Key Insights

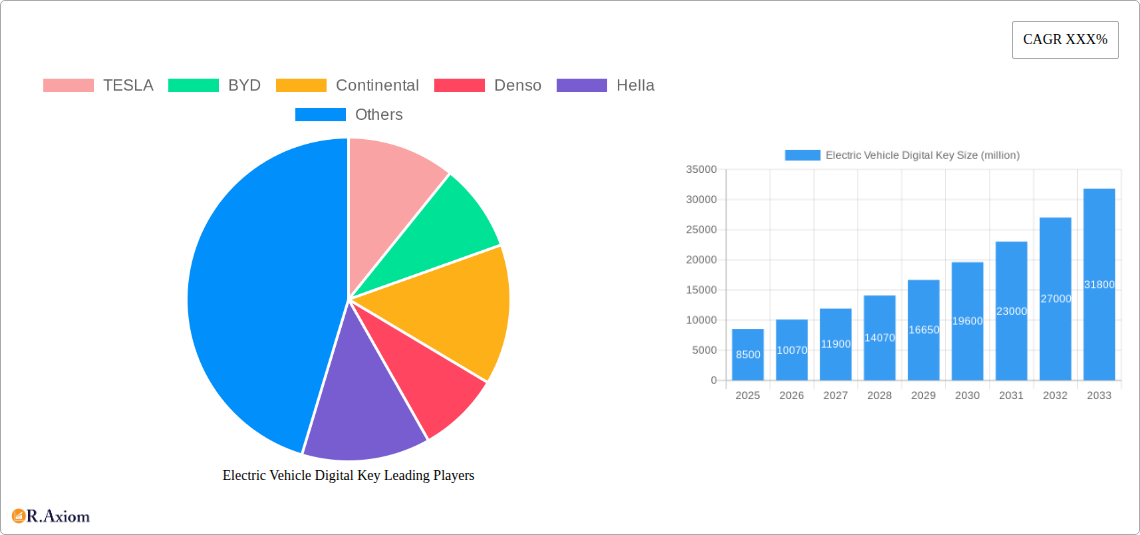

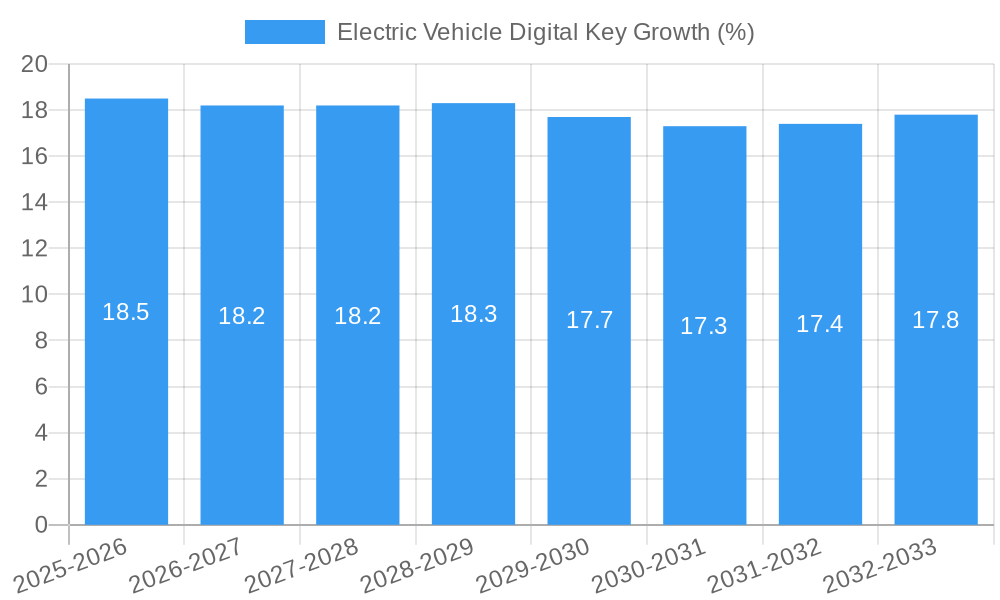

The global Electric Vehicle (EV) Digital Key market is poised for significant expansion, driven by an anticipated market size of approximately USD 8.5 billion by 2025. This burgeoning sector is expected to witness a Compound Annual Growth Rate (CAGR) of around 18.5% during the forecast period of 2025-2033, reaching an estimated value of over USD 30 billion by 2033. This robust growth is primarily fueled by the escalating adoption of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs), coupled with advancements in smartphone technology and the increasing demand for seamless, secure, and contactless vehicle access. The integration of digital keys into vehicle ecosystems is transforming the traditional ownership experience, offering unparalleled convenience and enhanced security features that resonate strongly with tech-savvy consumers. Furthermore, the growing emphasis on the Internet of Things (IoT) within the automotive industry is a major catalyst, enabling a more connected and intelligent vehicle infrastructure.

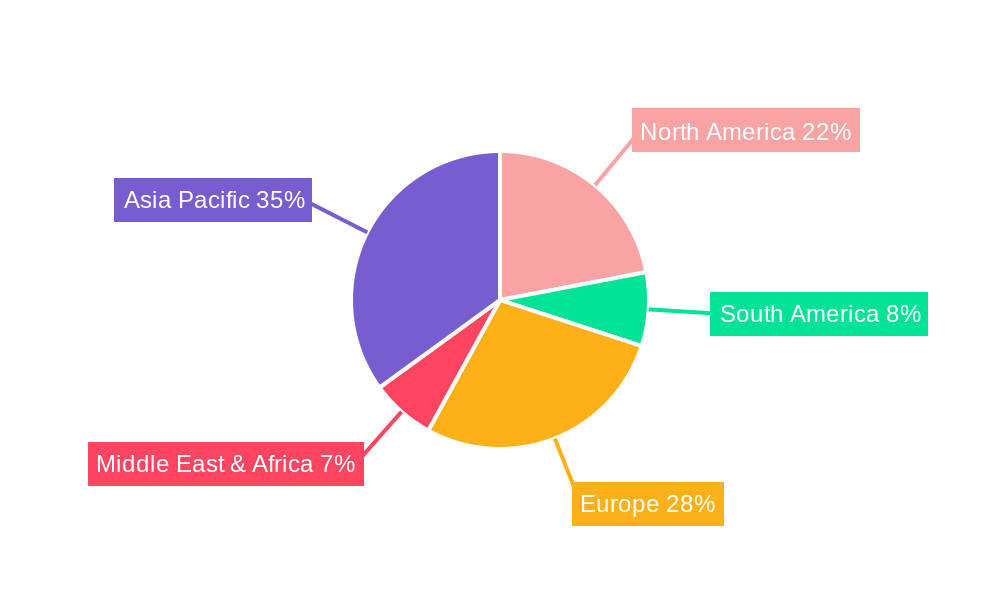

Key market drivers include the pervasive integration of smartphones as a primary digital identity tool, the growing consumer preference for advanced technological features, and the need for enhanced vehicle security and management. The market segments, encompassing both Remote Keyless Entry Systems (RKES) and Passive Keyless Entry Systems (PKES), are experiencing parallel growth as manufacturers strive to offer diverse digital key solutions. While the market exhibits immense potential, certain restraints, such as the initial cost of implementation for some legacy systems and concerns regarding cybersecurity vulnerabilities, need to be strategically addressed by industry stakeholders. Geographically, Asia Pacific, particularly China, is expected to lead the market, owing to its dominant position in EV manufacturing and a rapidly evolving digital landscape. North America and Europe are also projected to exhibit strong growth, driven by stringent emission regulations and a high propensity for adopting advanced automotive technologies. Leading companies like Tesla, BYD, Continental, and Denso are actively investing in research and development to innovate and capture a substantial share of this dynamic market.

Electric Vehicle Digital Key Market Concentration & Innovation

The Electric Vehicle Digital Key market exhibits a moderate to high concentration, with major players like TESLA, BYD, Continental, Denso, Hella, Lear, Valeo, Mitsubishi Electric, MARELLI, BCS, Tokai Rika, and ALPHA heavily influencing innovation and market share. TESLA, a pioneer in digital key technology, commands a significant share, driven by its integrated approach to vehicle ownership. BYD is rapidly expanding its digital key offerings across its diverse electric vehicle portfolio. Established automotive suppliers such as Continental, Denso, and Valeo are heavily investing in R&D to offer advanced, secure, and user-friendly digital key solutions, leveraging their existing automotive electronics expertise. The market is characterized by continuous innovation, with a strong focus on enhancing security protocols, seamless user experience through smartphone integration, and the development of multifactor authentication methods. Regulatory frameworks are slowly evolving to standardize digital key interoperability and security, though regional variations persist. Product substitutes include traditional key fobs and card keys, but the convenience and advanced features of digital keys are rapidly diminishing their market relevance. End-user trends overwhelmingly favor smartphone-centric solutions, with consumers seeking keyless entry, remote vehicle control, and shared access functionalities. Mergers and acquisitions (M&A) activities are observed as larger players aim to consolidate market presence and acquire specialized technological capabilities. For instance, M&A deals in the automotive electronics sector, often valued in the hundreds of millions, frequently include components related to digital key development and integration. The market share of leading players is estimated to be over 80% collectively, with TESLA holding approximately 30% in its proprietary ecosystem.

Electric Vehicle Digital Key Industry Trends & Insights

The Electric Vehicle Digital Key market is poised for substantial growth, propelled by accelerating electric vehicle adoption and the increasing demand for sophisticated, connected automotive experiences. The global market is projected to witness a Compound Annual Growth Rate (CAGR) of over 18% during the forecast period of 2025–2033. This surge is underpinned by several key trends. Firstly, the burgeoning electric vehicle (EV) market, encompassing Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs), forms the primary demand base. As more consumers transition to EVs, the integration of digital keys becomes a standard feature, enhancing convenience and aligning with the overall digital lifestyle. Market penetration of digital keys within new EV sales is expected to rise from approximately 40% in the base year of 2025 to over 75% by 2033. Technological advancements are a significant growth driver, with continuous improvements in Near Field Communication (NFC), Bluetooth Low Energy (BLE), and Ultra-Wideband (UWB) technologies offering enhanced security, accuracy, and range for digital key authentication. The development of secure element (SE) integration and blockchain-based solutions is further fortifying the security of digital key systems against unauthorized access. Consumer preferences are rapidly shifting towards seamless integration with smartphones, allowing for keyless entry, remote locking/unlocking, engine start, and even shared access for family members or ride-sharing services. This trend is further amplified by the growing demand for personalized vehicle experiences and the desire to reduce reliance on physical keys. Competitive dynamics are intensifying, with established automotive OEMs, Tier-1 suppliers like Continental, Denso, and Valeo, and specialized technology companies vying for market leadership. Companies are investing heavily in developing proprietary digital key platforms and collaborating to establish interoperability standards. The transition from traditional Remote Keyless Entry Systems (RKES) to more advanced Passive Keyless Entry Systems (PKES) and smartphone-based digital keys signifies a major technological shift. The global market size for EV digital keys is estimated to reach over $5,000 million by 2025, with projections indicating a market value exceeding $18,000 million by 2033. This exponential growth trajectory is a testament to the indispensable role digital keys are playing in the evolving automotive landscape, enhancing user convenience, security, and the overall connected car experience.

Dominant Markets & Segments in Electric Vehicle Digital Key

The dominant market for Electric Vehicle Digital Keys is unequivocally North America, driven by its robust electric vehicle infrastructure, high consumer adoption rates of advanced automotive technologies, and supportive government incentives. Within North America, the United States emerges as the leading country, accounting for an estimated 45% of the regional market share. This dominance is fueled by aggressive EV sales targets, significant investments in charging infrastructure, and a strong consumer appetite for connected car features.

Key Drivers of Dominance in North America:

- Economic Policies and Incentives: Federal and state-level tax credits, rebates, and subsidies for EV purchases significantly boost demand for electric vehicles, directly increasing the market for integrated digital key solutions. The Biden administration's ambitious EV targets and investments further solidify this trend.

- Infrastructure Development: Rapid expansion of charging networks across major cities and highways reduces range anxiety, making EVs a more practical choice for a larger consumer base, thereby expanding the addressable market for digital keys.

- Technological Adoption: North American consumers are early adopters of smart devices and connected technologies, readily embracing the convenience and advanced features offered by digital keys. This high propensity to adopt new technologies plays a crucial role.

- Automotive OEM Strategies: Leading automotive manufacturers like TESLA and other major OEMs have prioritized the integration of digital key technology into their EV models, offering it as a standard or attractive optional feature. TESLA's early implementation has set a benchmark.

In terms of application, Battery Electric Vehicles (BEVs) represent the largest and fastest-growing segment, accounting for over 70% of the market share. This is a direct reflection of the global shift towards fully electric powertrains. BEVs, by their nature, are inherently linked to advanced technology and connectivity, making the integration of digital keys a natural and expected feature.

Key Drivers for BEV Dominance:

- Environmental Regulations: Stringent emission standards and government mandates worldwide are pushing manufacturers and consumers towards BEVs.

- Advancements in Battery Technology: Improved battery range and faster charging times are making BEVs increasingly viable for a wider range of use cases.

- Lower Running Costs: The reduced cost of electricity compared to gasoline, coupled with fewer maintenance requirements, makes BEVs economically attractive.

The Passive Keyless Entry System (PKES) segment is also demonstrating significant growth and commands a substantial market share, estimated at around 60%. While Remote Keyless Entry Systems (RKES) are still present, the trend is clearly towards the more advanced and seamless PKES, which allows for keyless entry and ignition simply by having the smartphone or authorized device within proximity.

Key Drivers for PKES Dominance:

- Enhanced User Experience: PKES offers superior convenience, eliminating the need to search for a physical key or press a button.

- Integration with Smartphone Ecosystems: The seamless integration of PKES with smartphone apps provides a unified digital key experience.

- Technological Advancements: Improved security protocols and the adoption of UWB technology are making PKES more robust and reliable.

The overall dominance is further solidified by the presence of key industry players like Continental, Denso, and Valeo, who have established strong distribution networks and technological partnerships within North America, catering to both domestic and international automotive manufacturers operating in the region. The synergy between technological innovation, consumer demand, and supportive market conditions firmly positions North America and its BEV/PKES segments as the leading force in the Electric Vehicle Digital Key market.

Electric Vehicle Digital Key Product Developments

Product developments in the Electric Vehicle Digital Key market are rapidly advancing, focusing on enhanced security, seamless user experience, and broader interoperability. Innovations include the integration of Ultra-Wideband (UWB) technology for precise location tracking and enhanced security against relay attacks, as seen in advanced solutions from Continental and Denso. Companies are also prioritizing NFC and Bluetooth Low Energy (BLE) for reliable smartphone-based access, with many offering tiered access permissions for shared vehicle usage, a key feature promoted by Valeo and Lear. The competitive advantage lies in developing secure, intuitive, and feature-rich digital key platforms that can integrate with existing vehicle infotainment systems and third-party applications, creating a unified digital mobility experience. The trend towards cloud-based key management systems, offering remote key provisioning and revocation, is also a significant area of development, exemplified by initiatives from Mitsubishi Electric and MARELLI.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Electric Vehicle Digital Key market, segmented by application and type. The Application segment is divided into Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs). BEVs are expected to show a higher market share and faster growth due to the accelerating global shift towards fully electric powertrains and the inherent alignment of digital key technology with EV innovation. PHEVs, while still a significant segment, will likely represent a smaller portion of the market share and exhibit a more moderate growth rate.

The Type segment is categorized into Remote Keyless Entry Systems (RKES) and Passive Keyless Entry Systems (PKES). The PKES segment is projected to dominate in terms of market share and growth. This is driven by the superior convenience and seamless user experience offered by PKES, which is increasingly integrated with smartphone functionalities. RKES, while still present, represents a more mature technology and is expected to see slower growth as the market transitions towards more advanced, smartphone-centric solutions. Competitive dynamics within each segment are influenced by the technological capabilities and market penetration strategies of key players like TESLA, BYD, Continental, and Denso.

Key Drivers of Electric Vehicle Digital Key Growth

The Electric Vehicle Digital Key market is propelled by a confluence of powerful drivers. The accelerating global adoption of electric vehicles, spurred by environmental regulations and increasing consumer awareness, creates a foundational demand for integrated digital key solutions. Technological advancements, particularly in wireless communication protocols like UWB, NFC, and BLE, are enhancing security, reliability, and user convenience, making digital keys a superior alternative to traditional fobs. The growing consumer preference for seamless digital experiences and smartphone integration is a significant catalyst, as users expect their mobile devices to manage access and control for various aspects of their lives, including their vehicles. Furthermore, OEMs' strategic focus on connected car technologies and digital services is driving the inclusion of digital keys as a standard or premium feature, aiming to enhance customer loyalty and unlock new revenue streams through associated services.

Challenges in the Electric Vehicle Digital Key Sector

Despite robust growth, the Electric Vehicle Digital Key sector faces several challenges. Ensuring robust cybersecurity and preventing sophisticated hacking attempts remains a paramount concern, requiring continuous investment in advanced encryption and authentication protocols. The lack of universal interoperability standards across different vehicle manufacturers and smartphone operating systems can lead to fragmentation and hinder widespread adoption. Regulatory hurdles and compliance requirements, particularly concerning data privacy and security, can add complexity and cost to development and deployment. Supply chain disruptions and the availability of critical semiconductor components can impact production volumes and timelines. Finally, consumer education and overcoming resistance to adopting new technologies can be a slow process, especially for segments of the population less familiar with digital solutions.

Emerging Opportunities in Electric Vehicle Digital Key

Emerging opportunities in the Electric Vehicle Digital Key market are abundant and diverse. The development of interoperable digital key platforms that allow seamless sharing of vehicle access across different brands and models presents a significant opportunity for market consolidation and ecosystem building. The integration of digital keys with broader mobility-as-a-service (MaaS) platforms enables new business models for car-sharing, ride-hailing, and fleet management. Leveraging blockchain technology for enhanced security and transparent ownership tracking offers a path towards ultra-secure digital key solutions. Furthermore, the expansion of digital key functionalities beyond simple access, such as personalized vehicle settings, predictive maintenance alerts, and in-car service bookings, creates value-added services and new revenue streams for manufacturers and technology providers. The increasing adoption of digital keys in commercial and fleet vehicles represents a substantial untapped market segment.

Leading Players in the Electric Vehicle Digital Key Market

- TESLA

- BYD

- Continental

- Denso

- Hella

- Lear

- Valeo

- Mitsubishi Electric

- MARELLI

- BCS

- Tokai Rika

- ALPHA

Key Developments in Electric Vehicle Digital Key Industry

- 2023/09: Continental introduces next-generation UWB digital key technology for enhanced security and precision.

- 2023/11: Valeo announces a strategic partnership with a major automaker to integrate its advanced digital key solutions across a new EV lineup.

- 2024/01: Denso showcases a robust cloud-based digital key management system at CES, emphasizing scalability and security.

- 2024/03: BYD expands its in-house digital key development capabilities to support its growing global EV portfolio.

- 2024/05: TESLA continues to refine its proprietary digital key app, focusing on user experience and expanded remote control features.

- 2024/07: Hella enhances its digital key offerings with advanced biometric authentication options.

- 2025/XX: MARELLI is expected to launch a new modular digital key platform for flexible integration by various OEMs.

- 2025/XX: Lear is anticipated to unveil innovations in seamless in-cabin experience driven by digital key integration.

- 2025/XX: Mitsubishi Electric aims to bolster its presence with a focus on secure UWB implementation.

- 2025/XX: BCS and Tokai Rika are projected to introduce cost-effective digital key solutions for mid-segment EVs.

- 2025/XX: ALPHA is expected to focus on software-defined digital key solutions for enhanced customization.

Strategic Outlook for Electric Vehicle Digital Key Market

The strategic outlook for the Electric Vehicle Digital Key market is exceptionally bright, characterized by sustained innovation and expanding application horizons. Key growth catalysts include the ever-increasing penetration of electric vehicles globally, making digital key integration a standard expectation. The continued evolution of wireless technologies and cybersecurity measures will solidify digital keys as the most secure and convenient access method. Strategic partnerships between automotive OEMs, Tier-1 suppliers, and technology firms will drive the development of interoperable ecosystems and enhanced user experiences, fostering greater consumer adoption. The market will also benefit from the emergence of new business models centered around shared mobility and personalized in-car services, further embedding digital keys into the broader automotive digital transformation. Investments in research and development for advanced features like predictive access and seamless integration with smart home devices will shape the future competitive landscape.

Electric Vehicle Digital Key Segmentation

-

1. Application

- 1.1. BEV

- 1.2. PHEV

-

2. Type

- 2.1. RKES

- 2.2. PKES

Electric Vehicle Digital Key Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electric Vehicle Digital Key REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Vehicle Digital Key Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. BEV

- 5.1.2. PHEV

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. RKES

- 5.2.2. PKES

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Electric Vehicle Digital Key Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. BEV

- 6.1.2. PHEV

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. RKES

- 6.2.2. PKES

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Electric Vehicle Digital Key Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. BEV

- 7.1.2. PHEV

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. RKES

- 7.2.2. PKES

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Electric Vehicle Digital Key Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. BEV

- 8.1.2. PHEV

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. RKES

- 8.2.2. PKES

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Electric Vehicle Digital Key Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. BEV

- 9.1.2. PHEV

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. RKES

- 9.2.2. PKES

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Electric Vehicle Digital Key Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. BEV

- 10.1.2. PHEV

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. RKES

- 10.2.2. PKES

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 TESLA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BYD

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Continental

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Denso

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hella

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lear

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Valeo

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mitsubishi Electric

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MARELLI

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BCS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tokai Rika

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ALPHA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 TESLA

List of Figures

- Figure 1: Global Electric Vehicle Digital Key Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Electric Vehicle Digital Key Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Electric Vehicle Digital Key Revenue (million), by Application 2024 & 2032

- Figure 4: North America Electric Vehicle Digital Key Volume (K), by Application 2024 & 2032

- Figure 5: North America Electric Vehicle Digital Key Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Electric Vehicle Digital Key Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Electric Vehicle Digital Key Revenue (million), by Type 2024 & 2032

- Figure 8: North America Electric Vehicle Digital Key Volume (K), by Type 2024 & 2032

- Figure 9: North America Electric Vehicle Digital Key Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Electric Vehicle Digital Key Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Electric Vehicle Digital Key Revenue (million), by Country 2024 & 2032

- Figure 12: North America Electric Vehicle Digital Key Volume (K), by Country 2024 & 2032

- Figure 13: North America Electric Vehicle Digital Key Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Electric Vehicle Digital Key Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Electric Vehicle Digital Key Revenue (million), by Application 2024 & 2032

- Figure 16: South America Electric Vehicle Digital Key Volume (K), by Application 2024 & 2032

- Figure 17: South America Electric Vehicle Digital Key Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Electric Vehicle Digital Key Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Electric Vehicle Digital Key Revenue (million), by Type 2024 & 2032

- Figure 20: South America Electric Vehicle Digital Key Volume (K), by Type 2024 & 2032

- Figure 21: South America Electric Vehicle Digital Key Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Electric Vehicle Digital Key Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Electric Vehicle Digital Key Revenue (million), by Country 2024 & 2032

- Figure 24: South America Electric Vehicle Digital Key Volume (K), by Country 2024 & 2032

- Figure 25: South America Electric Vehicle Digital Key Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Electric Vehicle Digital Key Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Electric Vehicle Digital Key Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Electric Vehicle Digital Key Volume (K), by Application 2024 & 2032

- Figure 29: Europe Electric Vehicle Digital Key Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Electric Vehicle Digital Key Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Electric Vehicle Digital Key Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Electric Vehicle Digital Key Volume (K), by Type 2024 & 2032

- Figure 33: Europe Electric Vehicle Digital Key Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Electric Vehicle Digital Key Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Electric Vehicle Digital Key Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Electric Vehicle Digital Key Volume (K), by Country 2024 & 2032

- Figure 37: Europe Electric Vehicle Digital Key Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Electric Vehicle Digital Key Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Electric Vehicle Digital Key Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Electric Vehicle Digital Key Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Electric Vehicle Digital Key Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Electric Vehicle Digital Key Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Electric Vehicle Digital Key Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Electric Vehicle Digital Key Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Electric Vehicle Digital Key Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Electric Vehicle Digital Key Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Electric Vehicle Digital Key Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Electric Vehicle Digital Key Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Electric Vehicle Digital Key Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Electric Vehicle Digital Key Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Electric Vehicle Digital Key Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Electric Vehicle Digital Key Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Electric Vehicle Digital Key Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Electric Vehicle Digital Key Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Electric Vehicle Digital Key Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Electric Vehicle Digital Key Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Electric Vehicle Digital Key Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Electric Vehicle Digital Key Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Electric Vehicle Digital Key Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Electric Vehicle Digital Key Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Electric Vehicle Digital Key Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Electric Vehicle Digital Key Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electric Vehicle Digital Key Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Electric Vehicle Digital Key Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Electric Vehicle Digital Key Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Electric Vehicle Digital Key Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Electric Vehicle Digital Key Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Electric Vehicle Digital Key Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Electric Vehicle Digital Key Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Electric Vehicle Digital Key Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Electric Vehicle Digital Key Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Electric Vehicle Digital Key Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Electric Vehicle Digital Key Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Electric Vehicle Digital Key Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Electric Vehicle Digital Key Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Electric Vehicle Digital Key Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Electric Vehicle Digital Key Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Electric Vehicle Digital Key Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Electric Vehicle Digital Key Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Electric Vehicle Digital Key Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Electric Vehicle Digital Key Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Electric Vehicle Digital Key Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Electric Vehicle Digital Key Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Electric Vehicle Digital Key Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Electric Vehicle Digital Key Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Electric Vehicle Digital Key Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Electric Vehicle Digital Key Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Electric Vehicle Digital Key Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Electric Vehicle Digital Key Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Electric Vehicle Digital Key Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Electric Vehicle Digital Key Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Electric Vehicle Digital Key Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Electric Vehicle Digital Key Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Electric Vehicle Digital Key Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Electric Vehicle Digital Key Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Electric Vehicle Digital Key Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Electric Vehicle Digital Key Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Electric Vehicle Digital Key Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Electric Vehicle Digital Key Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Electric Vehicle Digital Key Volume K Forecast, by Country 2019 & 2032

- Table 81: China Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Electric Vehicle Digital Key Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Electric Vehicle Digital Key Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Vehicle Digital Key?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Electric Vehicle Digital Key?

Key companies in the market include TESLA, BYD, Continental, Denso, Hella, Lear, Valeo, Mitsubishi Electric, MARELLI, BCS, Tokai Rika, ALPHA.

3. What are the main segments of the Electric Vehicle Digital Key?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Vehicle Digital Key," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Vehicle Digital Key report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Vehicle Digital Key?

To stay informed about further developments, trends, and reports in the Electric Vehicle Digital Key, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence