Key Insights

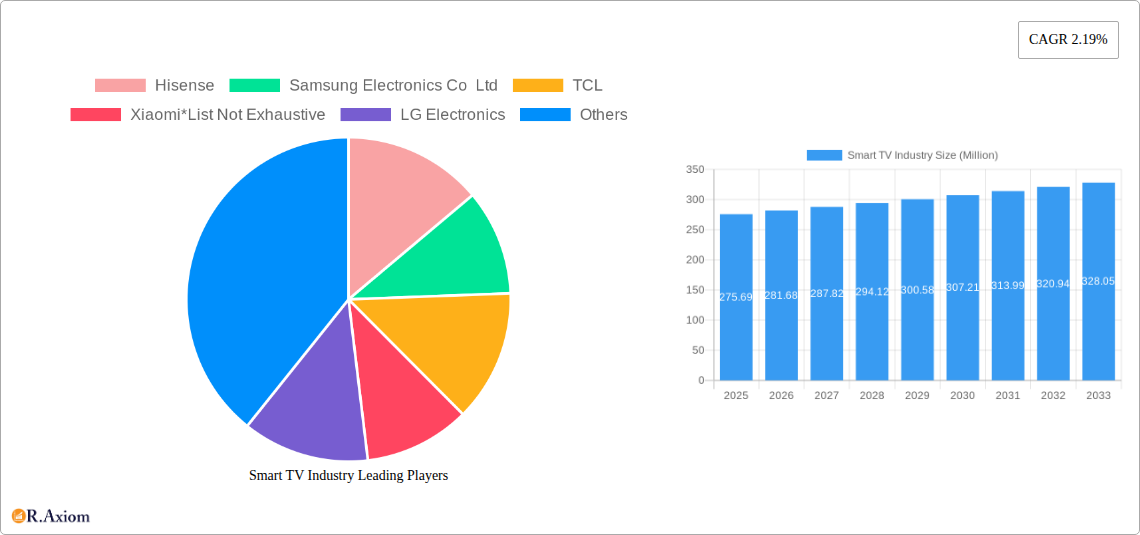

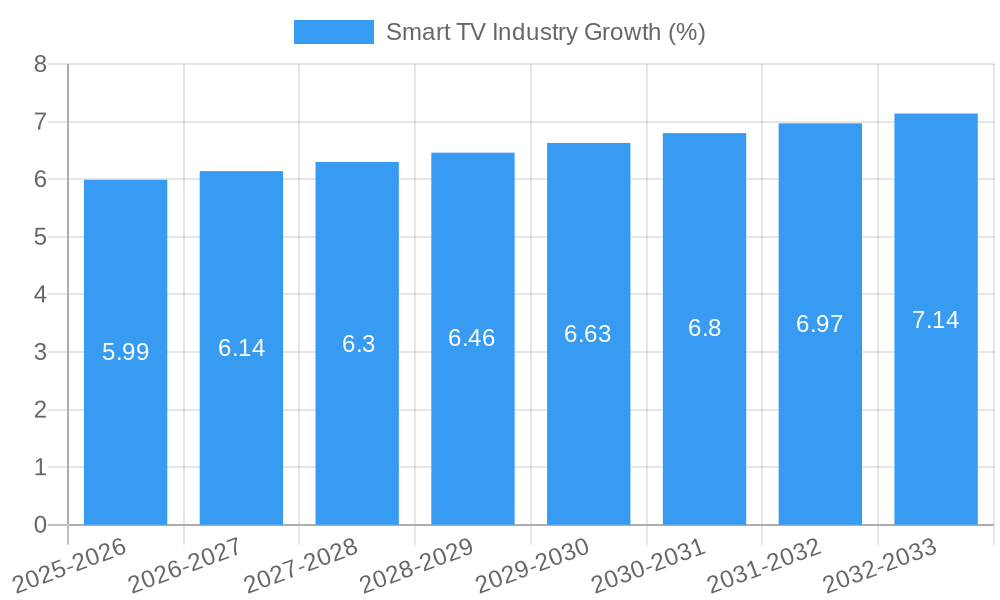

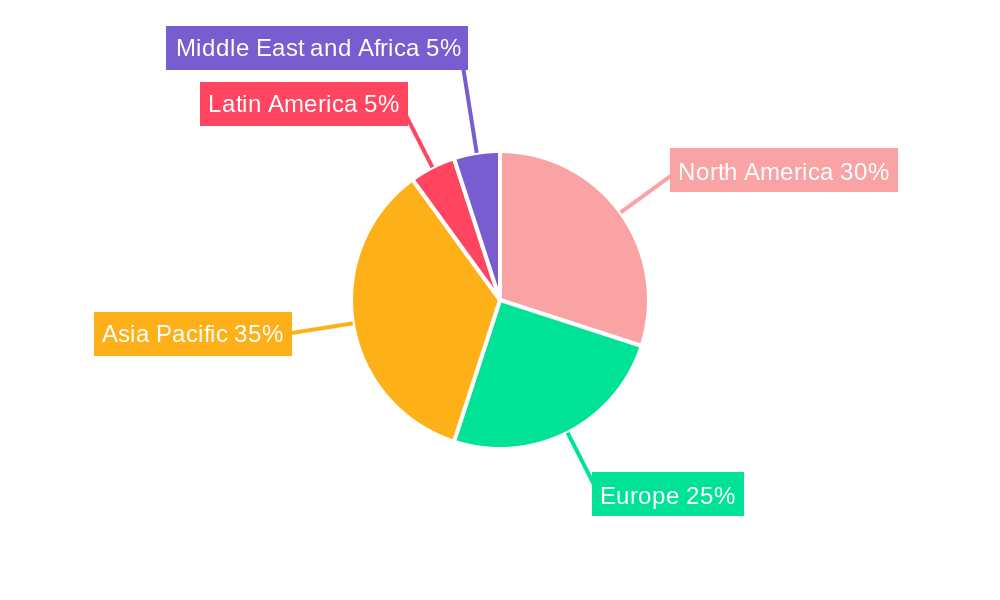

The global smart TV market, valued at $275.69 million in 2025, is projected to experience steady growth, driven by several key factors. Increasing disposable incomes in developing economies, coupled with the rising adoption of streaming services and high-speed internet, are fueling demand for larger screen sizes and higher resolutions. The shift towards premium features like OLED and QLED panels, offering superior picture quality and enhanced viewing experiences, further contributes to market expansion. Consumers are increasingly seeking immersive entertainment options, driving the demand for larger screen sizes (above 55 inches) and higher resolutions like 4K and 8K. Technological advancements in display technology, such as mini-LED backlighting and improved HDR capabilities, are also stimulating market growth. However, potential restraints include the cyclical nature of the consumer electronics market and price sensitivity among budget-conscious consumers. Competition among established players like Samsung, LG, Hisense, and TCL, along with the emergence of new entrants, is intensifying, leading to price wars and innovations in features and design. The market segmentation reveals that 4K resolution TVs are currently the dominant segment, but 8K is experiencing rapid growth, albeit from a smaller base. Regionally, the Asia-Pacific region, particularly India and Southeast Asia, is expected to witness significant growth due to its large population and expanding middle class. North America and Europe, while mature markets, will continue to contribute substantially to overall market value, driven by upgrades and replacement cycles.

The market's 2.19% CAGR suggests a moderate yet consistent growth trajectory. This growth is expected to be influenced by the ongoing technological innovations mentioned above, consumer preferences shifting towards premium features, and the increasing penetration of smart TVs in emerging markets. The continued expansion of streaming services, offering diverse content options, is further underpinning the demand. While economic fluctuations and supply chain challenges could pose short-term disruptions, the long-term outlook for the smart TV market remains positive, driven by evolving consumer preferences and technological progress. The anticipated growth will likely be concentrated in the premium segments (larger screen sizes, higher resolutions, and advanced panel technologies) alongside increasing adoption in emerging markets.

Smart TV Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global Smart TV industry, covering the period from 2019 to 2033. It offers actionable insights into market trends, competitive dynamics, and future growth opportunities, focusing on key players like Hisense, Samsung Electronics Co Ltd, TCL, Xiaomi, LG Electronics, and more. The report uses 2025 as the base and estimated year, with a forecast period extending to 2033. The historical period covered is 2019-2024. The report segments the market by resolution type (HD/FHD, 4K, 8K), size (less than 39 inches, 39-48 inches, 48-55 inches, 55+ inches), and panel type (LCD, OLED, QLED). Expect detailed analysis of market concentration, innovation, dominant markets, product developments, and future growth catalysts. The report features a market size of xx Million for the estimated year (2025). This report is intended for industry stakeholders, investors, and strategic decision-makers seeking a comprehensive understanding of this dynamic market.

Smart TV Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the smart TV industry, evaluating market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The report quantifies market share for major players, including Samsung, LG, Hisense, TCL, and Xiaomi, and explores the impact of their strategies on overall market concentration. The xx Million market size (2025) is analyzed against the backdrop of ongoing technological advancements, such as the introduction of 8K resolution and improved panel technologies (OLED, QLED, Mini-LED).

- Market Concentration: The industry exhibits a moderately concentrated structure, with a few dominant players controlling a significant market share.

- Innovation Drivers: Technological advancements in display technology (8K resolution, Mini-LED, MicroLED), improved processing power, AI features, and enhanced smart capabilities are key innovation drivers.

- Regulatory Frameworks: Government regulations regarding energy efficiency and environmental standards influence product development and market dynamics.

- Product Substitutes: Streaming services and other digital entertainment platforms offer competition to traditional Smart TVs.

- End-User Trends: Growing demand for larger screen sizes, higher resolutions, and advanced smart functionalities are shaping consumer preferences.

- M&A Activities: Mergers and acquisitions play a significant role in shaping the industry landscape, with deal values reaching xx Million in recent years (data from 2019-2024).

Smart TV Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the Smart TV industry. Analysis includes market growth drivers, technological disruptions, evolving consumer preferences, and intense competitive dynamics. The report projects a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors like increasing disposable incomes, growing urbanization, and rising penetration of high-speed internet. Market penetration rates for smart TVs are projected to reach xx% by 2033 in key regions.

Dominant Markets & Segments in Smart TV Industry

This section identifies the leading regions, countries, and market segments within the Smart TV industry. It focuses on a detailed analysis of dominant segments by resolution type (HD/FHD, 4K, 8K), size (less than 39 inches, 39-48 inches, 48-55 inches, 55+ inches), and panel type (LCD, OLED, QLED).

- Key Drivers (by segment):

- 4K Resolution: Driven by affordability and widespread availability.

- 55-inch Size: A popular size offering a balance between screen size and affordability.

- LCD Panel Type: Continues to dominate due to cost-effectiveness.

- Dominance Analysis: The report provides a detailed breakdown of the regional and segment-wise dominance, highlighting the factors contributing to their leading positions. This includes analysis of economic factors, infrastructure development, and consumer preferences.

Smart TV Industry Product Developments

This section summarizes recent product innovations, applications, and competitive advantages in the Smart TV market. The focus is on technological trends and their impact on market fit, highlighting the transition to higher resolutions, improved picture quality, and advanced smart features. Key advancements include the integration of AI, voice assistants, and improved gaming capabilities. The adoption of innovative panel technologies like Mini-LED and MicroLED also contributes to enhanced viewing experiences.

Report Scope & Segmentation Analysis

This section details the market segmentation by resolution type (HD/FHD, 4K, 8K), size (less than 39 inches, 39-48 inches, 48-55 inches, 55+ inches), and panel type (LCD, OLED, QLED). Each segment includes growth projections, market size estimations (in Millions), and analysis of competitive dynamics. For each segment, growth forecasts and competitive landscapes are provided.

Key Drivers of Smart TV Industry Growth

This section outlines the key drivers of growth in the smart TV industry, including technological advancements (8K resolution, AI integration, improved sound systems), increasing disposable incomes in developing economies, and government initiatives promoting digitalization. The growing adoption of streaming services and the demand for larger screen sizes also contribute significantly to market expansion.

Challenges in the Smart TV Industry Sector

This section addresses challenges faced by the smart TV industry, such as supply chain disruptions, increasing raw material costs, intense competition, and the potential for technological obsolescence. Regulatory hurdles and the impact of macroeconomic factors on consumer spending also pose significant challenges.

Emerging Opportunities in Smart TV Industry

This section highlights emerging opportunities in the Smart TV industry, including the expansion into new markets (developing economies), the adoption of innovative technologies (MicroLED, foldable screens), and the growth of niche applications (gaming, home fitness, professional use). Personalized content recommendations and advancements in immersive viewing experiences also present significant opportunities for growth.

Leading Players in the Smart TV Industry Market

Key Developments in Smart TV Industry Industry

- January 2021: Hisense launched its TriChroma Laser TV, featuring enhanced color purity and brightness (430-nit), available in screen sizes ranging from 75 inches to 100 inches. This signals a shift towards premium laser display technology.

- August 2021: Xiaomi launched the Mi TV 5X series in India, offering 43-inch, 50-inch, and 55-inch models with 4K resolution and features like Dolby Vision and Google Assistant integration. This strengthens Xiaomi's position in the Indian market.

Strategic Outlook for Smart TV Industry Market

The Smart TV industry is poised for continued growth driven by technological innovations, increasing consumer demand, and expansion into new markets. The long-term outlook remains positive, with opportunities for sustained market expansion and the emergence of new product categories and applications. The key to success will lie in adapting to evolving consumer preferences and investing in research and development to deliver innovative and high-quality products.

Smart TV Industry Segmentation

-

1. Resolution Type

- 1.1. HD/FHD

- 1.2. 4K

- 1.3. 8K

-

2. Size (in inches)

- 2.1. Greater than 32

- 2.2. 39-43

- 2.3. 48-50

- 2.4. 55-60

- 2.5. Less than 65

-

3. Panel Type

- 3.1. LCD

- 3.2. OLED

- 3.3. QLED

Smart TV Industry Segmentation By Geography

- 1. North America

- 2. Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. Southeast Asia

- 4. Latin America

- 5. Middle East and Africa

Smart TV Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Disposable Income Across Emerging Economies; Rising Trend of Video-on-Demand Service

- 3.3. Market Restrains

- 3.3.1. The Need for High Investment in Content Creation and Broadcasting; Bandwidth Allocation for 4K Resolution

- 3.4. Market Trends

- 3.4.1. QLED is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart TV Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resolution Type

- 5.1.1. HD/FHD

- 5.1.2. 4K

- 5.1.3. 8K

- 5.2. Market Analysis, Insights and Forecast - by Size (in inches)

- 5.2.1. Greater than 32

- 5.2.2. 39-43

- 5.2.3. 48-50

- 5.2.4. 55-60

- 5.2.5. Less than 65

- 5.3. Market Analysis, Insights and Forecast - by Panel Type

- 5.3.1. LCD

- 5.3.2. OLED

- 5.3.3. QLED

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Resolution Type

- 6. North America Smart TV Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Resolution Type

- 6.1.1. HD/FHD

- 6.1.2. 4K

- 6.1.3. 8K

- 6.2. Market Analysis, Insights and Forecast - by Size (in inches)

- 6.2.1. Greater than 32

- 6.2.2. 39-43

- 6.2.3. 48-50

- 6.2.4. 55-60

- 6.2.5. Less than 65

- 6.3. Market Analysis, Insights and Forecast - by Panel Type

- 6.3.1. LCD

- 6.3.2. OLED

- 6.3.3. QLED

- 6.1. Market Analysis, Insights and Forecast - by Resolution Type

- 7. Europe Smart TV Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Resolution Type

- 7.1.1. HD/FHD

- 7.1.2. 4K

- 7.1.3. 8K

- 7.2. Market Analysis, Insights and Forecast - by Size (in inches)

- 7.2.1. Greater than 32

- 7.2.2. 39-43

- 7.2.3. 48-50

- 7.2.4. 55-60

- 7.2.5. Less than 65

- 7.3. Market Analysis, Insights and Forecast - by Panel Type

- 7.3.1. LCD

- 7.3.2. OLED

- 7.3.3. QLED

- 7.1. Market Analysis, Insights and Forecast - by Resolution Type

- 8. Asia Pacific Smart TV Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Resolution Type

- 8.1.1. HD/FHD

- 8.1.2. 4K

- 8.1.3. 8K

- 8.2. Market Analysis, Insights and Forecast - by Size (in inches)

- 8.2.1. Greater than 32

- 8.2.2. 39-43

- 8.2.3. 48-50

- 8.2.4. 55-60

- 8.2.5. Less than 65

- 8.3. Market Analysis, Insights and Forecast - by Panel Type

- 8.3.1. LCD

- 8.3.2. OLED

- 8.3.3. QLED

- 8.1. Market Analysis, Insights and Forecast - by Resolution Type

- 9. Latin America Smart TV Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Resolution Type

- 9.1.1. HD/FHD

- 9.1.2. 4K

- 9.1.3. 8K

- 9.2. Market Analysis, Insights and Forecast - by Size (in inches)

- 9.2.1. Greater than 32

- 9.2.2. 39-43

- 9.2.3. 48-50

- 9.2.4. 55-60

- 9.2.5. Less than 65

- 9.3. Market Analysis, Insights and Forecast - by Panel Type

- 9.3.1. LCD

- 9.3.2. OLED

- 9.3.3. QLED

- 9.1. Market Analysis, Insights and Forecast - by Resolution Type

- 10. Middle East and Africa Smart TV Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Resolution Type

- 10.1.1. HD/FHD

- 10.1.2. 4K

- 10.1.3. 8K

- 10.2. Market Analysis, Insights and Forecast - by Size (in inches)

- 10.2.1. Greater than 32

- 10.2.2. 39-43

- 10.2.3. 48-50

- 10.2.4. 55-60

- 10.2.5. Less than 65

- 10.3. Market Analysis, Insights and Forecast - by Panel Type

- 10.3.1. LCD

- 10.3.2. OLED

- 10.3.3. QLED

- 10.1. Market Analysis, Insights and Forecast - by Resolution Type

- 11. North America Smart TV Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Smart TV Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Smart TV Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 Southeast Asia

- 14. Latin America Smart TV Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Smart TV Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Hisense

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Samsung Electronics Co Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 TCL

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Xiaomi*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 LG Electronics

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.1 Hisense

List of Figures

- Figure 1: Global Smart TV Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Smart TV Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Smart TV Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Smart TV Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Smart TV Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Smart TV Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Smart TV Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Smart TV Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Smart TV Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Smart TV Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Smart TV Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Smart TV Industry Revenue (Million), by Resolution Type 2024 & 2032

- Figure 13: North America Smart TV Industry Revenue Share (%), by Resolution Type 2024 & 2032

- Figure 14: North America Smart TV Industry Revenue (Million), by Size (in inches) 2024 & 2032

- Figure 15: North America Smart TV Industry Revenue Share (%), by Size (in inches) 2024 & 2032

- Figure 16: North America Smart TV Industry Revenue (Million), by Panel Type 2024 & 2032

- Figure 17: North America Smart TV Industry Revenue Share (%), by Panel Type 2024 & 2032

- Figure 18: North America Smart TV Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Smart TV Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Smart TV Industry Revenue (Million), by Resolution Type 2024 & 2032

- Figure 21: Europe Smart TV Industry Revenue Share (%), by Resolution Type 2024 & 2032

- Figure 22: Europe Smart TV Industry Revenue (Million), by Size (in inches) 2024 & 2032

- Figure 23: Europe Smart TV Industry Revenue Share (%), by Size (in inches) 2024 & 2032

- Figure 24: Europe Smart TV Industry Revenue (Million), by Panel Type 2024 & 2032

- Figure 25: Europe Smart TV Industry Revenue Share (%), by Panel Type 2024 & 2032

- Figure 26: Europe Smart TV Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Smart TV Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Smart TV Industry Revenue (Million), by Resolution Type 2024 & 2032

- Figure 29: Asia Pacific Smart TV Industry Revenue Share (%), by Resolution Type 2024 & 2032

- Figure 30: Asia Pacific Smart TV Industry Revenue (Million), by Size (in inches) 2024 & 2032

- Figure 31: Asia Pacific Smart TV Industry Revenue Share (%), by Size (in inches) 2024 & 2032

- Figure 32: Asia Pacific Smart TV Industry Revenue (Million), by Panel Type 2024 & 2032

- Figure 33: Asia Pacific Smart TV Industry Revenue Share (%), by Panel Type 2024 & 2032

- Figure 34: Asia Pacific Smart TV Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Smart TV Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Smart TV Industry Revenue (Million), by Resolution Type 2024 & 2032

- Figure 37: Latin America Smart TV Industry Revenue Share (%), by Resolution Type 2024 & 2032

- Figure 38: Latin America Smart TV Industry Revenue (Million), by Size (in inches) 2024 & 2032

- Figure 39: Latin America Smart TV Industry Revenue Share (%), by Size (in inches) 2024 & 2032

- Figure 40: Latin America Smart TV Industry Revenue (Million), by Panel Type 2024 & 2032

- Figure 41: Latin America Smart TV Industry Revenue Share (%), by Panel Type 2024 & 2032

- Figure 42: Latin America Smart TV Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Smart TV Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Smart TV Industry Revenue (Million), by Resolution Type 2024 & 2032

- Figure 45: Middle East and Africa Smart TV Industry Revenue Share (%), by Resolution Type 2024 & 2032

- Figure 46: Middle East and Africa Smart TV Industry Revenue (Million), by Size (in inches) 2024 & 2032

- Figure 47: Middle East and Africa Smart TV Industry Revenue Share (%), by Size (in inches) 2024 & 2032

- Figure 48: Middle East and Africa Smart TV Industry Revenue (Million), by Panel Type 2024 & 2032

- Figure 49: Middle East and Africa Smart TV Industry Revenue Share (%), by Panel Type 2024 & 2032

- Figure 50: Middle East and Africa Smart TV Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Smart TV Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Smart TV Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Smart TV Industry Revenue Million Forecast, by Resolution Type 2019 & 2032

- Table 3: Global Smart TV Industry Revenue Million Forecast, by Size (in inches) 2019 & 2032

- Table 4: Global Smart TV Industry Revenue Million Forecast, by Panel Type 2019 & 2032

- Table 5: Global Smart TV Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Smart TV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Smart TV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Smart TV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Smart TV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Smart TV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: India Smart TV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Southeast Asia Smart TV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Smart TV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Smart TV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Smart TV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Smart TV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Smart TV Industry Revenue Million Forecast, by Resolution Type 2019 & 2032

- Table 18: Global Smart TV Industry Revenue Million Forecast, by Size (in inches) 2019 & 2032

- Table 19: Global Smart TV Industry Revenue Million Forecast, by Panel Type 2019 & 2032

- Table 20: Global Smart TV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Smart TV Industry Revenue Million Forecast, by Resolution Type 2019 & 2032

- Table 22: Global Smart TV Industry Revenue Million Forecast, by Size (in inches) 2019 & 2032

- Table 23: Global Smart TV Industry Revenue Million Forecast, by Panel Type 2019 & 2032

- Table 24: Global Smart TV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Global Smart TV Industry Revenue Million Forecast, by Resolution Type 2019 & 2032

- Table 26: Global Smart TV Industry Revenue Million Forecast, by Size (in inches) 2019 & 2032

- Table 27: Global Smart TV Industry Revenue Million Forecast, by Panel Type 2019 & 2032

- Table 28: Global Smart TV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: India Smart TV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Southeast Asia Smart TV Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Smart TV Industry Revenue Million Forecast, by Resolution Type 2019 & 2032

- Table 32: Global Smart TV Industry Revenue Million Forecast, by Size (in inches) 2019 & 2032

- Table 33: Global Smart TV Industry Revenue Million Forecast, by Panel Type 2019 & 2032

- Table 34: Global Smart TV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Global Smart TV Industry Revenue Million Forecast, by Resolution Type 2019 & 2032

- Table 36: Global Smart TV Industry Revenue Million Forecast, by Size (in inches) 2019 & 2032

- Table 37: Global Smart TV Industry Revenue Million Forecast, by Panel Type 2019 & 2032

- Table 38: Global Smart TV Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart TV Industry?

The projected CAGR is approximately 2.19%.

2. Which companies are prominent players in the Smart TV Industry?

Key companies in the market include Hisense, Samsung Electronics Co Ltd, TCL, Xiaomi*List Not Exhaustive, LG Electronics.

3. What are the main segments of the Smart TV Industry?

The market segments include Resolution Type, Size (in inches), Panel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 275.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Disposable Income Across Emerging Economies; Rising Trend of Video-on-Demand Service.

6. What are the notable trends driving market growth?

QLED is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

The Need for High Investment in Content Creation and Broadcasting; Bandwidth Allocation for 4K Resolution.

8. Can you provide examples of recent developments in the market?

January 2021 - Hisense launched a new product line of laser TV, TriChroma Laser TV, using its cutting-edge display technology. The laser TV will control and package separate lasers to get purer colors for display. TriChroma will have 20% brightness enhancement at the pixel level with a 430-nit picture brightness. The new TV product line will be offered in various screen sizes, including 75-inch to 100-inch giant screens. The company also aims to provide its customers with customized solutions, home fitness screens, and various professional options for different industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart TV Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart TV Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart TV Industry?

To stay informed about further developments, trends, and reports in the Smart TV Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence