Key Insights

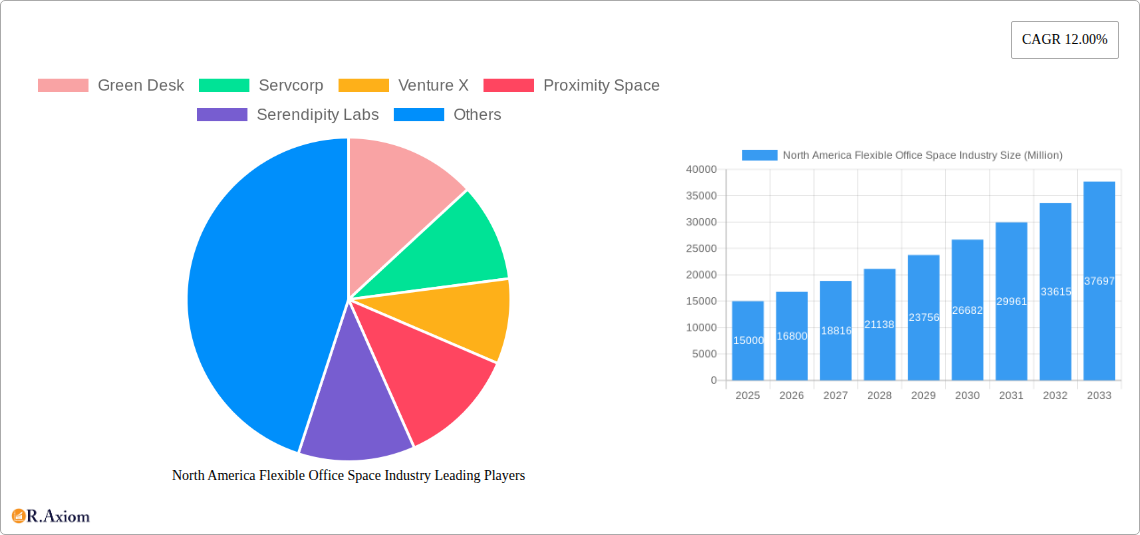

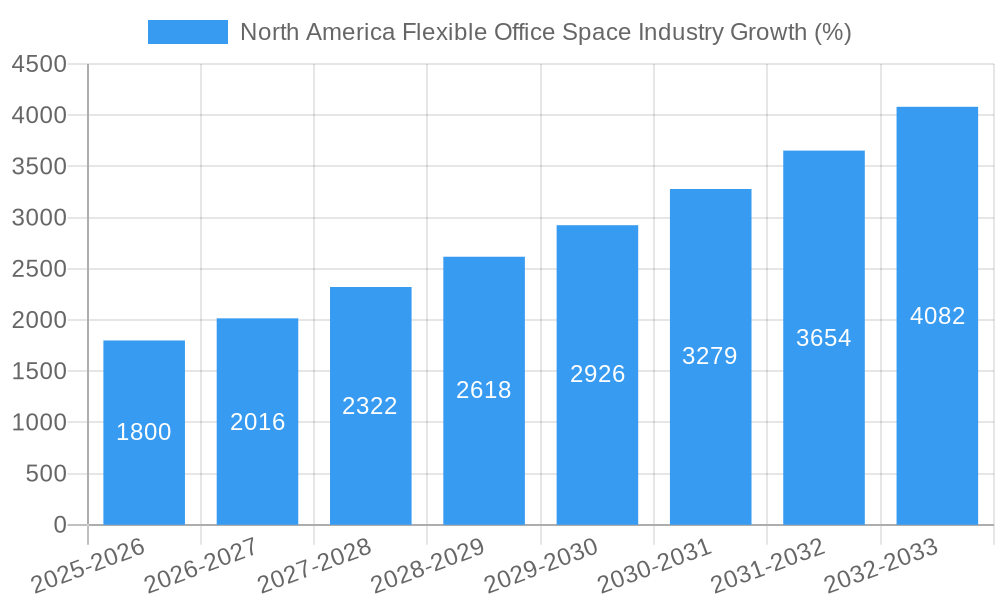

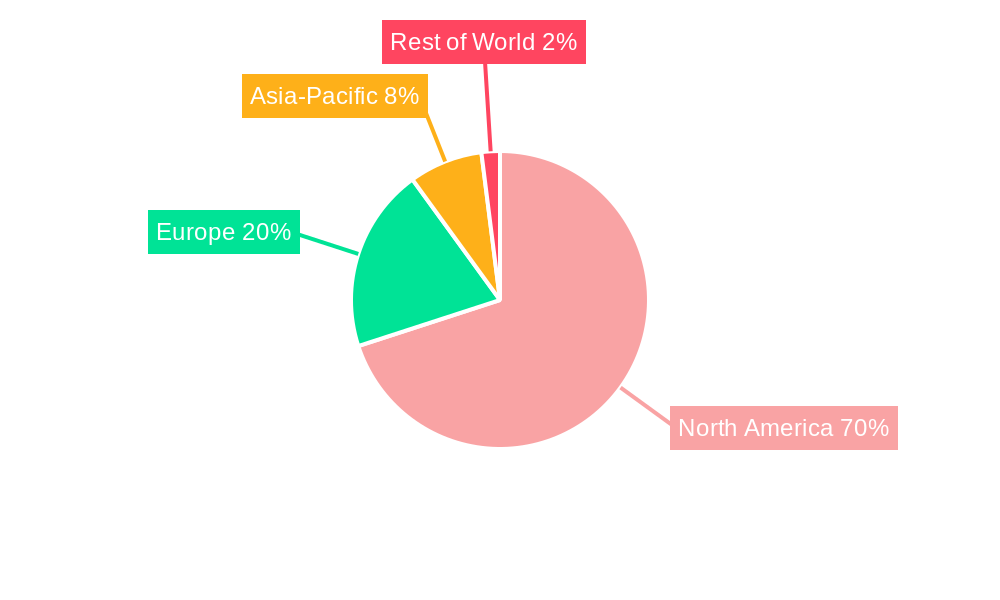

The North American flexible office space market, encompassing private offices, co-working spaces, and virtual offices, is experiencing robust growth, driven by the increasing adoption of hybrid work models and the demand for flexible and cost-effective workspace solutions. The market's value, estimated at $XX million in 2025, is projected to expand significantly over the forecast period (2025-2033), fueled by a Compound Annual Growth Rate (CAGR) of 12%. Key drivers include the rise of entrepreneurial ventures and startups, the preference for agile work arrangements among established corporations, and the need for businesses to optimize real estate costs. The IT and telecommunications sector, along with media and entertainment, are major end-user segments contributing substantially to market revenue. While the market faces restraints such as economic fluctuations and competition from traditional office spaces, the overall outlook remains positive, driven by technological advancements and evolving workplace dynamics. The United States, as the largest economy in North America, commands the lion's share of the market, followed by Canada and Mexico. Major players like WeWork, Regus, and Industrious are actively shaping the market landscape through strategic expansions and innovative service offerings. The increasing adoption of technology within flexible workspaces, such as smart building technology and virtual office solutions, is further accelerating the market's growth. Competition is intense, prompting companies to differentiate themselves through enhanced amenities, flexible lease terms, and premium service offerings.

The segmentation of the North American flexible office space market into private offices, co-working spaces, and virtual offices reflects diverse user preferences and business needs. Private offices cater to established businesses requiring dedicated and private work environments, while co-working spaces attract startups, freelancers, and smaller businesses seeking a collaborative atmosphere and cost-effective solutions. Virtual offices offer a cost-effective solution for businesses needing a professional address and business services without a physical office space. Geographical expansion continues, with a focus on major metropolitan areas offering high concentrations of businesses and skilled workers. Sustained growth is anticipated as more companies embrace flexible work arrangements and seek scalable workspace solutions to manage fluctuating workforce needs and maintain competitiveness in a dynamic business environment. The industry's success hinges on adapting to evolving workforce trends and delivering high-quality, technologically advanced, and cost-effective solutions that meet the demands of a modern and agile workforce.

North America Flexible Office Space Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the North America flexible office space industry, covering the period from 2019 to 2033. It offers invaluable insights into market trends, segment performance, competitive dynamics, and future growth potential, equipping stakeholders with actionable intelligence for strategic decision-making. The report leverages extensive primary and secondary research, incorporating data from key players like WeWork Inc, Industrious Office, Regus Corporation, Green Desk, Servcorp, Venture X, Proximity Space, Serendipity Labs, Knotel Inc, and Office Freedom (list not exhaustive), to deliver a robust and reliable assessment of this dynamic sector. The report forecasts a market value of xx Million by 2033.

North America Flexible Office Space Industry Market Concentration & Innovation

The North American flexible office space market exhibits a moderately concentrated landscape, with a few major players commanding significant market share. WeWork Inc, Regus Corporation, and Industrious Office currently hold the largest portions, estimated at xx%, xx%, and xx% respectively, in 2025. However, a diverse range of smaller players, including regional and specialized providers, contribute significantly to the overall market dynamism. The industry is characterized by continuous innovation driven by technological advancements (e.g., smart building technologies, booking platforms), evolving user preferences (demand for flexible lease terms and amenity-rich spaces), and regulatory changes (e.g., zoning regulations impacting space availability).

- Market Share: WeWork Inc (xx%), Regus (xx%), Industrious (xx%), Others (xx%).

- M&A Activity: The period 2019-2024 witnessed several significant mergers and acquisitions, with total deal values estimated at xx Million. These transactions primarily focused on consolidating market share and expanding geographical reach. The projected M&A activity for 2025-2033 is expected to be in the range of xx Million, driven by ongoing consolidation and the entry of new investors.

- Regulatory Framework: Zoning regulations and building codes vary across North American regions, influencing the availability and cost of flexible office space. Furthermore, evolving labor laws impact employment practices within these spaces.

- Product Substitutes: Remote work and traditional office leases remain primary substitutes, but the increasing demand for flexibility and collaborative work environments continues to bolster the flexible office space market.

North America Flexible Office Space Industry Industry Trends & Insights

The North American flexible office space market is experiencing robust growth, fueled by several key trends. The increasing adoption of hybrid work models and the rise of the gig economy have significantly boosted demand for flexible workspaces. Technological advancements like online booking platforms and smart office solutions are enhancing user experience and operational efficiency. Changing employee preferences, emphasizing work-life balance and collaborative environments, further drive market expansion.

The Compound Annual Growth Rate (CAGR) for the period 2019-2024 is estimated at xx%, while the projected CAGR for 2025-2033 is xx%. Market penetration is expected to increase from xx% in 2025 to xx% by 2033, primarily due to increasing awareness and adoption among businesses of all sizes. Competitive dynamics are marked by intense rivalry among established players and the emergence of innovative startups. This leads to continuous improvement in service offerings, pricing strategies, and technological integration.

Dominant Markets & Segments in North America Flexible Office Space Industry

The major metropolitan areas in the US and Canada such as New York, San Francisco, Toronto, and Chicago continue to dominate the flexible office space market. These regions benefit from robust economies, a high concentration of businesses, and strong infrastructure.

- By Type: Co-working spaces currently represent the largest segment, driven by their affordability and collaborative features. Private offices cater to businesses seeking greater privacy and customized solutions. Virtual offices provide cost-effective solutions for entrepreneurs and smaller businesses.

- By End-User: The IT and Telecommunications sector, along with Media and Entertainment, are significant drivers of growth, showing a high propensity to adopt flexible office solutions. Retail and consumer goods companies are also increasingly utilizing these spaces for satellite offices and pop-up stores.

Key Drivers for Dominant Markets:

- Robust Economic Activity: Strong economic growth fuels demand for office space.

- Developed Infrastructure: Efficient transportation networks and reliable internet connectivity are essential.

- Favorable Regulatory Environment: Supportive policies and streamlined approvals processes contribute to growth.

- High Concentration of Businesses: A large pool of potential customers drives demand.

North America Flexible Office Space Industry Product Developments

Recent product innovations focus on enhancing the user experience and incorporating technology to optimize space utilization. Smart building technologies, including integrated booking systems, environmental controls, and security features, are becoming increasingly prevalent. The integration of collaborative tools and communication platforms within the workspace enhances productivity and fosters teamwork. These advancements offer competitive advantages by attracting and retaining clients seeking advanced and efficient work environments, seamlessly integrating with their existing digital workflows.

Report Scope & Segmentation Analysis

This report segments the North American flexible office space market by type (private offices, co-working space, virtual offices) and end-user (IT and Telecommunications, Media and Entertainment, Retail and consumer goods).

- By Type: Private offices are projected to witness xx% growth from 2025-2033, driven by businesses prioritizing privacy and customization. Co-working spaces, with a projected xx% growth, remain the largest segment due to affordability and collaborative features. Virtual offices offer the most cost-effective solution, projected to grow at xx%.

- By End-User: The IT and Telecommunications sector is expected to lead in growth, followed by Media and Entertainment and Retail and consumer goods. The competitive landscape varies by segment, with intense competition in co-working spaces and more niche competition in private offices and virtual office solutions. Market sizes for each segment are detailed within the full report.

Key Drivers of North America Flexible Office Space Industry Growth

Several factors fuel the growth of the North American flexible office space market. Technological advancements, like online booking platforms and smart office technologies, enhance efficiency and user experience. The rise of the gig economy and hybrid work models increase the demand for flexible work arrangements. Favorable economic conditions and government support for entrepreneurship further stimulate market expansion. Finally, the increasing preference for collaborative work environments and the pursuit of work-life balance among employees contribute significantly to this growth.

Challenges in the North America Flexible Office Space Industry Sector

The industry faces challenges, including high initial investment costs for setting up flexible workspaces, fluctuating demand impacting occupancy rates, intense competition from established players and new entrants, and dependence on strong economic conditions. Additionally, evolving regulatory frameworks and unforeseen economic downturns pose potential risks. The impact of these challenges can be seen in profit margins and the overall stability of certain players within the market.

Emerging Opportunities in North America Flexible Office Space Industry

Emerging opportunities lie in the expansion into underserved markets, incorporating sustainable and eco-friendly designs in flexible workspaces, and offering specialized spaces catering to specific industries. The integration of advanced technologies, such as AI-powered solutions for space management and personalized work experiences, presents significant growth potential. Furthermore, focusing on wellness initiatives and creating vibrant community spaces within flexible work environments can create a competitive edge.

Leading Players in the North America Flexible Office Space Industry Market

- Green Desk

- Servcorp

- Venture X

- Proximity Space

- Serendipity Labs

- Knotel Inc

- Office Freedom

- WeWork Inc

- Industrious Office

- Regus Corporation

Key Developments in North America Flexible Office Space Industry Industry

- 2022 Q4: WeWork announces a new sustainability initiative, impacting its brand image and attracting environmentally conscious clients.

- 2023 Q1: Regus expands its presence in secondary cities across North America.

- 2023 Q2: A major co-working space provider in Canada is acquired by a global real estate firm.

- 2024 Q3: Several new flexible office space providers launch innovative technological solutions for workspace management.

Strategic Outlook for North America Flexible Office Space Industry Market

The North American flexible office space market is poised for continued growth, driven by sustained demand for flexible work arrangements, technological advancements, and evolving employee preferences. Strategic investments in technology, sustainable practices, and community building will be crucial for success. Expansion into secondary markets and specialization within specific industries offer significant opportunities. The long-term potential for this sector remains strong, with significant market expansion expected throughout the forecast period.

North America Flexible Office Space Industry Segmentation

-

1. Type

- 1.1. Private offices

- 1.2. Co-working space

- 1.3. Virtual offices

-

2. End User

- 2.1. IT and Telecommunications

- 2.2. Media and Entertainment

- 2.3. Retail and consumer goods

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Flexible Office Space Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Flexible Office Space Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise in e-commerce and digitalization

- 3.3. Market Restrains

- 3.3.1. The Complexity of regulations and property ownership

- 3.4. Market Trends

- 3.4.1. Increase in Office Space Vacancy Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Private offices

- 5.1.2. Co-working space

- 5.1.3. Virtual offices

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecommunications

- 5.2.2. Media and Entertainment

- 5.2.3. Retail and consumer goods

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Private offices

- 6.1.2. Co-working space

- 6.1.3. Virtual offices

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. IT and Telecommunications

- 6.2.2. Media and Entertainment

- 6.2.3. Retail and consumer goods

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Private offices

- 7.1.2. Co-working space

- 7.1.3. Virtual offices

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. IT and Telecommunications

- 7.2.2. Media and Entertainment

- 7.2.3. Retail and consumer goods

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Private offices

- 8.1.2. Co-working space

- 8.1.3. Virtual offices

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. IT and Telecommunications

- 8.2.2. Media and Entertainment

- 8.2.3. Retail and consumer goods

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Private offices

- 9.1.2. Co-working space

- 9.1.3. Virtual offices

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. IT and Telecommunications

- 9.2.2. Media and Entertainment

- 9.2.3. Retail and consumer goods

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. United States North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Flexible Office Space Industry Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Green Desk

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Servcorp

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Venture X

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Proximity Space

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Serendipity Labs

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Knotel Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Office Freedom**List Not Exhaustive

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Wework Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Industrious Office

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Regus Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Green Desk

List of Figures

- Figure 1: North America Flexible Office Space Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Flexible Office Space Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Flexible Office Space Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Flexible Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Flexible Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: North America Flexible Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Flexible Office Space Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Flexible Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Flexible Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Flexible Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Flexible Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Flexible Office Space Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Flexible Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Flexible Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 13: North America Flexible Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Flexible Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Flexible Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: North America Flexible Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 17: North America Flexible Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Flexible Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Flexible Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: North America Flexible Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 21: North America Flexible Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Flexible Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: North America Flexible Office Space Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: North America Flexible Office Space Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 25: North America Flexible Office Space Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Flexible Office Space Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Flexible Office Space Industry?

The projected CAGR is approximately 12.00%.

2. Which companies are prominent players in the North America Flexible Office Space Industry?

Key companies in the market include Green Desk, Servcorp, Venture X, Proximity Space, Serendipity Labs, Knotel Inc, Office Freedom**List Not Exhaustive, Wework Inc, Industrious Office, Regus Corporation.

3. What are the main segments of the North America Flexible Office Space Industry?

The market segments include Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise in e-commerce and digitalization.

6. What are the notable trends driving market growth?

Increase in Office Space Vacancy Rate.

7. Are there any restraints impacting market growth?

The Complexity of regulations and property ownership.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Flexible Office Space Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Flexible Office Space Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Flexible Office Space Industry?

To stay informed about further developments, trends, and reports in the North America Flexible Office Space Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence