Key Insights

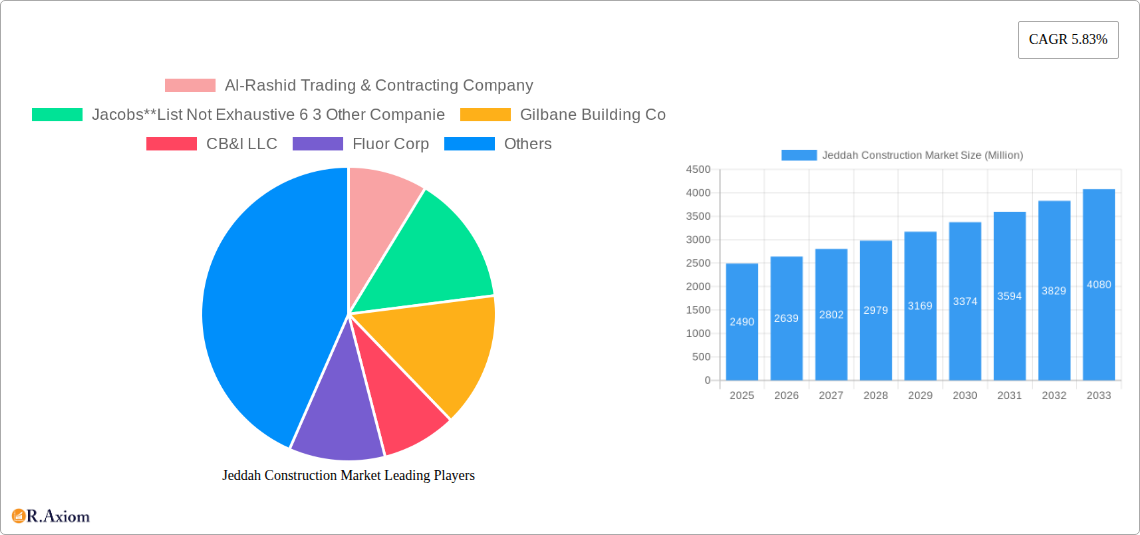

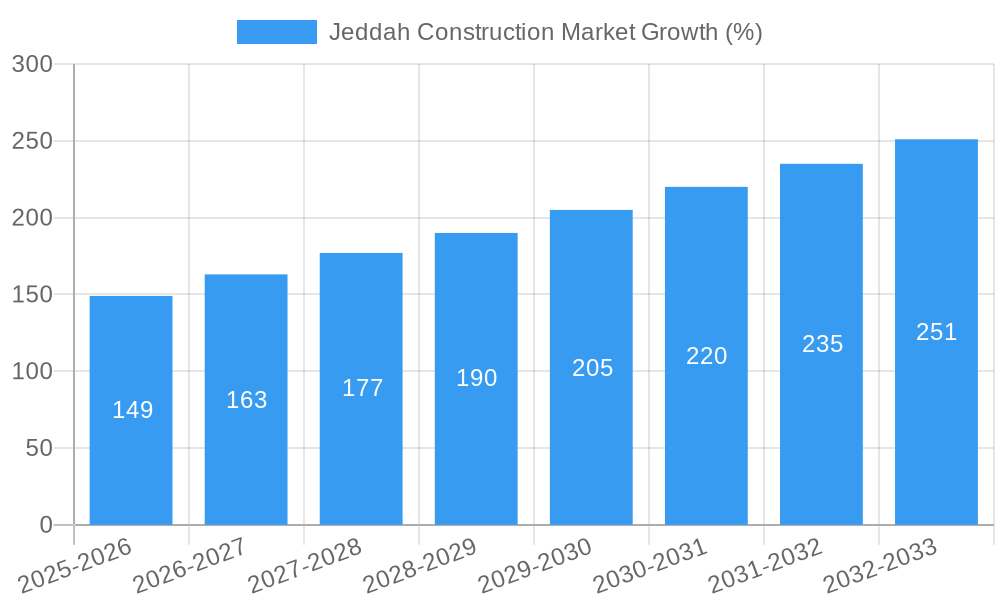

The Jeddah construction market, valued at $2.49 billion in 2025, is projected to experience robust growth, driven by significant infrastructure development initiatives within the city and the broader Kingdom of Saudi Arabia's Vision 2030. This ambitious plan emphasizes infrastructure modernization, sustainable urban development, and diversification of the Saudi economy, all of which directly fuel demand in the construction sector. Key drivers include the ongoing expansion of transportation networks (roads, railways, airports), the burgeoning energy and utility sectors requiring new power plants and grid infrastructure, and a considerable increase in residential and commercial construction projects to accommodate the growing population and influx of businesses. The market segmentation reveals a strong presence across all sectors, with residential, commercial, and infrastructure development projects likely leading the growth trajectory. Established international players like Bechtel and Fluor Corp alongside regional heavyweights such as Al-Rashid Trading & Contracting Company and Al Latifa Trading and Contracting are significant contributors to the market’s activity. Competition is expected to remain intense as both local and international firms vie for lucrative contracts.

While the market presents immense opportunity, several factors may present challenges. These could include potential fluctuations in global commodity prices impacting material costs, skilled labor shortages, and the overall economic climate within the region. However, the strategic investments and long-term vision outlined in Vision 2030 should mitigate some of these risks and ensure a steady upward trajectory for the foreseeable future. The consistent 5.83% CAGR suggests a continuously expanding market, offering significant potential for both established players and new entrants. The forecast period of 2025-2033 promises considerable growth, making Jeddah a highly attractive investment destination for construction companies.

Jeddah Construction Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Jeddah construction market, offering valuable insights for industry stakeholders, investors, and policymakers. The study covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The report leverages extensive primary and secondary research to deliver actionable intelligence on market size, growth drivers, challenges, and emerging opportunities. We analyze key market segments, dominant players, and significant industry developments to provide a holistic view of this dynamic market. Expected market value for 2025 is estimated at xx Million.

Jeddah Construction Market Concentration & Innovation

This section analyzes the competitive landscape of the Jeddah construction market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of large multinational corporations and local players, leading to varying levels of market share. While precise market share data for individual companies remains proprietary, Al-Rashid Trading & Contracting Company, Jacobs, Gilbane Building Co, CB&I LLC, Fluor Corp, Al Latifa Trading and Contracting, Bechtel, Tekfen Construction and Installation Co Inc, AL Jazirah Engineers & Consultants, and Afras Trading and Contracting Company are significant players. The presence of these companies reflects a blend of local expertise and global construction capabilities.

- Market Concentration: The market displays a moderately concentrated structure with a few dominant players, but a significant number of smaller and medium-sized enterprises (SMEs). Precise market share figures are unavailable publicly but are estimated to be highly variable across segments.

- Innovation Drivers: Innovation in the Jeddah construction market is driven by the need for sustainable and efficient construction methods, alongside government initiatives promoting green building practices and technological advancements such as BIM (Building Information Modeling) and advanced construction materials.

- Regulatory Frameworks: The regulatory environment plays a crucial role in shaping the market, with building codes and permits influencing project timelines and costs. Government initiatives impacting construction standards significantly influence the industry's growth trajectory.

- Product Substitutes: The market witnesses the emergence of alternative building materials and construction techniques, impacting traditional construction methods. Technological advancements continuously introduce substitutes which impact project economics.

- End-User Trends: Increasing urbanization and population growth fuel the demand for residential, commercial, and infrastructure projects, shaping construction market dynamics. Demand patterns shift dynamically reflecting evolving demographics and economic factors.

- M&A Activities: Mergers and acquisitions play a role in market consolidation, though specific deal values remain undisclosed publicly. Data on M&A activity in the Jeddah construction market is limited but likely reflects a pattern of consolidation amongst larger players.

Jeddah Construction Market Industry Trends & Insights

The Jeddah construction market exhibits robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected at xx%, indicating strong market expansion. This growth is fueled by massive infrastructure development projects, particularly in transportation and energy sectors, alongside a booming residential sector due to population growth and economic diversification initiatives within the Kingdom.

Technological advancements, such as the increased use of Building Information Modeling (BIM) and prefabrication techniques, are boosting efficiency and reducing project timelines. Government investment in mega-projects like NEOM, and the Red Sea Project is creating a massive surge in demand, driving market expansion. Changing consumer preferences, with an increasing focus on sustainable and eco-friendly construction practices, are also impacting the sector. Competitive dynamics are marked by a diverse range of players, with both local and international companies vying for market share. Market penetration of technologically advanced construction methods remains relatively low, presenting significant opportunities for future growth.

Dominant Markets & Segments in Jeddah Construction Market

The Jeddah construction market is segmented by sector: Residential, Commercial, Industrial, Infrastructure (Transportation), and Energy and Utility Construction. While all sectors contribute significantly, the infrastructure sector (specifically transportation projects) currently dominates due to the significant investments in expanding and improving transportation networks within Jeddah and the broader Kingdom.

- Key Drivers for Infrastructure Dominance:

- Massive government investment in transportation infrastructure upgrades and expansion projects.

- The need to support rapid urbanization and population growth.

- Strategic initiatives focusing on improving connectivity and logistics.

The residential sector is also experiencing strong growth, fueled by population growth and rising demand for housing, while commercial construction remains robust, driven by ongoing expansion of business activities and tourism. The energy and utility sectors are expected to witness steady growth, backed by infrastructure investments aligned with national energy diversification strategies. The industrial sector exhibits moderate growth, influenced by industrial diversification policies and investment in manufacturing facilities.

Jeddah Construction Market Product Developments

Recent product innovations focus on sustainable and efficient building materials, prefabrication methods, and advanced technologies like BIM. These innovations aim to improve project speed, reduce costs, and minimize environmental impacts. The adoption of these technologies remains an ongoing process, but early adoption is demonstrating significant gains in project delivery efficiency and construction quality.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the Jeddah construction market by sector:

- Residential: This segment encompasses the construction of housing projects, ranging from apartments and villas to larger residential complexes. The market is experiencing strong growth driven by population increase and government initiatives supporting housing development.

- Commercial: This includes the construction of offices, shopping malls, hotels, and other commercial buildings. Growth in this segment is linked to economic development and tourism expansion.

- Industrial: This covers the construction of industrial facilities, factories, and warehouses. This segment's growth reflects industrial diversification efforts and investment in manufacturing capacities.

- Infrastructure (Transportation): This segment is currently the largest, driven by extensive investments in transportation projects, including roads, railways, airports, and ports.

- Energy and Utility Construction: This segment focuses on power plants, pipelines, and other energy and utility infrastructure, experiencing growth reflecting energy sector diversification and related investments.

Each segment’s growth projections, market sizes, and competitive dynamics are detailed within the full report.

Key Drivers of Jeddah Construction Market Growth

Several factors drive the growth of the Jeddah construction market, including:

- Government Initiatives: Significant government investment in infrastructure projects, particularly transportation, energy and mega-projects such as NEOM, creates substantial market demand.

- Economic Growth: Continued economic growth and diversification strategies within Saudi Arabia fuel increased private sector investment in construction activities across various segments.

- Population Growth: Rapid urbanization and population growth create a high demand for residential, commercial, and infrastructure projects.

- Technological Advancements: Adoption of advanced construction technologies improves project efficiency, speed, and quality, attracting greater investment.

Challenges in the Jeddah Construction Market Sector

The Jeddah construction market faces several challenges including:

- Regulatory Hurdles: Complex permitting processes and bureaucratic procedures can delay projects and increase costs. The impact is estimated to add xx% to project timelines in certain cases.

- Supply Chain Issues: Potential supply chain disruptions can affect project timelines and budgets. Recent global events have highlighted the need for robust supply chain resilience strategies, adding xx Million annually in contingency planning costs for some projects.

- Labor Shortages: Skill shortages in specific construction trades can impede project progress and escalate labor costs. Addressing this challenge requires significant investment in workforce development initiatives.

- Competition: Intense competition amongst construction firms necessitates efficient operations and competitive pricing strategies for successful project acquisition and execution.

Emerging Opportunities in Jeddah Construction Market

Several emerging opportunities exist within the Jeddah construction market:

- Sustainable Construction: Growing demand for eco-friendly building materials and practices presents significant opportunities for companies specializing in sustainable construction solutions.

- Technological Adoption: Increased adoption of BIM and other advanced construction technologies offers efficiency gains and cost reductions.

- Specialized Construction: Demand for specialized construction services, such as high-rise construction and complex infrastructure projects, creates niche market opportunities.

- Public-Private Partnerships: Increased utilization of public-private partnerships (PPPs) presents alternative financing and project delivery mechanisms.

Leading Players in the Jeddah Construction Market Market

- Al-Rashid Trading & Contracting Company

- Jacobs

- Gilbane Building Co

- CB&I LLC

- Fluor Corp

- Al Latifa Trading and Contracting

- Bechtel

- Tekfen Construction and Installation Co Inc

- AL Jazirah Engineers & Consultants

- Afras Trading and Contracting Company

Key Developments in Jeddah Construction Market Industry

- 2022 Q4: Announcement of several major infrastructure projects under the Vision 2030 initiative. This resulted in a significant increase in bidding activity and contract awards.

- 2023 Q1: Introduction of new building codes emphasizing sustainable construction practices. This spurred investment in green technologies and sustainable building materials.

- 2023 Q2: Several large-scale mergers and acquisitions amongst major construction firms, leading to increased market consolidation. This impacted competitive dynamics and market share distribution. (Further details on specific deals are unavailable publicly).

Strategic Outlook for Jeddah Construction Market Market

The Jeddah construction market is poised for continued robust growth, driven by sustained government investment in infrastructure, population growth, and economic diversification initiatives. The adoption of innovative construction technologies and sustainable practices will play a crucial role in shaping the market's future. The focus on mega-projects and large-scale developments will continue to drive demand, offering significant opportunities for companies that can adapt to the evolving market dynamics and demonstrate innovative and efficient project delivery capabilities. The market will likely remain moderately concentrated, with opportunities for both large multinational corporations and specialized SMEs.

Jeddah Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure (Transportation)

- 1.5. Energy and Utility construction

Jeddah Construction Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Jeddah Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Green And Sustainable Buildings Initiatives

- 3.3. Market Restrains

- 3.3.1. Decliing Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Increase in Commercial Construction is dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Jeddah Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure (Transportation)

- 5.1.5. Energy and Utility construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Jeddah Construction Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1.4. Infrastructure (Transportation)

- 6.1.5. Energy and Utility construction

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Jeddah Construction Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1.4. Infrastructure (Transportation)

- 7.1.5. Energy and Utility construction

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Jeddah Construction Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1.4. Infrastructure (Transportation)

- 8.1.5. Energy and Utility construction

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Jeddah Construction Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1.4. Infrastructure (Transportation)

- 9.1.5. Energy and Utility construction

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Jeddah Construction Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1.4. Infrastructure (Transportation)

- 10.1.5. Energy and Utility construction

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Al-Rashid Trading & Contracting Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jacobs**List Not Exhaustive 6 3 Other Companie

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Gilbane Building Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CB&I LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fluor Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Al Latifa Trading and Contracting

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bechtel

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tekfen Construction and Installation Co Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AL Jazirah Engineers & Consultants

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Afras Trading and Contracting Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Al-Rashid Trading & Contracting Company

List of Figures

- Figure 1: Global Jeddah Construction Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Jeddah Construction Market Revenue (Million), by Sector 2024 & 2032

- Figure 3: North America Jeddah Construction Market Revenue Share (%), by Sector 2024 & 2032

- Figure 4: North America Jeddah Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Jeddah Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: South America Jeddah Construction Market Revenue (Million), by Sector 2024 & 2032

- Figure 7: South America Jeddah Construction Market Revenue Share (%), by Sector 2024 & 2032

- Figure 8: South America Jeddah Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Jeddah Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Jeddah Construction Market Revenue (Million), by Sector 2024 & 2032

- Figure 11: Europe Jeddah Construction Market Revenue Share (%), by Sector 2024 & 2032

- Figure 12: Europe Jeddah Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Europe Jeddah Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Middle East & Africa Jeddah Construction Market Revenue (Million), by Sector 2024 & 2032

- Figure 15: Middle East & Africa Jeddah Construction Market Revenue Share (%), by Sector 2024 & 2032

- Figure 16: Middle East & Africa Jeddah Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Middle East & Africa Jeddah Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Jeddah Construction Market Revenue (Million), by Sector 2024 & 2032

- Figure 19: Asia Pacific Jeddah Construction Market Revenue Share (%), by Sector 2024 & 2032

- Figure 20: Asia Pacific Jeddah Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Jeddah Construction Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Jeddah Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Jeddah Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global Jeddah Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Jeddah Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 5: Global Jeddah Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Jeddah Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 10: Global Jeddah Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Brazil Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Argentina Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of South America Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Jeddah Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 15: Global Jeddah Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Russia Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Benelux Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Nordics Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Jeddah Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 26: Global Jeddah Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Turkey Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Israel Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: GCC Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: North Africa Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East & Africa Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Jeddah Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 34: Global Jeddah Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: China Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: India Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Japan Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: South Korea Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: ASEAN Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Oceania Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Asia Pacific Jeddah Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Jeddah Construction Market?

The projected CAGR is approximately 5.83%.

2. Which companies are prominent players in the Jeddah Construction Market?

Key companies in the market include Al-Rashid Trading & Contracting Company, Jacobs**List Not Exhaustive 6 3 Other Companie, Gilbane Building Co, CB&I LLC, Fluor Corp, Al Latifa Trading and Contracting, Bechtel, Tekfen Construction and Installation Co Inc, AL Jazirah Engineers & Consultants, Afras Trading and Contracting Company.

3. What are the main segments of the Jeddah Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Green And Sustainable Buildings Initiatives.

6. What are the notable trends driving market growth?

Increase in Commercial Construction is dominating the Market.

7. Are there any restraints impacting market growth?

Decliing Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Jeddah Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Jeddah Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Jeddah Construction Market?

To stay informed about further developments, trends, and reports in the Jeddah Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence