Key Insights

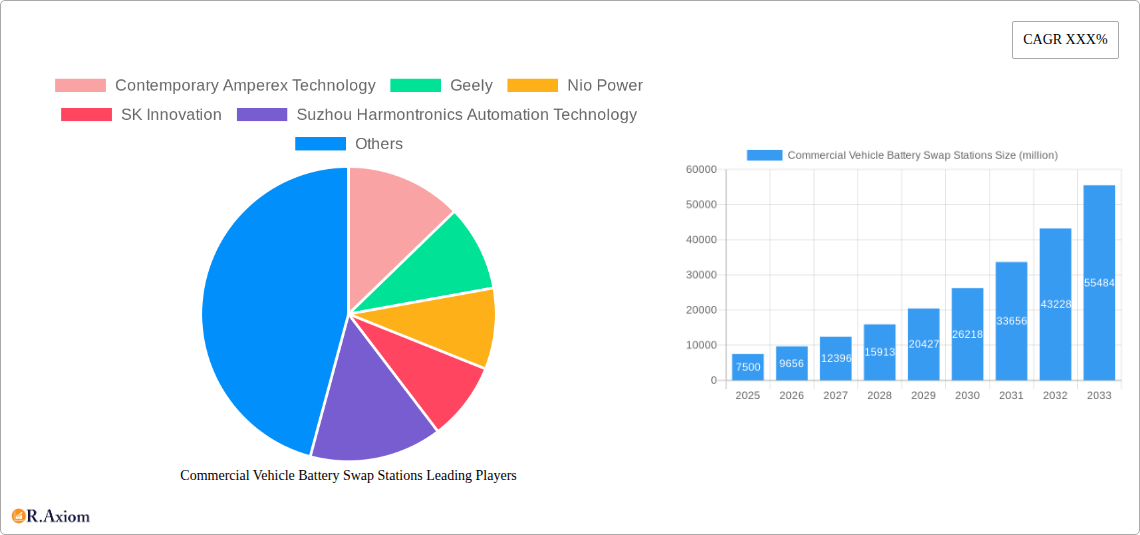

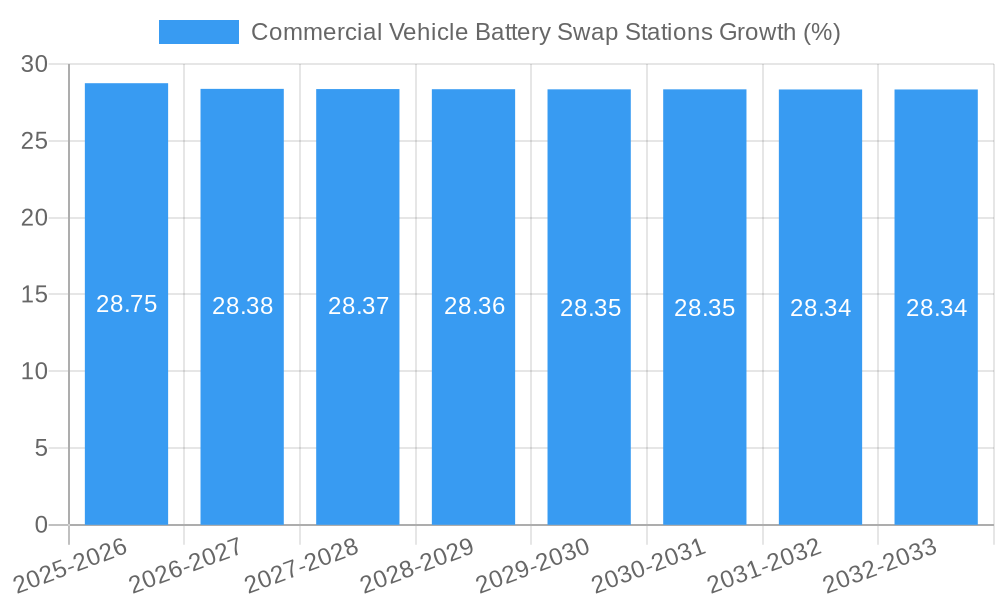

The global Commercial Vehicle Battery Swap Stations market is experiencing robust expansion, projected to reach an estimated market size of approximately $7,500 million in 2025. This growth is fueled by a compelling Compound Annual Growth Rate (CAGR) of around 28.5% over the forecast period of 2025-2033. The primary drivers behind this surge include the increasing adoption of electric commercial vehicles, particularly in the three-wheeler and four-wheeler light commercial vehicle segments, which are crucial for last-mile delivery and urban logistics. Government incentives and stringent emission regulations are further accelerating the transition to electric fleets, making battery swapping an attractive solution for mitigating range anxiety and reducing vehicle downtime. The subscription model, offering predictable costs and operational efficiency, is expected to gain significant traction, alongside the pay-per-use model, which provides flexibility for fluctuating operational needs. Key players like Contemporary Amperex Technology, Geely, and Nio Power are investing heavily in developing advanced battery swapping infrastructure and technologies, contributing to the market's dynamic growth.

The market's trajectory is further shaped by emerging trends such as the integration of smart grid technologies for optimized energy management and the development of standardized battery formats to enhance interoperability across different vehicle models and swap station providers. China is anticipated to dominate the Asia Pacific region, driven by its early adoption of EVs and a strong manufacturing base for both vehicles and swap station equipment. North America and Europe are also poised for substantial growth, supported by supportive policies and increasing demand for sustainable logistics solutions. Restraints such as high initial investment costs for establishing swap station networks and the need for robust standardization across the industry are being addressed through strategic partnerships and technological advancements. The focus on improving battery lifespan and developing efficient swapping mechanisms will be critical for sustained market development, ensuring a seamless and cost-effective transition to electric commercial mobility.

Here is the SEO-optimized, detailed report description for Commercial Vehicle Battery Swap Stations, designed for high search visibility and engagement with industry stakeholders.

Commercial Vehicle Battery Swap Stations Market Concentration & Innovation

The global commercial vehicle battery swap stations market is characterized by dynamic competition and rapid innovation, driven by a strong push towards electrification in logistics and transportation. Key players are actively investing in R&D to enhance battery swapping technology, aiming for faster swap times, improved battery management systems, and broader compatibility with diverse commercial vehicle types. Regulatory frameworks, particularly government incentives and mandates for zero-emission vehicles, are significant innovation drivers. The presence of established battery manufacturers such as Contemporary Amperex Technology, SK Innovation, and GCL Energy Technology, alongside dedicated swap station providers like Nio Power, Aulton New Energy Automotive Technology, and Ample, indicates a healthy ecosystem of innovation. Product substitutes, while evolving, are primarily other charging solutions. End-user trends favor operational efficiency and reduced downtime, making battery swapping an attractive proposition. Mergers, acquisitions, and strategic partnerships are prevalent, with M&A deal values projected to reach XX million during the study period, signaling consolidation and expansion efforts by companies like Geely, Suzhou Harmontronics Automation Technology, and Esmito Solutions to secure market share and technological prowess.

Commercial Vehicle Battery Swap Stations Industry Trends & Insights

The commercial vehicle battery swap stations market is poised for significant expansion, propelled by escalating demand for efficient and sustainable last-mile delivery solutions and an increasing focus on reducing operational costs for fleet operators. The market is projected to witness a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, with the base year 2025 showing an estimated market penetration of XX%. Technological advancements in battery technology, including higher energy densities and faster charging capabilities, are crucial enablers. Furthermore, the development of intelligent swap station networks, integrated with sophisticated data analytics and AI for optimized battery deployment and predictive maintenance, is a key trend. Consumer preferences are increasingly leaning towards solutions that minimize vehicle downtime, a critical factor in the highly competitive commercial logistics sector. Companies like Gogoro, Lifan Technology, and BAIC BluePark New Energy Technology are investing heavily in expanding their swap station infrastructure to cater to this growing demand. The competitive landscape is intensifying, with both established automotive manufacturers and specialized energy technology firms vying for market dominance. The shift towards subscription-based models and pay-per-use services is also gaining traction, offering flexible and cost-effective solutions for a wide range of commercial vehicle applications. The evolving regulatory environment, encouraging the adoption of electric commercial vehicles, further bolsters market growth.

Dominant Markets & Segments in Commercial Vehicle Battery Swap Stations

The dominance within the commercial vehicle battery swap stations market is significantly influenced by a confluence of economic policies, infrastructure development, and evolving end-user demands. Regions with strong governmental support for electric vehicle adoption and substantial investments in charging infrastructure are leading the charge. Asia-Pacific, particularly China, is expected to remain the dominant market, driven by its expansive logistics network and proactive government policies supporting electric commercial vehicle deployment.

Application: Three-Wheeler Light Commercial Vehicle This segment is a major driver of dominance, especially in developing economies and densely populated urban areas where three-wheelers are extensively used for last-mile delivery and intra-city transport. Factors contributing to its dominance include lower acquisition costs, ease of maneuverability in congested traffic, and a pressing need for rapid recharging solutions to maximize operational efficiency. Companies like Lifan Technology are likely to play a crucial role in this segment.

Application: Four-Wheeler Light Commercial Vehicle This segment is experiencing rapid growth due to the increasing electrification of delivery fleets for e-commerce and logistics companies. The need for higher payload capacity and longer range makes battery swapping an attractive proposition for minimizing downtime and maintaining delivery schedules. The expansion of charging networks and advancements in battery technology are further fueling its growth. Geely and BAIC BluePark New Energy Technology are key players here.

Type: Subscription Model The subscription model is emerging as a dominant force, offering fleet operators predictable operational costs and access to a network of swap stations without the significant upfront investment in battery ownership. This model fosters customer loyalty and provides revenue stability for swap station operators, including Nio Power and Aulton New Energy Automotive Technology.

Type: Pay-Per-Use Model The pay-per-use model offers flexibility, allowing users to pay only for the battery swaps they consume. This caters to a wider range of users, including smaller operators and those with fluctuating operational needs. Its accessibility and cost-effectiveness are key to its growing prominence. Esmito Solutions is actively exploring this model.

The detailed dominance analysis reveals a synergistic relationship between these segments. For instance, the widespread adoption of three-wheeler light commercial vehicles, coupled with the affordability and flexibility of pay-per-use models, creates a robust market foundation. Concurrently, the increasing demand for four-wheeler light commercial vehicles in expanding logistics operations is driving the adoption of more comprehensive subscription services, ensuring uninterrupted fleet operations. The continuous innovation in battery technology and swap station infrastructure by companies such as Contemporary Amperex Technology and SK Innovation further strengthens the market's trajectory.

Commercial Vehicle Battery Swap Stations Product Developments

Product developments in the commercial vehicle battery swap stations market are focused on enhancing speed, efficiency, and user experience. Innovations include automated battery identification and swapping systems, enabling swaps in under a minute for select vehicle types. Advanced battery management systems are being integrated to optimize battery health and performance, extending lifespan and reducing replacement costs. Modular battery designs are facilitating easier maintenance and upgrades. Competitive advantages stem from the ability to reduce vehicle downtime to mere minutes, thereby increasing fleet operational uptime and profitability, a critical factor for logistics and transportation companies relying on continuous service. Hangzhou Botan Technology Engineering and Shanghai Enneagon Energy Technology are at the forefront of these advancements.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the global commercial vehicle battery swap stations market, spanning the period from 2019 to 2033, with a base year of 2025. The market is segmented by Application and Type, providing granular insights into various sub-sectors.

Application: Three-Wheeler Light Commercial Vehicle This segment is characterized by its significant contribution to last-mile logistics and intra-city transportation, particularly in emerging economies. Growth projections for this segment are robust, driven by increasing urbanization and the need for cost-effective, agile delivery solutions. Market sizes are expected to expand considerably, with competitive dynamics driven by operational efficiency and cost per kilometer.

Application: Four-Wheeler Light Commercial Vehicle This segment is crucial for expanding delivery networks and e-commerce logistics. Market sizes are projected to grow substantially as more businesses electrify their fleets. Competitive dynamics will focus on rapid swap times, battery capacity, and integration with fleet management systems.

Application: Other This broad category encompasses specialized commercial vehicles, such as buses and larger trucks, where battery swapping can offer unique operational advantages. Growth projections and market sizes will vary based on the specific vehicle types and their electrification pace.

Type: Subscription Model The subscription model is expected to capture a significant market share, offering predictable revenue streams and catering to fleet operators seeking operational cost certainty. Growth projections are strong, with market sizes reflecting the increasing adoption of service-based models.

Type: Pay-Per-Use Model The pay-per-use model offers flexibility and accessibility, appealing to a wider customer base, including smaller operators. Growth projections are positive, with market sizes indicating its role in democratizing access to battery swapping technology. Shenzhen Qingcheng is a key player in this area.

Key Drivers of Commercial Vehicle Battery Swap Stations Growth

The growth of the commercial vehicle battery swap stations market is propelled by several key factors. Technological advancements in battery chemistry and swap station automation are enabling faster and more efficient battery exchanges, significantly reducing vehicle downtime. Government regulations and incentives promoting the adoption of electric commercial vehicles and the development of charging infrastructure are creating a favorable market environment. Rising operational costs for traditional internal combustion engine vehicles, coupled with the desire for reduced carbon emissions in logistics, are pushing fleet operators towards electric solutions like battery swapping. Furthermore, the increasing demand for last-mile delivery services driven by e-commerce growth necessitates highly efficient and quick turnaround times, which battery swapping effectively addresses. Amplify Cleantech Solutions is a company focused on leveraging these drivers.

Challenges in the Commercial Vehicle Battery Swap Stations Sector

Despite the promising growth, the commercial vehicle battery swap stations sector faces several challenges. High initial infrastructure costs for establishing swap station networks can be a significant barrier to entry and expansion. Standardization issues across different battery types and vehicle models can lead to interoperability problems, hindering widespread adoption. Regulatory hurdles and permitting processes for setting up new stations can be complex and time-consuming. Supply chain constraints for essential battery components and the need for robust battery recycling infrastructure also present ongoing challenges. Finally, competition from alternative charging technologies, such as fast DC charging, requires continuous innovation to maintain a competitive edge. Chargeup is navigating these challenges.

Emerging Opportunities in Commercial Vehicle Battery Swap Stations

The commercial vehicle battery swap stations market is ripe with emerging opportunities. The expansion of e-commerce and urban logistics presents a vast untapped market for efficient last-mile delivery solutions. The development of integrated energy management systems that combine battery swapping with renewable energy sources offers potential for cost savings and sustainability. Partnerships between battery manufacturers, vehicle OEMs, and swap station operators are creating synergistic business models that accelerate market penetration. The global push towards decarbonization and net-zero emission targets is a powerful long-term opportunity, driving sustained investment in electric vehicle infrastructure. Furthermore, the exploration of battery-as-a-service (BaaS) models for commercial fleets opens up new revenue streams and business opportunities. Lithion Power is exploring these opportunities.

Leading Players in the Commercial Vehicle Battery Swap Stations Market

- Contemporary Amperex Technology

- Geely

- Nio Power

- SK Innovation

- Suzhou Harmontronics Automation Technology

- Aulton New Energy Automotive Technology

- Gogoro

- Lifan Technology

- Esmito Solutions

- GCL Energy Technology

- BAIC BluePark New Energy Technology

- Hangzhou Botan Technology Engineering

- Shanghai Enneagon Energy Technology

- Shandong Weida Machinery

- Amplify Cleantech Solutions

- Chargeup

- Lithion Power

- Shenzhen Qingcheng

- Ample

Key Developments in Commercial Vehicle Battery Swap Stations Industry

- 2023/11: Aulton New Energy Automotive Technology expands its battery swap station network by XX stations, focusing on urban delivery hubs.

- 2024/01: Nio Power announces a strategic partnership with a major logistics provider to deploy XX commercial vehicle swap stations.

- 2024/03: Geely demonstrates its new electric van featuring a rapid battery swap capability, reducing swap time to XX seconds.

- 2024/05: Suzhou Harmontronics Automation Technology secures funding of $XX million to scale its automated battery swapping technology for light commercial vehicles.

- 2024/07: Gogoro partners with a regional government to establish a public battery swapping infrastructure for electric two-wheelers and three-wheelers, with potential expansion to light commercial vehicles.

- 2025/XX: Contemporary Amperex Technology announces its next-generation battery packs designed for enhanced swap compatibility and longer cycle life in commercial applications.

- 2025/XX: SK Innovation invests $XX million in R&D for advanced battery chemistries to support faster charging and swapping for commercial EVs.

Strategic Outlook for Commercial Vehicle Battery Swap Stations Market

The strategic outlook for the commercial vehicle battery swap stations market is exceptionally strong, driven by a clear trajectory towards electrification in the logistics sector. The increasing demand for efficient, cost-effective, and emission-free transportation solutions positions battery swapping as a critical enabler for fleet operators. Continued investment in technological innovation, particularly in battery longevity and swap station automation, will be paramount for maintaining a competitive edge. Strategic collaborations among industry players, coupled with supportive government policies, will accelerate market penetration and expand the addressable market. The growing emphasis on sustainability and the circular economy will also drive innovation in battery recycling and second-life applications, further enhancing the attractiveness of battery swapping solutions. The market is poised for substantial growth, offering significant opportunities for early movers and innovators.

Commercial Vehicle Battery Swap Stations Segmentation

-

1. Application

- 1.1. Three-Wheeler Light Commercial Vehicle

- 1.2. Four-Wheeler Light Commercial Vehicle

- 1.3. Other

-

2. Type

- 2.1. Subscription Model

- 2.2. Pay-Per-Use Model

Commercial Vehicle Battery Swap Stations Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Commercial Vehicle Battery Swap Stations REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Vehicle Battery Swap Stations Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Three-Wheeler Light Commercial Vehicle

- 5.1.2. Four-Wheeler Light Commercial Vehicle

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Subscription Model

- 5.2.2. Pay-Per-Use Model

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Commercial Vehicle Battery Swap Stations Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Three-Wheeler Light Commercial Vehicle

- 6.1.2. Four-Wheeler Light Commercial Vehicle

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Subscription Model

- 6.2.2. Pay-Per-Use Model

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Commercial Vehicle Battery Swap Stations Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Three-Wheeler Light Commercial Vehicle

- 7.1.2. Four-Wheeler Light Commercial Vehicle

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Subscription Model

- 7.2.2. Pay-Per-Use Model

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Commercial Vehicle Battery Swap Stations Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Three-Wheeler Light Commercial Vehicle

- 8.1.2. Four-Wheeler Light Commercial Vehicle

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Subscription Model

- 8.2.2. Pay-Per-Use Model

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Commercial Vehicle Battery Swap Stations Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Three-Wheeler Light Commercial Vehicle

- 9.1.2. Four-Wheeler Light Commercial Vehicle

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Subscription Model

- 9.2.2. Pay-Per-Use Model

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Commercial Vehicle Battery Swap Stations Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Three-Wheeler Light Commercial Vehicle

- 10.1.2. Four-Wheeler Light Commercial Vehicle

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Subscription Model

- 10.2.2. Pay-Per-Use Model

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Contemporary Amperex Technology

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Geely

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nio Power

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SK Innovation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Suzhou Harmontronics Automation Technology

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aulton New Energy Automotive Technology

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gogoro

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lifan Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Esmito Solutions

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GCL Energy Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BAIC BluePark New Energy Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Hangzhou Botan Technology Engineering

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Shanghai Enneagon Energy Technology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Shandong Weida Machinery

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Esmito Solutions

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Amplify Cleantech Solutions

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Chargeup

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Lithion Power

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Shenzhen Qingcheng

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Ample

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Contemporary Amperex Technology

List of Figures

- Figure 1: Global Commercial Vehicle Battery Swap Stations Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Commercial Vehicle Battery Swap Stations Revenue (million), by Application 2024 & 2032

- Figure 3: North America Commercial Vehicle Battery Swap Stations Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Commercial Vehicle Battery Swap Stations Revenue (million), by Type 2024 & 2032

- Figure 5: North America Commercial Vehicle Battery Swap Stations Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Commercial Vehicle Battery Swap Stations Revenue (million), by Country 2024 & 2032

- Figure 7: North America Commercial Vehicle Battery Swap Stations Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Commercial Vehicle Battery Swap Stations Revenue (million), by Application 2024 & 2032

- Figure 9: South America Commercial Vehicle Battery Swap Stations Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Commercial Vehicle Battery Swap Stations Revenue (million), by Type 2024 & 2032

- Figure 11: South America Commercial Vehicle Battery Swap Stations Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Commercial Vehicle Battery Swap Stations Revenue (million), by Country 2024 & 2032

- Figure 13: South America Commercial Vehicle Battery Swap Stations Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Commercial Vehicle Battery Swap Stations Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Commercial Vehicle Battery Swap Stations Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Commercial Vehicle Battery Swap Stations Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Commercial Vehicle Battery Swap Stations Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Commercial Vehicle Battery Swap Stations Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Commercial Vehicle Battery Swap Stations Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Commercial Vehicle Battery Swap Stations Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Commercial Vehicle Battery Swap Stations Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Commercial Vehicle Battery Swap Stations Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Commercial Vehicle Battery Swap Stations Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Commercial Vehicle Battery Swap Stations Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Commercial Vehicle Battery Swap Stations Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Commercial Vehicle Battery Swap Stations Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Commercial Vehicle Battery Swap Stations Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Commercial Vehicle Battery Swap Stations Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Commercial Vehicle Battery Swap Stations Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Commercial Vehicle Battery Swap Stations Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Commercial Vehicle Battery Swap Stations Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Commercial Vehicle Battery Swap Stations Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Commercial Vehicle Battery Swap Stations Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Vehicle Battery Swap Stations?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Commercial Vehicle Battery Swap Stations?

Key companies in the market include Contemporary Amperex Technology, Geely, Nio Power, SK Innovation, Suzhou Harmontronics Automation Technology, Aulton New Energy Automotive Technology, Gogoro, Lifan Technology, Esmito Solutions, GCL Energy Technology, BAIC BluePark New Energy Technology, Hangzhou Botan Technology Engineering, Shanghai Enneagon Energy Technology, Shandong Weida Machinery, Esmito Solutions, Amplify Cleantech Solutions, Chargeup, Lithion Power, Shenzhen Qingcheng, Ample.

3. What are the main segments of the Commercial Vehicle Battery Swap Stations?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Vehicle Battery Swap Stations," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Vehicle Battery Swap Stations report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Vehicle Battery Swap Stations?

To stay informed about further developments, trends, and reports in the Commercial Vehicle Battery Swap Stations, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence