Key Insights

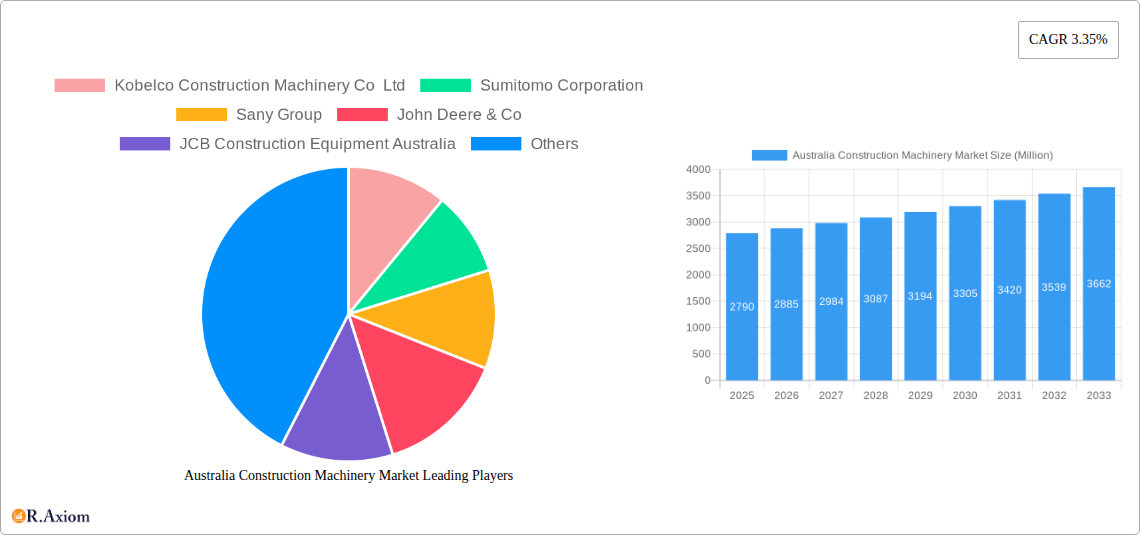

The Australian construction machinery market, valued at $2.79 billion in 2025, is projected to experience steady growth, driven by robust infrastructure development initiatives and ongoing urbanization. A Compound Annual Growth Rate (CAGR) of 3.35% from 2025 to 2033 suggests a market size exceeding $4 billion by the end of the forecast period. Key growth drivers include government investments in transportation networks (roads, railways), large-scale mining projects, and the burgeoning residential and commercial construction sectors. Demand is particularly strong for hydraulic excavators and wheel loaders, reflecting the need for efficient earthmoving and material handling capabilities. While rising material costs and potential labor shortages pose challenges, technological advancements such as automation and improved fuel efficiency are mitigating these restraints. The market is segmented by application type (material handling, earthmoving, transportation) and machinery type (hydraulic excavators, wheel loaders, crawler trucks, dump trucks, motor graders), with major players like Caterpillar, Komatsu, and others fiercely competing for market share. The strong presence of established international players alongside local businesses like JCB Construction Equipment Australia indicates a dynamic and competitive landscape. The continued expansion of Australia's economy and infrastructure spending promises sustained growth for the construction machinery market throughout the forecast period.

Australia Construction Machinery Market Market Size (In Billion)

The Australian construction machinery market's healthy growth is underpinned by a multitude of factors. Government policy focused on economic diversification and infrastructure modernization is key, boosting both public and private sector investment. This translates into increased demand for a broad range of machinery, from heavy-duty equipment for large-scale projects to smaller machines for residential construction. The mining sector continues to play a vital role, contributing significantly to the demand for specialized equipment such as crawler trucks and dump trucks. Moreover, the rising adoption of technologically advanced machines with improved efficiency and safety features is further fueling market expansion. While global economic uncertainties could influence growth, the resilience of the Australian economy and the ongoing need for infrastructure development suggest that the construction machinery market is well-positioned for continued expansion in the coming years. Competitive pressures from both domestic and international players will further drive innovation and enhance market competitiveness, ensuring a dynamic and prosperous future for the industry.

Australia Construction Machinery Market Company Market Share

Australia Construction Machinery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australia Construction Machinery Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with 2025 as the base year, this report unveils market trends, growth drivers, challenges, and opportunities, providing a detailed forecast for 2025-2033. The report meticulously segments the market by application type (Material Handling, Earth Moving, Transportation) and machinery type (Hydraulic Excavators, Wheel Loaders, Crawler Trucks, Dump Trucks, Motor Graders), offering granular data and analysis for each segment. Key players analyzed include Kobelco Construction Machinery Co Ltd, Sumitomo Corporation, Sany Group, John Deere & Co, JCB Construction Equipment Australia, Hitachi Construction Machinery Co Ltd, Manitou BF SA, Volvo Construction Equipment, Caterpillar Inc, Komatsu Ltd, CNH Australia, Wacker Neuson, Liebherr International, Doosan Infracore Ltd, Shandong Lin gong Construction Machinery, Yanmar Construction Equipment Co Ltd, and XCMG Group.

Australia Construction Machinery Market Concentration & Innovation

The Australian construction machinery market exhibits a moderately concentrated landscape, dominated by several multinational players and complemented by a number of regional companies. Market share data for 2024 reveals Caterpillar Inc. and Komatsu Ltd. holding significant positions, followed by other global players. Precise market share figures are detailed within the full report. However, smaller, specialized firms focusing on niche applications continue to carve out market space.

Innovation in the sector is driven by several factors including:

- Technological advancements: The increasing adoption of automation, telematics, and electric powertrains are revolutionizing the industry.

- Government regulations: Stringent emission standards and safety regulations are pushing companies to develop more environmentally friendly and safer equipment.

- Product substitutes: The emergence of alternative technologies and sustainable construction materials is impacting the demand for traditional machinery.

- End-user trends: A focus on improving efficiency, productivity, and safety demands innovation in construction machinery design and functionality.

Mergers and acquisitions (M&A) activity within the market has been relatively moderate in recent years, with xx Million in total deal value reported between 2020-2024. However, strategic partnerships and joint ventures are becoming increasingly important for collaboration and technological advancement.

Australia Construction Machinery Market Industry Trends & Insights

The Australian construction machinery market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several key factors. Significant infrastructure development projects, including government-led initiatives like road and railway upgrades, contribute considerably to market growth. The increasing urbanization and rising demand for housing also propel market expansion. Technological advancements such as the introduction of electric and hybrid machinery are influencing consumer preferences towards more sustainable and efficient equipment. However, economic fluctuations and variations in commodity prices remain potential headwinds. Market penetration of advanced technologies like autonomous operations is currently at xx%, and is projected to reach xx% by 2033. Competitive dynamics are marked by intense competition between global and local players. The market is witnessing a shift towards advanced technology adoption, while traditional players compete on cost optimization strategies.

Dominant Markets & Segments in Australia Construction Machinery Market

Within the Australian construction machinery market, the Earth Moving segment holds a dominant position, accounting for approximately xx% of the total market value in 2024. This segment's dominance is fueled by the substantial growth in infrastructure projects across the country.

- Key drivers for Earth Moving segment dominance:

- Significant investment in infrastructure development.

- Large-scale mining projects.

- Government initiatives promoting infrastructure spending.

- Growth in construction activity related to urbanization.

In terms of machinery types, Hydraulic Excavators maintain a leading share, driven by their versatility and widespread application across various construction activities.

Australia Construction Machinery Market Product Developments

Recent product innovations focus on enhanced fuel efficiency, improved safety features, and the integration of advanced technologies like telematics and automation. Electric and hybrid models are gaining traction, responding to environmental concerns and stricter emission regulations. These developments improve operational efficiency and reduce environmental impact, offering a strong competitive advantage to manufacturers. The market is also witnessing the introduction of autonomous features in certain machine types, although widespread adoption is still in its nascent stages.

Report Scope & Segmentation Analysis

This report provides an in-depth and comprehensive analysis of the Australian construction machinery market. We delve into key market segments, offering insights into their growth trajectories, competitive landscapes, and underlying drivers. The segmentation covers a granular view of how different applications and machinery types are performing and are expected to perform over the forecast period.

By Application Type:

- Material Handling: This dynamic segment encompasses a wide range of machinery crucial for lifting, transporting, and stacking materials efficiently on construction sites. With an anticipated Compound Annual Growth Rate (CAGR) of [Insert Projected CAGR Here]% during the forecast period, this segment is characterized by moderate competition. Established industry veterans and specialized niche players actively compete for market share, driven by innovations in automation and ergonomics.

- Earth Moving: As the largest and most significant segment of the market, earth-moving equipment is fundamental for excavation, leveling, grading, and transporting earth. This segment is projected to grow at a CAGR of [Insert Projected CAGR Here]%. The highly competitive nature of this segment sees numerous major global players vying for market dominance, fueled by demand from large-scale infrastructure projects and increasing urbanization.

- Transportation: This segment comprises machinery dedicated to the efficient movement of materials, equipment, and personnel across diverse construction environments. The market growth within this segment is intrinsically linked to the robust pipeline of infrastructure development projects across Australia, projecting a CAGR of [Insert Projected CAGR Here]%. Innovations in fuel efficiency and payload capacity are key trends.

By Machinery Type:

- Hydraulic Excavators: Characterized by exceptionally high demand and intense competition, hydraulic excavators are pivotal in numerous construction tasks. This segment showcases significant growth potential, with a projected CAGR of [Insert Projected CAGR Here]%. Technological advancements focusing on precision, power, and operator comfort are driving this growth.

- Wheel Loaders: Wheel loaders continue to experience steady and consistent growth, with a projected CAGR of [Insert Projected CAGR Here]%. Their inherent versatility across a broad spectrum of construction applications, from material handling to site preparation, makes them indispensable and drives their sustained demand.

- Crawler Trucks, Dump Trucks, Motor Graders: These essential heavy-duty segments collectively demonstrate consistent growth trajectories, with CAGRs projected to range from [Insert Lower Range CAGR Here]% to [Insert Upper Range CAGR Here]% respectively. The market dynamics are characterized by healthy competition, with both established global brands and agile new entrants actively participating and innovating to meet evolving project demands.

Key Drivers of Australia Construction Machinery Market Growth

The Australian construction machinery market is propelled by several key factors:

- Government investment in infrastructure: Major infrastructure projects are driving significant demand for construction equipment.

- Mining industry expansion: Australia's strong mining sector consistently necessitates specialized construction machinery.

- Urbanization and housing growth: Increasing urbanization and rising housing demands fuel construction activity.

- Technological advancements: Innovations in equipment design and automation are increasing efficiency and productivity.

Challenges in the Australia Construction Machinery Market Sector

The Australian construction machinery market, while robust, navigates a landscape dotted with several significant challenges that can impact profitability, operational efficiency, and market expansion. Addressing these hurdles is crucial for sustained growth and market resilience.

- Fluctuations in Commodity Prices: Volatility in global commodity prices directly influences the cost of raw materials used in machinery manufacturing, thereby impacting equipment prices and the overall profitability for manufacturers and end-users.

- Supply Chain Disruptions: Geopolitical events, logistical bottlenecks, and unforeseen global crises can lead to significant supply chain disruptions. These issues can result in extended lead times for new equipment, shortages of critical components, and upward pressure on pricing.

- Labor Shortages and Skills Gap: The construction industry faces a persistent challenge in attracting and retaining a skilled workforce. A shortage of experienced operators, technicians, and mechanics can limit the industry's capacity to execute projects efficiently and can also impact the adoption of new, advanced machinery.

- Stringent Environmental Regulations and Sustainability Demands: Increasingly stringent environmental regulations, particularly concerning emissions standards and noise pollution, necessitate significant investment in greener technologies. While this drives innovation, it can also increase the upfront cost of equipment and compliance burdens for businesses.

- Economic Downturns and Project Delays: Broader economic fluctuations and unexpected project delays can significantly impact the demand for new machinery, leading to reduced sales volumes and potentially longer equipment lifecycles.

Emerging Opportunities in Australia Construction Machinery Market

Despite the prevailing challenges, the Australian construction machinery market is ripe with emerging opportunities that are poised to drive future growth and innovation. These opportunities stem from evolving industry practices, technological advancements, and strategic government initiatives.

- Growing Adoption of Sustainable and Green Construction Practices: There is a significant and increasing demand for environmentally friendly construction machinery. This includes electric and hybrid-powered equipment, machinery with lower emissions, and solutions that minimize site impact, creating a strong market for eco-conscious manufacturers and suppliers.

- Increased Integration of Advanced Technologies: The adoption of cutting-edge technologies such as automation, robotics, telematics, IoT sensors, and data analytics is revolutionizing equipment operation. These technologies enhance efficiency, predictive maintenance, safety, and operational insights, offering significant value to end-users.

- Demand for Specialized and Niche Equipment: As Australia undertakes increasingly complex and unique infrastructure and resource projects, there is a growing demand for specialized equipment designed for specific applications. This presents opportunities for manufacturers and rental companies offering bespoke solutions and niche machinery.

- Robust Infrastructure Development and Government Investment: Ongoing and planned large-scale infrastructure projects, including transportation networks, renewable energy installations, and urban development, continue to be a major driver of demand for construction machinery. Government stimulus and investment in these areas provide a stable and predictable market.

- Growth in the Rental and Used Equipment Markets: To manage capital expenditure and project flexibility, construction companies are increasingly turning to equipment rental and the purchase of well-maintained used machinery. This creates a dynamic secondary market and opportunities for rental fleet expansion.

Leading Players in the Australia Construction Machinery Market Market

The Australian construction machinery market is highly competitive, featuring a mix of global giants and specialized local providers. These leading players are instrumental in shaping market trends through innovation, product development, and strategic partnerships.

- Kobelco Construction Machinery Co Ltd

- Sumitomo Corporation

- Sany Group

- John Deere & Co

- JCB Construction Equipment Australia

- Hitachi Construction Machinery Co Ltd

- Manitou BF SA

- Volvo Construction Equipment

- Caterpillar Inc

- Komatsu Ltd

- CNH Australia

- Wacker Neuson

- Liebherr International

- Doosan Infracore Ltd

- Shandong Lin gong Construction Machinery

- Yanmar Construction Equipment Co Ltd

- XCMG Group

Key Developments in Australia Construction Machinery Market Industry

The Australian construction machinery market is continuously shaped by strategic announcements, product launches, and technological advancements from key industry players. These developments often signal shifts in market focus, technological direction, and future growth areas.

October 2023: Isuzu Australia Limited (IAL) marked a significant step towards enhanced fuel efficiency and reduced emissions with the launch of its new medium-duty F-Series trucks in Australia. Featuring advanced four-cylinder engines, this initiative underscores a strategic commitment to providing more economical and environmentally conscious solutions in the vital heavy transport segment of the construction industry.

July 2023: Komatsu Ltd. further demonstrated its commitment to sustainability with the highly anticipated launch of its PC200LCE-11 and 210LCE-11 electric excavators. This introduction represents a pivotal moment, highlighting a clear industry shift towards embracing sustainable operating practices and offering machinery that significantly reduces emissions and environmental impact on construction sites.

[Insert Month, Year]: [Insert Company Name] announced the [describe key development, e.g., acquisition of a specialized technology firm, expansion of its rental fleet, or launch of a new series of autonomous equipment]. This strategic move is expected to [explain the expected impact, e.g., bolster its offerings in the automation sector, enhance its service capabilities, or cater to the growing demand for advanced machinery].

Strategic Outlook for Australia Construction Machinery Market Market

The Australian construction machinery market presents a strong outlook for continued growth, driven by sustained infrastructure investment, urbanization, and technological innovation. The increasing adoption of electric and autonomous machinery will further reshape the market landscape, favoring companies that effectively integrate these advancements into their product offerings and operations. The market's resilience to economic fluctuations will be a key determinant of future growth trajectories.

Australia Construction Machinery Market Segmentation

-

1. Application Type

- 1.1. Material Handling

- 1.2. Earth Moving

- 1.3. Transportation

-

2. Machinery Type

- 2.1. Hydraulic Excavators

- 2.2. Wheel Loaders

- 2.3. Crawler Trucks

- 2.4. Dump Trucks

- 2.5. Motor Graders

Australia Construction Machinery Market Segmentation By Geography

- 1. Australia

Australia Construction Machinery Market Regional Market Share

Geographic Coverage of Australia Construction Machinery Market

Australia Construction Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Infrastructure Development and Construction Activities to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Regulations and Internal Trade Policies May Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Infrastructure Development and Construction Activities to Drive the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Construction Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Material Handling

- 5.1.2. Earth Moving

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Machinery Type

- 5.2.1. Hydraulic Excavators

- 5.2.2. Wheel Loaders

- 5.2.3. Crawler Trucks

- 5.2.4. Dump Trucks

- 5.2.5. Motor Graders

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kobelco Construction Machinery Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sumitomo Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sany Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 John Deere & Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JCB Construction Equipment Australia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hitachi Construction Machinery Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Manitou BF SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Volvo Construction Equipment

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Caterpillar Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Komatsu Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CNH Australia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Wacker Neuson

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Liebherr International

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Doosan Infracore Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Shandong Lin gong Construction Machinery*List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Yanmar Construction Equipment Co Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 XCMG Group

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Kobelco Construction Machinery Co Ltd

List of Figures

- Figure 1: Australia Construction Machinery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Construction Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Construction Machinery Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: Australia Construction Machinery Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 3: Australia Construction Machinery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Construction Machinery Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 5: Australia Construction Machinery Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 6: Australia Construction Machinery Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Construction Machinery Market?

The projected CAGR is approximately 3.35%.

2. Which companies are prominent players in the Australia Construction Machinery Market?

Key companies in the market include Kobelco Construction Machinery Co Ltd, Sumitomo Corporation, Sany Group, John Deere & Co, JCB Construction Equipment Australia, Hitachi Construction Machinery Co Ltd, Manitou BF SA, Volvo Construction Equipment, Caterpillar Inc, Komatsu Ltd, CNH Australia, Wacker Neuson, Liebherr International, Doosan Infracore Ltd, Shandong Lin gong Construction Machinery*List Not Exhaustive, Yanmar Construction Equipment Co Ltd, XCMG Group.

3. What are the main segments of the Australia Construction Machinery Market?

The market segments include Application Type, Machinery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Infrastructure Development and Construction Activities to Drive the Market.

6. What are the notable trends driving market growth?

Rising Infrastructure Development and Construction Activities to Drive the Market..

7. Are there any restraints impacting market growth?

Regulations and Internal Trade Policies May Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

October 2023: Isuzu Australia Limited (IAL) has recently disclosed that the initial release of its advanced truck range in Australia will consist of the new medium-duty F Series models equipped with four-cylinder engines. The unveiling of the F-Series and its forthcoming model launch was announced at the 2023 Japan Mobility Show, where IAL actively participated. This event served as a platform for both commemorating the impending introduction of innovative models in the Australian market and gaining valuable insights into the latest technological advancements and industry updates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Construction Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Construction Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Construction Machinery Market?

To stay informed about further developments, trends, and reports in the Australia Construction Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence