Key Insights

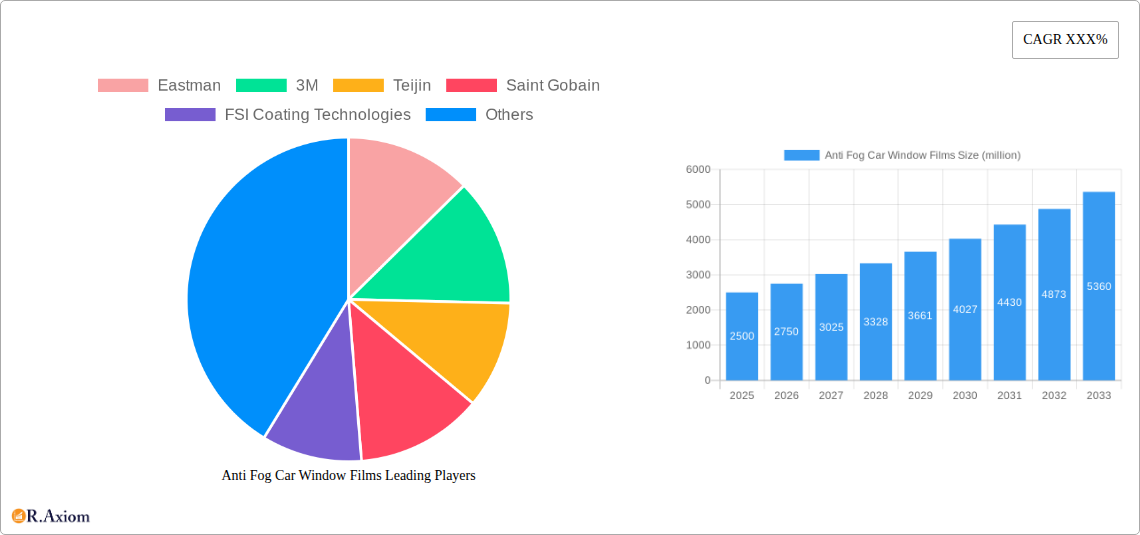

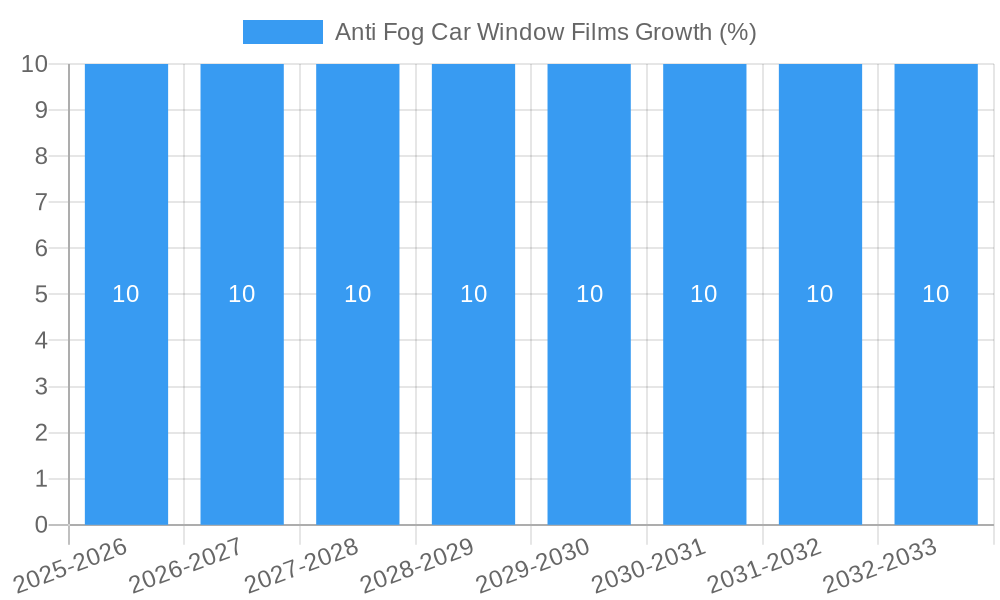

The global Anti Fog Car Window Films market is poised for significant expansion, projected to reach approximately $2,500 million by 2025 and surge to an estimated $5,000 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of around 10%. This growth is primarily fueled by escalating automotive production worldwide, a heightened consumer demand for enhanced driving safety and comfort, and the increasing adoption of advanced automotive technologies. The rising awareness of the detrimental effects of fogged windows on visibility and accident prevention is a critical driver. Furthermore, the integration of sophisticated features in modern vehicles, such as enhanced window coatings and intelligent climate control systems, indirectly bolsters the demand for high-performance anti-fog solutions. Applications like wing mirrors and windows are expected to lead the market, followed by glass panel roofs and headlights, as manufacturers prioritize safety and premium features.

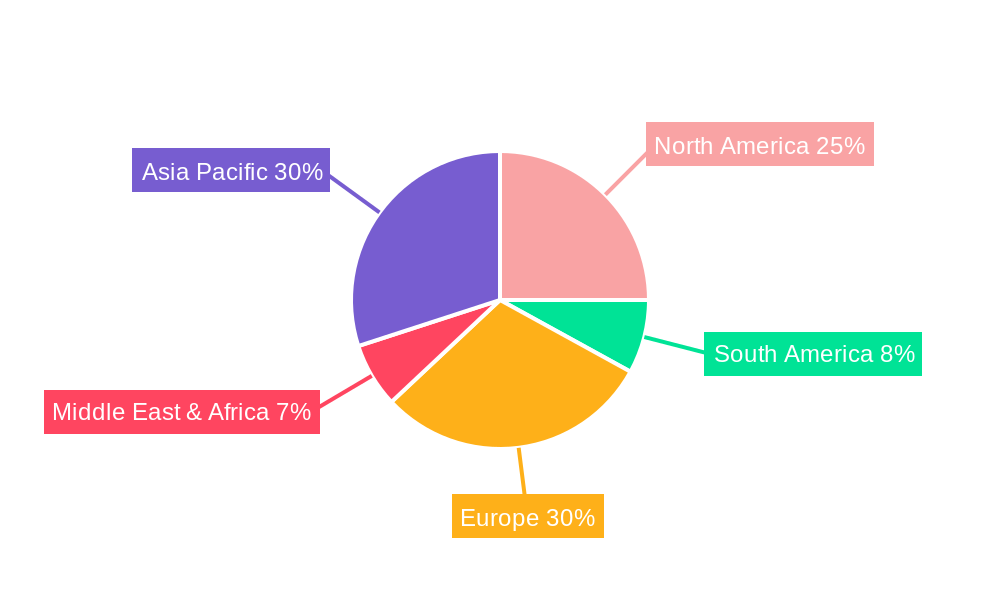

The market is characterized by key trends including the development of advanced material technologies, such as nano-coatings and hydrophobic treatments, offering superior and long-lasting anti-fog performance. The increasing preference for DIY application films, alongside professional installations, is also shaping the market landscape, catering to a broader consumer base. However, challenges such as the high cost of advanced film technologies and consumer price sensitivity could moderate growth in certain segments. The competitive landscape is dynamic, with established players like Eastman, 3M, and Saint Gobain, alongside emerging Chinese manufacturers like Jiangxi Kewei Film and Shenzhen Kang Sheng, vying for market share. Regional analysis indicates Asia Pacific, particularly China and India, as a high-growth region due to its massive automotive manufacturing base and rapidly expanding middle class. North America and Europe remain significant markets driven by stringent safety regulations and a strong demand for premium automotive accessories.

Anti Fog Car Window Films Market Concentration & Innovation

The Anti Fog Car Window Films market exhibits a moderate concentration, with key players like Eastman, 3M, Teijin, and Saint Gobain holding significant market share. Innovation is a critical driver, propelled by advancements in material science and coating technologies, exemplified by companies such as FSI Coating Technologies and WeeTect. Regulatory frameworks, though evolving, are increasingly focused on enhancing automotive safety and driver visibility, directly impacting the demand for effective anti-fog solutions. Product substitutes, such as de-misting systems integrated into vehicle manufacturing, pose a competitive challenge, but specialized anti-fog films offer a more cost-effective and retrofit solution for existing vehicles. End-user trends are leaning towards enhanced driving comfort and safety, with a growing awareness of the benefits of clear visibility in all weather conditions. Mergers and acquisitions (M&A) activities are observed as companies seek to expand their product portfolios and geographical reach. For instance, estimated M&A deal values in the automotive aftermarket accessories sector are in the range of hundreds of million dollars, indicating strategic consolidation.

- Market Share Dynamics: Major players collectively account for approximately 60% of the global market.

- Innovation Focus: Research and development efforts are concentrated on improving film durability, adhesion, and long-term anti-fog performance.

- Regulatory Impact: Stricter automotive safety standards globally are indirectly boosting the anti-fog film market.

- M&A Activity: Strategic acquisitions aim to leverage new technologies and secure market access.

Anti Fog Car Window Films Industry Trends & Insights

The Anti Fog Car Window Films market is poised for robust growth, driven by an escalating demand for enhanced automotive safety and driver comfort across a global vehicle parc. The Compound Annual Growth Rate (CAGR) is projected to be around 8.5% during the forecast period of 2025–2033. This sustained expansion is fueled by several interconnected trends. Firstly, increasing vehicle production worldwide, particularly in emerging economies, directly translates into a larger addressable market for automotive aftermarket products. Secondly, growing consumer awareness regarding the importance of clear visibility for safe driving, especially in adverse weather conditions like fog, rain, and snow, is a significant catalyst. This heightened awareness is amplified by digital marketing campaigns and the increasing interconnectedness of automotive communities online.

Technological disruptions are playing a pivotal role. Advancements in nanotechnology and polymer science have led to the development of highly effective hydrophobic and hydrophilic coatings that prevent condensation buildup on car windows. Companies are investing heavily in R&D to create thinner, more durable, and optically clear films that do not compromise the aesthetic appeal or visibility through the glass. The integration of smart technologies, though nascent, presents a future opportunity for films with self-cleaning or enhanced de-fogging capabilities.

Consumer preferences are evolving. Modern car buyers expect a premium driving experience, which includes unobstructed views. The aftermarket segment is witnessing a surge in demand for DIY-friendly anti-fog film applications, making them accessible to a wider consumer base. Furthermore, the trend towards autonomous and semi-autonomous driving systems necessitates near-perfect visibility, making anti-fog solutions indispensable for sensor performance and overall safety.

The competitive landscape is dynamic, characterized by both established automotive suppliers and specialized film manufacturers. Key players are competing on product performance, price, brand reputation, and distribution networks. The market penetration of anti-fog films, while significant in developed regions, still has considerable room for growth in developing markets, presenting substantial expansion opportunities. The increasing focus on vehicle customization and aftermarket upgrades further solidifies the market's growth trajectory.

- CAGR (2025-2033): Estimated at 8.5%.

- Market Drivers: Increasing vehicle production, rising safety consciousness, technological advancements in coatings.

- Consumer Trends: Demand for clear visibility, comfort, and enhanced driving experience.

- Competitive Landscape: Characterized by innovation, price competition, and expanding distribution.

- Market Penetration: High in developed regions, with significant growth potential in emerging economies.

Dominant Markets & Segments in Anti Fog Car Window Films

The Anti Fog Car Window Films market exhibits clear dominance in certain geographical regions and application segments, driven by a confluence of economic policies, infrastructure development, and consumer demand. Asia Pacific, particularly China and India, is emerging as a dominant region due to its massive vehicle production volume, a burgeoning middle class with increasing disposable income, and a growing awareness of automotive safety standards. Government initiatives promoting automotive manufacturing and infrastructure development further bolster this dominance. North America and Europe, owing to their mature automotive markets, stringent safety regulations, and a well-established aftermarket, also represent significant and stable demand centers.

Within the application segments, Windows constitute the largest and most dominant segment. This is primarily due to the widespread need for clear visibility from all primary window surfaces for drivers and passengers. The sheer number of windows in any vehicle makes this a consistently high-demand application. Wing mirrors also represent a substantial segment, as maintaining clear visibility of side and rear views is critical for safe maneuvering, especially in challenging weather.

The Type segment is dominated by PET (Polyethylene Terephthalate). PET films offer an excellent balance of optical clarity, durability, and cost-effectiveness, making them the preferred material for most anti-fog window film applications. Their adaptability to various coating technologies further enhances their appeal. PP (Polypropylene) films, while possessing some advantages, are typically found in niche applications or as part of multi-layer film structures.

- Dominant Region: Asia Pacific, driven by high vehicle production and growing consumer demand.

- Key Drivers in Asia Pacific: Favorable economic policies for automotive manufacturing, rapid infrastructure development, increasing per capita income.

- Country-Specific Dominance: China leads due to its vast automotive market and advanced manufacturing capabilities.

- Dominant Application Segment: Windows.

- Drivers for Windows Dominance: Essential for driver visibility, presence on all vehicle types, high replacement rate.

- Dominant Type Segment: PET (Polyethylene Terephthalate).

- Drivers for PET Dominance: Cost-effectiveness, optical clarity, durability, compatibility with various coatings.

- Emerging Segments: Glass Panel Roofs are gaining traction with the increasing popularity of panoramic sunroofs. Headlights are also seeing growing demand for anti-fog solutions to maintain optimal illumination.

Anti Fog Car Window Films Product Developments

Recent product developments in the Anti Fog Car Window Films market focus on enhancing performance and user experience. Innovations are centered on advanced hydrophilic coatings that effectively disperse moisture, preventing fog formation and ensuring crystal-clear visibility. Companies are also developing thinner, more flexible films with superior adhesion properties that are easier to apply and do not compromise the aesthetics of vehicle windows. These advancements offer significant competitive advantages by improving safety, reducing driver distraction, and contributing to a more comfortable driving environment. The market is seeing a trend towards more durable and scratch-resistant formulations that extend the lifespan of the anti-fog effect.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Anti Fog Car Window Films market, encompassing detailed segmentations based on application and film type. The Application segmentation includes Wing Mirrors, Windows, Glass Panel Roofs, Headlights, Dashboard Cockpit Clusters, and Others. The Type segmentation covers PET, PP, and Other film materials. Each segment is analyzed for market size, growth projections, and competitive dynamics.

Windows: This segment is projected to witness substantial growth, driven by its critical role in driver visibility and widespread adoption across all vehicle types. Market size is estimated to be in the range of millions of dollars.

Wing Mirrors: A vital segment focused on enhancing rear and side visibility, crucial for safe driving maneuvers. This segment is expected to show steady growth due to safety regulations and consumer demand.

Glass Panel Roofs: With the increasing popularity of panoramic sunroofs, this segment is poised for significant expansion as consumers seek to maintain clear visibility through these expansive glass surfaces.

Headlights: Anti-fog solutions for headlights are gaining traction to ensure optimal illumination and prevent performance degradation in foggy or humid conditions.

Dashboard Cockpit Clusters: While a smaller segment, there is growing interest in anti-fog films for instrument clusters to prevent distraction caused by condensation.

PET: This is the largest and most dominant type segment, offering a superior combination of cost, clarity, and durability, making it the preferred material.

PP: Polypropylene films may cater to specific niche applications requiring unique properties or as part of multi-layer structures.

Other: This category encompasses various other film types and advanced materials entering the market.

Key Drivers of Anti Fog Car Window Films Growth

The growth of the Anti Fog Car Window Films market is propelled by several interconnected drivers. Firstly, an escalating global emphasis on automotive safety and accident reduction is a primary catalyst. Clear visibility is paramount for safe driving, and anti-fog films directly address this concern, particularly in regions with variable and challenging weather conditions. Secondly, the continuous innovation in material science and coating technologies is yielding more effective, durable, and cost-efficient anti-fog solutions. This technological advancement makes the products more attractive to both consumers and automotive manufacturers. Thirdly, the robust growth in global vehicle production and the aftermarket automotive accessories sector provides a constantly expanding customer base. Finally, evolving consumer preferences for comfort, convenience, and enhanced driving experiences are driving demand for solutions that eliminate the nuisance of fogged-up windows.

Challenges in the Anti Fog Car Window Films Sector

Despite the promising growth trajectory, the Anti Fog Car Window Films sector faces several challenges. One significant barrier is the availability and cost of raw materials, which can fluctuate and impact the final product pricing. Intense price competition among numerous market players, especially in the aftermarket segment, can squeeze profit margins. Furthermore, consumer education and awareness remain a challenge, as many individuals are not fully aware of the benefits or the availability of such specialized films. Regulatory hurdles related to automotive aftermarket product certifications and safety standards, while generally supportive, can also add complexity. Lastly, counterfeit products entering the market can erode brand trust and negatively impact the perception of quality.

Emerging Opportunities in Anti Fog Car Window Films

Emerging opportunities in the Anti Fog Car Window Films market are diverse and promising. The increasing adoption of electric vehicles (EVs) presents a significant opportunity, as EVs often feature advanced sensor technologies and large glass surfaces where clear visibility is critical. The expansion into emerging markets with rapidly growing automotive sectors offers substantial untapped potential. Furthermore, advancements in smart materials and nanotechnology could lead to next-generation anti-fog films with integrated functionalities like self-cleaning or UV protection. The growing trend of DIY automotive accessories and the rise of online sales platforms provide new avenues for product distribution and direct consumer engagement.

Leading Players in the Anti Fog Car Window Films Market

- Eastman

- 3M

- Teijin

- Saint Gobain

- FSI Coating Technologies

- WeeTect

- Jiangxi Kewei Film

- Shenzhen Kang Sheng

- Shenzhen Yidafenghua

Key Developments in Anti Fog Car Window Films Industry

- 2023/01: Eastman launches a new line of advanced hydrophobic coatings for automotive glass, enhancing anti-fog performance.

- 2022/11: 3M introduces a next-generation automotive window film with improved durability and scratch resistance.

- 2022/08: Teijin develops a novel polymer composite for enhanced anti-fog film applications in extreme weather conditions.

- 2022/04: Saint Gobain invests in R&D for smart window technologies incorporating anti-fog capabilities.

- 2021/12: FSI Coating Technologies partners with a major automotive OEM for integrated anti-fog solutions.

- 2021/07: WeeTect expands its product portfolio to include specialized anti-fog films for commercial vehicles.

- 2020/10: Jiangxi Kewei Film announces capacity expansion to meet growing demand for automotive window films.

Strategic Outlook for Anti Fog Car Window Films Market

The strategic outlook for the Anti Fog Car Window Films market remains highly positive, driven by a convergence of favorable factors. The sustained growth in global vehicle production, coupled with an increasing emphasis on automotive safety and driver comfort, forms the bedrock of future market expansion. Continuous technological advancements in coating and material science will unlock new product potentials, offering enhanced performance and added functionalities. Companies that focus on product innovation, cost optimization, and expanding their distribution networks, particularly in emerging economies, are well-positioned for significant growth. Strategic collaborations and potential M&A activities will likely shape the competitive landscape, leading to market consolidation and enhanced capabilities. The market is set to witness a steady ascent, fueled by the universal demand for clear, unobstructed vision in automobiles.

Anti Fog Car Window Films Segmentation

-

1. Application

- 1.1. Wing Mirrors

- 1.2. Windows

- 1.3. Glass Panel Roofs

- 1.4. Headlights

- 1.5. Dashboard Cockpit Clusters

- 1.6. Others

-

2. Type

- 2.1. PET

- 2.2. PP

- 2.3. Other

Anti Fog Car Window Films Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Anti Fog Car Window Films REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anti Fog Car Window Films Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Wing Mirrors

- 5.1.2. Windows

- 5.1.3. Glass Panel Roofs

- 5.1.4. Headlights

- 5.1.5. Dashboard Cockpit Clusters

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. PET

- 5.2.2. PP

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Anti Fog Car Window Films Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Wing Mirrors

- 6.1.2. Windows

- 6.1.3. Glass Panel Roofs

- 6.1.4. Headlights

- 6.1.5. Dashboard Cockpit Clusters

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. PET

- 6.2.2. PP

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Anti Fog Car Window Films Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Wing Mirrors

- 7.1.2. Windows

- 7.1.3. Glass Panel Roofs

- 7.1.4. Headlights

- 7.1.5. Dashboard Cockpit Clusters

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. PET

- 7.2.2. PP

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Anti Fog Car Window Films Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Wing Mirrors

- 8.1.2. Windows

- 8.1.3. Glass Panel Roofs

- 8.1.4. Headlights

- 8.1.5. Dashboard Cockpit Clusters

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. PET

- 8.2.2. PP

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Anti Fog Car Window Films Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Wing Mirrors

- 9.1.2. Windows

- 9.1.3. Glass Panel Roofs

- 9.1.4. Headlights

- 9.1.5. Dashboard Cockpit Clusters

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. PET

- 9.2.2. PP

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Anti Fog Car Window Films Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Wing Mirrors

- 10.1.2. Windows

- 10.1.3. Glass Panel Roofs

- 10.1.4. Headlights

- 10.1.5. Dashboard Cockpit Clusters

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. PET

- 10.2.2. PP

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Eastman

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 3M

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Teijin

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Saint Gobain

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FSI Coating Technologies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 WeeTect

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Jiangxi Kewei Film

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shenzhen Kang Sheng

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shenzhen Yidafenghua

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Eastman

List of Figures

- Figure 1: Global Anti Fog Car Window Films Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Anti Fog Car Window Films Revenue (million), by Application 2024 & 2032

- Figure 3: North America Anti Fog Car Window Films Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Anti Fog Car Window Films Revenue (million), by Type 2024 & 2032

- Figure 5: North America Anti Fog Car Window Films Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Anti Fog Car Window Films Revenue (million), by Country 2024 & 2032

- Figure 7: North America Anti Fog Car Window Films Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Anti Fog Car Window Films Revenue (million), by Application 2024 & 2032

- Figure 9: South America Anti Fog Car Window Films Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Anti Fog Car Window Films Revenue (million), by Type 2024 & 2032

- Figure 11: South America Anti Fog Car Window Films Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Anti Fog Car Window Films Revenue (million), by Country 2024 & 2032

- Figure 13: South America Anti Fog Car Window Films Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Anti Fog Car Window Films Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Anti Fog Car Window Films Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Anti Fog Car Window Films Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Anti Fog Car Window Films Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Anti Fog Car Window Films Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Anti Fog Car Window Films Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Anti Fog Car Window Films Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Anti Fog Car Window Films Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Anti Fog Car Window Films Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Anti Fog Car Window Films Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Anti Fog Car Window Films Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Anti Fog Car Window Films Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Anti Fog Car Window Films Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Anti Fog Car Window Films Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Anti Fog Car Window Films Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Anti Fog Car Window Films Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Anti Fog Car Window Films Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Anti Fog Car Window Films Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Anti Fog Car Window Films Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Anti Fog Car Window Films Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Anti Fog Car Window Films Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Anti Fog Car Window Films Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Anti Fog Car Window Films Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Anti Fog Car Window Films Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Anti Fog Car Window Films Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Anti Fog Car Window Films Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Anti Fog Car Window Films Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Anti Fog Car Window Films Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Anti Fog Car Window Films Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Anti Fog Car Window Films Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Anti Fog Car Window Films Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Anti Fog Car Window Films Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Anti Fog Car Window Films Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Anti Fog Car Window Films Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Anti Fog Car Window Films Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Anti Fog Car Window Films Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Anti Fog Car Window Films Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Anti Fog Car Window Films Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti Fog Car Window Films?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Anti Fog Car Window Films?

Key companies in the market include Eastman, 3M, Teijin, Saint Gobain, FSI Coating Technologies, WeeTect, Jiangxi Kewei Film, Shenzhen Kang Sheng, Shenzhen Yidafenghua.

3. What are the main segments of the Anti Fog Car Window Films?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anti Fog Car Window Films," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anti Fog Car Window Films report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anti Fog Car Window Films?

To stay informed about further developments, trends, and reports in the Anti Fog Car Window Films, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence