Key Insights

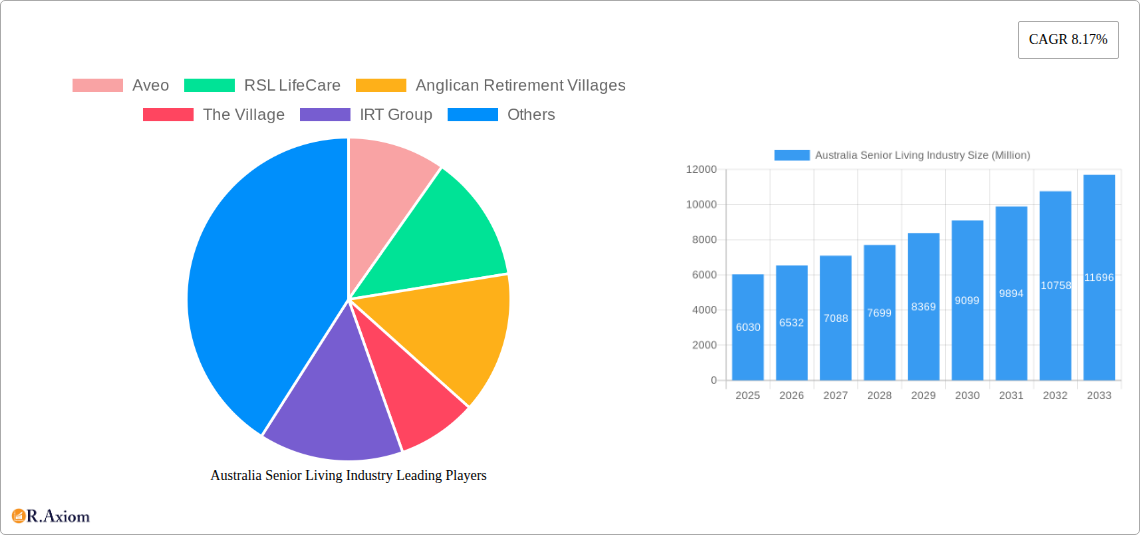

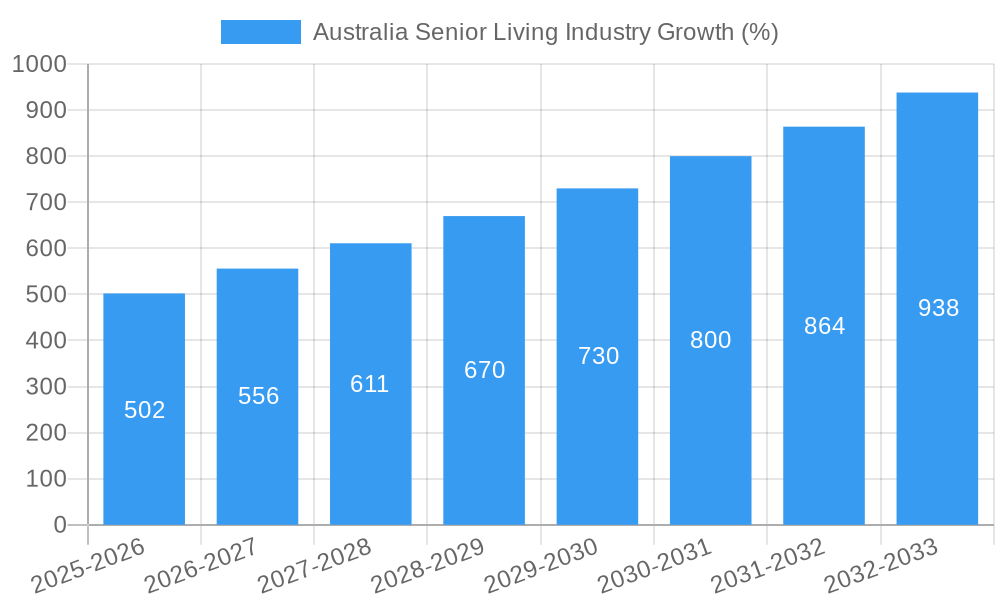

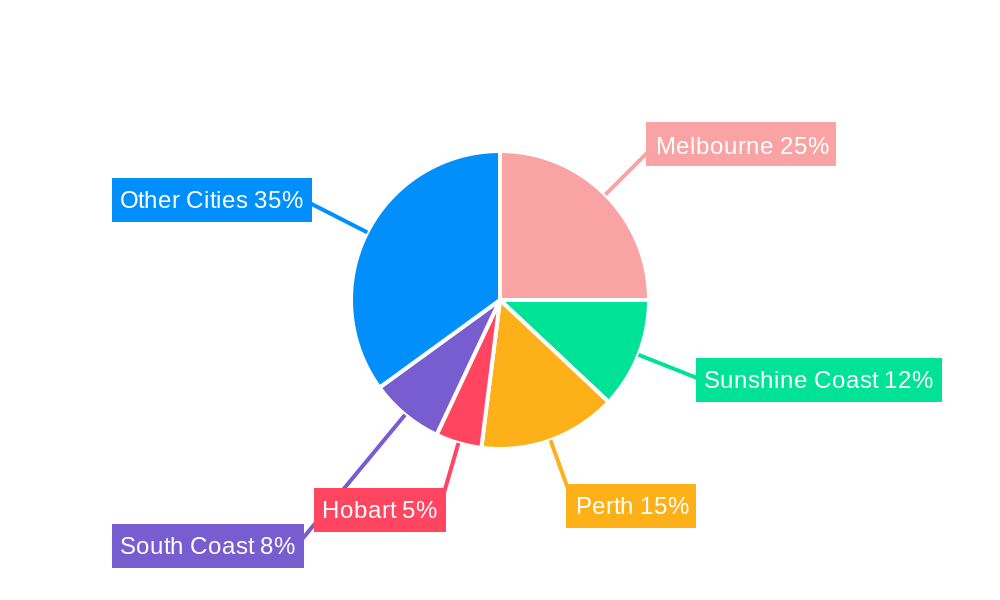

The Australian senior living market, valued at $6.03 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.17% from 2025 to 2033. This expansion is driven by several key factors. Australia's aging population, with a rising proportion of individuals aged 65 and older, fuels the increasing demand for assisted living, independent living, memory care, and nursing care facilities. Government initiatives supporting aged care and increasing awareness of the benefits of senior living communities further contribute to market growth. Furthermore, the growing preference for community-based care options, coupled with advancements in healthcare technologies and services within these facilities, enhances the appeal and overall quality of life for residents. Competition among established players like Aveo, RSL LifeCare, and Stockland, along with emerging operators, drives innovation and ensures a diverse range of options for seniors. However, potential constraints include the availability of skilled workforce and the increasing cost of providing high-quality care which impacts pricing and accessibility. Geographic variations in demand exist across cities like Melbourne, Perth, and the Sunshine Coast, reflecting population density and local economic conditions.

The segment breakdown shows a diverse landscape. While precise figures for each property type (Assisted Living, Independent Living, Memory Care, Nursing Care) and city are unavailable, the data suggests a significant market share across all segments. The substantial presence of major players like Aveo and Stockland indicates considerable investment and market consolidation. Future growth will likely be influenced by government policy changes regarding aged care funding, evolving consumer preferences towards personalized care, and the successful integration of technology to improve efficiency and care delivery. The projected CAGR suggests a considerable increase in market value by 2033, indicating significant opportunities for both existing and new entrants in the Australian senior living sector.

This comprehensive report provides an in-depth analysis of the Australian senior living industry, encompassing market size, segmentation, key players, trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers actionable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. The report utilizes data from the historical period (2019-2024) to project future market trends. Market values are expressed in Millions.

Australia Senior Living Industry Market Concentration & Innovation

The Australian senior living industry exhibits a moderately concentrated market structure, with several large players holding significant market share. Aveo, RSL LifeCare, Stockland, and Lendlease are among the leading operators, collectively controlling a significant portion (estimated xx%) of the market. However, numerous smaller, regional providers also contribute substantially to the overall market size. Innovation is driven by increasing demand for specialized care services, technological advancements in health monitoring and remote care, and a growing focus on creating age-friendly communities. The regulatory framework, while evolving, seeks to ensure quality standards and consumer protection. Product substitutes are limited, primarily focusing on home-based care services, although these often lack the community and specialized care options offered by senior living facilities. End-user trends indicate a preference for independent living options with access to assisted care services as needed, alongside a rising demand for memory care facilities. Mergers and acquisitions (M&A) activity has been notable, with deals often driven by the consolidation of regional operators by larger corporations to expand their geographic reach and service offerings. Recent M&A deal values are estimated at xx Million.

- Market Share: Aveo (xx%), RSL LifeCare (xx%), Stockland (xx%), Lendlease (xx%), Others (xx%)

- M&A Activity: Significant activity in recent years, driven by consolidation and expansion strategies. Total deal value (2019-2024): xx Million.

- Innovation Drivers: Technological advancements in health monitoring and remote care, growing demand for specialized care services.

Australia Senior Living Industry Industry Trends & Insights

The Australian senior living industry is experiencing robust growth, driven by several key factors. The aging population, coupled with increased life expectancy, is fueling demand for diverse senior living options. Technological disruptions, such as telehealth and remote monitoring systems, are transforming care delivery, improving efficiency, and enhancing the quality of life for residents. Consumer preferences are shifting towards personalized care plans, flexible accommodation choices, and community-based services that promote social engagement and well-being. Competitive dynamics are characterized by both consolidation and innovation, with larger operators expanding their portfolios through acquisitions while smaller providers focus on niche markets and specialized services. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to increase from xx% in 2025 to xx% by 2033.

Dominant Markets & Segments in Australia Senior Living Industry

The Australian senior living market is geographically diverse, with significant presence across various states and territories. Melbourne and other major metropolitan areas exhibit high demand due to higher population density and wealth accumulation. The Independent Living segment dominates the market share, reflecting the preference for maintaining independence while having access to support services. However, the Assisted Living and Memory Care segments are experiencing significant growth, driven by the increasing needs of an aging population.

- By Property Type:

- Independent Living: Largest segment, driven by preference for maintaining independence with support services.

- Assisted Living: Rapidly growing segment, catering to individuals requiring assistance with daily tasks.

- Memory Care: Significant growth potential due to the rising prevalence of dementia and Alzheimer's disease.

- Nursing Care: Essential segment, providing high-level medical care for residents with complex health needs.

- By Cities:

- Melbourne: High demand driven by population density and affluence.

- Sunshine Coast: Attractive due to climate and lifestyle factors.

- Perth: Significant growth potential driven by population growth and economic prosperity.

- Hobart: Moderate growth, driven by an aging population and rising demand for specialized care.

- South Coast: Similar to Sunshine Coast in terms of lifestyle appeal.

- Other Cities: Significant contribution to overall market size. Growth influenced by local demographic and economic factors.

Key Drivers: Aging population, rising disposable incomes, increased awareness of senior living options, government initiatives supporting aged care.

Australia Senior Living Industry Product Developments

Product innovation within the Australian senior living sector focuses on enhancing resident well-being and improving care delivery. Smart home technology is being integrated to monitor resident health and provide timely assistance. Innovative design features are creating age-friendly environments, promoting independence and reducing fall risks. Personalized care plans and flexible service packages are becoming increasingly common, catering to individual needs and preferences. The focus is on creating a continuum of care, allowing residents to age in place while receiving the appropriate level of support. Technology is key to achieving this, linking residents with remote monitoring and telehealth services.

Report Scope & Segmentation Analysis

This report segments the Australian senior living market by property type (Independent Living, Assisted Living, Memory Care, Nursing Care) and by city (Sunshine Coast, Hobart, Melbourne, Perth, South Coast, Other Cities). Each segment is analyzed based on its current market size, projected growth rate, and competitive dynamics. Growth projections consider factors such as demographic shifts, economic conditions, and government policies. The competitive landscape is assessed by analyzing the market share of key players, their strategies, and their strengths and weaknesses.

Key Drivers of Australia Senior Living Industry Growth

Several factors are driving growth in the Australian senior living industry. The most significant is the rapidly aging population, with a substantial increase in the number of people aged 65 and older. This demographic shift is creating a surge in demand for various senior living options. Rising disposable incomes and increased awareness of the benefits of senior living communities are also contributing to market expansion. Government initiatives and supportive regulatory frameworks aimed at improving access to quality aged care are further accelerating the growth of the sector.

Challenges in the Australia Senior Living Industry Sector

The Australian senior living industry faces several challenges. These include escalating operating costs, particularly staff wages and regulatory compliance, resulting in increased pricing pressure. The industry also faces a shortage of skilled workers, impacting the quality and availability of care. Competition among providers is intense, putting pressure on margins and profitability. Finally, maintaining high occupancy rates can be challenging, particularly in regions with slower population growth or a limited number of potential residents.

Emerging Opportunities in Australia Senior Living Industry

Significant opportunities exist in the Australian senior living market. The growing demand for specialized care services, such as dementia care and palliative care, presents significant market potential. Technological advancements, such as telemedicine and remote monitoring, offer opportunities to improve care delivery and reduce costs. The increasing focus on preventative healthcare provides opportunities for senior living operators to integrate wellness programs and promote healthy aging. Finally, there are opportunities to develop innovative housing models and community-based services that cater to the diverse needs of older Australians.

Leading Players in the Australia Senior Living Industry Market

- Aveo

- RSL LifeCare

- Anglican Retirement Villages

- The Village

- IRT Group

- Stockland

- Living Choice

- Lend Lease

- Oak Tree Group

- Gannon Lifestyle Group

Key Developments in Australia Senior Living Industry Industry

- August 2023: Aware Super acquired the remaining 30% stake in Oak Tree Retirement Villages, solidifying its position in the Eastern seaboard market. This signals a strong belief in the future growth of this sector and could lead to further expansion and investment in this senior housing platform's 48 complexes.

- February 2023: Lendlease's 'Grove' extension project in Ngunnawal added 45 independent villas and a 124-bed aged care facility, demonstrating a commitment to providing a continuum of care and meeting the growing demand for senior living options in the region.

Strategic Outlook for Australia Senior Living Industry Market

The Australian senior living industry is poised for continued growth, driven by demographic trends, technological advancements, and increasing consumer demand. Opportunities abound in specialized care, technology integration, and community-based services. Strategic partnerships and acquisitions will shape the market landscape, as larger operators consolidate their market share and smaller providers seek to differentiate themselves through specialized offerings and innovative care models. The future market potential is significant, with a continued increase in demand for high-quality senior living solutions across diverse segments and locations.

Australia Senior Living Industry Segmentation

-

1. Property Type

- 1.1. Assisted Living

- 1.2. Independent Living

- 1.3. Memory Care

- 1.4. Nursing Care

-

2. Cities

- 2.1. Sunshine Coast

- 2.2. Hobart

- 2.3. Melbourne

- 2.4. Perth

- 2.5. South Coast

- 2.6. Other Cities

Australia Senior Living Industry Segmentation By Geography

- 1. Australia

Australia Senior Living Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.17% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Aging Population4.; Increased Longevity

- 3.3. Market Restrains

- 3.3.1. 4.; Inadequate Staffing

- 3.4. Market Trends

- 3.4.1. Increasing Senior Population and Life Expectancy driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Senior Living Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Assisted Living

- 5.1.2. Independent Living

- 5.1.3. Memory Care

- 5.1.4. Nursing Care

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Sunshine Coast

- 5.2.2. Hobart

- 5.2.3. Melbourne

- 5.2.4. Perth

- 5.2.5. South Coast

- 5.2.6. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Aveo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RSL LifeCare

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Anglican Retirement Villages

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Village

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IRT Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Stockland

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Living Choice**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lend Lease

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oak Tree Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gannon Lifestyle Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aveo

List of Figures

- Figure 1: Australia Senior Living Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Senior Living Industry Share (%) by Company 2024

List of Tables

- Table 1: Australia Senior Living Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Senior Living Industry Revenue Million Forecast, by Property Type 2019 & 2032

- Table 3: Australia Senior Living Industry Revenue Million Forecast, by Cities 2019 & 2032

- Table 4: Australia Senior Living Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Senior Living Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Senior Living Industry Revenue Million Forecast, by Property Type 2019 & 2032

- Table 7: Australia Senior Living Industry Revenue Million Forecast, by Cities 2019 & 2032

- Table 8: Australia Senior Living Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Senior Living Industry?

The projected CAGR is approximately 8.17%.

2. Which companies are prominent players in the Australia Senior Living Industry?

Key companies in the market include Aveo, RSL LifeCare, Anglican Retirement Villages, The Village, IRT Group, Stockland, Living Choice**List Not Exhaustive, Lend Lease, Oak Tree Group, Gannon Lifestyle Group.

3. What are the main segments of the Australia Senior Living Industry?

The market segments include Property Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.03 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Aging Population4.; Increased Longevity.

6. What are the notable trends driving market growth?

Increasing Senior Population and Life Expectancy driving the market.

7. Are there any restraints impacting market growth?

4.; Inadequate Staffing.

8. Can you provide examples of recent developments in the market?

August 2023: Aware Super has invested an undisclosed amount to acquire the remaining 30% it does not own in Oak Tree Retirement Villages. This senior housing platform owns 48 complexes along Australia's Eastern seaboard.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Senior Living Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Senior Living Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Senior Living Industry?

To stay informed about further developments, trends, and reports in the Australia Senior Living Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence