Key Insights

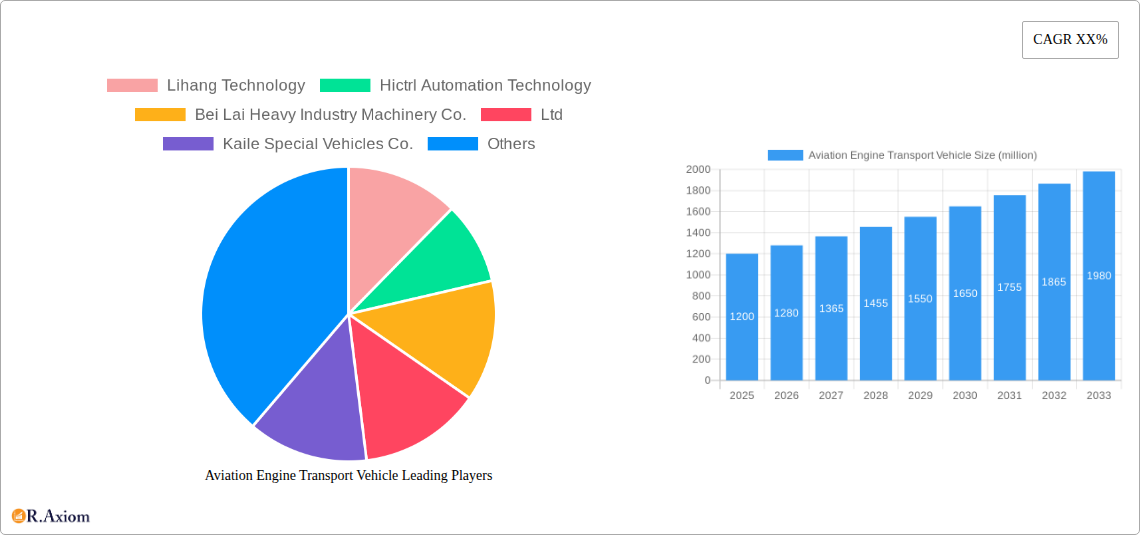

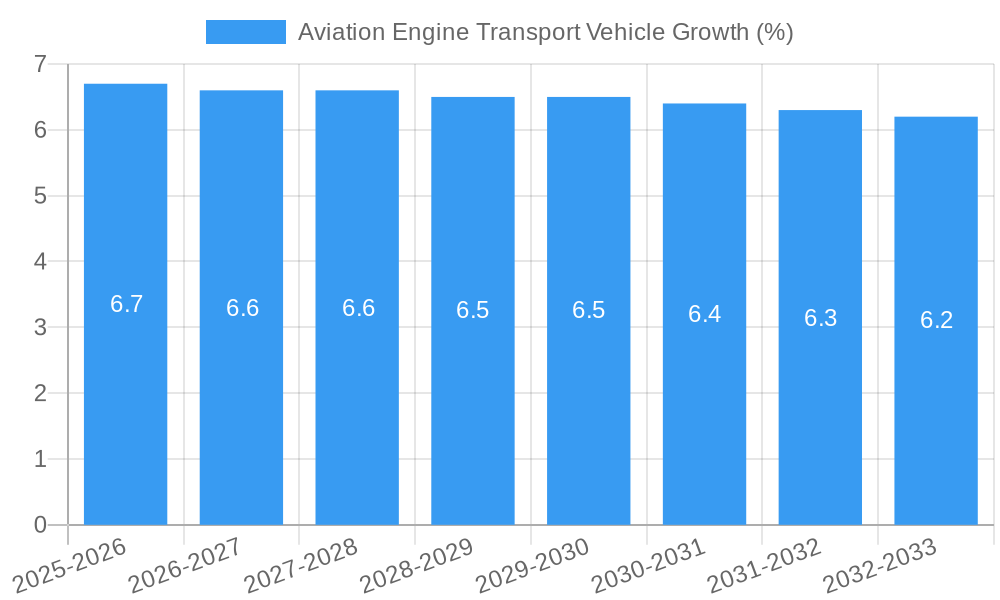

The global Aviation Engine Transport Vehicle market is projected to experience robust growth, reaching an estimated market size of approximately $1.2 billion by 2025, with a compound annual growth rate (CAGR) of around 6.5% anticipated through 2033. This expansion is primarily driven by the escalating global air travel demand, necessitating increased aircraft fleet expansion and consequently, a greater need for specialized transportation solutions for sensitive and high-value aircraft engines. The burgeoning aerospace industry, particularly in emerging economies, coupled with the continuous advancements in engine technology that often result in larger and more complex powertrains, further fuels the demand for these robust and precisely engineered transport vehicles. The market is segmented by application, with Airplane Engines holding the dominant share due to the sheer volume of commercial aviation, followed by Rocket Engines, reflecting the growth in space exploration and satellite launches. The "Others" category encompasses specialized niche applications within the aviation and defense sectors.

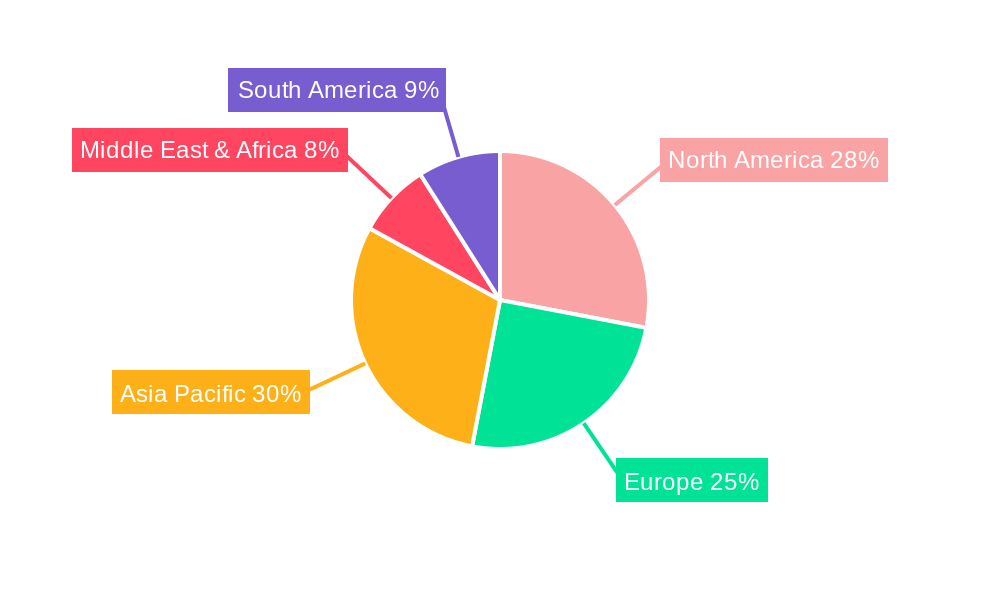

The market's growth is further bolstered by evolving industry standards for engine handling and safety, pushing manufacturers to innovate and develop more sophisticated transport solutions. Trends such as the adoption of smart technologies for real-time tracking and condition monitoring of engines during transit, alongside the development of lighter yet more durable materials for vehicle construction, are shaping the competitive landscape. However, the market also faces restraints, including the high initial investment cost associated with acquiring these specialized vehicles and the stringent regulatory compliance requirements for air cargo and ground handling operations. Geographically, the Asia Pacific region, led by China and India, is expected to witness the highest growth rates due to rapid industrialization and expanding aviation infrastructure. North America and Europe remain significant markets, driven by established aerospace hubs and substantial aftermarket services, with a growing emphasis on efficient and sustainable logistics solutions for engine maintenance, repair, and overhaul (MRO) operations.

Here is a detailed, SEO-optimized report description for the Aviation Engine Transport Vehicle market:

Aviation Engine Transport Vehicle Market Concentration & Innovation

The global Aviation Engine Transport Vehicle market is characterized by a moderate level of concentration, with key players like TLD Group, Tronair, Goldhofer, and Rico Equipment holding significant market share, estimated to be in the range of 30-40 million dollars cumulatively. Innovation is a primary driver, fueled by the increasing complexity and value of aircraft and rocket engines, necessitating specialized and secure transport solutions. Regulatory frameworks, particularly those concerning aviation safety and hazardous materials handling, play a crucial role in shaping product development and market entry. Strict adherence to international aviation standards and environmental regulations influences material selection, design features, and operational protocols. Product substitutes, such as traditional heavy-haul trucking with modified cradles, exist but offer less specialized protection and handling capabilities, making them less competitive for high-value aviation and rocket engines. End-user trends are leaning towards integrated logistics solutions, demanding vehicles that not only transport but also facilitate secure loading, unloading, and on-site positioning. This includes advancements in automated handling systems and real-time tracking. Mergers and acquisitions (M&A) activities are sporadic but significant, with potential deal values reaching up to 10-15 million dollars, aimed at consolidating market presence, acquiring new technologies, and expanding geographical reach. Companies like Lihang Technology, Hictrl Automation Technology, Bei Lai Heavy Industry Machinery Co.,Ltd, and Kaile Special Vehicles Co.,Ltd are active in niche segments and emerging markets, contributing to the dynamic competitive landscape. The overall market innovation is focused on enhancing payload capacity, improving shock absorption, and developing intelligent monitoring systems for engine condition during transit, with R&D investments estimated to be around 5-8 million dollars annually across leading firms.

Aviation Engine Transport Vehicle Industry Trends & Insights

The Aviation Engine Transport Vehicle market is poised for robust growth, driven by a confluence of factors including escalating air travel demand, the expansion of aerospace manufacturing, and the burgeoning space industry. The compound annual growth rate (CAGR) is projected to be approximately 6-8% over the forecast period of 2025–2033. Technological disruptions are at the forefront of market evolution, with a significant push towards intelligent transport systems that integrate advanced sensor technology, real-time GPS tracking, and remote diagnostics. These innovations ensure optimal conditions for engine transit, minimizing risks of damage and operational downtime. For instance, the development of specialized temperature and humidity-controlled transport solutions addresses the critical requirements for sensitive rocket engine components, projected to penetrate 15-20% of this niche market by 2033. Consumer preferences are shifting towards end-to-end logistics providers offering comprehensive engine handling and transportation services, rather than just standalone vehicle provision. This demand for integrated solutions is encouraging companies to invest in sophisticated trailer designs, customized cradles, and associated handling equipment. Competitive dynamics are intensifying, with established global players continuously innovating and expanding their product portfolios to cater to diverse engine types and transportation needs. New entrants, particularly from emerging economies, are also vying for market share, often by offering cost-effective solutions. The market penetration of specialized aviation engine transport vehicles is estimated to reach 70-80% by the end of the forecast period, indicating a strong reliance on these dedicated solutions. Key market segments, such as the transport of airplane engines, are expected to continue dominating the market, accounting for an estimated 80-85 million dollars in revenue by 2033. However, the rocket engine transport segment, while smaller, is exhibiting a significantly higher growth rate due to rapid advancements in space exploration and commercialization. The increasing complexity and cost of modern aircraft engines, with individual engine values often exceeding 10-15 million dollars, further underscore the necessity for highly specialized and secure transport, bolstering the market for premium aviation engine transport vehicles. Investments in advanced materials for vehicle construction, such as lightweight yet robust alloys, are also contributing to enhanced performance and fuel efficiency, creating a positive feedback loop for market expansion and innovation. The global value of the aviation engine transport vehicle market is projected to reach 400-500 million dollars by 2033.

Dominant Markets & Segments in Aviation Engine Transport Vehicle

The Airplane Engine application segment currently holds dominant market share, driven by the substantial global fleet of commercial and military aircraft. The sheer volume of engine maintenance, repair, and overhaul (MRO) activities, coupled with new aircraft production, necessitates a continuous demand for specialized transport vehicles. Countries with a strong aerospace manufacturing base and extensive air travel networks, such as the United States, European Union nations (Germany, France, UK), and China, represent the leading regional markets. For instance, the United States alone accounts for an estimated 25-30% of the global demand for aviation engine transport solutions, largely due to its significant airline industry and domestic aircraft production.

- Key Drivers for Airplane Engine Dominance:

- Economic Policies: Government support for aviation manufacturing and air travel, including subsidies and infrastructure development.

- Infrastructure: Well-developed airport infrastructure and robust MRO facilities that require efficient engine logistics.

- Fleet Size & Age: A large and aging global aircraft fleet necessitates frequent engine replacements and overhauls.

- Regulatory Compliance: Strict aviation safety regulations mandate the use of specialized and secure transport.

The Tablet Type of aviation engine transport vehicle is another dominant segment within the market, offering a versatile and secure platform for various engine models. Its design facilitates easy loading and unloading, crucial for efficient turnaround times at airports and MRO facilities.

- Key Drivers for Tablet Type Dominance:

- Versatility: Adaptable to a wide range of engine sizes and types.

- Ease of Use: Simplified loading and unloading procedures reduce handling risks.

- Security: Robust design and specialized securing mechanisms ensure engine stability during transit.

The Container Type segment, while smaller, is experiencing significant growth, particularly for long-haul transport and intercontinental shipping. These containers offer an additional layer of protection and security, making them ideal for high-value and sensitive engine shipments. The growth in global trade and the expansion of international air cargo operations are key contributors to this segment's upward trajectory.

- Key Drivers for Container Type Growth:

- Enhanced Protection: Provides superior protection against environmental factors and physical damage.

- Intermodal Transport: Facilitates seamless transfer between different modes of transportation (air, sea, road).

- Security Features: Offers tamper-evident seals and robust locking mechanisms for increased security.

The Rocket Engine application, though a nascent segment, exhibits the highest growth potential. The resurgence of space exploration, the rise of private space companies, and the development of new launch vehicles are creating an escalating demand for specialized transport solutions for rocket engines, which are often larger, more complex, and more sensitive than aircraft engines. Countries with active space programs and emerging private space industries, such as the United States, China, and India, are key markets for this segment. The projected market size for rocket engine transport vehicles is expected to grow from approximately 5-10 million dollars in the base year to 20-30 million dollars by 2033, representing a significant CAGR of 10-15%.

Aviation Engine Transport Vehicle Product Developments

Product developments in the aviation engine transport vehicle market are focused on enhancing safety, efficiency, and versatility. Innovations include the integration of advanced shock absorption systems, active stabilization technologies, and real-time environmental monitoring (temperature, humidity, vibration). Companies are developing modular designs that can be reconfigured to accommodate different engine sizes and types, reducing the need for multiple specialized vehicles. The introduction of intelligent load securing mechanisms and automated handling systems further minimizes human error and transit damage. Competitive advantages are being gained through lightweight yet durable materials, improved aerodynamics for fuel efficiency, and enhanced user interfaces for simplified operation and diagnostics. The market is witnessing a trend towards integrated solutions that combine transport with on-site positioning and secure storage capabilities, offering a comprehensive package to end-users.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Aviation Engine Transport Vehicle market, segmented by Application, Type, and Region. The Application segmentation includes Airplane Engine, Rocket Engine, and Others. The Airplane Engine segment, estimated at 300-350 million dollars in 2025, is projected to grow at a CAGR of 5-7%, driven by the vast commercial aviation sector. The Rocket Engine segment, valued at approximately 5-10 million dollars in 2025, is expected to experience a CAGR of 10-15%, fueled by the burgeoning space industry. The Others segment, encompassing specialized industrial engines or large turbine transport, is a smaller but developing area.

The Type segmentation covers Tablet Type, Container Type, and Others. The Tablet Type, representing a significant portion of the market (estimated 200-250 million dollars in 2025), is expected to grow at a CAGR of 6-8% due to its widespread applicability. The Container Type segment (estimated 80-100 million dollars in 2025) is projected to grow at a CAGR of 7-9%, driven by increasing demand for secure and intermodal transport. The Others segment includes specialized custom-built vehicles. Regional segmentation analyzes North America, Europe, Asia Pacific, and the Rest of the World, with North America and Europe currently holding dominant market shares due to established aerospace industries.

Key Drivers of Aviation Engine Transport Vehicle Growth

The growth of the Aviation Engine Transport Vehicle market is primarily propelled by several key drivers. Firstly, the expanding global air travel industry and increasing aircraft manufacturing activities directly correlate with the demand for engine transportation for maintenance, repair, overhaul, and new aircraft delivery. Secondly, the rapid growth in the space exploration sector, with numerous government and private initiatives, is significantly boosting the demand for specialized rocket engine transport vehicles. Technological advancements, such as the development of lighter, stronger materials and intelligent transportation systems, are enhancing the efficiency and safety of these vehicles, making them more attractive to users. Furthermore, stringent aviation safety regulations worldwide mandate the use of specialized equipment for transporting high-value and sensitive aircraft and rocket engines, creating a consistent demand for compliant transport solutions. Lastly, the increasing outsourcing of MRO services and the globalization of the aerospace supply chain necessitate robust and reliable transportation networks, further contributing to market expansion.

Challenges in the Aviation Engine Transport Vehicle Sector

Despite the promising growth, the Aviation Engine Transport Vehicle sector faces several challenges. The high cost of specialized vehicles and their associated maintenance can be a significant barrier, especially for smaller MRO providers or emerging space companies. Regulatory hurdles, including the need to comply with diverse international aviation and transportation safety standards, can prolong product development cycles and increase operational complexity. Supply chain disruptions, particularly for specialized components and raw materials, can lead to production delays and impact delivery timelines. The competitive pressure from traditional heavy-haul logistics providers, who may offer lower-cost alternatives, also presents a challenge, though these solutions often lack the specialized features and safety protocols of dedicated aviation engine transport vehicles. Furthermore, the limited number of highly skilled technicians required for the operation and maintenance of these sophisticated vehicles can create operational bottlenecks.

Emerging Opportunities in Aviation Engine Transport Vehicle

Emerging opportunities within the Aviation Engine Transport Vehicle market are abundant. The rapid growth of the commercial space sector, including satellite launches and private space tourism, presents a significant opportunity for the expansion of the rocket engine transport segment. The increasing adoption of electric and hybrid-electric aircraft technologies will likely drive the development of new transport solutions tailored for these next-generation engines. Furthermore, the demand for intelligent and connected transport solutions, offering real-time data on engine condition and location, is a growing area of opportunity for innovation and market differentiation. Expanding into developing regions with growing aerospace industries, such as parts of Southeast Asia and the Middle East, offers untapped market potential. The development of modular and adaptable transport systems that can cater to a wider range of specialized cargo, beyond just engines, also presents an avenue for diversification and revenue growth.

Leading Players in the Aviation Engine Transport Vehicle Market

- TLD Group

- Tronair

- Goldhofer

- Rico Equipment

- Lihang Technology

- Hictrl Automation Technology

- Bei Lai Heavy Industry Machinery Co.,Ltd

- Kaile Special Vehicles Co.,Ltd

Key Developments in Aviation Engine Transport Vehicle Industry

- 2023 October: TLD Group launches a new generation of intelligent aircraft engine dollies with advanced remote diagnostic capabilities, enhancing operational efficiency and safety.

- 2023 June: Goldhofer announces strategic partnerships to expand its heavy-duty transport solutions for aerospace components in the Asia-Pacific region.

- 2023 March: Tronair introduces a redesigned tablet-type engine transport stand featuring enhanced stability and payload capacity for newer generation aircraft engines.

- 2022 November: Lihang Technology showcases its innovative containerized rocket engine transport solution, designed for secure and efficient delivery to launch sites.

- 2022 July: Rico Equipment expands its product line to include specialized cradles for a wider range of turboprop engines.

- 2021 December: Hictrl Automation Technology demonstrates its automated engine loading and unloading system, aiming to reduce ground handling time and risk.

Strategic Outlook for Aviation Engine Transport Vehicle Market

The strategic outlook for the Aviation Engine Transport Vehicle market is exceptionally positive, driven by sustained growth in both the aviation and burgeoning space industries. Future success will hinge on companies focusing on technological innovation, particularly in areas of smart logistics, automation, and enhanced safety features. The increasing value and complexity of engines will continue to drive demand for premium, specialized transport solutions, allowing for higher profit margins for providers of advanced equipment. Strategic partnerships and potential mergers will likely play a role in market consolidation and expanding geographical reach. Adapting to emerging trends, such as the development of sustainable aviation technologies, and capitalizing on the rapid growth in the commercial space sector will be crucial for long-term market leadership and sustained growth, with a projected market value to reach 400-500 million dollars by 2033.

Aviation Engine Transport Vehicle Segmentation

-

1. Application

- 1.1. Airplane Engine

- 1.2. Rocket Engine

- 1.3. Others

-

2. Types

- 2.1. Tablet Type

- 2.2. Container Type

- 2.3. Others

Aviation Engine Transport Vehicle Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aviation Engine Transport Vehicle REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Engine Transport Vehicle Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Airplane Engine

- 5.1.2. Rocket Engine

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Tablet Type

- 5.2.2. Container Type

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aviation Engine Transport Vehicle Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Airplane Engine

- 6.1.2. Rocket Engine

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Tablet Type

- 6.2.2. Container Type

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Aviation Engine Transport Vehicle Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Airplane Engine

- 7.1.2. Rocket Engine

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Tablet Type

- 7.2.2. Container Type

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Aviation Engine Transport Vehicle Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Airplane Engine

- 8.1.2. Rocket Engine

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Tablet Type

- 8.2.2. Container Type

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Aviation Engine Transport Vehicle Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Airplane Engine

- 9.1.2. Rocket Engine

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Tablet Type

- 9.2.2. Container Type

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Aviation Engine Transport Vehicle Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Airplane Engine

- 10.1.2. Rocket Engine

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Tablet Type

- 10.2.2. Container Type

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Lihang Technology

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hictrl Automation Technology

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bei Lai Heavy Industry Machinery Co.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kaile Special Vehicles Co.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TLD Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tronair

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Goldhofer

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rico Equipment

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Lihang Technology

List of Figures

- Figure 1: Global Aviation Engine Transport Vehicle Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Aviation Engine Transport Vehicle Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Aviation Engine Transport Vehicle Revenue (million), by Application 2024 & 2032

- Figure 4: North America Aviation Engine Transport Vehicle Volume (K), by Application 2024 & 2032

- Figure 5: North America Aviation Engine Transport Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Aviation Engine Transport Vehicle Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Aviation Engine Transport Vehicle Revenue (million), by Types 2024 & 2032

- Figure 8: North America Aviation Engine Transport Vehicle Volume (K), by Types 2024 & 2032

- Figure 9: North America Aviation Engine Transport Vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Aviation Engine Transport Vehicle Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Aviation Engine Transport Vehicle Revenue (million), by Country 2024 & 2032

- Figure 12: North America Aviation Engine Transport Vehicle Volume (K), by Country 2024 & 2032

- Figure 13: North America Aviation Engine Transport Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Aviation Engine Transport Vehicle Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Aviation Engine Transport Vehicle Revenue (million), by Application 2024 & 2032

- Figure 16: South America Aviation Engine Transport Vehicle Volume (K), by Application 2024 & 2032

- Figure 17: South America Aviation Engine Transport Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Aviation Engine Transport Vehicle Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Aviation Engine Transport Vehicle Revenue (million), by Types 2024 & 2032

- Figure 20: South America Aviation Engine Transport Vehicle Volume (K), by Types 2024 & 2032

- Figure 21: South America Aviation Engine Transport Vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Aviation Engine Transport Vehicle Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Aviation Engine Transport Vehicle Revenue (million), by Country 2024 & 2032

- Figure 24: South America Aviation Engine Transport Vehicle Volume (K), by Country 2024 & 2032

- Figure 25: South America Aviation Engine Transport Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Aviation Engine Transport Vehicle Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Aviation Engine Transport Vehicle Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Aviation Engine Transport Vehicle Volume (K), by Application 2024 & 2032

- Figure 29: Europe Aviation Engine Transport Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Aviation Engine Transport Vehicle Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Aviation Engine Transport Vehicle Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Aviation Engine Transport Vehicle Volume (K), by Types 2024 & 2032

- Figure 33: Europe Aviation Engine Transport Vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Aviation Engine Transport Vehicle Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Aviation Engine Transport Vehicle Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Aviation Engine Transport Vehicle Volume (K), by Country 2024 & 2032

- Figure 37: Europe Aviation Engine Transport Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Aviation Engine Transport Vehicle Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Aviation Engine Transport Vehicle Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Aviation Engine Transport Vehicle Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Aviation Engine Transport Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Aviation Engine Transport Vehicle Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Aviation Engine Transport Vehicle Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Aviation Engine Transport Vehicle Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Aviation Engine Transport Vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Aviation Engine Transport Vehicle Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Aviation Engine Transport Vehicle Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Aviation Engine Transport Vehicle Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Aviation Engine Transport Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Aviation Engine Transport Vehicle Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Aviation Engine Transport Vehicle Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Aviation Engine Transport Vehicle Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Aviation Engine Transport Vehicle Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Aviation Engine Transport Vehicle Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Aviation Engine Transport Vehicle Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Aviation Engine Transport Vehicle Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Aviation Engine Transport Vehicle Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Aviation Engine Transport Vehicle Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Aviation Engine Transport Vehicle Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Aviation Engine Transport Vehicle Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Aviation Engine Transport Vehicle Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Aviation Engine Transport Vehicle Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Aviation Engine Transport Vehicle Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Aviation Engine Transport Vehicle Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Aviation Engine Transport Vehicle Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Aviation Engine Transport Vehicle Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Aviation Engine Transport Vehicle Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Aviation Engine Transport Vehicle Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Aviation Engine Transport Vehicle Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Aviation Engine Transport Vehicle Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Aviation Engine Transport Vehicle Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Aviation Engine Transport Vehicle Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Aviation Engine Transport Vehicle Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Aviation Engine Transport Vehicle Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Aviation Engine Transport Vehicle Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Aviation Engine Transport Vehicle Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Aviation Engine Transport Vehicle Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Aviation Engine Transport Vehicle Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Aviation Engine Transport Vehicle Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Aviation Engine Transport Vehicle Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Aviation Engine Transport Vehicle Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Aviation Engine Transport Vehicle Volume K Forecast, by Country 2019 & 2032

- Table 81: China Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Aviation Engine Transport Vehicle Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Aviation Engine Transport Vehicle Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Engine Transport Vehicle?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Aviation Engine Transport Vehicle?

Key companies in the market include Lihang Technology, Hictrl Automation Technology, Bei Lai Heavy Industry Machinery Co., Ltd, Kaile Special Vehicles Co., Ltd, TLD Group, Tronair, Goldhofer, Rico Equipment.

3. What are the main segments of the Aviation Engine Transport Vehicle?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Engine Transport Vehicle," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Engine Transport Vehicle report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Engine Transport Vehicle?

To stay informed about further developments, trends, and reports in the Aviation Engine Transport Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence