Key Insights

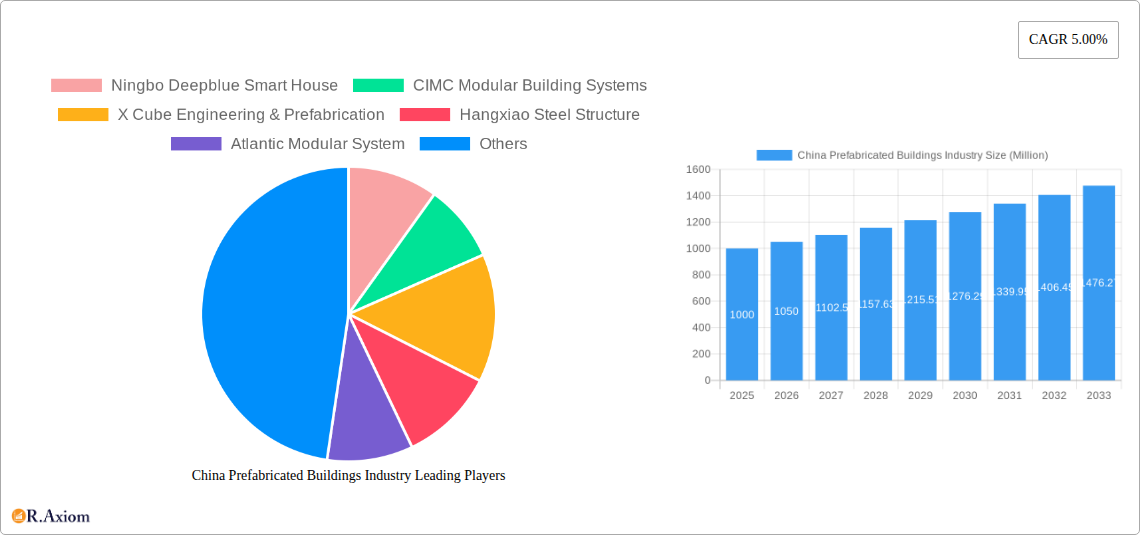

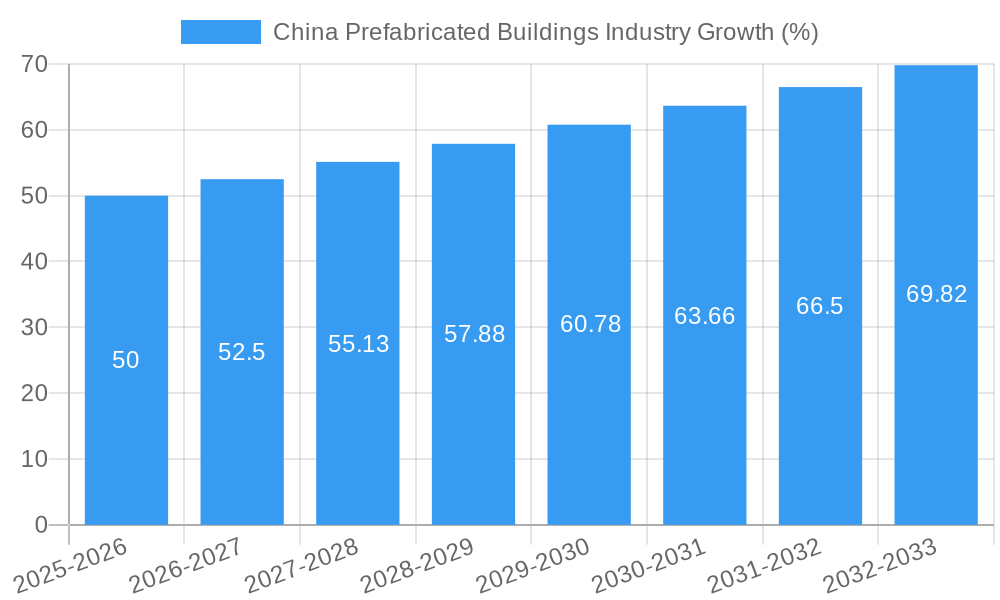

The China prefabricated buildings industry is experiencing robust growth, driven by increasing urbanization, government initiatives promoting sustainable construction, and a rising demand for efficient and cost-effective housing solutions. The market, currently valued at approximately $XX million (assuming a logical estimation based on the provided CAGR of 5% and a base year of 2025), is projected to expand significantly over the forecast period (2025-2033). Key market drivers include the government's focus on affordable housing and infrastructure development, coupled with the industry's inherent advantages in terms of speed of construction, reduced waste, and improved quality control. The rising adoption of sustainable building materials, such as timber and concrete, further fuels market expansion. Market segmentation reveals a strong presence across residential and commercial applications, with significant potential for growth in industrial, institutional, and infrastructure sectors. Leading players like Ningbo Deepblue Smart House, CIMC Modular Building Systems, and China State Construction are actively shaping the market landscape through technological advancements and strategic expansions.

Despite the positive outlook, certain challenges persist. These include the need for skilled labor to handle the specialized construction techniques involved and overcoming potential public perception issues related to the durability and aesthetics of prefabricated structures. Moreover, the relatively nascent nature of the modular construction industry in certain regions necessitates continuous innovation and standardization efforts to ensure wider adoption and market penetration. However, ongoing technological advancements and government support are expected to mitigate these challenges. The consistent 5% CAGR indicates a healthy and sustainable trajectory for the foreseeable future, making China a particularly attractive market for both domestic and international players in the prefabricated building sector.

This in-depth report provides a comprehensive analysis of the burgeoning China Prefabricated Buildings Industry, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, growth drivers, challenges, and opportunities within this dynamic sector. The report leverages extensive data analysis and expert insights to deliver actionable intelligence for navigating the complexities of this rapidly evolving market. The total market size in 2025 is estimated at xx Million USD.

China Prefabricated Buildings Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Chinese prefabricated buildings market, focusing on market concentration, innovation drivers, regulatory influences, and market dynamics. The industry shows a moderately concentrated structure, with several major players capturing significant market share. For example, CIMC Modular Building Systems and China State Construction hold a combined market share estimated at xx%, while other key players like Ningbo Deepblue Smart House and X Cube Engineering & Prefabrication contribute significantly, though precise figures are difficult to obtain due to incomplete public disclosures. Innovation is driven by the need for sustainable and cost-effective construction solutions, leading to advancements in materials, design, and construction technologies.

Regulatory frameworks, including environmental regulations and building codes, significantly impact industry development. The increasing adoption of green building practices and stringent environmental regulations are pushing the market toward sustainable prefabricated construction methods. Product substitutes, such as traditional construction methods, continue to compete, but the advantages of prefabrication in terms of speed, cost, and quality are steadily driving market adoption. End-user trends, primarily favoring faster construction timelines and improved building quality, contribute to the increasing demand. M&A activity has been relatively moderate in recent years, with a total deal value estimated at xx Million USD during the 2019-2024 period. Looking ahead, we anticipate increased M&A activity driven by consolidation and expansion strategies amongst market leaders.

- Key Market Players: CIMC Modular Building Systems, China State Construction, Ningbo Deepblue Smart House, X Cube Engineering & Prefabrication, Hangxiao Steel Structure, Atlantic Modular System, ARK Prefab, Matrix Living, Archi Space. (List not exhaustive)

- Market Concentration: Moderately concentrated, with top players holding xx% of market share (estimated).

- M&A Activity (2019-2024): Total deal value estimated at xx Million USD.

China Prefabricated Buildings Industry Industry Trends & Insights

The China Prefabricated Buildings Industry is experiencing robust growth, driven by several key factors. Government initiatives promoting sustainable and efficient construction practices are fostering significant market expansion. Rapid urbanization and infrastructure development are fueling the demand for quick and cost-effective building solutions. Technological advancements, such as Building Information Modeling (BIM) and advanced manufacturing techniques, are enhancing efficiency and quality. Furthermore, rising labor costs and a skilled labor shortage are incentivizing the adoption of prefabrication. Consumer preferences are shifting towards aesthetically pleasing, energy-efficient, and sustainable housing solutions, further propelling market growth.

The industry’s CAGR from 2019 to 2024 is estimated at xx%, and market penetration continues to increase, particularly in the residential and commercial sectors. Competitive dynamics are characterized by ongoing innovation, strategic alliances, and increasing competition from both domestic and international players. Challenges remain, including standardization issues, supply chain complexities, and technological barriers. However, the long-term outlook remains positive, driven by sustained government support, continuous technological advancements, and increasing consumer demand. The market is expected to reach xx Million USD by 2033.

Dominant Markets & Segments in China Prefabricated Buildings Industry

The Metal segment dominates the Material Type category, accounting for an estimated xx% of the market in 2025. This dominance is primarily attributed to its strength, durability, and versatility in various applications. The Residential application segment holds the largest share in the Application category, driving the majority of market demand.

- Dominant Material Type: Metal (xx% market share in 2025)

- Key Drivers: Strength, durability, versatility, cost-effectiveness.

- Dominant Application: Residential (xx% market share in 2025)

- Key Drivers: Government initiatives promoting affordable housing, rapid urbanization, increasing demand for quick construction solutions.

- Regional Dominance: Coastal regions and major urban centers, due to high population density and infrastructure development.

China Prefabricated Buildings Industry Product Developments

Recent product innovations have focused on enhancing energy efficiency, sustainability, and aesthetic appeal. Prefabricated buildings are increasingly incorporating smart home technologies and sustainable materials, catering to evolving consumer preferences. Modular designs, advanced construction techniques, and the use of high-performance materials are key competitive advantages, enabling faster construction timelines and superior building quality. Technological trends, including BIM and 3D printing, are revolutionizing the design and manufacturing processes, while market fit is continuously improving through advancements in modular design and customization options.

Report Scope & Segmentation Analysis

This report segments the China Prefabricated Buildings Industry by Material Type (Concrete, Glass, Metal, Timber, Other) and Application (Residential, Commercial, Other – Industrial, Institutional, Infrastructure). Each segment is analyzed in detail, including growth projections, market size, and competitive dynamics. The Metal segment is projected to witness the highest growth, followed by the Concrete segment. In terms of applications, the Residential segment is expected to maintain its dominance, driven by the burgeoning housing demand. The Commercial and Other segments are also poised for significant growth, fueled by infrastructure development and expansion in various sectors.

Key Drivers of China Prefabricated Buildings Industry Growth

Several factors contribute to the robust growth of the China Prefabricated Buildings Industry. Government policies supporting sustainable and efficient construction are a major driver, coupled with significant infrastructure development and urbanization. Technological advancements such as BIM and advanced manufacturing techniques improve efficiency and reduce construction time and costs. Furthermore, the rising cost of labor and the shortage of skilled workers are creating a strong impetus for prefabricated construction methods.

Challenges in the China Prefabricated Buildings Industry Sector

Despite its rapid growth, the industry faces certain challenges. Standardization issues and inconsistent building codes hinder industry growth. Supply chain disruptions and material price fluctuations pose significant risks. Competition from traditional construction methods and other emerging building technologies is also intense. These challenges can impact the industry's ability to meet the escalating demand for affordable and sustainable housing. The estimated impact of these challenges on market growth in 2025 is a reduction of xx Million USD.

Emerging Opportunities in China Prefabricated Buildings Industry

Several emerging opportunities exist in the China Prefabricated Buildings Industry. The growing demand for sustainable and green buildings presents a significant opportunity for manufacturers to produce eco-friendly prefabricated structures. Advances in 3D printing and other advanced manufacturing technologies offer potential for further cost reduction and efficiency improvements. Expansion into new market segments, such as disaster relief and temporary housing, presents further growth potential.

Leading Players in the China Prefabricated Buildings Industry Market

- CIMC Modular Building Systems

- China State Construction

- Ningbo Deepblue Smart House

- X Cube Engineering & Prefabrication

- Hangxiao Steel Structure

- Atlantic Modular System

- ARK Prefab

- Matrix Living

- Archi Space (List not exhaustive)

Key Developments in China Prefabricated Buildings Industry Industry

- 2022 Q4: CIMC Modular Building Systems announced a major expansion of its manufacturing facilities.

- 2023 Q1: New government regulations on sustainable building practices were implemented.

- 2023 Q3: A significant merger between two smaller prefabricated building companies was finalized.

- 2024 Q2: Several key players launched new product lines focusing on energy-efficient designs.

Strategic Outlook for China Prefabricated Buildings Industry Market

The China Prefabricated Buildings Industry is poised for continued robust growth over the forecast period. Government support, technological advancements, and escalating demand for efficient and sustainable construction solutions will drive market expansion. The industry's focus on innovation, sustainability, and improved building quality will contribute to its long-term success and solidify its position as a key player in the global construction industry. The market is projected to experience sustained growth, with significant opportunities for both established players and new entrants.

China Prefabricated Buildings Industry Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

China Prefabricated Buildings Industry Segmentation By Geography

- 1. China

China Prefabricated Buildings Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Aging Population Driving the Market4.; Healthcare and Long-term Care Needs Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; High Affordability and Cost of Care Affecting the Market4.; Staffing and Workforce Challenges Affecting the Market

- 3.4. Market Trends

- 3.4.1. Concrete Holds the Major Share in the Prefab Construction Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Prefabricated Buildings Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ningbo Deepblue Smart House

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CIMC Modular Building Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 X Cube Engineering & Prefabrication

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hangxiao Steel Structure

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Atlantic Modular System

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ARK Prefab

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Matrix Living **List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China State Construction

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Archi Space

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Ningbo Deepblue Smart House

List of Figures

- Figure 1: China Prefabricated Buildings Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Prefabricated Buildings Industry Share (%) by Company 2024

List of Tables

- Table 1: China Prefabricated Buildings Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Prefabricated Buildings Industry Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: China Prefabricated Buildings Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: China Prefabricated Buildings Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Prefabricated Buildings Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Prefabricated Buildings Industry Revenue Million Forecast, by Material Type 2019 & 2032

- Table 7: China Prefabricated Buildings Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: China Prefabricated Buildings Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Prefabricated Buildings Industry?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the China Prefabricated Buildings Industry?

Key companies in the market include Ningbo Deepblue Smart House, CIMC Modular Building Systems, X Cube Engineering & Prefabrication, Hangxiao Steel Structure, Atlantic Modular System, ARK Prefab, Matrix Living **List Not Exhaustive, China State Construction, Archi Space.

3. What are the main segments of the China Prefabricated Buildings Industry?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Aging Population Driving the Market4.; Healthcare and Long-term Care Needs Driving the Market.

6. What are the notable trends driving market growth?

Concrete Holds the Major Share in the Prefab Construction Sector.

7. Are there any restraints impacting market growth?

4.; High Affordability and Cost of Care Affecting the Market4.; Staffing and Workforce Challenges Affecting the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Prefabricated Buildings Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Prefabricated Buildings Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Prefabricated Buildings Industry?

To stay informed about further developments, trends, and reports in the China Prefabricated Buildings Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence