Key Insights

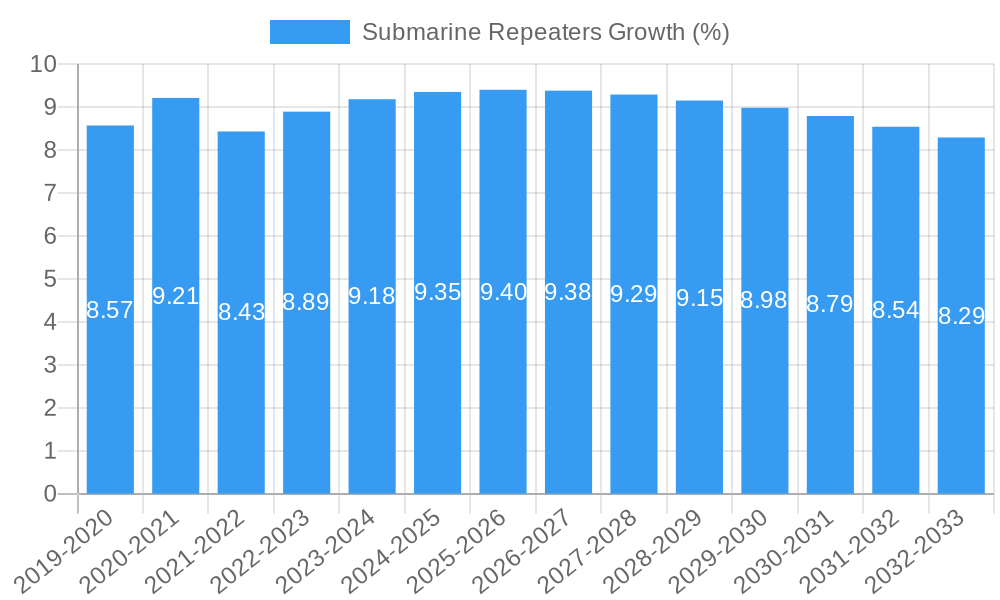

The global Submarine Repeaters market is poised for significant expansion, projected to reach an estimated value of $XXX million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% anticipated through 2033. This impressive growth is primarily fueled by the escalating demand for higher bandwidth and increased data traffic, driven by the proliferation of cloud computing, the burgeoning Internet of Things (IoT) ecosystem, and the ever-growing need for reliable intercontinental connectivity for businesses and consumers alike. The continuous upgrades and expansion of existing submarine cable networks, coupled with the deployment of new high-capacity systems, are critical drivers. Furthermore, the increasing reliance on subsea fiber optic cables for critical infrastructure, including financial transactions, telecommunications, and governmental communications, underscores the strategic importance and sustained demand for advanced submarine repeater technology. Investments in deep-sea exploration and data transfer necessitate resilient and high-performance repeater solutions, further propelling market advancement.

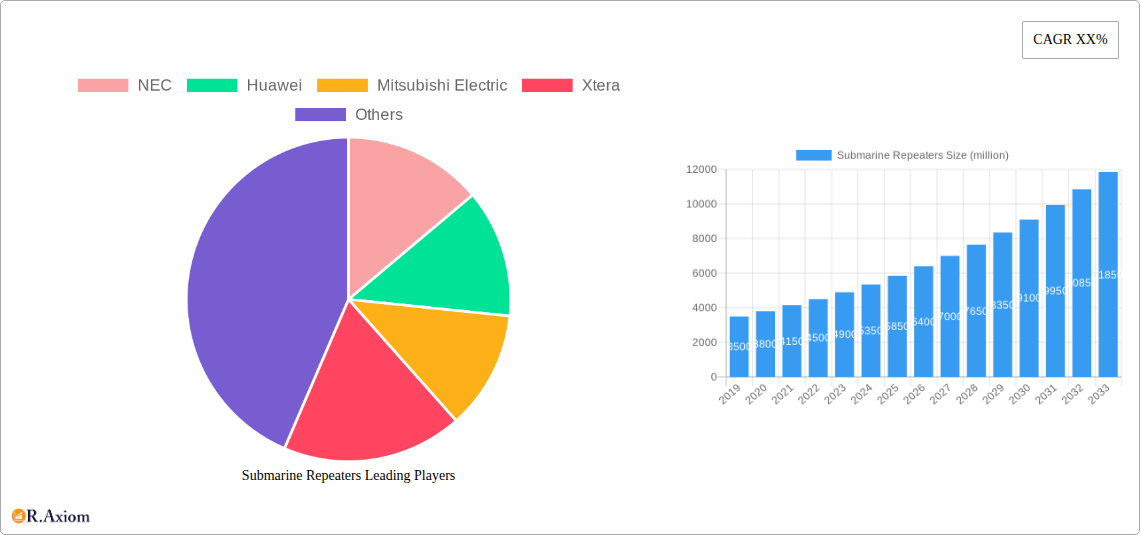

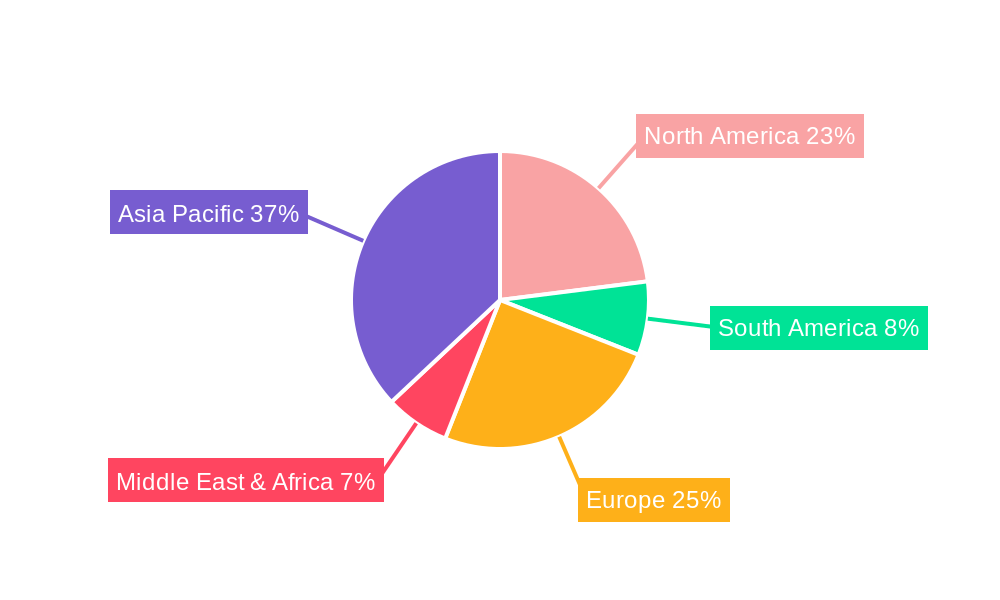

The market is segmented into applications, with the "Deep Sea" segment expected to command a larger share due to the increasing complexity and scale of intercontinental cable deployments, requiring advanced repeaters capable of operating under extreme pressure and environmental conditions. The "Shallow Sea" application also presents substantial opportunities, particularly for coastal connectivity and regional networks. In terms of types, the "8 Fiber Pair" segment is likely to witness the highest growth, reflecting the industry's move towards maximizing data transmission capacity per cable. Key industry players like NEC, Huawei, Mitsubishi Electric, and Xtera are actively investing in research and development to enhance repeater performance, reduce power consumption, and improve reliability, thereby addressing market restraints such as the high cost of deployment and maintenance, as well as the complex regulatory landscape associated with subsea cable installations. Regional analysis indicates Asia Pacific, particularly China and India, will be a dominant force, driven by rapid digital transformation and substantial investments in digital infrastructure, followed closely by North America and Europe.

Here is a detailed, SEO-optimized report description for Submarine Repeaters:

Submarine Repeaters Market Concentration & Innovation

The submarine repeaters market is characterized by a moderate to high level of concentration, with key players like NEC, Huawei, Mitsubishi Electric, and Xtera dominating a significant portion of the global market share, estimated at over $800 million in 2025. Innovation serves as a primary growth catalyst, driven by the relentless demand for higher bandwidth, lower latency, and increased data transmission capabilities across global subsea cable networks. Regulatory frameworks, while generally supportive of critical infrastructure development, can introduce complexities related to environmental impact assessments and international telecommunication standards. Product substitutes are largely non-existent for the core function of signal amplification in deep-sea optical fiber transmission, though advancements in fiber optic technology itself and more efficient transmission techniques indirectly influence repeater design and demand. End-user trends are overwhelmingly focused on expanding internet connectivity, enabling cloud computing, supporting AI and big data analytics, and facilitating the growing digital economy. Mergers and acquisitions (M&A) activity, though not as frequent as in some other tech sectors, are strategically important. Recent M&A deal values in the broader subsea cable infrastructure segment have reached over $500 million, indicating a consolidation trend for companies seeking to enhance their end-to-end service offerings and gain a competitive edge. The market is propelled by a steady increase in data traffic and the ongoing need to connect continents with robust and reliable communication links.

Submarine Repeaters Industry Trends & Insights

The submarine repeaters industry is experiencing robust growth, fueled by an ever-escalating demand for global connectivity and data transmission capacity. Market growth drivers are multifaceted, including the exponential rise in internet penetration, the proliferation of cloud computing services, the surge in video streaming, and the increasing adoption of emerging technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and 5G mobile networks, all of which necessitate high-capacity subsea communication infrastructure. The Compound Annual Growth Rate (CAGR) for the submarine repeaters market is projected to be approximately $7.5% from 2025 to 2033, with the market size expected to surpass $1.2 billion by 2033. Technological disruptions are at the forefront, with ongoing advancements in optical amplification technologies, such as Erbium-Doped Fiber Amplifiers (EDFAs) and potentially Raman amplifiers, pushing the boundaries of transmission distances and data rates. The integration of more sophisticated monitoring and management systems within repeaters is also a key trend, enhancing network reliability and reducing operational costs. Consumer preferences are increasingly directed towards seamless, high-speed, and low-latency internet experiences, directly translating into a demand for more extensive and resilient subsea cable systems that rely on advanced repeater technology. Competitive dynamics are characterized by a strategic focus on product innovation, cost optimization, and the ability to deliver integrated solutions for large-scale subsea cable projects. Key players are investing heavily in research and development to enhance repeater performance, miniaturization, and power efficiency. Market penetration is steadily increasing as new subsea cable routes are deployed globally and existing ones are upgraded to meet future bandwidth demands. The focus remains on ensuring the reliability, durability, and cost-effectiveness of these critical components in harsh marine environments.

Dominant Markets & Segments in Submarine Repeaters

The dominance within the submarine repeaters market is clearly bifurcated across different applications and technological configurations. In terms of application, the Deep Sea segment is a significant driver of market dominance, accounting for an estimated $650 million in market value for 2025. The economic policies supporting the expansion of global telecommunication networks, particularly intercontinental data transfer, are key drivers. Investments in transoceanic cables are substantial, often backed by consortia of major telecommunication companies and governments seeking to bolster their digital infrastructure and international trade capabilities. Infrastructure development in this segment focuses on resilience against environmental factors and the need for ultra-long-haul transmission, necessitating advanced and robust repeater designs.

Within the types of fiber pairs, the 4 Fiber Pair segment holds a dominant position, projected to capture over $400 million of the market in 2025. This dominance is attributed to its balanced offering of capacity and cost-effectiveness, making it a popular choice for a wide range of subsea cable deployments. The increasing need for redundant data paths and the growing demand for higher total capacity per cable system directly influence the preference for multi-fiber pair configurations.

The Shallow Sea application segment, while smaller than deep sea, is still a vital part of the market, with an estimated value of $150 million in 2025. This segment is driven by coastal connectivity, regional networks, and the expansion of data centers closer to populated areas. Infrastructure development here focuses on ease of deployment and cost-efficiency in less challenging marine environments.

The 8 Fiber Pair segment represents a high-growth area, with its market value projected to exceed $200 million by 2025, driven by the demand for maximum capacity in critical long-haul routes. This segment is favored for its ability to support massive data throughput, crucial for meeting the demands of cloud giants and large-scale internet service providers.

The 2 Fiber Pair segment, while the most basic, still commands a significant market share, estimated at $250 million in 2025. It remains crucial for specific applications where cost is a primary consideration or for shorter-haul routes where ultra-high capacity is not the sole requirement.

Key drivers across these segments include government initiatives for digital transformation, the growing reliance on cloud-based services, and the continuous expansion of internet connectivity to underserved regions. Economic policies that encourage foreign investment in telecommunications infrastructure and international collaboration on large-scale projects significantly bolster the market for submarine repeaters.

Submarine Repeaters Product Developments

Submarine repeater product developments are centered on enhancing transmission capacity, extending reach, and improving reliability in harsh subsea environments. Innovations focus on advancements in optical amplification technology, such as higher-gain EDFAs and integrated pump laser modules, enabling longer cable lengths without signal degradation. Miniaturization and increased power efficiency are also key trends, reducing the physical footprint and operational power consumption of repeaters. Companies are developing repeaters with enhanced diagnostic capabilities and remote monitoring features, allowing for proactive maintenance and reduced downtime. These developments are crucial for supporting the ever-increasing bandwidth demands driven by cloud services, AI, and the growing digital economy. The competitive advantage lies in offering repeaters that are not only high-performing but also cost-effective, environmentally robust, and easily deployable.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the global submarine repeaters market, meticulously segmented to offer comprehensive insights. The market is segmented by Application into Shallow Sea and Deep Sea. The Shallow Sea segment is projected to witness a market size of approximately $150 million by 2025, driven by regional connectivity and data center expansion. The Deep Sea segment, a larger and more critical area, is forecast to reach a market size of around $650 million by 2025, propelled by intercontinental data transfer and the backbone of global internet infrastructure.

Further segmentation is based on Types of fiber pairs: 2 Fiber Pair, 4 Fiber Pair, and 8 Fiber Pair. The 2 Fiber Pair segment, estimated at $250 million in 2025, caters to specific cost-sensitive applications and shorter routes. The 4 Fiber Pair segment is anticipated to be a dominant force, with a market size of over $400 million by 2025, offering a balanced blend of capacity and cost. The 8 Fiber Pair segment, representing the highest capacity offering, is projected to grow significantly, reaching an estimated $200 million by 2025, driven by the insatiable demand for bandwidth from hyperscale cloud providers and large enterprises. Competitive dynamics vary across these segments, with cost, capacity, and reliability being key differentiating factors.

Key Drivers of Submarine Repeaters Growth

The growth of the submarine repeaters market is propelled by several interconnected factors. A primary driver is the exponential growth in global data traffic, fueled by the increasing adoption of cloud computing, big data analytics, and the proliferation of digital services like video streaming and online gaming. Secondly, the ongoing expansion of 5G networks and the burgeoning Internet of Things (IoT) ecosystem necessitate higher bandwidth and lower latency, which are directly supported by advanced subsea cable systems incorporating sophisticated repeaters. Thirdly, governments worldwide are investing heavily in digital infrastructure to foster economic development and bridge the digital divide, leading to the deployment of new subsea cable routes. Finally, the ongoing need to connect continents and establish resilient global communication networks for critical infrastructure and international business operations remains a fundamental growth catalyst.

Challenges in the Submarine Repeaters Sector

Despite robust growth, the submarine repeaters sector faces several challenges. High upfront capital investment for subsea cable deployment, including repeaters, can be a significant barrier, particularly for smaller operators. Environmental concerns and stringent regulatory approvals for subsea cable installations, including considerations for marine ecosystems, can lead to project delays and increased costs. Supply chain disruptions, especially for specialized electronic components and raw materials, can impact manufacturing timelines and project execution. Furthermore, the competitive pressure to continuously innovate and reduce costs while maintaining extremely high reliability in harsh environments poses an ongoing challenge for manufacturers. The long lifecycle of subsea cables also means that upgrade cycles for repeaters are extended, requiring a long-term strategic outlook from all stakeholders.

Emerging Opportunities in Submarine Repeaters

Emerging opportunities in the submarine repeaters market are vast and diverse. The expansion of subsea cables into new geographical regions, such as the Arctic and developing economies, presents significant growth potential. The increasing demand for higher data transmission speeds, such as terabits per second (Tbps) capabilities, is driving innovation in repeater technology, creating opportunities for advanced optical amplification solutions. The development of more intelligent and self-monitoring repeaters, incorporating AI and advanced analytics for predictive maintenance, is another key area. Furthermore, the growing number of hyperscale data centers and cloud providers investing in private subsea networks creates a strong demand for customized and high-capacity repeater solutions. The focus on network resilience and redundancy in the face of increasing cyber threats and natural disasters also highlights the ongoing need for robust and reliable subsea infrastructure.

Leading Players in the Submarine Repeaters Market

- NEC

- Huawei

- Mitsubishi Electric

- Xtera

Key Developments in Submarine Repeaters Industry

- 2023: NEC announces advancements in optical amplifier technology, enabling higher transmission capacities for future subsea cable systems.

- 2023: Huawei reports successful testing of its next-generation submarine repeaters designed for increased power efficiency and smaller form factors.

- 2022: Mitsubishi Electric highlights its ongoing R&D efforts focused on enhancing the reliability and lifespan of repeaters for deep-sea deployments.

- 2022: Xtera unveils new repeater designs optimized for specific application needs, including high-density fiber configurations.

- 2021: Significant investment in new transoceanic cable projects worldwide underscores the sustained demand for advanced submarine repeaters.

Strategic Outlook for Submarine Repeaters Market

The strategic outlook for the submarine repeaters market remains exceptionally strong, underpinned by the fundamental and continuously growing global demand for data connectivity. The relentless expansion of digital services, cloud computing, and emerging technologies like AI and 5G will necessitate ongoing investment in subsea cable infrastructure, directly translating into sustained demand for repeaters. Future growth will be driven by the deployment of higher-capacity cables, the exploration of new subsea routes, and the continuous evolution of repeater technology towards greater efficiency, intelligence, and resilience. Companies that can innovate in terms of performance, cost-effectiveness, and integrated solutions will be well-positioned to capitalize on the expanding opportunities in this critical sector of global telecommunications.

Submarine Repeaters Segmentation

-

1. Application

- 1.1. Shallow Sea

- 1.2. Deep Sea

-

2. Types

- 2.1. 2 Fiber Pair

- 2.2. 4 Fiber Pair

- 2.3. 8 Fiber Pair

Submarine Repeaters Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Submarine Repeaters REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Submarine Repeaters Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Shallow Sea

- 5.1.2. Deep Sea

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 2 Fiber Pair

- 5.2.2. 4 Fiber Pair

- 5.2.3. 8 Fiber Pair

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Submarine Repeaters Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Shallow Sea

- 6.1.2. Deep Sea

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 2 Fiber Pair

- 6.2.2. 4 Fiber Pair

- 6.2.3. 8 Fiber Pair

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Submarine Repeaters Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Shallow Sea

- 7.1.2. Deep Sea

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 2 Fiber Pair

- 7.2.2. 4 Fiber Pair

- 7.2.3. 8 Fiber Pair

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Submarine Repeaters Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Shallow Sea

- 8.1.2. Deep Sea

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 2 Fiber Pair

- 8.2.2. 4 Fiber Pair

- 8.2.3. 8 Fiber Pair

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Submarine Repeaters Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Shallow Sea

- 9.1.2. Deep Sea

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 2 Fiber Pair

- 9.2.2. 4 Fiber Pair

- 9.2.3. 8 Fiber Pair

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Submarine Repeaters Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Shallow Sea

- 10.1.2. Deep Sea

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 2 Fiber Pair

- 10.2.2. 4 Fiber Pair

- 10.2.3. 8 Fiber Pair

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 NEC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Huawei

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitsubishi Electric

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Xtera

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 NEC

List of Figures

- Figure 1: Global Submarine Repeaters Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Submarine Repeaters Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Submarine Repeaters Revenue (million), by Application 2024 & 2032

- Figure 4: North America Submarine Repeaters Volume (K), by Application 2024 & 2032

- Figure 5: North America Submarine Repeaters Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Submarine Repeaters Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Submarine Repeaters Revenue (million), by Types 2024 & 2032

- Figure 8: North America Submarine Repeaters Volume (K), by Types 2024 & 2032

- Figure 9: North America Submarine Repeaters Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Submarine Repeaters Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Submarine Repeaters Revenue (million), by Country 2024 & 2032

- Figure 12: North America Submarine Repeaters Volume (K), by Country 2024 & 2032

- Figure 13: North America Submarine Repeaters Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Submarine Repeaters Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Submarine Repeaters Revenue (million), by Application 2024 & 2032

- Figure 16: South America Submarine Repeaters Volume (K), by Application 2024 & 2032

- Figure 17: South America Submarine Repeaters Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Submarine Repeaters Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Submarine Repeaters Revenue (million), by Types 2024 & 2032

- Figure 20: South America Submarine Repeaters Volume (K), by Types 2024 & 2032

- Figure 21: South America Submarine Repeaters Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Submarine Repeaters Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Submarine Repeaters Revenue (million), by Country 2024 & 2032

- Figure 24: South America Submarine Repeaters Volume (K), by Country 2024 & 2032

- Figure 25: South America Submarine Repeaters Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Submarine Repeaters Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Submarine Repeaters Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Submarine Repeaters Volume (K), by Application 2024 & 2032

- Figure 29: Europe Submarine Repeaters Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Submarine Repeaters Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Submarine Repeaters Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Submarine Repeaters Volume (K), by Types 2024 & 2032

- Figure 33: Europe Submarine Repeaters Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Submarine Repeaters Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Submarine Repeaters Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Submarine Repeaters Volume (K), by Country 2024 & 2032

- Figure 37: Europe Submarine Repeaters Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Submarine Repeaters Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Submarine Repeaters Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Submarine Repeaters Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Submarine Repeaters Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Submarine Repeaters Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Submarine Repeaters Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Submarine Repeaters Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Submarine Repeaters Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Submarine Repeaters Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Submarine Repeaters Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Submarine Repeaters Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Submarine Repeaters Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Submarine Repeaters Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Submarine Repeaters Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Submarine Repeaters Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Submarine Repeaters Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Submarine Repeaters Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Submarine Repeaters Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Submarine Repeaters Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Submarine Repeaters Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Submarine Repeaters Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Submarine Repeaters Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Submarine Repeaters Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Submarine Repeaters Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Submarine Repeaters Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Submarine Repeaters Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Submarine Repeaters Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Submarine Repeaters Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Submarine Repeaters Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Submarine Repeaters Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Submarine Repeaters Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Submarine Repeaters Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Submarine Repeaters Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Submarine Repeaters Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Submarine Repeaters Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Submarine Repeaters Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Submarine Repeaters Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Submarine Repeaters Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Submarine Repeaters Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Submarine Repeaters Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Submarine Repeaters Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Submarine Repeaters Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Submarine Repeaters Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Submarine Repeaters Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Submarine Repeaters Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Submarine Repeaters Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Submarine Repeaters Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Submarine Repeaters Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Submarine Repeaters Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Submarine Repeaters Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Submarine Repeaters Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Submarine Repeaters Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Submarine Repeaters Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Submarine Repeaters Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Submarine Repeaters Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Submarine Repeaters Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Submarine Repeaters Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Submarine Repeaters Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Submarine Repeaters Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Submarine Repeaters Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Submarine Repeaters Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Submarine Repeaters Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Submarine Repeaters Volume K Forecast, by Country 2019 & 2032

- Table 81: China Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Submarine Repeaters Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Submarine Repeaters Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Submarine Repeaters?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Submarine Repeaters?

Key companies in the market include NEC, Huawei, Mitsubishi Electric, Xtera.

3. What are the main segments of the Submarine Repeaters?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Submarine Repeaters," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Submarine Repeaters report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Submarine Repeaters?

To stay informed about further developments, trends, and reports in the Submarine Repeaters, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence