Key Insights

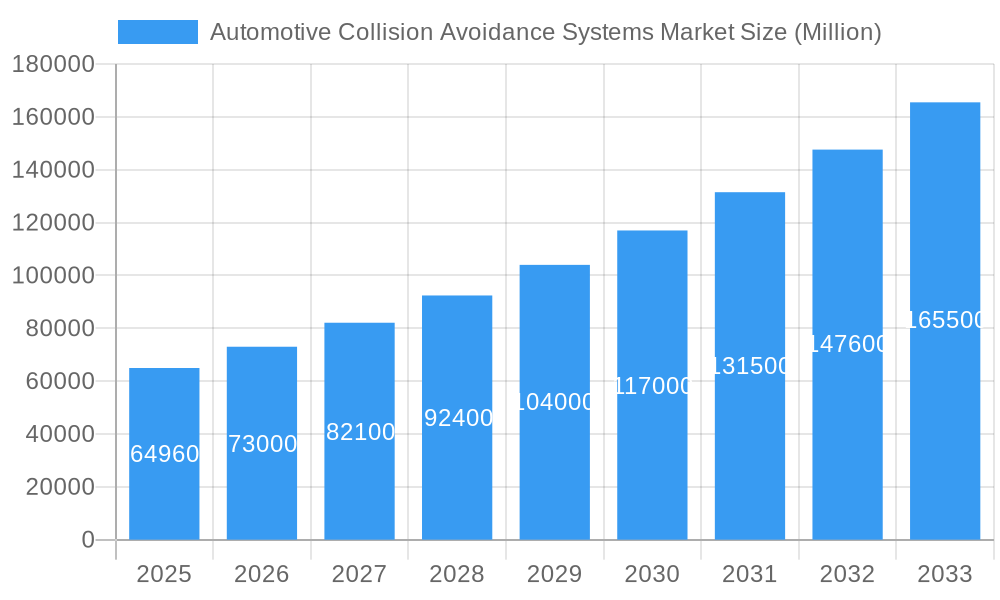

The Automotive Collision Avoidance Systems (ACAS) market is experiencing robust growth, driven by increasing vehicle automation, stringent safety regulations globally, and a rising consumer demand for enhanced vehicle safety features. The market, currently valued at approximately $65 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 12.20% from 2025 to 2033. This expansion is fueled by several key factors. Technological advancements in radar, lidar, camera, and ultrasonic sensor technologies are enabling the development of more sophisticated and effective ACAS. Furthermore, the integration of these systems into both passenger and commercial vehicles is accelerating, driven by government mandates aimed at reducing road accidents and fatalities. The rising adoption of Advanced Driver-Assistance Systems (ADAS) and autonomous driving features further contributes to the market's growth trajectory. Segment-wise, adaptive and automated systems are expected to dominate due to their superior capabilities in preventing collisions. Geographically, North America and Europe are currently leading the market due to early adoption and stringent safety regulations, but the Asia-Pacific region is poised for significant growth, driven by increasing vehicle production and rising disposable incomes.

Automotive Collision Avoidance Systems Market Market Size (In Billion)

Despite the optimistic outlook, the market faces certain challenges. High initial costs associated with ACAS implementation and the complexity of integrating these systems with existing vehicle infrastructure could act as restraints. Furthermore, concerns about data privacy and cybersecurity related to the increasing reliance on sensor data and connectivity remain a potential hurdle. However, ongoing technological innovation, the development of cost-effective solutions, and increasing awareness about road safety are expected to mitigate these challenges and continue to propel the market's growth in the coming years. The competitive landscape is highly fragmented, with numerous established automotive parts suppliers and technology companies vying for market share. Strategic collaborations and mergers & acquisitions are expected to further shape the industry's dynamics.

Automotive Collision Avoidance Systems Market Company Market Share

Automotive Collision Avoidance Systems Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Automotive Collision Avoidance Systems market, covering the period from 2019 to 2033. It delves into market dynamics, key players, technological advancements, and future growth prospects, offering actionable insights for industry stakeholders. The report segments the market by function type, technology type, and vehicle type, providing a granular understanding of market trends and opportunities. The estimated market value in 2025 is xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Automotive Collision Avoidance Systems Market Concentration & Innovation

The Automotive Collision Avoidance Systems market exhibits a moderately concentrated landscape, with several key players holding significant market share. Companies such as Robert Bosch GmbH, Continental AG, and Denso Corporation dominate the market, leveraging their extensive R&D capabilities and global reach. However, the market also features numerous smaller, specialized players, contributing to a dynamic competitive environment. Market share calculations reveal that the top 5 players collectively hold approximately xx% of the global market, indicating both opportunities for existing players to expand and for new entrants to establish a foothold.

Several factors drive innovation in this sector. Stringent government regulations mandating advanced driver-assistance systems (ADAS) are pushing companies to develop more sophisticated and effective collision avoidance technologies. Consumer demand for enhanced safety features is another significant driver. The integration of artificial intelligence (AI) and machine learning (ML) is revolutionizing the field, leading to the development of more intelligent and adaptable systems.

Mergers and acquisitions (M&A) activity is another significant factor influencing market dynamics. Recent deals, while precise values are unavailable (xx Million), have involved strategic partnerships to combine technological expertise and expand market reach. For example, collaborations between sensor manufacturers and automotive companies are becoming increasingly common. This consolidation strengthens the market position of major players and accelerates the pace of technological advancement. The industry is also witnessing an increase in strategic alliances to achieve economies of scale in production and distribution.

Automotive Collision Avoidance Systems Market Industry Trends & Insights

The Automotive Collision Avoidance Systems (ACAS) market is experiencing robust growth, fueled by a confluence of factors. The surge in global vehicle production, particularly within developing economies, significantly increases the demand for these vital safety systems. Concurrently, a rising consumer awareness of road safety and the inherent benefits of collision avoidance technologies are driving adoption rates. Technological advancements are paramount; the integration of Artificial Intelligence (AI), Machine Learning (ML), and sophisticated sensor technologies such as LiDAR, radar, and cameras are dramatically enhancing system performance and capabilities. This translates to higher market penetration, with a projected [Insert Precise Percentage]% increase in adoption across various vehicle segments by 2033. The Compound Annual Growth Rate (CAGR) for the market is estimated at [Insert Precise Percentage]%, signifying substantial growth potential.

Consumer preferences are demonstrably shifting towards vehicles equipped with advanced safety features. This trend is particularly pronounced among younger demographics and in regions characterized by high traffic density. The competitive landscape is fiercely dynamic, with manufacturers continually striving for product differentiation through innovation, cost optimization strategies, and strategic partnerships. The market is witnessing a gradual but significant transition towards autonomous driving technologies, a trend projected to further accelerate market expansion in the years to come. This evolution necessitates the development of more sophisticated and integrated ACAS capable of handling increasingly complex driving scenarios.

Dominant Markets & Segments in Automotive Collision Avoidance Systems Market

Leading Regions: North America and Europe currently hold the largest market share, driven by stringent safety regulations, high vehicle ownership rates, and a strong consumer preference for advanced safety technologies. However, the Asia-Pacific region is poised for remarkable growth, fueled by burgeoning vehicle sales and supportive government initiatives promoting ADAS adoption.

Dominant Segment (Function Type): Adaptive and Automated systems are outpacing Monitoring and Warning systems in growth. This reflects a heightened demand for proactive driver-assistance features that actively prevent collisions, rather than merely alerting the driver to potential hazards.

Dominant Segment (Technology Type): Radar systems currently command the largest market share due to their established technology and cost-effectiveness. Nevertheless, the LiDAR segment is experiencing rapid expansion, driven by improvements in sensor performance and decreasing costs. Camera-based systems remain crucial, particularly for functionalities such as lane keeping assist and pedestrian detection.

Dominant Segment (Vehicle Type): The passenger vehicle segment currently dominates the market. However, the commercial vehicle segment shows significant growth potential, propelled by the increasing demand for enhanced safety features within commercial fleets. This is motivated by stricter fleet safety regulations and the potential for substantial insurance cost savings resulting from accident reduction.

Automotive Collision Avoidance Systems Market Product Developments

Recent product innovations focus on the integration of multiple sensor technologies (sensor fusion) to enhance the accuracy and reliability of collision avoidance systems. The development of more sophisticated algorithms and AI-powered systems is enabling more proactive and effective collision avoidance. Improvements in sensor miniaturization and cost reduction are making these technologies more accessible to a wider range of vehicle manufacturers and consumers. The market is witnessing a shift towards the development of highly integrated and modular systems that can easily be adapted to different vehicle platforms. This modularity reduces development costs and accelerates time to market for new features.

Report Scope & Segmentation Analysis

This report segments the Automotive Collision Avoidance Systems market across various parameters:

By Function Type: Adaptive, Automated, Monitoring, Warning. Each segment's growth projections are detailed, along with market size estimates and a competitive landscape analysis. The adaptive and automated segments are projected to experience higher growth rates due to advancements in technology and increased demand for advanced safety features.

By Technology Type: Radar, Lidar, Camera, Ultrasonic. This section details the market size and growth trajectory for each technology. The LiDAR segment is expected to experience rapid growth, driven by improvements in sensor technology and decreasing costs.

By Vehicle Type: Passenger Vehicle, Commercial Vehicle. Each segment's growth potential and market dynamics are analyzed, considering factors such as regulations and consumer preferences. The commercial vehicle segment is expected to grow substantially, driven by increasing focus on fleet safety.

Key Drivers of Automotive Collision Avoidance Systems Market Growth

Several factors are driving the growth of the Automotive Collision Avoidance Systems market:

Stringent Government Regulations: Mandates for ADAS features in new vehicles are a major catalyst, pushing manufacturers to adopt these technologies.

Technological Advancements: Improvements in sensor technology (LiDAR, radar, cameras) and AI/ML algorithms are enhancing system performance and reliability.

Increased Consumer Awareness: Growing awareness of road safety and the benefits of collision avoidance features are boosting consumer demand.

Rising Vehicle Production: Global vehicle production growth directly correlates with demand for collision avoidance systems.

Challenges in the Automotive Collision Avoidance Systems Market Sector

The market faces several challenges:

High Initial Costs: The high cost of implementing advanced collision avoidance systems can limit adoption, especially in price-sensitive markets.

Supply Chain Disruptions: Global supply chain issues can impact the availability of essential components, affecting production and delivery timelines.

Cybersecurity Concerns: The increasing reliance on software and connectivity raises concerns about the vulnerability of these systems to cyberattacks.

Emerging Opportunities in Automotive Collision Avoidance Systems Market

Autonomous Driving: The development of autonomous driving technologies presents significant opportunities for the growth of collision avoidance systems.

Integration with V2X Technology: Vehicle-to-everything (V2X) communication allows vehicles to communicate with infrastructure and other vehicles, improving safety and efficiency.

Expansion in Developing Markets: The growing vehicle ownership in developing economies offers vast potential for market expansion.

Leading Players in the Automotive Collision Avoidance Systems Market Market

- Denso Corporation

- Mobileye

- Hyundai Mobis

- Infineon Technologies

- ZF Group

- Siemens AG

- Delphi Automotive

- Fujitsu Laboratories Ltd

- Continental AG

- Autoliv Inc

- Robert Bosch GmbH

- Magna International

- Bendix Commercial Vehicle Systems LLC

- Hella KGaA Hueck & Co

- WABCO Vehicle Control Services

- National Instruments Corp

- Panasonic Corporation

- Toyota

Key Developments in Automotive Collision Avoidance Systems Market Industry

- Aug 2023: Innoviz Technologies and BMW Group collaborate on a new generation of LiDAR technology, highlighting advancements in sensor technology.

- Sept 2023: Innoviz Technologies announces a distribution agreement with Ask Co. Ltd in Japan, expanding its market reach in a key region.

- Jun 2022: ZF Group inaugurates a new tech center in Hyderabad, India, underscoring investment in ADAS development and indicating a focus on emerging markets.

- Apr 2022: Hesai Technology and WeRide announce a strategic cooperation for autonomous driving lidar applications, showcasing collaboration in the autonomous driving sector.

- [Add more recent developments here with dates and brief descriptions]

Strategic Outlook for Automotive Collision Avoidance Systems Market Market

The Automotive Collision Avoidance Systems market is poised for significant growth, driven by technological advancements, stricter safety regulations, and increased consumer demand. The integration of AI and sensor fusion will further enhance system performance, leading to wider adoption across various vehicle segments. Expanding into developing markets and leveraging opportunities presented by autonomous driving technologies will be crucial for companies to achieve sustained growth in this dynamic sector. The market will continue to consolidate as larger players acquire smaller firms to expand their product portfolios and technological capabilities.

Automotive Collision Avoidance Systems Market Segmentation

-

1. Function Type

- 1.1. Adaptive

- 1.2. Automated

- 1.3. Monitoring

- 1.4. Warning

-

2. Technology Type

- 2.1. Radar

- 2.2. Lidar

- 2.3. Camera

- 2.4. Ultrasonic

-

3. Vehicle Type

- 3.1. Passenger Vehicle

- 3.2. Commercial Vehicle

Automotive Collision Avoidance Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Norway

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Collision Avoidance Systems Market Regional Market Share

Geographic Coverage of Automotive Collision Avoidance Systems Market

Automotive Collision Avoidance Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Autonomous Vehicle Demand To Propel The Market Growth

- 3.3. Market Restrains

- 3.3.1. High Installation Cost May Hamper The Market Growth

- 3.4. Market Trends

- 3.4.1. LiDAR Segment to Grow Significantly During The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function Type

- 5.1.1. Adaptive

- 5.1.2. Automated

- 5.1.3. Monitoring

- 5.1.4. Warning

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Radar

- 5.2.2. Lidar

- 5.2.3. Camera

- 5.2.4. Ultrasonic

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Vehicle

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Function Type

- 6. North America Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function Type

- 6.1.1. Adaptive

- 6.1.2. Automated

- 6.1.3. Monitoring

- 6.1.4. Warning

- 6.2. Market Analysis, Insights and Forecast - by Technology Type

- 6.2.1. Radar

- 6.2.2. Lidar

- 6.2.3. Camera

- 6.2.4. Ultrasonic

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Vehicle

- 6.3.2. Commercial Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Function Type

- 7. Europe Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function Type

- 7.1.1. Adaptive

- 7.1.2. Automated

- 7.1.3. Monitoring

- 7.1.4. Warning

- 7.2. Market Analysis, Insights and Forecast - by Technology Type

- 7.2.1. Radar

- 7.2.2. Lidar

- 7.2.3. Camera

- 7.2.4. Ultrasonic

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Vehicle

- 7.3.2. Commercial Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Function Type

- 8. Asia Pacific Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function Type

- 8.1.1. Adaptive

- 8.1.2. Automated

- 8.1.3. Monitoring

- 8.1.4. Warning

- 8.2. Market Analysis, Insights and Forecast - by Technology Type

- 8.2.1. Radar

- 8.2.2. Lidar

- 8.2.3. Camera

- 8.2.4. Ultrasonic

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Vehicle

- 8.3.2. Commercial Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Function Type

- 9. Rest of the World Automotive Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function Type

- 9.1.1. Adaptive

- 9.1.2. Automated

- 9.1.3. Monitoring

- 9.1.4. Warning

- 9.2. Market Analysis, Insights and Forecast - by Technology Type

- 9.2.1. Radar

- 9.2.2. Lidar

- 9.2.3. Camera

- 9.2.4. Ultrasonic

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Vehicle

- 9.3.2. Commercial Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Function Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Denso Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Mobileye

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hyundai Mobis

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Infineon Technologies

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ZF Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Delphi Automotive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Fujitsu Laboratories Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Continental AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Autoliv Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Robert Bosch GmbH

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Magna International

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Bendix Commercial Vehicle Systems LLC

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Hella KGaA Hueck & Co

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 WABCO Vehicle Control Services

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 National Instruments Corp

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Panasonic Corporation

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Toyota

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.1 Denso Corporation

List of Figures

- Figure 1: Global Automotive Collision Avoidance Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Collision Avoidance Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 3: North America Automotive Collision Avoidance Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 4: North America Automotive Collision Avoidance Systems Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 5: North America Automotive Collision Avoidance Systems Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 6: North America Automotive Collision Avoidance Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Collision Avoidance Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Collision Avoidance Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Collision Avoidance Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 11: Europe Automotive Collision Avoidance Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 12: Europe Automotive Collision Avoidance Systems Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 13: Europe Automotive Collision Avoidance Systems Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 14: Europe Automotive Collision Avoidance Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Collision Avoidance Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Collision Avoidance Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Collision Avoidance Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Collision Avoidance Systems Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Collision Avoidance Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Collision Avoidance Systems Market Revenue (Million), by Function Type 2025 & 2033

- Figure 27: Rest of the World Automotive Collision Avoidance Systems Market Revenue Share (%), by Function Type 2025 & 2033

- Figure 28: Rest of the World Automotive Collision Avoidance Systems Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 29: Rest of the World Automotive Collision Avoidance Systems Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 30: Rest of the World Automotive Collision Avoidance Systems Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 31: Rest of the World Automotive Collision Avoidance Systems Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: Rest of the World Automotive Collision Avoidance Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 2: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 3: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 6: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 7: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 13: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 14: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Norway Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 22: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 23: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 24: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Function Type 2020 & 2033

- Table 31: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 32: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Automotive Collision Avoidance Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Automotive Collision Avoidance Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Collision Avoidance Systems Market?

The projected CAGR is approximately 12.20%.

2. Which companies are prominent players in the Automotive Collision Avoidance Systems Market?

Key companies in the market include Denso Corporation, Mobileye, Hyundai Mobis, Infineon Technologies, ZF Group, Siemens AG, Delphi Automotive, Fujitsu Laboratories Ltd, Continental AG, Autoliv Inc, Robert Bosch GmbH, Magna International, Bendix Commercial Vehicle Systems LLC, Hella KGaA Hueck & Co, WABCO Vehicle Control Services, National Instruments Corp, Panasonic Corporation, Toyota.

3. What are the main segments of the Automotive Collision Avoidance Systems Market?

The market segments include Function Type, Technology Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Autonomous Vehicle Demand To Propel The Market Growth.

6. What are the notable trends driving market growth?

LiDAR Segment to Grow Significantly During The Forecast Period.

7. Are there any restraints impacting market growth?

High Installation Cost May Hamper The Market Growth.

8. Can you provide examples of recent developments in the market?

Aug 2023: Innoviz Technologies and the BMW Group announced a collaboration by starting a B-sample development phase on a new generation of LiDAR. Under the new development agreement, Innoviz will develop B-Samples based on its second-generation InnovizTwo LiDAR sensor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Collision Avoidance Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Collision Avoidance Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Collision Avoidance Systems Market?

To stay informed about further developments, trends, and reports in the Automotive Collision Avoidance Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence