Key Insights

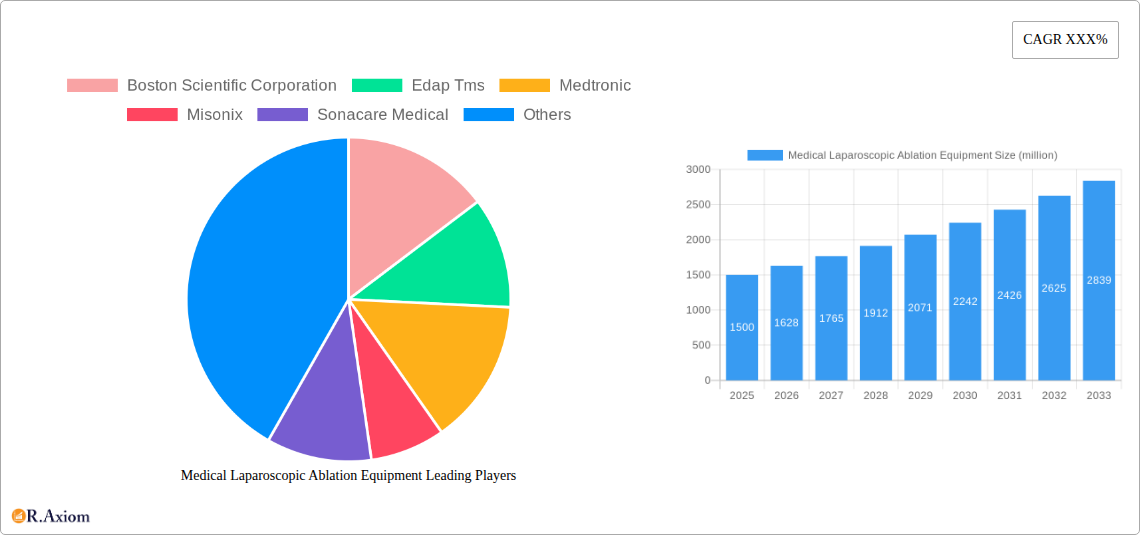

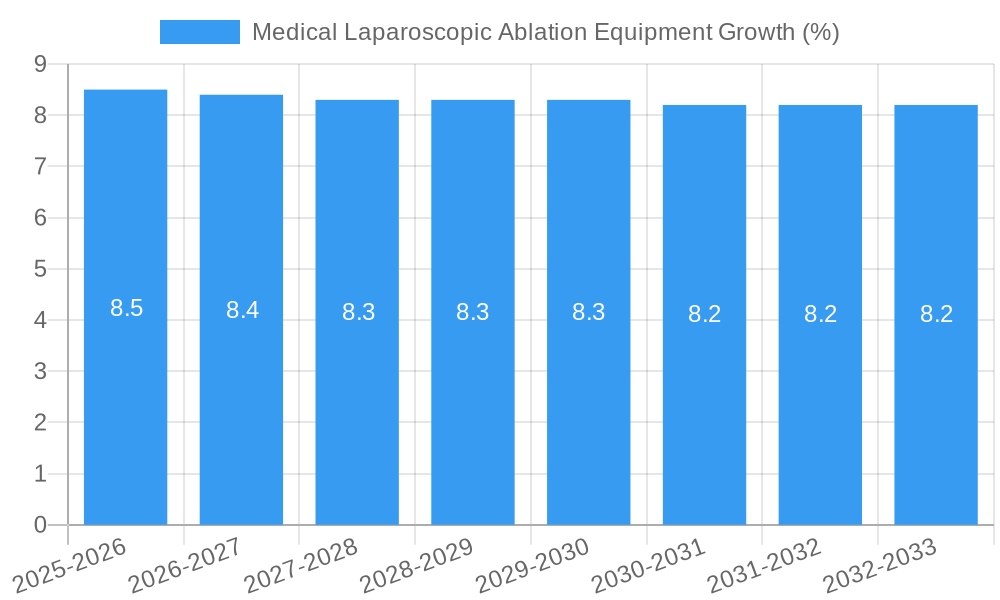

The global Medical Laparoscopic Ablation Equipment market is poised for significant expansion, projected to reach an estimated USD 1.5 billion in 2025 and grow at a Compound Annual Growth Rate (CAGR) of approximately 8.5% through 2033. This robust growth is primarily fueled by the increasing prevalence of chronic diseases requiring minimally invasive treatment options, such as certain cancers, cardiac arrhythmias, and gynecological conditions. Advancements in ablation technologies, offering enhanced precision, reduced patient trauma, and faster recovery times, are key drivers of market adoption. The growing preference for laparoscopic procedures over traditional open surgeries, driven by benefits like smaller incisions, decreased pain, and shorter hospital stays, further bolsters demand for these specialized ablation devices.

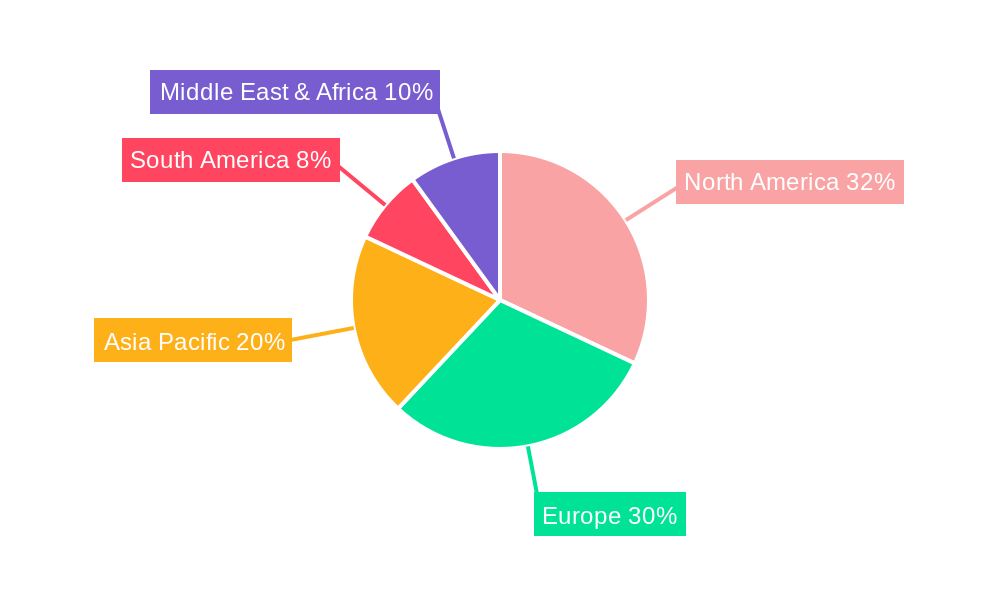

Hospitals and ambulatory surgery centers are the primary end-users, with a rising trend towards outpatient procedures in ambulatory settings contributing to market dynamism. Within the technology landscape, radiofrequency ablation and thermal ablation methods currently dominate, driven by their established efficacy and a broad range of clinical applications. However, cryoablation is gaining traction due to its potential for precise tissue destruction with minimal collateral damage. Geographically, North America and Europe are expected to lead the market, owing to well-established healthcare infrastructures, high adoption rates of advanced medical technologies, and favorable reimbursement policies. Emerging economies in the Asia Pacific region are also anticipated to witness substantial growth, propelled by improving healthcare access, increasing disposable incomes, and a growing awareness of minimally invasive treatment options.

Medical Laparoscopic Ablation Equipment Market Concentration & Innovation

The medical laparoscopic ablation equipment market exhibits a moderate to high concentration, with key players like Medtronic, Boston Scientific Corporation, and Olympus Corp. dominating significant market share, estimated at over 60% in the base year 2025. Innovation is primarily driven by advancements in energy delivery technologies (radiofrequency, thermal, and cryoablation), enhanced precision, minimally invasive techniques, and improved patient outcomes. Regulatory frameworks, while generally supportive of innovation, can present challenges in terms of approval timelines and stringent quality standards for devices, impacting market entry for new entrants. Product substitutes, though limited for highly specialized laparoscopic ablations, include open surgical procedures and alternative energy-based therapies. End-user trends indicate a growing preference for outpatient procedures in Ambulatory Surgery Centers (ASCs), driving demand for more portable and cost-effective laparoscopic ablation solutions. Mergers and Acquisitions (M&A) are a significant factor in market consolidation and technology acquisition. For instance, recent M&A deals in the broader surgical equipment sector have reached values exceeding $500 million, suggesting potential future consolidation in the laparoscopic ablation space as larger companies seek to expand their portfolios.

Medical Laparoscopic Ablation Equipment Industry Trends & Insights

The global medical laparoscopic ablation equipment market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This robust expansion is fueled by a confluence of compelling market growth drivers, including the increasing prevalence of chronic diseases requiring minimally invasive treatment, such as cancer, cardiovascular conditions, and gynecological disorders. The rising demand for sophisticated laparoscopic surgical procedures, coupled with a growing preference for minimally invasive approaches over traditional open surgeries due to reduced patient recovery times and lower complication rates, directly fuels market penetration. Technological disruptions are at the forefront of market evolution, with continuous innovation in energy sources, imaging integration, and robotics enhancing the precision and efficacy of laparoscopic ablation. For example, the development of advanced bipolar radiofrequency (RF) ablation probes has significantly improved lesion creation and reduced collateral tissue damage, leading to better patient outcomes. Furthermore, the integration of artificial intelligence (AI) for real-time guidance and pre-operative planning is an emerging trend that promises to revolutionize the field. Consumer preferences are increasingly aligned with outpatient settings, leading to a burgeoning demand for laparoscopic ablation procedures to be performed in Ambulatory Surgery Centers (ASCs), which offer cost efficiencies and convenience. This shift is compelling manufacturers to develop more compact and user-friendly equipment suitable for these settings. Competitive dynamics are characterized by strategic collaborations, product launches, and acquisitions as companies strive to capture market share. The competitive landscape is populated by established giants and agile innovators, all vying to introduce next-generation laparoscopic ablation solutions. The market penetration of advanced laparoscopic ablation techniques is steadily increasing, driven by physician training programs and the demonstrable clinical benefits these technologies offer, with an estimated penetration rate of over 50% for specific applications by the end of the forecast period.

Dominant Markets & Segments in Medical Laparoscopic Ablation Equipment

The Hospital segment is currently the dominant application for medical laparoscopic ablation equipment, driven by its comprehensive infrastructure, availability of specialized surgical teams, and the capability to handle complex procedures. Hospitals are the primary sites for advanced laparoscopic ablations, offering a wider range of therapeutic options and the necessary support systems for post-operative care. Key drivers for this dominance include:

- Infrastructure: Hospitals possess state-of-the-art operating rooms, advanced imaging modalities (CT, MRI, Ultrasound), and intensive care units essential for intricate laparoscopic surgeries and patient monitoring.

- Specialized Personnel: A concentration of highly skilled surgeons, anesthesiologists, and nursing staff trained in minimally invasive techniques ensures the safe and effective execution of complex ablation procedures.

- Reimbursement Policies: Established reimbursement pathways for inpatient procedures in hospitals facilitate the widespread adoption and utilization of these advanced technologies.

- Range of Procedures: Hospitals accommodate a broader spectrum of laparoscopic ablations, from oncological interventions to the treatment of cardiac arrhythmias and gynecological conditions.

Geographically, North America stands as the leading market for medical laparoscopic ablation equipment, with the United States at its forefront. This leadership is underpinned by several factors:

- High Healthcare Expenditure: The US boasts one of the highest per capita healthcare expenditures globally, enabling substantial investment in advanced medical technologies and devices.

- Technological Adoption: A strong culture of early adoption of cutting-edge medical innovations, particularly in minimally invasive surgery, fuels the demand for sophisticated laparoscopic ablation equipment.

- Favorable Regulatory Environment: While stringent, the FDA's regulatory framework provides a clear pathway for innovative medical devices, fostering market entry and growth.

- Prevalence of Target Conditions: The high incidence of conditions treatable with laparoscopic ablation, such as various cancers, uterine fibroids, and chronic pain, drives demand.

- Presence of Key Manufacturers: The US is home to several leading medical device manufacturers involved in the development and commercialization of laparoscopic ablation equipment, further stimulating market activity.

Among the types of ablation, Radiofrequency Ablation (RFA) commands the largest market share. This dominance is attributed to its well-established efficacy across a wide range of applications, including tumor ablation, cardiac rhythm management, and pain management. RFA technology has matured significantly, offering reliable and predictable outcomes. Key drivers for RFA's prominence include:

- Proven Clinical Outcomes: Extensive clinical data and a long history of successful use across diverse medical specialties validate its therapeutic benefits.

- Versatility: RFA probes and systems are adaptable to various anatomical locations and tissue types, making them suitable for a broad array of clinical indications.

- Technological Advancements: Ongoing innovations in RFA probes, including advanced cooling mechanisms and multipolar designs, enhance precision, reduce charring, and enable larger lesion creation.

- Cost-Effectiveness: Compared to some newer ablation modalities, RFA often presents a more cost-effective solution for healthcare providers.

Medical Laparoscopic Ablation Equipment Product Developments

Product developments in medical laparoscopic ablation equipment are characterized by enhanced precision, improved safety profiles, and greater versatility. Innovations focus on optimizing energy delivery mechanisms, such as advanced radiofrequency and thermal ablation technologies, and refining cryoablation techniques for targeted tissue destruction. The integration of real-time imaging feedback and robotic assistance further elevates procedural accuracy and reduces collateral damage. Competitive advantages are being carved out through miniaturization of devices for easier maneuverability in confined laparoscopic spaces, development of specialized probes for unique anatomical challenges, and the creation of integrated systems that streamline workflow for surgeons.

Report Scope & Segmentation Analysis

This report meticulously analyzes the medical laparoscopic ablation equipment market, segmenting it by Application and Type.

- Application: The market is segmented into Hospital and Ambulatory Surgery Center (ASC). Hospitals represent a larger segment due to their comprehensive facilities for complex procedures, while ASCs are a rapidly growing segment driven by cost-efficiency and patient preference for outpatient care. Projections indicate a steady growth for both, with ASCs demonstrating a higher percentage growth rate.

- Type: The market is further segmented into Radiofrequency Ablation, Thermal Ablation, and Cryoablation. Radiofrequency Ablation currently holds the largest market share due to its established efficacy and wide range of applications. Thermal Ablation and Cryoablation are also experiencing significant growth, driven by their specific clinical advantages in certain indications. Each segment's growth is influenced by specific technological advancements and emerging clinical applications.

Key Drivers of Medical Laparoscopic Ablation Equipment Growth

The growth of the medical laparoscopic ablation equipment market is propelled by several significant drivers. The escalating global incidence of chronic diseases, including various cancers, benign tumors, and cardiovascular conditions, necessitates minimally invasive treatment options, directly boosting demand for laparoscopic ablation devices. Technological advancements are paramount, with continuous innovation in energy delivery systems (RF, thermal, cryo), enhanced precision, and improved patient safety features driving adoption. The increasing preference for minimally invasive surgery over open procedures, owing to shorter recovery times, reduced pain, and fewer complications, further fuels market expansion. Furthermore, favorable reimbursement policies for minimally invasive procedures in many regions and the expanding healthcare infrastructure in emerging economies contribute to the market's robust growth trajectory.

Challenges in the Medical Laparoscopic Ablation Equipment Sector

Despite its promising growth, the medical laparoscopic ablation equipment sector faces several challenges. Stringent regulatory approval processes in major markets can lead to extended product launch timelines and increased development costs, acting as a barrier for smaller companies. The high initial investment required for acquiring advanced laparoscopic ablation equipment can be a significant restraint, particularly for smaller hospitals and clinics in cost-sensitive regions. Intense competition among established players and emerging innovators necessitates continuous research and development, putting pressure on profit margins. Moreover, the need for specialized training and expertise among healthcare professionals to effectively utilize these complex devices can limit widespread adoption in certain areas.

Emerging Opportunities in Medical Laparoscopic Ablation Equipment

Emerging opportunities in the medical laparoscopic ablation equipment market are abundant and diverse. The expanding application of ablation technologies in new therapeutic areas, such as neurological disorders and advanced oncological treatments, presents significant growth potential. The increasing demand for minimally invasive solutions in emerging economies, driven by improving healthcare access and rising disposable incomes, offers substantial market penetration opportunities. The development of next-generation ablation technologies, including image-guided systems, AI-enhanced robotics, and more targeted energy delivery methods, promises to enhance clinical outcomes and expand procedural indications. Furthermore, the growing trend towards outpatient procedures in Ambulatory Surgery Centers (ASCs) creates opportunities for the development of more portable, cost-effective, and user-friendly laparoscopic ablation equipment.

Leading Players in the Medical Laparoscopic Ablation Equipment Market

- Boston Scientific Corporation

- Edap Tms

- Medtronic

- Misonix

- Sonacare Medical

- Angiodynamics

- Btg International Ltd

- Healthtronics, Inc.

- Mermaid Medical, Inc.

- Neuwave Medical, Inc.

- Coopersurgical Inc.

- Ethicon, Inc. (Johnson & Johnson)

- Olympus Corp.

- Richard Wolf Gmbh

- Hologic, Inc.

- Minerva Surgical, Inc

- Lumenis

- Arthrex

- Icecure

- Merit Medical

Key Developments in Medical Laparoscopic Ablation Equipment Industry

- 2023: Launch of advanced radiofrequency ablation probes with enhanced cooling capabilities, leading to improved lesion predictability and reduced pain for patients.

- 2023: Acquisition of a key cryoablation technology firm by a major medical device manufacturer, indicating consolidation and strategic expansion in the thermal ablation segment.

- 2024: Introduction of AI-powered navigation systems for laparoscopic ablation procedures, enhancing surgical precision and reducing procedure times.

- 2024: FDA clearance for a novel laparoscopic ablation device for a specific oncological application, opening new market segments.

- 2025: Significant investment in R&D for robotic-assisted laparoscopic ablation platforms, promising greater dexterity and minimally invasive access.

Strategic Outlook for Medical Laparoscopic Ablation Equipment Market

The strategic outlook for the medical laparoscopic ablation equipment market remains exceptionally positive, driven by continuous innovation and an increasing global demand for minimally invasive treatments. The persistent rise in chronic diseases, coupled with advancements in energy delivery systems and precision targeting, will sustain robust market growth. Strategic focus on developing integrated solutions that combine ablation technology with advanced imaging and robotics will be crucial for competitive differentiation. Expansion into emerging markets, alongside the continued growth of Ambulatory Surgery Centers, will offer substantial opportunities for market players. Companies that prioritize patient outcomes, technological superiority, and cost-effectiveness will be well-positioned to capitalize on the evolving landscape and secure long-term market leadership.

Medical Laparoscopic Ablation Equipment Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Ambulatory Surgery Center

-

2. Type

- 2.1. Radiofrequency Ablation

- 2.2. Thermal Ablation

- 2.3. Cryoablation

Medical Laparoscopic Ablation Equipment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Laparoscopic Ablation Equipment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Laparoscopic Ablation Equipment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Ambulatory Surgery Center

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Radiofrequency Ablation

- 5.2.2. Thermal Ablation

- 5.2.3. Cryoablation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Laparoscopic Ablation Equipment Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Ambulatory Surgery Center

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Radiofrequency Ablation

- 6.2.2. Thermal Ablation

- 6.2.3. Cryoablation

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Laparoscopic Ablation Equipment Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Ambulatory Surgery Center

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Radiofrequency Ablation

- 7.2.2. Thermal Ablation

- 7.2.3. Cryoablation

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Laparoscopic Ablation Equipment Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Ambulatory Surgery Center

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Radiofrequency Ablation

- 8.2.2. Thermal Ablation

- 8.2.3. Cryoablation

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Laparoscopic Ablation Equipment Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Ambulatory Surgery Center

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Radiofrequency Ablation

- 9.2.2. Thermal Ablation

- 9.2.3. Cryoablation

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Laparoscopic Ablation Equipment Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Ambulatory Surgery Center

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Radiofrequency Ablation

- 10.2.2. Thermal Ablation

- 10.2.3. Cryoablation

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Boston Scientific Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Edap Tms

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Medtronic

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Misonix

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sonacare Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Angiodynamics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Btg International Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Healthtronics Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mermaid Medical Inc.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Neuwave Medical Inc.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Coopersurgical Inc.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ethicon Inc. Johnson & Johnson)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Olympus Corp.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Richard Wolf Gmbh

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hologic Inc.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Minerva Surgical Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Lumenis

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Arthrex

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Icecure

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Merit Medical

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Boston Scientific Corporation

List of Figures

- Figure 1: Global Medical Laparoscopic Ablation Equipment Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Medical Laparoscopic Ablation Equipment Revenue (million), by Application 2024 & 2032

- Figure 3: North America Medical Laparoscopic Ablation Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Medical Laparoscopic Ablation Equipment Revenue (million), by Type 2024 & 2032

- Figure 5: North America Medical Laparoscopic Ablation Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Medical Laparoscopic Ablation Equipment Revenue (million), by Country 2024 & 2032

- Figure 7: North America Medical Laparoscopic Ablation Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Medical Laparoscopic Ablation Equipment Revenue (million), by Application 2024 & 2032

- Figure 9: South America Medical Laparoscopic Ablation Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Medical Laparoscopic Ablation Equipment Revenue (million), by Type 2024 & 2032

- Figure 11: South America Medical Laparoscopic Ablation Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Medical Laparoscopic Ablation Equipment Revenue (million), by Country 2024 & 2032

- Figure 13: South America Medical Laparoscopic Ablation Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Medical Laparoscopic Ablation Equipment Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Medical Laparoscopic Ablation Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Medical Laparoscopic Ablation Equipment Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Medical Laparoscopic Ablation Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Medical Laparoscopic Ablation Equipment Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Medical Laparoscopic Ablation Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Medical Laparoscopic Ablation Equipment Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Medical Laparoscopic Ablation Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Medical Laparoscopic Ablation Equipment Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Medical Laparoscopic Ablation Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Medical Laparoscopic Ablation Equipment Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Medical Laparoscopic Ablation Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Medical Laparoscopic Ablation Equipment Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Medical Laparoscopic Ablation Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Medical Laparoscopic Ablation Equipment Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Medical Laparoscopic Ablation Equipment Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Medical Laparoscopic Ablation Equipment Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Medical Laparoscopic Ablation Equipment Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Medical Laparoscopic Ablation Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Medical Laparoscopic Ablation Equipment Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Laparoscopic Ablation Equipment?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Medical Laparoscopic Ablation Equipment?

Key companies in the market include Boston Scientific Corporation, Edap Tms, Medtronic, Misonix, Sonacare Medical, Angiodynamics, Btg International Ltd, Healthtronics, Inc., Mermaid Medical, Inc., Neuwave Medical, Inc., Coopersurgical Inc., Ethicon, Inc. Johnson & Johnson), Olympus Corp., Richard Wolf Gmbh, Hologic, Inc., Minerva Surgical, Inc, Lumenis, Arthrex, Icecure, Merit Medical.

3. What are the main segments of the Medical Laparoscopic Ablation Equipment?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Laparoscopic Ablation Equipment," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Laparoscopic Ablation Equipment report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Laparoscopic Ablation Equipment?

To stay informed about further developments, trends, and reports in the Medical Laparoscopic Ablation Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence