Key Insights

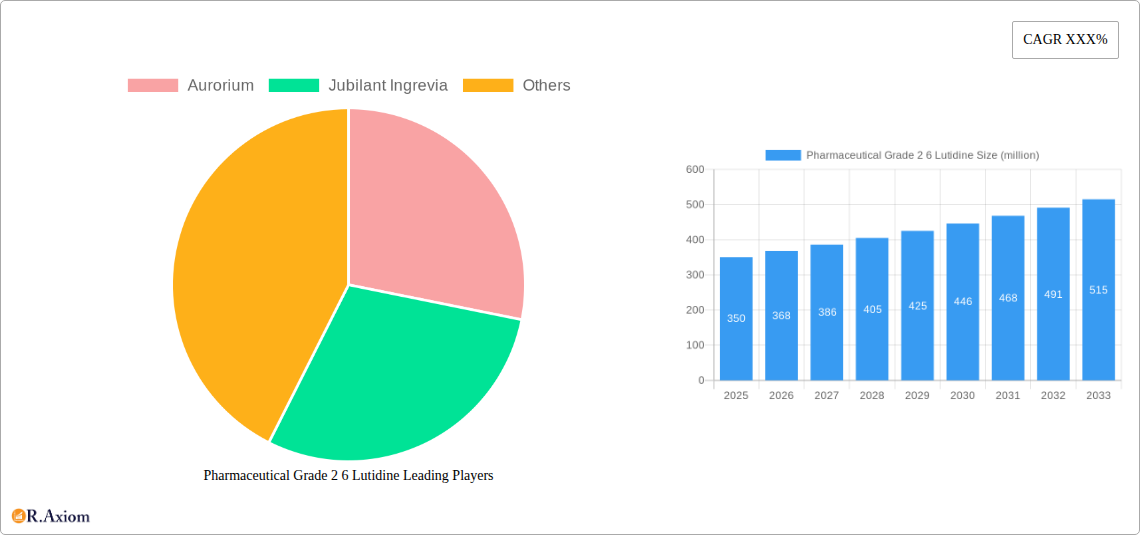

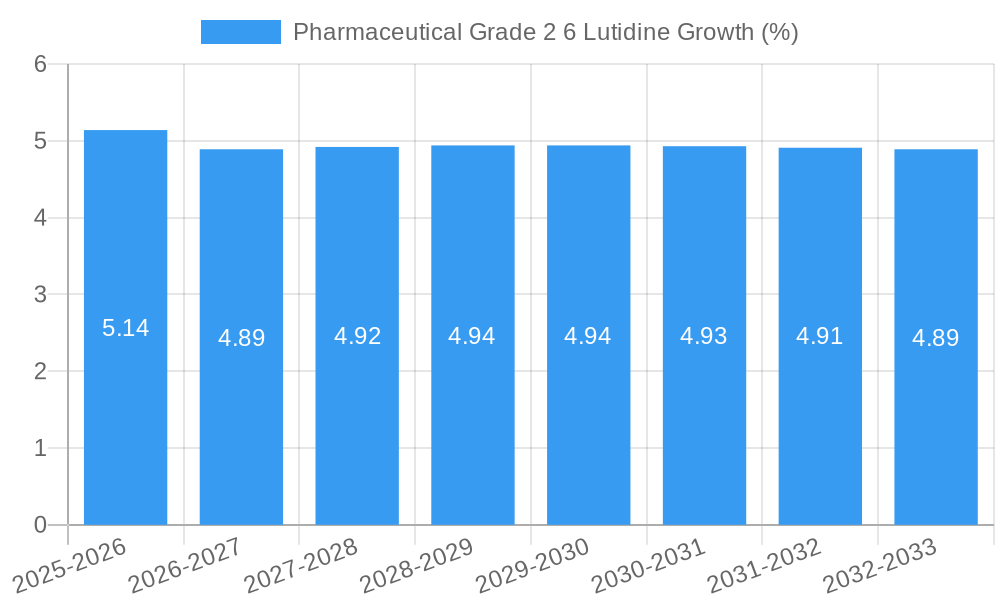

The global market for Pharmaceutical Grade 2,6-Lutidine is poised for significant expansion, with an estimated market size of USD 350 million in 2025, projected to reach USD 510 million by 2033. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of approximately 5.0% during the forecast period of 2025-2033. The primary driver for this upward trajectory is the escalating demand from the pharmaceutical industry, where 2,6-Lutidine serves as a critical intermediate in the synthesis of various active pharmaceutical ingredients (APIs) and drug formulations. The increasing prevalence of chronic diseases, coupled with advancements in drug discovery and development, are fueling the need for high-purity chemical compounds like 2,6-Lutidine. Furthermore, the growing application of 2,6-Lutidine as a specialized solvent in intricate chemical reactions within the pharmaceutical sector contributes to its market significance. The "Purity ≥99%" segment is anticipated to dominate the market due to stringent quality requirements in pharmaceutical manufacturing.

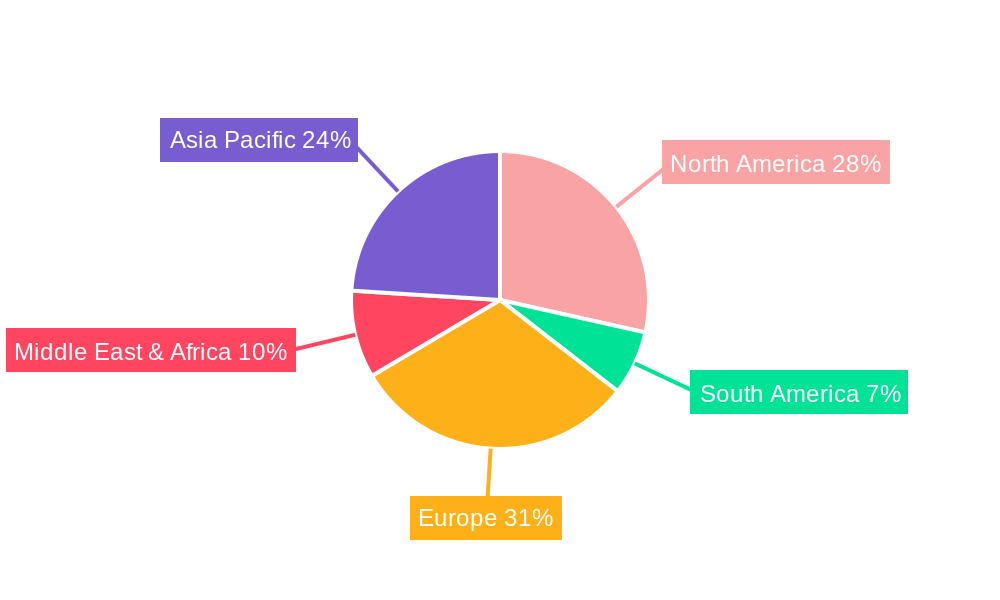

Despite the promising outlook, the market faces certain restraints, including the fluctuating prices of raw materials, which can impact production costs and profitability for key players such as Aurorium and Jubilant Ingrevia. Additionally, the complex synthesis process and the need for specialized handling due to the chemical properties of 2,6-Lutidine can pose operational challenges. Nonetheless, the ongoing research and development into novel applications, coupled with the expanding pharmaceutical landscape in regions like Asia Pacific, particularly China and India, are expected to create substantial opportunities. North America and Europe are expected to remain significant markets due to their established pharmaceutical infrastructure and high R&D spending. The market is segmented by application into Pharmaceutical Intermediates and Solvents, with Pharmaceutical Intermediates holding the larger share, and by type, with Purity ≥99% being the predominant category.

This in-depth report provides a thorough analysis of the global Pharmaceutical Grade 2 6 Lutidine market, a critical chemical compound with extensive applications in the pharmaceutical industry. Covering the study period from 2019 to 2033, with a base year of 2025 and an estimated year also of 2025, this report offers valuable insights into market dynamics, growth drivers, challenges, and opportunities. We project a significant compound annual growth rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. Our analysis leverages historical data from the historical period of 2019–2024, providing a robust foundation for future predictions. This comprehensive market intelligence report is essential for stakeholders seeking to understand the intricate landscape of pharmaceutical-grade 2,6-lutidine, including its supply chain, competitive environment, and emerging trends.

Pharmaceutical Grade 2 6 Lutidine Market Concentration & Innovation

The Pharmaceutical Grade 2 6 Lutidine market exhibits a moderate level of concentration, with key players like Aurorium and Jubilant Ingrevia holding significant market shares. Innovation is primarily driven by the demand for higher purity grades (Purity≥99%) and novel applications within pharmaceutical intermediates. Regulatory frameworks, particularly stringent quality control measures and compliance with Good Manufacturing Practices (GMP), are crucial for market entry and sustained growth. Product substitutes, though limited for specific high-purity applications, exist in less demanding industrial uses, requiring manufacturers to emphasize the superior quality of pharmaceutical-grade 2,6-lutidine. End-user trends highlight an increasing reliance on this chemical in the synthesis of complex Active Pharmaceutical Ingredients (APIs) and specialized drug formulations. Mergers and acquisitions (M&A) activities have been observed, with recent deals valued in the range of tens to hundreds of million dollars, indicating consolidation and strategic expansion by major companies to enhance their product portfolios and market reach. The market share of top players is estimated to be around 50-60% combined.

Pharmaceutical Grade 2 6 Lutidine Industry Trends & Insights

The Pharmaceutical Grade 2 6 Lutidine industry is experiencing robust growth, fueled by escalating demand from the global pharmaceutical sector. Market growth drivers include the continuous discovery and development of new drugs, many of which require high-purity chemical intermediates like 2,6-lutidine for their synthesis. Technological advancements in chemical manufacturing processes are enhancing production efficiency and product quality, leading to more cost-effective and environmentally friendly methods. Consumer preferences are shifting towards more targeted therapies and personalized medicine, which often involve intricate chemical synthesis pathways where 2,6-lutidine plays a vital role. The competitive landscape is characterized by a blend of established global manufacturers and emerging regional players, each vying for market share through product differentiation, cost leadership, and strategic partnerships. The pharmaceutical intermediates segment is projected to be the largest contributor to market revenue, with an estimated market penetration of over 70% within the pharmaceutical applications. The solvents segment also presents significant opportunities due to the unique solvent properties of 2,6-lutidine in specific chemical reactions. We anticipate a CAGR of approximately 6.5% over the forecast period, underscoring the strong growth trajectory of this market. The overall market size is projected to reach several hundred million dollars by 2025.

Dominant Markets & Segments in Pharmaceutical Grade 2 6 Lutidine

The Pharmaceutical Grade 2 6 Lutidine market is dominated by the Pharmaceutical Intermediates application segment. This dominance stems from the compound's indispensable role in the synthesis of a wide array of Active Pharmaceutical Ingredients (APIs), including those for oncology, cardiovascular diseases, and neurological disorders. The increasing global burden of chronic diseases and the subsequent rise in pharmaceutical R&D activities directly contribute to the demand for high-purity intermediates like 2,6-lutidine. North America and Europe currently represent the leading regional markets due to their well-established pharmaceutical industries, robust R&D infrastructure, and stringent regulatory standards that favor high-quality chemical inputs. However, the Asia-Pacific region, particularly China and India, is emerging as a significant growth hub, driven by the expansion of their domestic pharmaceutical manufacturing capabilities and increasing investments in drug discovery.

Within the Type segmentation, Purity≥99% is the overwhelmingly dominant category. This is directly correlated with the stringent purity requirements for pharmaceutical manufacturing. Any deviation from this purity level can render the product unsuitable for its intended use, leading to potential drug efficacy issues and regulatory non-compliance. The economic policies in major pharmaceutical-producing nations, which encourage domestic manufacturing and R&D, further bolster the demand for high-purity 2,6-lutidine. Infrastructure development, especially in logistics and chemical production facilities, also plays a crucial role in ensuring a consistent and reliable supply chain for this critical chemical.

- Key Drivers of Dominance in Pharmaceutical Intermediates:

- Growing global pharmaceutical R&D investments.

- Increasing prevalence of chronic diseases requiring specialized drug treatments.

- Stringent quality control in drug manufacturing favoring high-purity inputs.

- Expansion of generic drug manufacturing in emerging economies.

- Key Drivers of Dominance for Purity≥99%:

- Regulatory mandates for API purity.

- Need for predictable and consistent reaction outcomes in drug synthesis.

- Minimization of impurities that could affect drug safety and efficacy.

- Regional Dominance:

- North America: Strong pharmaceutical R&D pipeline, established manufacturing base, high demand for innovative drug intermediates.

- Europe: Robust regulatory framework, significant pharmaceutical production capacity, focus on specialty chemicals.

- Asia-Pacific: Rapidly growing pharmaceutical market, increasing contract manufacturing organizations (CMOs), cost-competitive production.

Pharmaceutical Grade 2 6 Lutidine Product Developments

Product developments in the Pharmaceutical Grade 2 6 Lutidine market are primarily focused on enhancing purity levels beyond the standard 99% and exploring novel synthesis routes for more efficient and sustainable production. Manufacturers are investing in advanced purification technologies to meet the evolving demands of the pharmaceutical industry for ultra-pure intermediates. These advancements aim to reduce manufacturing costs, minimize environmental impact, and ensure batch-to-batch consistency. The competitive advantage lies in offering a reliable supply of consistently high-quality 2,6-lutidine that adheres to the most rigorous pharmacopoeial standards, thereby supporting drug developers in their pursuit of safer and more effective therapeutics.

Report Scope & Segmentation Analysis

This report meticulously segments the Pharmaceutical Grade 2 6 Lutidine market based on key parameters to provide granular insights.

Application:

- Pharmaceutical Intermediates: This segment is expected to witness the highest growth, driven by the expanding pharmaceutical industry and the increasing demand for APIs. We project this segment to account for over 70% of the market share by 2025, with a CAGR of approximately 7.0% during the forecast period.

- Solvents: This segment, while smaller, is crucial for specific chemical reactions within pharmaceutical research and production. It is projected to grow at a CAGR of around 5.0%.

- Other: This category encompasses niche applications and emerging uses, with projected moderate growth.

Type:

- Purity≥99%: This is the dominant segment, driven by stringent pharmaceutical requirements. Its market share is estimated to be over 90%, with consistent growth aligned with the overall pharmaceutical industry.

- Other: This includes grades with lower purity or specialized specifications, catering to non-pharmaceutical or early-stage research applications.

The competitive dynamics within each segment are characterized by strategic partnerships and technological innovation. Market sizes for each segment are estimated to be in the tens to hundreds of million dollars, with specific projections available within the full report.

Key Drivers of Pharmaceutical Grade 2 6 Lutidine Growth

The growth of the Pharmaceutical Grade 2 6 Lutidine market is propelled by several key factors:

- Expanding Pharmaceutical Industry: A growing global population and an aging demographic are increasing the demand for a wide range of pharmaceuticals, directly boosting the need for essential chemical intermediates.

- Advancements in Drug Discovery and Development: Ongoing research into novel therapies, particularly in areas like oncology, immunology, and rare diseases, requires complex chemical synthesis routes where 2,6-lutidine is a vital component.

- Stringent Quality Standards: The pharmaceutical industry's unwavering commitment to quality and safety necessitates the use of high-purity chemicals, favoring pharmaceutical-grade 2,6-lutidine (Purity≥99%).

- Growth of Contract Manufacturing Organizations (CMOs): The outsourcing of pharmaceutical manufacturing to specialized CMOs, particularly in emerging markets, is driving demand for reliable chemical suppliers.

- Technological Innovations in Chemical Synthesis: Improvements in manufacturing processes for 2,6-lutidine are leading to greater efficiency, reduced costs, and enhanced product quality.

Challenges in the Pharmaceutical Grade 2 6 Lutidine Sector

Despite the positive growth trajectory, the Pharmaceutical Grade 2 6 Lutidine sector faces several challenges:

- Regulatory Hurdles: Navigating complex and evolving global pharmaceutical regulations can be time-consuming and costly for manufacturers. Compliance with GMP and other international standards is paramount.

- Supply Chain Volatility: Geopolitical factors, raw material price fluctuations, and logistical disruptions can impact the availability and cost of 2,6-lutidine. A potential disruption could lead to price increases of 5-10%.

- Competition from Alternative Synthesis Routes: While 2,6-lutidine is crucial for many applications, ongoing research may lead to the development of alternative synthesis pathways for certain APIs that do not require this specific intermediate.

- Environmental Concerns: Chemical manufacturing processes are under increasing scrutiny for their environmental impact. Manufacturers must invest in sustainable practices to mitigate these concerns.

- High Capital Investment: Establishing and maintaining state-of-the-art manufacturing facilities for pharmaceutical-grade chemicals requires significant capital investment.

Emerging Opportunities in Pharmaceutical Grade 2 6 Lutidine

The Pharmaceutical Grade 2 6 Lutidine market presents several emerging opportunities for growth and innovation:

- Biopharmaceutical Applications: As the biopharmaceutical sector expands, there may be novel applications for 2,6-lutidine in the synthesis of specific components or reagents.

- Green Chemistry Initiatives: Developing and implementing more environmentally friendly production methods for 2,6-lutidine can provide a competitive advantage and attract environmentally conscious customers.

- Emerging Markets: The expanding pharmaceutical industries in regions like Southeast Asia and Latin America offer significant untapped potential for market penetration.

- Custom Synthesis and Specialty Grades: Offering custom synthesis services and developing highly specialized grades of 2,6-lutidine for niche pharmaceutical applications can create new revenue streams.

- Technological Advancements in Purification: Continued innovation in purification technologies can lead to even higher purity grades, meeting the demands of next-generation drug development.

Leading Players in the Pharmaceutical Grade 2 6 Lutidine Market

- Aurorium

- Jubilant Ingrevia

Key Developments in Pharmaceutical Grade 2 6 Lutidine Industry

- 2023/2024: Increased investment in R&D for novel APIs, leading to a sustained demand for high-purity pharmaceutical intermediates like 2,6-lutidine.

- 2022: Several companies reported strategic collaborations to enhance supply chain resilience for critical chemical inputs.

- 2021: Focus on sustainability in chemical manufacturing processes gained momentum, driving interest in greener production of 2,6-lutidine.

- 2020: The global pandemic highlighted the importance of robust and localized supply chains for essential pharmaceutical ingredients.

- 2019: Introduction of new purification technologies by key manufacturers aimed at achieving higher purity levels for 2,6-lutidine.

Strategic Outlook for Pharmaceutical Grade 2 6 Lutidine Market

- 2023/2024: Increased investment in R&D for novel APIs, leading to a sustained demand for high-purity pharmaceutical intermediates like 2,6-lutidine.

- 2022: Several companies reported strategic collaborations to enhance supply chain resilience for critical chemical inputs.

- 2021: Focus on sustainability in chemical manufacturing processes gained momentum, driving interest in greener production of 2,6-lutidine.

- 2020: The global pandemic highlighted the importance of robust and localized supply chains for essential pharmaceutical ingredients.

- 2019: Introduction of new purification technologies by key manufacturers aimed at achieving higher purity levels for 2,6-lutidine.

Strategic Outlook for Pharmaceutical Grade 2 6 Lutidine Market

The strategic outlook for the Pharmaceutical Grade 2 6 Lutidine market is highly positive, driven by the enduring growth of the global pharmaceutical industry and the critical role of 2,6-lutidine in drug synthesis. Key growth catalysts include the continuous pipeline of new drug development, the increasing demand for specialized therapies, and the ongoing shift towards high-purity chemical inputs. Companies that focus on technological innovation, supply chain optimization, and adherence to stringent quality and regulatory standards will be best positioned for success. Furthermore, exploring opportunities in emerging markets and embracing sustainable manufacturing practices will be crucial for long-term market leadership and profitability, ensuring a steady supply of this vital chemical for the advancement of global healthcare. The market is projected to continue its upward trajectory, with significant opportunities for expansion and value creation.

Pharmaceutical Grade 2 6 Lutidine Segmentation

-

1. Application

- 1.1. Pharmaceutical Intermediates

- 1.2. Solvents

- 1.3. Other

-

2. Type

- 2.1. Purity≥99%

- 2.2. Other

Pharmaceutical Grade 2 6 Lutidine Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pharmaceutical Grade 2 6 Lutidine REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Grade 2 6 Lutidine Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmaceutical Intermediates

- 5.1.2. Solvents

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Purity≥99%

- 5.2.2. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Pharmaceutical Grade 2 6 Lutidine Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmaceutical Intermediates

- 6.1.2. Solvents

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Purity≥99%

- 6.2.2. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Pharmaceutical Grade 2 6 Lutidine Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmaceutical Intermediates

- 7.1.2. Solvents

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Purity≥99%

- 7.2.2. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Pharmaceutical Grade 2 6 Lutidine Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmaceutical Intermediates

- 8.1.2. Solvents

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Purity≥99%

- 8.2.2. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Pharmaceutical Grade 2 6 Lutidine Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmaceutical Intermediates

- 9.1.2. Solvents

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Purity≥99%

- 9.2.2. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Pharmaceutical Grade 2 6 Lutidine Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmaceutical Intermediates

- 10.1.2. Solvents

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Purity≥99%

- 10.2.2. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Aurorium

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jubilant Ingrevia

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.1 Aurorium

List of Figures

- Figure 1: Global Pharmaceutical Grade 2 6 Lutidine Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Application 2024 & 2032

- Figure 3: North America Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Type 2024 & 2032

- Figure 5: North America Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Country 2024 & 2032

- Figure 7: North America Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Application 2024 & 2032

- Figure 9: South America Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Type 2024 & 2032

- Figure 11: South America Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Country 2024 & 2032

- Figure 13: South America Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Pharmaceutical Grade 2 6 Lutidine Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Pharmaceutical Grade 2 6 Lutidine Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Pharmaceutical Grade 2 6 Lutidine Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Pharmaceutical Grade 2 6 Lutidine Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Grade 2 6 Lutidine?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Pharmaceutical Grade 2 6 Lutidine?

Key companies in the market include Aurorium, Jubilant Ingrevia.

3. What are the main segments of the Pharmaceutical Grade 2 6 Lutidine?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Grade 2 6 Lutidine," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Grade 2 6 Lutidine report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Grade 2 6 Lutidine?

To stay informed about further developments, trends, and reports in the Pharmaceutical Grade 2 6 Lutidine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence