Key Insights

The Canadian plant-based food and beverage market is experiencing robust growth, driven by increasing consumer awareness of health and environmental benefits, coupled with a rising preference for alternative protein sources. The market's expansion is fueled by several key factors: a growing vegan and vegetarian population, heightened concerns about animal welfare, and the increasing availability of diverse and palatable plant-based alternatives mimicking traditional meat and dairy products. This surge in demand is reflected across various product categories, including meat substitutes (e.g., burgers, sausages) and dairy alternatives (e.g., milk, yogurt, cheese). Supermarkets and hypermarkets remain dominant distribution channels, although online retail is rapidly gaining traction, providing convenient access for consumers. Major players like Nestle, Beyond Meat, and Danone are actively investing in research and development, expanding product lines, and enhancing distribution networks to capture significant market share. While pricing remains a potential constraint for some consumers, continuous innovation, focusing on improved taste, texture, and affordability, is expected to further drive market penetration. The Canadian market, aligning with global trends, projects continued substantial growth throughout the forecast period, with meat substitutes and dairy alternatives maintaining their leading positions.

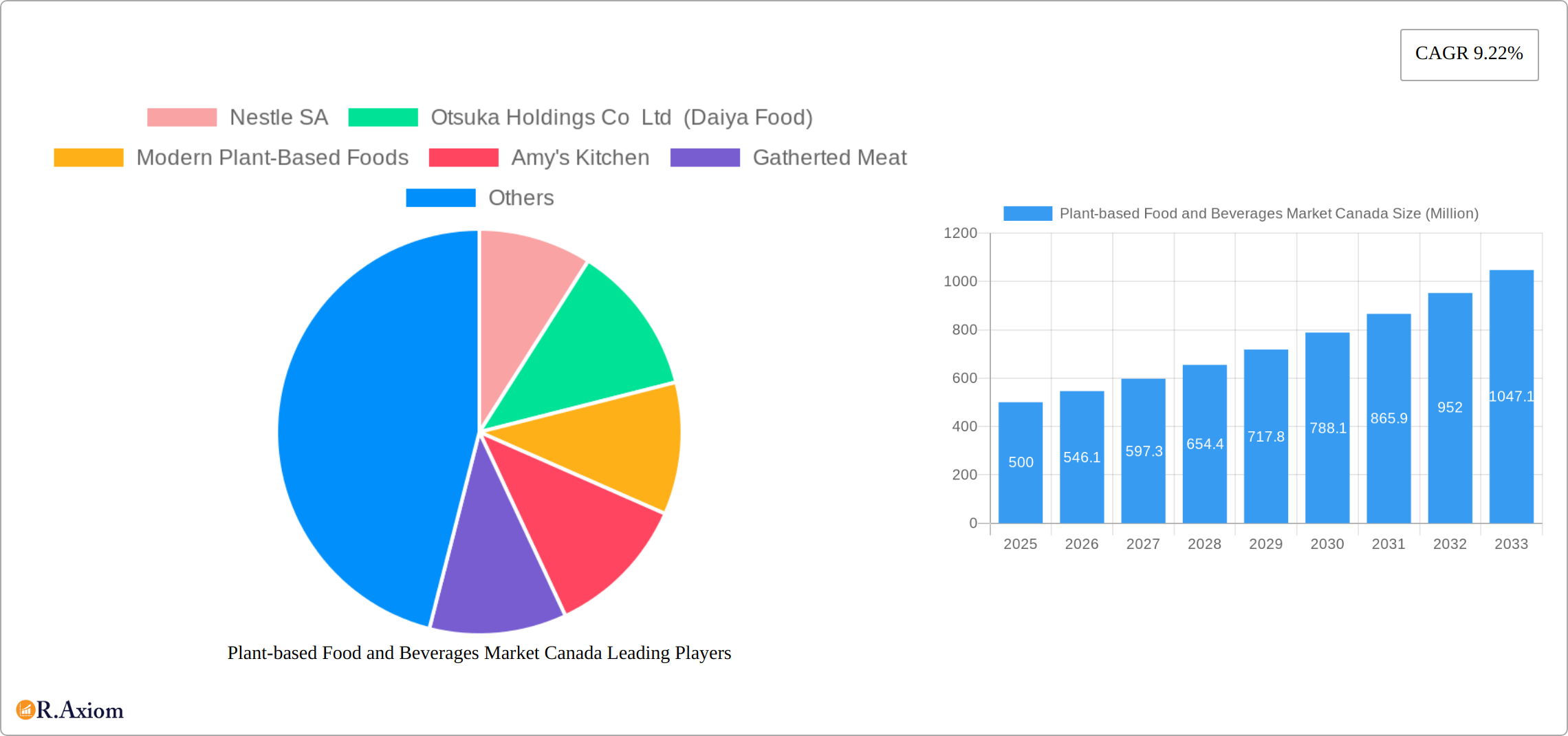

Based on the provided 9.22% CAGR and a global context showing significant growth in plant-based foods, we can reasonably assume substantial growth in the Canadian market. Considering the global market size is not provided, we must make logical estimations. Let's assume, for illustrative purposes, a 2025 Canadian market size of $500 million (USD). Applying the 9.22% CAGR, we can project future growth. The presence of significant international players implies a considerable market size. Regional factors within Canada itself (e.g., higher adoption rates in urban areas) will also influence growth. While precise figures require more granular data, the overall trend points to a continuously expanding and increasingly competitive landscape for plant-based food and beverages in Canada. This dynamic market presents significant opportunities for established players and new entrants alike.

This in-depth report provides a comprehensive analysis of the Plant-Based Food and Beverages Market in Canada, covering the period from 2019 to 2033. It offers valuable insights into market size, segmentation, growth drivers, challenges, and key players, equipping stakeholders with actionable intelligence for strategic decision-making. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. All financial values are expressed in Millions.

Plant-based Food and Beverages Market Canada Market Concentration & Innovation

The Canadian plant-based food and beverage sector is a dynamic and rapidly evolving landscape characterized by a compelling blend of established giants and agile innovators. While specific market share figures remain proprietary and are available in comprehensive market reports, key players such as Nestlé S.A., Danone S.A., Beyond Meat, and Impossible Foods Inc. are demonstrably influential, leveraging extensive distribution networks and brand recognition. The market's trajectory is significantly propelled by escalating consumer demand for foods that are not only perceived as healthier but also contribute to a more sustainable planet. This demand acts as a powerful catalyst for ongoing innovation, with companies consistently striving to enhance existing products and introduce novel offerings. The regulatory environment, encompassing stringent labeling standards and food safety protocols, plays a crucial role in shaping product development and market entry. Furthermore, the presence of a wide array of product substitutes, spanning both within the plant-based category and from traditional animal-derived products, fosters an intensely competitive arena. Mergers and acquisitions (M&A) are a recurring theme, signaling strategic moves by companies to fortify their market positions and diversify their product portfolios. A notable example includes HumanCo.'s acquisition of Coconut Bliss in 2020, underscoring the industry's consolidation and strategic expansion. The sustained and growing consumer interest in plant-based alternatives is the primary engine of industry growth, necessitating continuous innovation and the formation of strategic alliances to navigate the competitive pressures.

Plant-based Food and Beverages Market Canada Industry Trends & Insights

The Canadian plant-based food and beverage market is experiencing remarkable growth, propelled by a confluence of factors including heightened consumer awareness regarding the health and environmental advantages of plant-forward eating, and the burgeoning popularity of flexitarian and vegan dietary patterns. The market demonstrated a Compound Annual Growth Rate (CAGR) of [Insert Specific CAGR Here]% during the historical period (2019-2024). Projections indicate a sustained and significant CAGR of [Insert Specific CAGR Here]% for the forecast period (2025-2033). This expansion is underpinned by several pivotal trends. Advancements in food technology are revolutionizing product development, enabling the creation of plant-based alternatives that closely replicate the sensory attributes – taste, texture, and appearance – of their animal-based counterparts, thereby significantly enhancing consumer acceptance. The increasing adoption of plant-based diets, driven by growing concerns for animal welfare, environmental sustainability, and personal health, serves as a major accelerator for market growth. The penetration of plant-based products is observed across a widening spectrum of demographics, signaling an expanding and more diverse consumer base. The competitive landscape is characterized by intense rivalry, with both established food conglomerates and agile plant-based startups actively vying for market share. This elevated competition is stimulating product innovation and driving more competitive pricing strategies. Nevertheless, the sector must contend with challenges such as the volatility of raw material costs and ongoing discussions surrounding the long-term sustainability of certain plant-based ingredients.

Dominant Markets & Segments in Plant-based Food and Beverages Market Canada

- By Product Type: The meat substitutes segment currently dominates the market, driven by a growing preference for plant-based alternatives to meat. However, the dairy alternative beverages segment is also witnessing significant growth, fueled by consumer demand for plant-based milk alternatives and other dairy-free beverages. Increased awareness of lactose intolerance and the health benefits associated with plant-based dairy options contribute to this trend.

- By Distribution Channel: Supermarkets/hypermarkets remain the dominant distribution channel for plant-based food and beverages, offering convenient access to a wide range of products. Convenience stores are also gaining traction, providing quick and readily available options for consumers. Online retail channels are expanding rapidly, driven by increasing e-commerce penetration and consumer preference for home delivery. Other distribution channels such as food service establishments and specialty stores cater to specific consumer needs and preferences. Growth in these channels is influenced by consumer behavior and purchasing patterns. The expansion of online retail is specifically driven by improved logistics and convenience, while convenience stores' expansion relies on factors such as proximity to customers and quick access to products.

Plant-based Food and Beverages Market Canada Product Developments

Recent innovations in plant-based food and beverages focus on improving taste, texture, and nutritional value. Companies are employing advanced technologies to create products that closely mimic the sensory experience of animal-based counterparts, enhancing consumer appeal. This includes the development of novel plant-based proteins, improved formulations, and the utilization of advanced processing techniques to optimize texture and flavor profiles. The emphasis is on creating cost-effective and sustainable alternatives that cater to diverse consumer preferences and dietary requirements, highlighting the market’s dynamic and competitive nature.

Report Scope & Segmentation Analysis

This report comprehensively segments the Canadian plant-based food and beverage market by product type (Meat Substitutes and Others – including Dairy Alternative Beverages) and distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Channels, and Other Distribution Channels). Each segment's growth projections, market sizes, and competitive dynamics are analyzed. The growth of each segment is projected to be influenced by consumer preferences, pricing strategies, and technological advances. The competitive landscape within each segment is shaped by the range of products offered and the marketing strategies employed by companies.

Key Drivers of Plant-based Food and Beverages Market Canada Growth

The expansion of the Canadian plant-based food and beverage market is primarily fueled by a growing consumer consciousness surrounding the significant health benefits associated with plant-centric diets, alongside a heightened awareness of the environmental implications of conventional animal agriculture. Revolutionary advancements in food science and technology are instrumental in developing plant-based alternatives that closely mimic the taste, texture, and overall eating experience of their animal-derived counterparts, thereby significantly improving their appeal to a broader consumer base. Moreover, supportive government initiatives promoting sustainable agricultural practices and the ever-increasing availability and accessibility of plant-based products across diverse retail channels are also substantial contributors to the market's upward trajectory.

Challenges in the Plant-based Food and Beverages Market Canada Sector

Despite its impressive growth trajectory, the Canadian plant-based food and beverage market is not without its hurdles. Fluctuations in the cost and availability of raw materials, coupled with potential supply chain disruptions, can directly impact production expenses and the consistent supply of finished products. The competitive intensity is further amplified by the presence of well-established food manufacturers and the continuous influx of new market entrants, creating a crowded marketplace. Maintaining consistent product quality and uniformity across product lines can pose manufacturing challenges. Additionally, some consumer segments may still harbor skepticism or hold preconceived notions about certain plant-based products, necessitating ongoing efforts in consumer education and perception management.

Emerging Opportunities in Plant-based Food and Beverages Market Canada

The Canadian plant-based food and beverage market is ripe with emerging opportunities that promise further expansion and innovation. A significant avenue for growth lies in the strategic expansion of plant-based offerings into entirely new food categories, catering to unmet consumer needs. The continuous development of innovative products precisely engineered to address specific dietary requirements and preferences represents another key growth area. Increased investment in research and development (R&D) is not only improving the quality and palatability of plant-based products but also making them more accessible and affordable for a wider consumer base. Furthermore, the burgeoning growth of e-commerce and online retail platforms is unlocking new and efficient channels for product distribution, thereby enhancing consumer reach and accessibility across the nation.

Leading Players in the Plant-based Food and Beverages Market Canada Market

- Nestle SA

- Otsuka Holdings Co Ltd (Daiya Food)

- Modern Plant-Based Foods

- Amy's Kitchen

- Gatherd Meat

- Danone S A

- Beyond Meat

- Impossible Foods Inc

- Tonnies Holding Aps & Co KG

- The Meatless Farm Company

Key Developments in Plant-based Food and Beverages Market Canada Industry

- May 2022: Danone Canada launched Nextmil, a dairy-free beverage under its Silk Canada brand, expanding its plant-based offerings and strengthening its position in the market.

- August 2021: Beyond Meat partnered with A&W Canada to launch plant-based chicken nuggets, increasing its market reach and highlighting the growing demand for plant-based alternatives.

- July 2020: HumanCo acquired a majority stake in Coconut Bliss, a plant-based ice cream maker, showcasing the consolidation and expansion within the plant-based sector.

Strategic Outlook for Plant-based Food and Beverages Market Canada Market

The Canadian plant-based food and beverage market is poised for continued growth, driven by strong consumer demand and innovation in product development. Opportunities exist for companies to expand their product portfolios, explore new distribution channels, and target niche markets. Sustainability initiatives and partnerships will likely play an increasingly important role in the market's future. The market is expected to witness further consolidation and strategic alliances among key players.

Plant-based Food and Beverages Market Canada Segmentation

-

1. Product Type

-

1.1. Meat Substitutes

- 1.1.1. Textured Vegetable Protein

- 1.1.2. Tofu

- 1.1.3. Tempeh

- 1.1.4. Others

-

1.2. Dairy Alternative Beverages

- 1.2.1. Soy Milk

- 1.2.2. Almond Milk

- 1.2.3. Other Dairy Alternative Beverages

- 1.3. Non-dairy Ice Cream

- 1.4. Non-dairy Cheese

- 1.5. Non-dairy Yogurt

- 1.6. Other Plant Based Products

-

1.1. Meat Substitutes

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Convinience Sores

- 2.3. Online Retail Channels

- 2.4. Other Distribution Channels

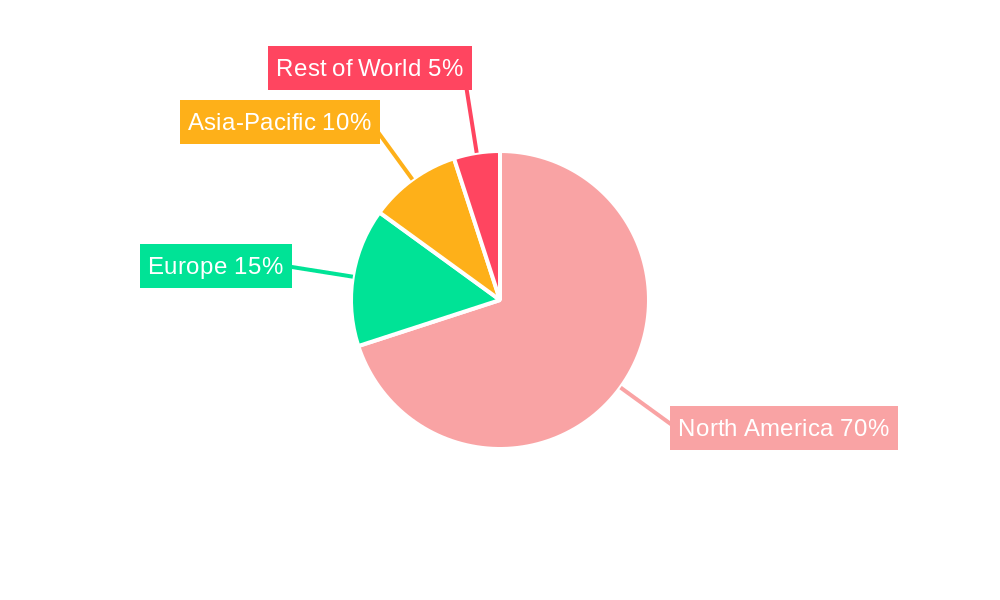

Plant-based Food and Beverages Market Canada Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plant-based Food and Beverages Market Canada REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.22% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exotic Flavor Combined with Nutritional Value; Growing Demand for Convenient Foods

- 3.3. Market Restrains

- 3.3.1. Increasing Prevalence of Diabetes and Obesity Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Awareness About Benefits Associated with Vegan Diet

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Meat Substitutes

- 5.1.1.1. Textured Vegetable Protein

- 5.1.1.2. Tofu

- 5.1.1.3. Tempeh

- 5.1.1.4. Others

- 5.1.2. Dairy Alternative Beverages

- 5.1.2.1. Soy Milk

- 5.1.2.2. Almond Milk

- 5.1.2.3. Other Dairy Alternative Beverages

- 5.1.3. Non-dairy Ice Cream

- 5.1.4. Non-dairy Cheese

- 5.1.5. Non-dairy Yogurt

- 5.1.6. Other Plant Based Products

- 5.1.1. Meat Substitutes

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Convinience Sores

- 5.2.3. Online Retail Channels

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Meat Substitutes

- 6.1.1.1. Textured Vegetable Protein

- 6.1.1.2. Tofu

- 6.1.1.3. Tempeh

- 6.1.1.4. Others

- 6.1.2. Dairy Alternative Beverages

- 6.1.2.1. Soy Milk

- 6.1.2.2. Almond Milk

- 6.1.2.3. Other Dairy Alternative Beverages

- 6.1.3. Non-dairy Ice Cream

- 6.1.4. Non-dairy Cheese

- 6.1.5. Non-dairy Yogurt

- 6.1.6. Other Plant Based Products

- 6.1.1. Meat Substitutes

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/ Hypermarkets

- 6.2.2. Convinience Sores

- 6.2.3. Online Retail Channels

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Meat Substitutes

- 7.1.1.1. Textured Vegetable Protein

- 7.1.1.2. Tofu

- 7.1.1.3. Tempeh

- 7.1.1.4. Others

- 7.1.2. Dairy Alternative Beverages

- 7.1.2.1. Soy Milk

- 7.1.2.2. Almond Milk

- 7.1.2.3. Other Dairy Alternative Beverages

- 7.1.3. Non-dairy Ice Cream

- 7.1.4. Non-dairy Cheese

- 7.1.5. Non-dairy Yogurt

- 7.1.6. Other Plant Based Products

- 7.1.1. Meat Substitutes

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/ Hypermarkets

- 7.2.2. Convinience Sores

- 7.2.3. Online Retail Channels

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Meat Substitutes

- 8.1.1.1. Textured Vegetable Protein

- 8.1.1.2. Tofu

- 8.1.1.3. Tempeh

- 8.1.1.4. Others

- 8.1.2. Dairy Alternative Beverages

- 8.1.2.1. Soy Milk

- 8.1.2.2. Almond Milk

- 8.1.2.3. Other Dairy Alternative Beverages

- 8.1.3. Non-dairy Ice Cream

- 8.1.4. Non-dairy Cheese

- 8.1.5. Non-dairy Yogurt

- 8.1.6. Other Plant Based Products

- 8.1.1. Meat Substitutes

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/ Hypermarkets

- 8.2.2. Convinience Sores

- 8.2.3. Online Retail Channels

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Meat Substitutes

- 9.1.1.1. Textured Vegetable Protein

- 9.1.1.2. Tofu

- 9.1.1.3. Tempeh

- 9.1.1.4. Others

- 9.1.2. Dairy Alternative Beverages

- 9.1.2.1. Soy Milk

- 9.1.2.2. Almond Milk

- 9.1.2.3. Other Dairy Alternative Beverages

- 9.1.3. Non-dairy Ice Cream

- 9.1.4. Non-dairy Cheese

- 9.1.5. Non-dairy Yogurt

- 9.1.6. Other Plant Based Products

- 9.1.1. Meat Substitutes

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/ Hypermarkets

- 9.2.2. Convinience Sores

- 9.2.3. Online Retail Channels

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Meat Substitutes

- 10.1.1.1. Textured Vegetable Protein

- 10.1.1.2. Tofu

- 10.1.1.3. Tempeh

- 10.1.1.4. Others

- 10.1.2. Dairy Alternative Beverages

- 10.1.2.1. Soy Milk

- 10.1.2.2. Almond Milk

- 10.1.2.3. Other Dairy Alternative Beverages

- 10.1.3. Non-dairy Ice Cream

- 10.1.4. Non-dairy Cheese

- 10.1.5. Non-dairy Yogurt

- 10.1.6. Other Plant Based Products

- 10.1.1. Meat Substitutes

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/ Hypermarkets

- 10.2.2. Convinience Sores

- 10.2.3. Online Retail Channels

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. United States Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 12. Canada Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 13. Mexico Plant-based Food and Beverages Market Canada Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Nestle SA

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Otsuka Holdings Co Ltd (Daiya Food)

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Modern Plant-Based Foods

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Amy's Kitchen

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Gatherted Meat

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Danone S A

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Beyond Meat

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Impossible Foods Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Tonnies Holding Aps & Co KG

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 The Meatless Farm Company*List Not Exhaustive

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Nestle SA

List of Figures

- Figure 1: Global Plant-based Food and Beverages Market Canada Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Plant-based Food and Beverages Market Canada Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Plant-based Food and Beverages Market Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America Plant-based Food and Beverages Market Canada Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America Plant-based Food and Beverages Market Canada Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Plant-based Food and Beverages Market Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 11: South America Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: South America Plant-based Food and Beverages Market Canada Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America Plant-based Food and Beverages Market Canada Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Plant-based Food and Beverages Market Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 17: Europe Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe Plant-based Food and Beverages Market Canada Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe Plant-based Food and Beverages Market Canada Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Plant-based Food and Beverages Market Canada Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Asia Pacific Plant-based Food and Beverages Market Canada Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific Plant-based Food and Beverages Market Canada Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific Plant-based Food and Beverages Market Canada Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific Plant-based Food and Beverages Market Canada Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Plant-based Food and Beverages Market Canada Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 11: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Argentina Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of South America Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 23: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Kingdom Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Germany Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Italy Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Russia Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Benelux Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Nordics Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Europe Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 34: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 35: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Turkey Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Israel Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: GCC Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: North Africa Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: South Africa Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Middle East & Africa Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Product Type 2019 & 2032

- Table 43: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 44: Global Plant-based Food and Beverages Market Canada Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: ASEAN Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Oceania Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific Plant-based Food and Beverages Market Canada Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plant-based Food and Beverages Market Canada?

The projected CAGR is approximately 9.22%.

2. Which companies are prominent players in the Plant-based Food and Beverages Market Canada?

Key companies in the market include Nestle SA, Otsuka Holdings Co Ltd (Daiya Food), Modern Plant-Based Foods, Amy's Kitchen, Gatherted Meat, Danone S A, Beyond Meat, Impossible Foods Inc, Tonnies Holding Aps & Co KG, The Meatless Farm Company*List Not Exhaustive.

3. What are the main segments of the Plant-based Food and Beverages Market Canada?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Exotic Flavor Combined with Nutritional Value; Growing Demand for Convenient Foods.

6. What are the notable trends driving market growth?

Increasing Awareness About Benefits Associated with Vegan Diet.

7. Are there any restraints impacting market growth?

Increasing Prevalence of Diabetes and Obesity Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

In May 2022, Danone Canada launched a fresh-new dairy-free beverage called - Nextmil under its Silk Canada brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plant-based Food and Beverages Market Canada," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plant-based Food and Beverages Market Canada report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plant-based Food and Beverages Market Canada?

To stay informed about further developments, trends, and reports in the Plant-based Food and Beverages Market Canada, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence