Key Insights

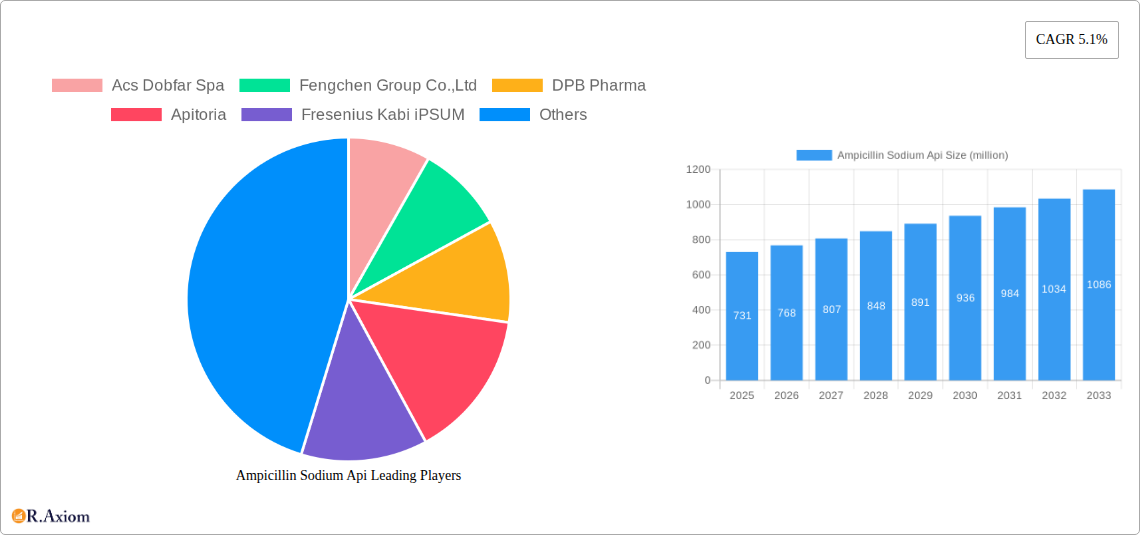

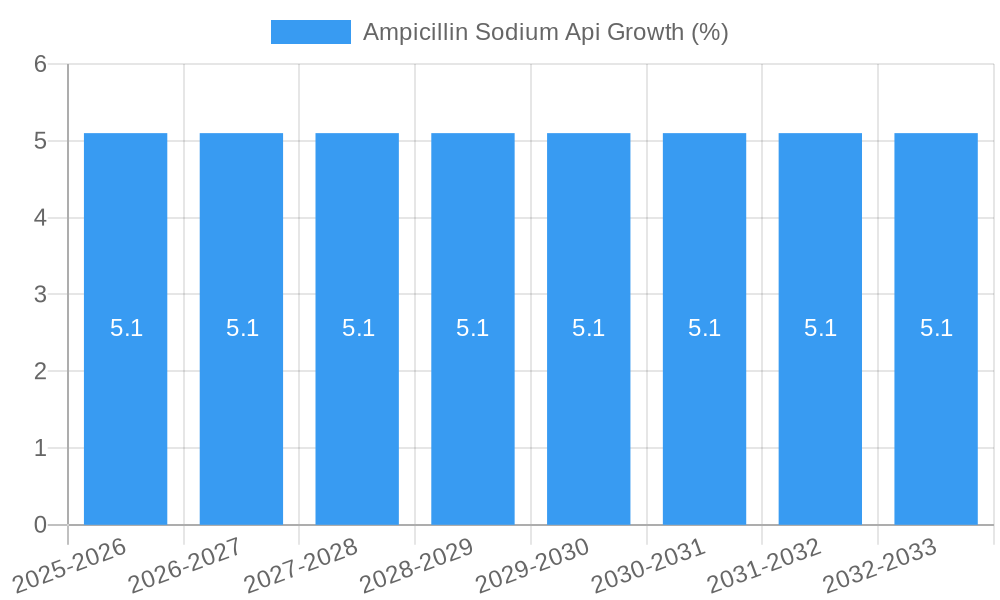

The Ampicillin Sodium API market is poised for robust expansion, projected to reach a significant valuation by 2033. With an estimated market size of USD 731 million in 2025, the sector is anticipated to witness a Compound Annual Growth Rate (CAGR) of 5.1% throughout the forecast period of 2025-2033. This steady growth trajectory is underpinned by a confluence of factors, most notably the increasing prevalence of bacterial infections globally, which directly fuels the demand for effective antibiotic treatments like Ampicillin Sodium. Furthermore, advancements in pharmaceutical manufacturing processes and a growing focus on producing high-purity Active Pharmaceutical Ingredients (APIs) are likely to propel market dynamics. The application segment is predominantly driven by the widespread use of Ampicillin Sodium in the production of injectables and tablets, catering to diverse therapeutic needs. The demand for higher purity levels, specifically Purity ≥99%, signifies a commitment to quality and efficacy in pharmaceutical formulations, a trend that will continue to shape the market.

The market's growth, however, is not without its challenges. The escalating concern over antibiotic resistance poses a significant restraint, prompting greater scrutiny on antibiotic usage and encouraging the development of novel therapeutic alternatives. Regulatory landscapes and stringent quality control measures within the pharmaceutical industry also present a complex environment for market players. Despite these hurdles, the sustained need for cost-effective and proven antibacterial agents like Ampicillin Sodium, particularly in emerging economies with a high burden of infectious diseases, will continue to be a primary driver. Continuous research and development efforts aimed at optimizing production efficiencies and ensuring product quality will be crucial for capitalizing on the prevailing market opportunities and navigating potential headwinds. The market is expected to see a consistent demand for both injection and tablet formulations, reflecting their established roles in treating a broad spectrum of bacterial infections.

This comprehensive report offers a detailed examination of the global Ampicillin Sodium API market, providing critical insights for industry stakeholders. Covering the historical period from 2019 to 2024, the base year of 2025, and projecting growth through 2033, this report delivers actionable intelligence on market dynamics, key players, and emerging trends.

Ampicillin Sodium Api Market Concentration & Innovation

The Ampicillin Sodium API market exhibits a moderate concentration, with a significant number of global manufacturers contributing to its supply. Innovation is primarily driven by the continuous demand for high-purity Active Pharmaceutical Ingredients (APIs) that adhere to stringent global regulatory standards. Key innovation areas include advanced synthesis processes to enhance purity levels, reduce impurities, and improve yield, alongside the development of more stable and bioavailable formulations. Regulatory frameworks, such as those mandated by the FDA, EMA, and other national health authorities, play a pivotal role in shaping market entry and product development, emphasizing Good Manufacturing Practices (GMP) and rigorous quality control. Product substitutes, while present in the broader antibiotic class, are limited for Ampicillin Sodium's specific therapeutic applications, maintaining its dedicated market share. End-user trends are characterized by an increasing reliance on cost-effective and reliable API suppliers, particularly in emerging economies. Mergers and Acquisitions (M&A) activities are observed, though often focused on specific regional expansions or vertical integration rather than broad consolidation. For instance, M&A deals in the API sector can range from tens of millions to hundreds of millions of dollars, depending on the size and strategic value of the acquired entity. Market share is fragmented across numerous players, with the top five typically holding around 40-50% of the global market.

Ampicillin Sodium Api Industry Trends & Insights

The Ampicillin Sodium API industry is poised for steady growth, fueled by several dynamic trends. A primary market growth driver is the sustained global demand for broad-spectrum antibiotics to combat bacterial infections, especially in developing nations where access to essential medicines is expanding. The increasing prevalence of antibiotic resistance, paradoxically, also drives the demand for established antibiotics like Ampicillin Sodium as a foundational treatment option, often in combination therapies. Technological disruptions are primarily focused on optimizing manufacturing processes for higher purity (Purity≥99%) and cost-effectiveness. Innovations in crystallization techniques, solvent recovery, and waste reduction are crucial for API manufacturers to remain competitive. The market penetration of Ampicillin Sodium API is significant within its therapeutic niches, with ongoing efforts to maintain and expand its application scope. Consumer preferences, in this context, translate to pharmaceutical companies seeking reliable, high-quality API suppliers who can ensure consistent supply chains and competitive pricing. The global market for Ampicillin Sodium API is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 3-5% during the forecast period. This growth is underpinned by increasing healthcare expenditure, particularly in Asia-Pacific and Latin America, and the continuous need for essential antibiotics in both human and veterinary medicine. The rise of generic drug manufacturing also plays a substantial role, as Ampicillin Sodium remains a cost-effective antibiotic option for a wide range of infections. Furthermore, advancements in pharmaceutical formulation technologies, such as novel drug delivery systems, are indirectly influencing the API market by creating demand for APIs with specific physicochemical properties, pushing manufacturers towards higher purity standards and customized specifications. The competitive landscape is characterized by a blend of established global players and emerging regional manufacturers, each vying for market share through a combination of product quality, pricing strategies, and supply chain reliability. The trend towards outsourcing API manufacturing also continues to shape the industry, creating opportunities for specialized API producers.

Dominant Markets & Segments in Ampicillin Sodium Api

The dominant region for Ampicillin Sodium API consumption is Asia-Pacific, driven by its large population, increasing healthcare infrastructure, and significant generic drug manufacturing capabilities. Within this region, China and India stand out as major production hubs and consumption markets. The Injection segment within the Application category is anticipated to hold the largest market share, owing to its efficacy and rapid therapeutic action for severe infections. In terms of Type, Purity≥99% is the predominant segment, reflecting the stringent quality requirements for pharmaceutical-grade APIs.

Ampicillin Sodium Api Product Developments

Product developments in the Ampicillin Sodium API market are focused on enhancing manufacturing efficiency and ensuring exceptional purity. Companies are investing in optimizing synthesis routes to achieve Purity≥99%, thereby meeting stringent pharmacopoeial standards and regulatory requirements. These advancements often involve adopting cleaner chemical processes, improving purification techniques like recrystallization and chromatography, and implementing advanced analytical methods for quality control. The competitive advantage lies in consistently delivering a high-quality, cost-effective API that pharmaceutical formulators can rely on for their drug products, particularly for injectable and oral formulations.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Ampicillin Sodium API market across various dimensions, providing a comprehensive segmentation. The Application segmentation includes:

- Injection

- Tablet

- Others (e.g., oral suspensions, capsules)

The Type segmentation focuses on:

- Purity≥99%

- Purity (referring to other specified purity grades as per pharmacopoeial standards)

The analysis encompasses the Study Period (2019–2033), with a Base Year of 2025, an Estimated Year also of 2025, and a Forecast Period spanning 2025–2033. The Historical Period covered is 2019–2024.

Key Drivers of Ampicillin Sodium Api Growth

Several key factors are propelling the growth of the Ampicillin Sodium API market. The persistent global burden of bacterial infections, particularly in developing economies with expanding healthcare access, is a primary driver. The ongoing need for cost-effective and broad-spectrum antibiotics ensures sustained demand. Technological advancements in API synthesis and purification processes are crucial, enabling manufacturers to achieve higher purity standards (Purity≥99%) and improve production efficiency, thereby reducing costs. Regulatory support for essential medicines and the continued role of Ampicillin Sodium in combination therapies against emerging drug-resistant strains also contribute significantly to market expansion.

Challenges in the Ampicillin Sodium Api Sector

The Ampicillin Sodium API sector faces several challenges. Intense price competition among numerous global suppliers can put pressure on profit margins, especially for generic API manufacturers. Stringent and evolving regulatory requirements across different regions necessitate continuous investment in quality control and compliance. Supply chain disruptions, driven by geopolitical factors or raw material availability, can impact production and delivery timelines. Furthermore, the growing concern regarding antibiotic resistance and the push for the development of newer, more targeted antimicrobial agents could, in the long term, pose a challenge to the market share of older antibiotics.

Emerging Opportunities in Ampicillin Sodium Api

Emerging opportunities in the Ampicillin Sodium API market lie in catering to the rising demand for high-purity APIs in emerging economies where healthcare infrastructure is rapidly developing. Advancements in sustainable manufacturing practices, such as green chemistry principles and waste reduction, present an opportunity for API producers to differentiate themselves and appeal to environmentally conscious pharmaceutical companies. The exploration of new therapeutic combinations and applications for Ampicillin Sodium, particularly in veterinary medicine and in combating specific multi-drug resistant infections, also offers avenues for market growth.

Leading Players in the Ampicillin Sodium Api Market

- Acs Dobfar Spa

- Fengchen Group Co.,Ltd

- DPB Pharma

- Apitoria

- Fresenius Kabi iPSUM

- Sterile India

- Shandong Lukang Pharmaceutical

- Sichuan Ren'an Pharmaceutical

- Zhuhai United Laboratories

- CSPC Zhongnuo Pharmaceutical (Shijiazhuang)

- Good Doctor Pharmaceutical

- Langzhi Group Bokang Pharmaceutical Co., Ltd.

- Shanghai Shanghai Pharmaceuticals New Asia Pharmaceutical Co., Ltd.

- Harbin Pharmaceutical Group General Pharmaceutical Factory

- North China Pharmaceutical Group Xiantai Pharmaceutical

- Sinopharm Weiqida Pharmaceutical

- Zhuhai United Laboratories Zhongshan Branch

- Anyang Kangxing Pharmaceutical, Henan Province

- Hebei United Pharmaceutical

- Henan Xinxiang Huaxing Pharmaceutical Factory

- Zhejiang Langhua Pharmaceutical

- Shandong Anxin Pharmaceutical

Key Developments in Ampicillin Sodium Api Industry

- 2023: Several manufacturers enhanced their GMP compliance certifications to meet stricter international standards for Purity≥99%.

- 2022: Investment in advanced purification technologies to reduce residual solvents and impurities.

- 2021: Increased focus on supply chain resilience due to global logistical challenges.

- 2020: Adaptation of manufacturing processes to meet the surge in demand for essential antibiotics during the initial phase of the pandemic.

- 2019: Introduction of new analytical techniques for more precise impurity profiling.

Strategic Outlook for Ampicillin Sodium Api Market

The strategic outlook for the Ampicillin Sodium API market remains positive, driven by its established efficacy and cost-effectiveness as a foundational antibiotic. Future growth will be underpinned by the increasing demand from emerging markets and the continuous need for reliable API suppliers. Companies that focus on achieving superior purity (Purity≥99%), optimizing manufacturing costs, and ensuring robust supply chains will be best positioned for success. Furthermore, exploring niche applications and sustainable production methods will be key to maintaining a competitive edge in the evolving pharmaceutical landscape.

Ampicillin Sodium Api Segmentation

-

1. Application

- 1.1. Injection

- 1.2. Tablet

- 1.3. Others

-

2. Type

- 2.1. Purity≥99%

- 2.2. Purity<99%

Ampicillin Sodium Api Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ampicillin Sodium Api REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ampicillin Sodium Api Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Injection

- 5.1.2. Tablet

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Purity≥99%

- 5.2.2. Purity<99%

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ampicillin Sodium Api Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Injection

- 6.1.2. Tablet

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Purity≥99%

- 6.2.2. Purity<99%

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ampicillin Sodium Api Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Injection

- 7.1.2. Tablet

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Purity≥99%

- 7.2.2. Purity<99%

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ampicillin Sodium Api Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Injection

- 8.1.2. Tablet

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Purity≥99%

- 8.2.2. Purity<99%

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ampicillin Sodium Api Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Injection

- 9.1.2. Tablet

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Purity≥99%

- 9.2.2. Purity<99%

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ampicillin Sodium Api Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Injection

- 10.1.2. Tablet

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Purity≥99%

- 10.2.2. Purity<99%

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Acs Dobfar Spa

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fengchen Group Co.Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DPB Pharma

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Apitoria

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fresenius Kabi iPSUM

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sterile India

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shandong Lukang Pharmaceutical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sichuan Ren'an Pharmaceutical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Zhuhai United Laboratories

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CSPC Zhongnuo Pharmaceutical (Shijiazhuang)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Good Doctor Pharmaceutical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Langzhi Group Bokang Pharmaceutical Co. Ltd.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Shanghai Shanghai Pharmaceuticals New Asia Pharmaceutical Co. Ltd.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Harbin Pharmaceutical Group General Pharmaceutical Factory

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 North China Pharmaceutical Group Xiantai Pharmaceutical

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Sinopharm Weiqida Pharmaceutical

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Zhuhai United Laboratories Zhongshan Branch

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Anyang Kangxing Pharmaceutical Henan Province

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Hebei United Pharmaceutical

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Henan Xinxiang Huaxing Pharmaceutical Factory

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Zhejiang Langhua Pharmaceutical

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Shandong Anxin Pharmaceutical

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Acs Dobfar Spa

List of Figures

- Figure 1: Global Ampicillin Sodium Api Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Ampicillin Sodium Api Revenue (million), by Application 2024 & 2032

- Figure 3: North America Ampicillin Sodium Api Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Ampicillin Sodium Api Revenue (million), by Type 2024 & 2032

- Figure 5: North America Ampicillin Sodium Api Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Ampicillin Sodium Api Revenue (million), by Country 2024 & 2032

- Figure 7: North America Ampicillin Sodium Api Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Ampicillin Sodium Api Revenue (million), by Application 2024 & 2032

- Figure 9: South America Ampicillin Sodium Api Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Ampicillin Sodium Api Revenue (million), by Type 2024 & 2032

- Figure 11: South America Ampicillin Sodium Api Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Ampicillin Sodium Api Revenue (million), by Country 2024 & 2032

- Figure 13: South America Ampicillin Sodium Api Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Ampicillin Sodium Api Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Ampicillin Sodium Api Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Ampicillin Sodium Api Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Ampicillin Sodium Api Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Ampicillin Sodium Api Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Ampicillin Sodium Api Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Ampicillin Sodium Api Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Ampicillin Sodium Api Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Ampicillin Sodium Api Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Ampicillin Sodium Api Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Ampicillin Sodium Api Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Ampicillin Sodium Api Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Ampicillin Sodium Api Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Ampicillin Sodium Api Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Ampicillin Sodium Api Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Ampicillin Sodium Api Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Ampicillin Sodium Api Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Ampicillin Sodium Api Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ampicillin Sodium Api Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ampicillin Sodium Api Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Ampicillin Sodium Api Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Ampicillin Sodium Api Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Ampicillin Sodium Api Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Ampicillin Sodium Api Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Ampicillin Sodium Api Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Ampicillin Sodium Api Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Ampicillin Sodium Api Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Ampicillin Sodium Api Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Ampicillin Sodium Api Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Ampicillin Sodium Api Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Ampicillin Sodium Api Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Ampicillin Sodium Api Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Ampicillin Sodium Api Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Ampicillin Sodium Api Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Ampicillin Sodium Api Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Ampicillin Sodium Api Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Ampicillin Sodium Api Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Ampicillin Sodium Api Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ampicillin Sodium Api?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Ampicillin Sodium Api?

Key companies in the market include Acs Dobfar Spa, Fengchen Group Co.,Ltd, DPB Pharma, Apitoria, Fresenius Kabi iPSUM, Sterile India, Shandong Lukang Pharmaceutical, Sichuan Ren'an Pharmaceutical, Zhuhai United Laboratories, CSPC Zhongnuo Pharmaceutical (Shijiazhuang), Good Doctor Pharmaceutical, Langzhi Group Bokang Pharmaceutical Co., Ltd., Shanghai Shanghai Pharmaceuticals New Asia Pharmaceutical Co., Ltd., Harbin Pharmaceutical Group General Pharmaceutical Factory, North China Pharmaceutical Group Xiantai Pharmaceutical, Sinopharm Weiqida Pharmaceutical, Zhuhai United Laboratories Zhongshan Branch, Anyang Kangxing Pharmaceutical, Henan Province, Hebei United Pharmaceutical, Henan Xinxiang Huaxing Pharmaceutical Factory, Zhejiang Langhua Pharmaceutical, Shandong Anxin Pharmaceutical.

3. What are the main segments of the Ampicillin Sodium Api?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 731 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ampicillin Sodium Api," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ampicillin Sodium Api report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ampicillin Sodium Api?

To stay informed about further developments, trends, and reports in the Ampicillin Sodium Api, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence