Key Insights

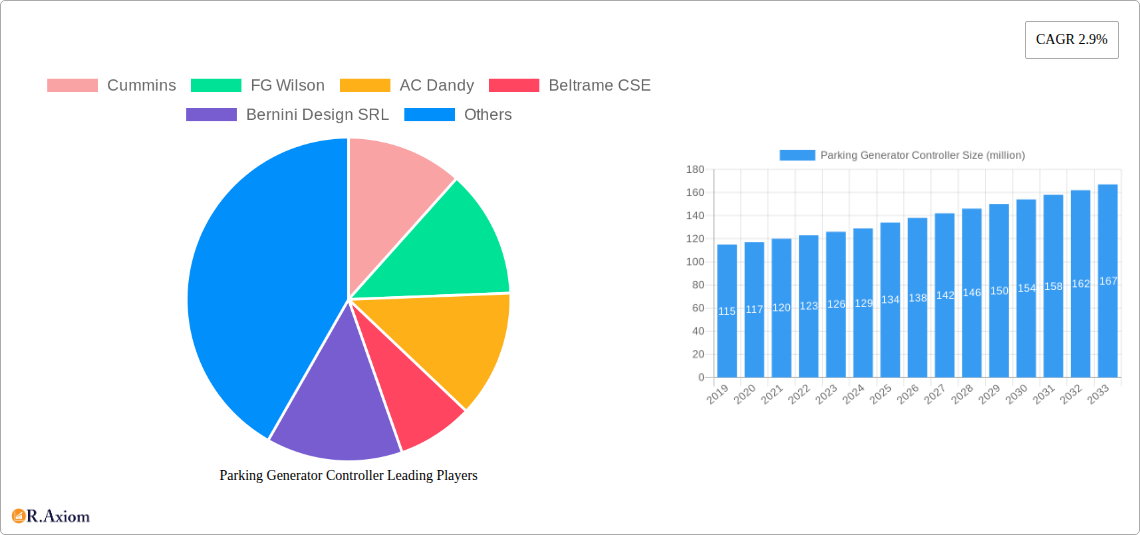

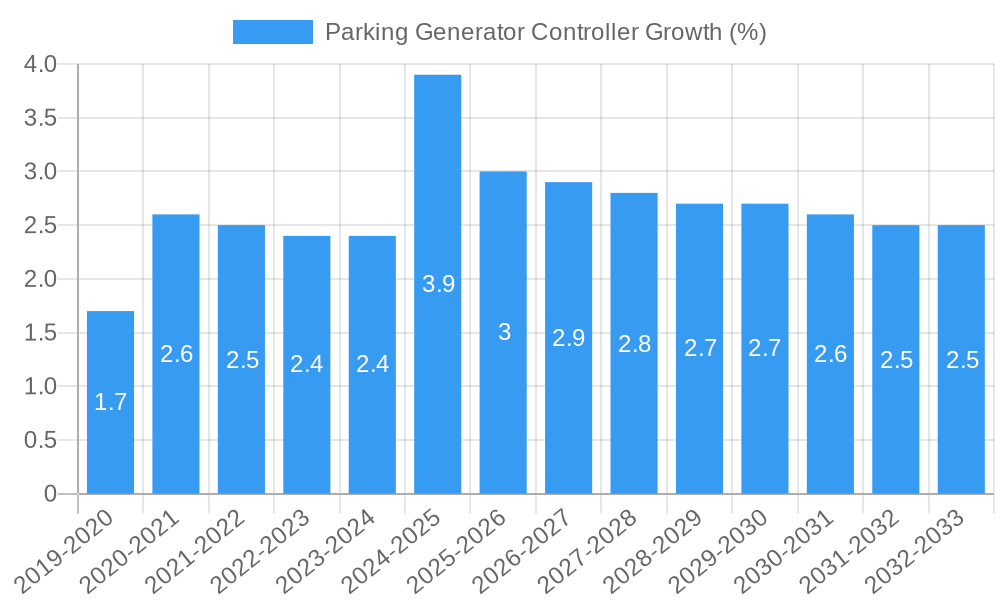

The global Parking Generator Controller market is poised for steady expansion, projected to reach a significant valuation by 2033. The market, currently valued at $134 million in 2025, is expected to grow at a Compound Annual Growth Rate (CAGR) of 2.9% over the forecast period. This consistent growth is primarily driven by the escalating demand for reliable backup power solutions across various sectors, particularly in commercial and special vehicle applications. The increasing adoption of automatic control systems, offering enhanced efficiency and user convenience, is a key trend shaping the market landscape. Furthermore, the ongoing need to ensure uninterrupted operations in critical infrastructure and a growing emphasis on remote monitoring and control capabilities are further fueling market expansion. The market’s expansion is also supported by advancements in generator control technology, leading to more intelligent and integrated solutions.

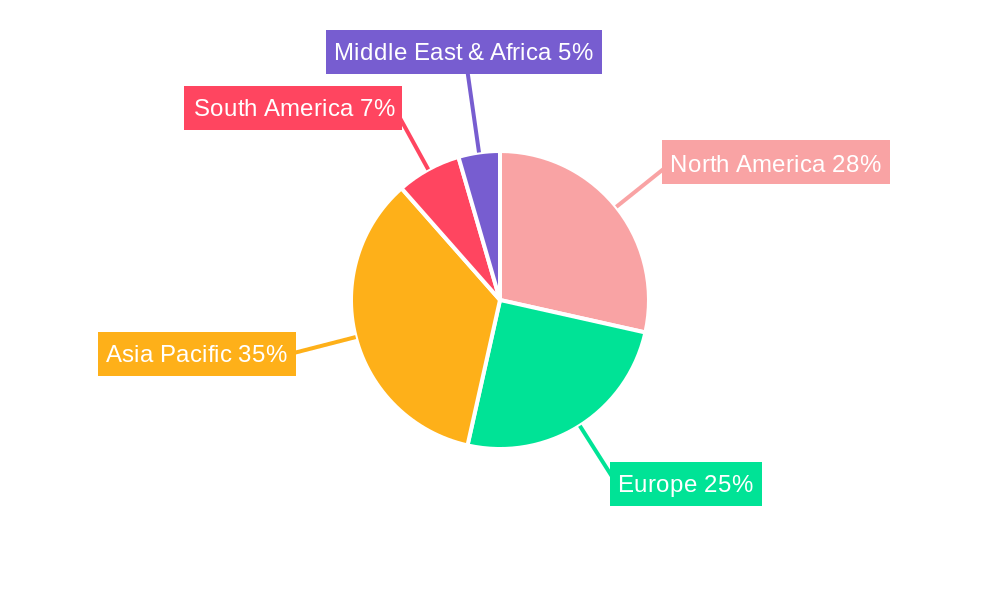

The market's trajectory is further influenced by a diverse range of factors, including evolving regulatory landscapes concerning emissions and power reliability, and a gradual shift towards more sophisticated generator management systems. While the overall outlook is positive, certain restraints, such as the initial cost of advanced controller systems and the complexity of integration with existing infrastructure, may pose challenges. However, the increasing awareness of the long-term benefits, including reduced operational costs and improved system longevity, is expected to mitigate these concerns. The Asia Pacific region, driven by rapid industrialization and a burgeoning automotive sector, is anticipated to emerge as a dominant force, followed by North America and Europe, which benefit from mature markets and a strong emphasis on technological adoption. Key industry players are actively engaged in research and development to introduce innovative features and expand their global footprint, ensuring the continued evolution and robustness of the Parking Generator Controller market.

This in-depth report provides a thorough analysis of the global Parking Generator Controller market, covering market concentration, industry trends, dominant segments, product developments, key drivers, challenges, emerging opportunities, and a strategic outlook. Covering the historical period from 2019–2024 and extending through the forecast period of 2025–2033, with a base year of 2025, this report offers actionable insights for stakeholders seeking to understand and navigate this dynamic sector.

Parking Generator Controller Market Concentration & Innovation

The Parking Generator Controller market exhibits a moderate level of concentration, with a mix of large, established players and emerging niche manufacturers. Innovation is a key differentiator, driven by the increasing demand for intelligent power management solutions, remote monitoring capabilities, and enhanced safety features. Regulatory frameworks, particularly concerning emissions and operational efficiency, are also shaping product development and market entry strategies. The presence of product substitutes, such as integrated battery storage systems and advanced grid connectivity, necessitates continuous innovation from parking generator controller manufacturers to maintain market share. End-user trends are leaning towards greater automation, predictive maintenance, and seamless integration with existing infrastructure. Mergers and acquisitions (M&A) activities are expected to increase as companies seek to expand their product portfolios, gain technological expertise, and broaden their geographical reach. Deal values in the past two years are estimated to be in the hundreds of millions, with strategic acquisitions focusing on companies with cutting-edge IoT integration and advanced control algorithms.

Key Innovation Drivers:

- IoT and AI-powered remote monitoring and diagnostics.

- Advanced energy management and load balancing algorithms.

- Enhanced cybersecurity features for connected controllers.

- Integration with renewable energy sources and smart grid technologies.

- Compact and robust designs for diverse vehicle and specialty applications.

Market Share Dynamics:

- The top five players are estimated to hold approximately 45% of the global market share in 2025.

- Emerging players are carving out significant niches by focusing on specialized applications and customized solutions.

M&A Activity:

- Anticipated M&A deal values to exceed one billion over the forecast period.

- Focus on acquiring companies with expertise in software development and smart grid integration.

Parking Generator Controller Industry Trends & Insights

The global Parking Generator Controller market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This robust expansion is fueled by a confluence of technological advancements, evolving end-user demands, and the increasing complexity of power management requirements across various applications. The market penetration of advanced parking generator control systems is steadily rising, driven by the recognized benefits of enhanced operational efficiency, reduced downtime, and optimized fuel consumption. Technological disruptions, particularly in the realm of the Internet of Things (IoT) and artificial intelligence (AI), are revolutionizing how parking generator controllers are designed, operated, and maintained. These technologies enable real-time monitoring, predictive maintenance, and remote diagnostics, offering unprecedented levels of control and visibility. Consumer preferences are shifting towards smart, automated, and integrated solutions that minimize manual intervention and maximize system reliability. This is evident in the growing demand for controllers that can seamlessly communicate with other vehicle systems and infrastructure. The competitive dynamics within the industry are characterized by both intense price competition and a strong emphasis on innovation and value-added services. Leading manufacturers are investing heavily in research and development to introduce next-generation controllers that offer superior performance, greater connectivity, and enhanced user experience. The increasing adoption of electric vehicles and the growing need for reliable backup power in commercial and specialized applications further bolster the market's growth trajectory. The market is also witnessing a trend towards more sustainable and energy-efficient solutions, with manufacturers exploring ways to optimize generator performance and reduce their environmental impact. Furthermore, the development of modular and scalable controller systems is catering to the diverse needs of various customer segments.

Market Growth Drivers:

- Increasing adoption of sophisticated power management systems in commercial and specialty vehicles.

- Demand for reliable backup power solutions in critical infrastructure and remote locations.

- Technological advancements in IoT, AI, and cloud computing enabling smart control functionalities.

- Growing awareness of energy efficiency and the need to optimize generator fuel consumption.

- Stringent regulatory mandates for emissions control and operational reliability.

Market Penetration:

- Estimated market penetration of advanced automatic control systems to reach 60% by 2030.

- Increasing adoption in fleets and critical power applications.

CAGR:

- Projected CAGR of 7.5% for the period 2025–2033.

Dominant Markets & Segments in Parking Generator Controller

The global Parking Generator Controller market is characterized by distinct regional strengths and segment dominance, with Asia-Pacific emerging as the leading region due to its robust manufacturing base and rapidly expanding industrial and commercial sectors. Within this region, China is a particularly strong contender, driven by significant investments in infrastructure development, a burgeoning automotive industry, and a growing demand for reliable power solutions across various applications. Economic policies promoting industrial growth and technological adoption further bolster the market's performance in this area. The Commercial Vehicles segment is a dominant application area, encompassing trucks, buses, recreational vehicles, and logistics fleets, all of which rely heavily on dependable generator power for extended operations and auxiliary functions. The growing global trade and e-commerce sector directly fuels the demand for efficient logistics and transportation, thereby driving the need for advanced parking generator controllers in this segment. Special Vehicles, including emergency response vehicles, construction equipment, and mobile command centers, also represent a significant and growing segment. These vehicles often require highly specialized and robust generator control systems to ensure uninterrupted operation in critical situations. The "Others" category, encompassing stationary backup power for commercial buildings, remote construction sites, and temporary power installations, also contributes substantially to market demand.

In terms of control type, the Automatic Control segment is witnessing faster growth and is projected to become increasingly dominant over the Manual Control segment. This shift is driven by the advantages of automatic systems, including enhanced safety, optimized fuel efficiency, reduced human error, and the ability to integrate with sophisticated monitoring and diagnostic platforms. The increasing complexity of modern vehicles and infrastructure, coupled with the need for seamless power management, further accelerates the adoption of automatic control solutions. The technological advancements in remote monitoring, predictive maintenance, and intelligent load balancing are key enablers of this trend. The competitive landscape within these dominant segments is dynamic, with manufacturers striving to offer tailored solutions that meet the specific performance and regulatory requirements of each application. The development of intelligent controllers that can adapt to varying power demands and environmental conditions is crucial for success.

Dominant Region:

- Asia-Pacific: Driven by China, India, and Southeast Asian nations.

- Key Drivers: Rapid industrialization, strong automotive manufacturing, significant infrastructure development projects, and increasing adoption of smart technologies.

- Market Size: Estimated to contribute over 35% of the global market revenue in 2025.

- Asia-Pacific: Driven by China, India, and Southeast Asian nations.

Dominant Application Segment:

- Commercial Vehicles:

- Key Drivers: Growth in logistics and transportation, increasing demand for auxiliary power in RVs and commercial fleets, and strict operational uptime requirements.

- Market Size: Expected to represent a significant share of the market, with an estimated 40% of the total application segment revenue in 2025.

- Commercial Vehicles:

Dominant Control Type:

- Automatic Control:

- Key Drivers: Enhanced safety features, improved fuel efficiency, reduced operational costs, integration with IoT and AI for remote management, and increasing complexity of power needs.

- Market Share Growth: Projected to grow at a higher CAGR than Manual Control, accounting for over 55% of the market by 2030.

- Automatic Control:

Parking Generator Controller Product Developments

The Parking Generator Controller market is witnessing a wave of innovative product developments focused on enhancing performance, connectivity, and user experience. Companies are introducing controllers with advanced features such as intelligent diagnostics, predictive maintenance capabilities leveraging AI algorithms, and seamless integration with cloud-based monitoring platforms. These innovations aim to improve system reliability, reduce downtime, and optimize operational efficiency for end-users. The development of compact and modular controller designs is also a key trend, allowing for easier installation and greater adaptability to diverse vehicle and application requirements. Furthermore, manufacturers are focusing on robust cybersecurity measures to protect connected controllers from unauthorized access and data breaches. These product developments are driven by the evolving needs of the commercial vehicle, special vehicle, and other application segments, offering significant competitive advantages in terms of enhanced functionality and cost-effectiveness.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Parking Generator Controller market segmented by Application and Type. The Application segments include Commercial Vehicles, Special Vehicles, and Others. The Type segments cover Manual Control and Automatic Control.

Commercial Vehicles Segment: This segment encompasses parking generator controllers used in trucks, buses, delivery vans, and recreational vehicles. It is driven by the need for reliable auxiliary power for onboard systems and extended operational capabilities. Projected market size for this segment is approximately one billion, with an estimated CAGR of 8% during the forecast period.

Special Vehicles Segment: This segment includes controllers for emergency vehicles, construction equipment, military vehicles, and other specialized applications requiring robust and reliable power solutions. The demand is driven by critical operational needs and stringent performance requirements. The market size for this segment is estimated at several hundred million, with a projected CAGR of 7%.

Others Segment: This segment covers applications such as portable generators for events, temporary power solutions for construction sites, and backup power for remote infrastructure. Its growth is influenced by infrastructure development and the increasing need for reliable off-grid power. The market size is anticipated to be in the hundreds of millions, with a CAGR of 6.5%.

Manual Control Segment: This segment includes traditional parking generator controllers that require direct human intervention for operation and monitoring. While still relevant, its growth is slower compared to automatic systems. The market size is projected to be in the hundreds of millions, with a CAGR of 4%.

Automatic Control Segment: This segment features advanced controllers that automate generator operation, load management, and diagnostics. It is driven by technological advancements and the demand for efficiency and remote management. The market size is substantial, estimated to be over one billion, with a strong CAGR of 9% projected for the forecast period.

Key Drivers of Parking Generator Controller Growth

The growth of the Parking Generator Controller market is propelled by several key factors, including the escalating demand for uninterrupted power in the logistics and transportation sector, necessitating reliable generator systems in commercial vehicles. Furthermore, the increasing adoption of sophisticated power management solutions in specialty vehicles, such as emergency response units and mobile command centers, is a significant growth catalyst. Technological advancements, particularly in IoT, AI, and cloud computing, are enabling the development of smart, remotely manageable, and highly efficient generator controllers. Government initiatives promoting energy efficiency and stricter emissions regulations are also driving the adoption of advanced control systems that optimize fuel consumption and reduce environmental impact. The expanding global trade and e-commerce landscape necessitates more robust and reliable transportation fleets, thereby increasing the demand for advanced generator controllers.

- Technological Advancements: Integration of IoT, AI, and cloud connectivity for remote monitoring, diagnostics, and predictive maintenance.

- Increasing Demand for Reliable Power: Essential for commercial vehicles, specialty vehicles, and critical infrastructure.

- Energy Efficiency and Emission Regulations: Driving the adoption of controllers that optimize fuel consumption and minimize environmental impact.

- Growth in Logistics and Transportation: Fueling the need for dependable power solutions in commercial fleets.

Challenges in the Parking Generator Controller Sector

Despite the promising growth trajectory, the Parking Generator Controller sector faces several challenges. Stringent and evolving regulatory frameworks concerning emissions and safety standards can pose compliance hurdles for manufacturers, requiring significant investment in research and development. Supply chain disruptions, particularly for critical electronic components, can impact production timelines and increase costs. Intense competition among market players can lead to price pressures, affecting profit margins. Furthermore, the initial cost of advanced automatic control systems can be a barrier to adoption for smaller businesses or in price-sensitive markets. Cybersecurity concerns related to connected controllers are also a growing apprehension, requiring robust security protocols and ongoing vigilance.

- Regulatory Hurdles: Compliance with evolving emissions and safety standards can be complex and costly.

- Supply Chain Volatility: Disruptions in the availability of key electronic components can affect production and pricing.

- Price Sensitivity: High initial costs of advanced automatic controllers can be a deterrent in certain market segments.

- Cybersecurity Risks: Protecting connected controllers from cyber threats requires constant vigilance and investment in security measures.

Emerging Opportunities in Parking Generator Controller

The Parking Generator Controller market presents a wealth of emerging opportunities. The rapid growth of the electric vehicle (EV) charging infrastructure creates a demand for reliable backup power solutions, where generator controllers can play a crucial role. The increasing trend towards remote work and decentralized operations is boosting the need for portable and reliable generator power in various sectors, including construction and events. Advancements in battery management systems and their integration with generator controllers offer opportunities for hybrid power solutions that enhance efficiency and reduce emissions. The development of smart city initiatives and the growing demand for autonomous systems in logistics and transportation will further drive the need for intelligent and automated power management. The focus on sustainable energy solutions also opens avenues for controllers that can seamlessly integrate with renewable energy sources, such as solar and wind power, to create hybrid power systems.

- EV Charging Infrastructure: Providing reliable backup power for charging stations.

- Hybrid Power Solutions: Integration with battery storage systems for enhanced efficiency and reduced emissions.

- Smart City and Autonomous Systems: Enabling intelligent power management for future urban and logistical networks.

- Remote and Portable Power Needs: Catering to the growing demand for off-grid power in various applications.

Leading Players in the Parking Generator Controller Market

- Cummins

- FG Wilson

- AC Dandy

- Beltrame CSE

- Bernini Design SRL

- Bruno Generators

- Brush HMA

- Cre Technology

- Deif

- Kohler Power Systems

- Kutai Electronics Industry Co., Ltd

- Meagacon AS

- S.I.C.E.S

- Tecnoelettra

- Wuxi JLC Technology

- SmartGen

- Sicote

- Lincontrol

Key Developments in Parking Generator Controller Industry

- 2023: Launch of AI-powered predictive maintenance features by several key players, significantly reducing unexpected downtime.

- 2023: Increased strategic partnerships focused on IoT integration and cloud-based fleet management solutions.

- 2022: Introduction of enhanced cybersecurity protocols for connected generator controllers to address growing security concerns.

- 2021: Acquisitions of smaller technology firms specializing in advanced control algorithms and software development.

- 2020: Significant product redesigns focusing on compact, modular, and energy-efficient controllers for specialized vehicles.

Strategic Outlook for Parking Generator Controller Market

The strategic outlook for the Parking Generator Controller market remains highly positive, driven by sustained technological innovation and increasing global demand for reliable and efficient power solutions. The continued integration of IoT and AI technologies will be pivotal, enabling advanced remote monitoring, diagnostics, and predictive maintenance capabilities. Manufacturers focusing on developing smart, connected, and energy-efficient controllers will be well-positioned to capitalize on market opportunities. The growing demand for hybrid power solutions and the integration with renewable energy sources present significant avenues for future growth. Strategic collaborations, mergers, and acquisitions will likely continue as companies seek to expand their market reach, enhance their technological prowess, and offer comprehensive power management solutions. The emphasis on cybersecurity will remain paramount, requiring continuous investment in robust security measures. The market's future success will be dictated by the ability to adapt to evolving regulatory landscapes and to anticipate the future power needs of an increasingly digitized and electrified world.

Parking Generator Controller Segmentation

-

1. Application

- 1.1. Commercial Vehicles

- 1.2. Special Vehicles

- 1.3. Others

-

2. Type

- 2.1. Manual Control

- 2.2. Automatic Control

Parking Generator Controller Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Parking Generator Controller REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.9% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Parking Generator Controller Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Vehicles

- 5.1.2. Special Vehicles

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Manual Control

- 5.2.2. Automatic Control

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Parking Generator Controller Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Vehicles

- 6.1.2. Special Vehicles

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Manual Control

- 6.2.2. Automatic Control

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Parking Generator Controller Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Vehicles

- 7.1.2. Special Vehicles

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Manual Control

- 7.2.2. Automatic Control

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Parking Generator Controller Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Vehicles

- 8.1.2. Special Vehicles

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Manual Control

- 8.2.2. Automatic Control

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Parking Generator Controller Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Vehicles

- 9.1.2. Special Vehicles

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Manual Control

- 9.2.2. Automatic Control

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Parking Generator Controller Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Vehicles

- 10.1.2. Special Vehicles

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Manual Control

- 10.2.2. Automatic Control

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cummins

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FG Wilson

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AC Dandy

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Beltrame CSE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bernini Design SRL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bruno Generators

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Brush HMA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cre Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Deif

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kohler Power Systems

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kutai Electronics Industry Co. Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Meagacon AS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 S.I.C.E.S

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Tecnoelettra

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Wuxi JLC Technology

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 SmartGen

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Sicote

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Lincontrol

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Cummins

List of Figures

- Figure 1: Global Parking Generator Controller Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Parking Generator Controller Revenue (million), by Application 2024 & 2032

- Figure 3: North America Parking Generator Controller Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Parking Generator Controller Revenue (million), by Type 2024 & 2032

- Figure 5: North America Parking Generator Controller Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Parking Generator Controller Revenue (million), by Country 2024 & 2032

- Figure 7: North America Parking Generator Controller Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Parking Generator Controller Revenue (million), by Application 2024 & 2032

- Figure 9: South America Parking Generator Controller Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Parking Generator Controller Revenue (million), by Type 2024 & 2032

- Figure 11: South America Parking Generator Controller Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Parking Generator Controller Revenue (million), by Country 2024 & 2032

- Figure 13: South America Parking Generator Controller Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Parking Generator Controller Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Parking Generator Controller Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Parking Generator Controller Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Parking Generator Controller Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Parking Generator Controller Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Parking Generator Controller Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Parking Generator Controller Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Parking Generator Controller Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Parking Generator Controller Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Parking Generator Controller Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Parking Generator Controller Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Parking Generator Controller Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Parking Generator Controller Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Parking Generator Controller Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Parking Generator Controller Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Parking Generator Controller Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Parking Generator Controller Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Parking Generator Controller Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Parking Generator Controller Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Parking Generator Controller Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Parking Generator Controller Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Parking Generator Controller Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Parking Generator Controller Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Parking Generator Controller Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Parking Generator Controller Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Parking Generator Controller Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Parking Generator Controller Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Parking Generator Controller Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Parking Generator Controller Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Parking Generator Controller Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Parking Generator Controller Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Parking Generator Controller Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Parking Generator Controller Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Parking Generator Controller Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Parking Generator Controller Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Parking Generator Controller Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Parking Generator Controller Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Parking Generator Controller Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Parking Generator Controller?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the Parking Generator Controller?

Key companies in the market include Cummins, FG Wilson, AC Dandy, Beltrame CSE, Bernini Design SRL, Bruno Generators, Brush HMA, Cre Technology, Deif, Kohler Power Systems, Kutai Electronics Industry Co., Ltd, Meagacon AS, S.I.C.E.S, Tecnoelettra, Wuxi JLC Technology, SmartGen, Sicote, Lincontrol.

3. What are the main segments of the Parking Generator Controller?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 134 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Parking Generator Controller," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Parking Generator Controller report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Parking Generator Controller?

To stay informed about further developments, trends, and reports in the Parking Generator Controller, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence