Key Insights

The automotive 3D printing market is experiencing significant expansion, driven by the demand for lightweighting, enhanced customization, and accelerated prototyping. Projections indicate a Compound Annual Growth Rate (CAGR) of 14.8%. This growth is propelled by the increasing adoption of additive manufacturing for producing complex, lightweight vehicle components, leading to improved fuel efficiency. Furthermore, the rapid iteration capabilities of 3D printing streamline product development, reducing time-to-market for new vehicles and parts. The rise of personalized automotive features and on-demand manufacturing also contributes to market expansion. While material costs and the need for skilled labor present challenges, ongoing technological advancements and a broader range of materials are mitigating these restraints. The market is dominated by Metal material types and technologies such as Selective Laser Melting (SLM) and Selective Laser Sintering (SLS), which are crucial for creating high-strength, intricate automotive components.

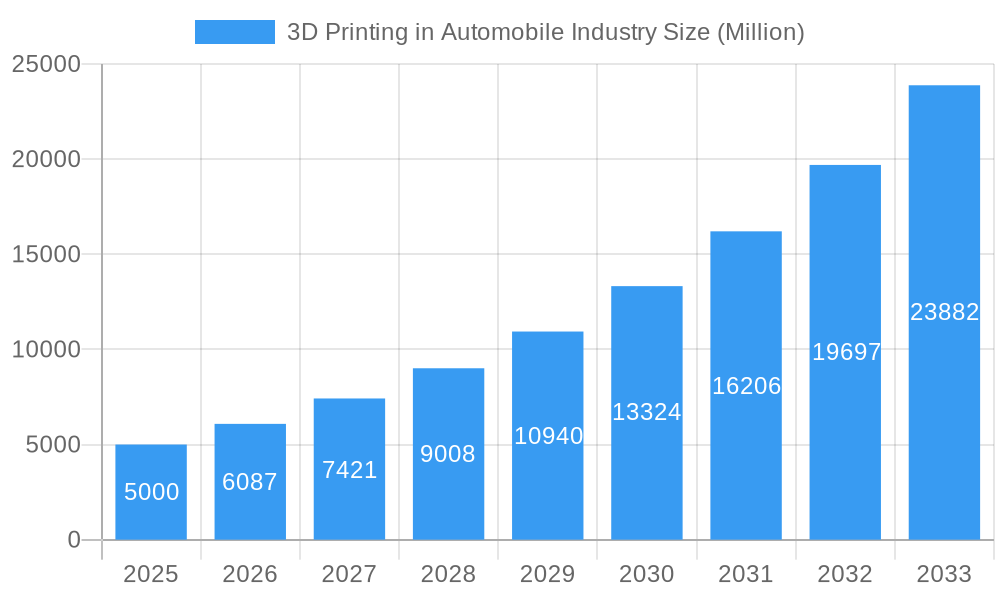

3D Printing in Automobile Industry Market Size (In Billion)

Geographically, North America and Europe are leading markets due to established automotive manufacturing bases and advanced technological infrastructure. However, the Asia-Pacific region, particularly China and India, is anticipated to witness substantial growth driven by increasing automotive production and wider adoption of 3D printing technologies. The market size was estimated at 5.93 billion in the base year 2025 and is projected to grow substantially through 2033. This expansion is further supported by the accelerating adoption of electric vehicles, a greater emphasis on sustainable manufacturing, and the continuous development of specialized 3D printing materials and processes for the automotive sector. The competitive landscape is dynamic, characterized by innovation and strategic partnerships among key players.

3D Printing in Automobile Industry Company Market Share

This comprehensive report analyzes the automotive 3D printing market from 2019 to 2033, providing actionable insights for stakeholders, investors, and businesses. It includes detailed segmentation, market sizing, growth forecasts, competitive analysis, and key industry developments, optimized with high-impact keywords for SEO. Market valuations are presented in Millions of USD.

3D Printing in Automobile Industry Market Concentration & Innovation

The 3D printing market in the automotive sector is characterized by a moderately concentrated landscape, with several key players holding significant market share. However, the market also exhibits substantial innovation, driven by ongoing advancements in additive manufacturing technologies and materials. The leading companies, including Arcam AB, Höganäs AB, 3D Systems Corporation, The Exone Company, EOS GmbH, Voxeljet AG, Materialise NV, Moog Inc., Ultimaker BV, Stratasys Ltd, and Envisiontec GmbH (list not exhaustive), are continuously investing in R&D to enhance their product offerings and expand their market reach. Competition is fierce, marked by strategic alliances, mergers & acquisitions (M&A), and the introduction of innovative products.

- Market Concentration: The top five players hold an estimated xx% of the global market share in 2025, while the remaining xx% is distributed amongst smaller players and emerging startups.

- Innovation Drivers: Advancements in materials science, software development, and printing technologies are driving innovation. The development of high-strength, lightweight materials like metal alloys optimized for additive manufacturing is a key trend.

- Regulatory Frameworks: Government regulations concerning emissions, safety, and manufacturing processes influence the adoption of 3D printing technologies. Policies promoting sustainable manufacturing practices are further driving market growth.

- Product Substitutes: Traditional subtractive manufacturing methods remain prevalent, but 3D printing offers advantages in terms of design flexibility, reduced material waste, and faster prototyping cycles, thus posing a significant challenge to traditional manufacturing.

- End-User Trends: The increasing demand for lightweight vehicles, customized designs, and efficient production processes is driving the adoption of 3D printing in the automotive industry.

- M&A Activities: The market has witnessed significant M&A activity in recent years, including Stratasys Ltd.'s acquisition of Covestro AG's additive materials business (August 2022) and Materialise N.V.'s acquisition of Identify3D (September 2022). The total value of M&A deals in the industry reached an estimated USD xx million in 2024.

3D Printing in Automobile Industry Industry Trends & Insights

The global automotive 3D printing market is experiencing explosive growth, fueled by several converging factors. Industry analysts project a robust Compound Annual Growth Rate (CAGR) of [Insert Updated CAGR]% during the forecast period (2025-2033), resulting in a market valuation of USD [Insert Updated Market Value] million by 2033. This expansion is driven by the accelerating adoption of additive manufacturing (AM) technologies across the entire automotive value chain, from initial design and prototyping through to high-volume production. Significant technological advancements, especially in materials science and printing processes, are enabling the creation of highly intricate and customized components with unprecedented precision. Furthermore, the automotive industry's relentless pursuit of lightweight vehicles, coupled with the demand for more efficient and agile manufacturing processes, is significantly accelerating the uptake of 3D printing. The burgeoning trend towards personalized vehicle designs and features also presents a substantial growth opportunity for AM within the automotive sector. The competitive landscape remains dynamic, with both established industry giants and innovative newcomers vying for market share through technological breakthroughs, novel materials, sophisticated software solutions, and comprehensive services. Market penetration of 3D printing in automotive manufacturing is steadily increasing, climbing from [Insert Updated 2024 Percentage]% in 2024 to a projected [Insert Updated 2033 Percentage]% by 2033. While challenges persist, including material costs, scalability limitations, and the need for a skilled workforce, ongoing innovation and collaborative industry efforts are actively addressing these hurdles.

Dominant Markets & Segments in 3D Printing in Automobile Industry

The North American and European regions dominate the global automotive 3D printing market, driven by high technological advancements, well-established automotive industries, and supportive regulatory frameworks. Within these regions, Germany and the United States are particularly prominent markets due to their significant investments in research and development and the presence of major automotive manufacturers.

By Material Type: Metal dominates the market, driven by the demand for high-strength, lightweight components in automotive applications. Polymer materials are also significant, primarily used in prototyping and the production of less critical parts. Ceramic materials have a smaller, but growing, market share.

By Application Type: Prototyping and R&D applications currently hold the largest market share, due to the flexibility and speed advantages of 3D printing in design iterations. However, the production segment is experiencing rapid growth, driven by advancements in materials and printing processes.

By Technology Type: Selective Laser Melting (SLM) and Selective Laser Sintering (SLS) are the most prevalent technologies, offering high precision and material versatility. Fused Deposition Modeling (FDM) remains significant for prototyping applications, while other technologies like Electron Beam Melting (EBM) and Digital Light Processing (DLP) are emerging as specialized solutions.

By Component Type: The hardware segment constitutes the largest share of the market, encompassing 3D printers, software, and associated equipment. The software segment is growing rapidly due to the increasing demand for design and simulation software, while the service segment is growing gradually as more companies outsource 3D printing services.

Key Drivers (by Region):

- North America: Strong automotive manufacturing base, high technological expertise, government funding for R&D.

- Europe: High demand for lightweight and efficient vehicles, presence of major automotive manufacturers, strong focus on innovation.

- Asia-Pacific: Rapidly growing automotive sector, increasing adoption of advanced manufacturing technologies, but with challenges in regulatory standards and infrastructure.

3D Printing in Automobile Industry Product Developments

Recent advancements in 3D printing technologies are focused on enhancing speed, precision, and material versatility. The development of novel materials exhibiting superior mechanical properties, improved thermal resistance, and enhanced durability is crucial in meeting the demanding specifications of the automotive industry. Simultaneously, software innovations are facilitating greater design freedom and streamlining production workflows. The incorporation of artificial intelligence (AI) and machine learning (ML) algorithms is further refining the efficiency and accuracy of 3D printing processes. These combined advancements are bolstering the market viability of 3D printing by mitigating cost concerns, addressing scalability limitations, and overcoming prior material constraints, thus significantly expanding the application potential across a wider range of automotive components. Specific examples include the creation of complex internal geometries for improved strength and weight reduction, the production of customized tooling for efficient assembly, and the development of personalized interior trims and exterior features.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global automotive 3D printing market, segmented by key parameters: material type (metal, polymer, ceramic, composite), application type (production, prototyping/R&D, tooling), technology type (SLS, SLA, DLP, EBM, SLM, FDM, MJF, Binder Jetting), and component type (body panels, interior parts, powertrain components, tooling, fixtures). A detailed examination of each segment's market size, growth trajectories, and competitive landscape is included. Metal and polymer materials currently dominate the material type segment, with projected CAGRs of [Insert Updated CAGR for Metal]% and [Insert Updated CAGR for Polymer]%, respectively, during the forecast period. Production applications are poised for substantial growth, while prototyping/R&D continues to play a vital role in design optimization and rigorous testing. SLS, SLM, and FDM technologies maintain leading positions in the technology segment, each catering to specific application needs and market opportunities. While hardware remains a substantial segment, the software and services sectors exhibit particularly strong growth potential, driven by the demand for integrated solutions and specialized expertise.

Key Drivers of 3D Printing in Automobile Industry Growth

Several factors drive the growth of 3D printing in the automotive industry. Firstly, the demand for lightweight and fuel-efficient vehicles is pushing automakers to adopt 3D printing for creating lightweight components from advanced materials like titanium alloys. Secondly, the increasing need for design customization is driving adoption, allowing manufacturers to create unique designs and tailor components to individual customer preferences. Thirdly, the desire to reduce lead times and inventory costs is promoting this technology. The ability to produce parts on-demand through 3D printing minimizes storage needs and accelerates production cycles. Finally, supportive government policies and industry initiatives are encouraging innovation and investment in this sector.

Challenges in the 3D Printing in Automobile Industry Sector

Despite its potential, the 3D printing industry faces various challenges. High material costs for advanced materials like metals limit its wider adoption, especially in mass production. Scaling up production to meet the demands of large-scale automotive manufacturing is also a significant hurdle. The availability of skilled labor to operate and maintain 3D printing systems remains a constraint, particularly in regions with limited access to training and education. Furthermore, concerns regarding the consistency and reliability of 3D-printed parts compared to traditionally manufactured components need to be addressed to enhance industry confidence. These challenges affect the overall growth potential and require innovative solutions and strategic partnerships to overcome.

Emerging Opportunities in 3D Printing in Automobile Industry

Emerging opportunities lie in the development of new materials, especially bio-based and recycled materials, aligned with sustainability goals. Advancements in multi-material printing and the integration of sensors into 3D-printed components will improve functionality and performance. The integration of AI and machine learning into the design and manufacturing processes enhances efficiency and personalization. The growing demand for personalized automotive features creates opportunities to tailor vehicle designs and components to individual customer needs. The expansion of 3D printing into after-market parts and repair services also presents significant growth potential.

Leading Players in the 3D Printing in Automobile Industry Market

- Arcam AB

- Höganäs AB

- 3D Systems Corporation

- The Exone Company

- EOS GmbH

- Voxeljet AG

- Materialise NV

- Moog Inc

- Ultimaker BV

- Stratasys Ltd

- Envisiontec GmbH

Key Developments in 3D Printing in Automobile Industry Industry

- [Insert Updated Month and Year]: [Insert Company Name] announced [Insert Specific Development and Significance]. This highlights [Insert Key takeaway/impact on the industry].

- [Insert Updated Month and Year]: [Insert Company Name] and [Insert Partner Company Name] collaborated on [Insert Specific Development and Significance]. This partnership resulted in [Insert Key takeaway/impact on the industry].

- [Insert Updated Month and Year]: [Insert Company Name] launched [Insert Specific Product/Service and Significance]. This innovation is expected to [Insert Key takeaway/impact on the industry].

- [Insert Updated Month and Year]: [Insert Company Name] achieved [Insert Specific Milestone and Significance] demonstrating [Insert Key takeaway/impact on the industry].

- [Insert Updated Month and Year]: [Insert Company Name] invested in [Insert Specific Area of Investment and Significance]. This strategic move is aimed at [Insert Key takeaway/impact on the industry].

- [Insert Updated Month and Year]: [Insert Company Name] secured [Insert Specific Contract/Partnership and Significance]. This underscores [Insert Key takeaway/impact on the industry].

Strategic Outlook for 3D Printing in Automobile Industry Market

The future of 3D printing in the automotive industry is exceptionally promising. Continuous advancements in materials science, printing technologies, and sophisticated software are poised to unlock a new wave of opportunities. The synergistic integration of AI and machine learning will accelerate efficiency and automate processes, while a growing emphasis on sustainable manufacturing practices will drive the adoption of eco-friendly materials and processes. This convergence of factors will further propel market growth, with 3D printing playing an increasingly pivotal role in the production of lighter, stronger, more fuel-efficient, and highly personalized vehicles. The industry is expected to witness ongoing consolidation through mergers and acquisitions, reshaping the competitive landscape and stimulating further innovation. The market is projected to attain a market value of USD [Insert Updated Market Value] million by 2033, representing a substantial expansion from its current size. This growth will be supported by factors such as increasing demand for customized vehicles, reduced lead times for prototyping and production, and the ability to produce complex geometries that are otherwise impossible to manufacture using traditional methods.

3D Printing in Automobile Industry Segmentation

-

1. Technology Type

- 1.1. Selective Laser Sintering (SLS)

- 1.2. Stereo Lithography (SLA)

- 1.3. Digital Light Processing (DLP)

- 1.4. Electronic Beam Melting (EBM)

- 1.5. Selective Laser Melting (SLM)

- 1.6. Fused Deposition Modeling (FDM)

-

2. Component Type

- 2.1. Hardware

- 2.2. Software

- 2.3. Service

-

3. Material Type

- 3.1. Metal

- 3.2. Polymer

- 3.3. Ceramic

-

4. Application Type

- 4.1. Production

- 4.2. Prototyping/R&D

3D Printing in Automobile Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Other Countries

3D Printing in Automobile Industry Regional Market Share

Geographic Coverage of 3D Printing in Automobile Industry

3D Printing in Automobile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasingly Focused On Lightweighting Vehicles

- 3.3. Market Restrains

- 3.3.1. High Production Cost

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Fused Deposition Modeling Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 3D Printing in Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 5.1.1. Selective Laser Sintering (SLS)

- 5.1.2. Stereo Lithography (SLA)

- 5.1.3. Digital Light Processing (DLP)

- 5.1.4. Electronic Beam Melting (EBM)

- 5.1.5. Selective Laser Melting (SLM)

- 5.1.6. Fused Deposition Modeling (FDM)

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Hardware

- 5.2.2. Software

- 5.2.3. Service

- 5.3. Market Analysis, Insights and Forecast - by Material Type

- 5.3.1. Metal

- 5.3.2. Polymer

- 5.3.3. Ceramic

- 5.4. Market Analysis, Insights and Forecast - by Application Type

- 5.4.1. Production

- 5.4.2. Prototyping/R&D

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 6. North America 3D Printing in Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 6.1.1. Selective Laser Sintering (SLS)

- 6.1.2. Stereo Lithography (SLA)

- 6.1.3. Digital Light Processing (DLP)

- 6.1.4. Electronic Beam Melting (EBM)

- 6.1.5. Selective Laser Melting (SLM)

- 6.1.6. Fused Deposition Modeling (FDM)

- 6.2. Market Analysis, Insights and Forecast - by Component Type

- 6.2.1. Hardware

- 6.2.2. Software

- 6.2.3. Service

- 6.3. Market Analysis, Insights and Forecast - by Material Type

- 6.3.1. Metal

- 6.3.2. Polymer

- 6.3.3. Ceramic

- 6.4. Market Analysis, Insights and Forecast - by Application Type

- 6.4.1. Production

- 6.4.2. Prototyping/R&D

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 7. Europe 3D Printing in Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 7.1.1. Selective Laser Sintering (SLS)

- 7.1.2. Stereo Lithography (SLA)

- 7.1.3. Digital Light Processing (DLP)

- 7.1.4. Electronic Beam Melting (EBM)

- 7.1.5. Selective Laser Melting (SLM)

- 7.1.6. Fused Deposition Modeling (FDM)

- 7.2. Market Analysis, Insights and Forecast - by Component Type

- 7.2.1. Hardware

- 7.2.2. Software

- 7.2.3. Service

- 7.3. Market Analysis, Insights and Forecast - by Material Type

- 7.3.1. Metal

- 7.3.2. Polymer

- 7.3.3. Ceramic

- 7.4. Market Analysis, Insights and Forecast - by Application Type

- 7.4.1. Production

- 7.4.2. Prototyping/R&D

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 8. Asia Pacific 3D Printing in Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 8.1.1. Selective Laser Sintering (SLS)

- 8.1.2. Stereo Lithography (SLA)

- 8.1.3. Digital Light Processing (DLP)

- 8.1.4. Electronic Beam Melting (EBM)

- 8.1.5. Selective Laser Melting (SLM)

- 8.1.6. Fused Deposition Modeling (FDM)

- 8.2. Market Analysis, Insights and Forecast - by Component Type

- 8.2.1. Hardware

- 8.2.2. Software

- 8.2.3. Service

- 8.3. Market Analysis, Insights and Forecast - by Material Type

- 8.3.1. Metal

- 8.3.2. Polymer

- 8.3.3. Ceramic

- 8.4. Market Analysis, Insights and Forecast - by Application Type

- 8.4.1. Production

- 8.4.2. Prototyping/R&D

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 9. Rest of the World 3D Printing in Automobile Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 9.1.1. Selective Laser Sintering (SLS)

- 9.1.2. Stereo Lithography (SLA)

- 9.1.3. Digital Light Processing (DLP)

- 9.1.4. Electronic Beam Melting (EBM)

- 9.1.5. Selective Laser Melting (SLM)

- 9.1.6. Fused Deposition Modeling (FDM)

- 9.2. Market Analysis, Insights and Forecast - by Component Type

- 9.2.1. Hardware

- 9.2.2. Software

- 9.2.3. Service

- 9.3. Market Analysis, Insights and Forecast - by Material Type

- 9.3.1. Metal

- 9.3.2. Polymer

- 9.3.3. Ceramic

- 9.4. Market Analysis, Insights and Forecast - by Application Type

- 9.4.1. Production

- 9.4.2. Prototyping/R&D

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Arcam AB

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Höganäs AB

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 3D Systems Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The Exone Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 EOS GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Voxeljet AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Materialise NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Moog Inc *List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ultimaker BV

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Stratasys Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Envisiontec GmbH

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Arcam AB

List of Figures

- Figure 1: Global 3D Printing in Automobile Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America 3D Printing in Automobile Industry Revenue (billion), by Technology Type 2025 & 2033

- Figure 3: North America 3D Printing in Automobile Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 4: North America 3D Printing in Automobile Industry Revenue (billion), by Component Type 2025 & 2033

- Figure 5: North America 3D Printing in Automobile Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 6: North America 3D Printing in Automobile Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 7: North America 3D Printing in Automobile Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 8: North America 3D Printing in Automobile Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 9: North America 3D Printing in Automobile Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 10: North America 3D Printing in Automobile Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America 3D Printing in Automobile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe 3D Printing in Automobile Industry Revenue (billion), by Technology Type 2025 & 2033

- Figure 13: Europe 3D Printing in Automobile Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 14: Europe 3D Printing in Automobile Industry Revenue (billion), by Component Type 2025 & 2033

- Figure 15: Europe 3D Printing in Automobile Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 16: Europe 3D Printing in Automobile Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 17: Europe 3D Printing in Automobile Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 18: Europe 3D Printing in Automobile Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 19: Europe 3D Printing in Automobile Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 20: Europe 3D Printing in Automobile Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe 3D Printing in Automobile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific 3D Printing in Automobile Industry Revenue (billion), by Technology Type 2025 & 2033

- Figure 23: Asia Pacific 3D Printing in Automobile Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 24: Asia Pacific 3D Printing in Automobile Industry Revenue (billion), by Component Type 2025 & 2033

- Figure 25: Asia Pacific 3D Printing in Automobile Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 26: Asia Pacific 3D Printing in Automobile Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 27: Asia Pacific 3D Printing in Automobile Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Asia Pacific 3D Printing in Automobile Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 29: Asia Pacific 3D Printing in Automobile Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Asia Pacific 3D Printing in Automobile Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific 3D Printing in Automobile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World 3D Printing in Automobile Industry Revenue (billion), by Technology Type 2025 & 2033

- Figure 33: Rest of the World 3D Printing in Automobile Industry Revenue Share (%), by Technology Type 2025 & 2033

- Figure 34: Rest of the World 3D Printing in Automobile Industry Revenue (billion), by Component Type 2025 & 2033

- Figure 35: Rest of the World 3D Printing in Automobile Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 36: Rest of the World 3D Printing in Automobile Industry Revenue (billion), by Material Type 2025 & 2033

- Figure 37: Rest of the World 3D Printing in Automobile Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 38: Rest of the World 3D Printing in Automobile Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 39: Rest of the World 3D Printing in Automobile Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 40: Rest of the World 3D Printing in Automobile Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of the World 3D Printing in Automobile Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 2: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Component Type 2020 & 2033

- Table 3: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 4: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 5: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 7: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Component Type 2020 & 2033

- Table 8: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 9: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 10: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 15: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Component Type 2020 & 2033

- Table 16: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 17: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 18: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Germany 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 24: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Component Type 2020 & 2033

- Table 25: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 26: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 27: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: China 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Japan 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: India 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 33: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Component Type 2020 & 2033

- Table 34: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 35: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 36: Global 3D Printing in Automobile Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Other Countries 3D Printing in Automobile Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 3D Printing in Automobile Industry?

The projected CAGR is approximately 14.8%.

2. Which companies are prominent players in the 3D Printing in Automobile Industry?

Key companies in the market include Arcam AB, Höganäs AB, 3D Systems Corporation, The Exone Company, EOS GmbH, Voxeljet AG, Materialise NV, Moog Inc *List Not Exhaustive, Ultimaker BV, Stratasys Ltd, Envisiontec GmbH.

3. What are the main segments of the 3D Printing in Automobile Industry?

The market segments include Technology Type, Component Type, Material Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasingly Focused On Lightweighting Vehicles.

6. What are the notable trends driving market growth?

Growing Adoption of Fused Deposition Modeling Technology.

7. Are there any restraints impacting market growth?

High Production Cost.

8. Can you provide examples of recent developments in the market?

November 2022- Desktop Metal, the parent company of ExOne, announced that it had won a USD 9 million order from one of the major German car manufacturers for binder jet additive manufacturing systems used for the mass production of powertrain components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "3D Printing in Automobile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 3D Printing in Automobile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 3D Printing in Automobile Industry?

To stay informed about further developments, trends, and reports in the 3D Printing in Automobile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence