Key Insights

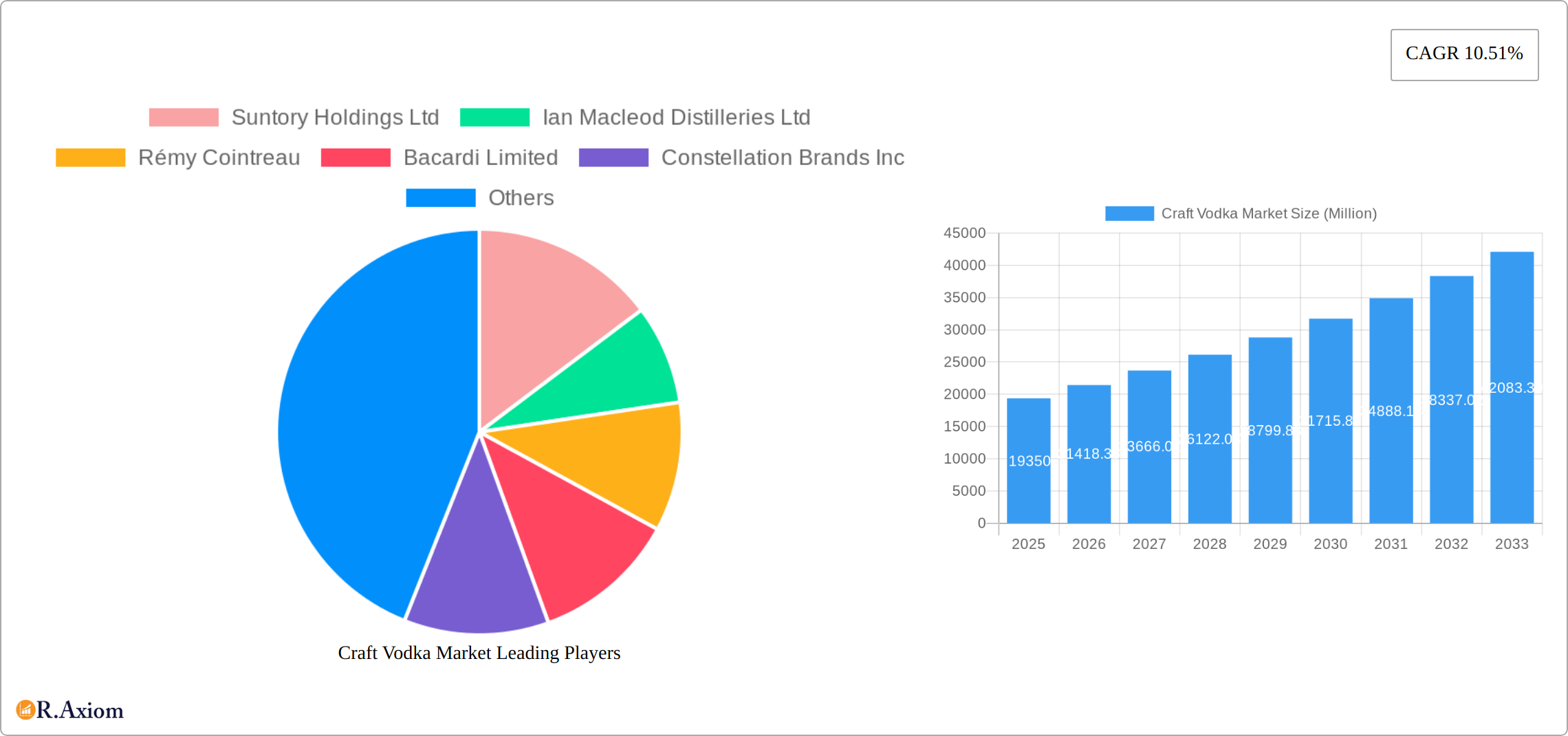

The global craft vodka market, valued at approximately $19.35 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.51% from 2025 to 2033. This expansion is driven by several key factors. A rising consumer preference for premium, high-quality spirits fuels demand for craft vodkas, which often utilize unique ingredients and production methods, differentiating them from mass-produced brands. The growing popularity of craft cocktails, featuring artisanal spirits, further propels market growth. Increased consumer disposable incomes, particularly in developed economies like North America and Europe, contribute to higher spending on premium alcoholic beverages. Furthermore, the expanding distribution channels, encompassing both on-trade (bars, restaurants) and off-trade (retail stores) segments, broaden market accessibility and fuel sales. The market's segmentation by type (vodka is the main focus, but the broader spirits market provides context) and distribution channel provides insights into consumer preferences and purchasing behavior. Key players like Suntory, Bacardi, and Diageo, alongside numerous smaller craft distilleries, compete intensely, driving innovation and product diversification. While challenges such as fluctuating raw material costs and stringent regulations exist, the overall outlook for the craft vodka market remains positive, indicating a significant growth trajectory in the coming years.

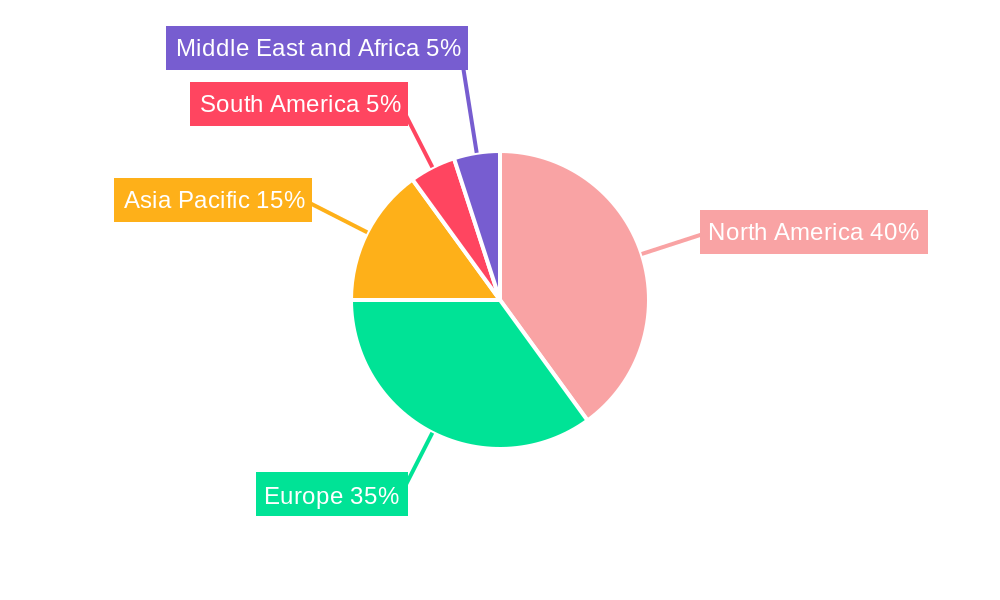

The regional distribution of the craft vodka market reflects established consumer preferences and economic conditions. North America and Europe currently hold substantial market share, driven by established craft distilling traditions and high consumer spending on premium alcoholic beverages. However, Asia-Pacific and South America are emerging as dynamic markets with high growth potential, fueled by increasing consumer disposable incomes and changing drinking habits. The competitive landscape is characterized by a blend of large multinational companies and smaller, independent craft distilleries. Larger players leverage their established distribution networks and brand recognition to maintain market leadership. Smaller craft distilleries focus on innovation, premiumization, and niche marketing strategies to establish brand loyalty and carve out market share. This dynamic competitive landscape fosters product innovation and contributes to the overall vibrancy of the craft vodka market. Sustained marketing efforts highlighting the unique qualities of craft vodka will play a key role in continued market expansion.

Craft Vodka Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Craft Vodka Market, covering market size, growth drivers, industry trends, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for industry stakeholders, including manufacturers, distributors, investors, and market researchers seeking a clear understanding of this dynamic market.

Craft Vodka Market Concentration & Innovation

This section analyzes the competitive landscape of the craft vodka market, assessing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The global craft vodka market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, smaller craft distilleries continue to emerge, driving innovation and diversifying product offerings.

- Market Share: The top five players (Suntory Holdings Ltd, Ian Macleod Distilleries Ltd, Rémy Cointreau, Bacardi Limited, and Constellation Brands Inc) collectively hold an estimated xx% market share, while the remaining market is fragmented among numerous smaller players.

- Innovation Drivers: Consumer demand for unique flavor profiles, premium ingredients, and sustainable production practices are key drivers of innovation. This has led to the emergence of craft vodkas infused with various fruits, herbs, spices, and other natural ingredients.

- Regulatory Frameworks: Varying regulations across different countries impact the production, distribution, and marketing of craft vodka, presenting both challenges and opportunities.

- Product Substitutes: Other alcoholic beverages, including whiskey, gin, and rum, compete with craft vodka, though each caters to specific consumer preferences.

- End-User Trends: Growing consumer awareness of quality and provenance drives preference for craft vodkas over mass-produced brands. The increasing popularity of premium cocktails and mixology further fuels market growth.

- M&A Activities: The craft vodka market has witnessed several M&A activities, with larger companies acquiring smaller craft distilleries to expand their portfolio and gain access to new markets. Total M&A deal value in the past five years is estimated to be $xx Million. Examples include Pernod Ricard's acquisition of stakes in Codigo 1530 (although not strictly vodka, it reflects industry M&A activity).

Craft Vodka Market Industry Trends & Insights

The craft vodka market is experiencing a period of dynamic expansion and innovation. Driven by a confluence of factors, including a discerning consumer base and evolving production techniques, the market's trajectory is exceptionally promising. While the Compound Annual Growth Rate (CAGR) from 2019 to 2024 was robust, projections indicate sustained and accelerated growth, with a significant CAGR anticipated from 2025 to 2033. Craft vodkas have already carved out a substantial presence, especially in mature markets. However, considerable untapped opportunities exist within burgeoning economies, presenting fertile ground for future market penetration.

A pivotal driver of this growth is the increasing consumer appetite for premium, high-quality spirits, underscored by a growing appreciation for locally sourced ingredients and artisanal craftsmanship. Cutting-edge advancements in distillation and production methodologies are not only elevating product quality but also enhancing operational efficiencies. The proliferation of e-commerce platforms and strategic alliances with esteemed bar and restaurant establishments are further accelerating market reach. The landscape remains intensely competitive, characterized by sophisticated brand development, distinctive product portfolios, and strategic pricing tactics designed to capture market share.

Dominant Markets & Segments in Craft Vodka Market

North America currently leads the global craft vodka market, with Europe following closely. Within these dominant regions, countries such as the United States and the United Kingdom, alongside several European Union nations, are showcasing particularly strong growth patterns.

-

Type: Vodka continues to hold its position as the leading segment within the broader craft spirit category. However, the market is witnessing a notable uptick in the production and popularity of other spirits, including Gin and Whiskey, by many craft distilleries, indicating diversification and expanding consumer interest.

-

Distribution Channel: The off-trade channel, encompassing retail stores, supermarkets, and online sales, commands a larger market share. Nonetheless, the on-trade channel, including bars, restaurants, and hotels, remains indispensable for brand visibility, premium positioning, and direct consumer engagement. The burgeoning growth of online sales is actively shaping a new and significant distribution segment.

Key contributing factors to North America's market dominance include a deeply ingrained consumer culture that values premium offerings and a well-developed ecosystem supporting the craft spirits industry. Europe mirrors these trends, though regional nuances in taste preferences play a crucial role in shaping overall market dynamics.

Craft Vodka Market Product Developments

Recent product innovations in the craft vodka market focus on unique flavor profiles, achieved through the use of diverse botanicals, fruits, and natural ingredients. Some distilleries are exploring innovative production methods, including sustainable and eco-friendly practices, to enhance brand appeal. These developments cater to consumer preferences for authenticity and high-quality, artisan-produced spirits. The integration of technology in production processes offers opportunities for greater efficiency and consistency.

Report Scope & Segmentation Analysis

This comprehensive report delves into a detailed segmentation analysis of the Craft Vodka Market, meticulously categorizing it by type and distribution channel.

-

Type: The market is segmented by type into Vodka, Whiskey, Gin, Brandy, Rum, and Other Spirit Types. While Vodka remains the most dominant and continues to exhibit robust growth, each segment presents unique growth trajectories influenced by evolving consumer preferences and distinct production trends.

-

Distribution Channel: Further segmentation is provided for On-trade and Off-trade channels. Both channels are experiencing substantial growth, with varying rates influenced by regional economic conditions and consumer behaviors. The Off-trade channel currently holds a larger volume due to widespread retail availability, whereas the On-trade channel typically offers higher profit margins and enhances brand equity.

The competitive landscape within each segment is diverse, marked by varying degrees of player concentration, distinct market share distributions, and a wide array of innovative product offerings.

Key Drivers of Craft Vodka Market Growth

Several factors drive the growth of the craft vodka market. These include the rising demand for premium spirits, the increasing popularity of handcrafted and artisanal products, consumer interest in supporting local businesses, and the expansion of the on-trade and off-trade channels. Furthermore, technological advancements in distillation and flavor infusion techniques contribute to product innovation and enhance production efficiency. Government regulations relating to labeling and responsible consumption impact market dynamics.

Challenges in the Craft Vodka Market Sector

The craft vodka market navigates a landscape marked by several significant challenges. Intense competition from both established global brands and a growing number of craft competitors necessitates continuous innovation and effective marketing. Rising costs of raw materials and the dynamic nature of evolving consumer preferences require agility and responsiveness from distillers. Navigating complex regulatory frameworks, including licensing and stringent labeling requirements, can present considerable barriers to market entry and expansion. Furthermore, maintaining consistent product quality and optimizing supply chain management to meet fluctuating consumer demands present ongoing operational hurdles. Macroeconomic factors, such as inflation and unemployment rates, can also influence consumer spending patterns and overall demand.

Emerging Opportunities in Craft Vodka Market

Emerging opportunities in the craft vodka market lie in expanding into new geographic markets, particularly in developing economies with a growing middle class and increasing disposable incomes. The development of new and unique flavor profiles using innovative ingredients and production techniques presents significant opportunities to attract health-conscious consumers. Opportunities exist through strategic partnerships with major beverage companies to accelerate distribution channels. Sustainability and ethical production methods are increasingly important factors in brand building and attracting environmentally-conscious consumers.

Leading Players in the Craft Vodka Market Market

- Suntory Holdings Ltd

- Ian Macleod Distilleries Ltd

- Rémy Cointreau

- Bacardi Limited

- Constellation Brands Inc

- Jw Distillers Limited

- Hotaling & Co

- William Grant & Sons Ltd

- Davide Campari-Milano NV

- Rogue Ales & Spirits

- Pernod Ricard

- Diageo PLC

Key Developments in Craft Vodka Market Industry

- October 2022: Pernod Ricard acquired majority stakes in ultra-premium tequila Código 1530.

- February 2022: Remy Cointreau's Bruichladdich released the final bottling of its Octomore 12s single malt whisky.

- December 2021: Diageo PLC launched its limited edition Epitome Reserve in India.

These developments highlight the ongoing consolidation and innovation within the broader spirits market, reflecting strategies to expand product portfolios and target niche consumer segments.

Strategic Outlook for Craft Vodka Market Market

The outlook for the craft vodka market is exceptionally bright, poised for continued and sustained growth. This expansion will be fueled by an ongoing evolution in consumer tastes, the adoption of cutting-edge technological advancements, and strategic market penetration into new territories. A growing emphasis on sustainable and ethically sourced production practices is set to become a key differentiator, increasingly influencing consumer purchasing decisions and fostering brand loyalty. The escalating demand for premium and distinctive flavor profiles will continue to drive innovation and the development of novel products. Sustained investment in robust marketing campaigns and brand-building initiatives will remain paramount for maintaining a competitive edge. Strategic expansion into untapped geographic markets, particularly within developing economies, is anticipated to be a significant contributor to overall market growth.

Craft Vodka Market Segmentation

-

1. Type

- 1.1. Whiskey

- 1.2. Gin

- 1.3. Vodka

- 1.4. Brandy

- 1.5. Rum

- 1.6. Other Types

-

2. Distribution Channel

- 2.1. On-trade Channels

- 2.2. Off-trade Channels

Craft Vodka Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Craft Vodka Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Growing Preference for Innovative Flavors

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Craft Vodka Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Whiskey

- 5.1.2. Gin

- 5.1.3. Vodka

- 5.1.4. Brandy

- 5.1.5. Rum

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade Channels

- 5.2.2. Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Craft Vodka Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Whiskey

- 6.1.2. Gin

- 6.1.3. Vodka

- 6.1.4. Brandy

- 6.1.5. Rum

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade Channels

- 6.2.2. Off-trade Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Craft Vodka Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Whiskey

- 7.1.2. Gin

- 7.1.3. Vodka

- 7.1.4. Brandy

- 7.1.5. Rum

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade Channels

- 7.2.2. Off-trade Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Craft Vodka Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Whiskey

- 8.1.2. Gin

- 8.1.3. Vodka

- 8.1.4. Brandy

- 8.1.5. Rum

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade Channels

- 8.2.2. Off-trade Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Craft Vodka Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Whiskey

- 9.1.2. Gin

- 9.1.3. Vodka

- 9.1.4. Brandy

- 9.1.5. Rum

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade Channels

- 9.2.2. Off-trade Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Craft Vodka Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Whiskey

- 10.1.2. Gin

- 10.1.3. Vodka

- 10.1.4. Brandy

- 10.1.5. Rum

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade Channels

- 10.2.2. Off-trade Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Craft Vodka Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Craft Vodka Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 Spain

- 12.1.4 France

- 12.1.5 Italy

- 12.1.6 Russia

- 12.1.7 Rest of Europe

- 13. Asia Pacific Craft Vodka Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Craft Vodka Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Craft Vodka Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 United Arab Emirates

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Suntory Holdings Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Ian Macleod Distilleries Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Rémy Cointreau

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Bacardi Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Constellation Brands Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Jw Distillers Limited*List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Hotaling & Co

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 William Grant & Sons Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Davide Campari-Milano NV

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Rogue Ales & Spirits

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Pernod Ricard

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Diageo PLC

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Suntory Holdings Ltd

List of Figures

- Figure 1: Global Craft Vodka Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Craft Vodka Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Craft Vodka Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Craft Vodka Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Craft Vodka Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Craft Vodka Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Craft Vodka Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Craft Vodka Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Craft Vodka Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Craft Vodka Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Craft Vodka Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Craft Vodka Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Craft Vodka Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Craft Vodka Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 15: North America Craft Vodka Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 16: North America Craft Vodka Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Craft Vodka Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Craft Vodka Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Craft Vodka Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Craft Vodka Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: Europe Craft Vodka Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: Europe Craft Vodka Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Craft Vodka Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Craft Vodka Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Craft Vodka Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Craft Vodka Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 27: Asia Pacific Craft Vodka Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 28: Asia Pacific Craft Vodka Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Craft Vodka Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Craft Vodka Market Revenue (Million), by Type 2024 & 2032

- Figure 31: South America Craft Vodka Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: South America Craft Vodka Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: South America Craft Vodka Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: South America Craft Vodka Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Craft Vodka Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Craft Vodka Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Craft Vodka Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Craft Vodka Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 39: Middle East and Africa Craft Vodka Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 40: Middle East and Africa Craft Vodka Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Craft Vodka Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Craft Vodka Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Craft Vodka Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Craft Vodka Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Craft Vodka Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Craft Vodka Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Craft Vodka Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United Kingdom Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Russia Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Craft Vodka Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: China Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Craft Vodka Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Craft Vodka Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: South Africa Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United Arab Emirates Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Middle East and Africa Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Craft Vodka Market Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Craft Vodka Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 34: Global Craft Vodka Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: United States Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Canada Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Mexico Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of North America Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Craft Vodka Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Craft Vodka Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: Global Craft Vodka Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United Kingdom Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Germany Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Russia Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Craft Vodka Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global Craft Vodka Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 51: Global Craft Vodka Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: China Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Japan Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Australia Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Asia Pacific Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Craft Vodka Market Revenue Million Forecast, by Type 2019 & 2032

- Table 58: Global Craft Vodka Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 59: Global Craft Vodka Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Brazil Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Argentina Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of South America Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Craft Vodka Market Revenue Million Forecast, by Type 2019 & 2032

- Table 64: Global Craft Vodka Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 65: Global Craft Vodka Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: South Africa Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: United Arab Emirates Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Rest of Middle East and Africa Craft Vodka Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Craft Vodka Market?

The projected CAGR is approximately 10.51%.

2. Which companies are prominent players in the Craft Vodka Market?

Key companies in the market include Suntory Holdings Ltd, Ian Macleod Distilleries Ltd, Rémy Cointreau, Bacardi Limited, Constellation Brands Inc, Jw Distillers Limited*List Not Exhaustive, Hotaling & Co, William Grant & Sons Ltd, Davide Campari-Milano NV, Rogue Ales & Spirits, Pernod Ricard, Diageo PLC.

3. What are the main segments of the Craft Vodka Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Growing Preference for Innovative Flavors.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

In October 2022, Pernod Ricard announced to acquire majority stakes in ultra-premium tequila Código 1530 to strengthen its portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Craft Vodka Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Craft Vodka Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Craft Vodka Market?

To stay informed about further developments, trends, and reports in the Craft Vodka Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence