Key Insights

Spain's office real estate market is poised for significant expansion, projected to grow from €28 billion in 2024 at a CAGR of 6%. This robust growth is underpinned by a strengthening Spanish economy, increased foreign direct investment, and a burgeoning technology sector. Major urban hubs like Madrid and Barcelona are experiencing heightened demand for premium office spaces, amplified by the rise of co-working solutions. A constrained supply of modern, strategically located office properties is fostering a competitive seller's market and driving rental value appreciation. While economic uncertainties and rising construction expenses present potential hurdles, the market's fundamental strengths suggest sustained growth throughout the forecast period.

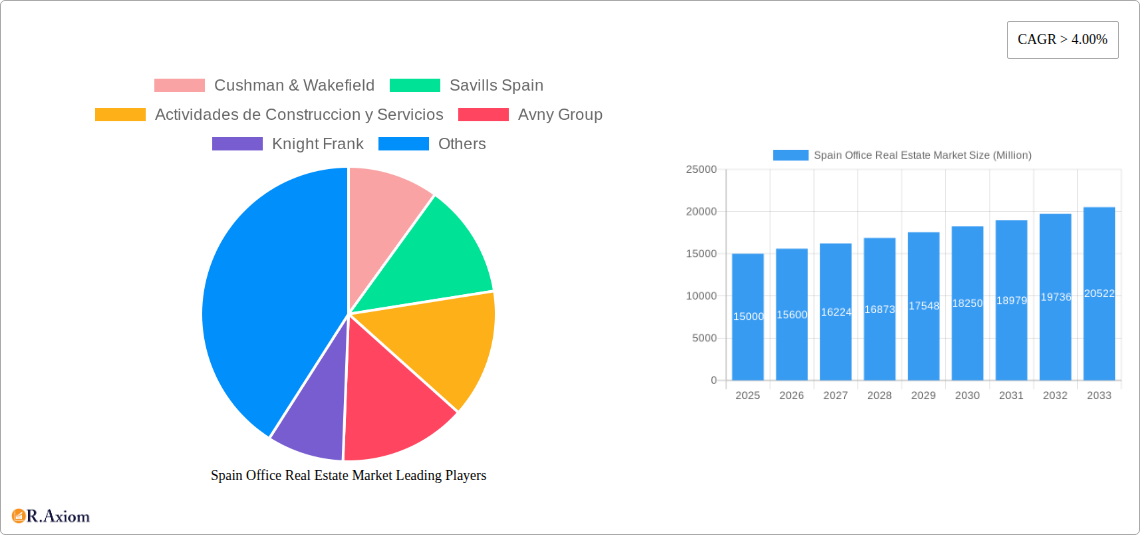

Spain Office Real Estate Market Market Size (In Billion)

Beyond the primary markets of Madrid and Barcelona, secondary cities such as Valencia and Seville are demonstrating increasing transactional activity. Leading international and domestic real estate firms, including Cushman & Wakefield, Savills Spain, Actividades de Construccion y Servicios, and Fomento de Construcciones y Contratas, are strategically positioned to capitalize on this upward trend. Heightened competition emphasizes the delivery of innovative and sustainable office environments to meet evolving tenant requirements. The industry is increasingly adopting sustainable building practices and smart technologies, signaling a market shift towards superior, energy-efficient workspaces. The long-term outlook for Spain's office real estate sector remains optimistic, contingent upon careful navigation of macroeconomic conditions and regulatory landscapes.

Spain Office Real Estate Market Company Market Share

This report delivers a comprehensive analysis of the Spanish office real estate market from 2019 to 2033. It delves into market dynamics, key stakeholders, growth catalysts, and prevailing challenges, providing actionable intelligence for investors, developers, and industry professionals. Leveraging historical data (2019-2024) and a 2024 base year, the analysis forecasts market trajectory through 2033. Key market segments under review include Madrid, Barcelona, Valencia, Seville, and other significant urban centers.

Spain Office Real Estate Market Concentration & Innovation

The Spanish office real estate market exhibits a moderately concentrated landscape, with several multinational players dominating alongside significant regional operators. Cushman & Wakefield, Savills Spain, CBRE Spain, and Knight Frank hold substantial market share, often engaging in mergers and acquisitions (M&A) to expand their portfolios and geographical reach. While precise market share figures fluctuate annually, these firms collectively account for an estimated 40% of the total market value. M&A activity has been particularly strong during the historical period (2019-2024), with total deal values exceeding €XX Million.

Innovation is driven by several factors:

- Technological advancements: Smart building technologies, improved energy efficiency solutions, and flexible workspace designs are shaping market preferences.

- Regulatory frameworks: Government incentives for sustainable development and building regulations influence construction and investment decisions.

- Product substitutes: The rise of co-working spaces and remote work models presents challenges, yet also creates opportunities for flexible office solutions.

- End-user trends: Demand for high-quality, sustainable, and amenity-rich office spaces is driving market segmentation and development.

- M&A activity: Consolidation among major players fosters innovation through resource sharing and technological integration.

Spain Office Real Estate Market Industry Trends & Insights

The Spanish office real estate market experienced a CAGR of XX% during the historical period (2019-2024), largely driven by economic growth and increasing demand from various sectors. Market penetration of sustainable building practices continues to increase, although adoption rates vary across cities and property types. Technological disruptions, including the rise of remote work, impacted demand, yet also fueled innovations in flexible workspace solutions. Consumer preferences are increasingly focused on sustainable and technologically advanced office spaces, leading to premium pricing for properties incorporating these features. Competitive dynamics are characterized by intense competition among major players, while local firms focus on niche market segments. The forecast period (2025-2033) anticipates a CAGR of XX%, albeit with potential fluctuations due to macroeconomic factors and geopolitical uncertainties.

Dominant Markets & Segments in Spain Office Real Estate Market

Madrid and Barcelona clearly dominate the Spanish office real estate market, accounting for approximately 70% of the total market value.

Madrid:

- Key Drivers: Strong economic activity, a large concentration of multinational corporations, robust infrastructure, and government support for development projects.

- Dominance Analysis: Madrid's central location, established business ecosystem, and high-quality office stock contribute to its sustained dominance.

Barcelona:

- Key Drivers: Thriving tech sector, a large and diverse workforce, strong tourism industry, and a reputation as a global business hub.

- Dominance Analysis: Barcelona's appeal to tech companies and its vibrant atmosphere drive demand, while its comparatively lower costs than Madrid attract a wider range of businesses.

Valencia and Seville exhibit moderate growth, driven by regional economic development and infrastructure improvements. "Other Cities" represent a diverse range of markets with varying growth trajectories.

Spain Office Real Estate Market Product Developments

Recent product innovations in the Spanish office market revolve around sustainable building materials, smart building technologies, flexible workspace designs, and enhanced amenities. These improvements cater to evolving user preferences for efficient, eco-friendly, and technologically advanced work environments. Market fit is strong, with premium pricing reflecting consumer demand for these upgraded features.

Report Scope & Segmentation Analysis

This report segments the Spanish office real estate market by key cities: Madrid, Barcelona, Valencia, Seville, and Other Cities. Each segment exhibits unique growth projections and competitive dynamics. Madrid and Barcelona show the highest growth, driven by strong demand and substantial investment. Valencia and Seville show moderate growth, whereas the "Other Cities" segment presents a diverse range of market conditions. Market sizes are detailed for each segment, showing the distribution of office space and investment across the country.

Key Drivers of Spain Office Real Estate Market Growth

Growth is driven by:

- Strong economic fundamentals: Sustained economic growth, particularly in key sectors like technology and tourism, fuels demand for office space.

- Infrastructure development: Investments in transportation networks and urban renewal projects enhance the attractiveness of office locations.

- Favorable regulatory environment: Government policies promoting sustainable development and inward investment create a supportive market environment.

Challenges in the Spain Office Real Estate Market Sector

Challenges include:

- Economic volatility: Global economic uncertainties can affect investment levels and occupancy rates.

- Supply chain disruptions: Global supply chain issues can increase construction costs and delay project completion.

- High construction costs: Rising material and labor costs affect project viability. These factors resulted in a €XX Million loss for some projects in 2024.

Emerging Opportunities in Spain Office Real Estate Market

Opportunities exist in:

- Sustainable office developments: Growing demand for green buildings presents opportunities for eco-friendly construction and refurbishment projects.

- Flexible workspace solutions: The continued rise of remote and hybrid work models creates demand for adaptable and flexible office layouts.

- Tech-enabled office spaces: Integration of smart building technology enhances operational efficiency and tenant appeal.

Leading Players in the Spain Office Real Estate Market Market

- Cushman & Wakefield

- Savills Spain

- Actividades de Construccion y Servicios

- Avny Group

- Knight Frank

- Fomento de Construcciones y Contratas

- Obrascon Huarte Lain

- CBRE Spain

- Dragados S A

Key Developments in Spain Office Real Estate Market Industry

- March 2022: Meta announced a new 2,000-staff Meta Lab in Madrid, boosting demand for flexible office spaces and supporting local tech entrepreneurs.

- February 2023: The limehome deal in Bremen, while outside Spain, highlights the growing trend towards utilizing apartment buildings for flexible office space solutions, a model which may be replicated in Spain. This indicates a potential shift in the types of properties considered "office space."

Strategic Outlook for Spain Office Real Estate Market Market

The Spanish office real estate market is poised for continued growth, driven by sustained economic expansion, technological advancements, and evolving user preferences. Opportunities exist in developing sustainable, flexible, and technologically advanced office spaces to meet the demands of a dynamic market. The long-term outlook remains positive, with potential for significant value creation for investors and developers who effectively adapt to market trends.

Spain Office Real Estate Market Segmentation

-

1. Key Cities

- 1.1. Madrid

- 1.2. Barcelona

- 1.3. Valencia

- 1.4. Seville

- 1.5. Other Cities

Spain Office Real Estate Market Segmentation By Geography

- 1. Spain

Spain Office Real Estate Market Regional Market Share

Geographic Coverage of Spain Office Real Estate Market

Spain Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Office Take-up Remains Strong in Spain

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. Madrid

- 5.1.2. Barcelona

- 5.1.3. Valencia

- 5.1.4. Seville

- 5.1.5. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cushman & Wakefield

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Savills Spain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Actividades de Construccion y Servicios

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Avny Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Knight Frank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fomento de Construcciones y Contratas

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Obrascon Huarte Lain

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CBRE Spain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dragados S A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Cushman & Wakefield

List of Figures

- Figure 1: Spain Office Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Spain Office Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Office Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 2: Spain Office Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Spain Office Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 4: Spain Office Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Office Real Estate Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Spain Office Real Estate Market?

Key companies in the market include Cushman & Wakefield, Savills Spain, Actividades de Construccion y Servicios, Avny Group, Knight Frank, Fomento de Construcciones y Contratas, Obrascon Huarte Lain, CBRE Spain, Dragados S A.

3. What are the main segments of the Spain Office Real Estate Market?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 28 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Office Take-up Remains Strong in Spain.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

Feb 2023: Hospitality technology provider and apartment operator, limehome, has signed 82 flats in the Balgequartier district of Bremen. The Balgequartier, a new inner-city district along Langenstraße, is currently being developed by Joh. Jacobs and Co. Four buildings of the mixed-use development will house shops and office space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Spain Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence