Key Insights

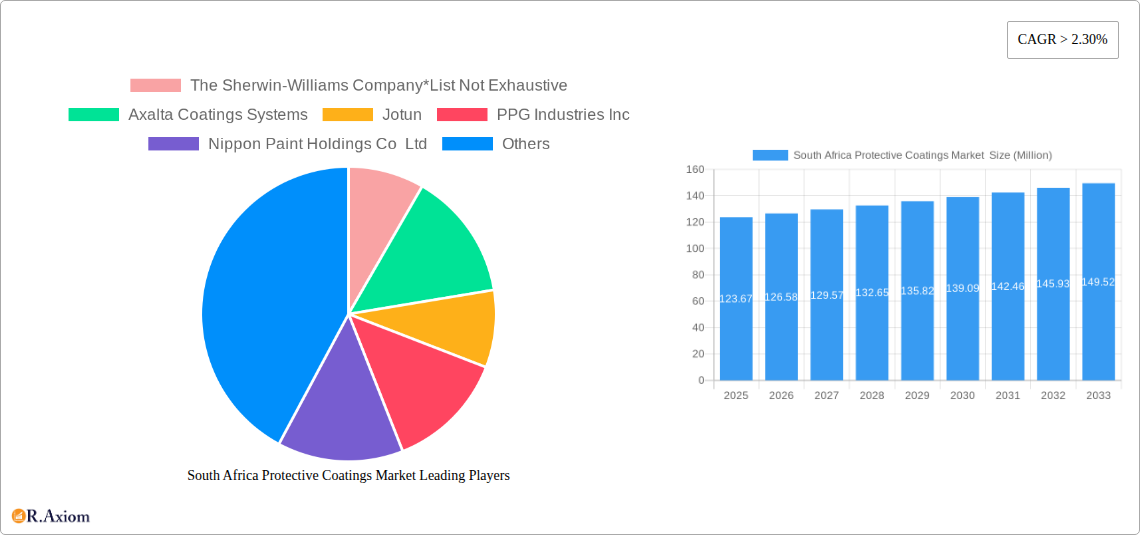

The South African protective coatings market is poised for steady expansion, with a current market size of approximately $123.67 million and a projected Compound Annual Growth Rate (CAGR) exceeding 2.30% for the period of 2025-2033. This growth is primarily propelled by substantial investments in infrastructure development, the burgeoning oil and gas sector, and the critical mining industry, all of which demand robust coating solutions for asset protection against harsh environmental conditions and corrosive elements. The demand for advanced protective coatings, particularly those offering enhanced durability, environmental compliance, and specialized functionalities, is a significant driver. The increasing focus on extending the lifespan of critical infrastructure and industrial assets further fuels the adoption of high-performance coatings.

South Africa Protective Coatings Market Market Size (In Million)

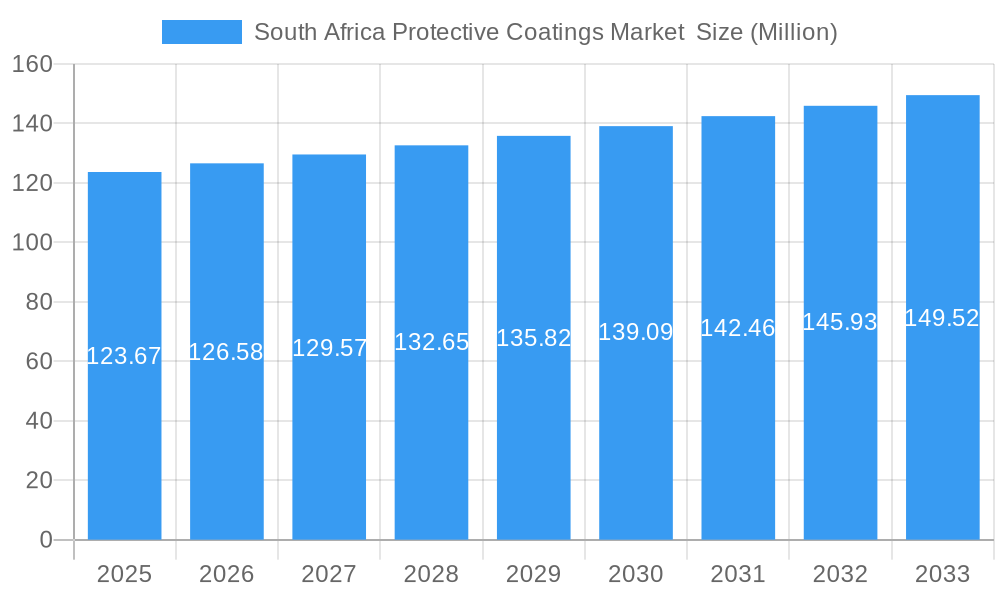

Key market segments like acrylic and polyurethane resins are expected to witness robust demand due to their versatile properties and wide application range. While solventborne coatings have traditionally dominated, there is a clear and accelerating shift towards more environmentally friendly technologies such as waterborne and UV-cured coatings. This transition is driven by stringent environmental regulations and a growing industry consciousness towards sustainability. However, the high initial cost of some advanced coating technologies and the availability of cheaper alternatives may present some restraints. Despite these challenges, the inherent need for corrosion prevention, asset longevity, and compliance with industrial standards will ensure the continued growth and evolution of the South African protective coatings market, with major players like The Sherwin-Williams Company, Axalta Coatings Systems, and Jotun leading the competitive landscape.

South Africa Protective Coatings Market Company Market Share

This in-depth report provides a detailed analysis of the South Africa Protective Coatings Market, offering critical insights for industry stakeholders, investors, and decision-makers. Covering the historical period from 2019 to 2024, the base year of 2025, and a comprehensive forecast period from 2025 to 2033, this study delves into market concentration, innovation, industry trends, dominant segments, product developments, key drivers, challenges, and emerging opportunities. Leveraging high-traffic keywords and detailed segmentation, this report is optimized for maximum search visibility and actionable intelligence.

South Africa Protective Coatings Market Market Concentration & Innovation

The South Africa Protective Coatings Market exhibits a moderate level of concentration, with a few key players holding significant market share. Major companies like The Sherwin-Williams Company, Axalta Coatings Systems, Jotun, PPG Industries Inc, Nippon Paint Holdings Co Ltd, BASF SE, Akzo Nobel N V, and Duram Smart Paints are actively shaping the competitive landscape through strategic initiatives and robust product portfolios. Innovation is a critical differentiator, driven by the increasing demand for high-performance coatings with enhanced durability, environmental sustainability, and specialized functionalities. Research and development efforts are focused on advanced resin technologies, novel additive formulations, and the development of coatings resistant to harsh environmental conditions prevalent in South Africa, such as extreme temperatures, UV radiation, and corrosive elements. Regulatory frameworks, particularly those related to VOC emissions and environmental protection, are increasingly influencing product development and market entry strategies. The availability of product substitutes, such as alternative materials or less durable coatings, poses a moderate threat, but the superior performance and longevity of protective coatings often outweigh these alternatives in critical applications. End-user trends indicate a growing preference for low-VOC, waterborne, and sustainable coating solutions, particularly within the infrastructure and power sectors. Mergers and acquisitions (M&A) activities are notable, with strategic consolidations aiming to expand market reach, acquire new technologies, and enhance competitive positioning. For instance, Akzo Nobel N.V.'s agreement with Kansai Paint Company in June 2022 to acquire its paints and coatings business in Africa underscores the ongoing consolidation and strategic focus on regional expansion. The M&A deal value is estimated to be in the range of tens of millions of US dollars, reflecting significant investment in capturing a larger share of the burgeoning African coatings market.

South Africa Protective Coatings Market Industry Trends & Insights

The South Africa Protective Coatings Market is poised for significant growth, driven by a confluence of favorable economic, industrial, and technological factors. The estimated Compound Annual Growth Rate (CAGR) for the forecast period is anticipated to be in the range of 5% to 7%, reflecting the robust demand for protective solutions across various industrial sectors. Market penetration is progressively increasing as industries recognize the long-term cost savings and operational efficiencies derived from utilizing high-quality protective coatings. Key growth drivers include substantial investments in infrastructure development, particularly in transportation networks, utilities, and construction projects, which necessitate durable and long-lasting coatings to withstand environmental degradation and ensure structural integrity. The burgeoning oil and gas sector, with ongoing exploration and production activities, further fuels demand for coatings capable of resisting corrosion and harsh chemical environments. Similarly, the mining industry, a cornerstone of the South African economy, requires specialized coatings for its heavy machinery, processing plants, and storage facilities to protect against abrasive wear and corrosive substances. Technological disruptions are playing a pivotal role, with a noticeable shift towards environmentally friendly and sustainable coating solutions. The adoption of waterborne and low-VOC (Volatile Organic Compound) technologies is gaining momentum, driven by stricter environmental regulations and increasing corporate responsibility initiatives. These technologies offer reduced environmental impact, improved worker safety, and compliance with international standards. Furthermore, advancements in nanotechnology and the incorporation of self-healing properties in coatings are emerging trends that promise enhanced performance and extended lifespan for protected assets. Consumer preferences are evolving to favor coatings that offer not only protection but also aesthetic appeal and ease of application. This is driving innovation in formulations that provide superior adhesion, faster curing times, and a wider range of color options. The competitive dynamics within the South African market are characterized by intense competition among both global players and local manufacturers. Companies are differentiating themselves through product innovation, strategic partnerships, and tailored solutions that address the specific needs of different end-user industries. The focus on providing comprehensive technical support and after-sales services is also becoming a crucial aspect of customer engagement and market retention. The expansion of existing manufacturing facilities and the potential for new entrants, particularly from emerging economies, could further intensify competition.

Dominant Markets & Segments in South Africa Protective Coatings Market

The South Africa Protective Coatings Market is segmented across various resin types, technologies, and end-user industries, with distinct segments demonstrating dominant growth and influence.

Resin Type Dominance:

- Epoxy: This segment holds a significant market share due to its exceptional adhesion, chemical resistance, and durability, making it ideal for heavy-duty applications in the oil and gas, mining, and infrastructure sectors. Its ability to withstand corrosive environments and abrasion makes it a preferred choice for protecting steel structures, concrete surfaces, and equipment.

- Polyurethane: Polyurethane coatings are dominant in applications requiring high flexibility, abrasion resistance, and UV stability. They are widely used in the automotive, industrial machinery, and architectural segments, offering excellent gloss retention and weatherability.

- Acrylic: While often used in architectural coatings, acrylics also play a crucial role in industrial applications, particularly in waterborne formulations due to their environmental friendliness and good performance characteristics. Their versatility and cost-effectiveness contribute to their widespread use.

- Alkyd: Traditionally a workhorse in the coatings industry, alkyd resins continue to be relevant in certain industrial and architectural applications where cost-effectiveness and ease of application are primary considerations. However, their market share is gradually being influenced by the growth of more advanced resin types.

Technology Dominance:

- Solventborne: Despite the growing trend towards eco-friendly alternatives, solventborne coatings continue to dominate in certain heavy-duty industrial applications where their performance characteristics, such as rapid drying times and superior film build, are critical. However, regulatory pressures are driving a gradual shift away from this technology.

- Waterborne: The waterborne technology segment is experiencing substantial growth due to increasing environmental regulations and a global push for sustainable solutions. Its low VOC content, reduced flammability, and improved health and safety profile are making it a preferred choice across various end-user industries, especially in architectural and some industrial applications.

- Powder Coatings: While not as dominant as liquid coatings, powder coatings are gaining traction in specific applications within the industrial sector, particularly for metal finishing, due to their excellent durability, minimal waste, and environmental benefits.

End-User Industry Dominance:

- Infrastructure: This sector is a major driver of the protective coatings market in South Africa. Government initiatives and private investments in roads, bridges, railways, airports, and water treatment facilities necessitate extensive use of protective coatings to prevent corrosion, extend asset life, and ensure structural integrity. The demand for durable and weather-resistant coatings is paramount in this segment.

- Oil and Gas: The upstream, midstream, and downstream segments of the oil and gas industry rely heavily on protective coatings to safeguard pipelines, storage tanks, offshore platforms, and processing equipment from corrosive environments, high temperatures, and chemical exposure. The inherent risks and high-value assets in this sector necessitate the highest levels of protection.

- Mining: South Africa's significant mining industry presents a robust demand for protective coatings used on mining equipment, mineral processing plants, and structural components. Coatings are essential to protect against abrasion, impact, chemical attack, and corrosion, thereby minimizing downtime and maintenance costs.

- Power: The power generation sector, encompassing thermal, renewable, and nuclear power plants, requires specialized protective coatings for turbines, boilers, transmission towers, and infrastructure to withstand extreme temperatures, corrosive agents, and environmental wear.

South Africa Protective Coatings Market Product Developments

Product development in the South Africa Protective Coatings Market is centered on enhancing performance, sustainability, and application efficiency. Innovations include the introduction of advanced epoxy formulations with improved chemical resistance and faster curing times, catering to the demanding oil and gas and mining sectors. Polyurethane coatings are being developed with superior UV stability and flexibility for infrastructure and automotive applications. A significant trend is the rise of waterborne technologies, offering low-VOC alternatives for architectural and industrial use without compromising on durability. Furthermore, developments in anti-corrosive and anti-microbial coatings are emerging, addressing specific needs in healthcare, food processing, and marine environments. These product enhancements aim to provide extended asset protection, reduce maintenance cycles, and meet stringent environmental regulations, giving manufacturers a competitive edge.

Report Scope & Segmentation Analysis

This report meticulously analyzes the South Africa Protective Coatings Market by segmenting it into key categories to provide granular insights. The segmentation includes:

- Resin Type: Acrylic, Epoxy, Alkyd, Polyurethane, Polyester, and Others (Phenolic, PTFE, etc.). The Epoxy segment is projected to exhibit strong growth driven by industrial applications, while Acrylics are anticipated to expand in architectural segments.

- Technology: Waterborne, Solventborne, Powder, and UV-Cured. Waterborne coatings are expected to witness the highest growth rate due to increasing environmental consciousness and regulatory mandates.

- End-User Industry: Oil and Gas, Mining, Power, Infrastructure, and Other Enterprises. Infrastructure and Oil and Gas are anticipated to remain the dominant segments, with substantial market sizes and steady growth projections due to ongoing development and operational demands.

Key Drivers of South Africa Protective Coatings Market Growth

The growth of the South Africa Protective Coatings Market is propelled by several key factors. Significant government investment in infrastructure development, including transportation, energy, and water projects, is a primary driver, requiring robust protective coatings for longevity and durability. The thriving oil and gas sector, with its extensive exploration and production activities, demands specialized coatings for protection against harsh environments and corrosion. The mining industry's continuous need for coatings to protect heavy machinery and infrastructure from wear and tear is another crucial growth catalyst. Furthermore, increasing awareness and adoption of environmentally friendly and sustainable coating solutions, such as low-VOC and waterborne technologies, are driven by regulatory compliance and corporate social responsibility. Technological advancements in coating formulations offering enhanced performance, such as improved corrosion resistance and UV stability, also contribute significantly to market expansion.

Challenges in the South Africa Protective Coatings Market Sector

Despite its promising growth trajectory, the South Africa Protective Coatings Market faces several challenges. Volatile raw material prices, particularly for petrochemical derivatives used in resin production, can impact manufacturing costs and profit margins. Stringent environmental regulations, while driving innovation in sustainable coatings, can also lead to increased compliance costs for manufacturers. Supply chain disruptions, exacerbated by global events, can affect the availability and timely delivery of raw materials and finished products. Intense competition from both established global players and emerging local manufacturers can lead to price pressures and challenges in market share acquisition. The need for skilled labor for the application of specialized protective coatings also presents a potential bottleneck, requiring ongoing training and development initiatives.

Emerging Opportunities in South Africa Protective Coatings Market

Emerging opportunities in the South Africa Protective Coatings Market are diverse and promising. The growing demand for sustainable and eco-friendly coatings presents a significant avenue for growth, with an increasing market for waterborne, low-VOC, and solvent-free formulations. The expansion of renewable energy projects, such as solar and wind farms, will create new demand for specialized coatings to protect infrastructure against environmental elements. The development of smart coatings with self-healing properties, enhanced anti-corrosion capabilities, and integrated sensors offers a niche but rapidly growing opportunity for high-value applications. Furthermore, increasing urbanization and the need for modernizing existing infrastructure provide continuous opportunities for protective coatings in construction and maintenance. Exploring new market segments, such as the automotive refinish market and the marine sector, could also unlock significant growth potential.

Leading Players in the South Africa Protective Coatings Market Market

- The Sherwin-Williams Company

- Axalta Coatings Systems

- Jotun

- PPG Industries Inc

- Nippon Paint Holdings Co Ltd

- BASF SE

- Dekro Paints

- Akzo Nobel N V

- Duram Smart Paints

- The Medal Paint

Key Developments in South Africa Protective Coatings Market Industry

- June 2022: Akzo Nobel N.V. made an agreement with Kansai Paint Company to acquire its paints and coatings business in the Africa region. The acquisition will help the company strengthen its position in the African coatings market.

Strategic Outlook for South Africa Protective Coatings Market Market

The strategic outlook for the South Africa Protective Coatings Market is strongly positive, driven by sustained industrial activity and infrastructure development. Key growth catalysts include the ongoing demand from the oil and gas and mining sectors, coupled with significant government expenditure on infrastructure projects. The accelerating adoption of sustainable and waterborne coating technologies presents a substantial opportunity for manufacturers focusing on eco-friendly solutions. Strategic partnerships and mergers, such as the Akzo Nobel N.V. and Kansai Paint Company agreement, will continue to reshape the competitive landscape, enabling companies to expand their geographical reach and product portfolios. Investments in research and development to create high-performance, durable, and specialized coatings will be crucial for maintaining a competitive edge. The market is expected to witness continued innovation in areas like smart coatings and advanced protective solutions, catering to evolving industry needs and regulatory requirements, thus ensuring long-term growth and profitability.

South Africa Protective Coatings Market Segmentation

-

1. Resin Type

- 1.1. Acrylic

- 1.2. Epoxy

- 1.3. Alkyd

- 1.4. Polyurethane

- 1.5. Polyester

- 1.6. Others (Phenolic, PTFE, etc.)

-

2. Technology

- 2.1. Waterborne

- 2.2. Solventborne

- 2.3. Powder

- 2.4. UV-Cured

-

3. End-User Industry

- 3.1. Oil and Gas

- 3.2. Mining

- 3.3. Power

- 3.4. Infrastructure

- 3.5. Other En

South Africa Protective Coatings Market Segmentation By Geography

- 1. South Africa

South Africa Protective Coatings Market Regional Market Share

Geographic Coverage of South Africa Protective Coatings Market

South Africa Protective Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 2.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Investments in Infrastructure Projects in South Africa; Increasing Demand from South Africa Oil and Gas Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Fluctuations in the prices of Raw materials; Other Restraints

- 3.4. Market Trends

- 3.4.1. The infrastructure segment dominates the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Protective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Acrylic

- 5.1.2. Epoxy

- 5.1.3. Alkyd

- 5.1.4. Polyurethane

- 5.1.5. Polyester

- 5.1.6. Others (Phenolic, PTFE, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Waterborne

- 5.2.2. Solventborne

- 5.2.3. Powder

- 5.2.4. UV-Cured

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Oil and Gas

- 5.3.2. Mining

- 5.3.3. Power

- 5.3.4. Infrastructure

- 5.3.5. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Sherwin-Williams Company*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Axalta Coatings Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jotun

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PPG Industries Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Paint Holdings Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BASF SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dekro Paints

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Akzo Nobel N V

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Duram Smart Paints

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ferro SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Medal Paint

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 The Sherwin-Williams Company*List Not Exhaustive

List of Figures

- Figure 1: South Africa Protective Coatings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Protective Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Protective Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: South Africa Protective Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 3: South Africa Protective Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: South Africa Protective Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 5: South Africa Protective Coatings Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: South Africa Protective Coatings Market Volume liter Forecast, by End-User Industry 2020 & 2033

- Table 7: South Africa Protective Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: South Africa Protective Coatings Market Volume liter Forecast, by Region 2020 & 2033

- Table 9: South Africa Protective Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 10: South Africa Protective Coatings Market Volume liter Forecast, by Resin Type 2020 & 2033

- Table 11: South Africa Protective Coatings Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: South Africa Protective Coatings Market Volume liter Forecast, by Technology 2020 & 2033

- Table 13: South Africa Protective Coatings Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: South Africa Protective Coatings Market Volume liter Forecast, by End-User Industry 2020 & 2033

- Table 15: South Africa Protective Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: South Africa Protective Coatings Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Protective Coatings Market ?

The projected CAGR is approximately > 2.30%.

2. Which companies are prominent players in the South Africa Protective Coatings Market ?

Key companies in the market include The Sherwin-Williams Company*List Not Exhaustive, Axalta Coatings Systems, Jotun, PPG Industries Inc, Nippon Paint Holdings Co Ltd, BASF SE, Dekro Paints, Akzo Nobel N V, Duram Smart Paints, Ferro SA, The Medal Paint.

3. What are the main segments of the South Africa Protective Coatings Market ?

The market segments include Resin Type, Technology, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 123.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Investments in Infrastructure Projects in South Africa; Increasing Demand from South Africa Oil and Gas Industry; Other Drivers.

6. What are the notable trends driving market growth?

The infrastructure segment dominates the market.

7. Are there any restraints impacting market growth?

Fluctuations in the prices of Raw materials; Other Restraints.

8. Can you provide examples of recent developments in the market?

June 2022: Akzo Nobel N.V. made an agreement with Kansai Paint Company to acquire its paints and coatings business in the Africa region. The acquisition will help the company strengthen its position in the African coatings market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Protective Coatings Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Protective Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Protective Coatings Market ?

To stay informed about further developments, trends, and reports in the South Africa Protective Coatings Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence