Key Insights

The Latin American façade market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 7.00% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, significant investments in both residential and commercial construction across major economies like Brazil, Mexico, and Argentina are creating substantial demand for aesthetically pleasing and high-performance building facades. Secondly, a growing preference for sustainable and energy-efficient building materials, such as those promoting natural ventilation and incorporating solar control features, is driving the adoption of innovative façade systems. The increasing urbanization across the region, coupled with rising disposable incomes and a burgeoning middle class, further contributes to the market's growth trajectory. Finally, the increasing adoption of prefabricated and modular construction techniques is streamlining installation and reducing overall project timelines, contributing to increased market penetration.

However, the market faces certain restraints. Fluctuations in raw material prices, particularly for metals and certain types of stone, can impact the overall cost of façade systems and affect project budgets. Additionally, stringent building codes and regulations in certain Latin American countries, especially regarding safety and energy efficiency, may pose challenges for manufacturers and installers. The market is segmented by type (ventilated, non-ventilated, others), material (wood, glass, metal, stone, ceramic, others), and end-user (residential, commercial, industrial). Key players such as BFG International, ULMA, PFEIFER Structures, Tecnoglass Inc., and others are actively competing in this dynamic market, offering diverse product portfolios and services to cater to the varied needs of the construction industry. The strong growth forecast suggests significant opportunities for market entrants and existing players alike, provided they can effectively navigate the challenges presented by fluctuating raw material prices and regulatory compliance.

Latin America Facade Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America facade market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025 as the base and estimated year, this report meticulously examines market trends, segmentation, competitive landscape, and future growth potential. The total market size in 2025 is estimated at xx Million, projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Latin America Facade Market Concentration & Innovation

The Latin America facade market displays a moderately concentrated landscape, with a few major players holding significant market share. BFG International, ULMA, PFEIFER Structures, and Tecnoglass Inc. are some of the key players, although the exact market share distribution remains dynamic. Innovation is driven by the increasing demand for energy-efficient and aesthetically pleasing facades, leading to advancements in materials, designs, and installation techniques. Regulatory frameworks, particularly concerning building codes and sustainability standards, influence market dynamics significantly. The increasing adoption of green building practices is fostering innovation in sustainable facade solutions. Product substitutes, such as advanced cladding systems and prefabricated facade panels, are also influencing market competition. Recent M&A activities, while not extensively documented publicly, suggest consolidation trends with an estimated xx Million in deal value over the past five years. End-user preferences are shifting towards customized facade solutions that integrate advanced technologies like smart sensors and building management systems.

Latin America Facade Market Industry Trends & Insights

The Latin American facade market is experiencing robust growth, driven by a surge in construction across residential, commercial, and industrial sectors. This expansion is fueled by rising disposable incomes in several countries, coupled with rapid urbanization and extensive infrastructure development projects. Technological advancements in materials science and manufacturing are introducing innovative facade systems with enhanced performance, including improved insulation, thermal efficiency, and aesthetic appeal. Consumer demand increasingly favors sustainable and energy-efficient designs, boosting the popularity of ventilated facades and other high-performance solutions. Competition is intense, with established players and emerging companies vying for market share through product innovation, customization, and competitive pricing. The market is witnessing a growing adoption of advanced facade systems, such as those integrating solar panels, reflecting a rising awareness of environmental sustainability and the pursuit of green building certifications.

Dominant Markets & Segments in Latin America Facade Market

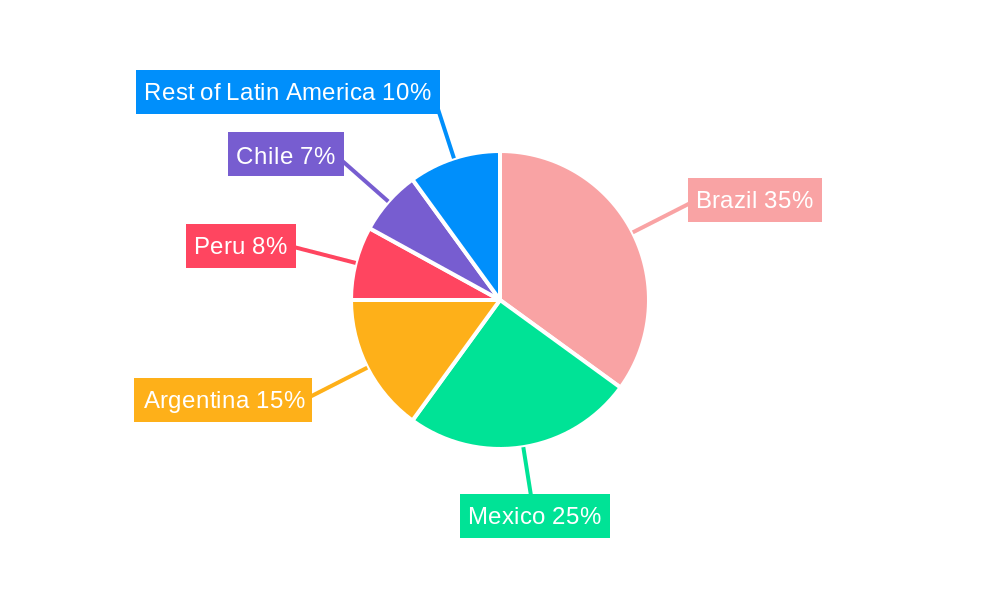

- Leading Regions: Brazil and Mexico are the dominant markets, fueled by robust construction activity and substantial infrastructure investments. Other key markets include Colombia, Argentina, and Chile, each exhibiting significant, albeit varied, growth trajectories.

- Key Market Drivers: Favorable economic policies in certain regions, increasing government investments in infrastructure, and supportive regulatory environments contribute significantly to market expansion. Furthermore, the burgeoning tourism sector in many Latin American countries is also driving demand for aesthetically pleasing and high-performing building facades.

- Dominant Segments:

- By Type: Ventilated facades are experiencing rapid growth due to their superior energy efficiency and design flexibility. Other types, such as curtain walls and rainscreen systems, also hold significant market share.

- By Material: Glass and metal facades remain dominant due to their durability and aesthetic versatility. However, a growing trend towards sustainability is driving increased adoption of eco-friendly materials, including recycled metals, sustainably sourced wood, and high-performance ceramics.

- By End-User: The commercial sector (office buildings, shopping malls, hotels) leads in facade installations. However, the residential sector is experiencing significant growth, particularly in high-rise and luxury residential developments.

The continued growth in these leading markets is projected to be sustained in the coming years, driven by ongoing economic development and urban expansion, alongside increasing governmental support for sustainable building practices.

Latin America Facade Market Product Developments

Recent product innovations focus on lightweight, high-performance materials, integrated building management systems, and prefabricated facade systems to expedite installation and minimize on-site construction. These developments aim to enhance energy efficiency, durability, and aesthetic appeal, while addressing specific challenges like seismic activity and extreme weather conditions prevalent in certain regions. The increasing use of Building Information Modeling (BIM) in the design and construction process further streamlines the integration of facade systems. This integration creates a competitive advantage by optimizing building performance and enhancing overall project efficiency.

Report Scope & Segmentation Analysis

This report comprehensively segments the Latin America facade market based on type (ventilated, non-ventilated, others), material (wood, glass, metal, stone, ceramic, others), and end-user (residential, commercial, industrial). Each segment is thoroughly analyzed, providing detailed growth projections, market sizes, and competitive dynamics. The analysis includes detailed assessments of market drivers, restraints, and future growth opportunities for each segment.

Key Drivers of Latin America Facade Market Growth

The Latin America facade market is driven by several factors: rapid urbanization, increased investment in infrastructure projects, growing demand for aesthetically pleasing and energy-efficient buildings, technological advancements in facade materials and systems, and favorable government policies promoting sustainable construction practices.

Challenges in the Latin America Facade Market Sector

Challenges facing the market include fluctuations in raw material prices (particularly metals and glass), potential supply chain disruptions, adherence to diverse and sometimes stringent building codes and regulations across different countries, and the intense competition among numerous market players. These factors can contribute to fluctuating project timelines and increased project costs. Furthermore, a shortage of skilled labor in certain regions presents a significant obstacle to consistent project delivery and overall market growth. Navigating the complexities of local regulations and ensuring consistent quality control across diverse projects also pose ongoing challenges.

Emerging Opportunities in Latin America Facade Market

Emerging opportunities include the rising adoption of sustainable and eco-friendly facade materials, the integration of smart technologies into facade systems, and the growing demand for customized facade solutions. The expansion of the green building movement and increasing awareness of sustainability provide significant opportunities for players offering energy-efficient facade solutions.

Leading Players in the Latin America Facade Market Market

- BFG International

- ULMA

- PFEIFER Structures

- Tecnoglass Inc

- Dante Tisi

- Shackerley (Holdings) Group

- Mallol Arquitectos

- Au-Mex

- Roofway

- Estudio Marshall & Associates

- Ventanar

Key Developments in Latin America Facade Market Industry

- 2022 Q4: Tecnoglass Inc. announced a new line of sustainable facade systems.

- 2023 Q1: A major M&A deal involving two leading facade companies was reported. (Specific details unavailable)

- 2023 Q3: BFG International launched a new product line for high-rise buildings. (Further details unavailable)

Strategic Outlook for Latin America Facade Market Market

The Latin America facade market is poised for continued growth driven by several factors including urbanization, construction investments, and technological advancements. Opportunities exist for companies focused on sustainable, energy-efficient, and technologically integrated facade solutions. Further consolidation through mergers and acquisitions is expected in the coming years, leading to a more concentrated market landscape.

Latin America Facade Market Segmentation

-

1. Type

- 1.1. Ventilated

- 1.2. Non-Ventilated

- 1.3. Others

-

2. Material

- 2.1. Wood

- 2.2. Glass

- 2.3. Metal

- 2.4. Stone

- 2.5. Ceramic

- 2.6. Others

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

Latin America Facade Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Facade Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions

- 3.3. Market Restrains

- 3.3.1. The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Increasing Construction Sector Boosting the Demand for Facade Installations

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Facade Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ventilated

- 5.1.2. Non-Ventilated

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Wood

- 5.2.2. Glass

- 5.2.3. Metal

- 5.2.4. Stone

- 5.2.5. Ceramic

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America Facade Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Facade Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Facade Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Facade Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Facade Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Facade Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 BFG International**List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 ULMA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 PFEIFER Structures

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Tecnoglass Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Dante Tisi

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Shackerley (Holdings) Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mallol Arquitectos

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Au-Mex

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Roofway

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Estudio Marshall & Associates

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Ventanar

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 BFG International**List Not Exhaustive

List of Figures

- Figure 1: Latin America Facade Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Facade Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Facade Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: Latin America Facade Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Latin America Facade Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Latin America Facade Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Peru Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Chile Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Latin America Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Latin America Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Latin America Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 15: Latin America Facade Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: Latin America Facade Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Chile Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Colombia Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Peru Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Venezuela Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ecuador Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Bolivia Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Paraguay Latin America Facade Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Facade Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Latin America Facade Market?

Key companies in the market include BFG International**List Not Exhaustive, ULMA, PFEIFER Structures, Tecnoglass Inc, Dante Tisi, Shackerley (Holdings) Group, Mallol Arquitectos, Au-Mex, Roofway, Estudio Marshall & Associates, Ventanar.

3. What are the main segments of the Latin America Facade Market?

The market segments include Type, Material, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions.

6. What are the notable trends driving market growth?

Increasing Construction Sector Boosting the Demand for Facade Installations.

7. Are there any restraints impacting market growth?

The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Facade Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Facade Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Facade Market?

To stay informed about further developments, trends, and reports in the Latin America Facade Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence