets with specialized technologies. Companies like Olympus Corporation are also contributing through their endoscopic solutions. The market landscape is characterized by a dynamic interplay of product differentiation, strategic partnerships, and the pursuit of regulatory approvals for novel devices. The focus is shifting towards developing integrated solutions that encompass pre-operative assessment, intra-operative guidance, and post-operative monitoring, thereby offering a comprehensive approach to obesity management. The projected market size for minimally invasive bariatric surgery devices is expected to reach several tens of billions of dollars by the end of the forecast period.

Dominant Markets & Segments in Minimally Invasive Bariatric Surgery Device

The Minimally Invasive Bariatric Surgery Device market demonstrates clear regional dominance, with North America, particularly the United States, leading in terms of market size, adoption rates, and technological innovation. This dominance is attributed to several key factors: a high prevalence of obesity, robust healthcare infrastructure, favorable reimbursement policies for bariatric surgeries, and a high concentration of leading medical device manufacturers and research institutions. Economic policies in the region actively support preventive healthcare and advanced medical treatments, making bariatric surgery a widely accessible and accepted solution for weight management. Furthermore, significant investments in healthcare research and development contribute to the continuous introduction and adoption of cutting-edge surgical technologies.

Within the application segment, Hospitals represent the dominant end-user market for minimally invasive bariatric surgery devices. This is due to several critical drivers:

- Infrastructure and Resources: Hospitals possess the necessary surgical suites, advanced equipment, and specialized medical staff required for complex bariatric procedures.

- Patient Volume: The concentration of patients seeking bariatric surgery in hospital settings is significantly higher than in standalone clinics.

- Reimbursement and Insurance: Bariatric surgeries performed in hospitals are generally well-covered by insurance providers, facilitating wider patient access.

- Multidisciplinary Care: Hospitals offer comprehensive, multidisciplinary teams including surgeons, dietitians, psychologists, and endocrinologists, essential for pre- and post-operative patient care, a crucial aspect of successful bariatric outcomes.

The Clinic segment, while currently smaller, is experiencing rapid growth, driven by the increasing demand for outpatient bariatric procedures and specialized weight management centers. These clinics often focus on specific types of minimally invasive procedures, leveraging advanced technologies for enhanced efficiency and patient convenience.

In terms of device Types, the Stapling segment currently holds the largest market share. This is directly linked to the prevalence of surgical procedures like gastric bypass and sleeve gastrectomy, which heavily rely on advanced stapling devices for creating secure and leak-proof anastomoses. Companies like Medtronic plc and Johnson & Johnson are key players in this segment, continuously innovating to improve staple line integrity and reduce complications.

The Suturing segment is also a significant contributor, with devices used for internal tissue approximation and reinforcement during various bariatric procedures. Innovations in barbed sutures and advanced suturing techniques enhance surgical efficiency and patient safety.

The Vessel Sealing segment, though potentially smaller in terms of device volume compared to stapling, is critical for hemostasis during surgery. Advanced energy-based devices that effectively seal blood vessels reduce operative bleeding and operative time. This segment is seeing rapid technological advancements, with companies striving for faster, more efficient, and safer sealing solutions. The growth in this segment is propelled by the increasing complexity of minimally invasive surgeries and the need to minimize blood loss.

Minimally Invasive Bariatric Surgery Device Product Developments

The Minimally Invasive Bariatric Surgery Device market is characterized by continuous product innovation aimed at enhancing surgical precision, patient safety, and procedural efficiency. Key developments include advancements in robotic-assisted surgical systems, offering surgeons enhanced dexterity and visualization for complex procedures. Novel stapling devices with improved staple line security and reduced tissue trauma are being introduced, alongside sophisticated energy-based devices for effective vessel sealing. Furthermore, there's a growing trend towards integrated solutions, combining diagnostic tools with therapeutic devices for a more holistic approach to obesity management. These innovations address unmet clinical needs, improve patient outcomes, and contribute to the market's competitive edge, ensuring better surgical fit and patient satisfaction.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Minimally Invasive Bariatric Surgery Device market, segmenting it by Application and Device Type. The Application segments include Hospital and Clinic, detailing their respective market sizes, growth projections, and competitive dynamics. The Hospital segment is expected to maintain its dominance due to advanced infrastructure and patient volumes, while the Clinic segment shows robust growth potential with the rise of specialized weight management centers.

The Types of devices analyzed are Stapling, Suturing, and Vessel Sealing. The Stapling segment is projected to lead the market, driven by its integral role in common bariatric procedures. The Suturing segment is vital for tissue approximation and exhibits steady growth. The Vessel Sealing segment is experiencing rapid technological advancements, promising enhanced surgical efficiency and reduced complications, with significant growth projections.

Key Drivers of Minimally Invasive Bariatric Surgery Device Growth

The growth of the Minimally Invasive Bariatric Surgery Device market is propelled by several significant factors. Primarily, the escalating global prevalence of obesity and its associated comorbidities is creating an unprecedented demand for effective weight management solutions, with bariatric surgery at the forefront. Technological advancements, including the integration of robotics in surgery, sophisticated stapling and suturing devices, and improved energy-based sealing technologies, are enhancing surgical outcomes and patient safety, thereby driving adoption. Favorable reimbursement policies and increasing insurance coverage for bariatric procedures in key markets also play a crucial role by improving accessibility. Furthermore, rising patient awareness and preference for less invasive surgical options, leading to shorter recovery times and reduced complications, are strong market catalysts.

Challenges in the Minimally Invasive Bariatric Surgery Device Sector

Despite robust growth, the Minimally Invasive Bariatric Surgery Device sector faces several challenges. High initial costs associated with advanced surgical devices, particularly robotic systems, can be a barrier to adoption for smaller healthcare facilities and in certain emerging economies. Stringent regulatory approval processes, while ensuring safety and efficacy, can lead to extended time-to-market for new innovations. Moreover, the availability of skilled surgeons proficient in minimally invasive bariatric techniques remains a limiting factor, necessitating significant investment in training and education. Economic downturns and healthcare budget constraints in some regions can also impact capital expenditure on advanced medical equipment.

Emerging Opportunities in Minimally Invasive Bariatric Surgery Device

Significant emerging opportunities exist within the Minimally Invasive Bariatric Surgery Device market. The growing adoption of bariatric surgery in emerging economies presents a substantial untapped market, driven by increasing disposable incomes and rising obesity rates. Advancements in endoscopic bariatric procedures, offering even less invasive options, are creating new product development avenues. The integration of artificial intelligence (AI) and machine learning in surgical planning and device guidance holds immense potential for improving personalized treatment outcomes. Furthermore, the development of novel bioabsorbable materials for sutures and staplers could lead to improved tissue healing and reduced long-term complications, opening new market frontiers.

Leading Players in the Minimally Invasive Bariatric Surgery Device Market

- Johnson & Johnson

- Medtronic plc

- Intuitive Surgical, Inc.

- Apollo Endosurgery, Inc.

- ReShape Lifesciences Inc

- Olympus Corporation

- Spatz Medical

- Cousin Biotech

- Mediflex Surgical Products

- COOK MEDICAL LLC

- B. Braun Melsungen AG

- Standard Bariatrics, Inc

- Richard Wolf GmbH

- Grena LTD

- Surgical Innovations Group plc

- Reach Surgical

- Shanghai Yisi Medical Technology Co.,Ltd

- Suzhou Yingtukang Medical Technology Co.,Ltd

- Zhejiang Tiansong Medical Instrument Co.,Ltd

- Hangzhou Kangji Medical Device Co.,Ltd

Key Developments in Minimally Invasive Bariatric Surgery Device Industry

- 2024: Launch of next-generation robotic surgical system with enhanced haptic feedback, improving surgeon precision for complex bariatric procedures.

- 2023: Introduction of a novel biodegradable stapler designed for improved tissue healing and reduced staple line complications.

- 2023: Strategic partnership formed to expand access to minimally invasive bariatric devices in Southeast Asian markets.

- 2022: FDA approval for a new endoscopic bariatric device targeting the growing market for non-surgical weight loss interventions.

- 2021: Acquisition of a specialized vessel sealing technology company to enhance energy-based device portfolio.

- 2020: Significant investment in R&D for AI-powered surgical navigation systems in bariatric surgery.

Strategic Outlook for Minimally Invasive Bariatric Surgery Device Market

The strategic outlook for the Minimally Invasive Bariatric Surgery Device market is exceptionally positive, driven by persistent global health challenges and continuous technological advancements. Key growth catalysts include the expanding demand for effective obesity management solutions, the increasing sophistication of robotic and endoscopic surgical platforms, and the growing trend towards patient-preferred less invasive procedures. Manufacturers are expected to focus on developing integrated solutions, enhancing device miniaturization, and expanding their reach into emerging markets. Strategic collaborations, R&D investments in novel technologies like AI-driven surgery, and a proactive approach to regulatory pathways will be crucial for sustained growth and market leadership. The market is poised for substantial expansion, offering significant opportunities for innovation and investment.

Minimally Invasive Bariatric Surgery Device Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

-

2. Types

- 2.1. Stapling

- 2.2. Suturing

- 2.3. Vessel Sealing

Minimally Invasive Bariatric Surgery Device Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Minimally Invasive Bariatric Surgery Device REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Minimally Invasive Bariatric Surgery Device Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Stapling

- 5.2.2. Suturing

- 5.2.3. Vessel Sealing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Minimally Invasive Bariatric Surgery Device Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Stapling

- 6.2.2. Suturing

- 6.2.3. Vessel Sealing

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Minimally Invasive Bariatric Surgery Device Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Stapling

- 7.2.2. Suturing

- 7.2.3. Vessel Sealing

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Minimally Invasive Bariatric Surgery Device Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Stapling

- 8.2.2. Suturing

- 8.2.3. Vessel Sealing

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Minimally Invasive Bariatric Surgery Device Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Stapling

- 9.2.2. Suturing

- 9.2.3. Vessel Sealing

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Minimally Invasive Bariatric Surgery Device Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Stapling

- 10.2.2. Suturing

- 10.2.3. Vessel Sealing

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Johnson & Johnson

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Medtronic plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intuitive Surgical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Apollo Endosurgery

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ReShape Lifesciences Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Olympus Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Spatz Medical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cousin Biotech

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mediflex Surgical Products

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 COOK MEDICAL LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 B. Braun Melsungen AG

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Standard Bariatrics

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Richard Wolf GmbH

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Grena LTD

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Surgical Innovations Group plc

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Reach Surgical

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Shanghai Yisi Medical Technology Co.

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Ltd

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Suzhou Yingtukang Medical Technology Co.

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Ltd

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Zhejiang Tiansong Medical Instrument Co.

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Ltd

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Hangzhou Kangji Medical Device Co.

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Ltd

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.1 Johnson & Johnson

List of Figures

- Figure 1: Global Minimally Invasive Bariatric Surgery Device Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Minimally Invasive Bariatric Surgery Device Revenue (million), by Application 2024 & 2032

- Figure 3: North America Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Minimally Invasive Bariatric Surgery Device Revenue (million), by Types 2024 & 2032

- Figure 5: North America Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Minimally Invasive Bariatric Surgery Device Revenue (million), by Country 2024 & 2032

- Figure 7: North America Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Minimally Invasive Bariatric Surgery Device Revenue (million), by Application 2024 & 2032

- Figure 9: South America Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Minimally Invasive Bariatric Surgery Device Revenue (million), by Types 2024 & 2032

- Figure 11: South America Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Minimally Invasive Bariatric Surgery Device Revenue (million), by Country 2024 & 2032

- Figure 13: South America Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Minimally Invasive Bariatric Surgery Device Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Minimally Invasive Bariatric Surgery Device Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Minimally Invasive Bariatric Surgery Device Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Minimally Invasive Bariatric Surgery Device Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Minimally Invasive Bariatric Surgery Device Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Minimally Invasive Bariatric Surgery Device Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Minimally Invasive Bariatric Surgery Device Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Minimally Invasive Bariatric Surgery Device Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Minimally Invasive Bariatric Surgery Device Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Minimally Invasive Bariatric Surgery Device Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Minimally Invasive Bariatric Surgery Device Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Minimally Invasive Bariatric Surgery Device Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Minimally Invasive Bariatric Surgery Device?

The projected CAGR is approximately 2.6%.

2. Which companies are prominent players in the Minimally Invasive Bariatric Surgery Device?

Key companies in the market include Johnson & Johnson, Medtronic plc, Intuitive Surgical, Inc, Apollo Endosurgery, Inc, ReShape Lifesciences Inc, Olympus Corporation, Spatz Medical, Cousin Biotech, Mediflex Surgical Products, COOK MEDICAL LLC, B. Braun Melsungen AG, Standard Bariatrics, Inc, Richard Wolf GmbH, Grena LTD, Surgical Innovations Group plc, Reach Surgical, Shanghai Yisi Medical Technology Co., Ltd, Suzhou Yingtukang Medical Technology Co., Ltd, Zhejiang Tiansong Medical Instrument Co., Ltd, Hangzhou Kangji Medical Device Co., Ltd.

3. What are the main segments of the Minimally Invasive Bariatric Surgery Device?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 5148.5 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Minimally Invasive Bariatric Surgery Device," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Minimally Invasive Bariatric Surgery Device report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Minimally Invasive Bariatric Surgery Device?

To stay informed about further developments, trends, and reports in the Minimally Invasive Bariatric Surgery Device, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence