Key Insights

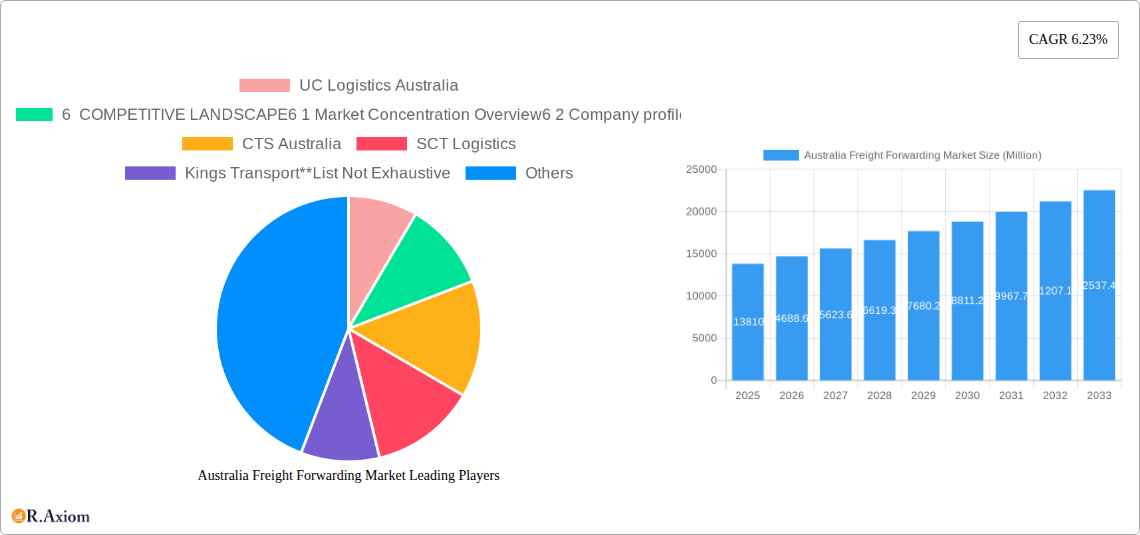

The Australian freight forwarding market, valued at $13.81 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.23% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning e-commerce sector fuels demand for efficient B2C logistics, particularly air and road freight forwarding. Simultaneously, the robust Australian industrial and manufacturing sectors, along with the expanding energy and resources sectors (Oil & Gas, etc.), necessitate reliable and cost-effective freight solutions, primarily leveraging ocean freight forwarding. Government investments in infrastructure upgrades, such as improved port facilities and rail networks, further facilitate market growth. However, challenges remain, including fluctuating fuel prices, driver shortages impacting road freight, and potential disruptions from geopolitical instability impacting global supply chains. The market is segmented by mode of transport (air, ocean, road, rail), customer type (B2B, B2C), and application (industrial, retail, healthcare, energy, food & beverage). Major players, including UC Logistics Australia, CEVA Logistics, Mainfreight Limited, and DHL, are fiercely competing, driving innovation and service enhancement to capture market share. The increasing focus on sustainability and technological advancements, such as AI-driven route optimization and real-time tracking, are reshaping the competitive landscape.

Australia Freight Forwarding Market Market Size (In Billion)

The competitive landscape is characterized by a mix of large multinational corporations and smaller, specialized freight forwarders. Larger players benefit from economies of scale and global networks, while smaller companies often excel in niche markets or offer personalized services. The market's future growth is likely influenced by the government's continued investment in infrastructure, the ongoing expansion of e-commerce, and the evolving needs of diverse industries. Fluctuations in global economic conditions and potential supply chain disruptions remain significant risks. The ongoing adoption of advanced technologies such as blockchain for enhanced transparency and security will also impact the market's trajectory. A focus on sustainable practices, such as reducing carbon emissions through optimized routes and alternative fuel sources, is becoming increasingly crucial for long-term competitiveness.

Australia Freight Forwarding Market Company Market Share

Australia Freight Forwarding Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australia freight forwarding market, covering market size, segmentation, competitive landscape, key drivers, challenges, and emerging opportunities from 2019 to 2033. The report leverages extensive primary and secondary research to deliver actionable insights for industry stakeholders, investors, and strategic decision-makers. With a focus on key performance indicators (KPIs), this report offers a granular view of the market, enabling informed strategic planning and investment decisions.

Australia Freight Forwarding Market Market Concentration & Innovation

The Australian freight forwarding market exhibits a moderately concentrated structure, with a few dominant players controlling a significant market share. While precise market share data for individual companies is proprietary, estimates suggest the top 5 players hold approximately xx% of the market (Base Year: 2025). This concentration is partly driven by economies of scale, established logistics networks, and strong client relationships. Innovation in the sector is spurred by technological advancements, including the adoption of digital platforms for freight management, real-time tracking systems, and data analytics for improved efficiency and cost optimization. Regulatory frameworks, including those related to safety, security, and environmental sustainability, significantly influence market dynamics. The rise of e-commerce has fueled the growth of B2C freight forwarding, creating opportunities for specialized services. Substitutes, such as direct shipping arrangements by large corporations, exert some pressure on the market. Significant M&A activity has been witnessed in recent years. For example, Dachser's acquisition of ACA International (March 2023) demonstrates the consolidation trend. The value of this deal was xx Million. This activity reflects the strategic imperative to expand market share and enhance operational capabilities within an increasingly competitive environment.

- Key Metrics:

- Top 5 Market Share: xx% (2025)

- Average M&A Deal Value: xx Million (2019-2024)

- Number of M&A deals: xx (2019-2024)

Australia Freight Forwarding Market Industry Trends & Insights

The Australian freight forwarding market is experiencing robust growth, driven primarily by the expansion of e-commerce, increasing international trade, and the growth of various industries like manufacturing, retail, and healthcare. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%. Market penetration of digital freight forwarding solutions is gradually increasing, though traditional methods still dominate. Consumer preferences are shifting towards greater transparency, real-time visibility, and environmentally friendly logistics solutions. Competitive dynamics are characterized by intense rivalry amongst established players, as well as the emergence of disruptive digital freight forwarders. This competition is driving innovation and improved service offerings. The market is witnessing a notable rise in demand for specialized services like temperature-controlled transportation and handling of hazardous goods. This specialization enhances the efficiency and reliability of the freight supply chain.

Dominant Markets & Segments in Australia Freight Forwarding Market

By Mode of Transport: Ocean freight forwarding remains the dominant segment, accounting for approximately xx% of the market in 2025, driven by Australia's reliance on seaborne trade. Air freight forwarding is a significant segment, especially for time-sensitive goods and smaller shipments. Road and rail freight forwarding are increasingly important for shorter distances and specific routes.

By Customer Type: B2B continues to be the largest segment, driven by businesses’ need for efficient and reliable logistics solutions. However, the B2C segment is showing rapid expansion owing to the booming e-commerce sector.

By Application: The industrial and manufacturing sector is a major driver for freight forwarding services, contributing approximately xx% to the market size. Retail, healthcare, and food and beverage sectors are also important application segments, each with unique needs and logistic requirements.

Key Drivers:

- Economic Policies: Government investment in infrastructure development and trade liberalization policies are boosting market growth.

- Infrastructure Development: Investments in ports, roads, and railways are enhancing the efficiency of the logistics network.

- Growth in E-commerce: Increasing online shopping is driving demand for faster and more reliable delivery services.

- Regional Disparities: The uneven distribution of population and economic activity across Australia influences the demand for freight services in different regions.

Australia Freight Forwarding Market Product Developments

Product innovation in the Australian freight forwarding market focuses on enhancing efficiency, transparency, and sustainability. Digital platforms are increasingly integrated with real-time tracking and data analytics capabilities, enabling better route optimization and improved customer service. The adoption of blockchain technology offers the potential for enhanced security and transparency in supply chain transactions. The focus on sustainability manifests in the use of electric vehicles and eco-friendly packaging solutions. These developments are aimed at meeting evolving customer demands and regulatory requirements, while simultaneously improving operational efficiency and competitiveness.

Report Scope & Segmentation Analysis

This report segments the Australian freight forwarding market based on mode of transport (air, ocean, road, rail), customer type (B2B, B2C), and application (industrial & manufacturing, retail, healthcare, oil & gas, food & beverage, other). Each segment's growth projection, market size (in Million), and competitive dynamics are analyzed in detail. The detailed segment analysis helps stakeholders identify lucrative segments and strategic opportunities. The market size for each segment in 2025 is estimated as follows (Million): Air Freight Forwarding - xx, Ocean Freight Forwarding - xx, Road Freight Forwarding - xx, Rail Freight Forwarding - xx. B2B represents a larger portion than B2C.

Key Drivers of Australia Freight Forwarding Market Growth

The growth of the Australian freight forwarding market is driven by several factors. The expanding e-commerce sector necessitates efficient last-mile delivery solutions. Government initiatives to improve infrastructure, such as port upgrades and road expansions, are significantly enhancing logistics efficiency. Technological advancements, including the use of AI and machine learning for route optimization and predictive analytics, contribute to improved operational efficiency and cost reduction. Increased foreign direct investment and the rise of domestic manufacturing also play a pivotal role. Lastly, changing consumer preferences towards faster and more reliable deliveries are creating opportunities for specialized freight forwarding services.

Challenges in the Australia Freight Forwarding Market Sector

The Australian freight forwarding market faces several challenges. High fuel costs significantly impact operational expenses. Fluctuations in global trade patterns and economic uncertainty can affect freight volumes. The geographically dispersed nature of Australia leads to increased transportation times and costs. Driver shortages are a growing concern, creating operational bottlenecks. Lastly, regulatory compliance and environmental regulations pose operational and financial constraints.

Emerging Opportunities in Australia Freight Forwarding Market

The Australian freight forwarding market presents numerous growth opportunities. The increasing adoption of automation and robotics offers potential for efficiency gains and cost savings. Specialized services catering to niche sectors such as cold chain logistics and hazardous materials handling are experiencing considerable demand. Partnerships with technology firms to leverage advanced data analytics and machine learning techniques offer new growth avenues. Lastly, growing awareness of sustainable logistics solutions opens new opportunities for environmentally conscious companies.

Leading Players in the Australia Freight Forwarding Market Market

- UC Logistics Australia

- CTS Australia

- SCT Logistics

- Kings Transport

- CEVA Logistics

- Mainfreight Limited

- Platinum Freight Management

- Think Global Logistics

- Yusen Logistics (Australia) Pty Ltd

- Deutsche Post DHL Group

Key Developments in Australia Freight Forwarding Market Industry

- March 2023: Dachser acquired ACA International, expanding its reach into Australia and New Zealand.

- February 2023: GEODIS partnered with Volvo Australia to trial electric trucks, promoting sustainable delivery options.

- September 2022: Ofload acquired CIA Logistics, expanding its workforce and market presence.

Strategic Outlook for Australia Freight Forwarding Market Market

The Australian freight forwarding market is poised for continued growth, driven by e-commerce expansion, infrastructure investments, and technological innovation. Companies that embrace digitalization, invest in sustainable solutions, and offer specialized services will be best positioned to capitalize on emerging opportunities. The market’s strategic outlook remains optimistic, with significant potential for expansion in the coming years. The increasing demand for enhanced supply chain transparency and resilience will also drive market evolution.

Australia Freight Forwarding Market Segmentation

-

1. Mode Of Transport

- 1.1. Air Freight Forwarding

- 1.2. Ocean Freight Forwarding

- 1.3. Road Freight Forwarding

- 1.4. Rail Freight Forwarding

-

2. Customer Type

- 2.1. B2C

- 2.2. B2B

-

3. Application

- 3.1. Industrial And Manufacturing

- 3.2. Retail

- 3.3. Healthcare

- 3.4. Oil And Gas

- 3.5. Food And Beverage

- 3.6. Other Application

Australia Freight Forwarding Market Segmentation By Geography

- 1. Australia

Australia Freight Forwarding Market Regional Market Share

Geographic Coverage of Australia Freight Forwarding Market

Australia Freight Forwarding Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Bulk Freight driving the market; Increasing Investments On Infrastructure

- 3.3. Market Restrains

- 3.3.1. Stringent emission regulations; Nearshoring manufacturing operations

- 3.4. Market Trends

- 3.4.1. Bulk Freight driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Freight Forwarding Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.1.1. Air Freight Forwarding

- 5.1.2. Ocean Freight Forwarding

- 5.1.3. Road Freight Forwarding

- 5.1.4. Rail Freight Forwarding

- 5.2. Market Analysis, Insights and Forecast - by Customer Type

- 5.2.1. B2C

- 5.2.2. B2B

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Industrial And Manufacturing

- 5.3.2. Retail

- 5.3.3. Healthcare

- 5.3.4. Oil And Gas

- 5.3.5. Food And Beverage

- 5.3.6. Other Application

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UC Logistics Australia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 6 COMPETITIVE LANDSCAPE6 1 Market Concentration Overview6 2 Company profiles

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CTS Australia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SCT Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kings Transport**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEVA Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mainfreight Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Platinum Freight Management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Think Global Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yusen Logistics (Australia) Pty Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Deutsche Post DHL Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 UC Logistics Australia

List of Figures

- Figure 1: Australia Freight Forwarding Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Freight Forwarding Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Freight Forwarding Market Revenue Million Forecast, by Mode Of Transport 2020 & 2033

- Table 2: Australia Freight Forwarding Market Revenue Million Forecast, by Customer Type 2020 & 2033

- Table 3: Australia Freight Forwarding Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Australia Freight Forwarding Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Australia Freight Forwarding Market Revenue Million Forecast, by Mode Of Transport 2020 & 2033

- Table 6: Australia Freight Forwarding Market Revenue Million Forecast, by Customer Type 2020 & 2033

- Table 7: Australia Freight Forwarding Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Australia Freight Forwarding Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Freight Forwarding Market?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the Australia Freight Forwarding Market?

Key companies in the market include UC Logistics Australia, 6 COMPETITIVE LANDSCAPE6 1 Market Concentration Overview6 2 Company profiles, CTS Australia, SCT Logistics, Kings Transport**List Not Exhaustive, CEVA Logistics, Mainfreight Limited, Platinum Freight Management, Think Global Logistics, Yusen Logistics (Australia) Pty Ltd, Deutsche Post DHL Group.

3. What are the main segments of the Australia Freight Forwarding Market?

The market segments include Mode Of Transport, Customer Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Bulk Freight driving the market; Increasing Investments On Infrastructure.

6. What are the notable trends driving market growth?

Bulk Freight driving the market.

7. Are there any restraints impacting market growth?

Stringent emission regulations; Nearshoring manufacturing operations.

8. Can you provide examples of recent developments in the market?

March 2023: Dachser acquired ACA International, based in Melbourne, Australia. With this acquisition, Dachser's own air and sea freight network now includes Australia and New Zealand. These are two economically powerful countries that are also directly linked to Asia, Europe, and North America. Dachser, a family-owned firm based in Kempten, Germany, offers transport logistics, warehousing, and customized services via two divisions: Dachser Air & Sea Logistics and Dachser Road Logistics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Freight Forwarding Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Freight Forwarding Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Freight Forwarding Market?

To stay informed about further developments, trends, and reports in the Australia Freight Forwarding Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence