Key Insights

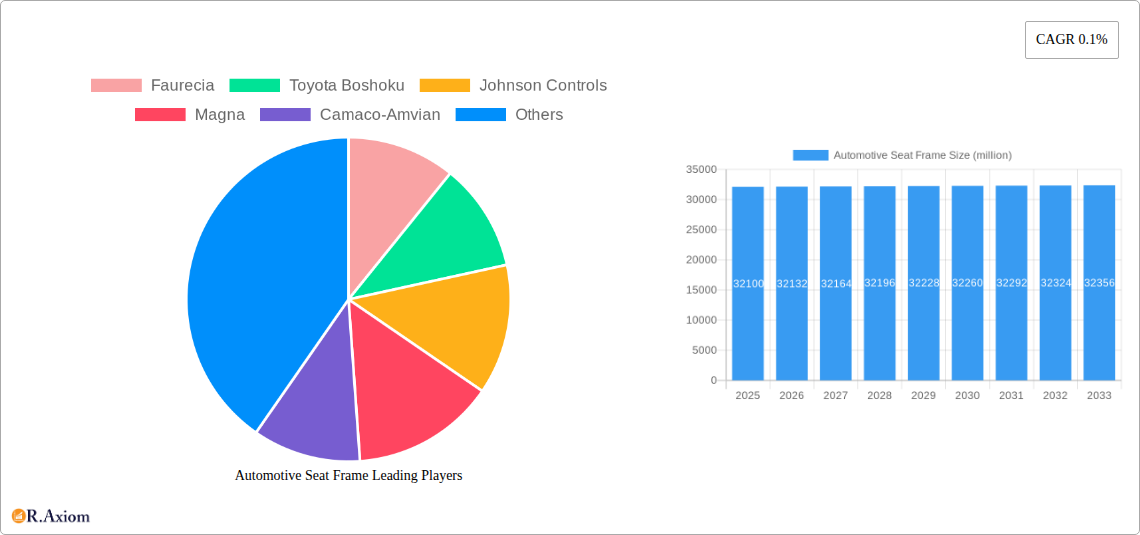

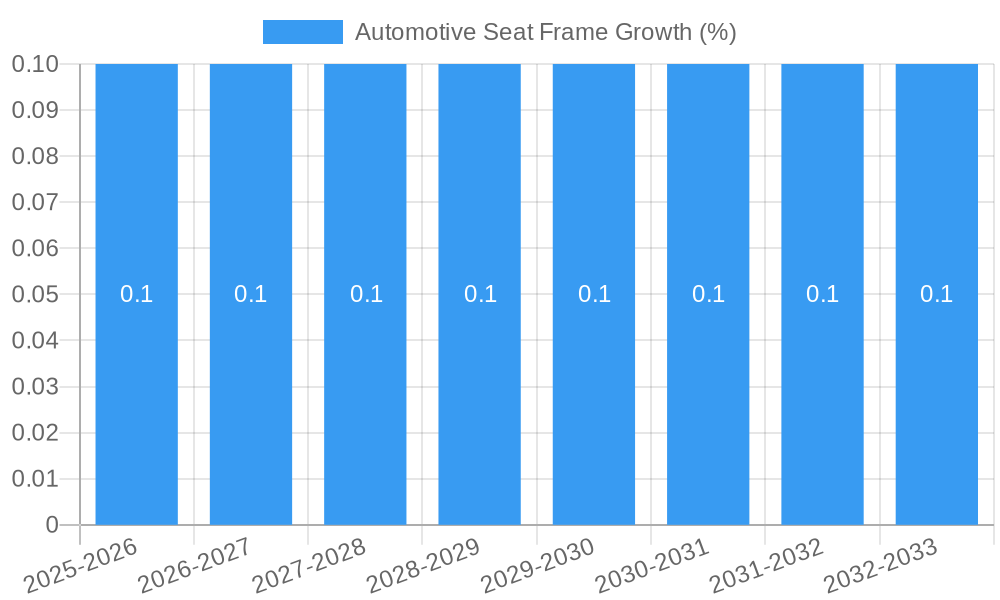

The global Automotive Seat Frame market is projected to reach a substantial size, with an estimated market value of $32,100 million. However, the market is expected to experience a very modest Compound Annual Growth Rate (CAGR) of 0.1% during the forecast period. This subdued growth suggests a mature market with limited expansion opportunities, potentially driven by incremental technological advancements and evolving vehicle designs rather than significant volume increases. The primary application segments for automotive seat frames are Passenger Vehicles and Commercial Vehicles. Passenger vehicles, with their higher production volumes, are likely to constitute the larger share of demand. Within material types, traditional materials are expected to remain dominant due to their cost-effectiveness and established manufacturing processes. Nevertheless, there is a nascent but growing interest in alternative materials such as Magnesium Alloys and "Other New Materials," which are being explored for their potential lightweighting benefits, improved safety, and enhanced sustainability profiles, though their widespread adoption will depend on cost reductions and performance validation.

The market's growth trajectory is influenced by a complex interplay of factors. Key drivers likely include the constant pursuit of vehicle weight reduction for improved fuel efficiency and reduced emissions, coupled with stringent safety regulations that necessitate robust and innovative seat frame designs. The increasing demand for enhanced comfort and ergonomic features in vehicles also plays a role in shaping product development. Conversely, the market faces significant restraints. The high cost associated with newer materials like magnesium alloys and other advanced composites can hinder their adoption, especially in cost-sensitive vehicle segments. Furthermore, the automotive industry's inherent cyclical nature and its susceptibility to global economic downturns can impact production volumes and, consequently, the demand for seat frames. Mature market saturation in certain regions and the increasing use of integrated seat designs that may consolidate component manufacturing could also present challenges. The competitive landscape is populated by established players such as Faurecia, Toyota Boshoku, Johnson Controls, and Magna, all vying for market share through innovation and strategic partnerships.

Automotive Seat Frame Market Concentration & Innovation

The automotive seat frame market exhibits a moderate to high concentration, with key players like Faurecia, Toyota Boshoku, Johnson Controls, and Magna dominating a significant portion of the global market share. These industry giants have established extensive manufacturing footprints and strong relationships with major automotive OEMs. Innovation within this sector is primarily driven by the relentless pursuit of lightweighting, enhanced safety, and improved comfort. Advancements in material science, particularly the adoption of magnesium alloys and other new materials beyond traditional steel, are crucial for reducing vehicle weight and improving fuel efficiency. Regulatory frameworks, such as stringent safety standards and emissions targets, further fuel innovation, pushing manufacturers to develop more sophisticated and robust seat frame designs. Product substitutes, while present in the form of different material compositions or integrated functionalities, are largely overshadowed by the core structural integrity and cost-effectiveness of optimized seat frames. End-user trends lean towards premium features, modularity, and customizable seating solutions, especially within the passenger vehicle segment, influencing design and material choices. Mergers and acquisitions (M&A) remain a strategic tool for market consolidation and technological acquisition. Recent M&A activities have seen deals valued in the hundreds of millions, aimed at expanding geographical reach, acquiring specialized expertise, or integrating advanced manufacturing capabilities. For instance, a hypothetical M&A deal in the past year could have involved a major Tier 1 supplier acquiring a niche player specializing in advanced composite seat frame technology for an estimated $250 million, signaling a strategic shift towards future materials.

Automotive Seat Frame Industry Trends & Insights

The automotive seat frame industry is poised for sustained growth, driven by several overarching trends. The increasing global vehicle production volumes, particularly in emerging economies, is a primary growth driver. As more passenger and commercial vehicles roll off assembly lines, the demand for seat frames naturally escalates. This expansion is further amplified by the growing adoption of advanced driver-assistance systems (ADAS) and the evolving interior design philosophies of modern vehicles, which necessitate more sophisticated and integrated seat frame structures to accommodate sensors, actuators, and enhanced occupant protection systems. Lightweighting initiatives are paramount, fueled by stringent fuel economy regulations and the surging popularity of electric vehicles (EVs), where every kilogram saved directly translates to extended range. This trend is pushing the adoption of magnesium alloys, aluminum, and advanced composites as viable alternatives to traditional steel. The market penetration of these advanced materials is projected to grow at a substantial Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period, moving from an estimated market size of $15 billion in 2025 to over $25 billion by 2033. Consumer preferences are increasingly shifting towards enhanced comfort, ergonomic design, and personalized seating experiences. This includes features like heated and ventilated seats, advanced lumbar support, and reconfigurable seating layouts, all of which place greater demands on the underlying seat frame structure. The competitive landscape is characterized by intense rivalry among established players and emerging innovators, with a focus on cost optimization, technological differentiation, and supply chain resilience. Companies are investing heavily in research and development to optimize manufacturing processes, reduce material waste, and develop smart seating solutions that integrate seamlessly with vehicle connectivity and autonomous driving technologies. The market penetration of advanced seat frame solutions is expected to reach an estimated 35% by 2033, up from approximately 20% in 2025.

Dominant Markets & Segments in Automotive Seat Frame

The global automotive seat frame market is significantly influenced by the dominance of the Passenger Vehicle segment. This segment accounts for an estimated 85% of the total market revenue, driven by sheer production volumes and the increasing demand for feature-rich and comfortable seating solutions. Within the passenger vehicle application, the Traditional Material segment, primarily comprising steel and its alloys, still holds a substantial market share due to its cost-effectiveness and proven durability. However, the Magnesium Alloy segment is experiencing rapid growth, projected to capture an additional 15% market share by 2033, fueled by lightweighting mandates.

Key Drivers for Passenger Vehicle Dominance:

- Global Vehicle Production: The sheer volume of passenger cars manufactured worldwide dwarfs that of commercial vehicles, directly impacting seat frame demand.

- Consumer Preferences: Growing consumer desire for comfort, luxury, and advanced features in personal vehicles translates into demand for more sophisticated seat frame designs and materials.

- Technological Advancements: Integration of smart seating technologies, advanced safety features, and premium interior aesthetics are driving innovation and demand within this segment.

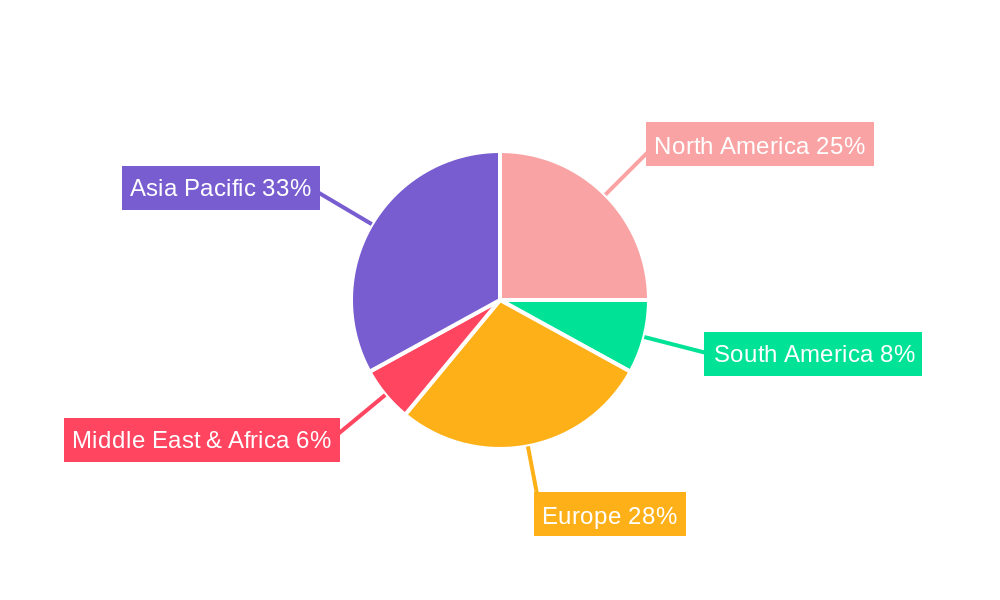

Geographically, Asia-Pacific continues to be the dominant region, representing an estimated 40% of the global market share. This dominance is attributed to the presence of major automotive manufacturing hubs in China, Japan, South Korea, and India, coupled with a burgeoning middle class driving vehicle sales.

Key Drivers for Asia-Pacific Dominance:

- Manufacturing Prowess: The region hosts a vast network of automotive manufacturers and Tier 1 suppliers, facilitating efficient production and supply chain operations.

- Growing Automotive Markets: Rapidly expanding economies and increasing disposable incomes in countries like China and India are fueling a surge in vehicle demand.

- Government Initiatives: Favorable government policies supporting automotive manufacturing and electrification further bolster market growth.

Within the Type segmentation, while Traditional Material currently leads, the Magnesium Alloy segment is the fastest-growing, with an anticipated CAGR of 9.2% over the forecast period. This growth is propelled by the critical need for weight reduction in electric vehicles to extend range, and the increasing cost-competitiveness of magnesium alloy production. The Other New Material segment, encompassing advanced composites and novel alloys, is also poised for significant expansion, driven by ongoing research and development and the pursuit of ultra-lightweight solutions.

Automotive Seat Frame Product Developments

Product developments in the automotive seat frame market are centered on creating lighter, stronger, and more sustainable solutions. Innovations include the use of high-strength steel alloys, advanced forming techniques to reduce material usage, and the increasing integration of magnesium alloys for significant weight reduction, offering competitive advantages in fuel efficiency and EV range. Furthermore, manufacturers are focusing on modular seat frame designs that facilitate easier assembly, repair, and customization, catering to evolving consumer preferences for personalized interiors. These developments are crucial for meeting stringent safety regulations and enhancing occupant comfort in the face of rapidly advancing vehicle technologies.

Automotive Seat Frame Report Scope & Segmentation Analysis

The scope of this report encompasses a comprehensive analysis of the automotive seat frame market, segmented by Application: Passenger Vehicle and Commercial Vehicle. The Passenger Vehicle segment is expected to witness robust growth, driven by evolving consumer demands for comfort and advanced features, with a projected market size of $20 billion by 2033. The Commercial Vehicle segment, while smaller, is projected to grow at a steady pace of 5.8% CAGR, driven by fleet modernization and the need for durable and ergonomic seating solutions in logistics and transportation.

Further segmentation includes Type: Traditional Material, Magnesium Alloy, and Other New Material. The Traditional Material segment, primarily steel, is projected to maintain a significant market share, estimated at $10 billion by 2033, due to its cost-effectiveness. The Magnesium Alloy segment is anticipated to experience the highest growth rate, with an estimated market size of $7 billion by 2033, propelled by lightweighting initiatives. The Other New Material segment, including composites, is expected to reach $3 billion by 2033, driven by technological advancements.

Key Drivers of Automotive Seat Frame Growth

Several key factors are propelling the growth of the automotive seat frame market. The relentless push for lightweighting vehicles to improve fuel efficiency and extend EV range is a primary driver, encouraging the adoption of materials like magnesium alloys and advanced composites. Increasing global vehicle production volumes, particularly in emerging economies, directly translates to higher demand for seat frames. Furthermore, stringent safety regulations, such as those mandating enhanced occupant protection in collisions, necessitate the development of more robust and sophisticated seat frame designs. The growing trend towards premiumization and customization of vehicle interiors, with consumers demanding enhanced comfort and ergonomic features, also fuels innovation and market expansion.

Challenges in the Automotive Seat Frame Sector

Despite robust growth prospects, the automotive seat frame sector faces several challenges. Fluctuating raw material prices, particularly for steel and aluminum, can significantly impact manufacturing costs and profitability. Intense price competition among numerous suppliers, especially in high-volume markets, puts pressure on profit margins. Evolving regulatory landscapes regarding material sourcing, sustainability, and safety can create compliance hurdles and necessitate costly redesigns. The supply chain disruptions, exacerbated by geopolitical events and logistical complexities, pose a constant threat to timely delivery and production continuity. Finally, the high capital investment required for advanced manufacturing technologies, such as those for processing magnesium alloys and composites, can be a barrier to entry for smaller players.

Emerging Opportunities in Automotive Seat Frame

The automotive seat frame market is ripe with emerging opportunities. The accelerated adoption of electric vehicles (EVs) presents a significant opportunity for lightweight materials like magnesium alloys and composites, as manufacturers strive to maximize battery range. The growing demand for smart and connected vehicle interiors opens avenues for integrated seat frames that accommodate sensors, heating/cooling elements, and advanced adjustment mechanisms. The increasing focus on sustainability and circular economy principles presents opportunities for the development of recyclable and biodegradable seat frame materials and manufacturing processes. Furthermore, the expansion of autonomous driving technologies will likely lead to reconfigurable and more comfortable interior layouts, requiring innovative seat frame solutions to support these evolving cabin designs.

Leading Players in the Automotive Seat Frame Market

- Faurecia

- Toyota Boshoku

- Johnson Controls

- Magna

- Camaco-Amvian

- Lear

- Brose

- HYUNDAI DYMOS

- TS TECH

- Futuris Group

- HANIL E-HWA

- SI-TECH Dongchang

- XuYang Group

Key Developments in Automotive Seat Frame Industry

- 2023 October: Faurecia announces a new lightweight seat frame technology utilizing advanced high-strength steel, aiming for a 15% weight reduction.

- 2024 January: Magna showcases a modular seat frame concept for autonomous vehicles, focusing on reconfigurability and passenger comfort.

- 2024 March: Toyota Boshoku invests in a new facility for the mass production of magnesium alloy seat frames to meet EV demand.

- 2024 May: Johnson Controls unveils an innovative integrated seat frame design that accommodates advanced sensor technology for enhanced safety monitoring.

- 2024 July: Lear acquires a specialized composite materials company to bolster its capabilities in advanced seat frame development.

Strategic Outlook for Automotive Seat Frame Market

The strategic outlook for the automotive seat frame market is overwhelmingly positive, driven by transformative trends in the automotive industry. The ongoing electrification of vehicles and the imperative for lightweighting will continue to be the most significant growth catalysts, driving demand for innovative materials like magnesium alloys and advanced composites. Furthermore, the industry's shift towards autonomous driving and enhanced in-cabin experiences will foster opportunities for integrated and highly customizable seat frame solutions. Strategic partnerships and acquisitions will remain crucial for players seeking to expand their technological capabilities and market reach. Companies that can effectively balance cost optimization with the adoption of cutting-edge materials and intelligent design will be well-positioned for sustained success in this dynamic and evolving market.

Automotive Seat Frame Segmentation

-

1. Application

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Type

- 2.1. Traditional Material

- 2.2. Magnesium Alloy

- 2.3. Other New Material

Automotive Seat Frame Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automotive Seat Frame REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Seat Frame Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Traditional Material

- 5.2.2. Magnesium Alloy

- 5.2.3. Other New Material

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive Seat Frame Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Vehicle

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Traditional Material

- 6.2.2. Magnesium Alloy

- 6.2.3. Other New Material

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automotive Seat Frame Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Vehicle

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Traditional Material

- 7.2.2. Magnesium Alloy

- 7.2.3. Other New Material

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automotive Seat Frame Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Vehicle

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Traditional Material

- 8.2.2. Magnesium Alloy

- 8.2.3. Other New Material

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automotive Seat Frame Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Vehicle

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Traditional Material

- 9.2.2. Magnesium Alloy

- 9.2.3. Other New Material

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automotive Seat Frame Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Vehicle

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Traditional Material

- 10.2.2. Magnesium Alloy

- 10.2.3. Other New Material

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Faurecia

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toyota Boshoku

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Johnson Controls

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Magna

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Camaco-Amvian

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lear

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Brose

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HYUNDAI DYMOS

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TS TECH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Futuris Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 HANIL E-HWA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SI-TECH Dongchang

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 XuYang Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Faurecia

List of Figures

- Figure 1: Global Automotive Seat Frame Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Seat Frame Revenue (million), by Application 2024 & 2032

- Figure 3: North America Automotive Seat Frame Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Automotive Seat Frame Revenue (million), by Type 2024 & 2032

- Figure 5: North America Automotive Seat Frame Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Automotive Seat Frame Revenue (million), by Country 2024 & 2032

- Figure 7: North America Automotive Seat Frame Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Automotive Seat Frame Revenue (million), by Application 2024 & 2032

- Figure 9: South America Automotive Seat Frame Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Automotive Seat Frame Revenue (million), by Type 2024 & 2032

- Figure 11: South America Automotive Seat Frame Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Automotive Seat Frame Revenue (million), by Country 2024 & 2032

- Figure 13: South America Automotive Seat Frame Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automotive Seat Frame Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Automotive Seat Frame Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Automotive Seat Frame Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Automotive Seat Frame Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Automotive Seat Frame Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Automotive Seat Frame Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Automotive Seat Frame Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Automotive Seat Frame Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Automotive Seat Frame Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Automotive Seat Frame Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Automotive Seat Frame Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Automotive Seat Frame Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Seat Frame Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Automotive Seat Frame Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Automotive Seat Frame Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Automotive Seat Frame Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Automotive Seat Frame Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Automotive Seat Frame Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Seat Frame Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Seat Frame Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Automotive Seat Frame Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Automotive Seat Frame Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Automotive Seat Frame Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Automotive Seat Frame Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Automotive Seat Frame Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Seat Frame Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Automotive Seat Frame Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Automotive Seat Frame Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Seat Frame Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Automotive Seat Frame Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Automotive Seat Frame Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Automotive Seat Frame Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Automotive Seat Frame Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Automotive Seat Frame Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Automotive Seat Frame Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Automotive Seat Frame Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Automotive Seat Frame Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automotive Seat Frame Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Seat Frame?

The projected CAGR is approximately 0.1%.

2. Which companies are prominent players in the Automotive Seat Frame?

Key companies in the market include Faurecia, Toyota Boshoku, Johnson Controls, Magna, Camaco-Amvian, Lear, Brose, HYUNDAI DYMOS, TS TECH, Futuris Group, HANIL E-HWA, SI-TECH Dongchang, XuYang Group.

3. What are the main segments of the Automotive Seat Frame?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 32100 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Seat Frame," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Seat Frame report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Seat Frame?

To stay informed about further developments, trends, and reports in the Automotive Seat Frame, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence